April 2025

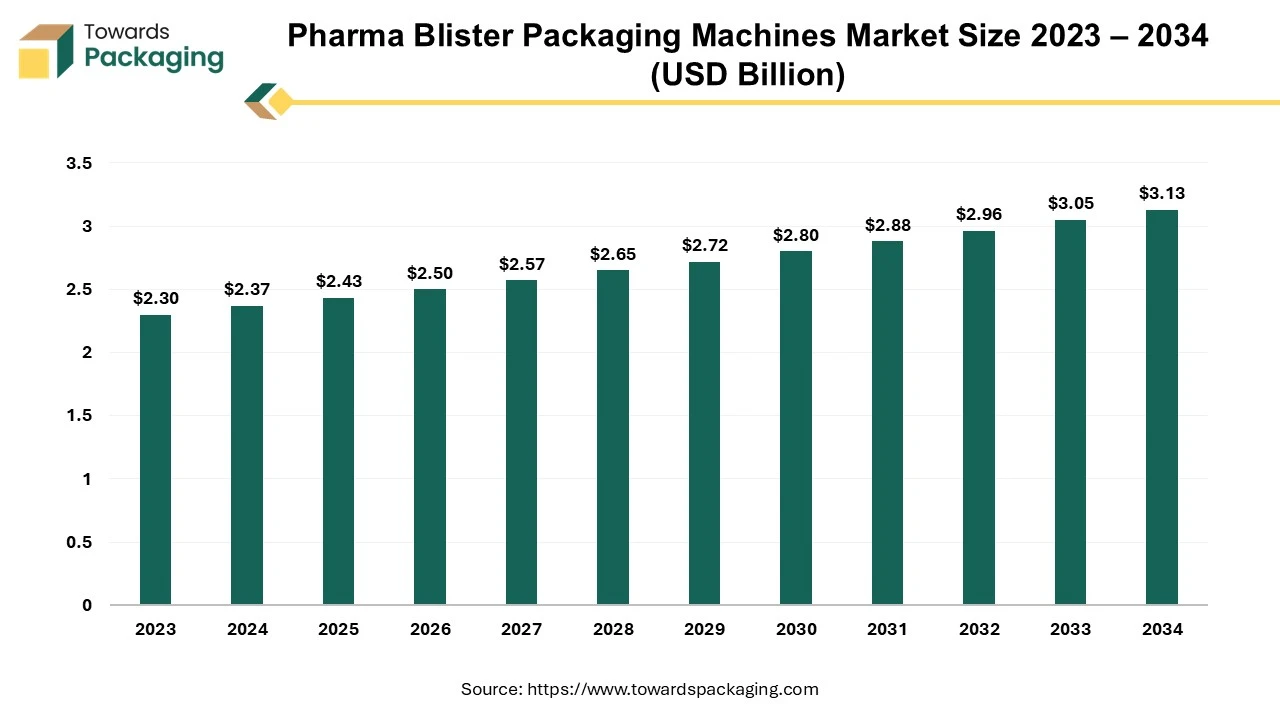

The pharma blister packaging machines market is projected to grow from USD 2.37 billion in 2024 to USD 3.13 billion by 2034, expanding at a CAGR of 2.85% from 2025 to 2034. Key industry players are adopting inorganic growth strategies such as mergers and acquisitions to advance technology in pharma blister packaging, driving market expansion.

A pharma blister packaging machine is a specialized piece of equipment utilized in the pharmaceutical industry to package capsules, tablets, and other solid dosage forms. The machine creates blister packs, which are protective packaging designed to safeguard products from environmental factors like air, moisture, and contamination, while also providing ease of use for consumers.

Blister packs protect tablets or capsules from moisture, light, air, and contamination, ensuring the product maintains its efficacy and safety. Blister packaging is often tamper-evident, meaning it is easy to spot if a product has been tampered with before reaching the consumer. Blister packaging allows for easy, precise dispensing of medications. Each tablet or dose is easily accessible, helping consumers with dosage management. Due to its protective properties, blister packaging can extend the shelf life of pharmaceutical products by maintaining their integrity over time.

Pharma blister packaging machines play a significant role in the pharmaceutical industry, ensuring that products are packaged securely, safely, and efficiently. By protecting the integrity of the pharmaceutical product and offering convenient, tamper-evident packaging, these machines contribute to both consumer safety and operational efficiency.

