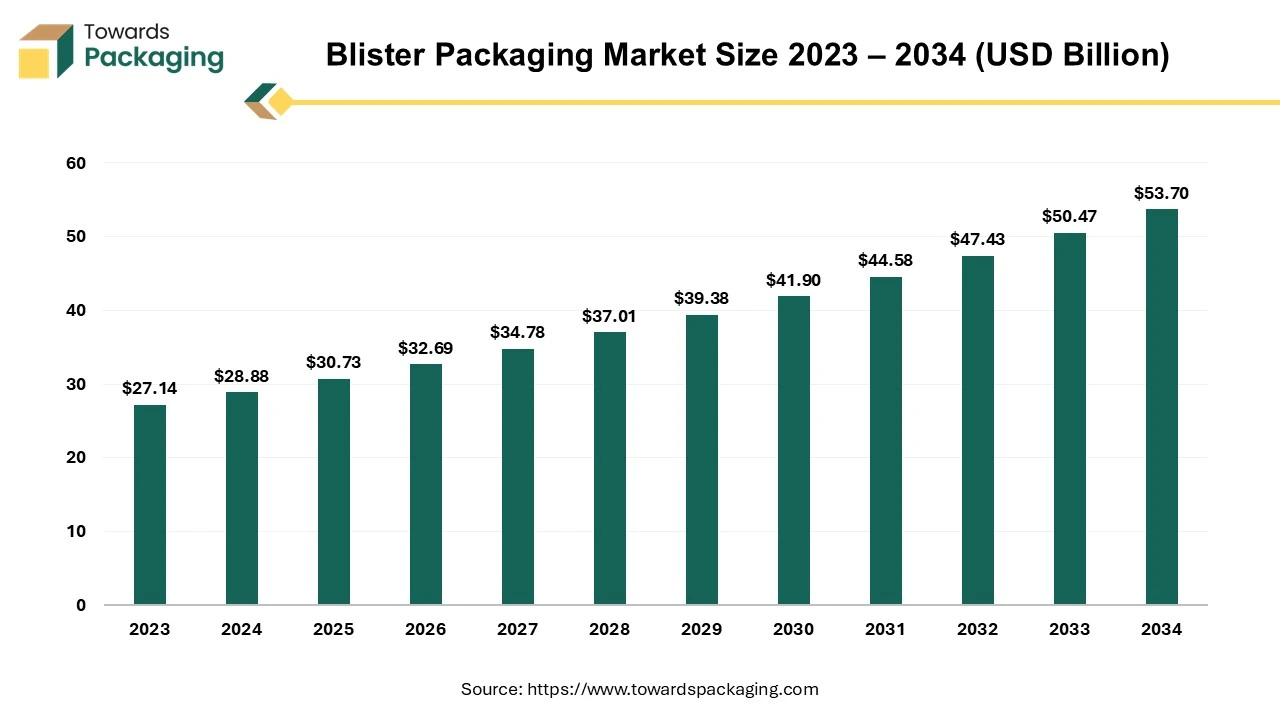

The blister packaging market is forecasted to expand from USD 32.69 billion in 2026 to USD 57.14 billion by 2035, growing at a CAGR of 6.4% from 2026 to 2035. This comprehensive report highlights the significant trends in the blister packaging market, including technological advancements in thermoforming, sustainability efforts, and the increasing demand from pharmaceuticals, food, and consumer goods industries.

Blister packing is a pre-formed plastic pack that is used for packaging purposes. The formable web in blister packs is created using thermoformed plastic. These formable webs are used to create blister pack cavities or pockets. Blister packaging has numerous applications. Many manufacturers utilize blister packaging to provide transparency to their clients, allowing them to view the genuine product packaged. The backing of blister packs is made of paperboard, aluminium foil, or plastic. Blister packing is used in pharmaceutical applications to package disintegrating capsules, tablets, and other medicinal products.

