April 2025

The packaging watermarking technology market is experiencing rapid growth, with projections estimating revenue to reach hundreds of millions between 2025 and 2034. This surge is driven by the rising demand for secure, smart, and sustainable packaging solutions, revolutionizing global infrastructure and enhancing anti-counterfeiting measures across industries.

The packaging watermarking technology market is likely to grow at a considerable CAGR in the near future. Packaging watermarks are smaller watermarks that are engraved into plastic or placed on packing labels. The codes on the watermarks provide information on the kind of plastic that was used, along with other pertinent details like the product's composition, colorants, and if it needs to be kept apart from other recyclables. The packaging is tracked and sorted in the recycling facility using high-resolution cameras that read the watermarks.

Adding digital watermarking to the brand has several advantages at a time when sustainability is important. Digital watermarking is the approach of the future for traceability, recycling, and the development of the circular economy.

The increasing percentage of the counterfeit products along with the stringent government regulations for the utilization of the secure packaging technologies is expected to augment the growth of the packaging watermarking technology market during the forecast period. Furthermore, the growing consumer awareness about the product safety and brand integrity coupled with the technological advancements such as the integration of blockchain as well as IoT with packaging systems is also anticipated to augment the growth of the market.

Additionally, the rising demand for the sustainable packaging as well as the global initiatives like the "HolyGrail 2.0" project is also projected to contribute to the growth of the market in the near future.

The rapid growth of the e-commerce due to the convenience of shopping from anywhere and at any time as well as the increasing penetration of the internet and widespread adoption of smartphones is expected to augment the growth of the packaging watermarking technology market within the estimated timeframe.

