Corrugated Packaging Market Investment Opportunities & Competitive Benchmarking

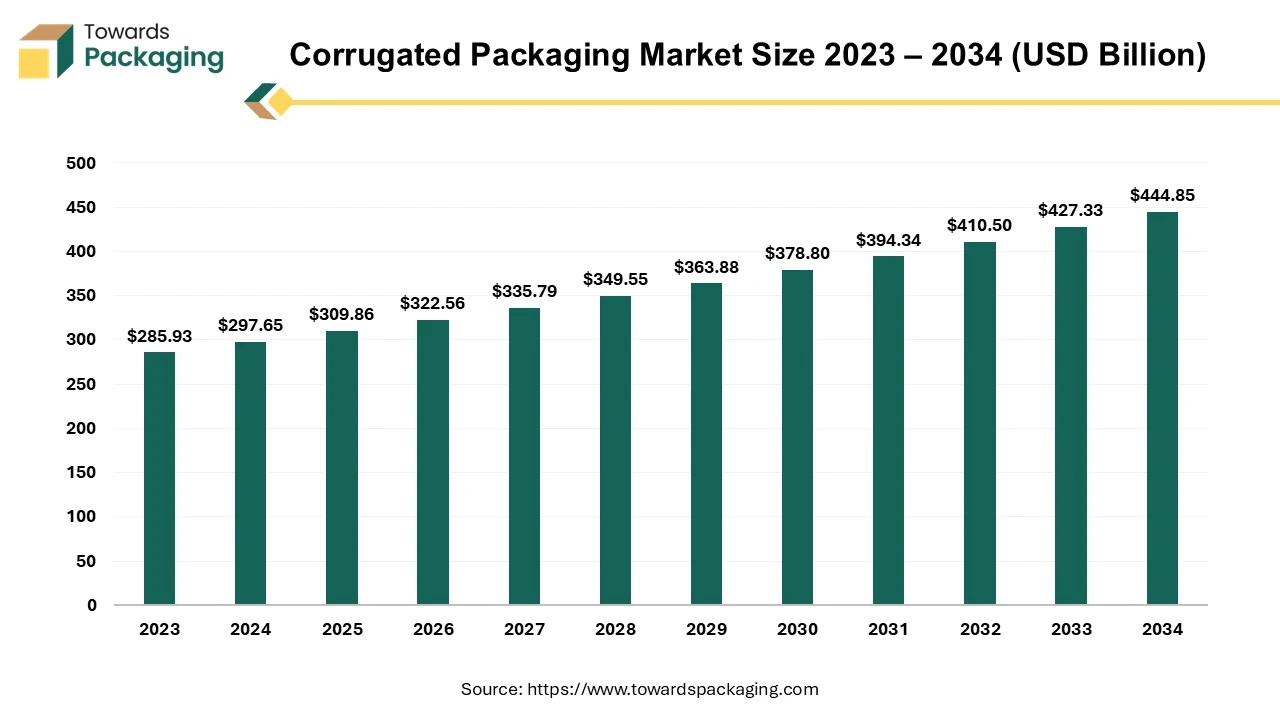

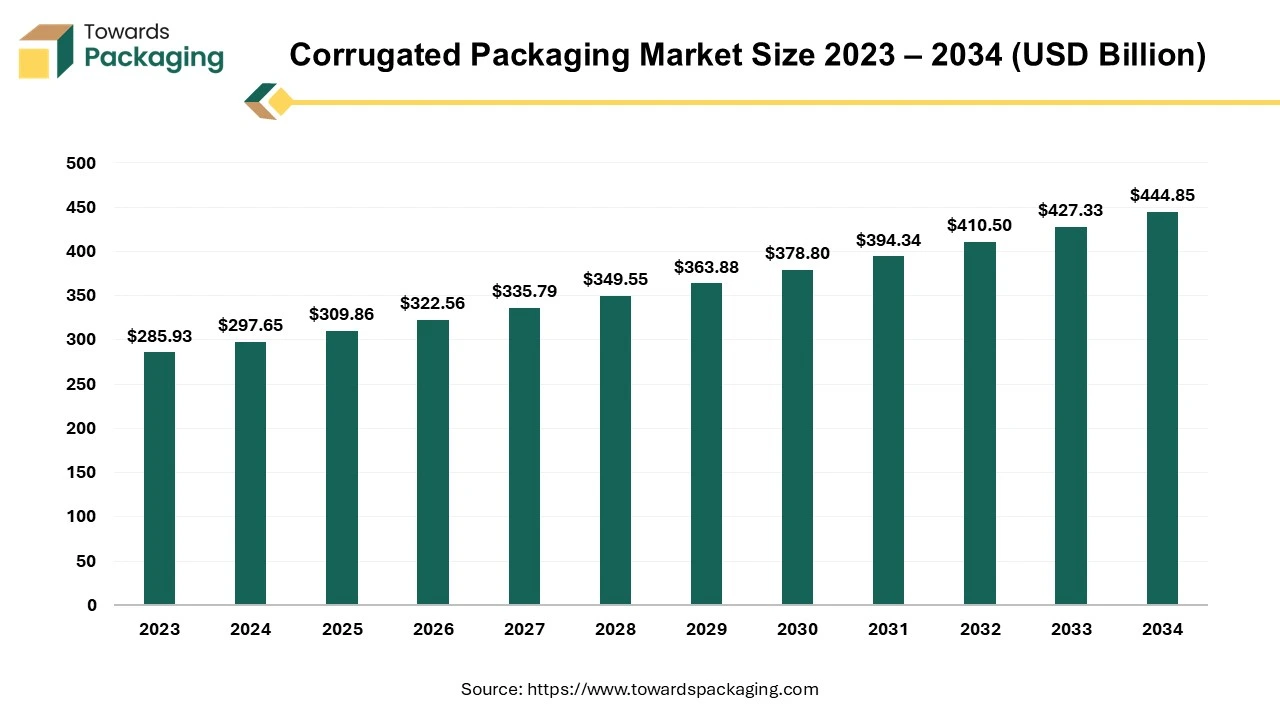

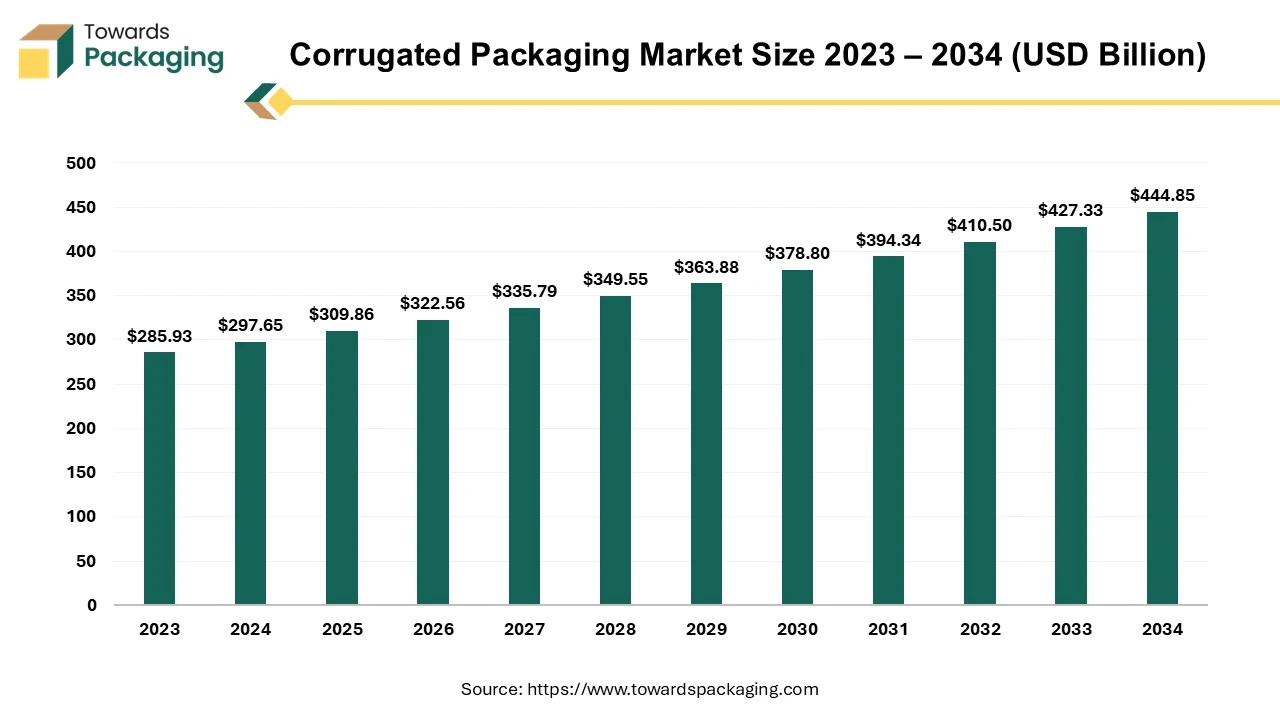

The corrugated packaging market is forecasted to expand from USD 322.56 billion in 2026 to USD 463.09 billion by 2035, growing at a CAGR of 4.1% from 2026 to 2035. This growth is driven by the rise of e-commerce, where corrugated packaging plays a crucial role in product shipping and protection. The market’s expansion is also fueled by the increasing adoption of eco-friendly alternatives, with sustainability becoming a key driver.

