April 2025

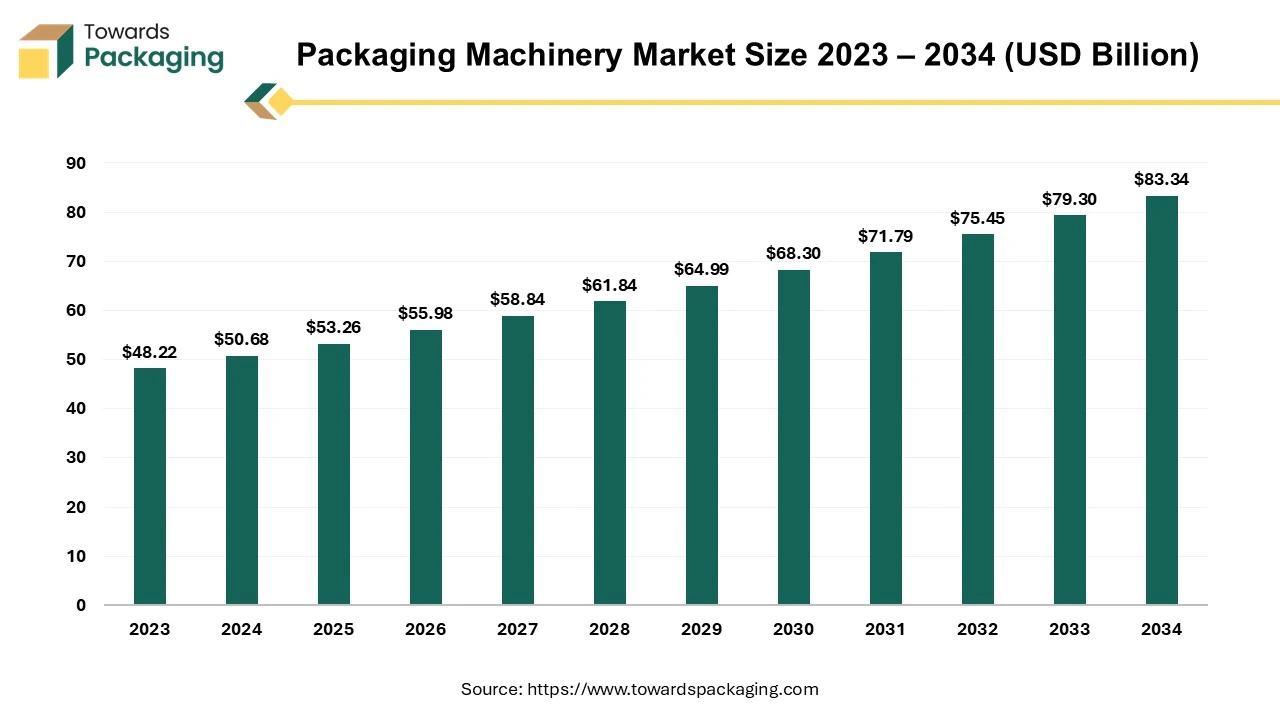

The packaging machinery market is projected to reach USD 83.34 billion by 2034, expanding from USD 53.26 billion in 2025, at an annual growth rate of 5.1% during the forecast period from 2025 to 2034.

Packaging machinery is the machinery used to package and protect goods inside containers to be sold, distributed, shipped, stored, and used. This procedure is essential to marketing because it guarantees that products are displayed appropriately and communicate the intended image and design. "Packaging equipment" refers to the machinery that quickly and effectively places goods into wrappings or containers for protection.

The market for packaging machines grew significantly by more than 13% in 2022, demonstrating its adaptability and resilience. Growth in the packaging industry was spurred by significant expenditures made by manufacturers during the epidemic, which improved production and supply chain management and raised demand for packing machines and equipment. This shows how bright the sector's future looks, giving rise to optimism about its resilience. Packaging, with its pivotal role in product protection and conveying crucial information, is greatly enhanced by the efficiency of packaging equipment. This equipment, a testament to technological advancement in the industry, optimizes packaging processes, lowers labor costs, and boosts productivity. Its ability to perform a variety of functions efficiently and affordably, including shrink wrapping, coding, marking, and case packing and sealing, reassures its ability to streamline operations.

