April 2025

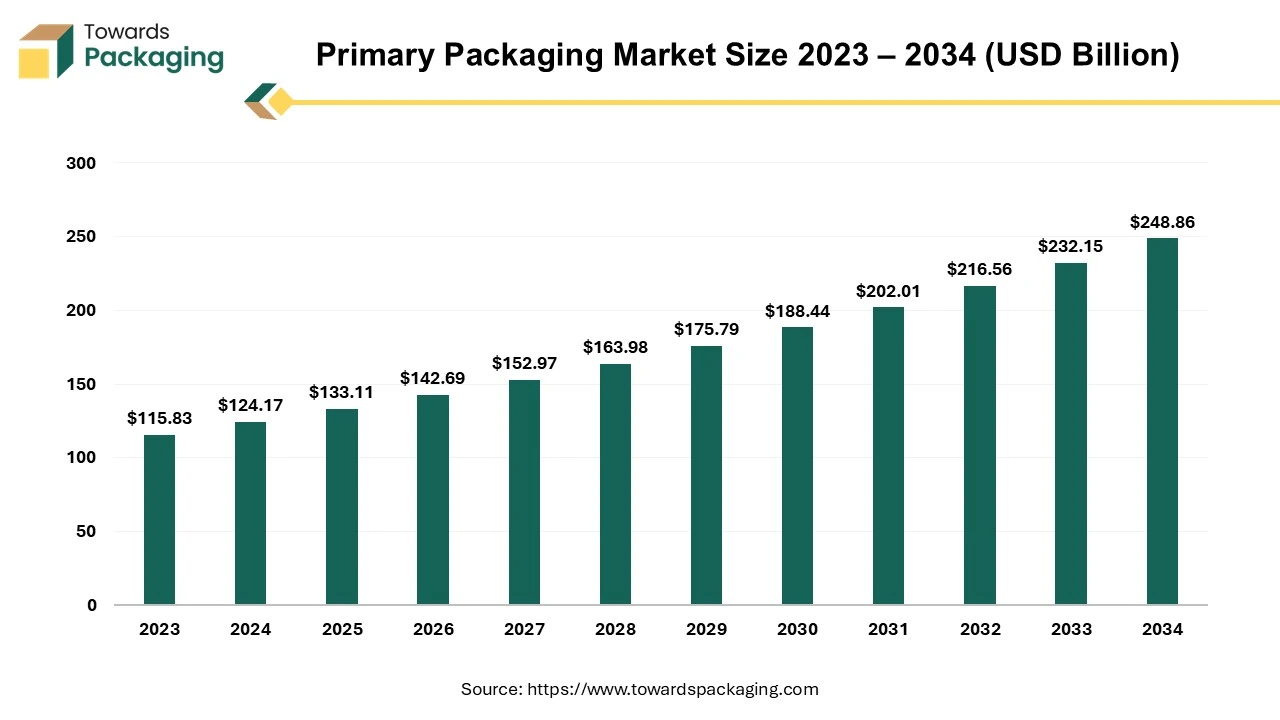

The primary packaging market is forecasted to expand from USD 133.11 billion in 2025 to USD 248.86 billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034.

Primary packaging signifies the first layer of protection against external elements that come into direct contact with the product. Its design is customized to meet both the product's features and any supplementary packaging that may exist. The primary goal of primary packaging is to protect the product from physical damage, contamination, and chemical changes, whether in transit, stored, or used.

Primary packaging serves multiple functions depending on the product, transit conditions, and storage requirements. It protects the goods throughout storage, even for extended periods, and improves their appearance and consumer appeal. A vast array of items, including cereal boxes, soda cans, detergent pod bags, and chocolate bar wrappers, are examples of primary packaging. Each is designed to meet the specific requirements of the item it contains.

From production to consumption, primary packaging protects a product's integrity, safety, and appeal by acting as an essential interface between it and its surroundings. It is necessary for packaging design and product protection due to its flexibility and adaptability.

Customers are expecting their favorite brands to follow suit as they choose more eco-friendly packaging for their products. In response to consumer demand, companies like Procter & Gamble Company and Coca-Cola have already launched 500 million bottles that contain 25 percent recycled plastic, and Procter & Gamble is going to launch new recycling programs.

