The accessible packaging market is experiencing rapid growth, with forecasts projecting revenue to reach hundreds of millions between 2025 and 2034. Driven by the rising demand for inclusive, user-friendly, and sustainable packaging solutions, this expansion is set to revolutionize global infrastructure while enhancing accessibility and eco-conscious innovation across industries.

The accessible packaging market is likely to witness considerable growth during the forecast period. The design concept of the accessible packaging takes into account the various demands as well as capabilities of every user. It aims to create packaging that is simple to open, handle and use; independent of the user's physical or cognitive skills. It guarantees that every client may independently access and use goods, irrespective of their abilities.

In order to assure that every individual, even people having cognitive impairments or literacy issues, can make informed choices about the products they purchase, accessible packaging goes beyond simple physical access and comprises clear and intelligible product information. Accessible packaging can help brands through improving client satisfaction while providing brand identity, in addition to helping consumers. Also, inclusive packaging reduces waste by considering sustainability.

The aging population across the globe along with the regulatory frameworks in North America and Europe is expected to augment the growth of the accessible packaging market during the forecast period. Furthermore, the rising consumer awareness about accessibility coupled with the increase in the prevalence of disabilities globally is also anticipated to augment the growth of the market. Additionally, the focus on universal design principles as well as the push for sustainability and the growing demand from the emerging markets is also projected to contribute to the growth of the market in the near future.

The aging population is expected to augment the growth of the accessible packaging market within the estimated timeframe. This is owing to the increased life expectancy and declining birth rates as well as innovations in the healthcare sector. As per the United Nations Department of Economic and Social Affairs, Population Division, it is predicted that by the end of the 2070s, there will be 2.2 billion people worldwide who are 65 years of age or older, exceeding the number of children (those below the age of 18). By the middle of the 2030s, it is expected that there will be an estimated 265 million people aged 80 and over, exceeding the total population of the infants that are 1 year old or under. The percentage of the people 65 and older is projected to increase swiftly, almost doubling from 17% to 33% between 2024 and 2054.