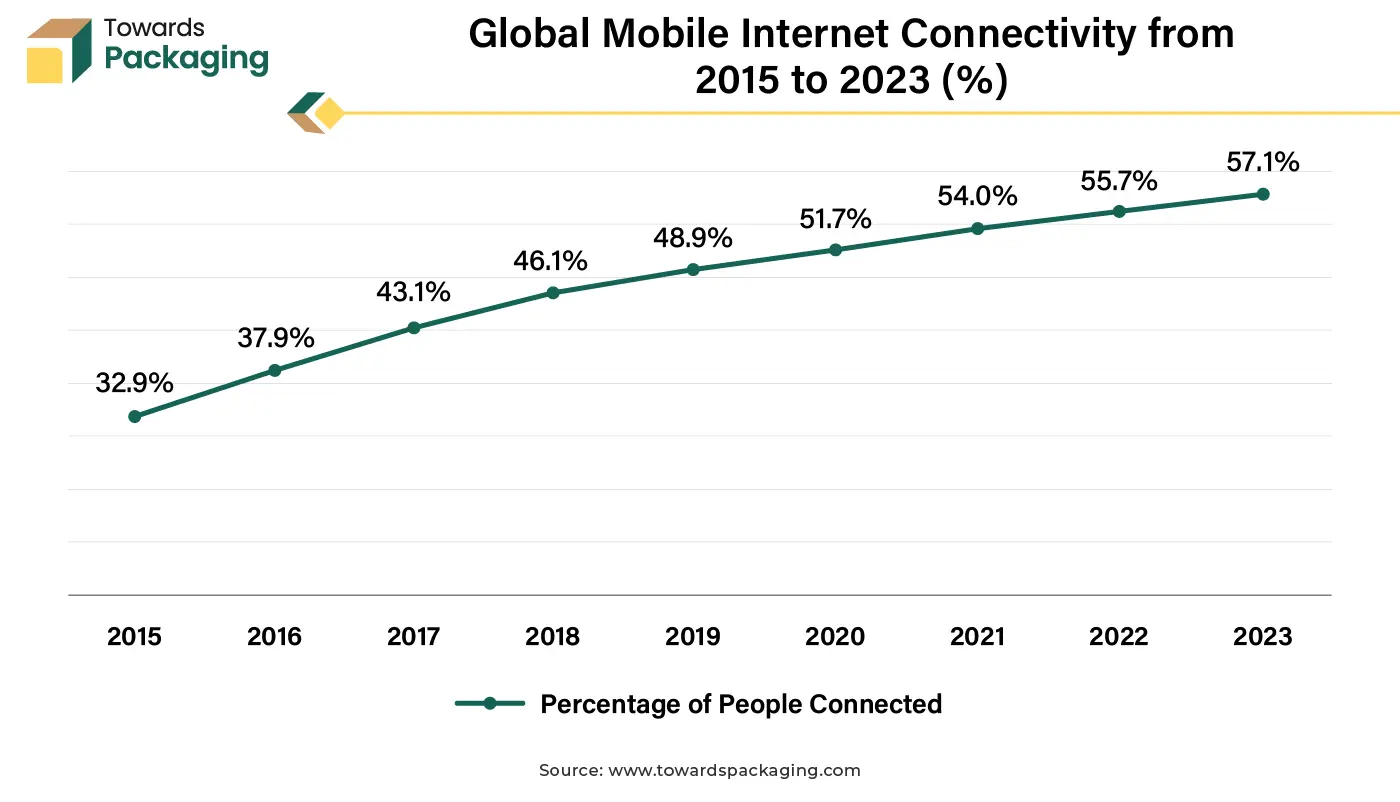

As per the GSMA’s ‘State of Mobile Internet Connectivity 2024’ report, nearly 57% of the world's population, or 4.6 billion people, use mobile internet on their own devices. LMICs (low- and middle-income countries) accounted for over 90% of the growth in 2023. The number of individuals using 4G or 5G smartphones to access the internet has increased by 330 million between 2022 and 2023, reaching over 80% of all mobile internet subscribers worldwide. Thus, the e-commerce sector has witnessed a surge in the volume of goods being transported across the complex supply chains.

This growth has increased the concerns about product authenticity as well as the integrity of the products in transit in sectors such as electronics, pharmaceuticals, and luxury goods, where counterfeiting is a major risk. Digital watermarking is expected to respond to these issues by incorporating undetectable codes into packaging that can be scanned to verify product authenticity and track its travel through the supply chain. This promotes transparency and trust between brands and consumers because products can be tracked from production to delivery.

Furthermore, digital watermarks are also likely to help companies to battle challenges such as product return fraud and unlawful distribution, so protecting their reputation and revenue. As e-commerce grows globally, companies that invest in secure and trackable packaging not only handle urgent logistical and security concerns, but can also improve customer satisfaction.

The limited infrastructure for recycling in many regions is projected to impede the growth of the packaging watermarking technology market during the estimated timeframe. While few economies have long-standing recycling initiatives, others lack the infrastructure and resources important to effectively handle plastic waste. As a result, plastic waste winds up in the oceans, landfills as well as other ecosystems. In emerging nations that are projected to be responsible for a large portion of the increase in the plastics manufacturing, the absence of the recycling infrastructure is specifically severe.

Similarly, Brazil is another country that recycles the least amount of plastic waste worldwide and ranks fourth in terms of production. According to World Bank data, over 2.4 million tons of plastic are disposed of in Brazil in open dumps in an irregular manner without any kind of treatment, and over a million tons are not even handled by collecting systems. Brazil's recycling rate of 4% is considerably lower than that of nations with comparable income ranges and levels of economic growth, as per the International Solid Waste Association.

This absence of infrastructure not only reduces recycling efficiency, but also decreases the potential benefits of watermarking technology such as supporting circular economy principles and minimizing landfill dependency. In addition, the high cost associated with updating or developing advanced recycling facilities creates a new barrier for governments and organizations in resource-constrained economies.

Sustainability Focus and Initiatives:

The global shift towards sustainability and the growing focus on circular economy principles owing to the increasing environmental concerns as well as rising pressure to adopt sustainable practices is expected to create substantial growth opportunity for the packaging watermarking technology market in the near future. The implementation of digital watermarking technology improves waste management and recycling procedures.

During recycling, packing materials may be precisely identified and sorted due to the encoded digital watermarks. Digital watermarks serve as a predictor of future developments. Prominent industry participants are assessing the application of digital watermarks for better sorting capabilities and expand accessibility for additional demographics. The use of the digital watermarks has been strongly supported by institutions, governments, and organizations. Here are a few relevant companies and projects to follow:

The most prominent digital watermark project is led by HolyGrail 2.0. More than 160 organizations and companies from the entire packaging value chain make up this consortium. The project's goal is to demonstrate both the technological as well as financial feasibility of using the digital watermarks for precise waste classification at waste sorting plants on a wide scale.

