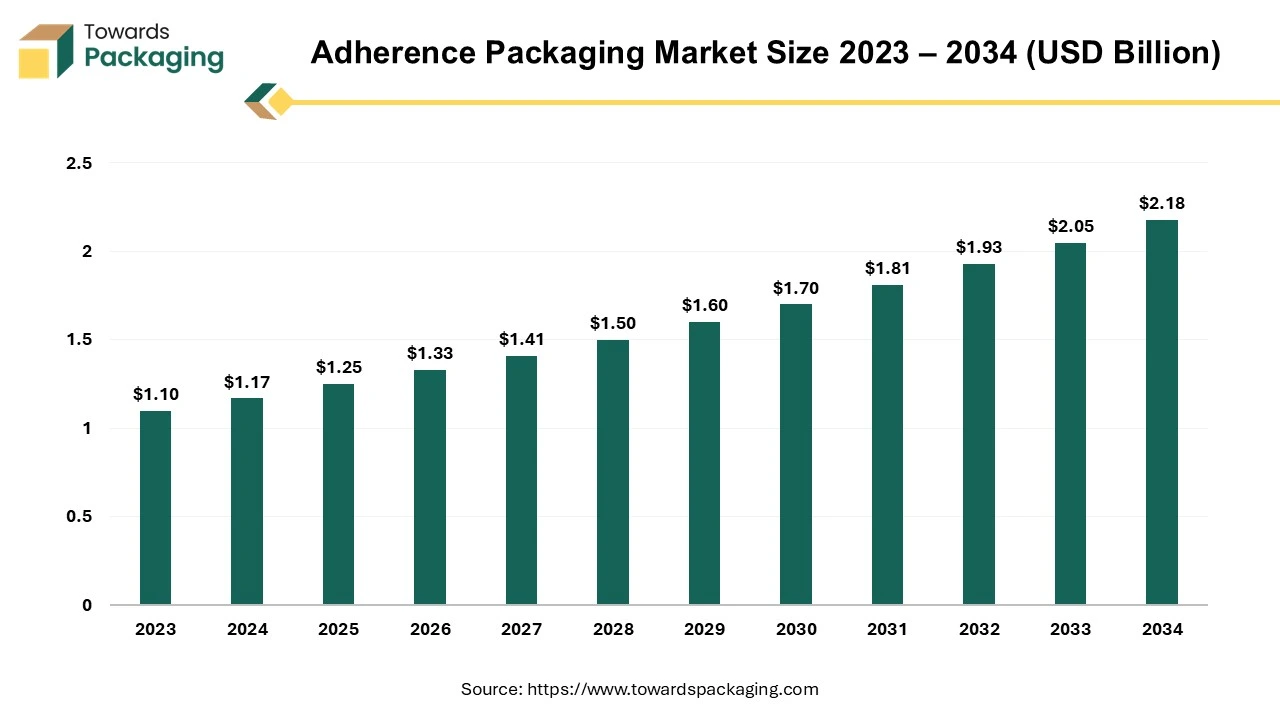

The adherence packaging market is projected to rise from USD 1.25 billion in 2025 to USD 2.18 billion by 2034 (CAGR 6.43%), propelled by higher disposable incomes, expanding personal care consumption, and growing demand for medication adherence in healthcare settings. Our report quantifies 2024 baselines—North America at 37% share, hospitals at 49%, blister as the leading pack format, and plastics as the dominant material—and models Asia Pacific as the fastest-growing region.

It delivers full segment splits (material: plastics/paper/aluminium/others; type: unit-dose blisters/multi-dose pouches; end user: pharmacies/hospitals/others), regional dashboards for NA/EU/APAC/LA/MEA, competitive benchmarking of key players, value-chain and pricing analysis, import–export/trade flows, and verified manufacturer & supplier directories. Innovations in multi-dose blisters and sustainable solutions are mapped with case examples and statistics.

Adherence packaging is a broadly applicable approach that aids in resolving a variety of staff and patient difficulties. Packaging for compliance: Ensures patient adherence. reduces the amount of time needed to give medicine. keeps outdated or unused medicine dosages from being mixed up with fresh ones. Medication adherence packaging initiatives can help patients achieve significant patient-centered outcomes, such more independence, by relieving them of the strain of managing several prescriptions, which is a common cause of both purposeful and inadvertent nonadherence.