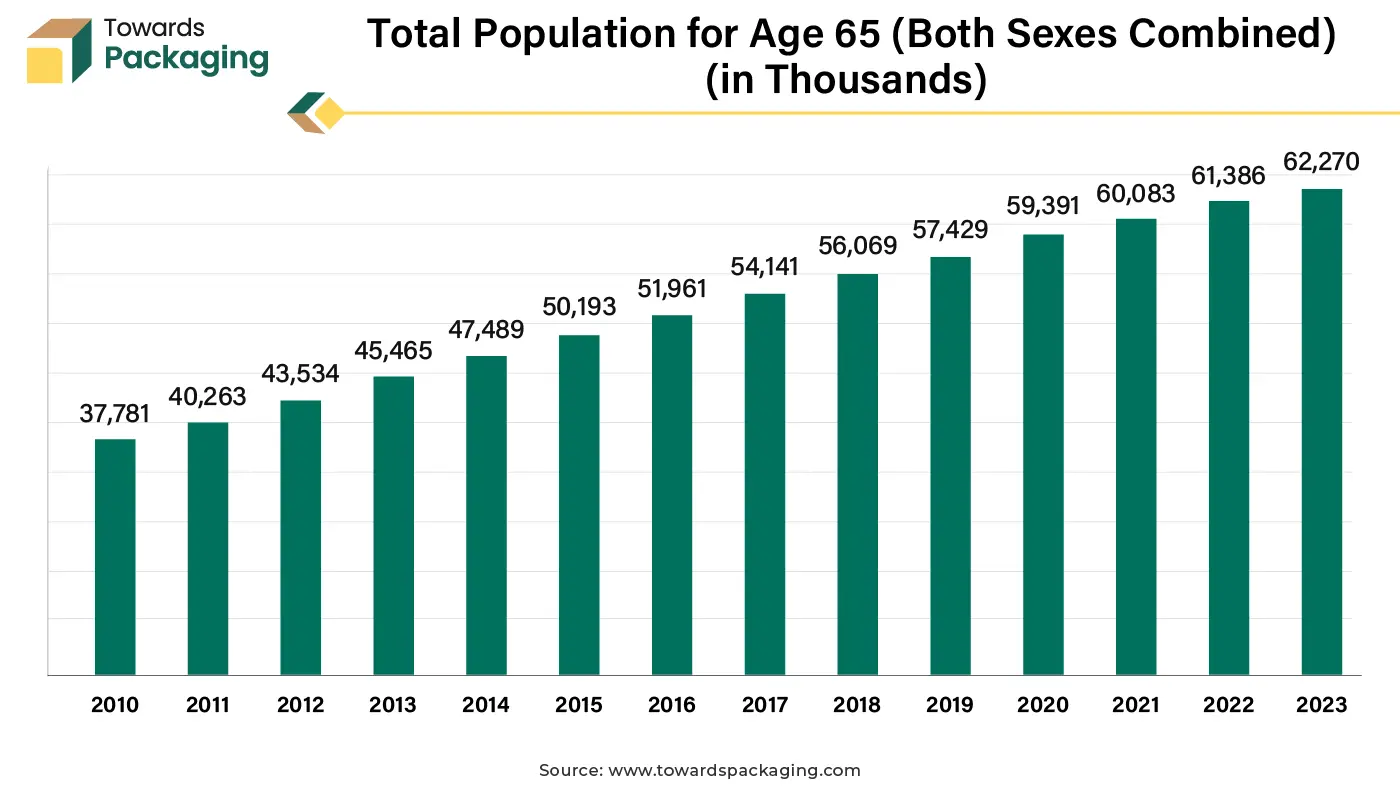

The graph above depicts the increase in the global population aged 65. Starting at roughly 37.69 million in 2010, the population continues to rise year after year, reaching over 62.27 million in 2023. This inclination reflects the global demographic transition towards an elderly population. The aging presents specific challenges for older persons, such as limited mobility, diminished grip strength, and declining vision. Traditional packaging designs frequently fail to solve these issues, making it difficult for the elderly to obtain ordinary products such as food and beverages, healthcare items, and prescriptions. As a result, there is an increased demand for ergonomically developed, easily accessible packaging.

The limited awareness in emerging markets & lack of standardization in many regions is likely to restraint the growth of the accessible packaging market during the forecast period. In many developing countries, the main focus is still on cost efficiency rather than inclusiveness, as affordability is a top priority for consumers. As a result, accessibility is sometimes considered as a secondary or specialized necessity, rather than an important part. This approach reduces demand for such packaging products, preventing companies from making investments in innovation and production customized to accessibility requirements. Industries in these regions frequently promote traditional packaging designs that are economical to manufacture but fail to fulfill the needs of people with physical or sensory disabilities.

Furthermore, without clear, globally recognized standards, organizations suffer difficulties in knowing the specific needs required to make their packaging accessible to individuals with disabilities. This lack of uniformity leads to unequal implementation of the accessibility features, resulting in a fragmented approach in which packaging choices differ greatly between regions, industries and even specific brands. Thus, consumers who rely on accessible packaging may experience difficulty while attempting to utilize the products, as the accessibility features may not be standardized or easily identifiable.

For example, the usage of Braille and color contrasts may be inconsistent, making it difficult for the people with disabilities to select packaging that fits their needs. This lack of awareness and standardization hinders the possibility for accessible packaging to achieve its complete market potential by preventing companies from recognizing its broad value while also limiting customers' ability to readily obtain the products they need.

The increasing prevalence of physical and visual impairments worldwide owing to the aging population as well as improved survival rates from accidents and diseases is expected to create substantial growth opportunity for the accessible packaging market in the near future. Chronic diseases such as diabetes, cardiovascular conditions and arthritis are likely to contribute considerably to the long-term disabilities, as these conditions become more prevalent with lifestyle changes and aging.