The adoption of automation and Industry 4.0 technologies is transforming blister packaging operations. Advanced motion control, modular software design, and human-machine interface (HMI) connectivity enhance efficiency, precision, and flexibility in packaging processes. Robotic integration and machine learning facilitate high-speed production, reduce human error, and enable real-time monitoring and predictive maintenance.

Rising emphasis on sustainability in packaging. Manufacturers are exploring the use of recyclable and biodegradable materials to reduce environmental impact. Innovations in material science are leading to the development of eco-friendly blister packs that maintain product integrity while minimizing ecological footprints.

Advancements in blister packaging are focusing on improved product protection against factors like light, moisture, and oxygen, which can compromise pharmaceutical efficacy. Developments such as prototype tooling for preliminary blister-card assessment and child-resistant features are contributing to safer packaging solutions.

Modern blister packaging machines are designed for greater flexibility, allowing for quick changeovers and the ability to handle various product types and packaging designs. This adaptability is significant for meeting diverse market demands and accommodating small batch productions, which are increasingly common in personalized medicine.

Artificial intelligence (AI) is poised to play a transformative role in the pharmaceutical blister packaging machine industry, driving growth by improving efficiency, reducing costs, and enhancing product quality. The artificial intelligence integration support the predictive analytics can monitor machine performance in real time, identifying potential issues before company lead to downtime. Sensors embedded in blister packaging machines collect data, which AI algorithms analyze to predict when maintenance is needed. This minimizes machine breakdowns, reduces operational costs, and maximizes uptime.

AI can monitor and manage energy consumption in blister packaging machines. By analyzing energy usage patterns, AI helps identify areas for improvement, enabling more sustainable and cost-effective operations. The pharmaceutical industry is heavily regulated. AI can assist by monitoring and documenting production processes to ensure compliance with regulations such as GMP (Good Manufacturing Practices). It can also generate audit trails, ensuring traceability and transparency.

The rise of personalized medicine, requiring small batch productions and customized packaging, is boosting the demand for flexible blister packaging machines. Machines designed for quick changeovers and adaptability to different product types cater to growth of the pharma blister packaging machines market in the near future. Personalized medicine involves tailoring treatments to individual patients or small groups with similar characteristics. This shift requires packaging solutions that can handle smaller, customized batches efficiently.

Blister packaging machines designed for flexibility and quick changeovers will see increased demand. Personalized medicine calls for precise tracking and tracing of medications. Blister packaging machines equipped with serialization and track-and-trace capabilities ensure compliance with regulatory requirements while maintaining product integrity. Blister packaging machines capable of automated, high-precision customization will be essential to meet the diverse requirements of personalized medicine, such as labeling, dose-specific packaging, and patient-specific information.

The key players operating in the market are facing issue due to slower adoption of blister packaging machines and supply chain disruption which may restrict the growth of the pharma blister packaging machines market in the near future. Emerging markets often face challenges such as lack of infrastructure, insufficient funding, and limited access to advanced technologies. These factors slow the adoption of high-end blister packaging machines in these regions.

In mature markets like North America and Europe, the high penetration of advanced blister packaging machinery limits opportunities for further growth. Global supply chain challenges, such as delays in sourcing raw materials and components for machines, can affect production and delivery timelines. These disruptions may lead to higher costs and reduced market competitiveness.

The rise of online pharmacies and direct-to-consumer healthcare products increases the need for compact, tamper-proof, and secure packaging. E-commerce growth in the pharmaceutical industry. The growing focus on sustainability presents a significant opportunity to develop machines capable of working with eco-friendly materials like biodegradable plastics and recyclable aluminum foils. Consumer demand for green packaging and stricter environmental regulations.

Increasing pharma sector and sales through e-commerce platform has created lucrative opportunity for the growth of the pharma blister packaging machines market in the near future.