Blister packs are also used to pack contact lenses, which are filled with a predetermined volume of saline solution and heat-sealed around the contact lens compartment. Blister packs shield the goods from moisture and contamination. Many types of blister packaging, suc as clamshell, carded, and so on, are utilized depending on the specific packaging requirements. Blister packaging has several advantages, including freshness, a wide range of packaging materials, visibility, design variety, security, and customization.

The growing demand for enhanced product safety, expressed by manufacturers, consumers, and regulatory bodies, positions blister packaging as an increasingly pragmatic choice. Critical factors such as product integrity and prolonged shelf life become imperative in the pharmaceutical sector. This is particularly significant as many consumers store medications in environments with temperature variations that could harm unprotected medicines.

The escalating requirement for adherence to safety regulations and a heightened demand for packaging products that offer convenience and ease of use is anticipated to propel market growth. This trend has led market vendors to collaborate with technology companies to integrate such features, expanding their product differentiation advantages for bulk purchasers.

The pharmaceutical industry faces mounting pressure to produce medicines with distinctive and tamper-resistant packaging. This goes beyond the fundamental requirement of maintaining effectiveness for the intended purpose and aims to ensure patient availability. The increase in diseases and stringent government regulations against counterfeit drugs are significant drivers for this demand. Blister packaging emerges as an effective solution for implementing anti-counterfeit systems akin to banknote authentication systems and others.

| Supplier (Global Blister Presence) | 2024 EBITDA (%) | Company Description |

| Amcor plc | 14.40% | One of the largest global packaging suppliers, offering flexible and rigid packaging with a strong presence in pharmaceutical blister films and lidding foils. |

| Winpak Ltd. | 21.30% | North American leader specializing in thermoformable films, lidding materials, and medical packaging solutions widely used in blister applications. |

| UFlex Ltd. | 11.90% | A global flexible packaging manufacturer with strong capabilities in pharma blister substrates, including PVC, PVdC, and aluminum foils. |

| Bilcare Ltd. | 5.20% | A specialist provider of PVC/PVdC blister films, primarily catering to pharmaceutical companies with cost-effective solutions. |