According to the World Health Organization, it is estimated that 1.3 billion people suffer from severe disabilities. This amounts to 1 in 6 persons, or 16% of the world's population. Some disabled people die off up to 20 years before their non-disabled counterparts. Also, those with disabilities are twice as likely to experience obesity, poor oral health, diabetes, stroke, depression, or asthma.

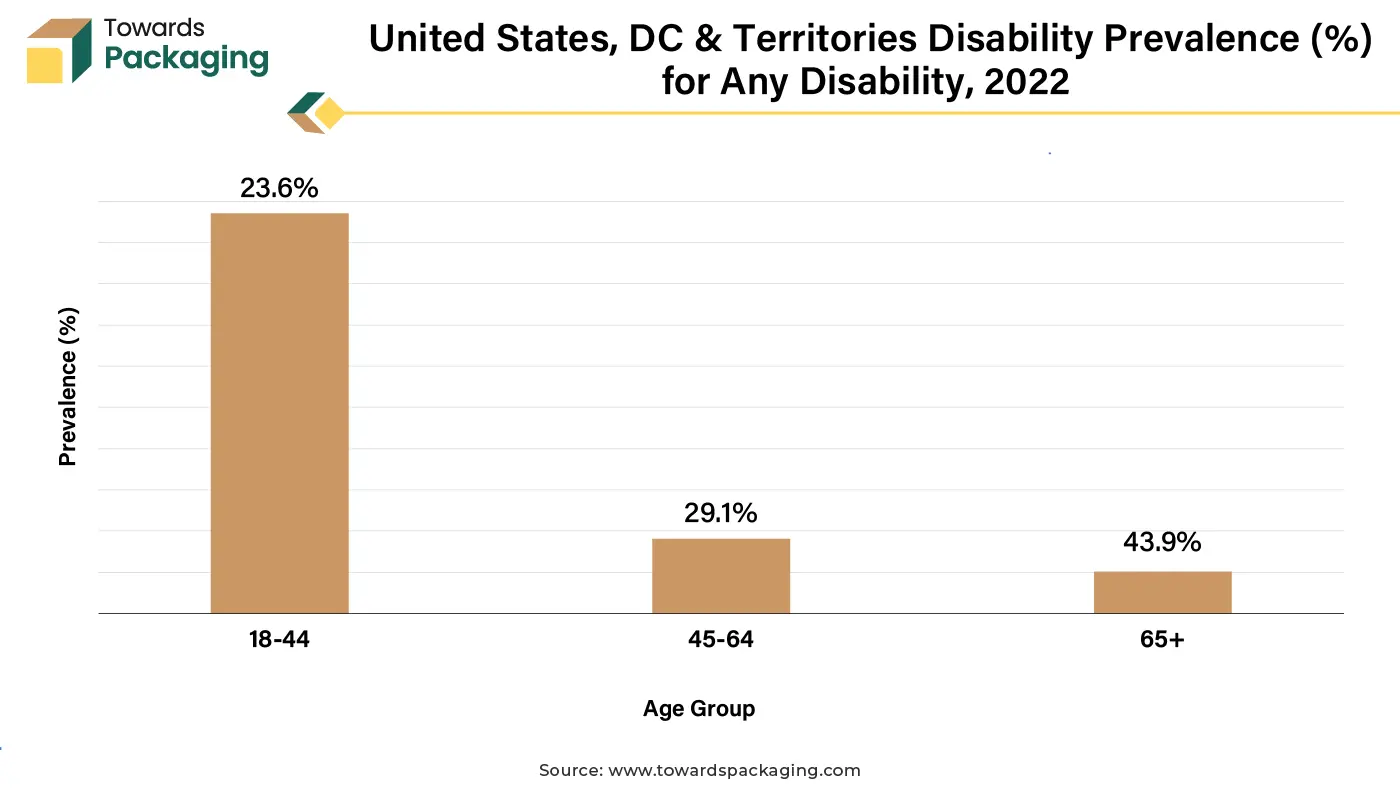

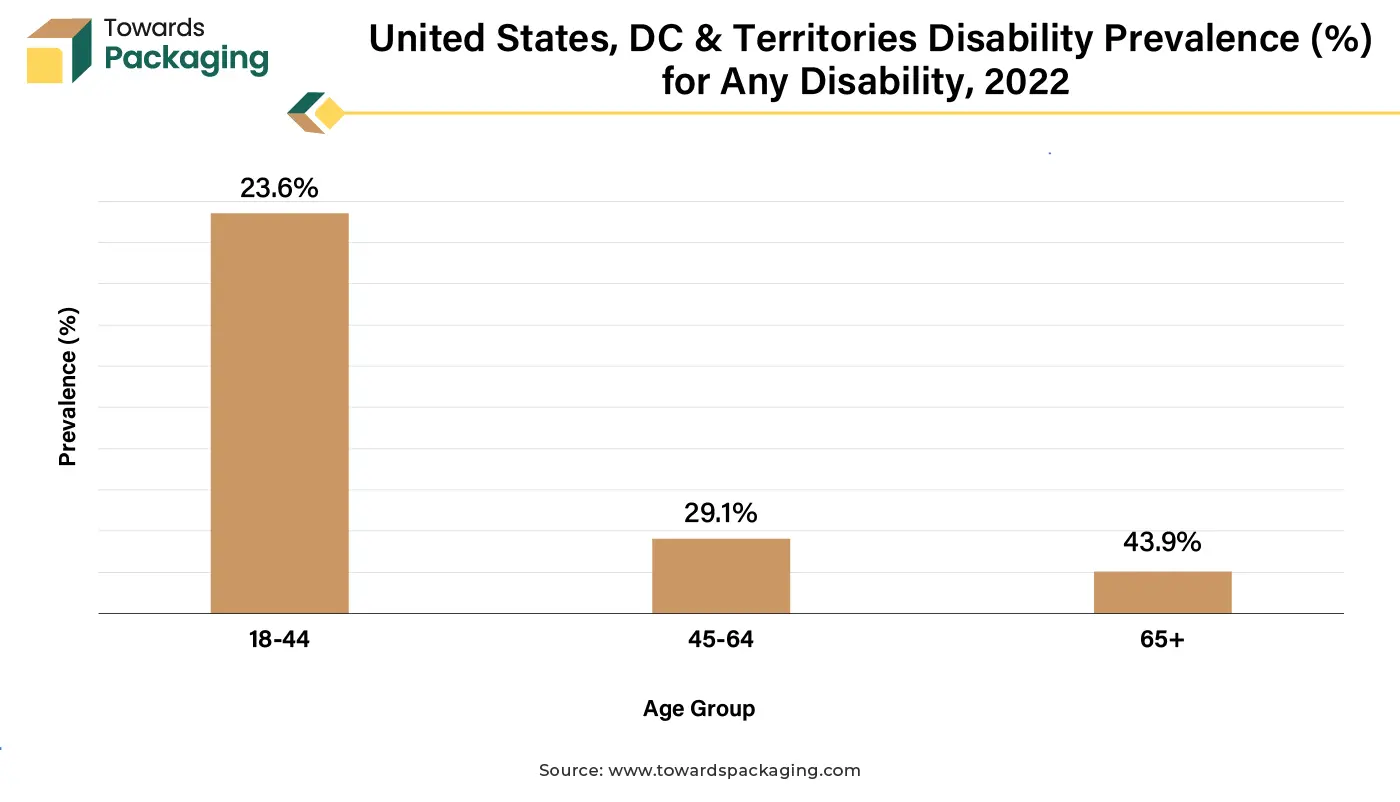

Furthermore, according to the most recent statistics from the 2022 Behavioral Risk Factor Surveillance System (BRFSS), over 70 million of the adults in the US that is more than one in four people reported having a disability in the year 2022. This rising demographic shows the need for packaging products which tackle the specific issues that people with disabilities encounter, such as trouble reading small text, opening tightly sealed containers, or discriminating between items with similar designs. Adaptive packaging methods are intended to bridge this gap.