Additionally, the growing demand for customized, fit-to-product packaging to optimize logistics and reduce waste is reshaping the industry. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Major Key Insights of the Corrugated Packaging Market

- Asia Pacific dominated the corrugated packaging market in 2024.

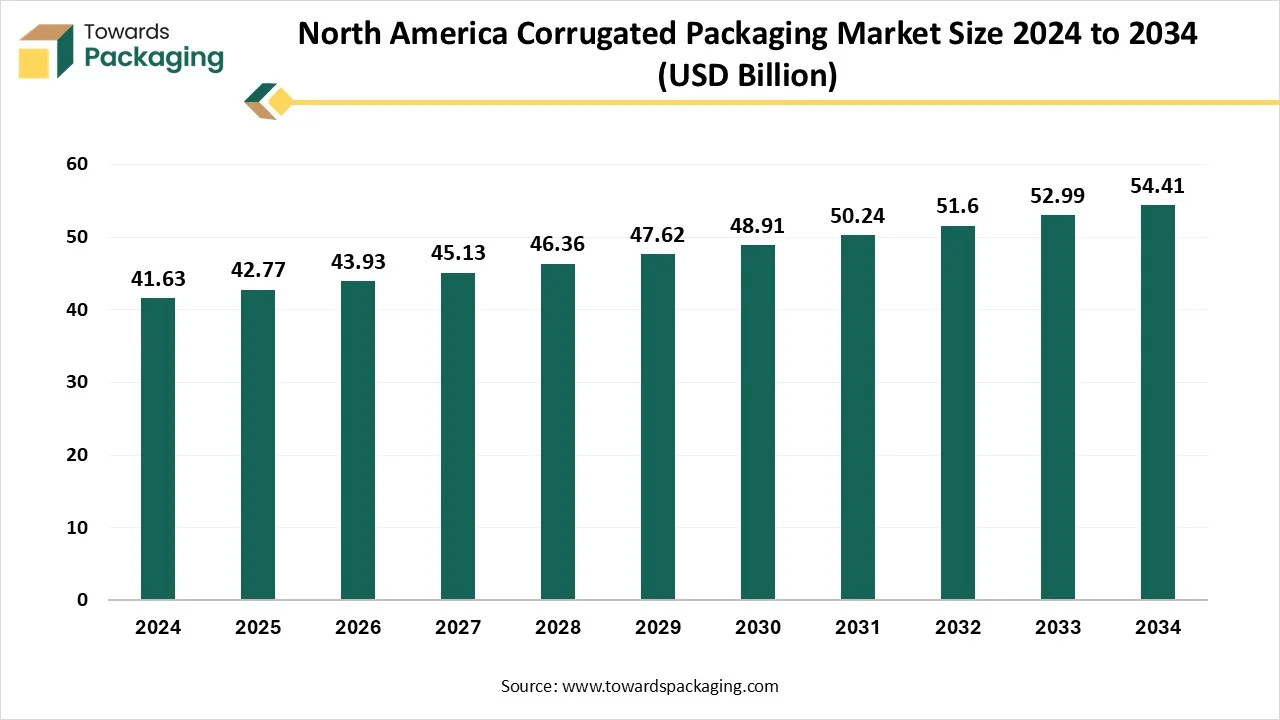

- North America is expected to grow at a significant rate in the market during the forecast period.

- By wall type, the single wall board segment dominated the market with the largest share in 2024.

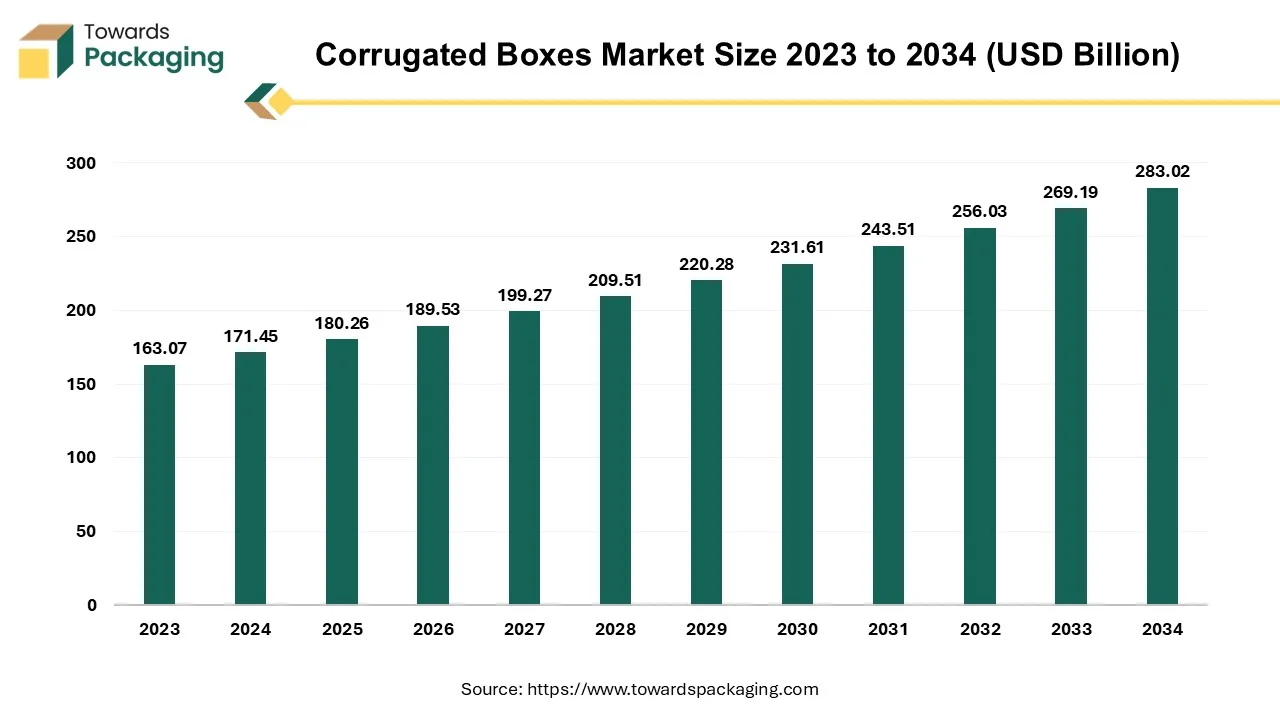

- By packaging type, the boxes segment dominated the corrugated packaging market in 2024.

- By application, the food & beverages segment registered its dominance over the global corrugated packaging market in 2024.

Corrugated Packaging Market Overview

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 309.85 Billion |

| Projected Market Size in 2035 |

USD 463.09 Billion |

| CAGR (2026 - 2035) |

4.10% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Wall Type, By Packaging Type, By Application and By Region |

| Top Key Players |

Mondi Group, WestRock Company, International Paper Company, DS Smith PLC, Smurfit Kappa Group, Nine Dragons Paper (Holdings) Limited |

Key Factors Influencing Market Trends

- The rising complicated logistics chain for direct-to-consumer delivery means packages that are handled several times that are necessarily durable and cost-effective secondary corrugated packaging. This transformation has encouraged brands to accept packaging that prevents products and rebuilds their brand image directly in customers’ homes which raises the demand for high-quality graphic design on shippers.

- E-commerce has also led to fit-to-product packaging that customizes boxes to the accurate size of products which vanishes the need for excess filler material. This specifically benefits companies like Amazon, which requires customized packaging for different product shapes and sizes.

Retail -Ready packaging continues to be a growing trend, especially in Western Europe, where it has grown as a significant cost-effective measure. Retail-ready packaging includes pre-packed products that are easy to display and require minimal display to setup time.

- Sustainability remains a top factor in the corrugated packaging sector. With the growth in consumer awareness around environmental problems, corrugated board is rising favored for its recyclability and eco-friendliness.

- Lightweighting which includes using thinner yet stronger board grades has been specifically successful in European countries.

EUROPE CORRUGATED PACKAGING MARKET - 2025-2034 (EUR MILLION)

| Europe Corruagted Packaging Market |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Value (EUR Million) |

79.3 |

82.6 |

86.0 |

89.6 |

93.4 |

97.3 |

101.4 |

105.8 |

110.4 |

115.3 |

EUROPE CORRUGATED PACKAGING MARKET - 2025-2034 BY COUNTRY (EUR MILLION)

| By Country (Value) |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Germany |

16.4 |

17.1 |

17.9 |

18.7 |

19.5 |

20.4 |

21.3 |

22.3 |

23.3 |

24.4 |

| Poland |

4.5 |

4.7 |

4.9 |

5.2 |

5.4 |

5.7 |

6.0 |

6.3 |

6.6 |

6.9 |

| Austria |

2.2 |

2.3 |

2.3 |

2.4 |

2.5 |

2.6 |

2.7 |

2.8 |

2.9 |

3.0 |

| Czech Republic |

1.9 |

1.9 |

2.0 |

2.1 |

2.2 |

2.2 |

2.3 |

2.4 |

2.5 |

2.6 |

| Belgium |

2.6 |

2.7 |

2.8 |

2.9 |

3.0 |

3.1 |

3.3 |

3.4 |

3.5 |

3.6 |

| Netherlands |

3.9 |

4.1 |

4.2 |

4.4 |

4.5 |

4.7 |

4.9 |

5.1 |

5.3 |

5.5 |

| Switzerland |

1.5 |

1.6 |

1.7 |

1.7 |

1.8 |

1.9 |

2.0 |

2.1 |

2.3 |

2.4 |

| Turkey |

2.1 |

2.2 |

2.3 |

2.5 |

2.6 |

2.7 |

2.9 |

3.0 |

3.2 |

3.3 |

| Rest of Europe |

44.3 |

46.0 |

47.9 |

49.8 |

51.8 |

53.9 |

56.1 |

58.5 |

60.9 |

63.5 |

Market Trends

Sustainability and Eco-Friendly Innovations

Environmental concerns are driving the industry towards more sustainable practices. Companies are increasingly adopting recyclable materials, reducing waste, and developing biodegradable packaging solutions. For instance, innovations in paper-based packaging and reusable designs are gaining traction, aligning with consumer demand for environmentally friendly products.