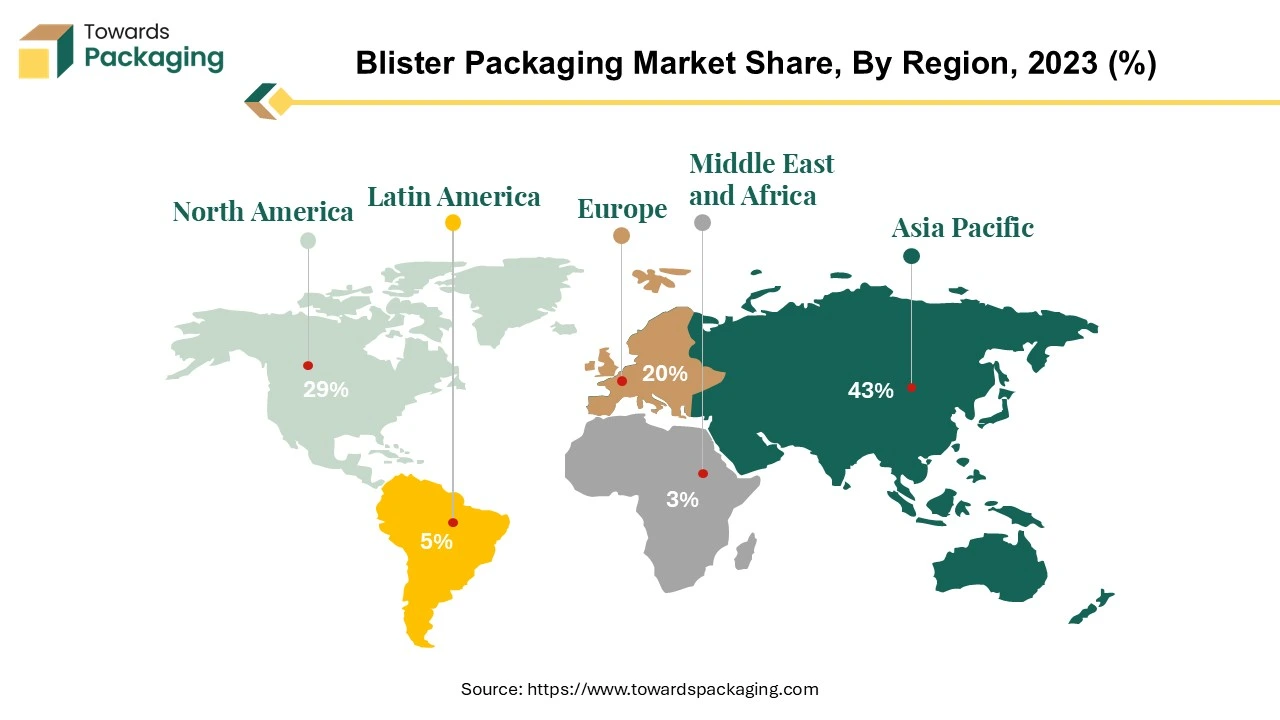

As of 2022, the Asia Pacific region commands the largest market share, and this dominance is expected to continue throughout the forecast period. The demand for blister packaging is rising, particularly in the healthcare and food industries. The market growth is driven by Asian countries, with notable contributions from China and India. These nations possess the potential availability of the required material types for manufacturing blister packaging, further contributing to the market expansion.

One of the primary drivers of the blister packaging market in the Asia-Pacific region is the burgeoning population coupled with rising disposable incomes. The expanding consumer base has increased demand for various packaged products, ranging from pharmaceuticals to consumer electronics. Blister packaging offers a versatile and efficient solution, protecting external factors such as moisture, light, and contaminants. Its ability to enhance product visibility and aesthetics aligns with the changing consumer preferences for visually appealing packaging.

The regulatory landscape in the Asia-Pacific region has played a pivotal role in shaping the blister packaging market. Stringent regulations governing product safety and the need for tamper-evident packaging have prompted businesses to adopt blister packaging as a reliable and secure option. This is particularly crucial in the pharmaceutical industry, where the integrity of medicinal products is paramount. Blister packaging not only meets these regulatory requirements but also enhances the shelf life of pharmaceutical products, contributing to the market's overall growth.

Pharmaceutical companies are facing escalating pressure to increase the production of medicines, driven by the growing prevalence of diseases and stringent government regulations to combat counterfeit drugs. These factors are significant contributors to propelling the market forward. The pharmaceutical sector places a premium on product integrity and extended shelf life. This emphasis is crucial, given that many consumers store their medications in environments with temperature variations, which can be detrimental to unprotected medicines.

The region has a burgeoning demand for pharmaceutical and personal care products. A notable increase in consumer expenditure on pharmaceutical and personal care items drives this surge. This demand encompasses a variety of products, including capsules, tablets, sterile products, and liquid cosmetics such as perfumes.

The Asia Pacific region is the third-largest pharmaceutical market globally, following North America and Europe. This region's healthcare and pharmaceutical sector demands blister packaging solutions that cater to specific needs, including insulation from external surroundings, high levels of protection, cost-effectiveness, and ease of handling. The blister packaging market in the Asia Pacific is predominantly driven by the pharmaceutical and healthcare industry, with China playing a pivotal role as one of the world's largest pharmaceutical markets and a strategic focus for numerous global players. Notably, China is the leading producer of active pharmaceutical ingredients globally.

The consumer goods sector is anticipated to substantially contribute to the region's blister packaging market over the forecast period. This diverse market landscape underscores the critical role of blister packaging in meeting the varied requirements of different industries within the Asia Pacific region.

Blister packaging is experiencing moderate growth in the North American region, driven by the heightened demand for solutions that offer high safety standards. The stringent regulations and increasing expectations from manufacturers and consumers contribute to the rising adoption of blister packaging solutions. The growth in over-the-counter drugs further stimulates the market.