Recognizing the vast array of products, packages, materials, and items on the market, the industry has developed a diverse range of packing equipment to cater to specific requirements. This diversity ensures no one-size-fits-all approach but a tailored solution for each packaging need, reassuring the industry's ability to meet unique demands. Strapping machines, pallet wrappers, carton and container sealers, and industrial scales are some of the most used packing devices. There are also sorting, counting, and accumulating equipment and machines for closing and sealing products with glue, caps, corks, heat seals, and other techniques.

The multifunctionality and specialized designs of packaging equipment inspire a sense of versatility. There is a distinct machine for each packaging requirement, making classification a challenge. Custom-designed machines, tailored to specific and atypical applications, further enable packing versatility and adaptability, inspiring innovation in the industry. Other equipment is designed for specialized packaging activities, such as accumulators for gathering commodities, batching machines for preparing items, and bagging, banding, sleeving, and box manufacturing machines for finishing diverse packaging procedures.

For Instance,

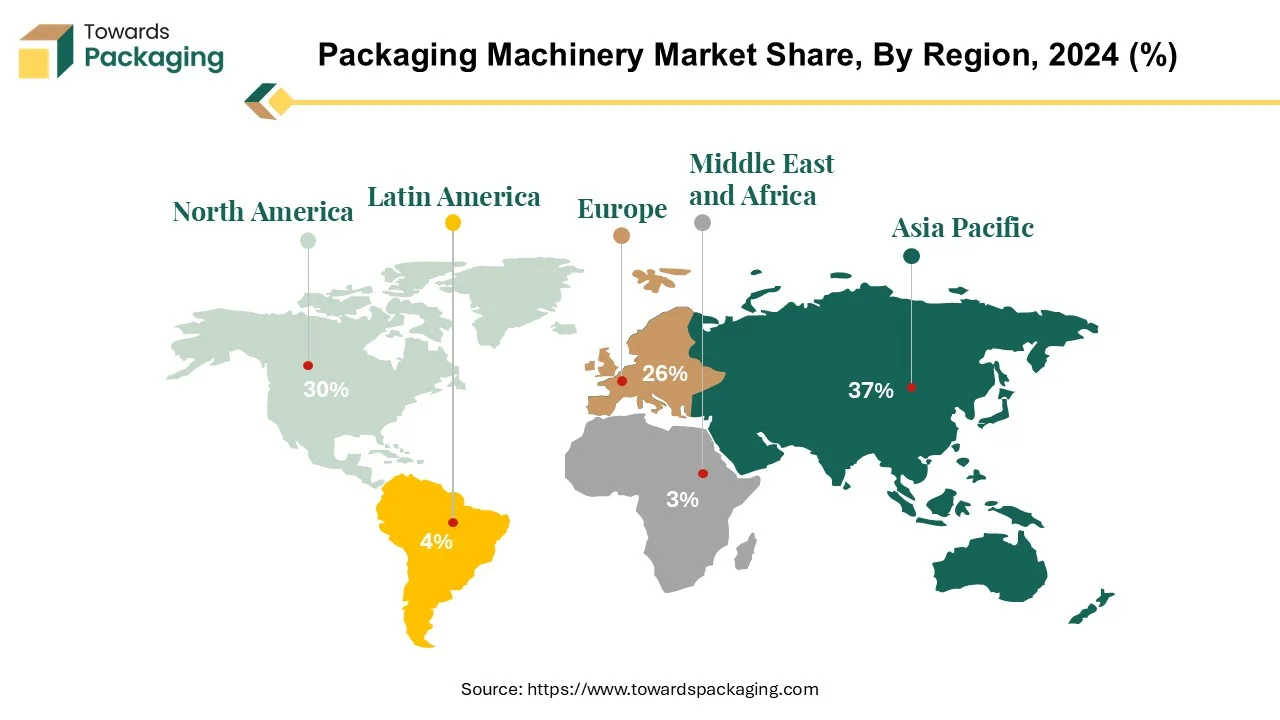

The Asia-Pacific region, a powerhouse in the worldwide packaging machinery market, has the largest share. This dominance is shaped by many factors influencing the region's packaging machinery sector. The Asia-Pacific packaging machinery market, projected to be valued at US$ 15.5 billion, underscores the region's significant contribution to the global landscape, presenting a wealth of opportunities for industry players. The Asia-Pacific packing machinery industry is experiencing growth, propelled by several key factors. Paramount among these is the region's burgeoning population and the rise of a prosperous middle class, particularly in developing nations. China and India have largest market for packaging machinery. This demographic shift is fuelling increased consumer spending power, driving demand for packaged goods across various sectors, and necessitating the adoption of advanced packaging technologies and machinery.