Integration of Smart Technology

The incorporation of smart technologies into corrugated packaging is enhancing supply chain efficiency and customer engagement. Features such as QR codes, RFID tags, and NFC technology enable real-time tracking, authentication, and interactive consumer experiences. This trend is particularly beneficial for inventory management and combating counterfeit products.

Advancements in Automation and Manufacturing

Automation is revolutionizing the production of corrugated packaging by improving precision, reducing labor costs, and increasing output. The adoption of advanced machinery and robotics facilitates faster turnaround times and customization capabilities, allowing manufacturers to meet diverse client needs more effectively.

Customization and Enhanced Consumer Experience

Brands are leveraging customized packaging designs to enhance the unboxing experience and strengthen customer loyalty. Techniques such as die-cut designs and personalized prints not only protect products but also serve as powerful marketing tools, creating memorable interactions with consumers.

Global Corrugated Packaging Market Shares of Leading Manufacturers (2024)

| Rank |

Manufacturer |

Share (%) |

| 1 |

International Paper |

7 |

| 2 |

WestRock (merged with Smurfit Kappa in 2024; shown separately for 2024) |

5.5 |

| 3 |

Smurfit Kappa |

4.8 |

| 4 |

Oji Holdings |

4 |

| 5 |

Nine Dragons Paper |

3.7 |

| 6 |

DS Smith |

3.3 |

| 7 |

Mondi |

3.1 |

| 8 |

Georgia-Pacific |

2.8 |

| 9 |

Lee & Man Paper |

2.4 |

| 10 |

Packaging Corporation of America (PCA) |

2.2 |

2024 Market Share & Highlights

- International Paper 7.0%: Largest global corrugated player with strong North American and Latin American presence.

- WestRock 5.5%: Major U.S. corrugated supplier, merged with Smurfit Kappa in 2024 to form global giant.

- Smurfit Kappa 4.8%: Europe’s leader in corrugated packaging with strong e-commerce and FMCG customer base.

- Oji Holdings 4.0%: Japan’s top producer, expanding in Southeast Asia with large containerboard capacity.

- Nine Dragons Paper 3.7%: China’s largest recycled containerboard producer with strong domestic footprint.

- DS Smith 3.3%: European leader in sustainable corrugated solutions, serving retail and e-commerce.

- Mondi 3.1%: Integrated global packaging group with large European and African operations.

- Georgia-Pacific 2.8%: U.S.-based private producer with wide corrugated and containerboard network.

- Lee & Man Paper 2.4%: Hong Kong–based company, strong in China with recycled containerboard operations.

- Packaging Corporation of America (PCA) 2.2%: Major U.S. supplier serving industrial and consumer packaging needs.

How Can AI Improve the Corrugated Packaging?

AI-powered sensors monitor equipment performance, predicting failures before they occur, reducing downtime and maintenance costs. AI-driven robotics optimize cutting, folding, and printing processes, increasing precision and speed in manufacturing. AI detects defects (such as misprints, weak glue bonds, or structural weaknesses) in real time, ensuring high-quality output and reducing waste. AI algorithms predict demand and optimize stock levels, reducing raw material waste and avoiding overproduction. AI analyzes real-time data to optimize delivery routes, reducing fuel consumption and ensuring timely deliveries. AI-enabled RFID and QR codes help track packages in real time, improving supply chain visibility.

The potential application of artificial intelligence (Al) in the paper-to-packaging process presents a game-changing prospect for the sector, particularly with regard to the simplification of intricate computer models. This strategy could transform conventional techniques by allowing Al to identify complex connections between different production parameters and the characteristics of the corrugated board that is produced.

By using Al, producers may learn more about how variables like humidity, temperature, and adhesive concentration during production could affect the finished product. This innovative approach's first step is to use Al to evaluate large datasets that include a variety of industrial characteristics. Al algorithms are skilled at finding correlations and patterns that conventional analysis can miss, especially in machine learning models.

Driver

E-commerce Boom & Online Retail Expansion

The rise of e-commerce giants (Amazon, Alibaba, Flipkart) has significantly increased demand for durable, lightweight, and cost-effective corrugated boxes for shipping. Corrugated packaging ensures product protection during transit, making it the preferred choice for fragile and perishable items. The shift toward subscription-based delivery models (groceries, pet food, and electronics) is further driving demand. In January 2025, according to the data published by the National e-commerce associations, as of the first three quarters of 2024, retail commerce sales in the United States were US$879.54 billion.

- In the third quarter of 2024, US commerce sales totalled US$300.05 billion, up 2.8% from the previous quarter and 7.2% from the same quarter the year before. As of the first three quarters of 2024, the nation's total e-commerce sales came to US$879.54 billion. Sales are expected to reach US$1.26 trillion by year's end and US$1.72 trillion by 2027, according to experts. Online sales will account for roughly 22.6% of all retail sales in the US by that time.

Restraint

Fluctuating Raw Material Costs & Environmental Regulations

The key players operating in the market are facing issue such as fluctuating raw material prices, environmental regulations & sustainability challenges, which has estimated to restrict the growth of the corrugated packaging market. Governments worldwide are implementing strict environmental regulations on packaging waste and deforestation, impacting production. The need for eco-friendly inks, adhesives, and coatings increases production costs. Companies are facing pressure to reduce carbon footprints, requiring investments in renewable energy and greener production methods.

Corrugated packaging relies on kraft paper and recycled fibers, both of which are subject to price fluctuations due to supply-demand imbalances and environmental regulations. Increased demand for sustainable packaging is driving up the cost of recycled paper and virgin fiber materials. Energy-intensive manufacturing processes further contribute to rising production costs.

Market Opportunity

Growth in the Food & Beverage Industry

Increasing demand for corrugated food packaging in fresh produce, takeout, frozen foods, and ready-to-eat meals. Rising adoption of corrugated packaging in dairy, meat, and seafood due to its moisture resistance and protective properties. Innovations like corrugated insulated boxes for temperature-sensitive foods offer new business opportunities.

The global pharmaceutical industry requires secure, tamper-proof, and eco-friendly packaging solutions. Growth in the medical supplies and diagnostics sector is increasing demand for sterile and durable corrugated packaging. Corrugated fiberboard with anti-microbial coatings presents a new market opportunity in healthcare packaging.

What Makes Corrugated Packaging a Resilient and High Demand Market Globally?

| Growth Factor |

Market Strength |

Industry Advantage |

| Strong Global Demand Base |

Widely used across food & beverages, FMCG, pharmaceuticals, electronics, and industrial sectors. |

Ensures consistent and recurring demand worldwide. |

| E-commerce Expansion |

Rapid growth in online shopping significantly increases demand for protective shipping boxes. |

Continuous volume growth driven by digital retail trends. |

| Essential Product Packaging |

Critical for packaging groceries, medicines, and daily-use goods. |

Maintains stable demand regardless of economic cycles. |

| High Sustainability Profile |

100% recyclable, biodegradable, and widely recovered material with high recycling rates globally. |

Aligns with ESG targets and environmental regulations. |

| Lightweight & High Strength |

Excellent strength-to-weight ratio supports stacking and product protection. |

Reduces transportation costs while maintaining durability |

| Plastic Replacement Trend |

Growing shift from plastic to fiber-based sustainable packaging solutions. |

Expands application areas and long-term growth potential. |

| Continuous Innovation |

Development of lightweight boards and improved protective designs. |

Strengthens competitive positioning and future readiness. |

How Are Government Policies Driving the Growth In The Corrugated Packaging Market?

Ban on Single-Use Plastics

The Indian government has restricted the use of several single-use plastic products to reduce environmental pollution. This move has increased the demand for eco-friendly alternatives such as corrugated boxes and paper-based packaging, especially in FMCG, food delivery, and e-commerce sectors.

Make in India Initiative

The government promotes domestic manufacturing under the “Make in India” program, offering policy support and investment opportunities in the paper and packaging sector. This initiative strengthens local production capacity and boosts exports of corrugated packaging products.

100% FDI in Paper & Packaging Sector

Foreign Direct Investment is allowed under the automatic route in the paper and packaging industry. This has attracted global players, encouraged technology upgrades, and expanded manufacturing infrastructure in the corrugated packaging market.

GST Reforms

Revisions in GST rates on packaging materials have helped reduce cost burdens for manufacturers and end users. Tax rationalization supports MSMEs operating in the corrugated box segment and improves price competitiveness.

