Seaweed Packaging Market Strategic Growth, Innovation & Investment Trends

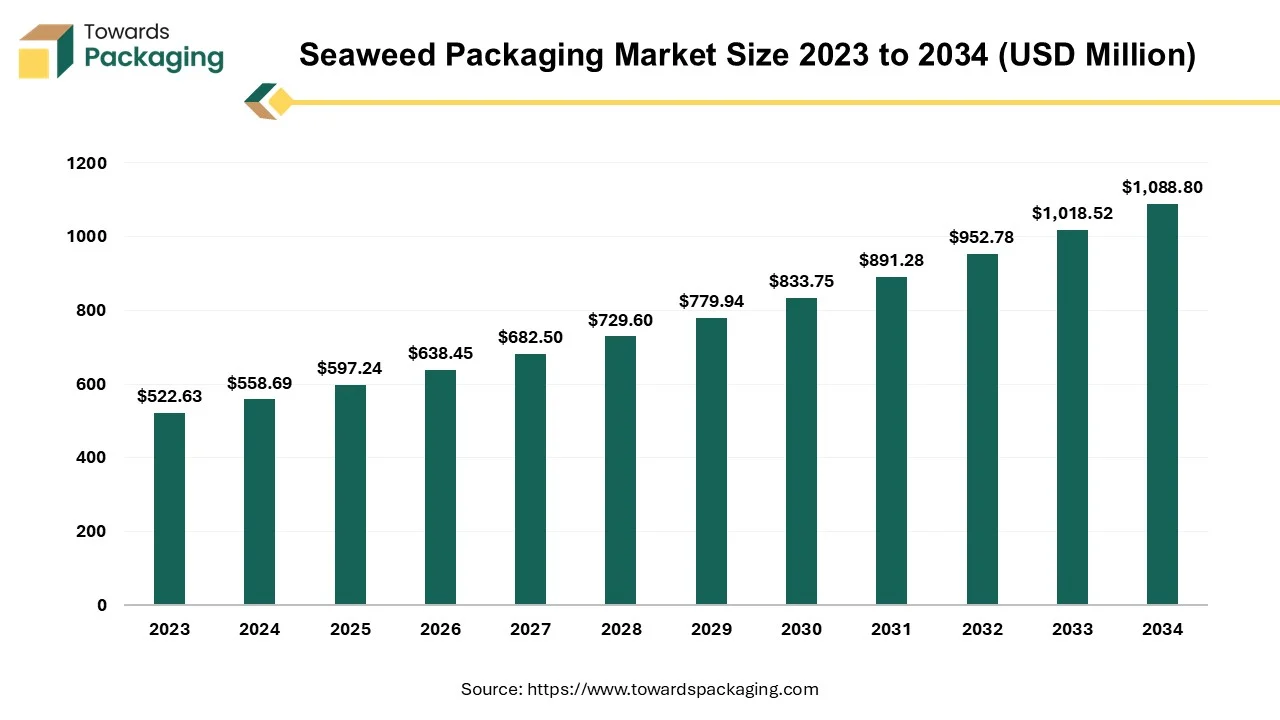

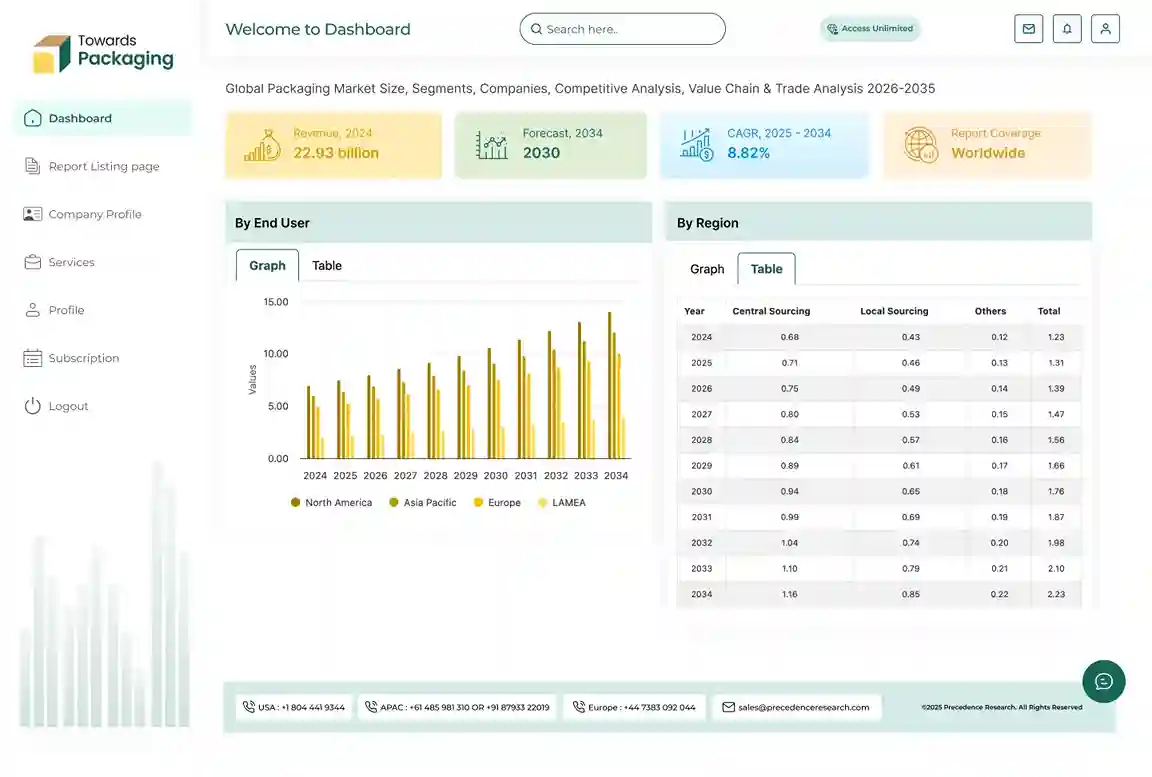

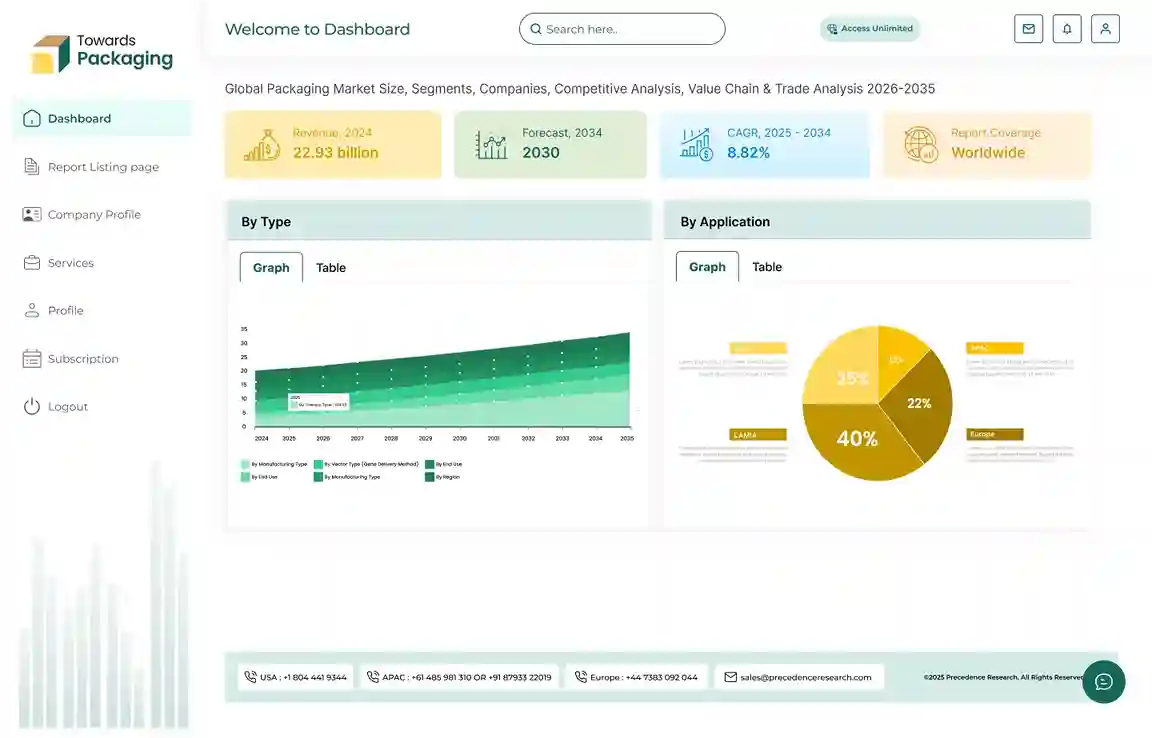

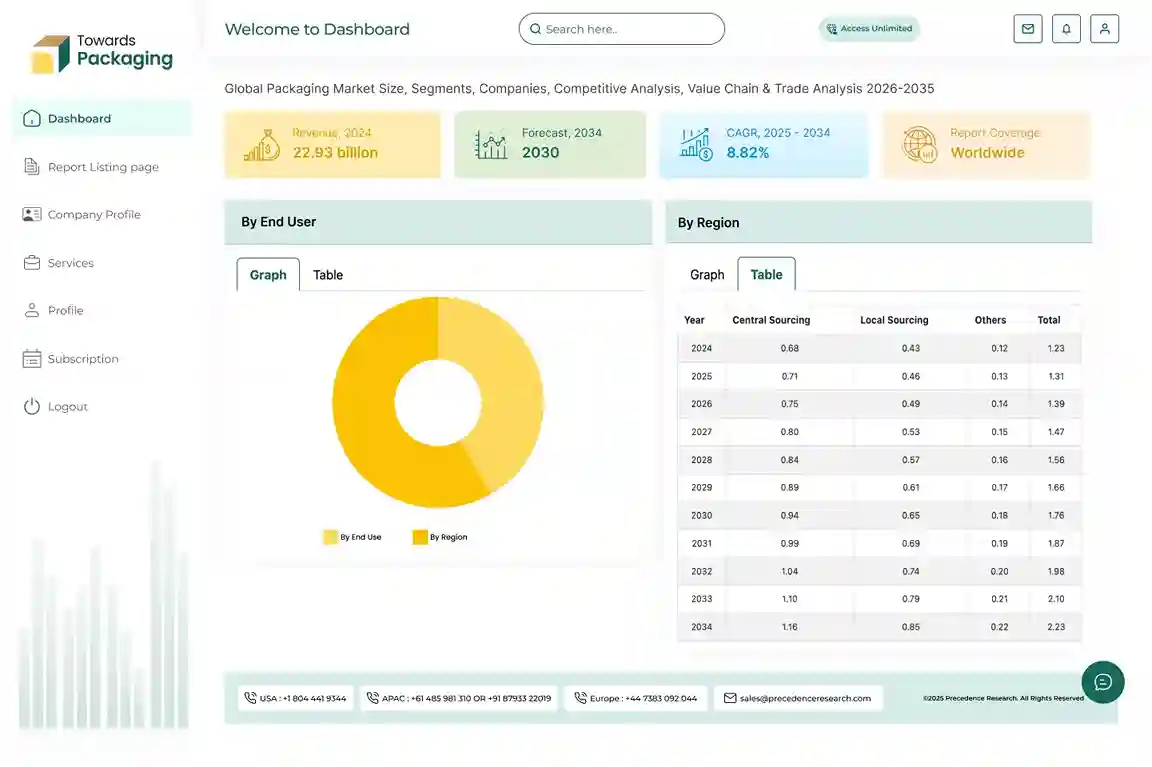