Nevertheless, there are currently few studies that have been published evaluating the effects of pharmaceutical packing services on patients' medication-taking habits and patient-centered outcomes. The goal was to assess the effects of a thorough medication adherence program.

These services frequently involve the packing of drugs in single- or multi-dose packs as well as synchronization, which enables the filling of all drugs on the same day every month. These pill packets are arranged to help the patient administer medication more easily by providing the right days and times, such as morning, noon, dinner, and night-time dosing. Several neighbourhood pharmacies that offer medication adherence packaging services additionally incorporate planned communication points (such phone calls) with patients to recognize and address medication-related issues and ensure the patient’s current medication regimen.

Packaging plays a crucial role in the nasal delivery of dry powder biologics. When considering this method for nasally inhaled drugs, it's essential to evaluate the primary packaging early in development, as packaging choices can significantly impact the final product’s performance, says a packaging expert.

Nasal delivery of dry powder biologics offers promising benefits in terms of efficacy, patient convenience, and logistics. These stable powders do not require temperature-controlled storage, making them easier to distribute globally and increasing the availability of therapies and vaccines. This is particularly beneficial for regions with limited cold chain infrastructure. For certain patients, such as those for whom injections are not feasible, dry powder delivery provides a valuable alternative.

One notable example is glucagon, a nasal powder used to treat severe hypoglycemia in diabetes patients, which has become the leading prescribed glucagon in the U.S. Another example is ONZETRA Xsail, a sumatriptan nasal powder approved for migraine treatment.

Experts highlight the potential of dry powder nasal delivery in areas such as vaccines, monoclonal antibodies, and treatments for central nervous system (CNS) disorders. Compared to liquid nasal formulations, dry powders can offer a longer residence time in the nasal cavity and may be enhanced with bioavailability boosters for improved absorption.

In the context of vaccines, the elimination of cold chain requirements could make vaccines more accessible worldwide. The room-temperature stability of dry powders facilitates global distribution, reducing logistical costs and benefiting developing countries. Additionally, nasal delivery allows for self-administration, which simplifies the process for patients and reduces the need for specialized healthcare workers.

Increasing Launch of New Packaging Solution Product In The Market

The rise in prevalence of chronic disease across the globe is driving the demand of the new drug product launch along with sustainable patient-centric packaging which is estimated to drive the growth of the global adherence packaging market.

In February, 2023, according to the data published by the World Health Organization (WHO), chronic disease such as cancer, cardiovascular disease, diabetes and respiratory diseases are estimated to report for over 70% death globally. Patients with most chronic illnesses must adhere to intricate prescription treatment regimens that include several medications, some of which must be given multiple times daily. Patients with chronic illnesses frequently have poor medication adherence; studies have shown that about half of patients do not take their prescribed drugs as directed by their doctors. This frequently results in worse patient outcomes, higher healthcare expenses, and disease complications. Adherence packing is important in this situation.

Adherence packaging aids patients in simplifying complex treatment regimens by distributing drugs in blister packs or dose-wise sachets for each day of the week for convenience. Medication adherence is increased when patients can quickly identify the appropriate medication at the appropriate time thanks to this style. It also makes it possible for caregivers and family members to monitor whether prescriptions are being filled correctly. The personalized packaging technique facilitates the organized dispensing of multi-drug regimens by pharmacies.

The National Association of State Mental Health Program Directors (NASMHPD) reports that in long-term care facilities for individuals with mental illness, adherence packaging resulted in a 50–70% decrease in drug delivery errors. The key market players are focused on launching the new packaging solution for the pharmaceutical entity which is expected to drive the growth of the adherence packaging market over the forecast period.