Support Through Indian Institute of Packaging (IIP)

The Indian Institute of Packaging, under the Ministry of Commerce, provides research, training, testing, and certification services. This improves packaging standards, promotes innovation, and enhances the quality of corrugated packaging solutions.

Segmental Insights

Single Wall Boards Led the Market in 2024

The single wall boards to segment held a dominant presence in the corrugated packaging market in 2024. Single-wall corrugated boards are the most widely used type of corrugated packaging due to their lightweight nature, cost-effectiveness, and versatility. Lower material and production costs make single-wall boards the preferred choice for manufacturers and businesses. Compared to double-wall or triple-wall boards, they require less raw material, reducing expenses while maintaining adequate protection. Single-wall corrugated boards are widely used in food & beverage, consumer goods, pharmaceuticals, and electronics.

Boxes Packaging Type to Show a Significant Rate of Growth

The boxes packaging type segment accounted for a considerable share of the corrugated packaging market in 2024. Boxes provide shock absorption and cushioning to protect goods from damage during shipping and storage. Boxes can be easily stacked for efficient storage and transportation. The box packaging supports logos, product details, and QR codes for marketing and customer engagement. Box packaging dominates the market due to its durability, cost-efficiency, sustainability, and adaptability across industries. Its growing use in e-commerce, food, electronics, and logistics ensures continued demand.

Food & Beverages Segment Led the Market in 2024

The food & beverages segment led the global corrugated packaging market. Corrugated packaging is a preferred choice for food and beverage packaging due to its strength, sustainability, and ability to protect perishable goods. The corrugated packaging supports eco-conscious businesses and reduces waste. Online grocery and meal deliveries require sturdy, protective, and customizable packaging. Corrugated pizza boxes, takeout containers, and beverage carriers are widely used in fast food and restaurant deliveries. Right-sized packaging innovations help reduce material waste and optimize shipping.

Asia’s Diversified End-Use Market to Promotes Dominance

Asia Pacific region dominated the global corrugated packaging market in 2024. APAC has the largest e-commerce market globally, with countries like China, India, Japan, and Southeast Asia experiencing rapid online retail growth. Countries like China, India, Indonesia, and Vietnam are undergoing rapid industrial growth, leading to higher packaging demand in manufacturing, logistics, and exports. Asia Pacific is a global manufacturing hub for industries like electronics, textiles, pharmaceuticals, and automotive, all requiring corrugated packaging for exports. Countries like China, India, Vietnam, and Thailand produce high volumes of corrugated board, cartons, and customized packaging for international markets. APAC companies are investing in automated packaging, AI-driven customization, and smart packaging solutions (RFID, QR codes, IoT-enabled tracking).

China Corrugated Packaging Trends

China is the largest producer and consumer of corrugated packaging globally. The market is expanding due to industrial growth, booming e-commerce, government regulations on sustainability, and increasing demand for food and consumer goods packaging. China has the world’s largest e-commerce market, with platforms like Alibaba, JD.com, Pinduoduo, and Douyin (TikTok Shop) driving high demand for durable and customized corrugated packaging.

China remains a global manufacturing hub for industries like electronics, automotive, textiles, pharmaceuticals, and consumer goods, all requiring large volumes of corrugated packaging. China remains a global manufacturing hub for industries like electronics, automotive, textiles, pharmaceuticals, and consumer goods, all requiring large volumes of corrugated packaging. China’s “Plastic Ban 2025” policy is phasing out single-use plastics, boosting demand for eco-friendly corrugated alternatives.

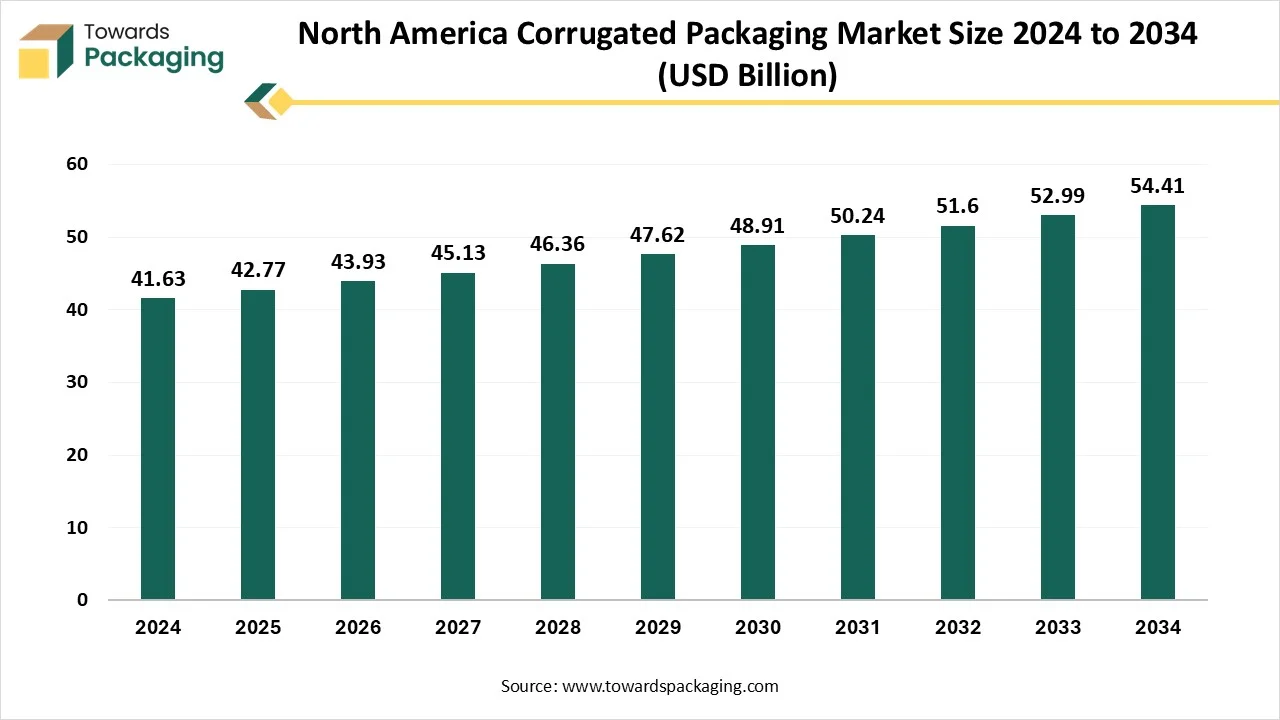

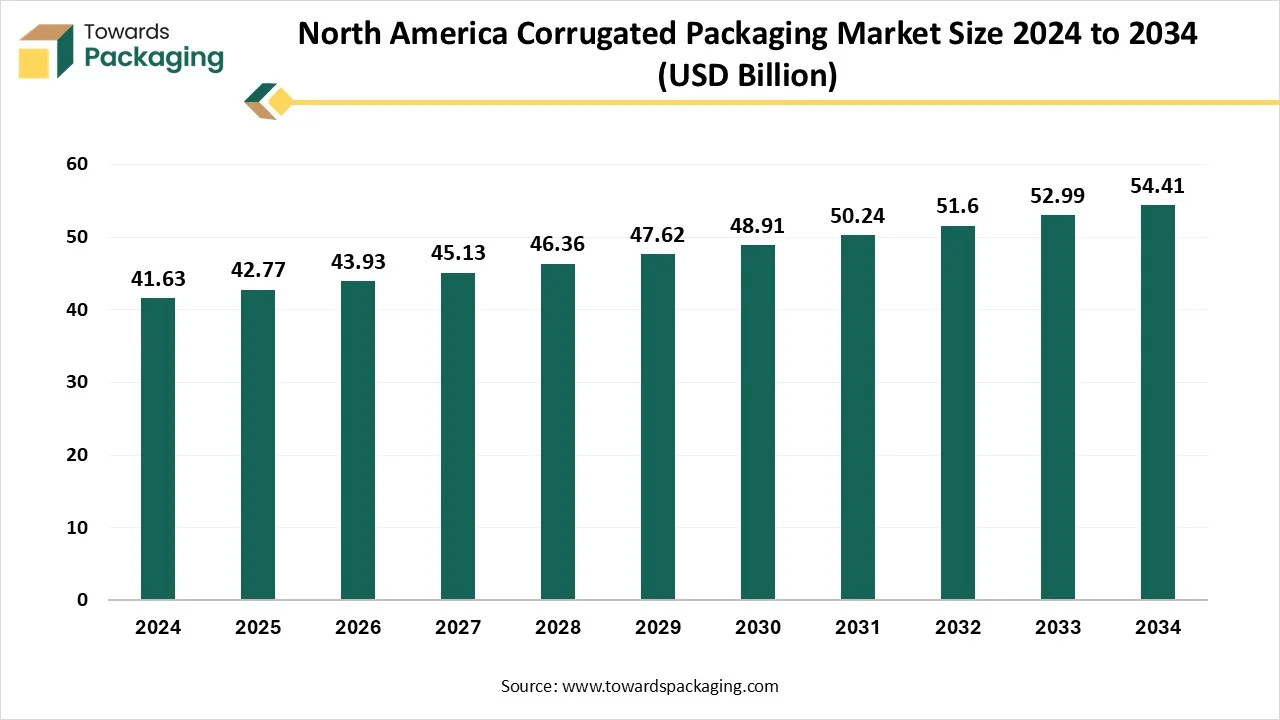

North America’s 75% Ecommerce Business Supports Rapid Growth

North America is projected to host the fastest-growing corrugated packaging market in the coming years. North America, led by the United States, Canada, and Mexico, is one of the largest and most advanced markets for corrugated packaging. North America has a high e-commerce penetration rate, with giants like Amazon, Walmart, Shopify, and eBay relying heavily on corrugated packaging for shipping and fulfillment. North America has strong domestic production of kraft paper and recycled fiber, ensuring a steady supply of raw materials for corrugated packaging.

