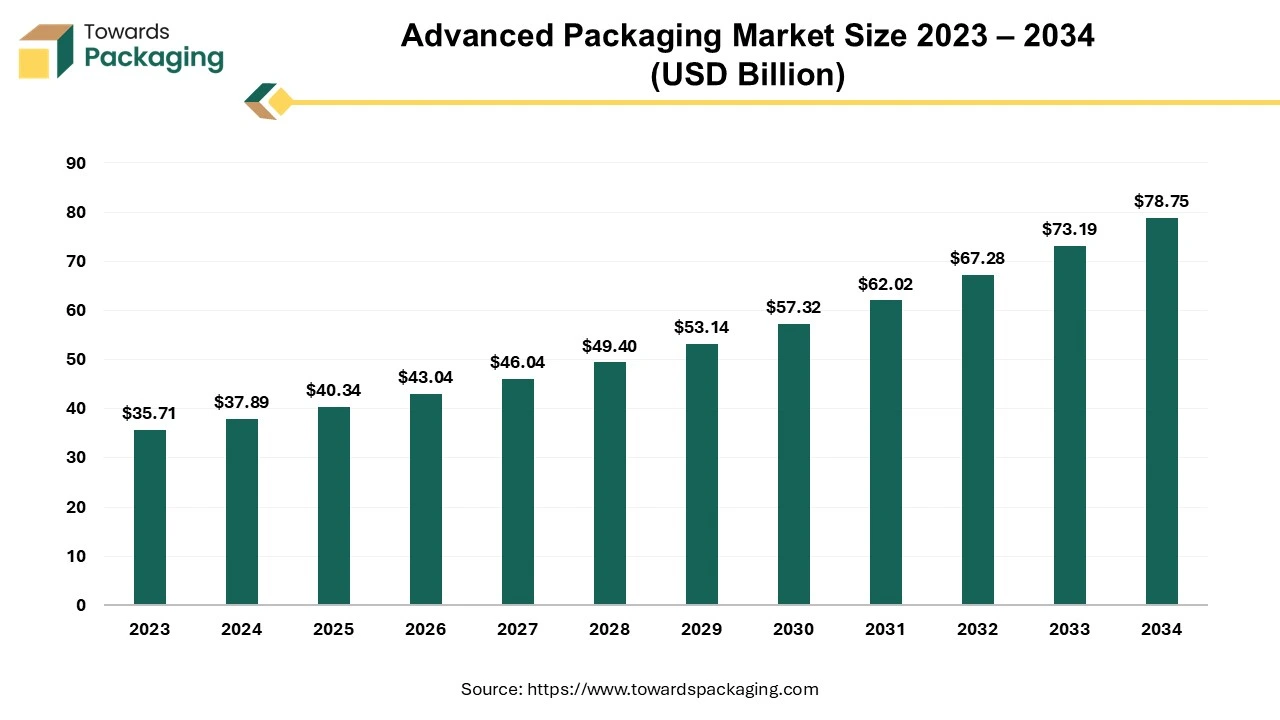

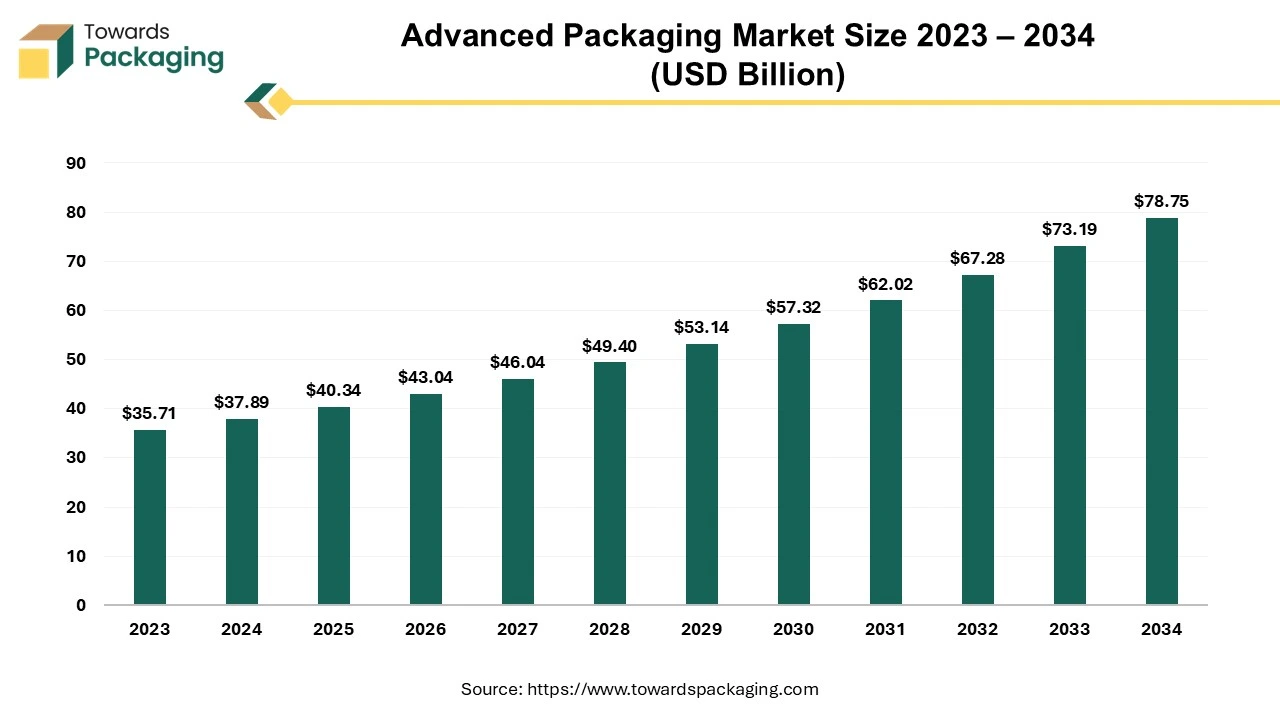

The advanced packaging market is forecasted to expand from USD 44.07 billion in 2026 to USD 87.01 billion by 2035, growing at a CAGR of 7.59% from 2026 to 2035. This growth is driven by increasing demand for high-performance, sustainable, and efficient packaging solutions across various industries.

The industry for advanced packaging is set to achieve substantial development in the years ahead. Multiple semiconductor chips are combined into a single chip package using a variety of manufacturing techniques known as advanced semiconductor packaging. This method lowers costs and power consumption while increasing capabilities. The most widely used methods in advanced packaging are system-in-package, fan-out wafer-level packaging, heterogeneous integration, 2.5D, and 3D-IC.

Placing chips with various functionalities close to one another has the added benefit of lowering power consumption, improving speed, and combining multi-function components into a single package. Large IDMs like Intel and Samsung, four sizable international OSATs, and the foundry and packaging company TSMC dominate the market for advanced packaging. Many advanced packaging platforms are being developed by these leaders. Every platform continues to gain a lot of popularity; however they all have unique qualities and possibilities.

The surge in demand for high-performance electronic devices such as smartphones, wearables, and IoT gadgets along with the growing adoption of technologies like 5G, artificial intelligence (AI) and the Internet of Things (IoT) are expected to augment the growth of the advanced packaging market during the forecast period. Furthermore, the miniaturization trends in the automotive sectors as well as shift towards the electric vehicles with autonomous driving systems are also anticipated to augment the growth of the market.

Additionally, the growing demand for the energy-efficient options in the data centers and cloud computing infrastructure coupled with the increasing investments in the semiconductor manufacturing and the growing government initiatives supporting domestic semiconductor production are also projected to contribute to the growth of the market in the near future.

| Metric | Details |

| Market Size in 2025 | USD 40.86 Billion |

| Projected Market Size in 2035 | USD 87.01 Billion |

| CAGR (2026 - 2035) | 7.59% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Packaging Platform, By End-Use Industry and By Region |

| Top Key Players | ASE Technology Holding Co. Ltd., Amkor Technology, Taiwan Semiconductor Manufacturing Company (TSMC), Intel Corporation, Samsung Electronics Co. Ltd. |

