April 2025

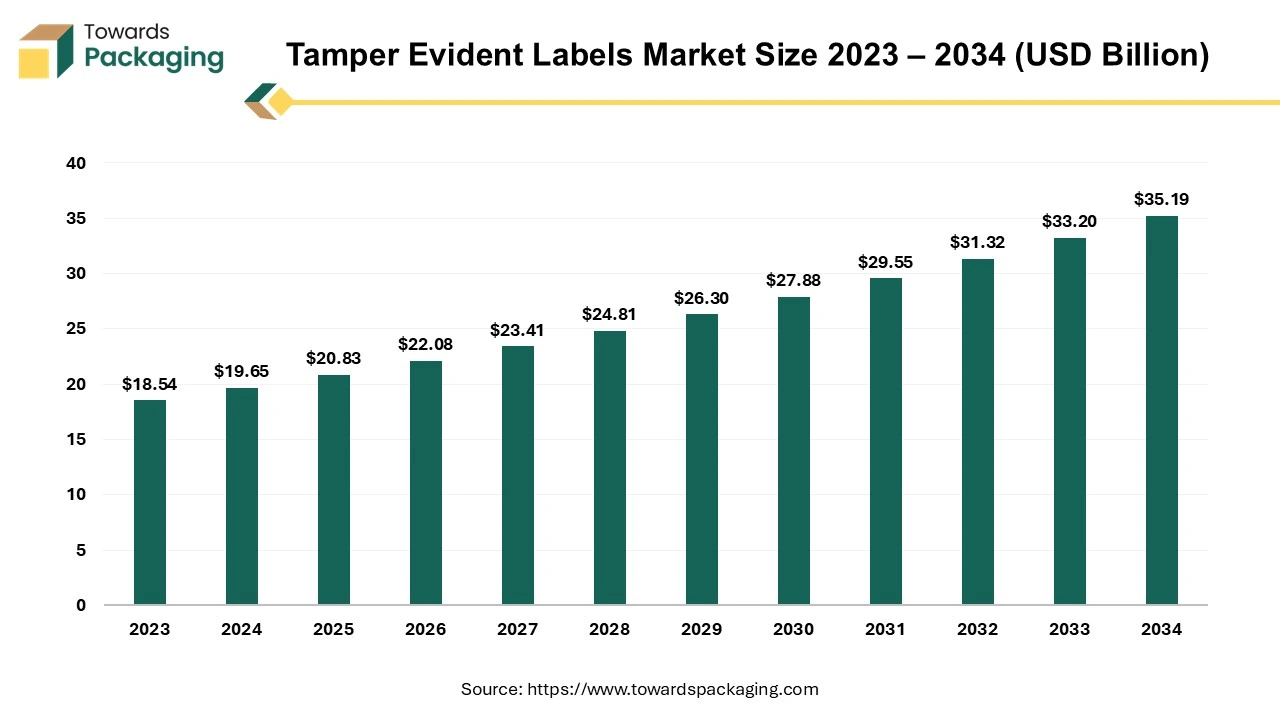

The tamper evident labels market is anticipated to grow from USD 20.83 billion in 2025 to USD 35.19 billion by 2034, with a compound annual growth rate (CAGR) of 6.00% during the forecast period from 2025 to 2034.

The tamper evident labels market is likely to register considerable growth during the projected period. The purpose of the tamper-evident labels is to prevent tampering and to provide visible proof of tamper or attempted tampering, thus securing the product to which they are attached. From valuable goods to important documents, the tamper-evident products are utilized in the security as well as protection of a wide range of objects. Once a security label has been applied, it will show signs of tampering. Each label product has a different tamper-evident feature. Product tampering, theft, and counterfeiting are constant issues that numerous organizations in a wide range of industries deal with. Due to this, the market for tamper-evident products is growing substantially and will continue to grow as more companies seek to safeguard their items, packaging and warranties.

The rising need for improved security in the pharmaceutical industry as well as the growing pharmaceutical industry is expected to augment the growth of the tamper evident labels market during the forecast period. Furthermore, the surge in global e-commerce along with the growth in the food and beverage industry is also anticipated to augment the growth of the market. Additionally, the advancements in smart labeling technologies such as QR codes and RFID-enabled tamper-evident labels coupled with the increased government regulations worldwide, mainly in the food and healthcare is also projected to contribute to the growth of the market in the near future.

The rapid expansion of the e-commerce and increase in the number of digital buyers is projected to augment the growth of the tamper evident labels market during the forecast period. As per the International Trade Administration, by 2027, globally the B2C e-commerce sale is predicted to surpass USD$5.5 trillion at a constant yearly growth rate of 14.4%. Also, the worldwide retail e-commerce CAGR was projected to be 11.16 % during the time period 2023 through 2027 based on latest industry projections. In addition, 27 million Canadians, or 75 percent of the country's population, used e-commerce in 2022. Furthermore, the Ministry of Economy, Trade, and Industry (METI) of Japan published its yearly e-commerce Market Survey in August 2022, revealing that in 2021, Japanese customers spent $3.1 billion on cross-border online purchases from US retailers.

