April 2025

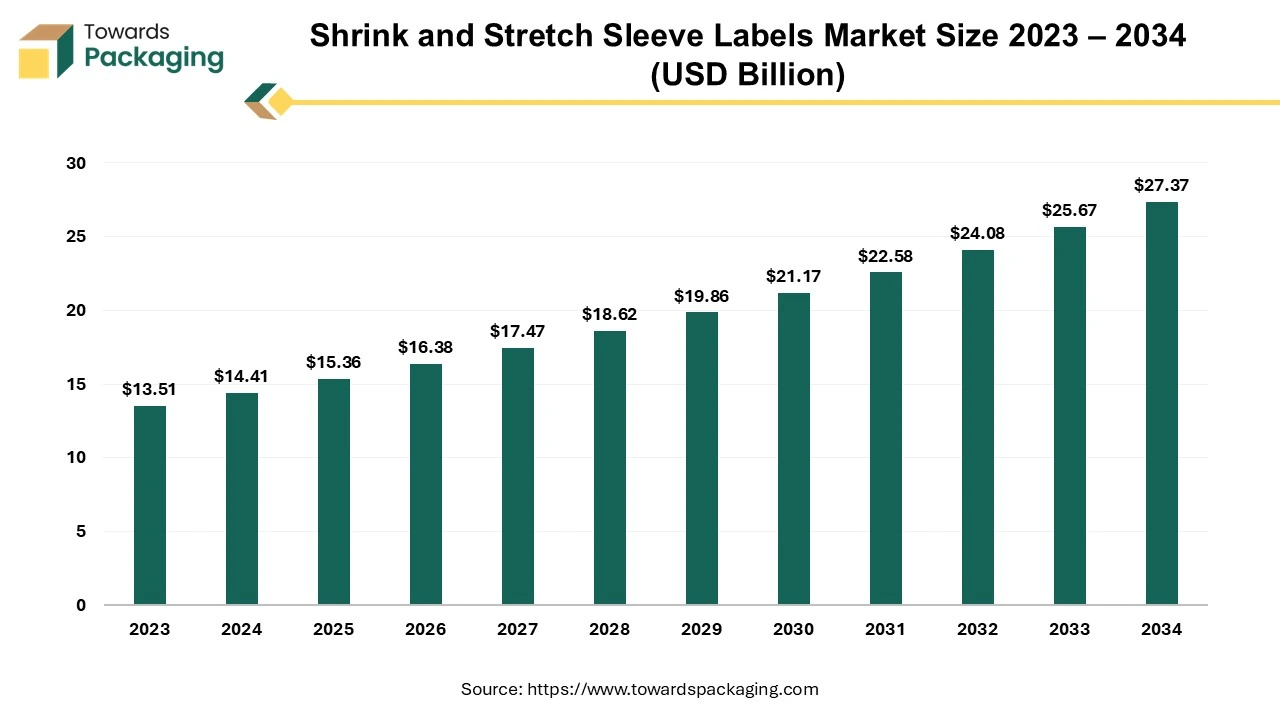

The global shrink and stretch sleeve labels market size was evaluated at US$ 13.51 billion in 2023 and is expected to attain around US$ 27.37 billion by 2034, growing at a CAGR of 6.63% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The shrink and stretch sleeve labels market is anticipated to witness significant growth during the forecast period. Stretch and shrink sleeve labels are made of plastic or polyester and wrapped around a product, fitting the specific dimensions of the package. Stretch labels can be dragged across the product container since they are very elastic and usually made-up of LDPE. When exposed to the heat, shrink sleeves are applied loosely and adapt to the product package by passing the product via a heat tunnel. As they provide a 360-degree message branding that improves the product's effective presentation on the store shelf, stretch and shrink sleeve labels are becoming one of the most desired type of product labeling.

The growing popularity of premium and innovative packaging solutions along with the rise in e-commerce is likely to contribute to the growth of the shrink and stretch sleeve labels market within the estimated timeframe. The growing demand for tamper-evident packaging in food, beverages, and pharmaceuticals are also projected to support the market growth during the forecast period. Furthermore, the versatility of these labels in accommodating various container shapes and sizes as well as the increasing use of labels for product personalization and storytelling is also anticipated to augment the growth of the market in the years to come.