A well-known digital watermark company, Digimarc Recycle assists companies in digitizing their goods and packaging to improve sustainability.

Digimarc barcode recognition and data validation were integrated by a big brand in the business sector to improve control over quality without reducing printing quality. France has been chosen by Digimarc as the first nation to integrate the technology across three brands: Procter & Gamble, L'Oreal and Henkel. These companies are going to update their line of rigid high-density polyethylene packaging to incorporate the digital watermarks.

The watermark detecting equipment will separate the discarded packaging with digital watermarks from the non-enhanced packaging waste at Veolia's PlastiLoop Brenouille factory. Through implementing digital watermarks, brands not only surpass regulatory and consumer sustainability standards, but also improve their reputation by supporting global sustainability objectives, resulting in a win-win situation for both companies and the environment.

Artificial intelligence (AI) is expected to transform the packaging watermarking technology market by increasing the efficiency, functionality, and adaptability of existing watermarking methods. Combining the rapidly evolving field of packaging watermarking with the potential of artificial intelligence (AI) can help create a more effective circular economy. Artificial intelligence (AI) is already being utilized today to further improve recycling procedures and reduce waste heaps. Intelligent systems equipped with cameras and sensors are already able to identify the items being transported on the sorting belts as the waste is being sorted.

These systems are not only able to differentiate between paper, plastic and metal, but also between various types of plastic that are automatically separated into the appropriate flows. In addition to the sorting waste, AI can track how much energy recycling facilities use, evaluate the quality of the recycled material, or boost plant productivity via predictive maintenance.

Additionally, AI can also improve the supply chain transparency through integrating watermarking with real-time tracking and data analytics, helping companies to monitor the movement of goods and guarantee authenticity. Lately, Tomra, a recycling expert, has unveiled a deep learning-based sorting system. It sorts PET, PP and HDPE flows based on whether or not they have come into touch with the food using artificial intelligence.

Similarly, AI-integrated watermarking technology is likely to improve the identification as well as sorting of the packaging during recycling by embedding the material-specific and usage information within the packaging itself. Thus, the combination of AI with watermarking is not only projected to elevate the market's potential but also transform how industries approach packaging security and innovation.

The invisible watermarking segment held substantial market share in the year 2024. Invisible watermarks, also known as hidden watermarks, get their name from the fact that they are not easily visible to those who are unaware of their existence. They have unnoticed symbols or patterns that represent information.

Unlike visible watermarking, invisible watermarks are embedded directly onto the packaging materials without affecting their aesthetic value, making them perfect for high-security applications such as anti-counterfeiting, product verification, and traceability. This technology gained the prominence owing to its ability to stay unnoticed to the human eye while being easily scanned by specialized devices or cellphones. Additionally, its versatility combined with its ability to integrate seamlessly into various materials and packaging formats is also likely to support the segmental growth of the market during the forecast period.

The food & beverage segment held considerable market share in the year 2024. This is owing to the evolving consumer lifestyles, increased focus on the product safety as well as the rise of the convenience-driven consumption across the globe. Furthermore, the rising online grocery platforms and food delivery services along with the growing concerns about the counterfeiting is also likely to contribute to the growth of the segment within the estimated timeframe.

Additionally, the global efforts to reduce the food waste and improve sustainability coupled with the increasing consumers preference for ready-to-eat, single-serve and packaged food products is further expected to support the segmental growth of the market in the near future.

Asia Pacific is likely to grow at the fastest CAGR during the forecast period. This is due to the growing urban populations and expanding industrial bases in economies like India and China. Also, the surge in online retail as well as rising counterfeiting concerns is likely to contribute to the regional growth of the market. The first half of 2024 saw substantial growth in China's e-commerce industry, which fueled the second-largest economy in the world's consumption recovery.

According to the figures issued by the Ministry of Commerce (MOC), online retail sales during this period increased 9.8% year over year to USD 996 billion (about 7.1 trillion Yuan), of which retail sales of items reached 5.96 trillion Yuan, representing an 8.8% growth. Furthermore, the rapid adoption of advanced technologies is also expected to contribute to the regional growth of the market.

North America held largest market share in 2024. This is owing to the strict regulations regarding product safety, traceability and anti-counterfeiting. Additionally, the rapid growth of online shopping in the U.S. and Canada along with the surge in the online grocery and beverage sales is also expected to contribute to the regional growth of the market.