For Instance,

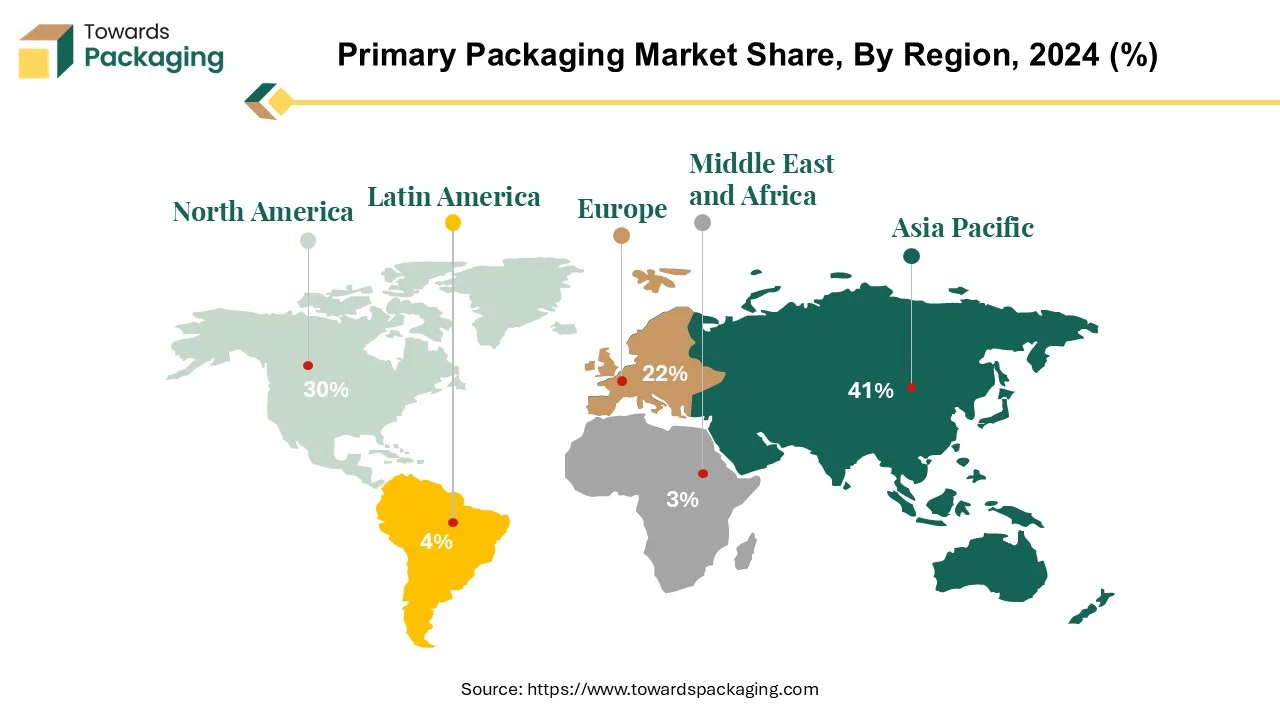

The Asia-Pacific region is the world's largest user of primary packaging, accounting for 44% of all consumption. This supremacy is due to several factors, including the region's large population, which translates to big domestic markets, and its critical role as a manufacturing hub that supplies goods worldwide. The Asia-Pacific region is predicted to experience the most rapid rise in sustainable packaging solutions. This growth can be linked to increased environmental awareness, rising consumer demand for eco-friendly products, and government programs supporting sustainable packaging techniques.

This expansion will be spearheaded by China and India, putting the Asia-Pacific region at the forefront of adopting sustainable packaging. The food and beverage business mainly uses sustainable packaging solutions, closely followed by the personal care and cosmetics industry. The demand for sustainable packaging in Asia-Pacific countries is expected to increase significantly as consumer preferences shift toward more environmentally friendly solutions, indicating a significant change in the packaging industry.

For Instance,

North America is the second largest region in the primary packaging market. Despite the significant increase in plastic usage, concerns about its environmental impact have resulted in stronger laws, boosting demand for other sustainable packaging options. However, North America remains prominent, accounting for 22% of the worldwide industry due to its size and continued innovation activities.

In developed areas such as North America, converters are turning their attention to a more in-depth viewpoint, which helps them to spot growth prospects and decide on competitive tactics more accurately. Paper and paperboard are two of the most often used primary materials worldwide. Approximately 81% of paper-based packaging in the US is recycled, while more than 96% of corrugated cardboard boxes are recycled. Nevertheless, just 14% of plastic packaging is recycled in the United States.