The pharmaceutical industry faces growing pressure to produce medicines with distinctive packaging that is challenging to imitate. This requirement goes beyond the essential need for maintaining efficacy and accessibility for patients. The disease surge and stringent government regulations against counterfeit drugs propel this market growth. Blister packaging emerges as an effective solution for implementing anti-counterfeit systems, comparable to banknote authentication systems and others.

Expansion into Emerging Markets: Emerging markets offer significant opportunities for the blister packaging market due to rapid growth in the healthcare, pharmaceutical, and consumer goods sectors. Rising disposable incomes and expanding middle-class populations are driving demand for packaged and convenient products. Increased awareness of product safety and hygiene further fuels the adoption of blister packaging for medicines and consumer goods. Additionally, growing retail and e-commerce penetration in these regions creates a need for durable, transport-friendly packaging solutions. Overall, the combination of economic growth, urbanization, and evolving consumer preferences makes emerging markets a key growth area for blister packaging.

Thermoforming technology has become a cornerstone in the blister packaging market, reshaping how products are presented and protected. In business, understanding the intricacies of thermoforming is crucial for companies aiming to leverage its benefits and gain a competitive edge.

Thermoforming is a versatile and cost-effective process that involves heating a plastic sheet to a pliable temperature and forming it into a specific shape using a mold. This technique is particularly well-suited for blister packaging, providing a visually appealing and customizable solution for various industries. The business advantages of thermoforming in blister packaging are multifaceted.

First and foremost, thermoforming allows for the creation of blister packs that enhance the product's visual appeal and ensure its protection during transportation and display. The transparency of thermoformed blister packs offers consumers a clear view of the product, fostering trust and confidence by allowing them to inspect the contents before purchasing. This level of transparency is especially critical in industries like pharmaceuticals, where product integrity is paramount and regulatory compliance is stringent.

Moreover, thermoforming's adaptability makes it suitable for various products and industries, contributing to its widespread adoption. From electronics to food and cosmetics to pharmaceuticals, companies can tailor blister packs to meet the specific needs of their products. This versatility not only enhances the packaging aesthetics but also ensures that the packaging is functional, meeting the unique requirements of each industry.

Sustainability has become a key consideration in modern business practices, and thermoforming aligns well with this trend. The ability to use recyclable materials in the thermoforming process contributes to reducing the environmental impact of packaging. As consumers become increasingly eco-conscious, businesses that adopt sustainable packaging solutions, such as thermoforming, fulfil their corporate social responsibility and appeal to a growing market segment.

From a technological standpoint, innovations in thermoforming continue to shape the blister packaging landscape. Integrating smart technologies, such as RFID and NFC, enhances the functionality of thermoformed blister packs. This provides companies with valuable data on consumer behavior and opens up avenues for supply chain optimization and anti-counterfeiting measures. Embracing these technological advancements positions businesses at the forefront of innovation, ensuring they stay ahead in a competitive market.

The blister packaging market within the healthcare sector has grown substantially, driven by the increasing demand for efficient and secure packaging solutions for pharmaceutical and medical products.

Packaging is crucial in the pharmaceutical industry, ensuring the secure and undamaged delivery of medicinal products from manufacturing facilities to patients. Specialized packaging options are instrumental in achieving tamper- and damage-free transportation. Blister packaging is one such option that safeguards therapeutic products, maintaining their integrity by keeping them safe from moisture and protected against various external contaminants.

Blister packaging can be composed of thermoformed plastic, with the lid crafted from materials such as paper, foil, Plastic, or a combination thereof. Another prevalent form of blister packaging involves using foil and cold-stretching. In either case, opaque alternatives provide protection from UV rays, which is particularly beneficial for light-sensitive medicines.