For instance,

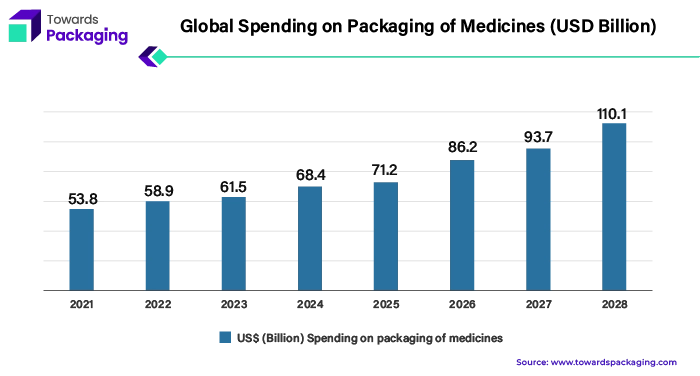

Stringent Regulatory Law And Fluctuating Cost Of Raw Material

The changing norms and strict laws of the government for packaging pharmaceuticals has imposed restriction om the growth of the adherence packaging market. The expansion of the global market for adherence packaging is facing formidable obstacles in the form of mounting packaging expenses and regulatory mandates. The cost of raw materials used to make adherent blisters and strip packaging, including as plastic, paper, and aluminium, has grown for packaging makers. The disruption of global supply chains during the epidemic and the current geopolitical difficulties have caused a dramatic increase in the prices of oil and plastic resins, which are the raw materials used to make polymers, in the last year. As a result, the cost of producing adherent packaging has increased.

Additionally, the burden of compliance for adherence packaging has increased due to strict regulatory standards, particularly in the pharmaceutical business. To avoid unintentional usage, regulators are requiring senior-friendly designs and packaging that is resistant to children. They also need improved systems to avoid product theft and tamper evidence features. Adherence to these requirements necessitated an expensive certification and testing procedure. In order to comply with requirements, packaging designs have gotten increasingly intricate, including multiple materials and sophisticated sealing methods. Manufacturers of adherent packaging have seen a large increase in their overall R&D and capital investment expenses as a result.

Increasing Adoption Of The Inorganic Strategies Like Partnership

The global market for adherence packaging has enormous potential due to unexplored areas in developing nations. With rising income levels and growing health awareness, regions like South Asia, Africa, and parts of Latin America are still in the developmental stages of their economies. People in these markets are able to purchase more advanced medical treatments and healthcare, which were previously unaffordable or unimportant, as living standards continually rise. For medication management, treatment continuity, and overall health outcomes, adherence packaging is essential. It assists patients in adhering to their dosage regimens, taking their prescribed medications on time, and finishing their therapy. This is especially crucial for long-term treatment-adherence chronic illnesses including diabetes, hypertension, asthma, etc.

The global rise in non-communicable diseases as a result of changing lifestyles will significantly increase the demand for adherence solutions. The World Health Organization reports that just 50% of patients in underdeveloped nations adhere to long-term therapy for chronic illnesses. The efficacy of treatment is greatly impacted by inadequate drug intake monitoring, which also raises the risk of problems or readmissions. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to develop and introduce packaging machine to meet the rising demand of adherence packaging is estimated to create lucrative opportunity for the growth of the adherence packaging market.

For instance,

Parata Systems’ Survey on U.S. Strip Packaging Solutions

According to a survey done by Parata Systems, LLC, a company that provides pharmacy automation solutions for all pharmacy end-markets, prescription non-adherence damages the U.S. economy US$300 billion annually on average. Patient outcomes have improved and healthcare costs have decreased thanks to pouch packing. Patients' increased knowledge of strip packaging is anticipated to put pressure on pharmacies that do not have the right packaging to be left behind.

The Plastic Material Segment Held the Lion’s Share in the Market in 2024

The plastic segment held dominating share of the global adherence packaging market in 2024. Plastic's cost-effectiveness, durability, and adaptability make it the most extensively used material in adherent packaging. It is an excellent option for producing blister packs, pouches, and strips in adherence packaging due to its additional moisture resistance. Focusing on the advantages offered by the plastic material for manufacturing adherence packaging for medicines the demand for the plastic packaging has increased. The key players operating in the market are focused on launching new plastic adherence packaging brand in the market to meet the rising demand of the consumers, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The paper segment is estimated to grow at fastest rate over the forecast period, owing to its sustainable qualities and affordability. The goal of adherence packaging is to minimize pharmaceutical waste and promote specified dosing regimens, hence the cost of obtaining and producing the packaging is quite important. Paper-based packaging is becoming more prominent because it is biodegradable and recyclable. It is rapidly being used into sustainable packaging initiatives and is frequently used in secondary packaging.

Paper and paperboard provide an affordable option that works well for blister and strip packaging in large quantities. Because it is renewable and biodegradable, it is possibly the most environmentally friendly material option. This is a major factor in patient demographics and price-sensitive areas when it comes to treatment plan adherence. Because of the adaptability of paper and paperboard, creative package formats that support dose administration tracking and compliance can be created. Due to its excellent cost-to-performance ratio, it is the preferred material for managing chronic diseases that are widely prevalent worldwide.

