April 2025

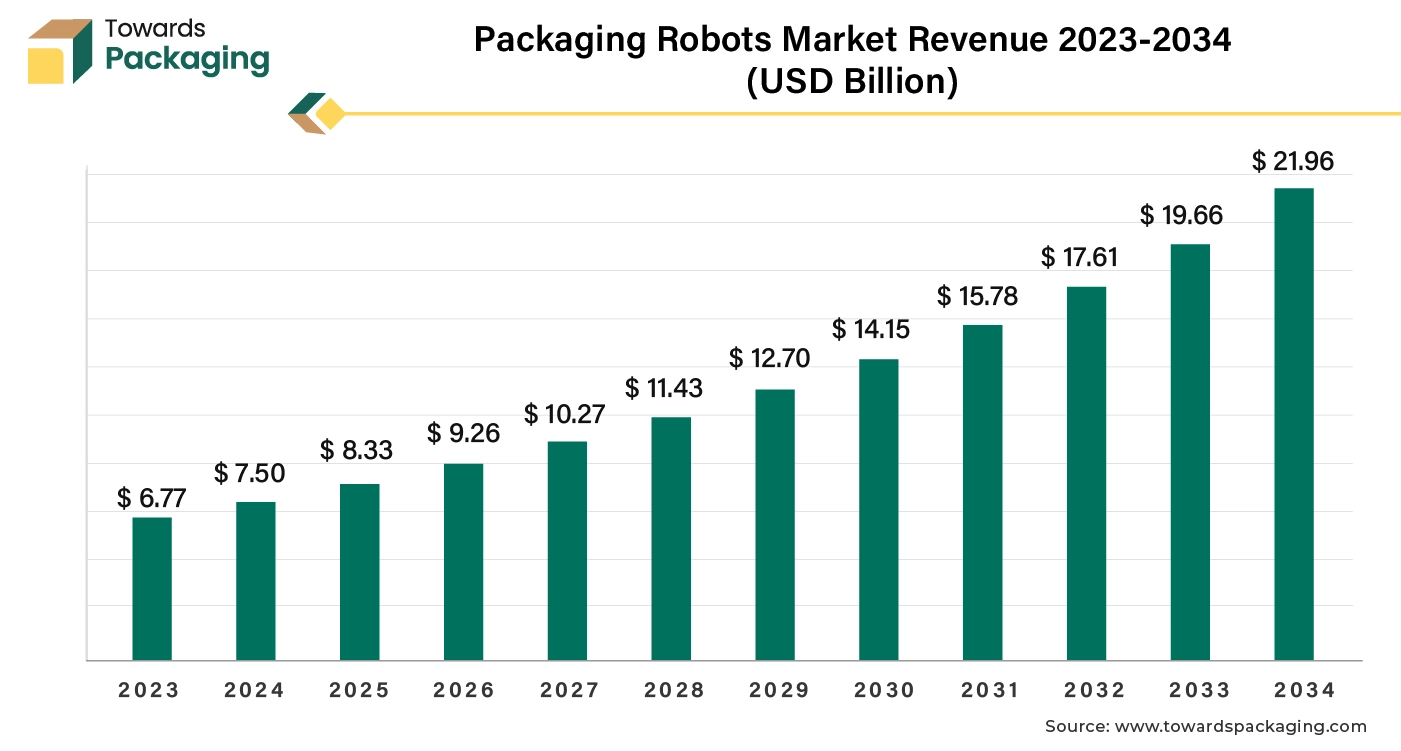

The packaging robots market is forecasted to expand from USD 8.33 billion in 2025 to USD 21.96 billion by 2034, growing at a CAGR of 11% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Packaging robots can be programmed for various tasks, catering to diverse product types and packaging requirements. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing packaging robots which is estimated to drive the global packaging robots market over the forecast period.

Packaging robots are automated systems designed to perform various tasks in the packaging process of products across different industries. These robots enhance efficiency, accuracy, and speed while reducing labor costs and minimizing human error. There are different types of packaging robots which have been mentioned here as follows: articulated robots, delta robots, SCARA Robots, collaborative robots (Cobots), and mobile robots. Articulated Robots have rotary joints and can move in multiple axes, making them highly versatile for tasks like palletizing, picking, and placing. The packaging robots carry out function of sorting, filling, sealing, labeling, palletizing, and wrapping.