Blister packaging is a robust method for packaging and transporting essential medical products. This form of packaging offers protection against impacts, moisture, and heat, thereby enhancing the shelf life and facilitating the transportation of medicines. The advantages of blister packaging became evident during the pandemic, where the surface of the packaging played a crucial role in the international transport and storage of medications. However, the transmission of the virus through surfaces highlighted the need for improvements in the outer materials, an aspect that packaging manufacturers will likely focus on in the future.

Significant investments in healthcare to enhance diagnostics and overall standards, including pharmaceuticals, have spurred the need for advancements in medicine packaging. The global rise in drug consumption, facilitated by widespread accessibility, has once again underscored the importance of blister packaging solutions in the pharmaceutical industry. This demand is notably influenced by the expansion of e-commerce platforms, which promote convenient access to medications and ensure secure logistics.

Key market players engage in self-assessment initiatives to establish a robust triple-bottom-line approach. This strategy aims to achieve higher profits, optimize distribution networks, and develop a sustainable product portfolio, aligning with evolving market trends and consumer preferences.

In Europe, oral medications are primarily packaged as single solid oral dosage forms (SODF) in blister cards. These cards are made from multilayer laminates of aluminum and/or various plastic polymers, creating blister chambers (alveoli) separated by gaps. This study aimed to calculate the annual packaging waste generated by these blister cards and explore potential waste reduction through optimizing the arrangement of the alveoli.

We analyzed the packaging of the 50 most frequently prescribed SODFs in Germany, focusing on 45 products (13 aluminum-aluminum blisters and 32 mixed material blisters). We measured and weighed the packaging materials and content, estimated the annual waste produced, and assessed how much waste could be saved by optimizing the layout of the blister chambers. Additionally, we examined the variability in blister packaging among eight groups of commonly prescribed generics of the same strength.

Our detailed analysis showed that 69% of the material was used for the gaps between blister chambers. Aluminum-aluminum blisters were found to be over four times larger than the actual dosage forms they contained. The annual composite waste generated from these blister packs was estimated at 3,868 tons in Germany, with an extrapolated total of 8,533 tons for the entire German pharmaceutical market. By optimizing the arrangement of blister chambers such as using a 2-mm sealing area around each alveolus and arranging the SODFs in two rows waste could be reduced by approximately 37%.

With other ecological strategies still in development, optimizing the arrangement of blister chambers presents a straightforward and immediately implementable solution to significantly reduce packaging waste in the pharmaceutical industry.

In the competitive landscape of the blister packaging market, several key players stand out, each contributing to the industry's growth and evolution. Prominent companies in this landscape include Amcor Limited, Bemis Company, Inc., WestRock Company, and Sonoco Products Company.

These industry leaders play a pivotal role in shaping the market dynamics through innovative packaging solutions, extensive distribution networks, and strategic collaborations. Amcor Limited, for instance, is recognized for its global presence and focus on sustainable packaging, aligning with the growing environmental consciousness in the business world. Bemis Company, Inc. boasts a diverse product portfolio and a commitment to technological advancements, ensuring it remains at the forefront of blister packaging innovation. WestRock Company, with its comprehensive packaging solutions, has established itself as a reliable partner for businesses seeking end-to-end packaging services. Sonoco Products Company's emphasis on consumer-friendly designs and customization capabilities further contributes to the competitive landscape.

The comparative analysis of these key players underscores the importance of innovation, sustainability, and customer-centric approaches in navigating the dynamic blister packaging market. As companies strive for market leadership, strategic partnerships, technological investments, and a keen understanding of evolving consumer preferences will be instrumental in staying ahead in this competitive arena.