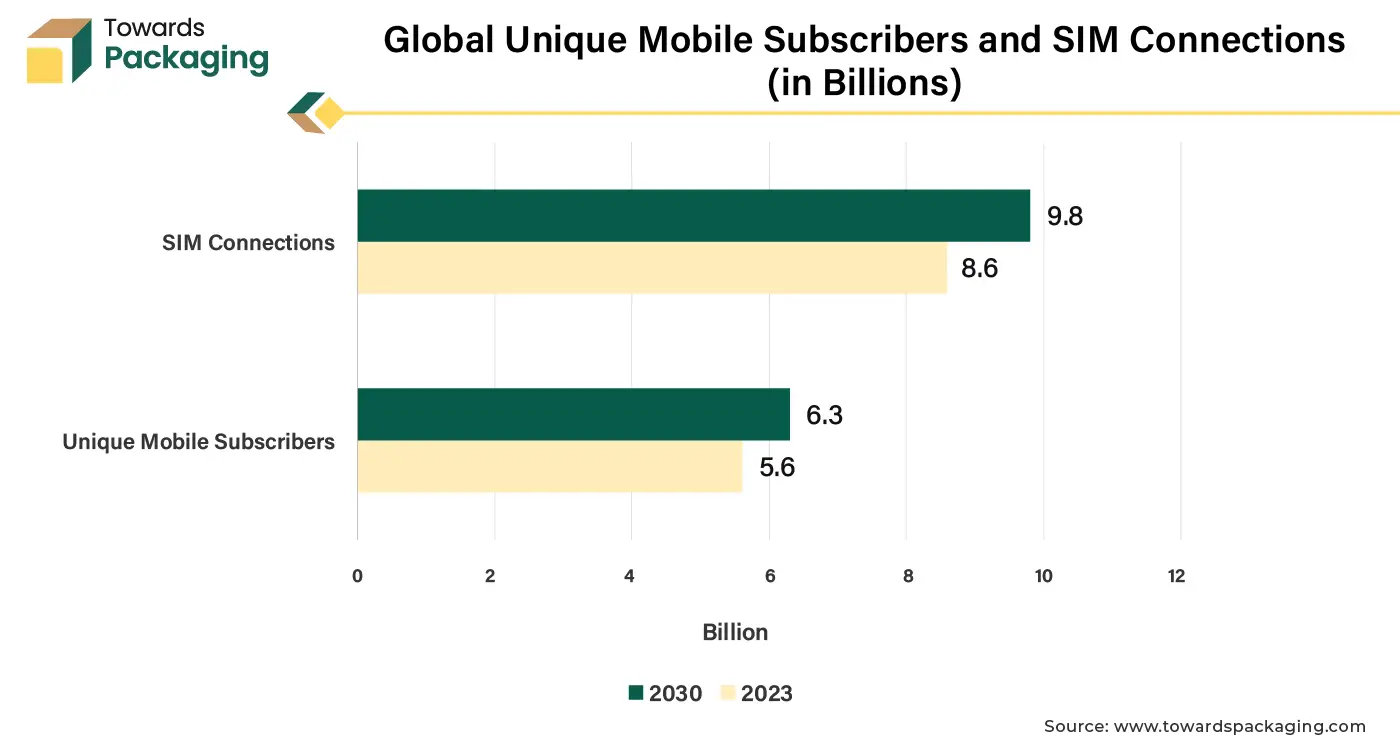

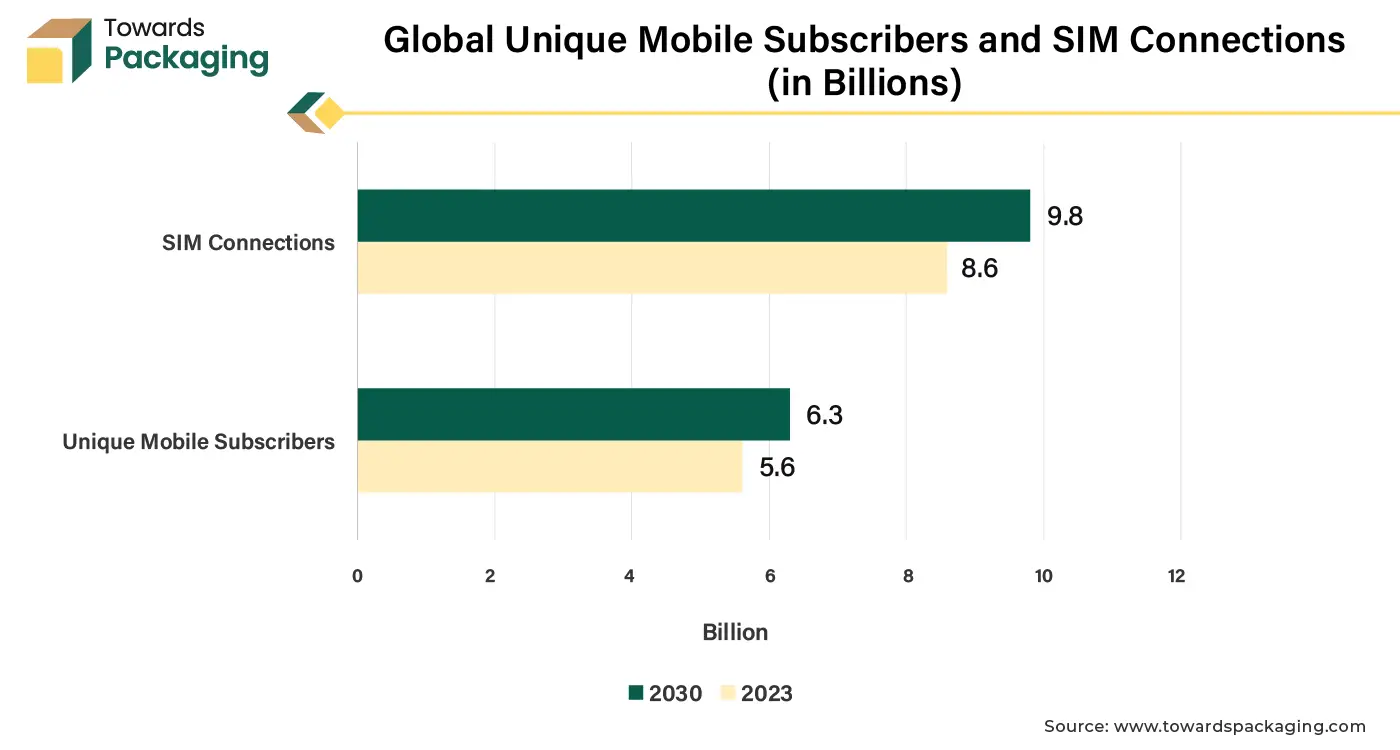

The surge in the consumer electronics due to the rising adoption of smaller, faster, and more energy-efficient devices such as smartphones, laptops, and wearable electronics is anticipated to augment the growth of the advanced packaging market during the forecast period. According to the Global System for Mobile Communications Association, 5.6 billion individuals (almost 69% of the world's population) had a mobile service subscription by the end of 2023, up 1.6 billion since 2015. It is predicted that by 2030, 74% of the world's population that is 6.3 billion people will be using smartphones.

The penetration of mobile internet has grown much more quickly. In North America, 332 million people (82 percent of the population) had a mobile service subscription by the end of 2023, up 70 million from 2015. By 2030, 364 million individuals will have a mobile service subscription in North America, representing an 87% adoption rate.

Furthermore, according to the most recent statistics from IDC (International Data Corporation) Worldwide Quarterly Wearable Device Tracker, shipments of the wearable devices are expected to increase at a CAGR of 6.1% to 537.9 million units in 2024. Hearables, which account for more than 60% of the total wearables sector, are anticipated to grow in popularity in emerging nations and begin a new cycle in developed markets as customers try to replace purchases made during the epidemic.

Smartphones, laptops, tablets, wearable devices, and gaming consoles dominate the consumer electronics market, with users always looking for high-performance features in compact and lightweight designs. Advanced packaging technologies are important for handling these requirements as they facilitate the integration of greater functionality in smaller form factors while increasing thermal and electrical performance.

The issues with managing thermal reliability are expected to hamper the market growth within the estimated timeframe. In advanced packaging, thermal reliability can be divided into two primary categories thermal cycling and high-temperature thermal fields. Advanced packaging is made up of multi-layer structures and is distinguished by a much higher density than standard packing. The restricted space makes it difficult to dissipate the heat produced efficiently, which can result in mechanical deformation such as warpage or cracks.