The sorting is carried out to organise products based on size type, or other criteria before packaging. Palletizing is done for stacking packaged products onto pallets for shipment and storage. The packaging robots provide various advantages like increased efficiency, consistency and precision, labor cost reduction, enhanced safety, space optimization and scalability. In conclusion, packaging robots are integral to modern manufacturing and logistics, streamlining operations and ensuring high-quality packaging. Their continued evolution promises even greater efficiency and adaptability in the future. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

Integrating AI into the packaging robotics industry can significantly enhance efficiency and accuracy. AI algorithms can optimize robot operations, allowing for faster and more precise packaging processes, reducing cycle times and improving throughput. Machine learning can enable real-time monitoring of packaging quality, detecting defects or inconsistencies and ensuring that products meet standards.

AI algorithms can optimize the movement and operations of robots, reducing downtime and increasing throughput. Predictive analytics can anticipate demand and adjust operations accordingly.

AI can analyze data from robots to predict failures before they occur, minimizing downtime and maintenance costs.

Machine learning can enable real-time monitoring of packaging quality, detecting defects or inconsistencies and ensuring that products meet standards.

AI-powered robots can quickly adjust to different products and packaging styles, allowing manufacturers to easily switch between various tasks without extensive reprogramming. AI-driven interfaces can simplify operations for human operators, making it easier to monitor and control robotic systems, thus improving overall user experience. AI can facilitate better communication and coordination between packaging robots and other parts of the supply chain, leading to improved inventory management and fulfillment processes.

By automating routine tasks, AI can allow human workers to focus on more complex, value-added activities, enhancing overall productivity. AI-driven interfaces can simplify operations for human operators, making it easier to monitor and control robotic systems, thus improving overall user experience.

By leveraging these AI capabilities, the packaging robotics industry can achieve greater agility, higher productivity, and improved product quality, ultimately leading to enhanced customer satisfaction and reduced operational costs.