These technologies not only improve usability for persons with impairments, but they also promote independence and respect in daily chores like accessing food, prescriptions, and home supplies. Brands are also concentrating on the development of adaptive packaging to define them as inclusive and socially responsible, resulting in increased customer loyalty.

The integration of artificial intelligence is expected to modernize the accessible packaging market through improving the efficiency as well as helping with customization. Manufacturers can analyze consumer behavior and simulate user interactions to create packaging that will suit for elder individuals and people with disabilities with the utilization of AI models. For example, AI can optimize the ergonomics of the packaging and provide clear labeling for maximum usability. AI can also be used in the predictive maintenance as well as quality control during production, reducing the defects and confirming that the accessibility features are consistently implemented.

Although QR codes are already amazing on their own, they can be even more effective if used with artificial intelligence. Due to the Natural Language Processing (NLP), AI is able to examine not only the text contained in a QR code but also its context and its fundamental meaning. AI can better interpret the purpose of a QR code because of NLP techniques. Additionally, artificial intelligence algorithms can improve the quality of a QR code image by pre-processing it. This involves methods like sharpening, contrast correction, and noise reduction.

AI algorithms make sure that the data and the pattern of the QR code are more readable and unique through improving the image quality. Companies can accelerate the development of the innovative and inclusive solutions with AI while reducing costs, thereby making accessible packaging more widely available. This combination of AI and packaging technology has the potential to alter the market, solving the different needs of the consumers more effectively.

The bottles and containers segment held substantial market share in the year 2024. This is owing to its widespread applicability across industries such as food & beverages, healthcare and personal care. These packaging formats are very versatile and suitable for products like liquids, solids as well as semi-solids. The rising consumption of liquid medications, supplements, and health drinks is expected to contribute to the growth of the segment within the estimated timeframe. Additionally, both plastic and glass bottles are recyclable, with most being suitable for local collections and this is also likely to support the segmental growth of the market during the forecast period.

The food & beverage segment held considerable market share in the year 2024. This is owing to the increasing demand for the convenience packaging as well as the preference for the ready-to-eat, single-serve and portable food products across the globe. Furthermore, the rise in health-conscious eating habits along with the growing packaging innovations like easy-to-open caps and ergonomic designs is also likely to contribute to the growth of the segment within the estimated timeframe. Additionally, the presence regulatory requirements that focus food safety, traceability, and accessibility coupled with the rise of premium and organic food products is further expected to support the segmental growth of the market in the near future.

North America held substantial market share in the year 2024. This is owing to the stringent regulatory frameworks like the FDA (Food and Drug Administration) and ADA (Americans with Disabilities Act). Additionally, the well-developed healthcare and pharmaceutical industries along with the prevalence of the disabilities as well as chronic conditions is also expected to contribute to the regional growth of the market.

