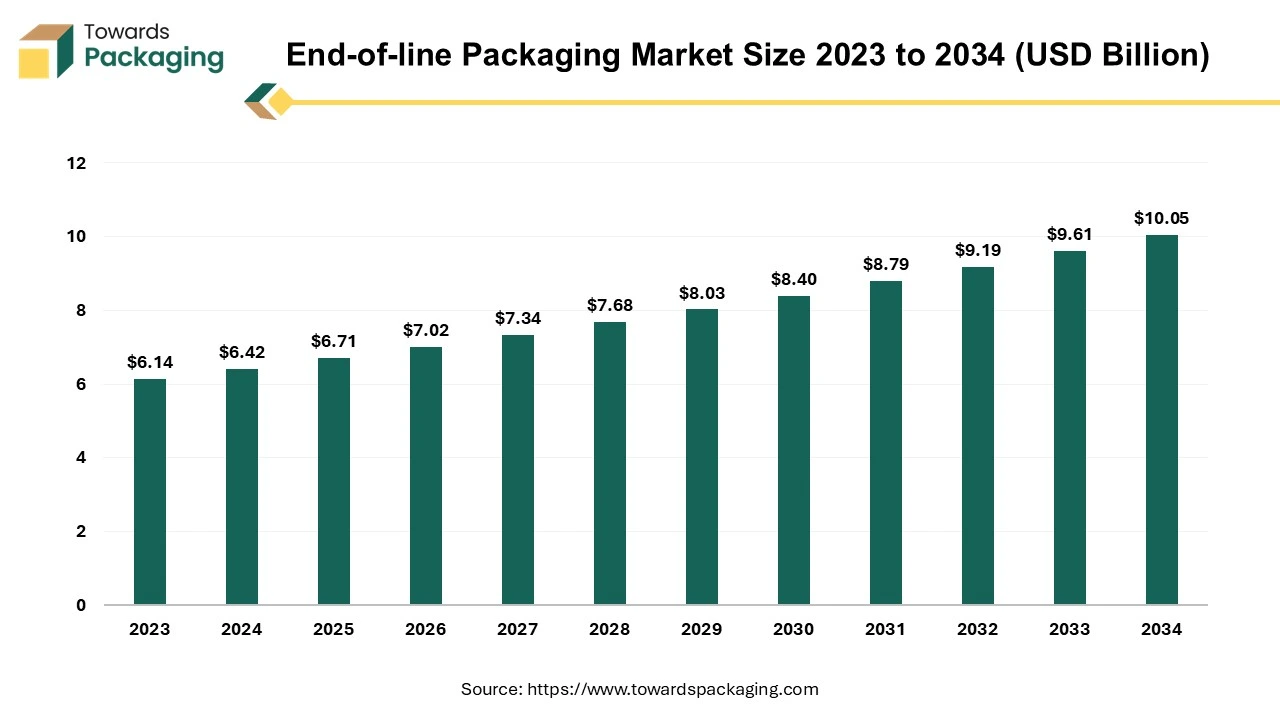

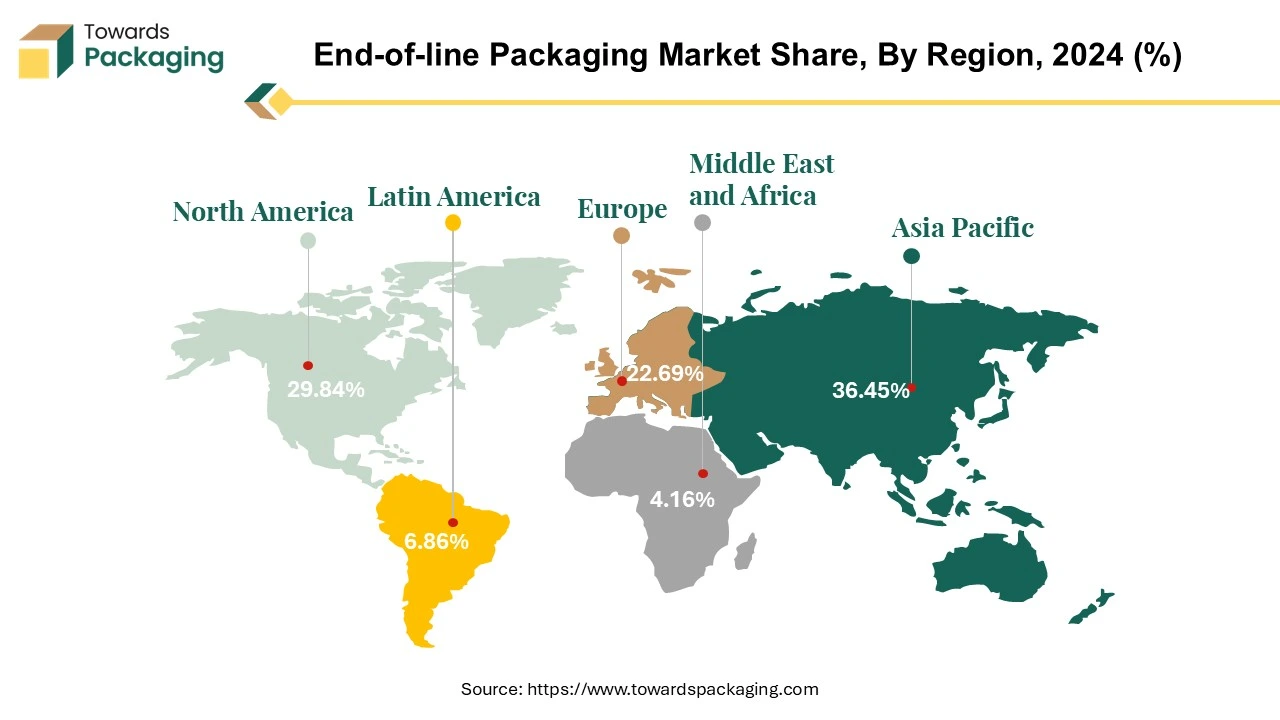

The end-of-line packaging market was valued at USD 6.42 billion in 2024 and is projected to reach USD 10.05 billion by 2034, expanding at a CAGR of 4.60%. This report provides detailed segmentation by technology (automatic, semi-automatic), function (stand-alone, labeling, palletizing, packing, etc.), and end-user industries (food & beverages, pharmaceuticals, electronics, automotive, consumer goods). It covers in-depth regional data across North America (29.84% share in 2024), Europe, Asia Pacific (fastest CAGR 6.32%), Latin America, and Middle East & Africa, along with trade flow insights, manufacturer profiling, supplier network mapping, and a comprehensive value chain analysis that highlights automation and Industry 4.0 integration across the packaging ecosystem.

The end-of-line packaging market is likely to witness strong growth over the forecast period. The term "end-of-line" (EOL) packaging describes the point at which a product is manufactured and ready for the sale or distribution. A range of packaging procedures are utilized at this step to guarantee that the products are packaged both elegantly as well as securely. A few of the most important steps in EOL packaging are product inspection, cartoning/case packing, printing, labeling, sealing and wrapping. Depending on the size of production and the nature of the items, end-of-life packaging can be either highly automated using robotic arms, conveyor belts and automated labellers, or the process can include manual operations.

The rising demand for automation across industries along with the integration of Industry 4.0 technologies such as robotics and the Internet of Things (IoT) are expected to augment the growth of the end-of-line packaging market during the forecast period. Furthermore, the labor shortages in various regions as well as the expansion of the manufacturing sector in emerging economies are further driving its adoption globally.

Additionally, the rising consumer demand for packaged food and beverages as well as the growth of the e-commerce and the advancements in technology such as the development of more efficient palletizing and case packing machines is also projected to contribute to the growth of the market in the years to come. The global packaging industry size is growing at a 3.16% CAGR.

The increasing textile production is projected to support the growth of the end-of-line packaging market during the forecast period. This is owing to the growing need for increased efficiency, cost reduction and consistency in the production processes. The packaging sector has always used automation. Nonetheless, the sector has undergone an unparalleled transformation in the past few years due to the introduction of emerging technologies such as R-connect and Cube Technology, as well as growing demand from the customers.

Manual product packaging is no longer sufficient in the highly competitive commercial environment of today. To stay competitive, companies are making substantial investments in the automation. Automation increases the productivity and efficiency considerably by streamlining the procedures, eliminating the need of manual labor and allocating the resources optimally. Automated systems have the capacity to function nonstop without difficulty, which increases industrial output.

Furthermore, according to a recent Automation World survey on the robotics adoption, 44.9% of participants stated they presently utilize robots in their assembly and production processes. To be more precise, among those who own robots, 34.9% utilize collaborative robots (cobots) and 65.1% use simply industrial robots. As cobots do not require industrial-grade electricity, they are a more affordable option than industrial robots.

