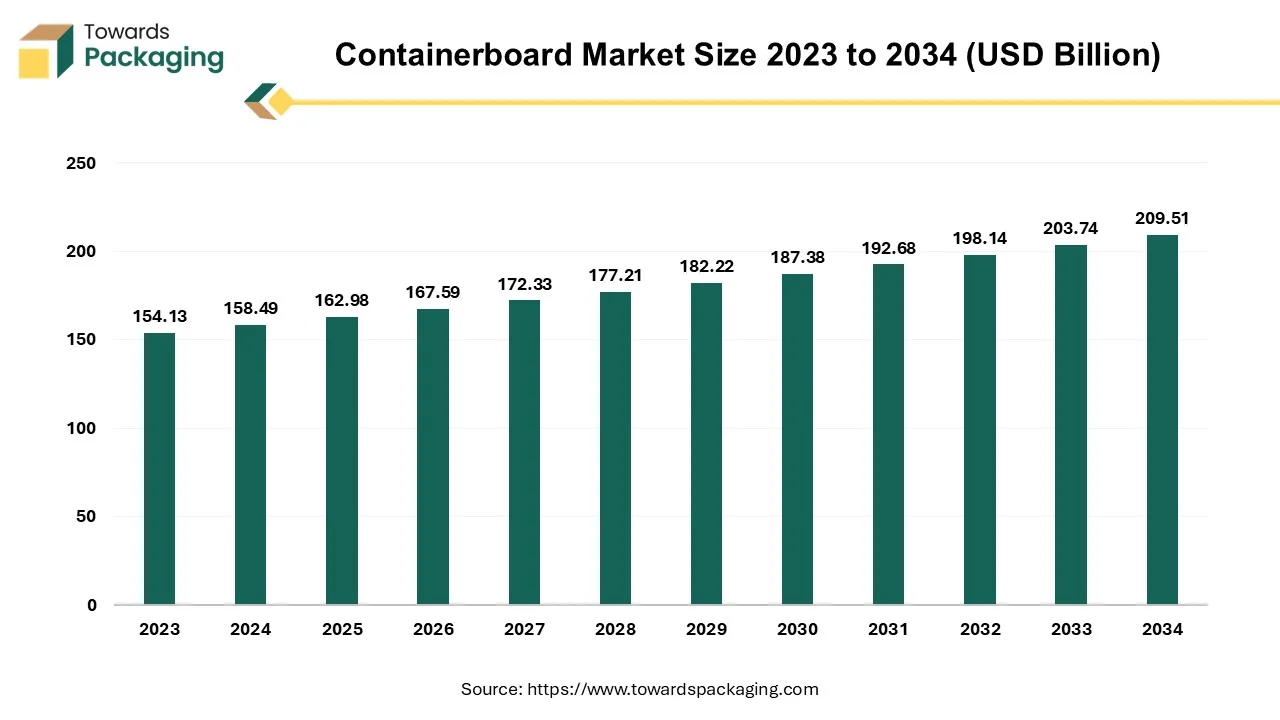

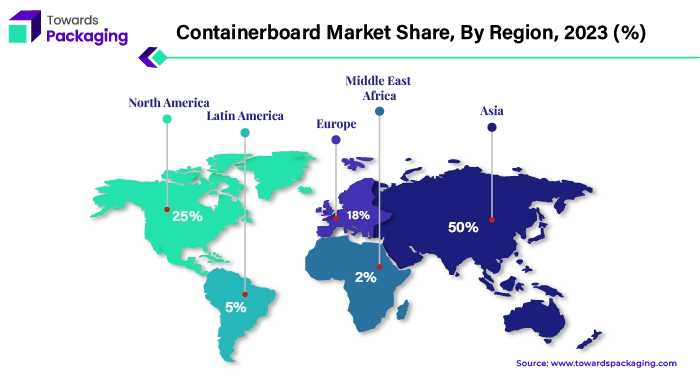

The containerboard market is forecasted to expand from USD 167.59 billion in 2026 to USD 215.44 billion by 2035, growing at a CAGR of 2.83% from 2026 to 2035. We cover full segmentation by material (recycled 78% share in 2024; virgin fastest-growing) and end-use (food & beverage 33% share in 2024; consumer goods fastest-growing), with regional data for North America (fastest growth), Europe, Asia Pacific (50% revenue share in 2024), Latin America, and Middle East & Africa.

