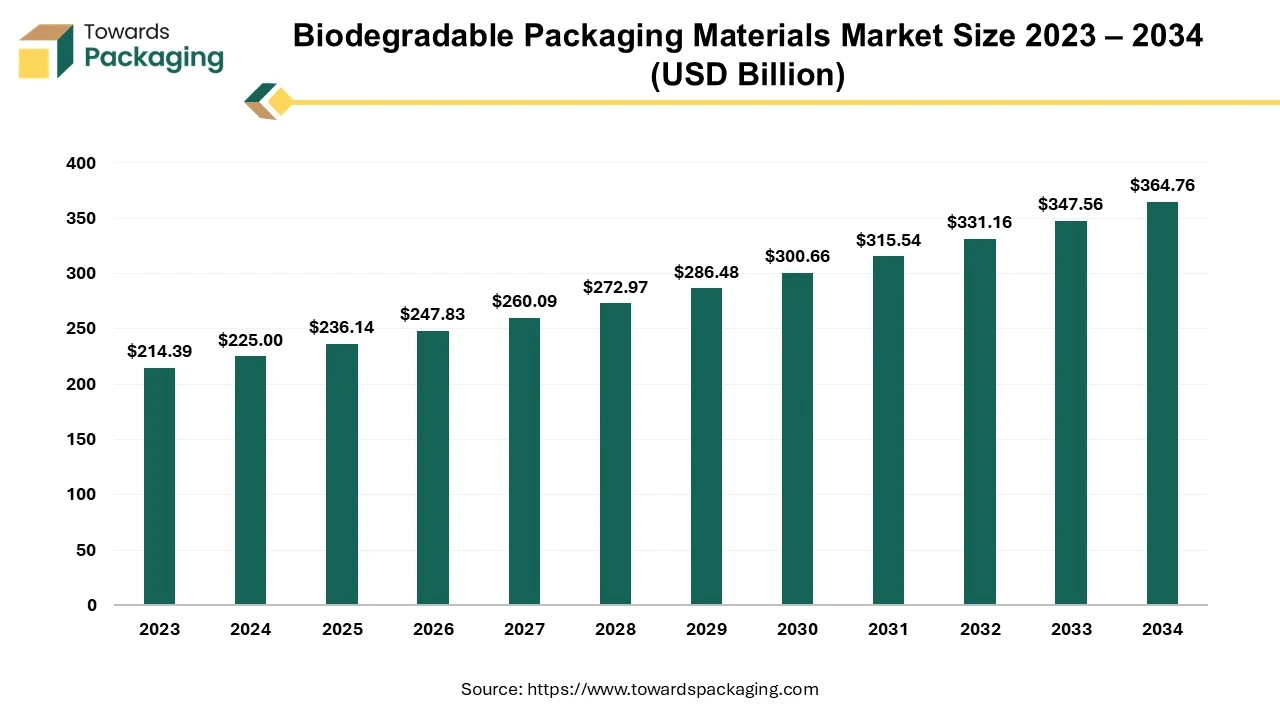

The biodegradable packaging materials market is projected to expand from USD 236.14 billion in 2025 to USD 364.76 billion by 2034, growing at a CAGR of 4.95% during the forecast period.

The packaging material made from natural resources benefits the environment. The market for biodegradable packaging materials centers around producing and distributing packaging materials made from renewable sources such as plants and microorganisms. Utilization of these materials reduces plastic waste, polluting the ocean and landfills since it decomposes naturally. Along with this, reducing carbon emissions and recycling and repurposing features of sustainable packaging are the leading objectives of the market.

The decomposition of biodegradable materials occurs through microorganisms such as bacteria, fungi, and algae, breaking the materials down into different substances like water, carbon dioxide, and biomass. Conserving resources and maintaining a circular economy contribute to market growth. Apart from this, the demand for biodegradable packaging spans various sectors, such as food and beverages, pharmaceuticals, and consumer goods.

The primary function of biodegradable packaging materials is to reduce waste by using packaging materials such as paper and cardboard due to their recycling properties and edible films made from plant-based materials. The mushroom packaging is made from powdered agricultural waste and tied together by a matrix of mushroom roots; mycelium is used for packaging food items due to its easy-opening container. The implementation of sustainable packaging plays a crucial role in enhancing the use of recycled production by significantly reducing the waste of PET material and minimizing the use of traditional plastic products.