U.S. Corrugated Packaging Trends

The U.S. has a high online shopping penetration rate, led by Amazon, Walmart, Target, eBay, and Shopify, all relying on corrugated boxes for shipping. U.S. companies are shifting away from plastic due to federal and state bans on single-use plastics (e.g., California’s plastic packaging restrictions). Big brands like Amazon, Walmart, and Unilever are investing in 100% recyclable, compostable, and FSC-certified corrugated packaging. Advances in water-based coatings, biodegradable adhesives, and reusable corrugated packaging are driving sustainability efforts.

Future of North America Corrugated Packaging Market

The North America corrugated packaging market is projected to reach USD 54.41 billion by 2034, expanding from USD 42.77 billion in 2025, at an annual growth rate of 2.72% during the forecast period from 2025 to 2034. Processed foods will dominate North America’s corrugated packaging market in the year 2024 due to their widespread consumption and rigid FDA labelling rules and regulations. Corrugated boxes are important for processing fresh produce during transport, especially in the U.S and Canada, where sustainability trade policies and sector assistance further drive market development.

Corrugated packaging is a kind of cardboard material that is made up of three layers: an inside liner, an outside liner, and a fluting corrugated medium sandwiched between the liner sheets. The fluting corrugated medium is generally made of kraft paper, which is rigid and more durable than regular paper. Corrugated containers remain stable even when exposed to moisture, shocks, and sudden temperature fluctuations. While no container is discreet to extreme force or prolonged or rigid conditions, corrugated serves a great level of assurance that our products will shift from our warehouse to their final point in great shape.

Europe’s Sustainability Initiatives to Project Steady Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The European Green Deal & Circular Economy Action Plan promote recyclable, biodegradable, and reusable packaging. EU Single-Use Plastics Directive (SUPD) is banning plastic packaging, increasing demand for corrugated alternatives. Europe is a global leader in automotive, electronics, pharmaceuticals, and machinery production, requiring heavy-duty corrugated packaging for exports.

Global Trade Flow and Market Value Analysis of Corrugated Paper and Paperboard Boxes (HS Code 4819.10), 2024 Regional Breakdown

South America Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Argentina |

M |

$13,189,650 |

6,469,296.60 |

6,469,297 |

| Argentina |

X |

$13,016,153 |

9,977,004.50 |

9,977,005 |

| Brazil |

M |

$44,775,654 |

15,575,524.30 |

15,575,524 |

| Brazil |

X |

$36,857,005 |

31,358,095.30 |

31,324,159 |

| Colombia |

M |

$5,124,053 |

1,691,216.10 |

1,691,216 |

| Colombia |

X |

$9,409,607 |

7,029,687.40 |

7,029,687 |

Oceania and Asia-Pacific Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Australia |

M |

$91,782,039 |

45,271,960.80 |

45,271,961 |

| Australia |

X |

$5,989,719 |

10,087,620 |

10,087,620 |

| China |

M |

$27,748,762 |

5,698,137.70 |

5,698,138 |

| China |

X |

$1,553,371,837 |

689,417,307.50 |

689,417,308 |

| Sri Lanka |

M |

$4,110,343 |

1,886,645.50 |

1,886,645 |

| Sri Lanka |

X |

$13,728,757 |

5,039,734.80 |

5,039,735 |

| India |

M |

$32,952,906 |

10,810,037.10 |

10,810,037 |

| India |

X |

$55,789,995 |

38,399,014.90 |

38,399,015 |

| Malaysia |

M |

$69,357,353 |

36,112,165.80 |

36,112,166 |

| Malaysia |

X |

$74,875,031 |

47,136,610.30 |

47,136,610 |

Europe Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Belgium |

M |

$326,013,482 |

213,513,453.70 |

213,513,454 |

| Belgium |

X |

$244,109,185 |

176,726,989.50 |

176,726,989 |

| France |

M |

$578,183,203 |

349,689,757 |

349,689,757 |

| France |

X |

$231,799,062 |

0 |

0 |

| Germany |

M |

$568,272,275 |

0 |

0 |

| Germany |

X |

$1,218,280,031 |

807,330,574.10 |

807,330,574 |

| Italy |

M |

$97,450,353 |

34,735,239.80 |

34,735,240 |

| Italy |

X |

$468,861,118 |

0 |

0 |

| Netherlands |

M |

$852,646,541 |

1,010,697,743 |

1,010,697,743 |

| Netherlands |

X |

$332,348,774 |

195,425,455 |

195,425,455 |

| United Kingdom |

M |

$331,131,467 |

0 |

0 |

| United Kingdom |

X |

$187,934,181 |

0 |

0 |

Middle East Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Israel |

M |

$16,170,000 |

6,553,493.80 |

6,553,494 |

| Israel |

X |

$16,161,000 |

7,839,285.30 |

7,839,285 |

| Saudi Arabia |

M |

$88,399,655 |

0 |

0 |

| Saudi Arabia |

X |

$216,770,067 |

72,508,673 |

72,508,673 |

| Turkey |

M |

$20,274,719 |

9,417,195 |

9,417,195 |

| Turkey |

X |

$323,249,943 |

248,118,837 |

248,118,837 |

Africa Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Egypt |

M |

$23,886,273 |

10,270,822.30 |

10,270,822 |

| Egypt |

X |

$61,098,956 |

32,280,136.70 |

32,280,137 |

| South Africa |

M |

$13,193,274 |

0 |

5,672,956 |

| South Africa |

X |

$71,581,689 |

37,818,432 |

37,818,432 |

Asia and Pacific Islands Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| China, Hong Kong SAR |

M |

$93,569,089 |

80,883,078 |

80,883,078 |

| China, Hong Kong SAR |

X |

$20,445,241 |

3,655,815 |

3,655,815 |

| China, Macao SAR |

M |

$760,534 |

579,971.30 |

579,971 |

| China, Macao SAR |

X |

$2,062 |

1,382 |

1,382 |

| New Zealand |

M |

$18,896,716 |

0 |

8,125,370 |

| New Zealand |

X |

$716,555 |

0 |

378,575 |

North America Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Canada |

M |

$577,474,900 |

287,684,093.30 |

287,684,093 |

| Canada |

X |

$223,335,445 |

117,993,810.80 |

117,993,811 |

| USA |

M |

$747,203,934 |

344,218,154.50 |

344,218,155 |

| USA |

X |

$1,383,886,590 |

0 |

669,498,165 |

Latin America Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Mexico |

M |

$788,089,384 |

402,922,834 |

402,922,834 |

| Mexico |

X |

$319,691,638 |

555,192,081.20 |

555,192,081 |

Eastern Europe and CIS Trade Flow and Market Value, 2024 (Product: 481910 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Hungary |