In the Asia Pacific region, a heightened awareness and concern for sustainability are catalyzing the shift towards eco-friendly packaging solutions such as recyclable or biodegradable materials. This trend, championed by consumers, governments, and corporations alike, is driving a surge in demand for packaging machinery capable of producing these sustainable materials, reflecting the changing market dynamics. The growing adoption of flexible packaging fuels market growth in the Asia Pacific. Flexible packaging has various advantages, including versatility, lightweight, and cost-effectiveness, making it a popular choice for products ranging from food and beverages to pharmaceuticals and personal care items. The need for intelligent packaging solutions that use technology like QR codes and augmented reality is also increasing in the Asia Pacific area. These technologies improve consumer interaction, product identification, and supply chain traceability, necessitating modern packaging machinery capable of effortlessly incorporating such features. Serialization technologies are also gaining traction in Asia Pacific, owing to regulatory regulations and customers' desire for product traceability and authenticity. Serialization allows producers to track and trace their products throughout the supply chain, increasing consumer confidence and regulatory compliance.

The Asia-Pacific region's dominance in the packing machinery market is driven by demographic shifts, sustainability concerns, technical improvements, and changing customer tastes. As the region's economy grows and industrial development accelerates, demand for innovative packaging machinery solutions will likely rise, creating further market expansion and prospects for industry participants.

For Instance,

The packaging machinery industry in North America is increasing, bringing a wide range of equipment necessary for effectively packaging items in various industries. To increase production, guarantee product quality, and comply with regulations, packing activities must be automated, which is made possible by this machinery. The need for sophisticated packaging solutions keeps growing as companies aim for increased productivity and competitiveness. Innovative machinery is becoming increasingly expensive for manufacturers who want to maximize resource utilization, minimize downtime, and streamline operations. North American modern manufacturing methods rely heavily on packing machinery for its critical role in improving operational efficiency and preserving product quality.

The value of packaging machinery shipments to North America in 2022 increased significantly from the previous year by about 12.4% to $10.2 billion. This increase is in line with the robust demand seen in the prior year when shipments increased by 15.8% at their peak. There is a backlog of orders and difficulties in the supply chain due to the pandemic's ongoing effects on the market. Despite the pandemic's continued effects, growth in the packaging machinery industry is anticipated to slow down shortly. In the first quarter of 2023, backlogs continue to expand; however, a steady decline is expected in the year's second half.

North America's packing machinery industry remains dynamic, driven by growing automation, efficiency gains, and the need to respond to changing market needs and regulatory constraints.

For Instance,

The filling machine is a significant segment of the packaging machinery market. Several causes contribute to its prominence, emphasizing its essential position in various industries worldwide. Filling machines are essential in packaging various products, including beverages, medications, cosmetics, and home chemicals. Whether filling bottles, cans, pouches, or containers, these devices enable precise and effective dosing of liquid, semi-liquid, or powdered ingredients, increasing production efficiency and product quality. The adaptability of filling machines makes them helpful in handling a wide range of packing forms and container sizes. From small-scale operations to high-speed production lines, filling machines provide flexibility and scalability, allowing producers to address changing production demands and market trends.

Technological developments in filling machines have enhanced their accuracy, speed, and dependability. Sophisticated technologies, including servo motors, computerized controls, and automatic changeover systems, are present in modern filling machines, which improve performance and save downtime. Manufacturers benefit from improved output and lower costs due to this enhanced efficiency. The increasing need for personalized and innovative products is propelling the use of specialty filling machines that can manage distinct packaging needs. Filling machines offer customized solutions to fulfill various business needs, such as aseptic filling for perishable items, hot filling for temperature-sensitive products, or volumetric filling for exact dosing.

| Top Ten Packaging Companies, 2022 ($, Billion) | |

| Company | Revenue (Billion) |

| Westrock | 21.3 |

| International Paper Company | 19.4 |

| Tetra Laval International | 16.3 |

| Amcor Plc | 14.54 |

| Berry Global Group Inc | 14.5 |

| Ball Corp | 13.8 |

| Oji Holdings Corp | 13.1 |

| Stora Enso Oyj | 12 |

| Smurfit Kappa Group Plc | 11.95 |

Westrock Co. has surpassed International Paper Company to become the largest packaging company by yearly revenue. During this period, packaging businesses actively disclose their ESG (Environmental, Social, and Governance) aims. Consumer pressures, board expectations, and environmental advocacy groups all push them to make environmentally conscientious investments and collaborations while addressing operational challenges quickly.