The structure and characteristics of the materials may also be affected by the movement of atoms/ions driven by high temperatures activating the thermal energy. The reliability under thermal cycling, on the other hand, refers to the thermal stress cycles that occur between materials with various CTEs during the production or maintenance of packaged devices and are brought on by recurring temperature changes in the surrounding environment. This may cause packing structures to crack.

Most of the packaging reliability issues are primarily caused by the high-temperature thermal field. Chips are frequently positioned on substrates in advanced packaging, and TSVs and bumps are used to create interconnects. Temperature variations cause variable levels of expansion for the materials in the package, each of which has a unique CTE. Consequently, portions of the solder joint or bonding interfaces experience temperature mismatch, which causes structural failures like cracking and fracture inside the packaging. The packaging substrate may deform due to the thermal mismatches, creating open circuits between the substrate and the bumps.

Interconnecting cracking may also result from the thermal stress caused by high-temperature thermal fields. The complexities and costs involved in addressing these issues also act as a substantial restraint, hindering the widespread adoption and scalability of the advanced packaging technologies.

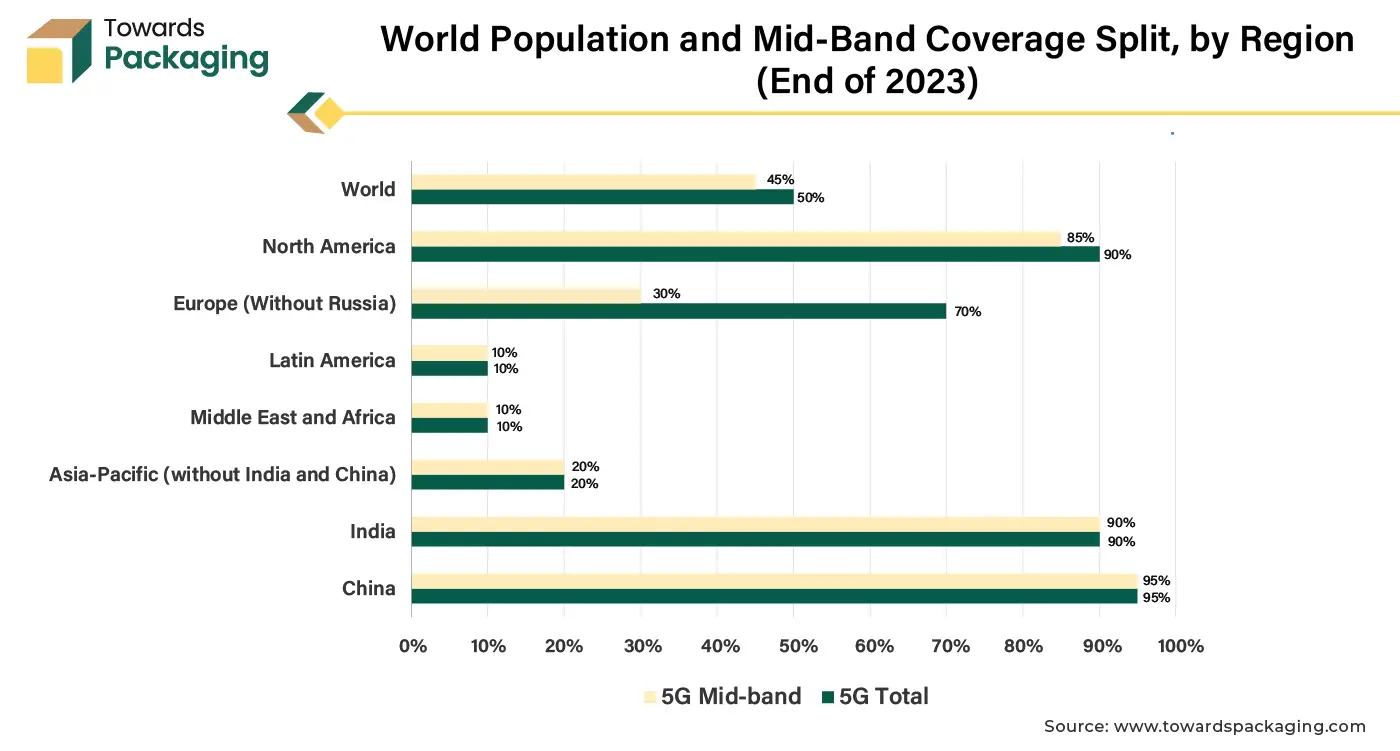

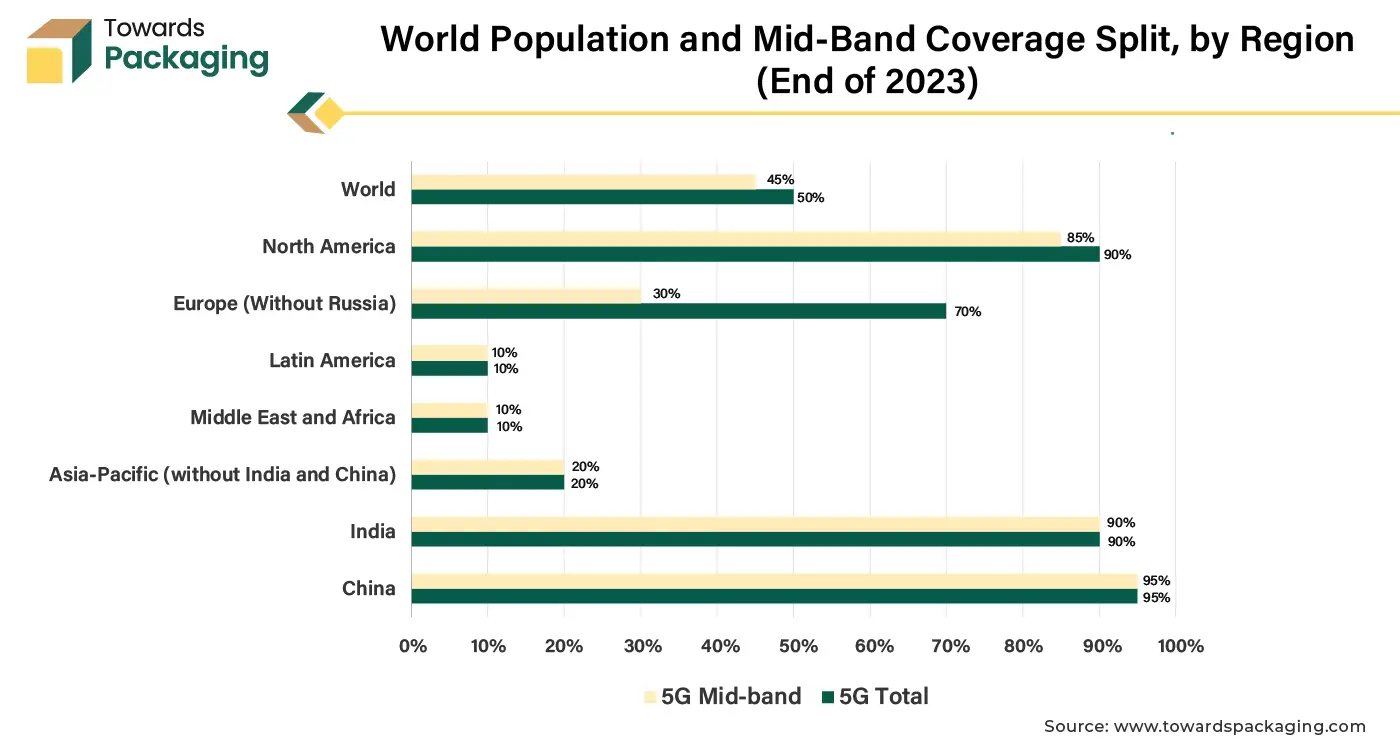

The global deployment of the 5G network owing to the growing demand for high-speed internet and seamless connectivity to support applications like video streaming, online gaming, virtual reality (VR) and augmented reality (AR) is anticipated to create immense growth opportunities for the market in the years to come. As per the data by Ericsson Mobility Report 2024, there have been about 300 networks launched globally as part of the ongoing 5G rollout.

Apart from the mainland China, the percentage of the world's population with 5G coverage was approximately 40% at the end of 2023 and is anticipated to grow by nearly 80% by 2029. At present, 830 connections of 4G are in service across the globe, 346 of which are converted to LTE-Advanced and 161 are activated for gigabit. Except for mainland China, 4G coverage reached almost 85% of the global population by the end of 2023 and is predicted to cross 95% by 2029.

