April 2025

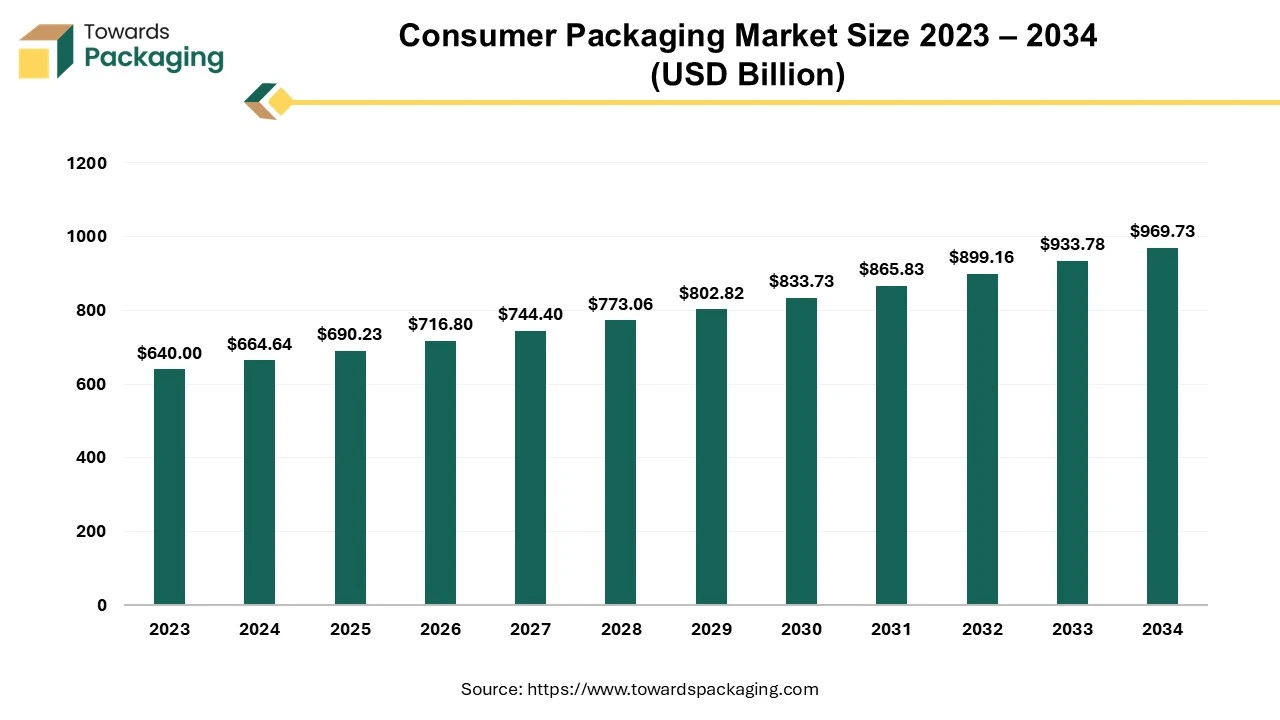

The consumer packaging market is projected to reach USD 969.73 billion by 2034, growing from USD 690.23 billion in 2025, at a CAGR of 3.85% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The consumer packaging market centers on efficiently producing and distributing various materials for consumer products, including food and beverages, personal care, home care, and industrial and pharmaceutical industries. The market's primary objectives are protecting the product during transit and storage and creating appealing packaging with unique logos to attract consumers. The ability to enhance the brand's image and customize it according to consumer preferences while prioritizing their emotions will positively impact and contribute to the market growth.

The primary function of consumer packaging is to protect the products from external factors like oxygen and moisture. Home care products are used in day-to-day life activities and require easy-dispensing packaging that is easy to open and dispose of. Packaging types such as laminated pouches, plastic containers, thermoformed products, and shrink wraps are popular among consumers for their convenience features.

Improvisation of the containerboard packaging market with the help of AI-based innovations. AI has improved market by developing new designs and enhancing every market feature, whether the properties or shipping. It can create new products by analyzing their weight and the material requirement due to the growing demand for smaller design packaging, which will need less space and shipping fees. It can also analyze consumer preferences and, based on that, can innovate products that will be cost-effective. Apart from this, AI can analyze the supply chain and predict the outcomes for leading consumers and leading regions.

Demand for packed food drives the consumer packaging market

The major driving factor in the consumer packaging market is the increasing demand for packed food. Packing is convenient for the consumer, and food products have extended shelf life due to solid barrier protection. The packaging also ensures that the food will be protected from contamination and spoilage. The rise in grocery delivery apps and rapid expansion of the food and beverage segments in regions such as North America and the Asia-Pacific contribute to higher demand in the market.

A sustainable solution is the future of the consumer packaging market

The growing consumer preference for sustainable packaging has perceived growth in the market as top companies are influenced to adopt packaging solutions such as plant-based polymers, recycled paper, and composed plastics. Using alternative materials such as paper, glass, or cardboard will reduce plastic waste, and the circular economy will thrive due to the usage of recycled or reused packaging, which will boost the development of recyclable infrastructures.