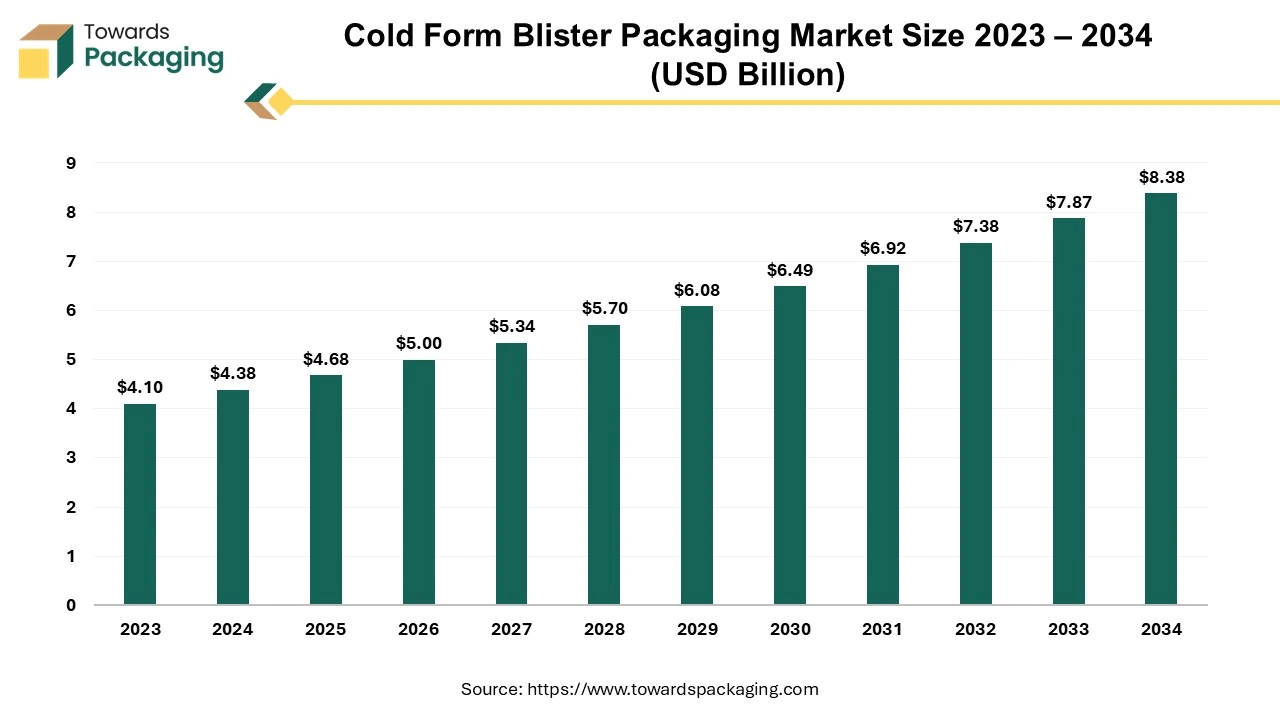

The cold form blister packaging market size is projected to reach USD 8.38 billion by 2034, growing from USD 4.68 billion in 2025, at a CAGR of 6.75% during the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing cold form blister packaging which is estimated to drive the global cold form blister packaging market over the forecast period.

Cold form blister packaging is a type of pharmaceutical and medical packaging used to protect products like tablets, capsules, or sensitive medical devices. It is made by pressing aluminum-based laminate sheets into the desired shape without the use of heat, hence the term "cold form." The components of cold form blister packaging have been mentioned here as follows: aluminum foil, polymer film (e.g., PVC or PVDC), and nylon film. The aluminium foil offers and impermeable barrier to moisture, light, oxygen and other environmental factors. The polymer film adds structural support and acts as a sealing layer. The nylon films provide extra durability and strength, making it resistant to punctures.