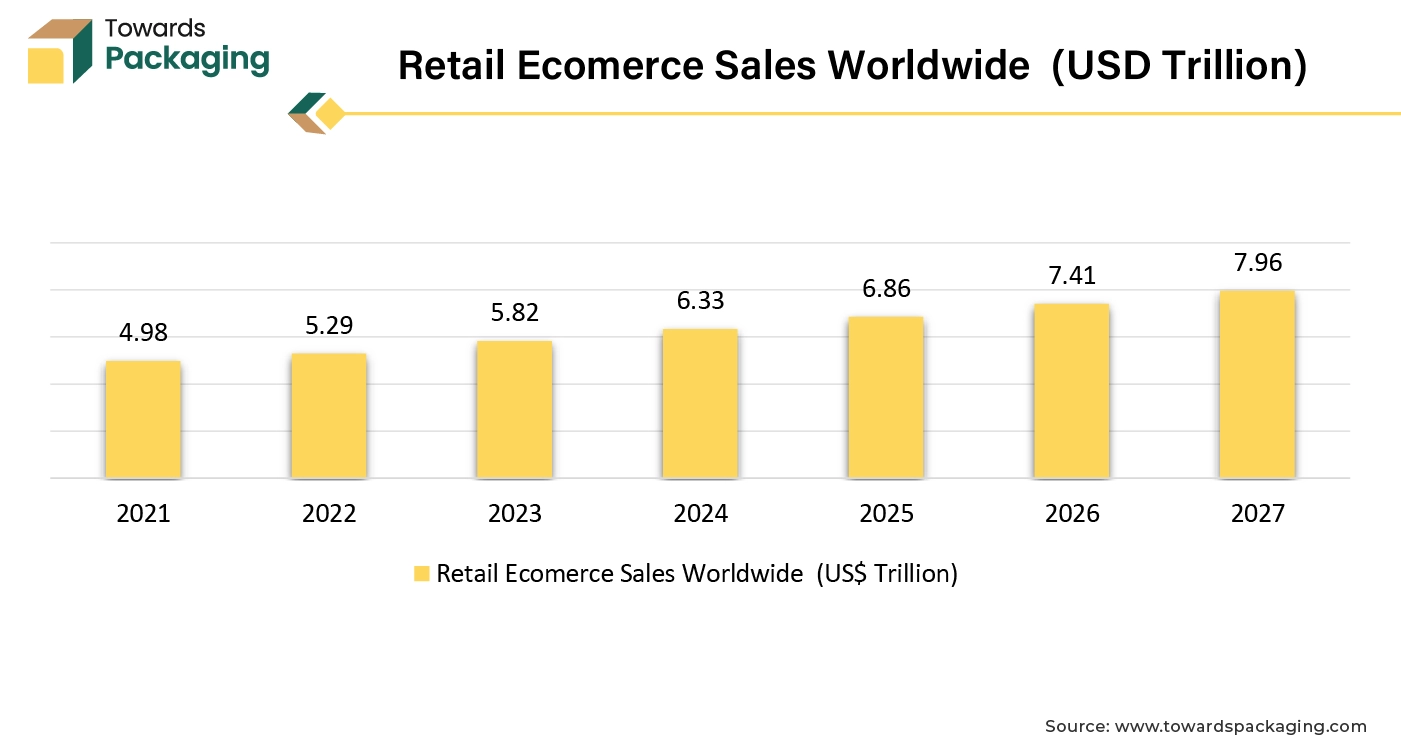

The rise of online shopping has boosted demand for packaging solutions that are faster and more reliable. Many industries face challenges in finding skilled labor, prompting a shift toward robotic solutions. Packaging robots can automate repetitive tasks, allowing for faster order fulfillment, which is crucial in the competitive e-commerce landscape. Robots ensure uniformity in packaging, reducing errors and improving the overall quality of packaging. Automation can lower operational costs by reducing labor expenses and minimizing material waste, leading to higher profit margins.

Many businesses face challenges in hiring and retaining staff. Robots can help alleviate these labor shortages by performing essential packaging tasks. As e-commerce demand fluctuates, robots can be easily scaled up or down to match production needs, providing flexibility. Advanced packaging robots can be integrated into existing workflows, helping to maximize space in warehouses and fulfillment centers. Overall, the rise in e-commerce has created a strong demand for efficient, reliable, and scalable packaging solutions, driving the adoption of packaging robots.

According the data published by the eCommerce Association of India (ECAI), in April 2024, association in India promoting the business of eCommerce in India, reported that India’s e-commerce sales is estimated to reach US$ 52.5 billion in 2024, with an annual growth rate of 11.45% to reach US$ 90.4billion by year 2029. Ecommerce growth is estimated to continue to grow, with 20.1% of retail purchases projected to be made online in 2024. This is estimated to increase to 22.6% by 2027. Online sales in the nation increased dramatically in 2020 as a result of the pandemic. In 2020, sales were reported at $159.8 billion in the first quarter. This amount increased by 33.5% to $213.3 billion in the second quarter. The transition to internet shopping was sped up by approximately five years by this surge.

The key players operating in the market face issue due to technical complexity and zero knowledge about the working and functions of packaging robots, which is estimated to restrict the growth of the packaging robots market. Implementing robotic systems requires technical expertise and ongoing maintenance, which can deter some companies. Many products require specialized packaging solutions, and not all robots can easily adapt to varying sizes and shapes. The cost of purchasing and integrating packaging robots can be prohibitive for smaller businesses, limiting their adoption.

Fluctuations in the economy can lead businesses to delay investments in automation, including packaging robots. The potential for job displacement may lead to resistance from employees and unions, creating barriers to adoption. Some companies may not fully understand the benefits or capabilities of packaging robots, leading to hesitation in investment. Issues in supply chains can affect the availability of necessary components and technology for packaging robots.

Businesses are adopting automation to enhance efficiency, reduce labor costs, and improve accuracy in packaging processes. Innovations in robotics, AI, and machine learning are improving the capabilities and flexibility of packaging robots. Increasing adoption of the automated system for packaging by the key players operating in the market has created potential for development of packaging robots market. The key players operating in the market are focused on innovating and launching new packaging robots, which is estimated to create lucrative opportunity for the growth of the packaging robots market in the near future.

Additionally, on April 09, 2024, Liberty Robotics company announced the formal introduction of Pick and VPack, its flagship line of robotic palletizing and depalletizing solutions. These systems improve warehouse dependability and productivity by utilizing cutting-edge Al vision technologies. Robots in fulfillment, distribution, and warehouse facilities are guided by pick in an intuitive manner. With nearly 100% pick rates, the system's precise "pick on first sight" capabilities improve warehousing procedures. Palletizing, depalletizing, and pallet decanting are just a few of the many tasks that VPick can perform. It supports a broad variety of pallet kinds, including mono, mixed, and rainbow pallets. It is capable of providing dependable picking abilities without requiring pre-training box parameters or deep learning.

Doosan Robotics Inc. company claims that bespoke modules are enabled by the Dart-Suite ecosystem. Dart-Suite, according to Doosan, is a robot ecosystem that "redefines" the interaction between its customers and its robots while lowering the barrier to automation. The platform combines AI to enable users to design, sell, download, and trigger actions through multiple interfaces. According to Doosan, the suite's integrated development environment (IDE) enables users to design modules that are customized to their requirements, much like mobile apps.