The automatic segment held a dominant presence in the pharma blister market in 2024. The main reasons an automatic blister packaging machine is chosen as it provides much faster production rates, increased accuracy, lower labor costs, consistent quality, and less waste, which makes it more effective for large-scale production, particularly in sectors like pharmaceuticals where accuracy and high volume are essential. Compared to semi-automatic machines, where operator intervention slows down the process, automatic machines can create a significantly higher volume of blister packs per unit time. Precise product placement within the blister is ensured by sophisticated sensors and automated feeding systems on automated equipment, reducing mistakes and waste. Because automatic machines require less manual handling, require fewer operators, which reduces labor costs.

The thermoforming segment accounted for a considerable share of the pharma blister packaging machines market in 2024. Thermoforming allows for easy customization of blister cavities to accommodate various product shapes, sizes, and dosages, making it ideal for pharmaceutical products like tablets, capsules, and syringes. It involves heating a plastic sheet and forming it into precise shapes using molds, enabling tailored packaging solutions. Thermoforming uses less material compared to other packaging methods, making it a cost-efficient option for large-scale production. It minimizes material wastage by forming only the required cavities, reducing overall production costs.

Thermoformed blisters provide excellent protection against physical damage, moisture, and contamination. The plastic forms a tight seal around the product, ensuring integrity during storage and transport. Thermoforming works well with a wide range of materials like PET, PVC, and polypropylene, which can be combined with aluminum foils for added protection. This versatility allows manufacturers to choose materials based on specific product requirements, such as barrier properties and cost. Thermoformed blister packs are lightweight and compact, reducing transportation and storage costs. Thermoforming is highly compatible with automated blister packaging machines, enabling high-speed production.

The 201 to 600 blisters/min segment registered its dominance over the global pharma blister packaging machines market in 2024 which is supposed to sustain in the upcoming period. Increasing launches of 201 to 600 blisters/min has driven the growth of the segment over the forecast period. These machines are ideal for medium to high production scales, fitting the needs of most mid-sized pharmaceutical manufacturers. They provide a balance between high-speed production and the ability to handle a variety of packaging formats.

These machines are generally more affordable compared to ultra-high-speed machines (e.g., >600 blisters/min), making them attractive for manufacturers with budget constraints. They have lower operating and maintenance costs while still offering efficient throughput. These machines are often equipped with features that ensure compliance with global standards (e.g., serialization, traceability, and GMP standards), which are crucial in regulated markets. In summary, the combination of efficiency, cost-effectiveness, and adaptability makes 201 to 600 blisters/min machines particularly popular in the pharmaceutical packaging market.

It offers features like a maximum operating speed of 200 blisters per minute, a fixing area that comes after the camera but before the sealing station, a 120mm mechanical space needed for the suction mouth on the guide track, etc. For additional information, get in touch with us.