In contrast, packaging products made from a 100% blend of co-polyester and PLA (sugar cane) will fuel the market growth. Utilizing compostable bags that are leakproof and fully recyclable will, in turn, lead to less use of petroleum supplies and optimized shipping costs. The biodegradable packaging materials market comes in various sizes and shapes since the customization option provides consumer-preferred packaging that comes in trays, rigid boxes, unique product configurations like upright, flat, or angled, and heavy objects showcasing the versatile use of the bio-based packaging and ensuring the transportation and protected packaging of products. It also ensures cost-effectiveness and less carbon reduction, given that biodegradable plastics emit only 0.8 tons of carbon – a 500% reduction.

| Metric | Details |

| Market Size in 2024 | USD 225 Billion |

| Projected Market Size in 2034 | USD 364.76 Billion |

| CAGR (2025 - 2034) | 4.95% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Material, By Packaging Format, By End Use and By Region |

| Top Key Players | Amcor PLC, Smurfit WestRock, Sonoco Products Company, Mondi Group, Sealed Air Corporation |

By 2040, the biodegradable packaging market is expected to be a cornerstone of the global packaging industry, characterized by:

The integration of AI in the biodegradable packaging materials market is reflected through improvements in the manufacturing process, wherein advanced technology like injection molding, extrusion, and blow molding techniques are used to enhance the precise and efficient production of biodegradable materials. The automation process assists in creating complex shapes and designs, making biodegradable packaging more versatile and suitable for various applications.

In addition, advancements in additive manufacturing (3D printing) provide customization and rapid prototyping of biodegradable packaging, thereby minimizing waste generation and production time. Implementing advanced technology enables biodegradable materials to have stronger barrier properties than traditional plastic. Inculcation of nanocomposites and multi-layered biopolymer films are developed to extend shelf life and protection.

Active and intelligent packaging technologies are included in biodegradable packaging solutions as they will contribute to their functionality. The packaging also integrates oxygen scavengers, moisture absorbers, or antimicrobial agents. Furthermore, sensors and indicators enable real-time information about the product's condition.

The major driving factors are the increasing consumption of automated process packaging, the implementation of technology to increase the manufacturing process of biodegradable materials, and the changing preferences of consumers. The rising urbanization wants cost-effective recycled material packaging as it utilizes few resources and circulates the economy, thereby driving the biodegradable packaging materials market. The non-toxic and allergen-free properties of packaging also contribute to the market growth.

The emerging awareness of consumers fuels the market as it appeals to them to use eco-friendly packaging, resulting in increased sales. Biodegradable adhesives, made from natural polymers and bio-based materials, play a crucial role by offering strength and versatility, increasing their popularity in various packaging needs and applications. Biodegradable adhesives are used for laminating paper and cardboard, gluing product labels, biodegradable stickers, seals, and lining packaging such as beverage cans.

The leading challenge that hinders the growth of the biodegradable packaging materials market is the high costs of the manufacturing process and lack of performance durability. The materials might not match the barrier properties of traditional practice, which are major hindrances. Apart from this, standardized tests and certification processes are unable to assess the impact of different biodegradable products. The emission of greenhouse gas emissions (GHGs) produced after the decomposition of compostable products and bioplastics is 30 times more potent than the emissions produced by carbon dioxide. Furthermore, government regulations on the disposal of bio-based materials also pose a challenge to the market.

The opportunities in the biodegradable packaging materials market are expected to grow, driven by advancements in robotics, vision technology, and other innovative solutions that enhance and monitor temperature, humidity, and freshness, offering valuable data to consumers and businesses. The integration of new material dynamics in the manufacturing process, such as injection molding, extrusion, and blow molding techniques. Additionally, the rise in consumer preferences for eco-friendly packaging products will further boost market growth, as it necessitates packaging processes capable of designing complex packaging patterns.