The increasing demand labels from various industries globally are expected to augment the growth of the shrink and stretch sleeve labels market within the forecast period. Many food and beverage retailers are already utilizing the shrink sleeve labels on their products, which include sauces, snacks, beverages and more. They like that these labels are tamper-resistant and allow the implementation of a 360-degree design. Furthermore, the shrink sleeves are also being adopted by the pet care sector; food containers, snack packs and the pet shampoos and conditioners are common examples of products with this kind of labeling. Pet care manufacturers like that shrink sleeve labels fit any bottle or container shape and offer tamper-resistance and simple branding.

Additionally, an increasing number of nutraceutical companies are also utilizing shrink sleeve label techniques to make visually appealing packaging for items such as protein powder containers, vitamin/supplement packets and the like. Also, these labels are often applied on personal care and household products, such as cosmetics that must be sealed with a label that is both tamper-evident and visually appealing. Shrink sleeve labels on some makeup items, like pressed powders, can also aid in minimizing undesired moving of the product itself. Tamper-evident packaging and 360-degree label design are advantageous for sealants, cleansers, and auto fuel additives. Measurement windows may also be readily accommodated with this form of labeling, which is an essential component in the packaging of many automobile products. Thus, the diverse application of these labels across multiple industries is supporting the growth of the market during the estimated timeframe.

The presence of various other labeling and packaging solutions is likely to hamper the growth of the shrink and stretch sleeve labels market within the estimated timeframe. Pressure-sensitive (PS) labels are highly versatile among the various labeling solutions available. They are possibly one of the affordable marketing tool available to companies due to the numerous ways in which adhesives, coatings, multiple panels, facestocks, inks and the die cuts can be combined. With PS labels, brands can easily alter label designs to satisfy the changing consumer preferences. For brand communication, they provide a colorful canvas for everything from images to educational panels. The versatility, reliability as well as the customizability of pressure-sensitive labels makes them useful in a wide range of applications.

For Instance,

Furthermore, the way in which the products are packaged, kept and delivered has been completely transformed by flexible packaging solutions like sachets and pouches. Its versatility, strength and portability make it an attractive choice for a range of uses. Flexible pouches have many advantages for food, drink, pharmaceuticals and industrial items. Due to its great barrier qualities against moisture and oxygen, minimal material consumption, and affordability, stand-up pouches have emerged as one of the most popular packaging items.

Since pillow pouches are being used more frequently in the dairy, food, and beverage industries, they have also seen a significant growth. These alternatives often come with lower initial investment costs, simpler application processes as well as the ability to meet specific regulatory and consumer demands more effectively. Since companies continue to explore and adopt these diverse labeling and packaging options, the competitive landscape becomes increasingly challenging for the shrink and stretch sleeve labels market.

Consumer packaged goods companies are increasingly adopting stretch and shrink sleeves labels due to their many advantages, which include 360 degree label coverage, precise label shrinkage to any unusual form or size, a simpler and more economical application method. But as shrink sleeves have become more widely used, so too have the worries regarding their potential for recycling. However, the discussion around de-inking has started to shift with the development of washable solvent-based shrink sleeve inks, which have given environmentally conscious companies the opportunity to offer their customers a recyclable product together with stunning, eye-catching shrink sleeve labels. Ink particles created by washable solvent-based inks are large enough to be easily filtered out of the caustic wash without causing damage to the plastic. This is achieved through a restricted and controlled release of ink from the shrink sleeve film. Therefore, this kind of ink preserves all of the advantages of solvent-based inks while enabling greater recyclability.

Furthermore, to get the customers' attention, the majority of companies are adopting sustainable and eco-friendly materials. For instance, shrink sleeves are frequently made of polyethylene terephthalate (PET). PET is inexpensive and resistant to UV rays. It's a great option for sustainability because it can be recycled with ease. It's also quite adjustable. The recycled polyethylene terephthalate (rPET), which is 100 percent recycled, keeps plastic out of landfills and the ocean by recycling it back into the circulation system. Also, during the past few years, polylactic acid (PLA) has drawn a lot of interest due to its sustainable and the environmentally beneficial qualities. PLA is a renewable thermoplastic and a biodegradable material that is made from the sugar beets, starch of corn, or the sugar cane. This shift towards the sustainable materials opens up new avenues for innovation and differentiation in the competitive packaging market.