For instance,

The aluminium segment is expected to be the second fastest growing segment over the forecast period. Aluminium is prized for its superior barrier qualities, which shield prescription drugs from oxygen, light, and moisture. In order to protect the integrity of pharmaceutical products, blister packs are the main application for it.

The Unit-dose Blister Packaging to Grow at a Significant Rate

The unit-dose blister packaging segment is estimated to grow at significant rate over the forecast period. Unit-dose blister packaging confirms absolute medication adherence, decreasing the risk of missed or overdose doses, which is important for chronic disease management. The key players operating in the market are focused on launching the new unit-dose blister packaging solution to meet the rising demand from the hospitals which is estimated to drive the growth of the segment over the forecast period.

For instance,

Multi-dose pouches segment is estimated to grow at fastest rate over the forecast period. A packaging structure or system intended to hold several doses of a drug or product in a single package is known as multi-dose packaging. In the pharmaceutical sector, it is frequently employed to offer a practical and well-organized method of distributing and giving drugs over an extended period of time. The patient can keep track of medicines dosages and make sure patient don't miss any by keeping all of meds grouped in a single multi-dose pack. Patients who must take several medications during the day may find this to be extremely helpful. Maintaining a regular medication regimen is one of the main issues that patients face. Because multi-dose packets make it simpler to remember to take drugs at the appropriate time, they may enhance adherence and result in better health results.

Purchasing drugs in larger quantities can often be more affordable than buying single dosages or lesser amounts. In the long run, this can save patients money and lower the total cost of their care. As opposed to supplying extra medication that might be unneeded and need to be disposed of, multi-dose packets provide the precise amount of medication required for each dose, therefore reducing medication waste. Multi-dose packets can be tailored to each patient's unique pharmaceutical requirements and can contain any information or instructions needed to help patients understand how to take their medication as directed.

The Blister Segment Led the Market with the Largest Share in 2024

The blister segment held the largest share of the global adherence packaging market in 2024 due to its lower expenses and faster packaging than with conventional packing materials. Since, medications that are wrapped in blisters are protected from unfavourable conditions, blister packing aids in maintaining the integrity of the product.

Moreover, there are very little chances of product contamination. The product name, lot number, and expiration date are used to identify each dose. Because of their tamper-evident qualities and ease of usage. Individual pre-formed chambers offer strong, leak-proof containment for tablets, capsules, or sachets containing liquid or solid medications. This feature makes blister foils user-friendly for people of all ages and abilities: it allows for the clear printing of dose directions and labeling. Assuring content integrity, once sealed, the lidding material cannot be taken out and replaced without obvious evidence. Blister packs are very easy to use for patients: just peel out the foil to get each dose sequentially. Those with dexterity problems also experience improved compliance due to the push-through nature.

Blisters are becoming increasingly popular because they fulfill all requirements for efficient adherence packaging, from point-of-care to production. Increasing initiative by the key players operating in the market to develop sustainable blister packaging to meet the rising demand of the blister packaging is estimated to drive the growth of the segment over the forecast period.

For instance,

Pouches segment is estimated to grow at fastest rate over the forecast period. Increasing adoption of the inorganic growth strategies like collaboration to develop multi-dose packaging, is estimated to drive the growth of the segment over the forecast period.

For instance,

Hospitals to Spurge in the Upcoming Period

The hospitals segment is estimated to show significant growth over the forecast period. Hospitals oversee a high volume of patients, many of whom have complicated drug schedules. To guarantee that all patients receive their prescriptions on time, effective medication management systems are required. Increasing hospital admission of patient has risen the demand for the medicine in hospitals, which is estimated drive the growth of the segment in near future.

For instance,

The pharmacies segment is estimated to grow at fastest rate over the forecast period. The last point of contact for the dispensing of medications is a pharmacy. Pharmacies are already equipped with the knowledge and resources needed to provide prescription drugs. They are accustomed to managing prescriptions and patient needs, but adding adherence packaging calls for some modifications. Adherence packaging offers a fresh service and could boost revenue as well.

The increasing significance of impeding dispensing errors and intensifying the operational capacity are the significant factors driving the high adoption of adherence packaging in pharmacies. The rising focus of pharmacies to upgrade patient safety will also fuel the segment’s growth. Formulation and innovation of new immunity supplements is key trend acquiring admiration in the market. Moreover, increasing launch of the new drugs and medicines has risen the demand for the adherence packaging which is estimated to drive the growth of the segment over the forecast period.