Comparably, in Canada, it is estimated that 85% of old corrugated boxes are recovered nationally, with some provinces having recycling programs that reach as high as 98%. These figures demonstrate North America's continuous efforts to support sustainable packaging practices and encourage recycling, underscoring the region's dedication to environmental care.

For Instance,

Paper and cardboard packaging is the most popular material in the primary packaging sector. Paper and cardboard packaging is often known as leading packing. Paperboard and cardboard are two packaging materials widely utilized in various industries. While the two may appear identical, there are some significant variances.

Paperboard is a thick, lightweight, and long-lasting material with compressed paper fibers. It's widely utilized in food packaging, cosmetics, and pharmaceuticals. Paper and paperboard can be found wherever products are manufactured, delivered, marketed, and used, accounting for around one-third of the overall packaging market. Packaging accounts for more than 40% of total paper and paperboard use in Europe, with the food industry accounting for more than half of that total.

The global paper and paperboard packaging industry will be worth 398.65 billion US dollars in 2023. The paper and paperboard packaging industry are expected to grow in size over the next few years, reaching more than 501.08 billion US dollars by 2029. The e-commerce industry's growing demand for corrugated cardboard boxes will likely drive much of this development.

For Instance,

Primary packaging in the food and beverage industry is the first layer of enclosure that items are placed in and comes into direct contact with their contents. This group has a wide range of packaging, including bottles, cans, jars, cartons, sachets, and single wrappers, used to store perishable and non-perishable food and beverage products. Primary packaging is essential to preserving the quality and safety of the product since it acts as the principal barrier separating it from its surroundings.

In primary packaging for food and beverages, strict protocols are implemented to guarantee the authenticity of incoming packaging materials and streamline verification procedures.

For Instance, In March 2023, Foodservice, a new line of primary packaging that is 100% recyclable and targeted at the prepared foods and beverage markets, was introduced by Hinojosa Packaging Group.

Barcodes on labels or sleeves provide quick identification and confirmation of packaging contents, necessitating modern technologies capable of reading barcodes in any orientation. This allows smooth operations at high line speeds without sacrificing barcode scanning accuracy.

Adopting cutting-edge technologies is critical for food and beverage firms to improve operational efficiency and drive business growth. Innovations in primary packaging technologies not only expedite processes but also help to increase product traceability, compliance, and customer satisfaction.

Primary packaging, also called retail packaging in the retail sector, is the first layer of protection surrounding products on sale to customers. This covers a range of shapes and sizes, including bottles, boxes, bags, and wrappers, intended to present and safeguard the goods during transportation or exhibition. Retail packaging is essential for drawing customers' attention, conveying product details, and maintaining the integrity of the product until it is used.

Primary packaging in retail environments is carefully crafted to improve the overall display of goods, expressing company identity and swaying consumer decisions. It must satisfy functional needs like security, stackability, simplicity of handling, and aesthetic standards. Furthermore, barcodes and labeling are frequently integrated into primary packaging for pricing and inventory management, which makes point-of-sale transactions easier.

For Instance,

The competitive landscape of the primary packaging market is dominated by established industry giants such as Amcor Ltd., Etimex Primary Packaging GmbH. Bemis Company Inc., Capsugel Inc., Albea Group, Ardagh Group, Bormioli Rocco Spa, Clondalkin Group Holdings B.V., Datwyler Holding Inc., Gerresheimer AG, Heinz-Glas GmbH, Wihuri Group, Becton, Dickinson & Company, Hindustan National Glass & Industries Ltd., ITC Koa Glass Co. Ltd., MeadWestvaco Corp. , Schott AG, West Pharmaceutical Services, Inc. and Mondi plc. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Innovation, personalization, and sustainability are the three main pillars of Amcor's packaging strategies, which allow the business to offer value-added solutions that help clients succeed and contribute to a more sustainable future.

For Instance,

ETIMEX is a major European manufacturer of innovative plastic primary packaging goods. Demands flexible and efficient packaging solutions manufactured from plastic sheets, films, and containers. We use cutting-edge technologies in extrusion, thermoforming, injection molding, barrier injection molding, and IML manufacturing stages.

For Instance,

By Material

By Application

By Distribution

By Region

April 2025

April 2025

April 2025

April 2025