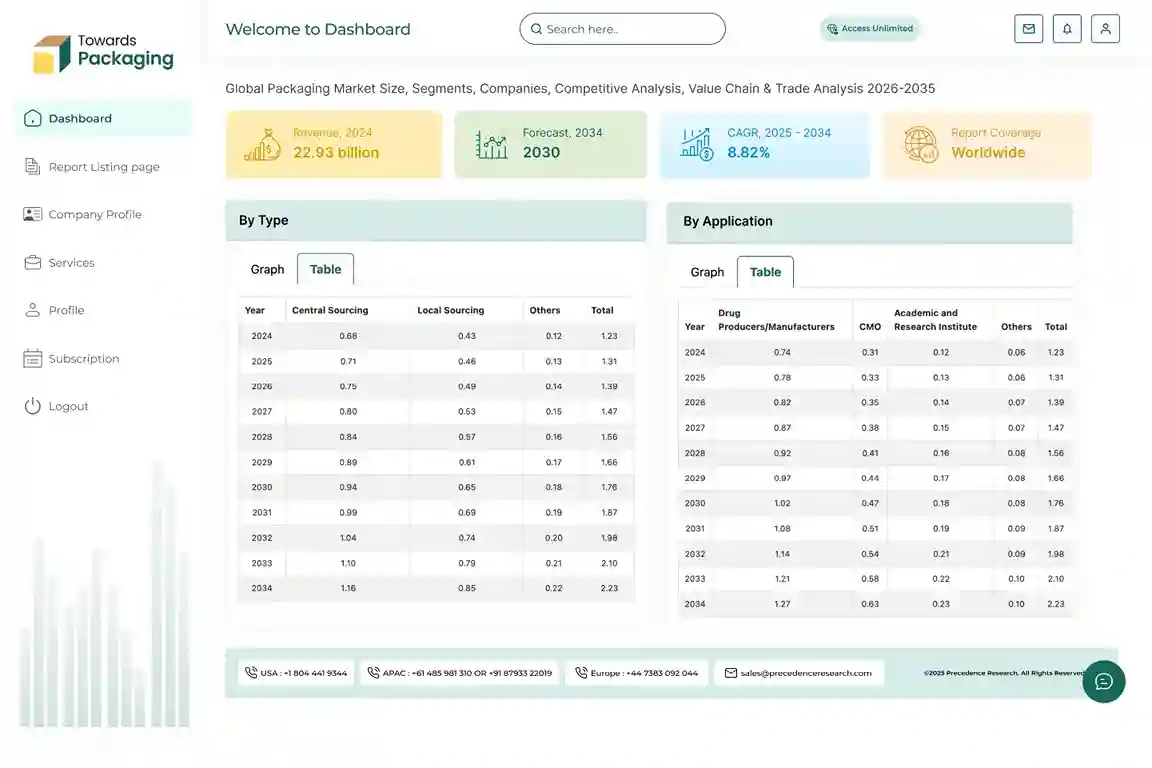

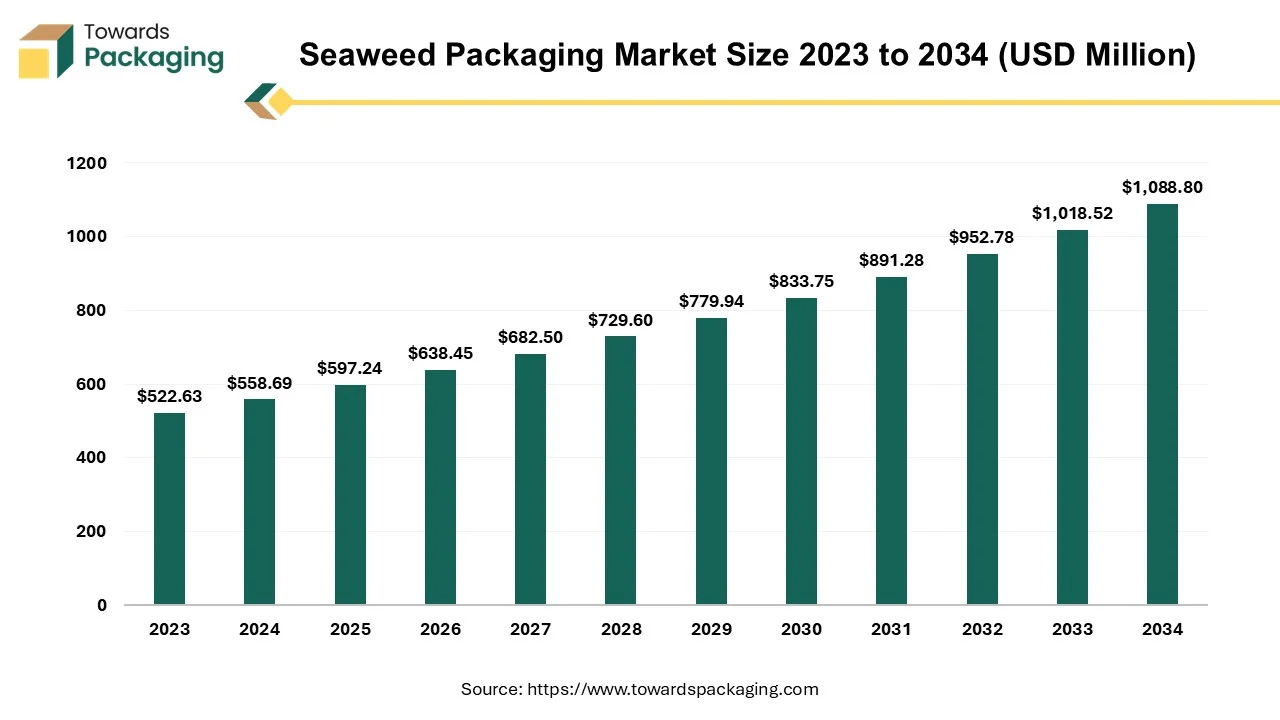

The seaweed packaging market is forecasted to expand from USD 638.45 million in 2026 to USD 1,163.93 million by 2035, growing at a CAGR of 6.9% from 2026 to 2035. The market is segmented by source, packaging process, and end-use. In 2024, the plant segment dominated the market, and antimicrobial packaging was the leading process. The food & beverages sector held the largest share in end-use applications.