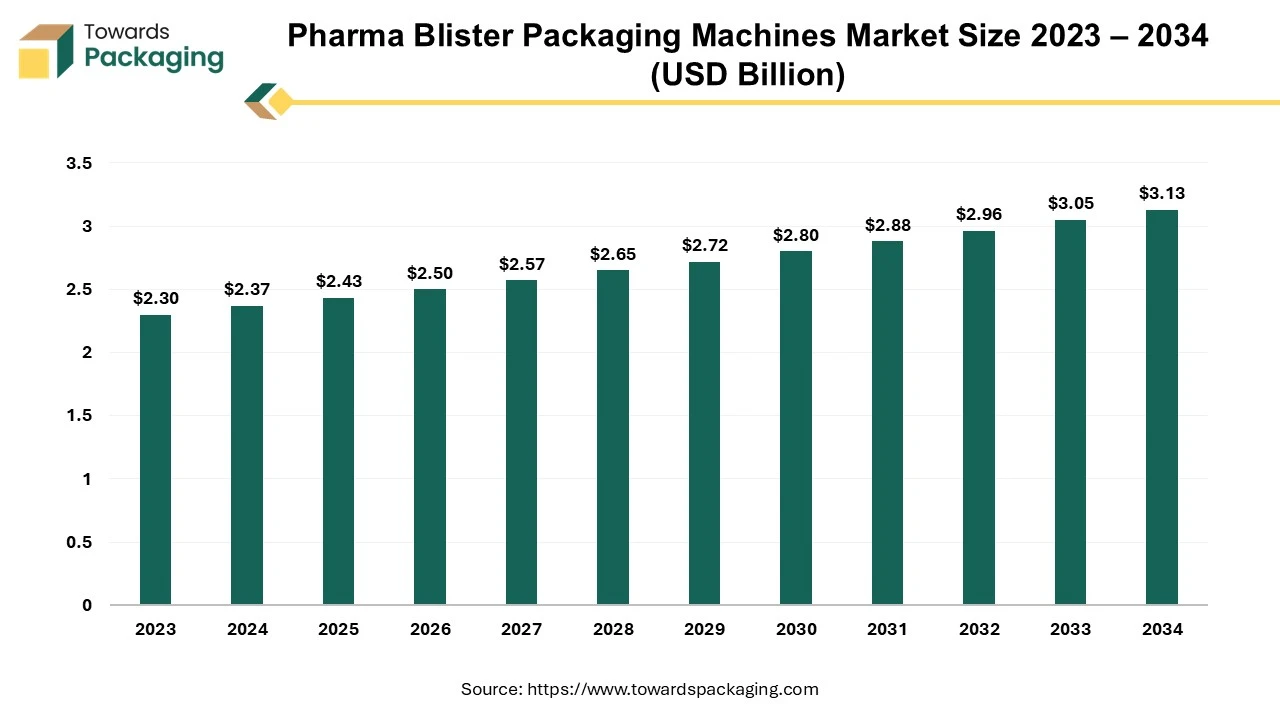

The pharma blister packaging machines market is projected to grow from USD 2.37 billion in 2024 to USD 3.13 billion by 2034, expanding at a CAGR of 2.85% from 2025 to 2034. Key industry players are adopting inorganic growth strategies such as mergers and acquisitions to advance technology in pharma blister packaging, driving market expansion.

A pharma blister packaging machine is a specialized piece of equipment utilized in the pharmaceutical industry to package capsules, tablets, and other solid dosage forms. The machine creates blister packs, which are protective packaging designed to safeguard products from environmental factors like air, moisture, and contamination, while also providing ease of use for consumers.