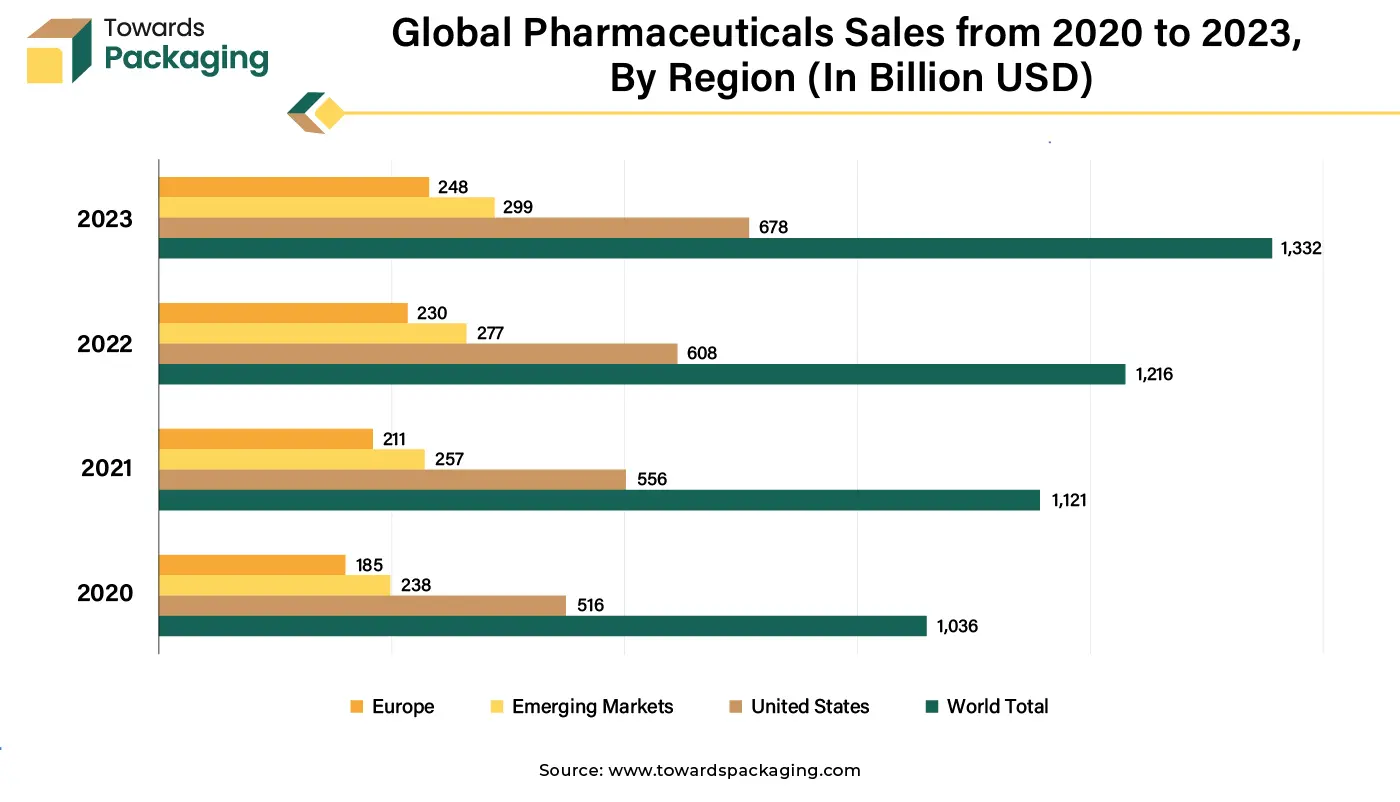

North America dominated the global pharma blister packaging machines market in 2024. North America, particularly the United States, has one of the largest pharmaceutical markets globally, with significant investment in R&D, manufacturing, and distribution. The region is home to leading pharmaceutical companies like Pfizer, Johnson & Johnson, and Merck, which drive demand for advanced packaging solutions. North America has a well-established healthcare system and one of the highest healthcare expenditures per capita globally, supporting the pharmaceutical industry's growth. Increased spending translates into higher demand for quality packaging solutions to ensure product safety and compliance.

Europe region is anticipated to grow at the fastest rate in the pharma blister packaging machines market during the forecast period. Europe is home to a thriving pharmaceutical sector, with major players like Novartis, Roche, Bayer AG, and Sanofi. The European Union's focus on sustainability has spurred the development of eco-friendly blister packaging materials and machinery. Industries working on recyclable or biodegradable packaging materials collaborate with blister machine manufacturers to meet stringent environmental regulations.

These industries collectively bolster the demand for pharmaceutical blister packaging machines in Europe, driven by trends like sustainability, automation, and the increasing need for high-quality, tamper-evident packaging solutions. Europe's regulatory environment, focus on innovation, and inter-industry collaboration further strengthen market growth.

The pharmaceutical industry in Asia-Pacific is experiencing significant growth due to increasing demand for medicines, especially in countries like China, India, Japan, and South Korea. India is the world's largest producer of generic drugs, driving demand for cost-effective blister packaging solutions. The region has a large and aging population, resulting in higher demand for pharmaceutical products, including those that require unit-dose packaging. The rise in chronic diseases (e.g., diabetes, cardiovascular diseases) has increased the need for precise and secure packaging for long-term medication. Growing foreign direct investments (FDI) in pharmaceutical manufacturing and packaging facilities in countries like China, India, and Vietnam fuel the demand for advanced machinery.

ACG Packaging Materials' general manager of development and technology, Dr. Sheikh Akbar Ali, stated that the company is thrilled to have Jochen join the team. ACG company’s European expansion will be greatly aided by his team's efforts to showcase ACG company’s sustainable products and processes, as well as his leadership and extensive knowledge in pharmaceutical packaging.

By Technology

By Sealing Process

By Operating Speed

By Region

April 2025

April 2025

April 2025

April 2025