The report delivers company profiles and benchmarking (International Paper, Nine Dragons, Smurfit Kappa, Mondi, WestRock, Oji, etc.), competitive analysis, value chain & cost structure, trade statistics and flows, and manufacturer/supplier databases with capacity and footprint mapping.

Containerboard is a type of paperboard designed for making corrugated fiberboard, essential in the packaging industry. It consists of multiple layers: a corrugated medium between two flat linerboards. The corrugated medium provides strength and rigidity, while the linerboards offer a smooth surface for printing and extra support. This composition makes container boards ideal for creating corrugated boxes and packaging materials used for shipping and storing goods.

There is a growing preference for sustainable and eco-friendly packaging solutions among consumers and companies. Containerboard, being recyclable and made from renewable resources, aligns well with this trend, boosting its demand. The future of the containerboard market looks promising with continued growth expected, driven by sustainable packaging trends, increasing e-commerce activities, and robust demand from various end-use industries. Innovations in manufacturing processes and recycling technologies will further support market expansion.

| Metric | Details |

| Market Size in 2025 | USD 162.98 Billion |

| Projected Market Size in 2035 | USD 215.44 Billion |

| CAGR (2026 - 2035) | 2.83% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By End-use and By Region |

| Top Key Players | International Paper, Oji Fibre Solutions (NZ) Ltd, Nine Dragons Paper (Holdings) Limited, Smurfit Kappa Group, Mondi Limited, WestRock Company. |

The growth of the food and beverage industry has raised the need for containerboard on a worldwide scale. The growing demand for packaged, frozen, and ready-to-eat goods as well as changing lifestyles have contributed to the growth of this industry. The market for containerboards is growing as a result. This industry is also being driven by the explosive expansion of e-commerce, since product-specific corrugated boxes are required to safeguard goods and guarantee safe delivery.

One of the top providers of packaging solutions, Saica Group, teamed up with one of the top producers of fast-moving consumer goods, Mondelez, in June 2024 to introduce a new paper-based product aimed at multipacks—goods for the chocolate, cookie, and confectionery industries. The novel paper-based packaging is appropriate for heat-sealing processes and is made to be recyclable in the paper waste stream.

The growing trend towards digitalization poses a challenge to the containerboard market. As communication and documentation increasingly shift to digital platforms, the demand for traditional paper usage declines. Also, Businesses and consumers are opting for digital alternatives for online advertising, electronic communication, and document storage. This preference for digital mediums reduces the demand for printed materials, which can impact the need for container boards in packaging applications.

The growth of digitization, especially e-commerce, often leads to a shift towards more efficient and less bulky packaging solutions, reducing the demand for traditional containerboard. With the rise of digital documentation, storage, and communication, there is a decreasing need for paper-based products, including containerboard, which is used extensively in office supplies and paper-based packaging.

The growing demand for innovative lightweight materials is a key trend shaping the global containerboard market. Manufacturers are providing more lightweight, high-performance corrugated materials to reduce costs, improve performance, and to make sure compliance with regulations. Lower material consumption during production also minimizes environmental impact. The packaging industry is witnessing numerous innovations in response to this trend.

Lightweight materials reduce the overall weight of packaging, leading to lower transportation costs. This is particularly important in the containerboard market, where shipping efficiency can result in substantial savings. Lightweight materials often have a smaller environmental footprint, requiring less energy and resources to produce and transport. This aligns with increasing regulatory pressures and consumer demand for sustainable packaging solutions.

Industrial sectors, particularly in developing regions, are increasingly adopting lightweight containerboard for packaging due to its cost-effectiveness and efficiency. This trend is expected to drive market growth as industries seek to optimize their packaging solutions. Lightweight containerboard offers advantages in global trade by reducing shipping costs and meeting international standards for sustainable packaging. This opens up new markets and export opportunities for manufacturers.