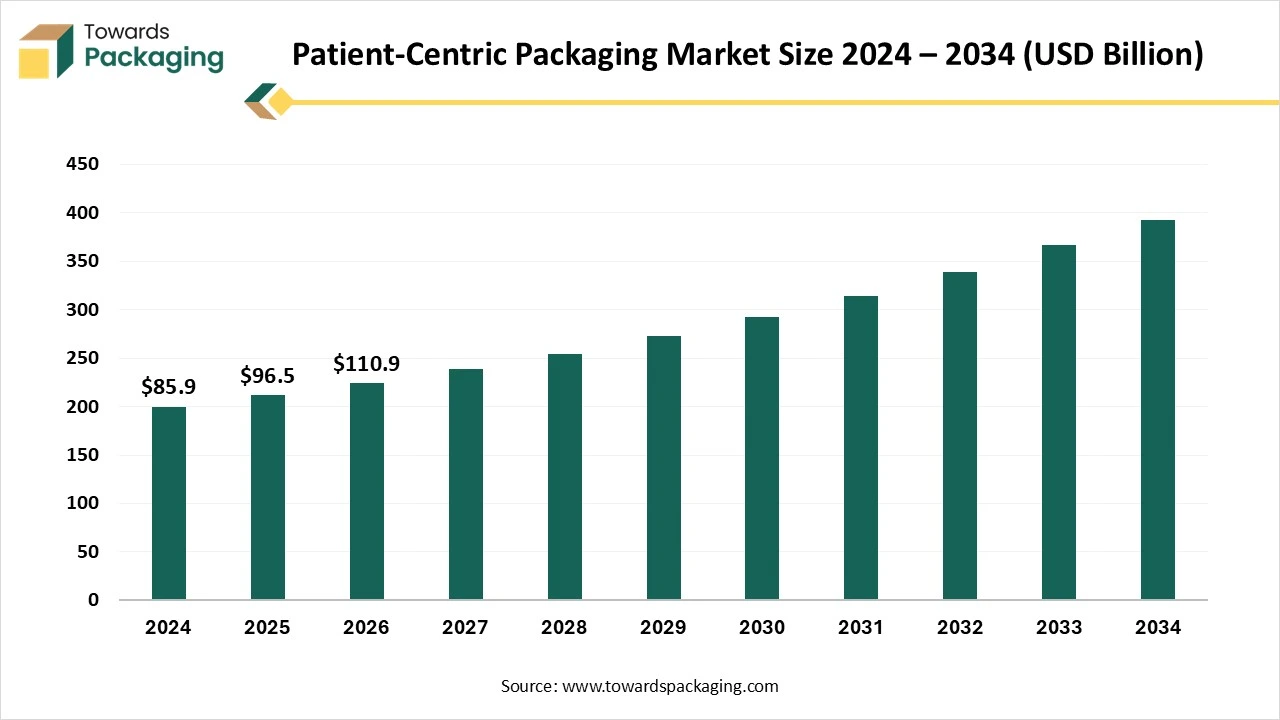

The patient-centric packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The rising prevalence of diseases has led to the advancement in pharmaceutical sector and also encouraged the extension of personalized treatment plans, such innovation has influenced the demand for patient-centric packaging market. Plastic packaging materials dominate this market due to its lightweight and cost-effectiveness. Innovation in the healthcare sector is the major factor behind the growth of this market in North America which is the dominating region of this industry.

Patient-centeric packaging is the incorporation of pharmacological goods packaging with the patient’s requirement for availability to, data about, and training in the usage of that goods. This phenomenon is also called as patient centricity which means that packaging reflects the requirements and capabilities of patients to support them use and manage medicine correctly and live more self-reliantly. Light weight packaging is a rising trend in the patient-centric packaging sector, it is to enhance the quality of packaging for safe delivery of the products.

The PET packaging in the pharmaceutical market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The pharmaceutical sector urges packaging that ensures product sterility, safety, and durability. PET has come up with a top solution for storing syrups, vitamin supplements, and liquid medications. Lightweight and Durable feature even reduces transportation costs and breakage risk too. With Asia Pacific emerging as the fastest-growing area and North America holding the greatest share in 2024, the PET packaging market for pharmaceuticals is expanding quickly.

The most popular packaging style was PET bottles, but blister packs are predicted to rise significantly. Drug packaging was dominated by solid dosage forms, and the market for ophthalmic and nasal solutions will grow considerably. Thermoforming was becoming more popular, but stretch blow molding was the best technology. Prescription drugs accounted for the largest end use, while nutraceuticals and supplements are set to grow quickly. Pharmaceutical manufacturers were the main distribution channel, but contract packaging organizations are poised for notable expansion.

By Product

By Technology

By Material

By End-Use

By Region

December 2025

December 2025

December 2025

December 2025