The growth of sectors, including food and beverage, medicines, and personal care, on a global scale drives the demand for filling machines. Manufacturers look for packaging machinery to optimize manufacturing procedures, guarantee product purity, and boost brand competitiveness as customer preferences and market dynamics change.

The food and beverage sector dominates the packaging machinery market. In 2022, the food industry accounted for 43% of packaging machinery exports, with the beverage sector accounting for 15% of investments. However, in 2023, fewer significant planned expansions have been revealed in the food industry than in prior years. On the other hand, the beverage sector has a higher number of anticipated investments, albeit on a smaller scale than other industries. The beverage sector is expected to increase at a moderate rate over the projection period, notwithstanding the reduced level of investment. This suggests that the beverage industry will continue to have a consistent need for packaging machinery due to market expansion, product innovation, and changing consumer preferences. Even if anticipated expansions in the food industry may have temporarily stalled, the sector continues to play a vital role in the packaging machinery market.

China's consumption of organic packaged foods and beverages has increased significantly in recent years. This trend is primarily driven by several critical variables, including shifting consumer choices, changing lifestyles, and increased knowledge of health and sustainability.

It's crucial to remember that several factors impact the packing machines market, including technology developments, governmental regulations, and economic situations. Trends in the industry are also influenced by changes in customer behaviour, such as the growing desire for sustainability and ease. Though they still dominate the packaging machinery market, investments in the food and beverage sectors may differ in timing and amount. It is imperative to address these industries' distinct demands and requirements to effectively leverage market prospects, even if they continue to be significant drivers of demand for packing machines.

One important indicator of consumer preferences and market trends is the percentage of organic packaged food and beverage consumption relative to the overall amount of health and wellness items consumed. This ratio shows the percentage of consumers prioritizing organic options in the more significant health and wellness category.

For Instance,

Last year witnessed a remarkable increase in packaging productivity, driven by advancements in machinery technology and a heightened focus on productivity measurement and enhancement strategies among end users.

A comprehensive study measured both labor productivity and multifactor productivity within the packaging industry. Labor productivity, which gauges packaging output per unit of labor, saw a 7.9 percent increase, closely mirroring the 7.8 percent rise reported in 2000. While this measurement is specific to packaging, the growth compares favorably with broader industry trends.

Multifactor productivity in packaging, which takes into account employee benefits and wages, packaging material usage and costs, and capital inputs such as machinery and energy, rose by 6.8 percent in 2002. This increase reflects the impact of higher wage and benefit costs, along with rising material and energy expenses. This profit-directed measure, although less complex and more specialized in its focus on packaging, provides a comprehensive view of productivity changes.

The study revealed that 89.1 percent of respondents systematically measure their company's productivity and actively seek ways to enhance it. According to the survey, 54.6 percent of packagers reported an increase in productivity, while 7.6 percent experienced a decline, and 37.8 percent saw no change from the previous year.

Overall, the findings underscore the positive impact of technological advancements and strategic productivity management in the packaging industry, leading to significant improvements in both labor and multifactor productivity.

The competitive landscape of the packaging machinery market is characterized by established industry leaders such as Tetra Laval International S.A., MULTIVAC Group Source, FujiMachinery Co., Ltd., ProMach, Syntegon Technology GmbH, Krones AG, SIG Combibloc Group Ltd., ROVEMA GmbH, Maillis Group, Robert Bosch GmbH and Bradman Lake Ltd. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

Tetra Laval International S.A.'s responsibilities go beyond delivering machinery and equipment. The company also provides comprehensive services, such as technical support, maintenance, and training, to help customers maximise the productivity and dependability of their packing processes.

MULTIVAC understands the value of sustainable packaging solutions in today's ecologically sensitive world. The company actively develops packaging machines and materials that minimize waste, save energy, and reduce carbon footprints.

ProMach provides various packaging machinery and solutions, including filling, capping, labeling, coding, and end-of-line equipment. ProMach's vast portfolio enables it to meet the packaging needs of a wide range of products, including food and drinks, pharmaceuticals, and consumer goods.

By Machinery

By End User

By Region

April 2025

April 2025

April 2025

April 2025