5G communications technology aims to reduce latency, increase speed, and increase transmission capacity. To protect these components from the humidity and possible water exposure that could affect their efficacy and safety, advanced packaging alternatives are important. The greater the 5G chip's performance, higher will be the demand for the technology. Two areas of development could be made technology scaling to lower the L/S (Line/Space) to increase speed of computation in the constrained space, and advanced packaging that solves problems with product size, power usage, and heat dissipation, in addition to incorporate antennas into the package for increased speed.

As technology scaling involves higher equipment installation costs as well as complicated yield and technology requirements, the second choice, advanced packaging, is currently being prioritized to improve performance, lower process costs, and overcome physical boundaries. Consequently, as telecom providers expand 5G networks globally, specifically in the emerging economies, the demand for advanced packaging is expected to accelerate.

The flip-chip segment held largest market share of 76.18% in 2024. The process of electrically attaching the die with the package carrier is referred to as flip chip. The connection between the die and the package's exterior is subsequently made by the package carrier, which can be either a substrate or a lead frame. Multiple factors from various sectors of the silicon industry are contributing to the popularity of flip chip interconnect technology. The adoption of flip chip connection has numerous potential benefits for the user. Power can be delivered straight to the die's core by using flip chip connection, eliminating the need for altering to the edges. This significantly reduces core power noise, strengthening silicon performance.

Furthermore, flip chips can accommodate more interconnects on a single die size since they can link across the die's surface. Flip chips are also utilized to reduce the overall size of the package. This can be accomplished by using greater density substrate technology, which permits a lower package pitch, or by minimizing the die to package edge ratios. These factors makes flip chips the preferred choice for advanced computing, telecommunications and consumer electronics and are expected to contribute to the segmental growth of the market.

The consumer electronics segment held largest market share of 57.16% in 2024. This is due to the increasing demand for streaming platforms and the growing adoption of smart TVs designed to support these services. Furthermore, the increasing trend of shifting production from high-cost regions to lower-cost locations supporting the evolution in countries like China, India, South Korea, and Taiwan is also expected to contribute to the segmental growth of the market. Additionally, the increase in smartphone penetration and tablets usage in the education and government sector is also expected to support the growth of the segment in the global market.