M |

$204,476,527 |

116,267,751.80 |

116,267,752 |

| Hungary |

X |

$196,570,130 |

112,325,021.70 |

112,325,022 |

| Ukraine |

M |

$20,539,684 |

9,187,597.90 |

9,187,598 |

| Ukraine |

X |

$6,461,734 |

4,947,481.30 |

4,947,481 |

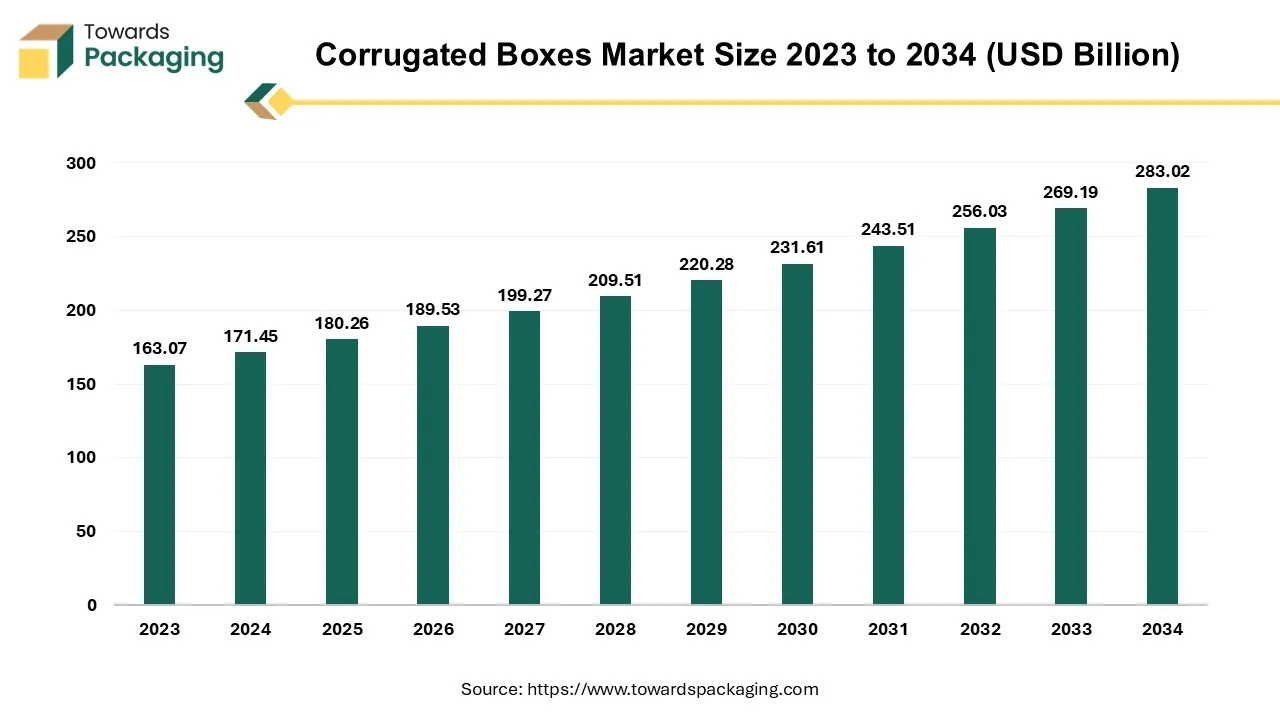

Future of Corrugated Boxes Market

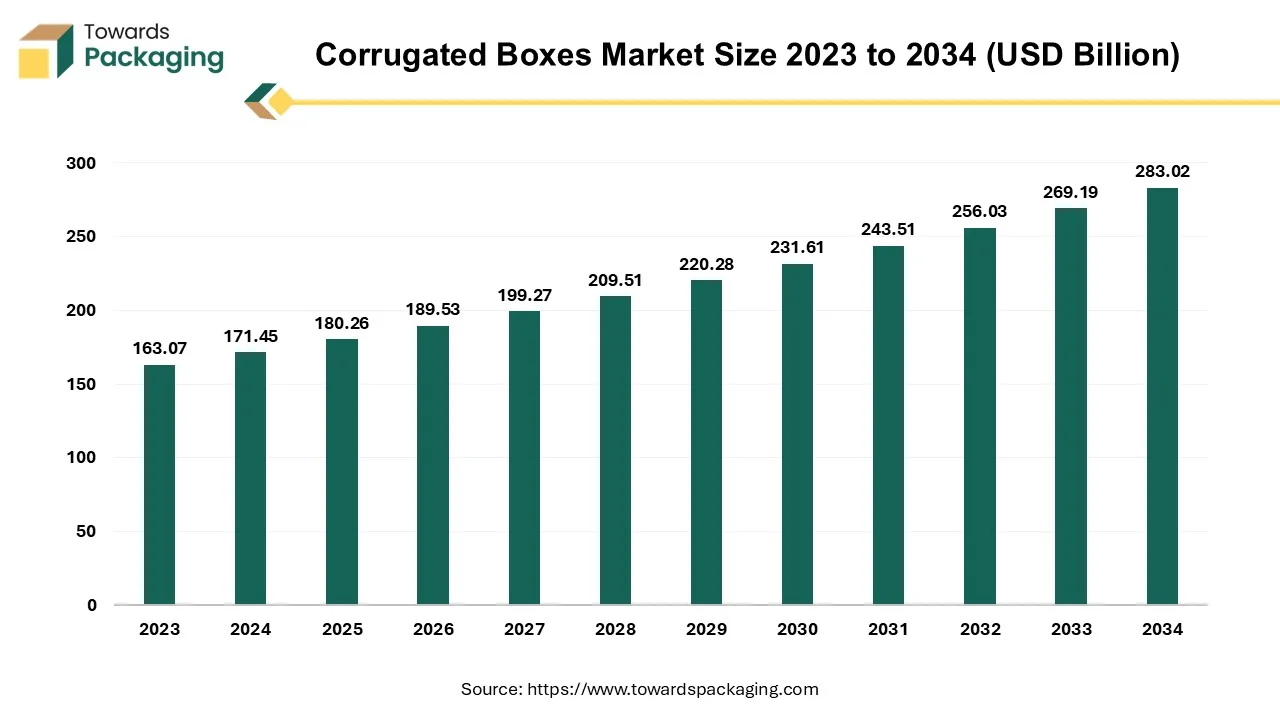

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

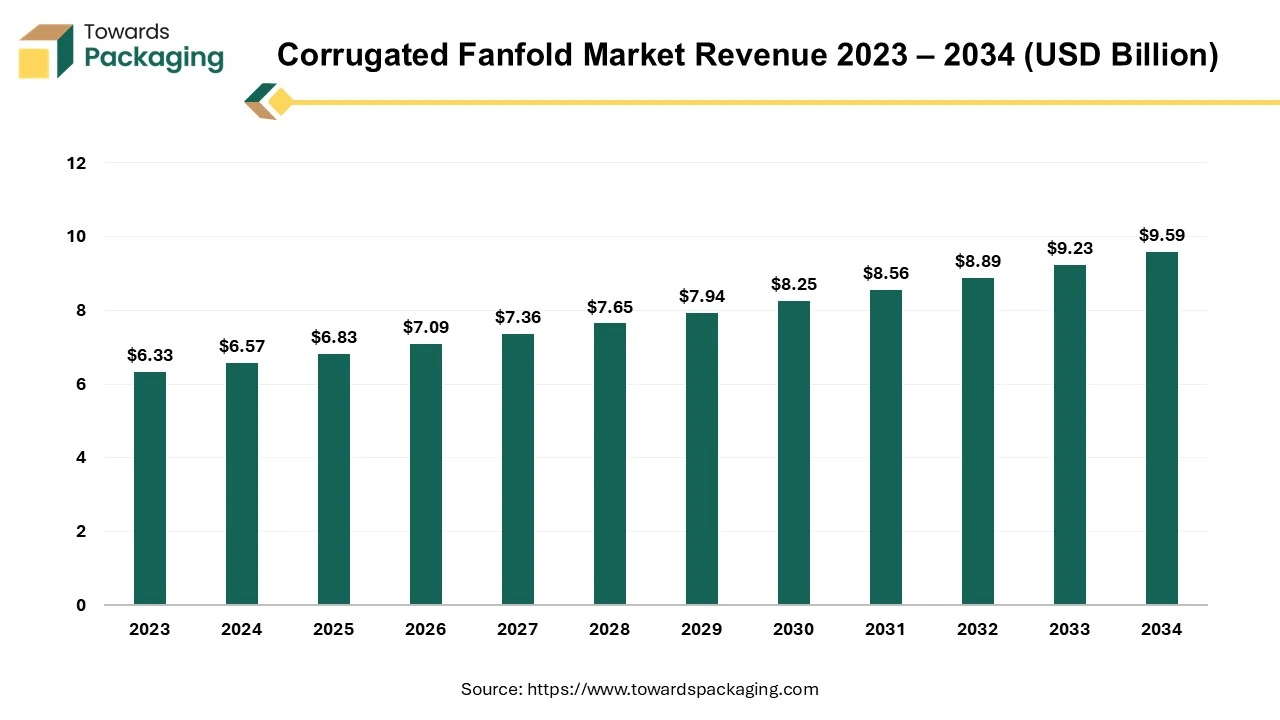

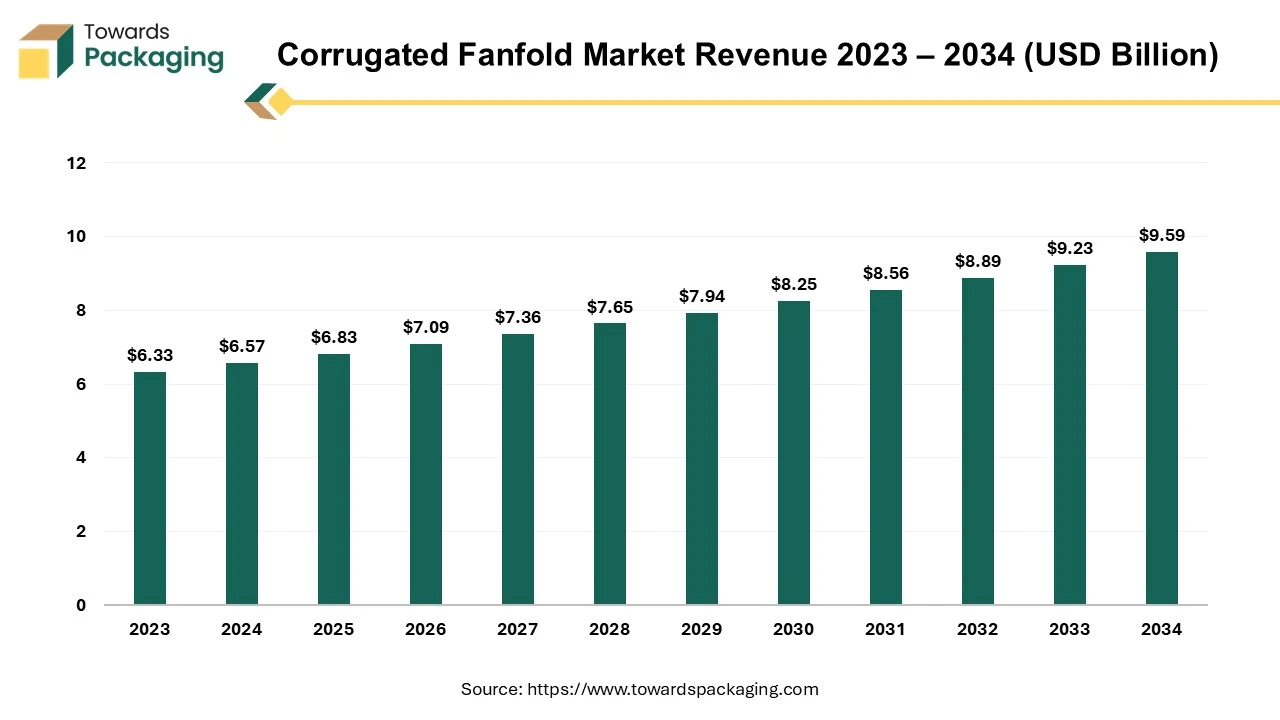

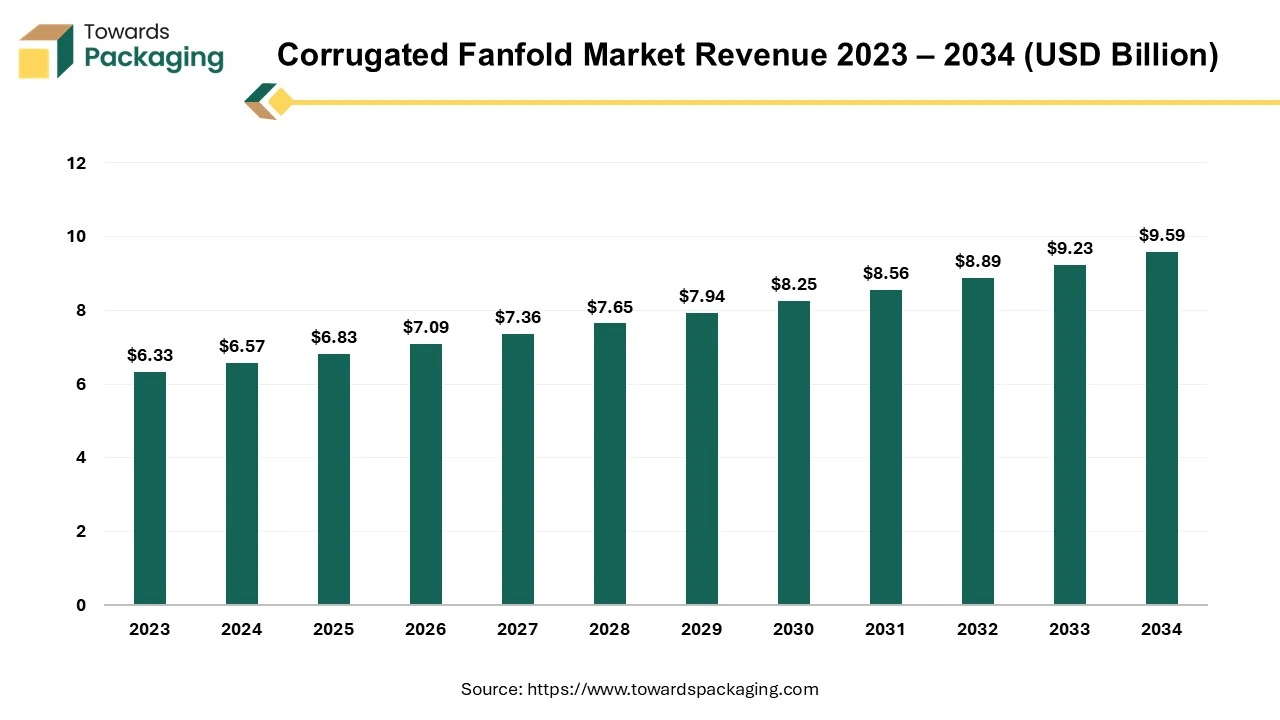

Future of Corrugated Fanfold Market

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

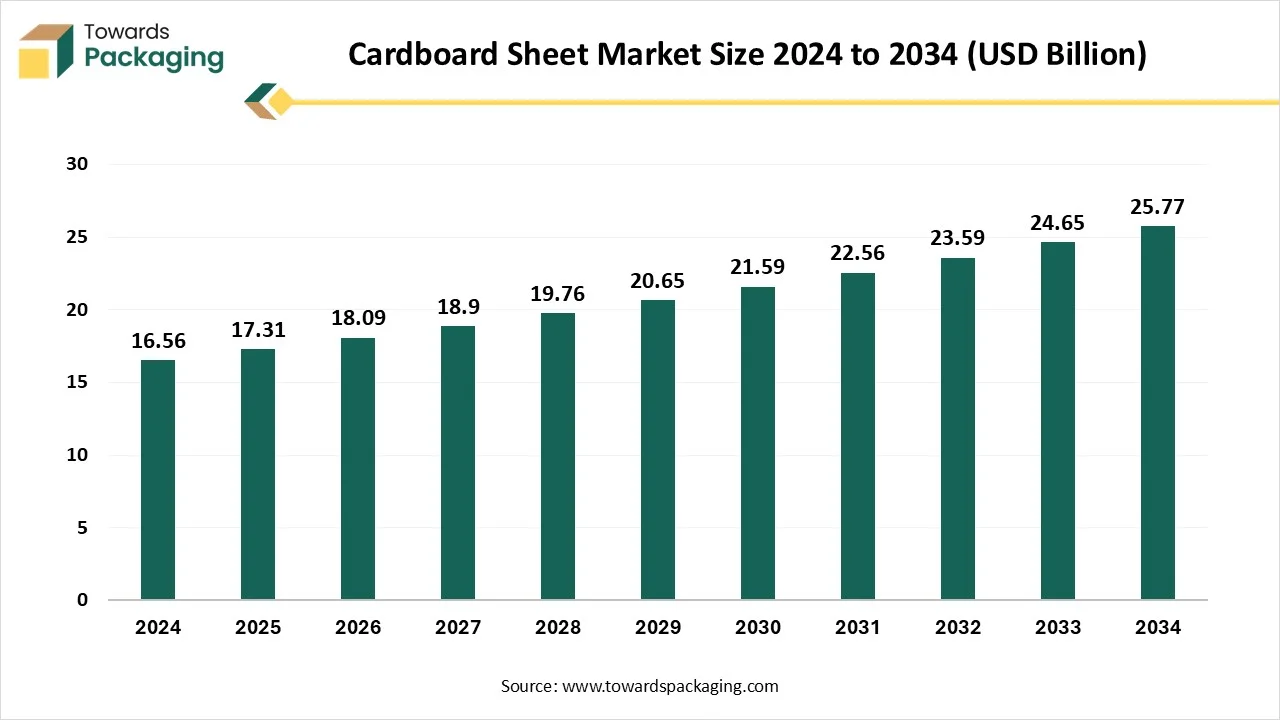

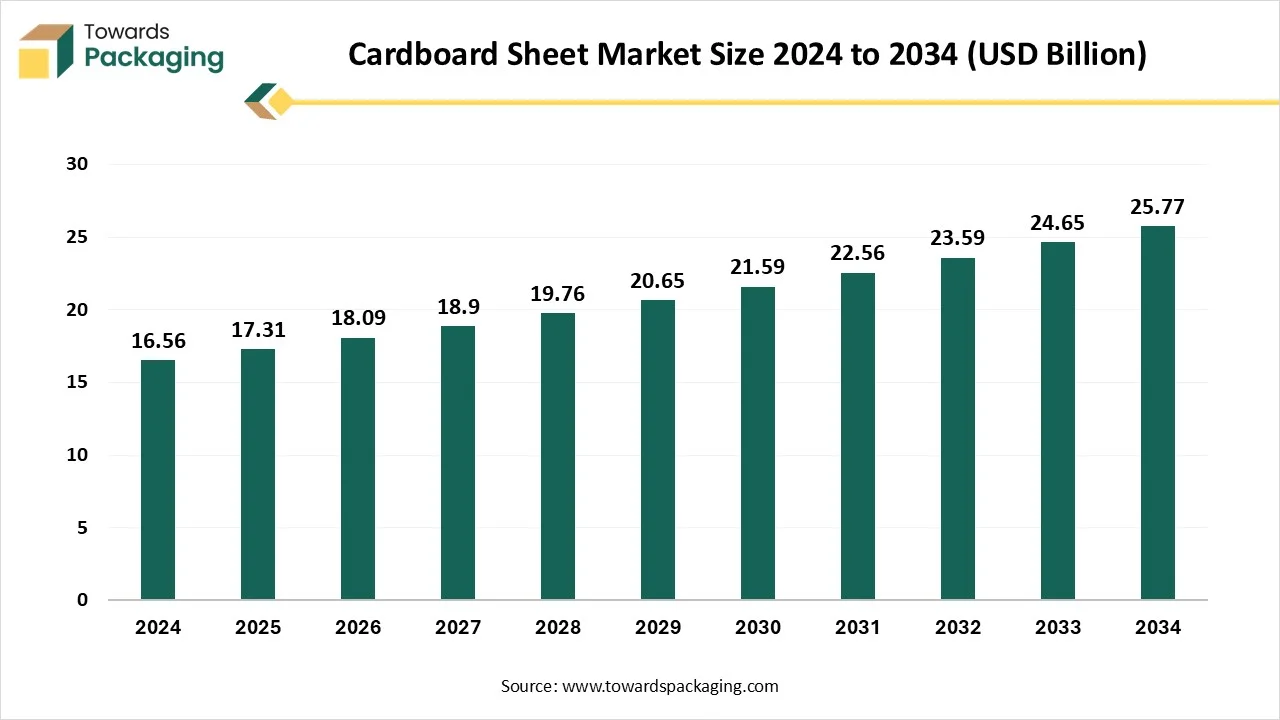

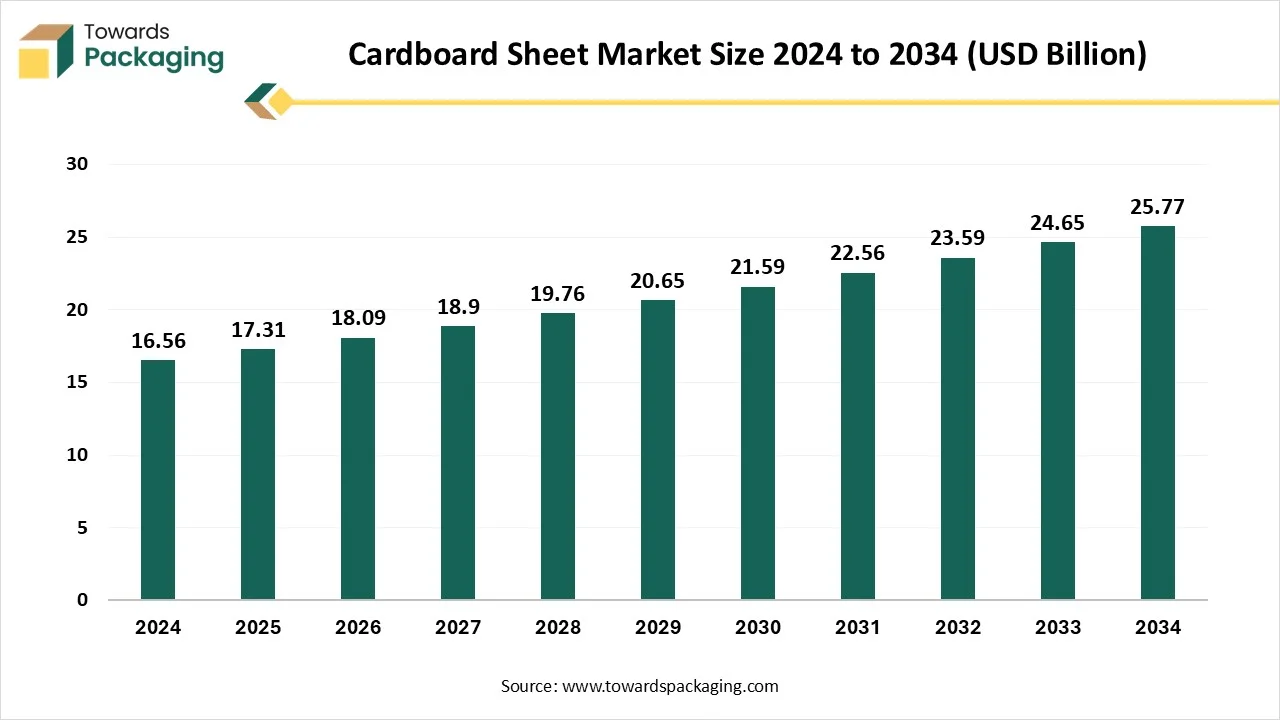

Future of Cardboard Sheet Market

The global cardboard sheet market is forecast to grow from USD 17.31 billion in 2025 to USD 25.77 billion by 2034, driven by a CAGR of 4.53% from 2025 to 2034. The rising demand for sustainable packaging in several industries is due to growing ecological concerns. The increasing e-commerce industry and protective packaging have influenced the growth of the market due to their recyclability, versatility, and cost-effectiveness.

The cardboard sheet market is facing significant development because of the growing demand in the packaging sector. These cardboard sheets are extensively utilised by the retail, e-commerce, and food and beverages sectors due to their eco-friendly and cost-effectiveness nature. The increasing shift in the direction of sustainable packaging options is the major reason behind the growth of the cardboard sheet sector. As a consequence, companies are concentrating on the rise of lightweight, recyclable, and biodegradable cardboard sheets. Moreover, the rising online shopping trend and home delivery services have made a huge contribution to the development of cardboard sheets packaging. The continuous innovation in the production procedure causes the enhancement of the quality and decreases the charges, which supports the market to rise.

Value Chain Analysis

R&D

Investment focuses on lightweight, high-strength, and eco-friendly corrugated boards. Smart printing and water-resistant coatings are also being developed.

Key Players: International Paper, DS Smith, Smurfit Kappa, Georgia-Pacific, WestRock

Logistics & Distribution