Robotic packaging will enhance the market by reducing labor costs and excessive use of materials. The use of biodegradable inks is important for printing and finishing biodegradable packaging as they are made from natural pigments and water-based formulations, making them safe for the environment and human health. Apart from this, innovation in biodegradable coatings has made them water-resistant, glossy, and durable, hence enhancing their aesthetic appeal.

By material type, the paper segment dominates the biodegradable packaging materials market. Paper is versatile and decomposes quickly compared to other materials. Paper has emerged as an attractive choice for biodegradable packaging due to a global shift towards more eco-friendly packaging demand. The mushroom-based products and sugarcane-based packaging products offer water resistance, are customizable, and are a renewable resource. It includes packaging products such as lunch boxes, plates, bowls, cutlery, straws, and cups.

By end-user industry, the food segment dominates the biodegradable packaging materials market. The segment dominates due to increasing consumer awareness regarding hygiene and visual appeal. The packaging prevents product contamination, increases the supply chain market due to e-commerce, and reduces packaging waste by following government guidelines.

Asia-Pacific is the dominating region and owns the largest share of the biodegradable packaging materials market due to growing consumer awareness around the environmental impact of non-biodegradable packaging. Rising urbanization and increasing disposable incomes have also contributed to market growth. Asia-Pacific focuses on the adoption of biodegradable packaging and materials to initiate and support a sustainable drive and increase the market rate. Although consumer demand expands market growth, the limited infrastructure for waste regeneration and supply chain have hindered the development of sustainable packaging solutions.

India Market Trends

India biodegradable packaging materials market is driven by the abundant availability of raw materials and corporate sustainability initiatives in the country. India has implemented stringent policies to combat plastic pollution, notably the nationwide ban on specific single-use plastic items effective from July 01, 2022. This ban encompasses items like plastic plates, cups, and cutlery, thereby encouraging the adoption of biodegradable alternatives. Additionally, initiatives such as the Swachh Bharat Abhiyan (Clean India Mission) emphasize waste management and environmental sustainability, creating a favorable regulatory environment for sustainable packaging investments.

India’s rich agricultural base offers a steady supply of raw materials for biodegradable packaging production. Plant-based materials like sugarcane, cornstarch, bamboo, and seaweed are commonly used in biodegradable packaging. Additionally, recyclable paper and cardboard offer sustainable alternatives. Many Indian businesses, particularly in the food and hospitality sectors, have started to embrace biodegradable packaging materials. This adoption is driven by consumer demand and the desire to enhance corporate sustainability and eco-friendliness.

![Biodegradable Packaging Materials Market Set to Expand with a Robust CAGR [Countries CAGR (2024 - 2034)] Biodegradable Packaging Materials Market Set to Expand with a Robust CAGR [Countries CAGR (2024 - 2034)]](../insightimg/biodegradable-packaging-materials-market-to-expand-with-robust-cagr.webp)

North America plays a notable part in the biodegradable packaging materials market due to industries shifting towards eco-friendly packaging. Increased awareness around global warming and its impacts are pushing many Americans away from utilizing single plastics, which are being banned in the region. Instead, the adoption of compostable alternatives has accelerated the market growth. The restriction on using single-use plastic has increased the utilization of bio-degradable packaging solutions, as companies also want to attract a consumer base by presenting sustainable packaging. Government and corporate initiatives have also contributed significantly to the awareness of using eco-friendly packaging for various sectors.

U.S. Market Trends

U.S. biodegradable packaging materials market is driven by technology advancement and innovation of biodegradable material in the country. Innovations in materials science have led to the development of biodegradable packaging materials such as polylactic acid (PLA), starch-based plastics, and cellulose-based plastics. These materials offer functionality comparable to traditional plastics while being more environmentally friendly. Federal, states, and local governments in the U.S. have implemented regulations to reduce plastic waste, such as bans on single-use plastics and mandates for biodegradable materials in packaging. These policies create a favorable environment for the adoption of biodegradable packaging solutions.

Europe region is seen to grow at a notable rate in the foreseeable future. The European Union has implemented comprehensive policies to reduce plastic waste and promote sustainable packaging: single-use plastics directive, packaging and packaging waste directive (94/62/EC), and circular economy action plan.

By Material

By Packaging Format

By End Use

By Region

December 2025

December 2025

December 2025

December 2025