According to the American Forest and Paper Association, the data illustrates that in 2022, paper was recycled by 68%, wherein half was used in manufacturing cardboard. The portion is made of boxboards, tissues, and other packaging material. This insight suggests that there are significant opportunities for growth and development within all segments. As a result, there is a potential increase in demand for sustainable packaging for consumer products.

The consumer packaging market faces hindrances through strict regulations as they change according to consumer and government preferences. This can disrupt supply chains and regulations on importing and exporting material. Technology change also affects market growth as integrating advanced technology leads to packaging design customization, ultimately leading to high capital costs. Plastic being used for its flexible and readily available features can pose a hindrance since its excessive waste can cause harm to the environment. This negative impact can challenge the market growth.

By packaging format, the rigid packaging segment dominates the consumer packaging market due to its versatile usage and cost-effective material. Packaging types like pouches, wraps, films, bags, and stick packs are popular choices among consumers. Rigid packaging has several advantages, including higher protection, versatility, and stackability. The packaging is more durable due to the materials used to make it. Rigid packaging also has a higher shelf appeal, and integrating smart packaging solutions with this kind of packaging allows for a more interactive experience. The packaging provides high resistance to vibrations and protects the product during transit.

Flexible packaging is the fastest-growing segment in the consumer packaging market due to its increased versatility and ease of storage. Companies are increasingly looking to optimize supply chains and make inventory storage and logistics more cost-effective, and flexible packaging can help firms achieve higher cost-effectiveness. Packaging types like pouches, wraps, films, bags, and stick packs are popular choices among consumers.

By material, plastics dominate the consumer packaging market. Plastic is highly durable but versatile, allowing for cost-effective packaging solutions. The rise of bio-plastics is allowing businesses to transition to more sustainable forms of plastic packaging. The paper segment is the fastest-growing in the market. The global push towards environmental sustainability leads more businesses to switch to paper and other fully recyclable packaging.

By end-user industry, the pharmaceutical segment dominates the consumer packaging market due to increasing demand for drugs and other therapeutics. The global rise of the pharmaceutical sector is driven by an aging population and demand for more healthcare services in emerging economies due to pollution and other lifestyle changes. The food segment is the fastest growing in the market. Demand is driven by the e-commerce boom and consumer preference for quality packaging. Companies are also increasingly looking to differentiate their product with the help of functional, interactive packaging.

By level of packaging, primary packaging dominates the market due to its features such as physical integrity and excellent barrier properties. Primary packaging is the first barrier between the product and its immediate environment. Consumer preference for packaging aesthetics is pushing businesses towards primary packaging applications. Tertiary packaging is the fastest-growing segment in the market. The rise of e-commerce and the expansion of global shipping are leading to higher demand for this kind of packaging. Tertiary packaging usually includes corrugated cardboard boxes, pallets, shrink film, and shipping and transit containers.

By manufacturing technology, the injection molding segment dominates the consumer packaging market due to its versatile features, such as excellent functional integration and enhanced high performance. Thermoforming is the fastest-growing segment in the market. Thermoforming uses pliable plastic sheets that are heated and formed into desired shapes. Once it cools, the plastic retains its shape. This production technique is becoming increasingly popular due to packaged products by consumers due to shifts in dietary habits, growing income, and changing lifestyles.

By distribution channel, the offline segment dominates the market. Consumers who do not have access to the e-commerce market still rely on offline retail sales to purchase the fast-moving consumer goods. Growing international trade has made a host of retail products available globally. The online segment is the fastest-growing in the market. The advent of e-commerce offers increased convenience to consumers. Technological developments such as augmented reality software have enabled consumers to visualize products before purchasing them online. This mitigates the necessity to examine products in a brick-and-mortar store physically.

The Asia-Pacific region is dominant in the market thanks to its rapid urbanization and robust economic growth. Consumer packaging plays a crucial role in this market by providing hygiene and preventing wear and tear, effectively controlling brand image, and ensuring the quality of products in various consumer applications. The rapid expansion of the homecare industry, driven by the growing desire for personal care, has significantly contributed to market growth.

Personal care products are consumer products commonly used in every household where easy dispensing is required. The demand for these products in the market is boosted by the specific requirements of the people, where efficient and high-quality packaging is essential. Plastic packaging is popular for home care products due to its cost-effectiveness and flexibility. Countries like India and China are the leading contributors to the consumer packaging market.

North America is the fastest-growing regional market due to its robust advanced packaging innovations and the high demand for quality packaging. The choice between packaging good products in cans or pouches depends on their ability to perform effectively during transit or travel. This is particularly important because Americans strongly prefer eating convenience store food. The packaging must withstand the rigors of transportation and storage, ensuring that the food remains secure and ready for use when needed. The industry strongly emphasizes developing innovative packaging designs for packed food products to enhance convenience and efficiency. This strategic focus meets consumer demand for more user-friendly packaging and positively impacts the market, driving growth and increasing consumer appeal.

By Packaging Format

By Material

By End-use

By Level of Packaging

By Manufacturing Technology

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025