Corrugated boxes are optimized for transport efficiency and stacking strength. Integration with e-commerce and retail logistics is a key trend.

Key Players: DS Smith, Smurfit Kappa, WestRock, International Paper, Packaging Corporation of America

Recycling & Waste Management

Corrugated packaging is highly recyclable, and companies promote waste recovery programs. Recycled fiber content is increasing in production to minimize environmental impact.

Key Players: Smurfit Kappa, WestRock, International Paper, DS Smith, Georgia-Pacific

Corrugated Packaging Market Top Players

Latest Announcements by Corrugated Packaging Industry Leaders

- In January 2025, DS Smith's innovative product manager, Marlena Hardy, stated that in addition to providing a recyclable product for clients looking to fulfill environmental goals, TailorTemp shows how adaptable and dependable fiber-based materials can be in cold chain logistics. Since design is crucial, DS Smith team uses specialized predictive modeling to create solutions for pharmaceutical clients that are appropriate for their intended use and promptly validate them in the lab.

New Advancements in Corrugated Packaging Industry

- On 16 April 2025, Xact Pre-pack and Frutmac revealed the latest range of 100% recycled cardboard trays and punnets for vegetables, fruits, and baked goods.

- On 24 March 2025, Oji India Packaging Pvt Ltd a subsidiary of Japan’s Oji Group and top company in paper products inaugurated its fifth manufacturing institution in India at Sri City, Andhra Pradesh.

- In March 2025, The Boxery, a prominent supplier of packaging solutions, debuted its ground-breaking range of creative wholesale corrugated boxes at its offices in New York. The goal of this launch is to transform packaging for companies across the country and meet the increasing need for shipping solutions that are effective, long-lasting, and space-efficient.

- On 31 January 2025, Biedronka joined forces with Mondi in a closed-loop program in order to supply, regenerate, and collect its corrugated packaging in line with the retailer's plastic consumption and CO2 emission targets.