The company revealed that Dart-Suite can save up to 80% of the development time. For end customers with tight margins who need to start reaping the rewards of their cobots right away, this time savings can be vital. Otto Matic palletizes using AI A palletizing and depalletizing technology that can manage haphazardly sized and disorganized boxes is called Otto Matic. According to Doosan, the system was created to provide its cobots access to more deep learning and computer vision capabilities.

The clamp and claw segment held a dominant presence in the packaging robots market in 2024. The clamp and claw type of gripper can handle a variety of package sizes and shapes, making them suitable for different products and industries. These type of robots offer accurate placement and handling, reducing the risk of damage to products during the packaging process. Their design allows for quick and efficient operation, which is essential for high-throughput environments like e-commerce and manufacturing.

The packaging robots with the clamp and claw gripe can easily integrate into automated production lines, enhancing overall efficiency and reducing labor costs. Clamp and claw mechanisms are typically durable, allowing them to operate effectively in demanding environments. They often require less maintenance and can operate continuously, minimizing downtime in packaging operations. These features make clamp and claw packaging robots an attractive choice for companies looking to optimize their packaging processes. The key players operating in the market are focused on developing clamp and claws type of gripper packaging robots, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The pick & place segment accounted for a considerable share of the packaging robots market in 2024. The pick & place type of packaging robots automates the repetitive task of picking and placing items, significantly increasing speed and throughput in packaging operations. Pick and place robots can be programmed to handle various product types and sizes, making them adaptable to different production needs. These robots offer high accuracy in handling products, reducing the risk of damage and ensuring consistent placement.

They minimize the risk of workplace injuries associated with manual handling, creating a safer working environment. By automating manual labor, businesses can lower labor costs and reduce errors, leading to higher profitability. As production demands fluctuate, pick and place robots can be scaled up or down, allowing for flexible operations. These advantages make pick and place packaging robots a popular choice across various industries, including food and beverage, pharmaceuticals, and consumer good.

Increasing innovation and launch of the pick & place packaging robots by the key players to meet the consumers demand is estimated to drive the growth of the segment over the forecast period.

For instance,

B&R's whole Codian portfolio is on display at Booth 5442 in the Central Hall of the Las Vegas Convention Center at PACK EXPO, in 2023. There are currently over 100 variations available, including industry-leading hygienic models that can be used in packaging for pharmaceuticals and food and beverage products. B&R demonstrated robotics in "seamless" synchronization with machine vision and mechatronic product transport systems like ACOPOStrak and ACOPOS 6D at Booth 4343 at the PACK EXPO, in 2023.

The food & beverages segment registered its dominance over the global packaging robots market in 2024. The food and beverage industry experiences constant consumer demand, necessitating efficient and scalable packaging solutions. Strict hygiene and safety regulations require consistent and reliable packaging processes, making automation an attractive option. Innovations in robotics, such as improved sensors and AI, enhance the capabilities of packaging robots, making them more appealing for this sector.

The wide range of products, from liquids to solids, requires versatile packaging solutions, which robots can provide. Labor shortages and rising labor costs drive companies to adopt robotic solutions for efficiency and cost-effectiveness. Increased competition and the need for faster distribution in global markets push food and beverage manufacturers to adopt advanced packaging technologies. Automated systems minimize human contact with food products, reducing the risk of contamination and ensuring compliance with health regulations.

Asia Pacific region dominated the global packaging robots market in 2024. Governments and private sectors in countries like Japan and South Korea are heavily investing in advanced manufacturing technologies, including robotics, to improve productivity and competitiveness. The Asia Pacific region is a hub for technological innovation, with companies investing in R&D to develop smarter and more efficient robotic solutions tailored for packaging.

A burgeoning middle class and changing consumer preferences in Asia-Pacific are increasing the demand for packaged goods, necessitating more advanced packaging solutions. Countries like China, India, and Vietnam are undergoing significant industrial growth, driving demand for automation in various sectors, including packaging. Various governments are promoting automation and technology adoption through incentives and policies, further stimulating growth in the robotics sector.

Asia Pacific region has the well-developed Pharma industries which requires packaging robots for various purpose such filling, labelling and stacking etc. The key players operating in the market are expanding their robotics manufacturing capabilities in Asia Pacific region.

For instance,

With the introduction of MCXC in November 2022, Medtronic has trained over 2,000 healthcare professionals (HCPs) across Asia and led close to 1,400 training and experience sessions, demonstrating significant progress in medical education and upskilling. These efforts will be boosted by the inclusion of the Robotics Experience Studio, which will give HCPs access to state-of-the-art tools to improve their proficiency in robotic-assisted procedures and artificial intelligence (AI) applications.