The hot foil segment captured largest market share of 65.18% in 2023. Adding embellishments to the labels can help set a business apart from rivals. Higher quality and greater detail can be achieved with the use of hot foil method of foiling. Hot foil conveys quality with an upscale, opulent appearance. With a heated, engraved plate, colored foil is pressed onto label material to create the hot foil labels. A wide range of color tints can be used with the hot foil labels to create different stunning glows. They complement any branded color scheme and are a widely used method of giving goods a high-end, polished appearance.

Many companies offer hot foil labels in almost any die cut to fit almost any size bottle, can, jug and container. The impact is amplified when embossing is incorporated. Since the foil may be applied to the raised parts without changing the overall design, foil prints are simple to apply to embossed sections. Its versatility makes it applicable to a wide range of industries, including as household goods, pharmaceuticals and food and beverage products.

The beverages segment held largest market share of 44.12% in 2023. Customers are looking for more beverage choices as health and wellbeing has become a priority. Thus, there is a growing demand for drinks including sports drinks, probiotics and enhanced waters. Also, growing consumer awareness of sugar intake and the effects of their decisions on the environment have increased the popularity of natural, organic and low-sugar beverages. The need for unique flavors, origins and brewing techniques has also led to a rise in popularity for artisanal coffees, craft beverages as well as the specialty teas.

Furthermore, demand for convenient and portable beverage options has increased due to the busy lifestyles and the growth of e-commerce. Ready-To-Drink (RTD) beverages have also seen prominent growth, including the energy drinks, bottled teas and the single-serve coffee pods. The demand for convenient yet high-quality beverages has also increased due to the widespread acceptance of the delivery services and grab-and-go formats in stores. With the increasing consumption of beverages the demand for stretch and shrink sleeves labels is also increasing as these labels are waterproof. For packing the beverages, shrink sleeves have emerged as a great option due to their strength and resistance to moisture.

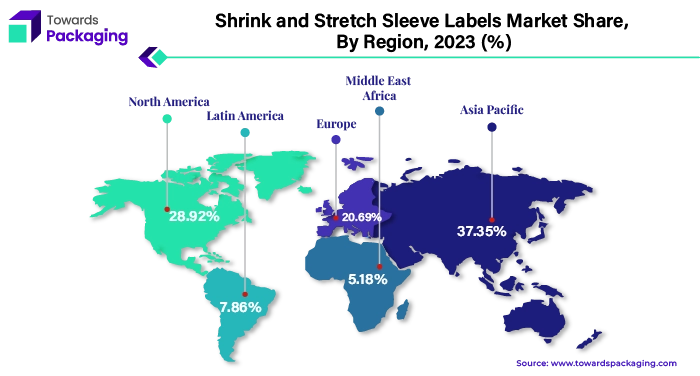

North America is expected to grow at a considerable CAGR of 5.42% during the forecast period. This is owing to the increasing preference for visually appealing and informative packaging in the industries like food and beverages, personal care, and household products. Furthermore, the well-established manufacturing infrastructure and the adoption of efficient labeling solutions are also likely to support the regional growth of the market. Additionally, the growing emphasis on sustainability and reducing the environmental impact is also expected to contribute to the regional growth of the market in the years to come.

Asia Pacific held largest market share of 37.35% in 2023 is expected to grow at a fastest CAGR of 8.30% during the forecast period. This is due to the rapid urbanization and strong economic growth in the countries like China, India, and Southeast Asian nations. Also, the increasing population and rising middle class population is further expected to drive the demand for shrink and stretch sleeve labels in the years to come. Furthermore, the growing demand for soft drinks, alcoholic beverages and functional drinks along with the rising health and wellness awareness among consumers is also expected to support the regional growth of the market in the near future.

Berry Global, packaging company, environmentally friendly packaging solutions, recently inaugurated its "Circular Innovation and Training Center" in Tulsa, Oklahoma. The new 12,000 square foot facility will support a collaborative training environment, incubate cutting-edge stretch film ideas that help keep materials in use and out of the environment, and speed up the development of highly inventive products powered by exceptional materials science and engineering.

By Polymer Film

By Embellishing Type

By Printing Technology

By Application

By Region

April 2025

April 2025

March 2025

February 2025