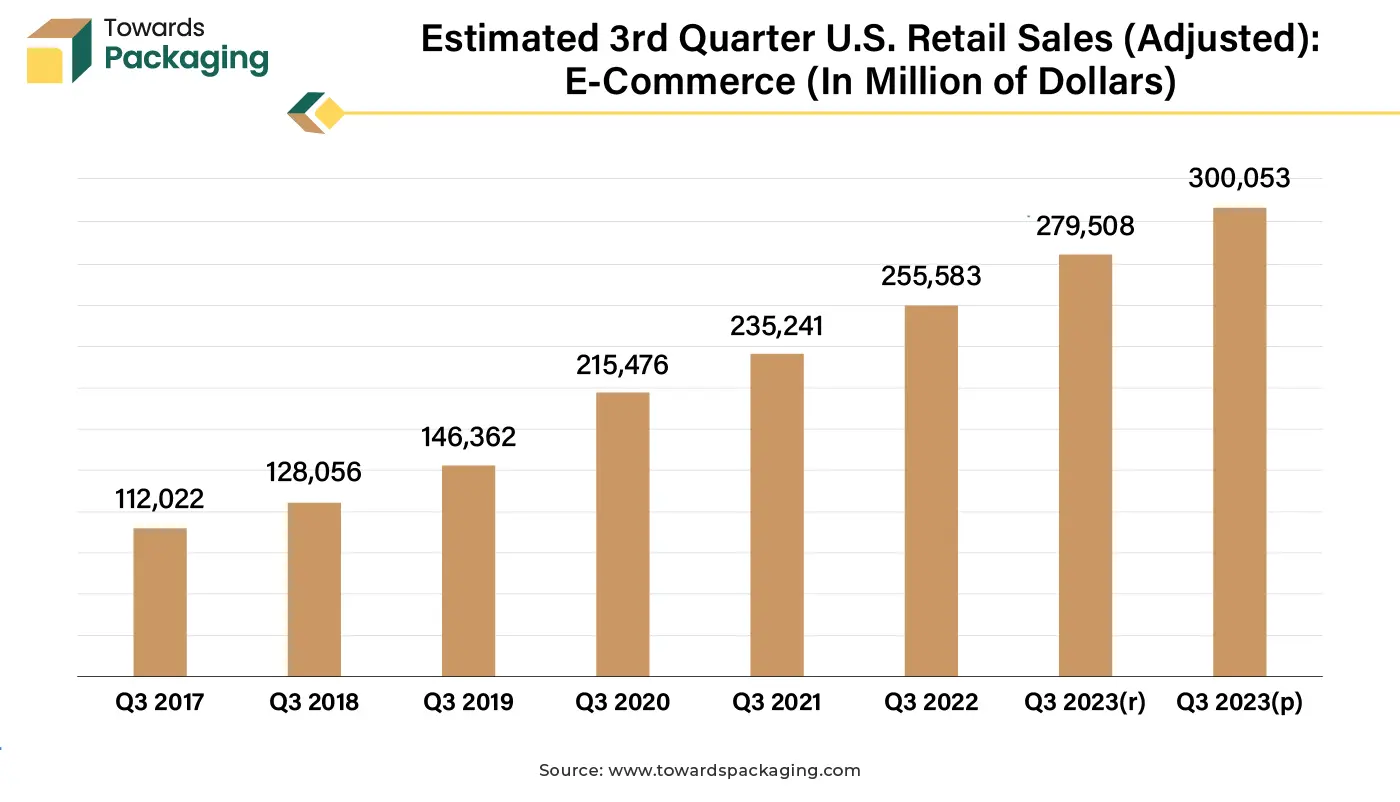

The U.S. retail e-commerce sales estimates for the 3rd quarter of the year 2024, adjusted for seasonal variation but not for rising prices, was $300.1 billion, according to the Census Bureau of the Department of Commerce. The expected total retail sales for 2024's third quarter were $1,849.9 billion. In the 3rd quarter of 2024, 16.2 percent of all revenues came from e-commerce. Furthermore, the presence of well-established recycling systems is also expected to contribute to the regional growth of the market.

By Technology Type

By End-User Industry

By Region

April 2025

April 2025

April 2025

April 2025