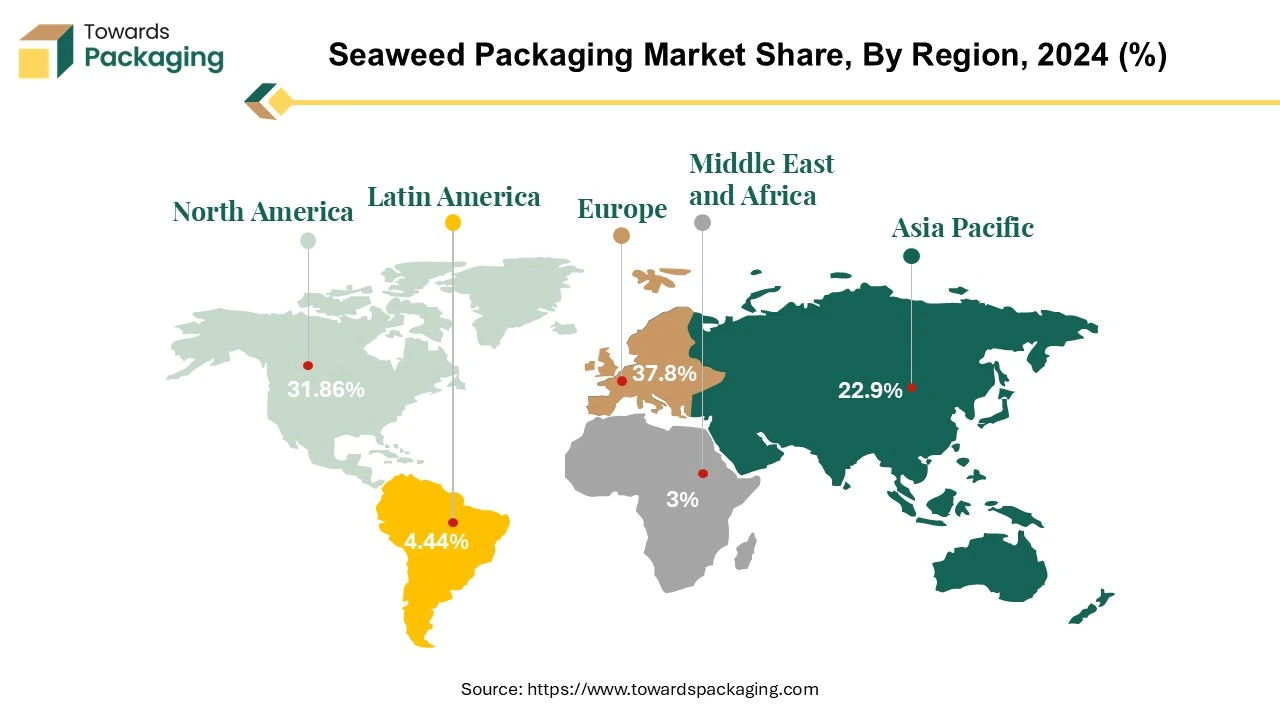

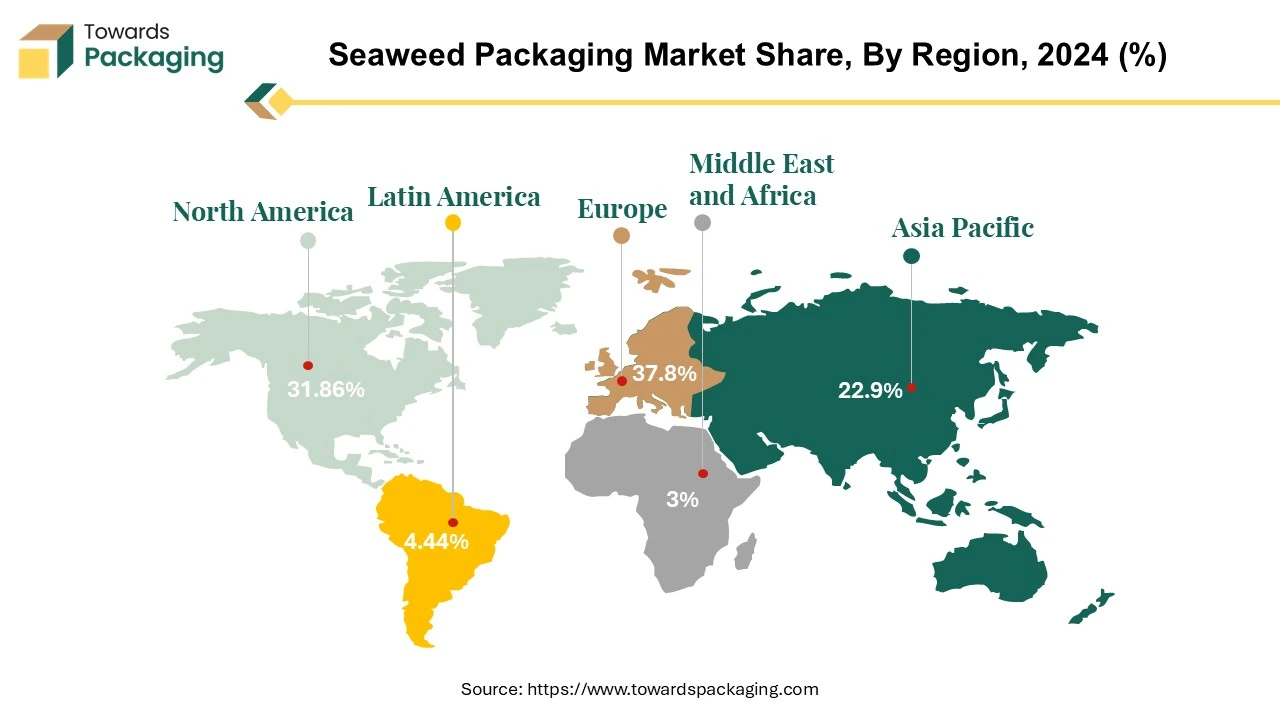

The market is geographically divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe led the market in 2024, with North America expected to experience significant growth due to its booming e-commerce industry and growing demand for sustainable packaging.

Major Key Insights of the Seaweed Packaging Market

- Europe dominated the market in 2024 with the largest share.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By source, the plant segment dominated the market with the largest share in 2024.

- By packaging process, the antimicrobial segment registered its dominance over the global seaweed packaging market in 2024.

- By end use, the food & beverages segment dominated the seaweed packaging market in 2024.

Seaweed Packaging Market: Edible Packaging Overview

Seaweed packaging is known as biodegradable and edible packaging manufactured from algae-based or seaweed materials. It is an eco-friendly alternative to plastic, as it decomposes naturally and reduces environmental pollution. Seaweed-based packaging is used for food wrapping, sachets, and even water-soluble films. It is sustainable because seaweed grows rapidly without the need for fertilizers or freshwater, making it a promising solution for reducing plastic waste.

Market Trends

Diversification of Packaging Formats

Manufacturers are expanding their product lines beyond traditional films to include containers, trays, and even edible packaging options. This diversification caters to varying consumer preferences and broadens the potential applications of seaweed packaging across the food industry.

Integration of Functional Properties

Innovations in seaweed-based materials now incorporate essential oils, antioxidants, and antimicrobial agents. These enhancements improve food safety and quality by extending shelf life, making seaweed packaging more appealing to food manufacturers.

Technological Innovations

Advancements in seaweed processing and packaging technologies have improved material quality and decreased production costs. These innovations address scalability concerns and enhance the versatility of seaweed-based packaging, making it more accessible for broader industry adoption.

How Can AI Improve the Seaweed Packaging Industry?

AI-driven satellite imaging and underwater sensors can track seaweed growth, water quality, and optimal harvesting times, ensuring higher yields. AI can analyze climate patterns, ocean conditions, and nutrient levels to optimize seaweed farming, reducing waste and maximizing productivity. Robotics and AI-controlled systems can streamline the cultivation and harvesting process, reducing labor costs and improving efficiency. AI can help develop new formulations for seaweed-based packaging by analyzing material properties and suggesting additives that improve durability, flexibility, or water resistance. Machine learning models can detect defects in packaging materials, ensuring only high-quality products reach the market.