According to the above data, e-commerce is growing rapidly, but with advancement, there are obstacles along the way. Nearly one out of every four packages that are ordered online is returned. In certain instances, customers placed orders for different products and received different ones whereas in other cases, duplicate and used products were delivered; and in some cases, sellers of counterfeit goods were reported and arrested for using the branded packaging and labels to sell lower-quality goods. Due to these events, the tamper-evident labels are becoming more popular. Tamper-evident labels provide visible evidence that the product was not altered or opened during transit, which is important in establishing confidence between companies and customers. For example, Amazon has established stringent packing standards, specifically for high-value and sensitive commodities, urging sellers to incorporate tamper-evident measures to prevent fraudulent returns and illegal access.

There are a number of limitations associated with using tamper-evident labels, however they don't receive the attention they need because counterfeiters have already figured out how to get around them. First of all, any visible identifier creates a false impression of authenticity and with the correct tools; a determined thief may quickly produce thousands of replicas. The exclusivity aspect is long gone since label imprinting technology is now readily accessible. The equipment and software that are used to create these labels are not proprietary, so anyone with the right information may creatively take use of them, even though they are not very affordable. For instance, one may transport the security labels themselves first and then attach them afterward, instead of sticking a phony label on the product before shipping. Once someone is able to produce realistic fakes of security labels, it is not very difficult for them to execute this scam.

Furthermore, this sort of advancement is much more costly to deploy than one might anticipate, even though it is widely used. By selecting the incorrect software, a business can unintentionally become reliant on and locked into a particular supplier that utilizes proprietary technologies. Also, the labels may be so unattractive that they distract consumers away from the vibrant branding and product images. Incorporating additional security measures, like holograms or holographic fingerprints, makes issues much more complicated and costly to execute. As a result, no end-user will have the ability to distinguish between authentic and counterfeit labels. When a label is broken, unknowingly removed, or ruined during delivery, it becomes much more questionable. Thus, these factors pose a major challenge and are likely to limit the growth of the market within the estimated timeframe.

The rising demand for the sustainable packaging is likely to create growth opportunities for the companies in the tamper-evident labels market. The increasing global awareness of environmental issues such as pollution and climate change has amplified the concerns about the waste produced by conventional packaging materials. Consumers are increasingly aware of the environmental impact of the single-use plastics and excessive packaging, leading to a preference for recyclable, compostable and biodegradable alternatives that have a smaller ecological footprint. Also, governments and regulatory bodies are introducing policies across the globe that are aimed at reducing the waste as well as promoting sustainable packaging. For instance, the European Union implemented bans on few single-use plastics and has also introduced packaging waste targets, pushing the companies to adopt sustainable practices.

Labels that are made-up of compostable paper and eco-friendly adhesives minimize environmental impact and attract the eco-conscious consumers who view sustainability as a core purchasing factor. A number of companies are already pioneering these advancements. For instance:

Additionally, innovations in the adhesive technology now allow for tamper-evident labels that are strong yet fully biodegradable, guaranteeing package integrity without adding to plastic pollution. By investing in sustainable tamper-evident solutions, companies can fulfill consumer demand for eco-friendly options, improve brand loyalty and establish a competitive advantage. This shift toward sustainability in tamper-evident labeling not only meets market demand but also supports broader environmental goals.

The void labels segment held largest market share of 40.21% in 2024. Void labels are known for their special security features and tamper-evident characteristics. When removed, these labels leave behind a variety of designs, such "VOID," "DOTS," "CHECK BOX," or a unique name that is customized to each customer's demands. They are designed to offer an indestructible barrier for the product authenticity and warranties. These labels are carefully attached to the products' vulnerable points and important seams, making any illegal access or tampering immediately apparent. Due to this such labels are difficult to counterfeit, any tampering or alteration of the product will be detected. The demand for the void labels is rising across end-use sectors such as pharmaceuticals, consumer electronics, and food and beverage, among others since they are used to prevent fraud and shield products from tampering.

The healthcare & pharmaceuticals segment dominated the market with substantial share in 2024. This is attributed to the strict regulatory demands and the need for product safety. Moreover, the increasing healthcare spending and the expansion of the biologics and specialty drugs are some factors contributing to the segmental growth of the tamper evident labels market. Apart from that, the OTC sector is currently growing faster than the majority of industries, opening up new markets for companies and brands and paving the way for a more robust 3.8% global growth rate this year. According to the IQVIA Consumer Health's OTC Forecasts, the market is anticipated to maintain its current development trajectory, reaching 5.4% growth by 2025. Additionally, the growing e-commerce sector is also expected to increase the sales of the OTC products. In terms of revenue, e-commerce sales of healthcare products climbed from 27% in 2019 to 34% in 2022, as per the Consumer Healthcare Products Association.