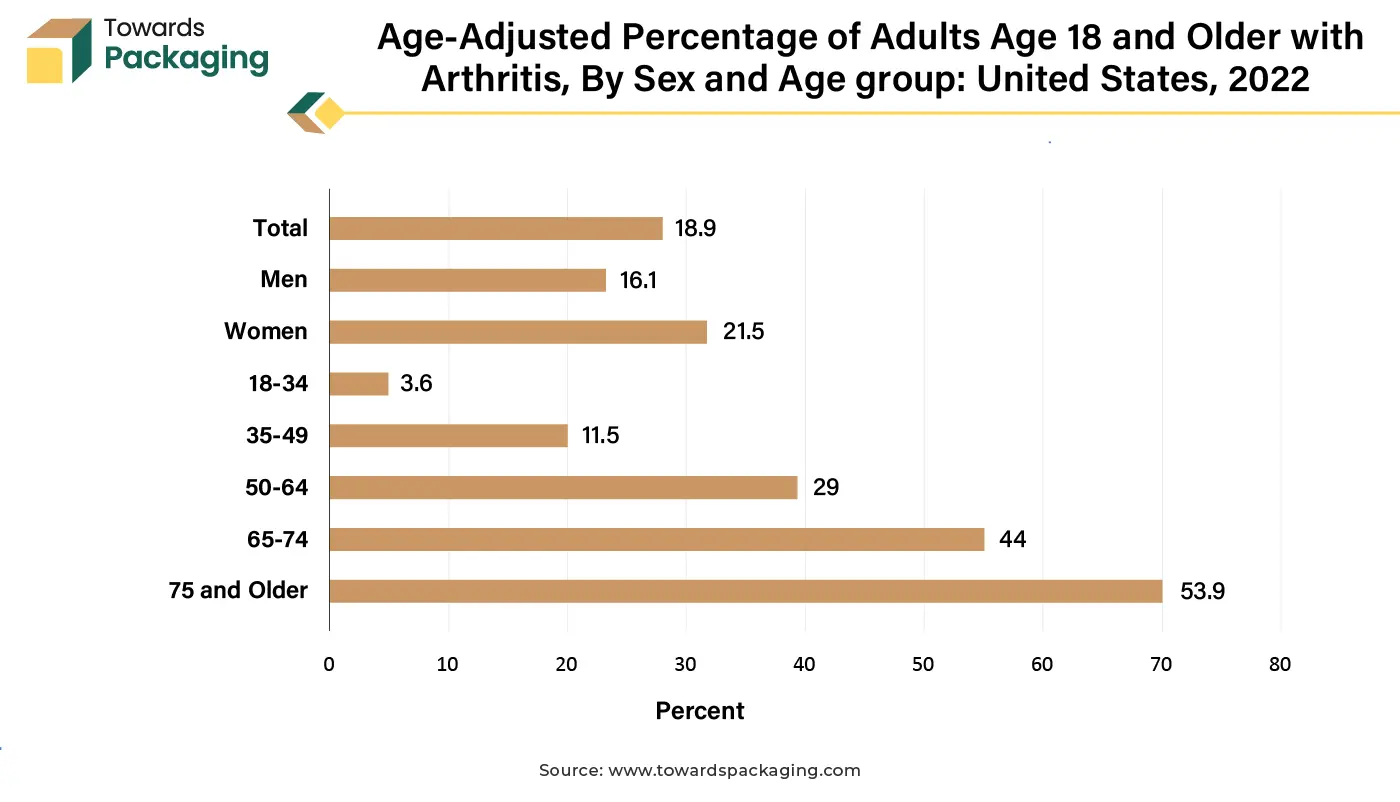

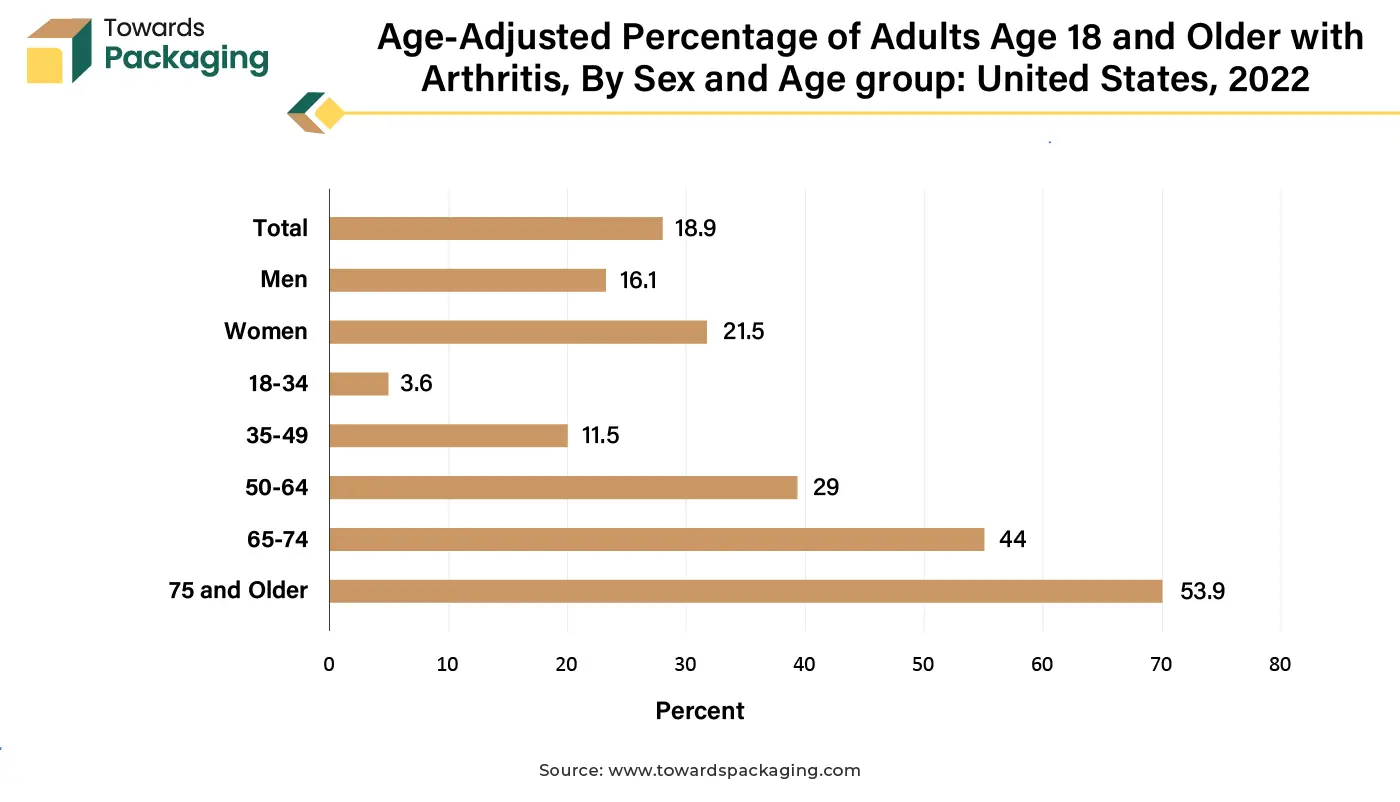

The National Center for Health Statistics revealed that women had a higher likelihood of having arthritis (21.5%) than men (16.1%) in 2022, with the age-adjusted rate of diagnosed arthritis among individuals aged 18 and older being 18.9%. The prevalence of arthritis escalated with age, rising from 3.6% among people aged 18–34 to 53.9% in individuals aged 75 and above. Arthritis is one of the leading causes of disability and can make tasks such as opening bottles, jars and other packaging challenging, requiring user-friendly designs. Furthermore, the growing focus on the sustainability is also expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at the fastest CAGR during the forecast period. This is due to the growing urbanization and aging population in the economies like China, India, and Japan. According to the Ministry of Internal Affairs and Communications, as of September 2024, Japan's aging rate that is the proportion of the population over 65 is increased by 0.2 percentage points. From September 2023, Japan's elderly population increased by 20,000 and reached 36.25 million, making up a record 29.3 percent of the country's total population.

The number of people aged 80 and older grew by 310,000 reaching 12.9 million, or 10.4% of the total. Compared to last year, the over-80 rate has increased by 0.3 percentage points. Also, the increase in chronic illnesses as well as the growing demand for products such as functional beverages and supplements is likely to contribute to the regional growth of the market. Furthermore, the higher disposable incomes are also expected to contribute to the regional growth of the market.

By Product Type

By Material

By End-Use Industry

By Region

March 2026

March 2026

March 2026

March 2026