North America region is anticipated to grow at the fastest rate in the packaging robots market during the forecast period. The packaging robots market is growing rapidly in North America due to several factors such as increased automation adoption, e-commerce growth, focus on sustainability, etc. Continuous advancements in robotics technology, such as AI and machine learning, are improving the capabilities and versatility of packaging robots. Businesses are increasingly investing in automation to enhance operational efficiency, reduce labor costs, and improve productivity. The surge in e-commerce has driven demand for efficient packaging solutions to handle higher volumes and faster turnaround times.

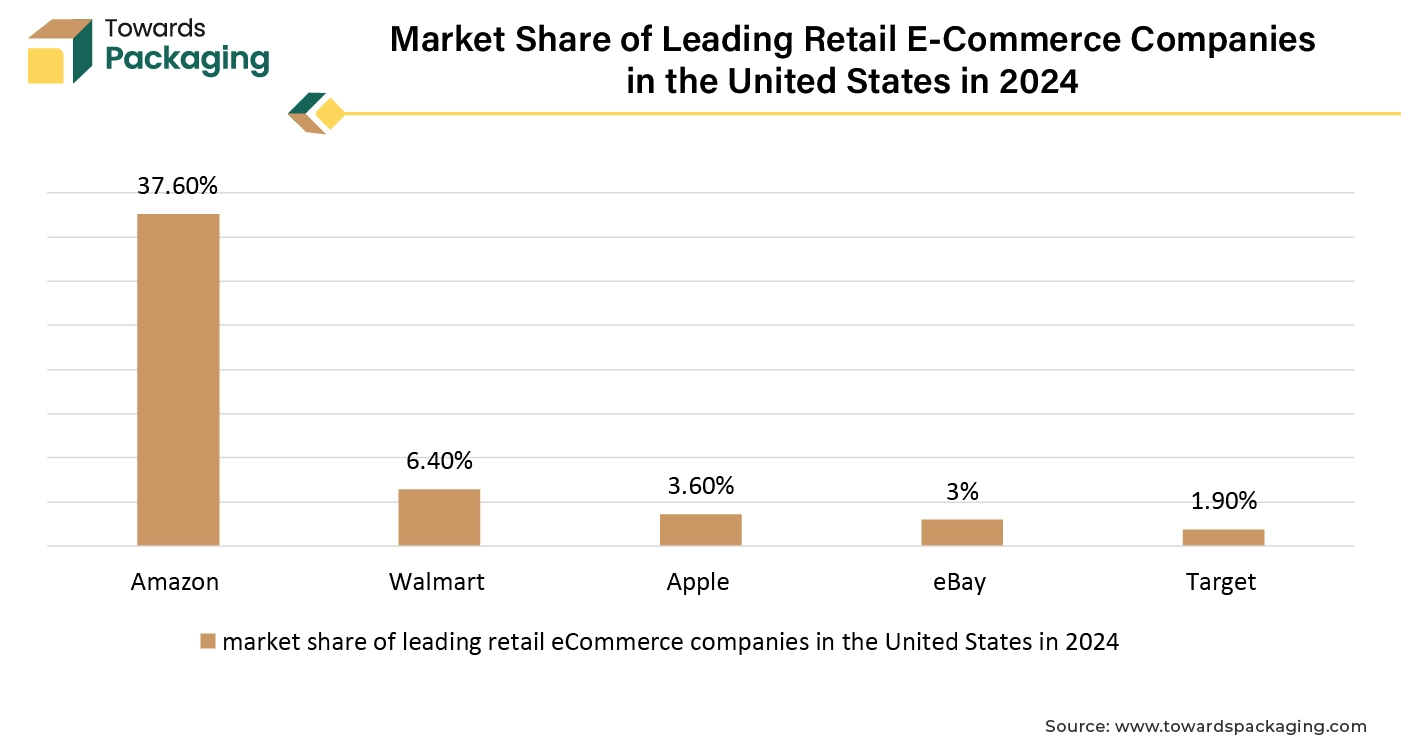

In the US, Amazon has a 37.6% market share in commerce. Amazon now holds the most market share in the US, with Walmart coming in second with a 6.4% market share. Amazon triumphed with a massive $1.7 billion spent, which is more than four times the spend of Walmart. Conversely, Aliexpress spent the least amount of money, only $322,000—5,000 times less than Amazon. This is mostly because Aliexpress is utilized more frequently outside of the US than it is here. Even with this meager investment, Aliexpress.com has experienced a notable increase in US website traffic. Ebay, the third-ranked website in terms of traffic, spent less on advertising than Target.com ($ 604 million) and Homedepot.com ($166 million).

By Gripper Type

By Service

By End User

By Region

April 2025

April 2025

April 2025

April 2025