For instance,

North America witnessed the highest revenue share of 37% for the year 2024. The United States leads the region with the largest market share because of its highly developed healthcare infrastructure and widespread use of cutting-edge packaging techniques. To further bolster its leading position, the region leads the world's pharmaceutical market in terms of pharmaceutical output. The adoption of adherence packaging solutions has been widely driven by the size and developed healthcare sector in countries such as the United States. A number of pharmaceutical manufacturers in the region have integrated compliance packaging into their medication dispensing process.

The U.S. market for adherence packaging is anticipated to grow significantly and account for a sizeable portion of the industry. The nation's older population is the reason behind the rise in adherence packaging. The Population Reference Bureau projects that the number of Americans 65 and older will rise from 58 million in 2022 to 82 million in 2050. Pharmaceutical companies may therefore be compelled by the growing elderly population to implement adherence packaging, which will reduce the amount of time needed to provide elderly patients medications.

However, there are demonstrable differences across the nations in terms of GDP levels, healthcare spending intensity, population sizes, and health insurance plan designs. The United States represents one of the largest geographical markets for adherence packaging products in the world due to its advanced primary medical community, extensive medical and life science research activities, high healthcare spending intensity, and sizable pharmaceutical and medical supply and device industries. Additionally, there is an improvement in medication adherence in the correctional context in the U.S.

Most correctional facilities' inmate population fills their prescriptions through an outside pharmacy. In certain circumstances, a pharmacist may be available on-site. But these employees are frequently constrained since they depend on a central location for drug supplies and an on-site nurse manager or something similar for dispensing. This supports the idea of providing administration systems that require little efforts from staff members and are effectively managed to ensure patient adherence. Moreover, increasing adoption of the inorganic growth strategies like partnership to develop and expand pharmacy services is estimated to drive the growth of the adherence packaging market in the North America over the forecast period.

By centralizing prescription fulfillment, Baptist Health can better serve its patients in southern Indiana and Kentucky by offering pharmacy services. This will also give Baptist employees and their families access to more resources and the infrastructure they need to satisfy their needs. This service will make it easier for patients who live in rural and urban areas to obtain their prescription drugs. Through an extended pharmacy accreditation process, the Central Pharmacy Services Center may accommodate increasing traffic and provide access to an even wider assortment of specialized pharmaceuticals by distributing prescriptions directly to patients.

Asia Pacific is estimated to witness the fastest growth over the forecast period. Asia-Pacific nations, including China, India, and Japan, are spending a lot more money on healthcare. In order to enhance patient outcomes and lower healthcare costs, there is a growing demand for innovative healthcare solutions, such as adherence packaging. Owing to expanding population and rising healthcare costs, the Asia Pacific region is now home to the world's fastest-growing adherence packaging market. Asia's economy is growing quickly, raising living standards and placing a greater emphasis on healthcare. This has increased the distribution and sales of numerous prescription medications.

As a result, both doctors and patients are calling for packaging designs that encourage medication compliance. The rise of both local and foreign pharmaceutical companies throughout Asia Pacific is being driven by low-cost manufacturing centers and a favourable business environment, which are further enhancing growth. With their sizable populations and expanding pharmaceutical sectors, nations like China and India have emerged as important markets for adherence packaging solutions.

Driven by the previously mentioned factors, Asia Pacific is anticipated to have a significant influence on the future dynamics of this market. Increasing investment and funding activities in the Asia Pacific healthcare sector to improve pharma services offerings is estimated to drive the growth of the adherence packaging market over the forecast period.

For instance,

Europe region is expected to be the second fastest growing region over the forecast period. The number of elderly people in Europe is rising, and they frequently need complicated drug schedules. Because they ensure that dosage information is included on the packaging, this may increase demand for adherence packaging goods. In Europe, medication non-adherence is a serious issue that costs billions of euros a year. This problem is addressed by adherence packaging, which makes medication schedules easier to follow and offers visual cues to take pills on time.

The launch of several initiatives aimed at promoting the development of a national medication plan for individuals taking numerous medications. This strategy has the ability to increase drug adherence awareness and improve the appeal of adherence packaging. The key players operating in the market are focused on expanding the production capacity which is estimated to fuel the growth of the adherence packaging market over the forecast period.

For instance,

By Material

By Type

By End User

By Region

December 2025

December 2025

December 2025

December 2025