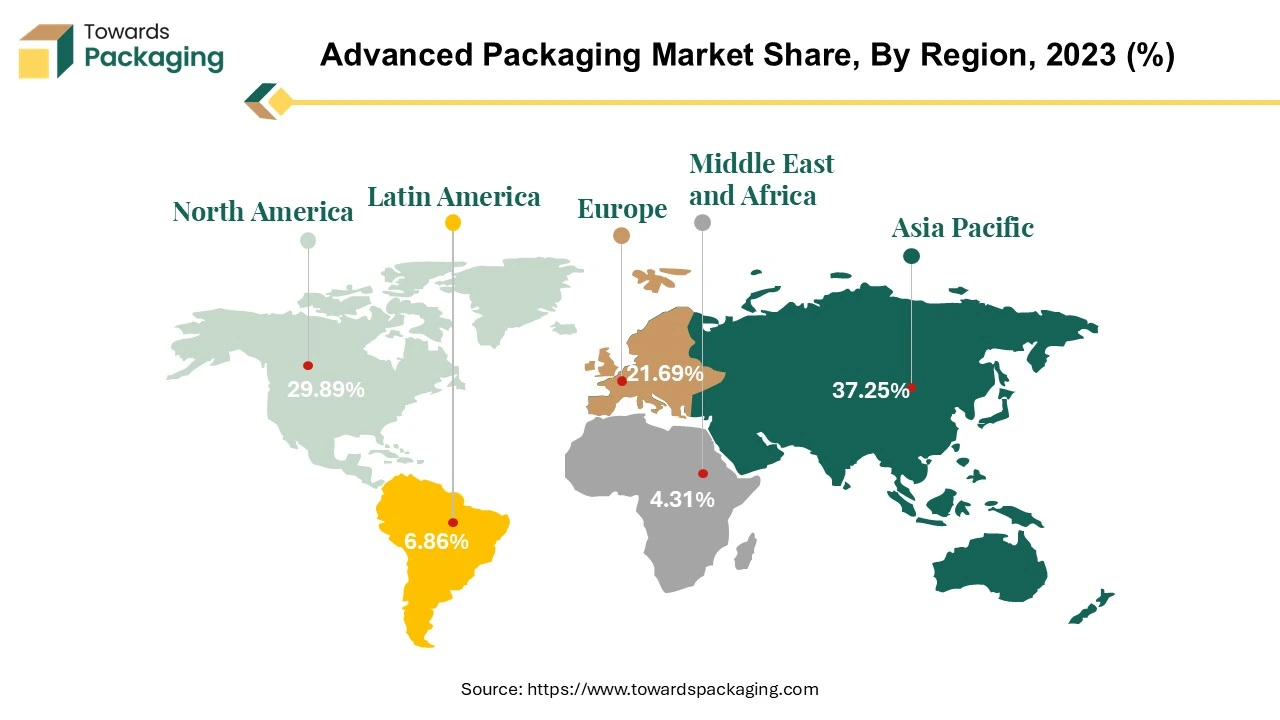

Asia Pacific is likely to grow at fastest CAGR of 9.66% during the forecast period. This is due to the presence of major semiconductor manufacturing hubs in economies such as China, Taiwan, South Korea, and Japan. Also, the surge in the production and consumption of the consumer electronics is likely to contribute to the regional growth of the market. As per the India Brand Equity Foundation, with a 42% increase to US$ 15.6 billion in FY24, smartphones are now India's fourth-largest export category.

By 2025, the consumer electronics and appliances sector in India, which was valued at US$ 9.84 billion in 2021, is predicted to reach US$ 21.18 billion (Rs. 1.48 lakh Crore). In 2022, the nation's revenue of electronic hardware was valued at US$87 billion. The Indian market for home appliances and consumer electronics is expected grow at a compound annual growth rate (CAGR) of 1.31% between 2022 and 2027. Furthermore, the rapid urbanization and rising disposable incomes is also expected to contribute to the regional growth of the market.

India Advanced Packaging Market Trends

India advanced packaging market is driven by the growth of the consumer electronics industry in the country. The consumer electronics industry in India is rapidly growing, driven by the adoption of smartphones, laptops, tablets, wearables, and other connected devices. These devices require advanced packaging solutions to support complex and high-performance components. India has approved the construction of three semiconductor plants worth US$ 15.2 billion, aiming to become a leading electronics manufacturer. These plants, involving partnerships with companies like Tata Group and CG power, will produce chips for sectors including defense, telecommunications, and automotive.

China Advanced Packaging Market Trends

China advanced packaging market is growing owing to emergence of 5G technology and growth of electric vehicles in the country. This national strategic plan aims to transform China into a global leader in high-tech industries, including semiconductors. The Chinese government has committed substantial investments, estimated in the hundreds of billions of dollars, to support industries under the made in China 2025, plan. This includes funding for research and development in advanced packaging technologies. The rise of electric vehicles in China drives the demand for advanced packaging solutions, as EVs rely heavily on sophisticated electronics for functions like battery management and autonomous driving systems.

North America held considerable market share of 29.87% in 2024. This is owing to the presence of tech giants and cloud service providers like Google, Microsoft and Amazon that are providing the high-performance computing systems. Furthermore, the growing investments in the research and development with continuous improvement as well as the increasing focus on the next-generation packaging technologies is also expected to contribute to the regional growth of the market.

U.S. Advanced Packaging Market Trends

U.S. advanced packaging market is driven by the significant investment by private sector and growing demand from high-tech sectors in the country. Major semiconductor companies are making substantial investments in the U.S. Taiwan Semiconductor Manufacturing Co. is committed US$ 100 billion to build three new chip factories two advanced chip-packaging facilities, and a research and development center in the U.S. marking the largest single foreign direct investment in U.S. history.

Additionally, the push for electric and autonomous vehicles along with the rising U.S. initiatives like the CHIPS and Science Act for providing funding for the domestic semiconductor production is also anticipated to promote the growth of the market in the region in the near future.

By Packaging Platform

By End-Use Industry

By Region

February 2026

February 2026

February 2026

February 2026