Asia Pacific dominated the containerboard market in 2024. The market growth in the region is driven by increasing industrial trade, growing rapid urbanization, increasing consumer expenditure, and increasing demand for containerboards. In addition, the increasing use of sustainable materials, growing e-commerce and retail sectors, and increasing demand for attractive, cost-effective, durable, and functional packaging solutions are further expected to drive market growth.

The strong presence of end-use industries such as food and beverage, consumer goods, and agriculture is driving the demand for containerboard in the region. Additionally, increasing consumer spending, rapid urbanization, industrial trade, and production in countries like India and China are further enhancing the need for packaging materials. The retail and e-commerce sectors have also experienced substantial growth in the region in recent years.

China is the world's largest manufacturing hub, producing a wide range of goods that require containerboard for packaging. The extensive use of containerboard in shipping and packaging manufactured products significantly contributes to the market's dominance. Significant investments in the paper and packaging industry in countries like China, Japan, and South Korea have led to the development of advanced manufacturing facilities. These investments enhance production capabilities and meet the growing regional and global demand for containerboard.

Countries in Asia Pacific are implementing extensive recycling programs to ensure the sustainability of packaging materials. For instance, China has set ambitious recycling targets and policies to support the circular economy, which benefits the containerboard market

Another major player in the containerboard market, this Hong Kong-based company has invested heavily in production facilities across China and other regions to cater to the increasing demand.

Asia Pacific dominated the containerboard market in 2024. The market growth in the region is driven by increasing industrial trade, growing rapid urbanization, increasing consumer expenditure, and increasing demand for containerboards. In addition, the increasing use of sustainable materials, growing e-commerce and retail sectors, and increasing demand for attractive, cost-effective, durable, and functional packaging solutions are further expected to drive market growth.

The continent has a high demand for packaging materials due to its large consumer market and industrial base, driving the need for containerboard products. Efficient transportation networks and infrastructure support the distribution of containerboard products across the continent and internationally, enhancing market reach and competitiveness.

Fahrenheit for more than 40 hours. It is a sustainable alternative to expanded polystyrene (EPS) foam boxes.

The recycled material segment dominated the containerboard market in 2024. The increasing environmental concerns are driving the use of sustainable packaging materials. Recycled fiber can be reused 6-7 times while maintaining durability, by reducing waste. Additionally, recycled materials are favored for their cost-effectiveness and compliance with government sustainability standards and regulations.

Producing containerboard from recycled materials is often more cost-effective compared to using virgin fibers. The recycling process typically requires less energy and water, leading to lower production costs. This cost advantage makes recycled containerboard an economically viable option for manufacturers, especially in price-sensitive markets.

There is a growing emphasis on environmental sustainability and reducing the carbon footprint in manufacturing processes. Recycled materials in containerboard production help conserve natural resources, reduce waste, and lower greenhouse gas emissions. This aligns with the global push towards more sustainable practices, making recycled containerboards more attractive to consumers and businesses alike.

The virgin material segment is expected to grow at the fastest rate during the forecast period in the containerboard market. In the containerboard market, the virgin segment pertains to containerboard made from entirely new and unused paper fibers. This segment highlights high-quality packaging materials, providing superior strength and printability. Current trends in the virgin segment emphasize sustainability through the responsible sourcing of raw materials and environmentally friendly production processes.

In 2024, the food & beverage segment dominated the containerboard market by holding the largest market share. this is because Packaged foods are in high demand due to their minimal preparation time. This demand is driven by a growing young population and an increasing number of working women, contributing to market growth. moreover, Food and beverage companies are using corrugated board packaging because it can withstand long delivery times and keeps moisture away from food products. Therefore, the food and beverage market is expected to account for a significant portion of the containerboard market.

The consumer goods segment is the fastest growing segment over the forecast period in the containerboard market. This can be attributed to Increasing purchasing power, higher living standards, and rapid urbanization in both developed and developing countries are expected to propel the consumer goods sector, and hence can drive the demand for containerboard. As competition in the consumer goods industry intensifies, the need for container boards for effective branding is anticipated to rise.

By Material

By End-use

By Region

January 2026

January 2026

January 2026

January 2026