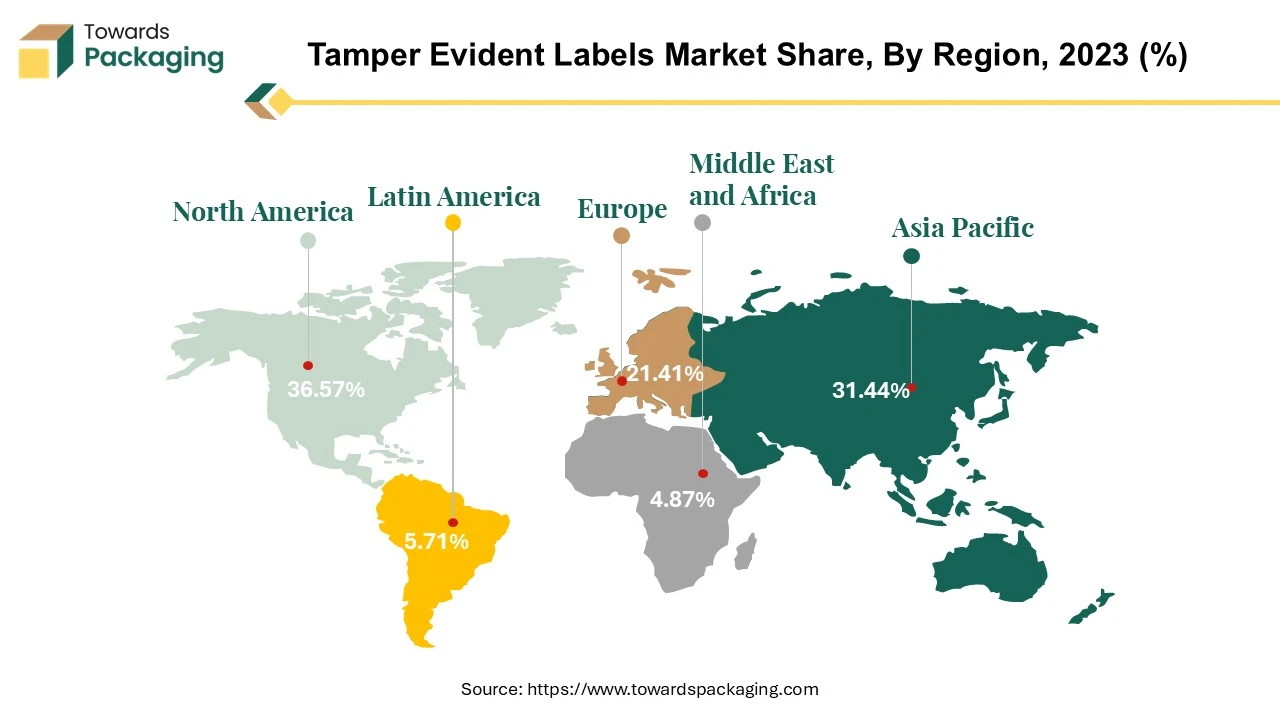

North America held the largest market share of 36.57% in 2024. This is attributed to the stringent regulations, large industrial base, vast pharmaceutical industry, and growing expenditures on packaging. Stringent regulations and guidelines for packaging in sectors like pharmaceuticals, food and beverages have been the major demand drivers for tamper evident labels. For instance, FDA requires tamper evident characteristics for certain products (21 CFR 211.132) specifically over-the-counter drugs and food items, which further fuels the demand for these labels. Moreover, the rising efforts towards combatting counterfeiting and improving the product security companies are focusing on strengthening their portfolio which ultimately promotes the growth of the market.

Asia Pacific is likely to grow at fastest CAGR of 8.18% during the forecast period. This is attributed to the presence of huge and growing healthcare markets such as China and India combined with the rising adoption of advanced packaging options across the end-use industries. Healthcare and pharmaceuticals are the major consumers of tamper evident labels and growing healthcare spending in these countries is likely to create lucrative opportunities for the market. According to the India Brand Equity Foundation, the healthcare industry in India was valued at USD 110 billion in 2016 and it is expected to reach USD 638 billion by 2025. Moreover, as per the Economic Survey 2022-23, public spending on healthcare held a 2.1 % share of GDP in FY23 and 2.2% in FY22, against 1.6% in FY21 and the Indian Health Ministry aims to reach 2.5% by FY25. Additionally, the local regulatory standards in food and healthcare and demand for the security are also projected to support the growth of the market in the region in the near future.

By Material

By Product

By End-Users

By Region

April 2025

April 2025

April 2025

April 2025