AI-powered manufacturing systems can optimize drying, molding, and packaging processes, reducing waste and energy consumption. AI can improve logistics by predicting demand, optimizing inventory, and reducing transportation costs. AI-powered scheduling tools can enhance factory efficiency by adjusting production rates based on real-time market demand. AI can optimize energy usage in processing facilities, making seaweed packaging production more sustainable and cost-effective. AI can simulate how different seaweed-based materials break down in various environments, helping researchers develop packaging that decomposes efficiently.

Driver

Growing Environmental Awareness & Plastic Pollution Crisis

Rising awareness of plastic pollution and its harmful effects on marine life is pushing consumers and businesses toward eco-friendly alternatives like seaweed packaging. Governments and environmental organizations are actively promoting biodegradable packaging solutions to reduce landfill waste. The growing environmental awareness & plastic pollution crisis has increased the demand for the seaweed packaging, which has estimated to drive the growth of the seaweed packaging market in the near future.

- For instance, on February 18, 2025, Shri Bhupender Yadav, the Union Minister for Environment, Forests, and Climate Change, opened a one-day conference on "Waste Recycling & Climate Change 2025" hosted by the Recycling and Environment Industry Association of India (REIAI). The Union Minister said during the first session that India produces about 62 million tons of waste a year, with the amount of plastic, electronic, and hazardous waste increasing quickly.

Restraint

Durability & Performance Limitations and Limited Seaweed Supply

The key players operating in the market are facing issue due to limitations in performance & durability as well as limited sewed supply which has estimated to restrict the growth of the seaweed packaging market in the near future. Seaweed-based biopolymers cost more than conventional plastic and even some other biodegradable alternatives (e.g., paper or cornstarch-based packaging). Not all regions have access to large quantities of seaweed, making sourcing difficult and increasing transportation costs.

Seaweed packaging is naturally water-soluble, which limits its applications, especially for products requiring moisture resistance. Many consumers and businesses are not familiar with seaweed packaging and its benefits. Misconceptions about edible or biodegradable packaging (e.g., doubts about safety or performance) may slow adoption. Government agencies may take time to approve seaweed packaging for food contact safety and biodegradability claims.

Market Opportunities

Growth of the Retail Sector and E-commerce

The booming e-commerce industry is looking for sustainable packaging solutions to replace plastic-based shipping materials. Major retailers and brands are pledging to reduce plastic waste, further driving market demand. The expansion of retail and e-commerce is a significant driver for the seaweed packaging market. As businesses seek sustainable alternatives to plastic, seaweed packaging is emerging as an eco-friendly solution for product packaging, shipping, and branding. Retail and e-commerce giants like Amazon, Walmart, and Alibaba are under pressure to reduce plastic waste due to consumer demand and government regulations.

Many brands are committing to plastic-free packaging, leading to increased adoption of biodegradable options like seaweed-based films, wrappers, and pouches. Companies focused on ethical and sustainable branding are turning to seaweed packaging to enhance their environmental image. The rise of Direct-to-Consumer (DTC) brands in fashion, cosmetics, and food industries is fueling demand for custom, eco-friendly packaging. Sustainable brands use biodegradable seaweed packaging as a unique selling point (USP) to attract eco-conscious consumers.

- In January 2025, according to the data published by the E-Commerce and Digital Marketing Association, global retail sales are expected to expand at the quickest rate since 2021 in 2025, increasing by 2.2% in volume to US$35.18 trillion. By the end of 2025, it is anticipated that e-commerce revenues will have grown to US$6.86 trillion.

Stringent Government Regulations on Single-Use Plastics

Bans and restrictions on plastic packaging in many countries (e.g., the European Union’s Single-Use Plastics Directive and Canada’s plastic ban) are creating demand for sustainable alternatives. Regulatory frameworks are encouraging companies to adopt biodegradable and compostable packaging to meet compliance standards.

What Makes Seaweed a Highly Sustainable Raw Material?

Seaweed is considered a highly sustainable raw material since it grows swiftly in the ocean without the need for pesticides, fertilizers, freshwater, or agricultural land. As a result, it requires a lot fewer resources than traditional plastic or bioplastic derived from plants. As it grows, it also takes up carbon dioxide, which helps maintain environmental equilibrium. Packaging made from seaweed decomposes naturally without leaving behind toxic residues or microplastics because it is biodegradable and compostable. For businesses looking to cut back on plastic waste and their overall carbon footprint, these qualities make it an environmentally friendly substitute.

How Are Regulations Influencing Market Growth?

Government regulations aimed at reducing plastic pollution are playing a major role in accelerating the seaweed packaging market. Businesses are encouraged to switch to biodegradable materials by the introduction of sustainability targets, tougher waste management regulations, and bans on single-use plastics in many nations. Eco-labeling regulations, plastic taxes, and environmental policies are pressuring brands and manufacturers to investigate renewable packaging options. Product development is also influenced by food safety and packaging regulations to guarantee that materials derived from seaweed satisfy quality and safety standards. The combination of these incentives and regulatory pressures is strongly driving market expansion.

What Innovations Are Shaping the Future of this Market?