- In January 2025, Biedronka and Mondi signed collaboration on a closed-loop initiative to supply, collect, and re-produce its corrugated packaging in order to meet the retailer's CO2 emission and plastic usage goals. In a collaborative webinar, the partners described how the program uses a paper mill in Swiecie to handle waste paper. After being supplied to one of Mondi's six plants in Poland, the resulting paper is processed into corrugated cardboard packaging, such as crates for fruits and vegetables. Products are packed in this packaging by Biedronka's suppliers and sent to logistical hubs before being delivered to retail locations. Customers purchase goods in their individual packs, leaving this corrugated cardboard on the shelf.

Corrugated Packaging Market Segments

By Wall Type

- Single Wall Boards

- Standard Single Wall

- High-Density Single Wall

- Light-Weight Single Wall

- Double Wall Boards

- Regular Double Wall

- High-Density Double Wall

- Reinforced Double Wall

- Triple Wall Boards

- Standard Triple Wall

- Heavy Duty Triple Wall

- Single Face Boards

- Standard Single Face

- High-Density Single Face

By Packaging Type

- Boxes

- Regular Slotted Containers (RSC)

- Die-Cut Boxes

- Full Overlap Slotted Containers (FOL)

- Half Slotted Containers (HSC)

- Telescope Boxes

- Containers

- Self-Locking Containers

- Folding Containers

- Large Corrugated Containers

- Trays

- Single Wall Trays

- Double Wall Trays

- Multi-Compartment Trays

- Sheets

- Plain Corrugated Sheets

- Printed Corrugated Sheets

- Coated Corrugated Sheets

- Others

- Corrugated Pallets

- Corrugated Tubes

- Corrugated Display Units

By Application

- Food & Beverages

- Fresh Produce Packaging

- Processed Food Packaging

- Beverage Packaging

- Dairy Products Packaging

- Electronics & Electricals

- Consumer Electronics Packaging

- Industrial Electronics Packaging

- Electrical Appliance Packaging

- Transport & Logistics

- Heavy Duty Packaging

- Shipping Packaging

- Protective Packaging

- E-Commerce

- Product Shipping Boxes

- Custom Packaging for E-commerce

- Packaging for Fragile Items

- Personal Care Goods

- Cosmetics Packaging

- Toiletries Packaging

- Fragrance Packaging

- Healthcare

- Pharmaceutical Packaging

- Medical Equipment Packaging

- Healthcare Product Packaging

- Homecare Goods

- Cleaning Products Packaging

- Laundry Packaging

- Home Improvement Products Packaging

- Others

- Automotive Parts Packaging

- Toys & Games Packaging

- Hardware and Tools Packaging

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait