April 2025

.webp)

Principal Consultant

Reviewed By

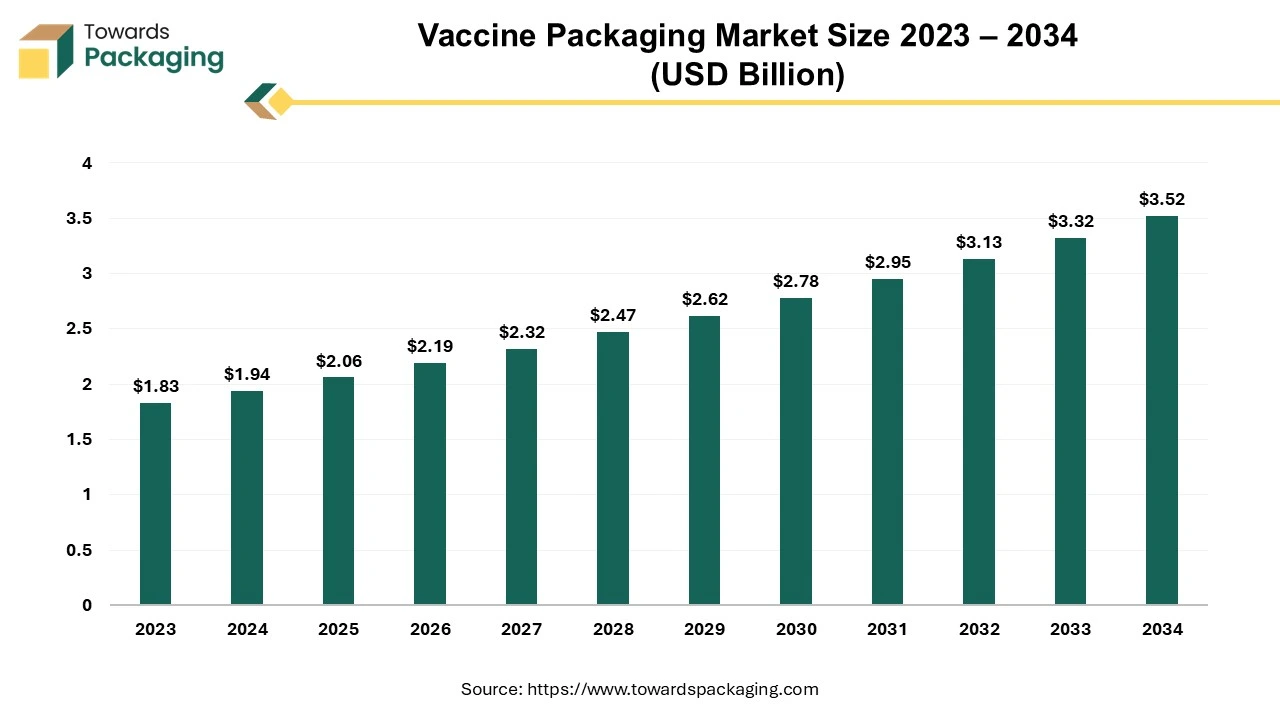

The global vaccine packaging market size is expected to attain USD 3.52 billion by 2034, rising from USD 1.94 billion in 2024, at a compound annual growth rate (CAGR) of 6.14% from 2024 to 2034.

The vaccine packaging market is set to expand substantially over the forecast timeline. Innovations in vaccine packaging may have an effect on user acceptance and adoption as well as the supply chain. The benefits of these innovative package designs for public health are evident in their simplicity in use, increased safety, and improved logistics of supply and uptake that creates new chances for vaccination. Furthermore, there appears to be strong user acceptance at the national level. Stakeholders worldwide are interested in two packaging innovations currently that are the dual-chamber delivery devices and the compact pre-filled auto-disable devices (CPADs).

The rising incidence of infectious diseases, such as influenza, measles and COVID-19 along with the growing global immunization programs is expected to augment the growth of the vaccine packaging market during the forecast period. Furthermore, the advancements in biotechnology as well as the expansion of the cold chain logistics sector driven by the need to transport temperature-sensitive vaccines safely are also anticipated to augment the growth of the market.

Additionally, the rising investments in healthcare infrastructure and the shift toward single-dose vaccines is increasing the demand for unit-dose packaging formats is also projected to contribute to the growth of the market in the years to come. The global packaging industry size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Artificial Intelligence (AI) has already integrated itself into the healthcare and pharmaceutical industry in the last few years. It is being widely used in drug development and processing vast amounts of data to help researchers work smarter and faster. The vaccine packaging industry has been slowly finding applications for AI into their infrastructure. AI helps improves overall efficiency of operations, that helps in streamlining production processes. Consistent quality and anomaly detection can be accomplished by utilizing AI-based technologies.

With any health-related packaging, regulation compliance plays an important part. AI can ensure that all compliances are being met during the production with quality control. Supply chain optimization is crucial to conduct proper logistics as these are essential goods. AI combined with Internet of Things (IoT), can help track and optimize routes for delivery ensuring the process runs smoothly. Artificial Intelligence’s full potential is yet to be explored in the vaccine packaging industry and is anticipated to help this market’s growth during the forecast period.

The expansion of vaccine production capacities is expected to fuel the growth of the vaccine packaging market within the estimated timeframe. This is owing to the rise of infectious diseases, pandemics like COVID-19 and the need for routine immunization programs. Thus, pharmaceutical companies and governments are rapidly increasing their vaccine production capacity.

For instance,

These expansions are not just aimed to fulfill urgent demands, but also to prepare for possible future pandemics and epidemics. As manufacturing capacity increases, so does the demand for efficient, dependable and scalable packaging. The increase in production, particularly in developing countries, is likely to drive the demand for high-volume packaging materials such as vials, prefilled syringes and ampoules.

The disruptions in the global supply chain for raw materials like glass, plastics and polymers is expected to limit the growth of the market during the forecast period. Geopolitical issues such as the war in Israel, the US-China rivalry, the Russian invasion of Ukraine and elections, had a substantial impact on the global supply chain, particularly on the essential raw materials used by numerous industry verticals. Sharp price increase and the production delays across industries are being caused by constraints on the supplies of certain raw materials, mainly polypropylene (PP), polyethylene (PE) and monoethylene (MEG). These chemicals are utilized to make plastics that are found in almost every type of the product such as equipment and packaging.

Moreover, global epidemics and the possibility of new variations increasing could result in labor shortages and border closures that worsen interruptions to the packaging material supply chain. All of these factors focus on the complicated connection that exists among geopolitical stability and the seamless functioning of international supply networks in the packaging industry.

Furthermore, the daily operations of plastics manufacturing firms as well as other organizations outside the sector have been directly impacted by these issues with the raw material supply chain. This material is utilized for manufacturing a multitude of products considered essential for health and wellbeing such as gloves, syringes and medical equipment. This industry is directly and severely impacted by the disruption in the supply chain today. Additionally, the lack of resin has led to an increase in the resin costs globally. Pharmaceutical companies sometimes bear the burden of these higher costs, which may restrict their capacity to mass-produce packaging for vaccines. Consequently, the market's capacity to grow is limited by the general instability of the supply chain, especially in regions with inadequate infrastructure.

The developments and advancements in the vaccine technologies are anticipated to augment the growth of the vaccine packaging market in the near future. The landscape of vaccine production has changed due to the emergence of novel immunization techniques as viral vector and mRNA vaccines. A recent advancement incorporates the successful application of mRNA as a protective vaccination. The addition of 5' Kozak and cap sequences, 3' poly-A sequences, codon optimization, altered nucleosides to increase mRNA stability and reduce detection by innate immune cell receptors, intradermal injection to minimize the RNA degradation and the production of thermostable mRNA are some of the methods that can increase the effectiveness of mRNA vaccines.

Some of the recent developments in the new vaccines include

The packaging sector is likely to gain from the growing complexity of vaccines as they continue to develop, creating a higher need for specialized, cutting-edge, and dependable packaging options. This trend presents substantial opportunities for packaging companies to innovate and provide value-added solutions for the next generation of vaccines.

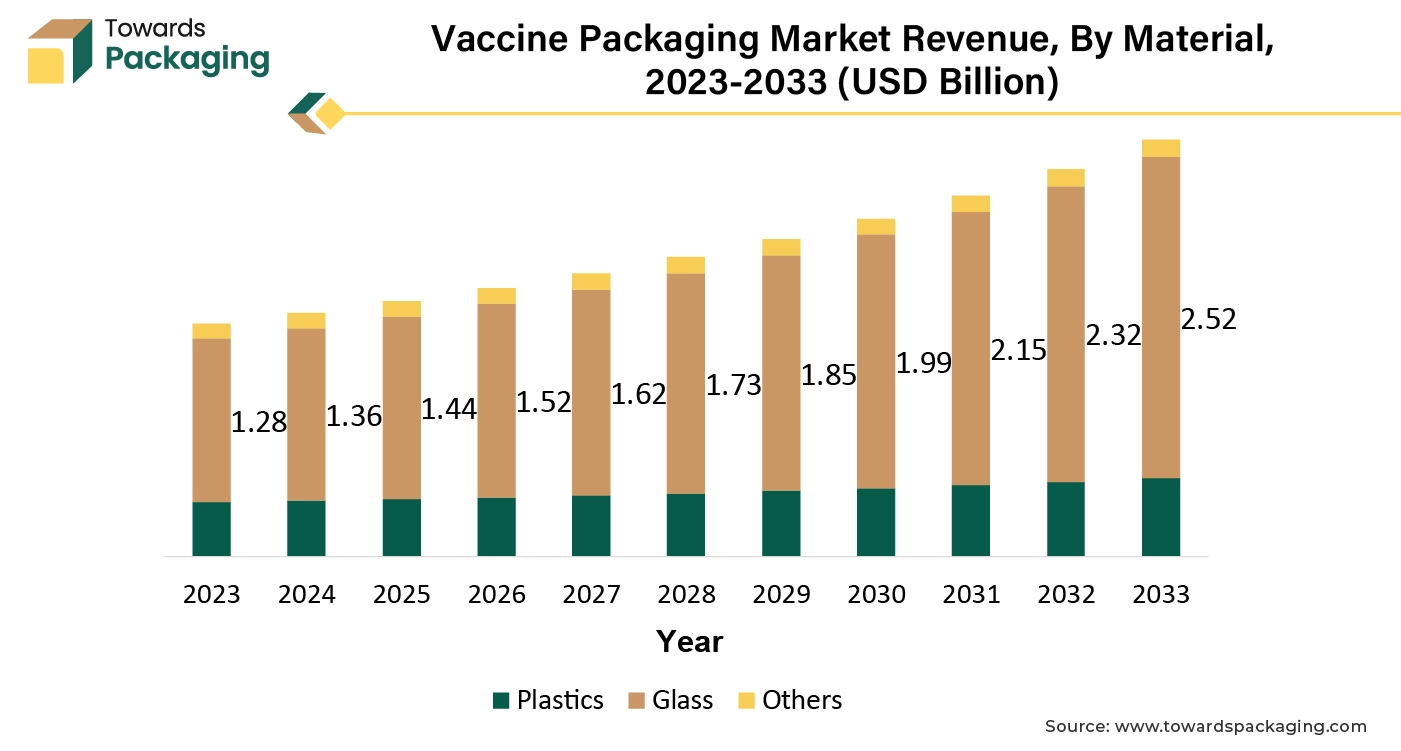

The glass segment captured largest market share in 2023. This is due to its unmatched properties that make it the preferred material for vaccine packaging. As it is inert, borosilicate glass is the most common material utilized for packaging vaccines. The ability of this unique glass to withstand chemicals as well as, in particular, heat from the outside is essential for preserving the vaccine. The vaccination within the glass bottles is therefore kept as durable and optimally protected as possible due to the glass only minimally expands in response to variations in the outside temperature.

Further, the packaging used for vaccines needs to be resilient to both the risks associated with international shipping and extremely high temperatures. As a result, glass is the material most frequently used to make vaccine vials since it is strong and can withstand high temperatures. Certain vaccine makers are likely to stick with the current packaging type, even though better packaging is still needed as COVID-19 vaccines require different storage conditions than regular glass vials.

The vials segment held the largest market share in 2023. Glass vials are preferred for their ability to preserve the stability as well as effectiveness of the vaccines over long periods. Globally, over fifty billion glass vials are made and sold for a variety of uses. SCHOTT, having 20 authorized glasses and factories worldwide, is one of the biggest producers of pharmaceutical packaging units. SCHOTT vials were utilized by three of the four vaccine studies that are undergoing the clinical testing for their vaccination campaigns. It generates approximately eleven billion glass vials annually in total.

Major participants in the pharmaceutical glass vial industry such as SCHOTT, Gerresheimer, Stevanto group, Corning and DWK Life Sciences have expanded their production capacity and quality in response to the continuous demand. Furthermore, vials also comply with the strict regulatory requirements for pharmaceutical packaging, providing the safety required for large-scale vaccination campaigns.

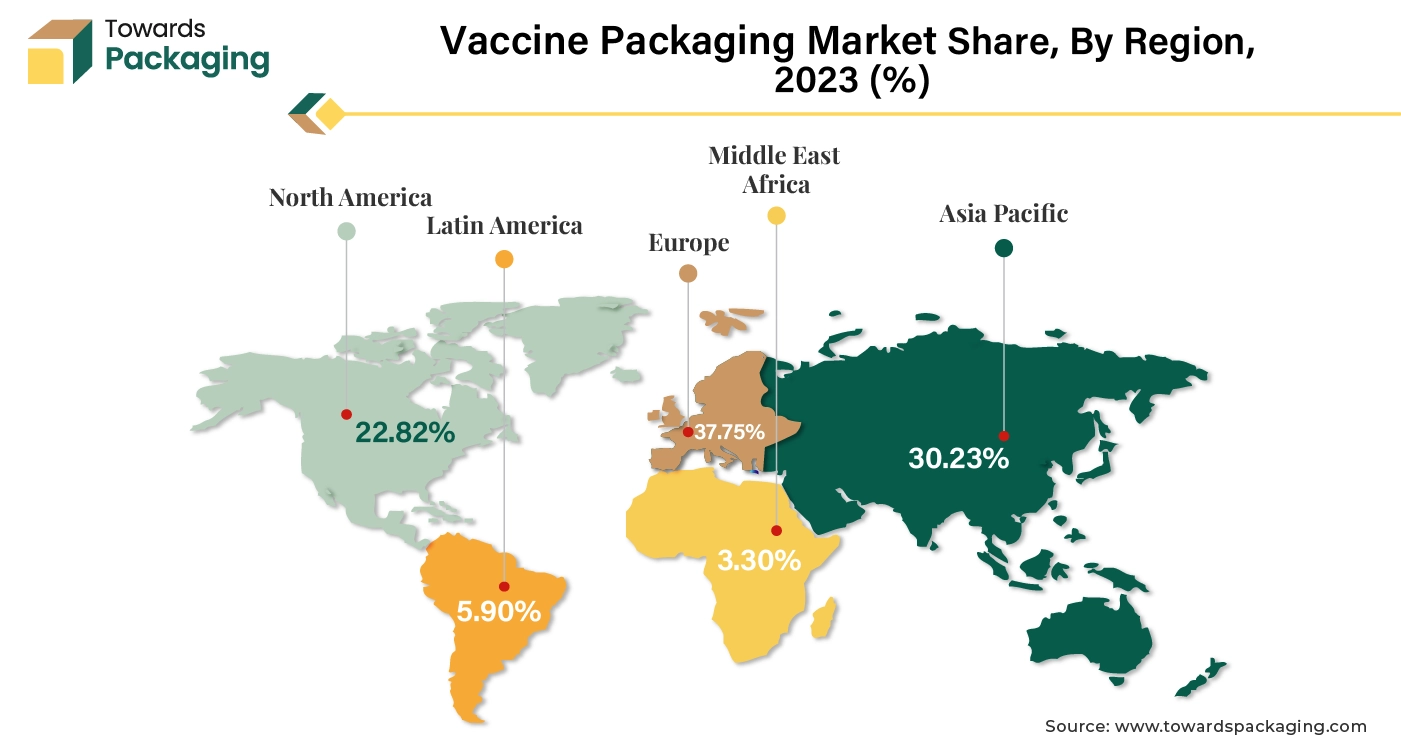

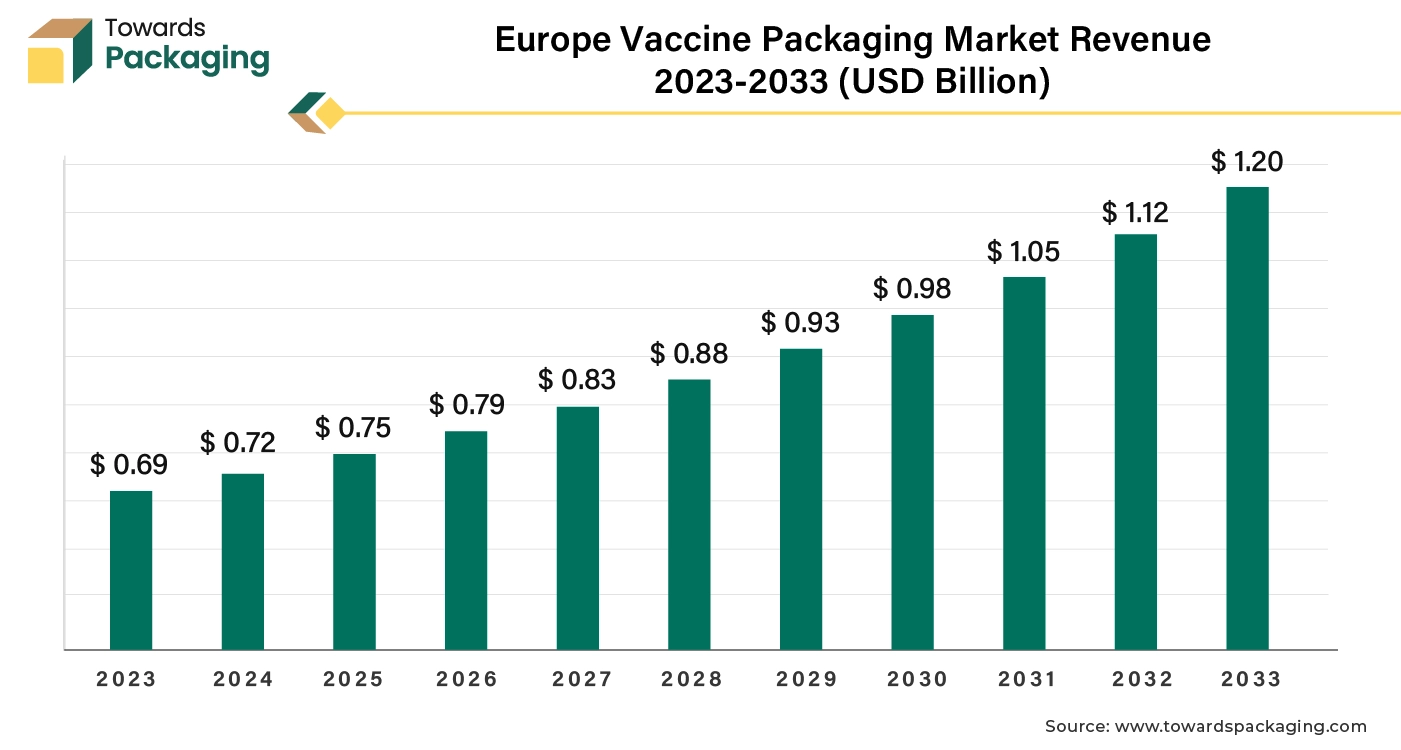

Europe held the largest market share of 37.75% in the world in 2023. This is due to the well-established and highly advanced healthcare system that supports large-scale vaccine production and distribution across the region. Furthermore, the presence of the most stringent regulatory requirements for vaccine packaging, governed by agencies like the European Medicines Agency (EMA) as well as the expansion of vaccine production capacities is also expected to contribute to the regional growth of the market.

For instance,

Asia Pacific is likely to grow at fastest CAGR of 8.29% during the forecast period. This is owing to the increasing vaccine production in economies like China and India. As per the data by the Invest India, India has emerged as a dominant force in vaccines for diseases such as measles, Bacillus Calmette–Guérin (BCG), and Diphtheria, Tetanus and Pertussis (DPT).

Asia Pacific is poised to be the fastest expanding market for vaccine packaging in the forecast period. In India, for example, the pharmaceutical and healthcare industry expansion is on the rise. The government of India is taking constant efforts and making investments in improving the healthcare and pharmaceutical sector paving the way for new opportunities. The growing population directly increase the need for vaccines. India is leading innovation and development in drugs and medicine at a lower cost for various diseases. The country could become a growth opportunity for the vaccine packaging market in the Asia Pacific region during the forecast period.

For instance,

Some of the key players in vaccine packaging market Schott AG, Gerresheimer AG, Stevanato Group, SGD Pharma, Nipro Corporation, Corning Incorporated, West Pharmaceutical Services, Inc., AptarGroup, Inc., Becton, Dickinson and Company (BD), and Catalent, Inc., among others.

By Material

By Type

By End-Use

By Region

April 2025

April 2025

April 2025

March 2025