Advances in technology are facilitating the transition of seaweed packaging from small-scale ideas to profitable solutions. To improve strength, flexibility, and moisture resistance, researchers and businesses are refining extraction techniques and combining seaweed polymers with other biomaterials. Its use in the food, personal care, and retail industries is growing thanks to new product formats like edible films, dissolvable sachets, flexible wraps and molded containers. Cost efficiency is also being increased by initiatives to integrate seaweed materials into current manufacturing systems and scale production. Seaweed packaging is becoming a viable and sustainable substitute for conventional plastic packaging thanks to these advancements.

Wide Availability: Plant Segment to Continue its Dominance

The plant segment held a dominant presence in the seaweed packaging market in 2024. Seaweed is primarily obtained from marine algae (macroalgae) rather than land-based plants for packaging due to several environmental, biological, and functional advantages. Seaweed grows rapidly, often at a rate of up to 60 cm per day, making it one of the most sustainable and renewable natural resources. Unlike land-based plants, it does not require freshwater, fertilizers, or pesticides, reducing its environmental footprint. Seaweed absorbs CO₂ and releases oxygen, assisting to combat climate change while being harvested for packaging. Seaweed-based packaging biodegrades in weeks, unlike plastics that take hundreds of years. It is home-compostable and dissolves in water, preventing pollution in oceans and landfills.

Many land-based plant materials require industrial composting, whereas seaweed decomposes naturally in various environments. Seaweed is cultivated in oceans, meaning it does not compete for agricultural land like corn, sugarcane, or bamboo used in bioplastics. The seaweed farming industry is already well-developed, making it easier to scale production for packaging materials. Unlike land-based plants, it does not require freshwater, fertilizers, or agricultural land, making it an ideal alternative to plastic and other plant-based packaging materials. As demand for eco-friendly packaging grows, seaweed-based materials are expected to play a significant role in reducing plastic waste and promoting sustainable practices.

Antimicrobial Segment Led in 2024: Zero Waste Initiatives to Get Support

The antimicrobial segment led the global seaweed packaging market. Antimicrobial packaging is commonly integrated into seaweed-based packaging due to its ability to extend shelf life, enhance food safety, and prevent microbial contamination. Rich in bioactive compounds: Seaweed contains polyphenols, flavonoids, and sulphated polysaccharides, which have natural antimicrobial and antioxidant properties. Inhibits pathogens: Some seaweed extracts can inhibit harmful bacteria like E. coli, Salmonella, and Listeria, making it ideal for food and medical packaging. Many synthetic antimicrobial agents cause pollution and may not be biodegradable. Seaweed-based antimicrobial packaging breaks down naturally, making it an eco-friendly alternative to plastic packaging with synthetic antimicrobial coatings. Supports zero-waste and compostable packaging solutions, which are highly valued in the food and beverage, healthcare, and pharmaceutical industries.

Food & Beverages Segment to Show Significant Share in Upcoming Years

The food & beverage segment accounted for a significant share of the seaweed packaging market in 2024. Consumers are increasingly seeking eco-friendly and plastic-free packaging for food and drinks. Governments worldwide are banning single-use plastic in food packaging, making seaweed-based alternatives more attractive. Brands are adopting biodegradable packaging solutions to improve sustainability and reduce environmental impact. Seaweed packaging is edible, biodegradable, and compostable, making it ideal for food applications. It eliminates packaging waste by allowing consumers to eat or dispose of packaging without harming the environment.

Europe’s Growing Trend of Sustainable Packaging to Promote Dominance

Europe region dominated the seaweed packaging market because of strict laws that encourage the decrease of plastic waste. Opportunities for seaweed packaging to replace traditional plastics have been made possible by the European Union's Single-Use Plastics Directive. Countries like France and the UK are leading the way in this change, as numerous businesses in the food, beverage, and cosmetics industries are implementing seaweed packaging solutions.

North America’s Food Industries to Support Region’s Expansion

North America region is anticipated to grow at the steady rate in the seaweed packaging market during the forecast period. North America has a booming e-commerce industry (Amazon, Walmart, Shopify), increasing the need for sustainable shipping materials. Seaweed-based mailers, films, and protective wraps are replacing plastic bubble wrap and polybags. Large retailers like Walmart and Target have committed to zero-waste packaging initiatives, driving demand for seaweed-based alternatives.

North America has a green startup ecosystem, with companies innovating in biodegradable materials. For instance, seaweed packaging startups in the region: Notpla (partly operating in North America) – Developed seaweed-based food & beverage packaging, Loliware (U.S.) – offers edible and compostable seaweed-based straws, Ecovative Design (U.S.) – Exploring seaweed-based materials for food and cosmetic packaging.

U.S. Seaweed Packaging Market Trends

The U.S. seaweed packaging market is driven by the growth in the adoption of biodegradable packaging by the various industries. Increasing government initiatives for manufacturing biodegradable packaging has estimated to drive the growth of the seaweed packaging market in the U.S. region. For instance, in August 2024, in order to help entrepreneurs and small businesses throughout the plastics value chain develop solutions that reduce plastic consumption, address plastic waste, and create circular economies, Unilever, the US Agency for International Development, and EY have partnered to invest US$21 million.

Asia’s Well Established Pharmaceutical Sector to Support Notable Growth

Asia Pacific region is estimated to grow at steady rate over the forecast period. Asia Pacific's seaweed resources and growing demand for environmentally friendly packaging are driving the region's seaweed packaging industry's explosive expansion, especially in nations like China, South Korea, and Japan. Market expansion has also been aided by government programs supporting biodegradable products and increased awareness of environmental issues. Japan has traditionally used seaweed-based packaging for foods like sushi, and new developments are now spreading to other industries including medicine and personal care.

India Seaweed Packaging Market Trends

Due to the abundance of seaweed resources found along its vast coastline, India's seaweed packaging market is expanding. The goal of government programs like the Seaweed Mission is to improve seaweed farming, which will open doors for regional seaweed packaging businesses. The food and agriculture industries' need for sustainable packaging is also driving expansion as companies search for environmentally appropriate substitutes for plastic packaging.

Seaweed Packaging Market Top Players

- Regeno

- JRF Technology, LLC

- Evo &Co.

- Monosol LLC

- Amtrex Nature Care Pvt. Ltd.

- EnviGreen

- Devro

- Montrose UK Ltd.

- Marine Innovation

- KELP INDUSTRIES LTD

- Searo

- FlexSea

- AGreenPlus

- ZEROCIRCLE ALTERNATIVES PVT. LTD.

- LOLIWARE Inc.

- Evoware

- Sway Innovation Co.

- Notpla Limited

- BZEOS

- PT Seaweedtama Biopac Indonesia

Latest Announcements by Seaweed Packaging Industry Leaders

Nordic SeaFarm CEO Simon Hilmersson states, The Nordic Seafarm, an InnoEnergy portfolio company is excited to work with FutureLab & Partners in launching Manatee Biomaterials.This collaboration puts Nordic Seafarm company at the forefront of regenerative material solutions by allowing to fully utilize seaweed. Nordic Seafarm, an InnoEnergy portfolio company think biomaterials derived from seaweed have the potential to transform entire industries and hasten the transition to a circular economy.

- In October 2024, the material innovation company Sway said that four fashion labels will take part in the debut of their polybags, which are printed using algae-derived ink and manufactured from seaweed, plants, and biodegradable polymers. They are made to break down in composting conditions, both residential and commercial. It is anticipated that Prana, Faherty, Alex Crane, and Florence would start packing clothes like shirts and shorts in the first quarter of 2025 and the fourth quarter of 2024 utilizing the bags.

New Advancements in Seaweed Packaging Industry

- In August 2024, PA Consulting company and Searo Labs company revealed the launch of the seaweed-based packaging products in an effort to reduce the amount of plastics, single-use packaging, and PFAS used in the food, personal care, and home care industries worldwide. Searo's materials are said to be heat sealable, optically clear, safe for food contact, home biodegradable, and tunable in terms of texture and wetness. They are said to be produced using low-energy technologies, locally produced, sustainably oriented farming methods, and without any chemical alterations.

- In January 2024, Boulder, Colorado EcoEnclose, a leading provider of sustainable packaging, has partnered with Sway, a business that specializes in next-generation materials, to create and introduce the first seaweed-windowed retail box in history. This retail box reimagines the effect that businesses can enable through their packaging decisions. It is curbside recyclable, fossil-free, and extremely customizable.

Global Seaweed Packaging Market Segments

By Source

- Plant

- Red Seaweed (Rhodophyta)

- Brown Seaweed (Phaeophyceae)

- Green Seaweed (Chlorophyta)

- Agar-based Seaweed Extract

- Carrageenan-based Materials

- Alginate-based Materials

- Animal

- Gelatin–Seaweed Composite Films

- Chitosan–Seaweed Blends

- Collagen–Seaweed Hybrid Materials

- Protein-enriched Seaweed Films

By Packaging Process

- Antimicrobial

- Natural Antimicrobial-infused Films

- Essential Oil-embedded Seaweed Packaging

- Active Antibacterial Coatings

- Oxygen & Moisture Barrier Films

- Nanotechnology

- Nano-reinforced Seaweed Films

- Nano-clay Composite Packaging

- Silver Nanoparticle-infused Films

- Nano-cellulose Reinforced Structures

- Electrohydrodynamic (EHD)

- Electrospun Seaweed Nanofibers

- EHD Jet Printing Packaging Films

- High-precision Thin-layer Coatings

- Fiber-based Biodegradable Mesh Packaging

- Coatings

- Edible Seaweed Coatings

- Moisture-resistant Coatings

- Biodegradable Barrier Coatings

- Shelf-life Extension Coatings

- Laminated Seaweed Coatings

- Microorganisms

- Probiotic-infused Packaging

- Enzyme-active Films

- Bio-fermented Seaweed Packaging

- Controlled Degradation Packaging

By End-Use

- Food & Beverages

- Fresh Produce Packaging

- Meat & Seafood Packaging

- Dairy Product Wrapping

- Ready-to-Eat Food Packaging

- Beverage Pods & Sachets

- Edible Food Wrappers

- Personal Care

- Shampoo & Conditioner Sachets

- Soap & Bar Wraps

- Wet Wipe Packaging

- Biodegradable Refills

- Cosmetics

- Face Mask Sheets

- Sample Sachets

- Cream & Lotion Packaging

- Serum & Gel Pods

- Sustainable Luxury Packaging

- Pharmaceuticals

- Capsule & Tablet Blister Films

- Sachets for Powders

- Medical Device Sterile Packaging

- Controlled-release Drug Films

- Single-dose Packaging

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (3)