Also, as proof of the growing trend, the Robotic Industries Association's findings showed that the food and consumer firms increased the orders of robotics by 56% in 2021 compared to the previous year. This surge in demand for robotics illustrates how automation is becoming essential in industries that prioritize fast, accurate and scalable packaging solutions. The integration of cobots and industrial robots not only improves the production throughput but also reduces human error, reinforcing the growing demand for automation as a key driver in the End-of-Line (EOL) packaging market. As companies look to optimize their packaging processes, the adoption of robotics is expected to accelerate further.

The availability of the various substitute packaging is projected to hinder the growth of the end-of-line packaging market during the forecast period. The price range for automatic packing equipment is few hundred dollars to more than fifty thousand dollars. There are instances when equipment can be rented or paid for in installments owing to the high costs. Along with the initial costs, the packaging machinery needs continuous maintenance and in most cases, an inventory of substitute parts. For the SMEs, the cost of implementing such technologies might be too costly, as many operate on the limited funds and may lack the financial flexibility to invest in the automation. This initial investment comprises not only the acquisition of packaging equipment, but also extra costs such as personnel training, and necessary infrastructure modifications to support the new systems.

The packaging procedures must be somewhat centralized in order to be automated. While this is often beneficial in terms of the efficiency and space allocation, it might be challenging to guarantee that the operation can adjust to a new centralized arrangement. For example, case sealing may not be able to be handled in one or two central places in a distribution facility with several hundred loading docks.

Also, there is various application challenges related to the automated packaging. Certain production and distribution processes are not well suited for packaging automation. Examples of tasks that can be challenging to automate consist of refurbishing and repair operations, in which each package is unique, shipping cases that are incredibly big or small, pallets or unitized loads that are incredibly light, and severe outdoor or indoor environments that can cause equipment to corrode. These factors are further likely to restrict the growth of the market during the forecast period.

There is a needed movement towards digitalization as automation becomes more advanced. A greater volume of data needs to be handled as more sensors are used and the technology is required to do more. In the end, that data can be saved and examined to improve process effectiveness later on. Packaging lines are getting nearer to a zero-downtime condition where productivity can be optimized due to the connectivity to the internet and AI.

Also, brand owners and businesses both gain from improved standardized operations and an overall decrease in customer dissatisfaction when machine learning is implemented in processes such as date labeling. Products with incorrect labels may not pass inspections, cause customer complaints, reduce a company's earnings and increase the expenses overall. Date labeling can be made standard by utilizing machine learning, which guarantees less manual errors and more control over process efficiency for companies.

The application of AI is already helping forecast the degradation of machines and identify the need for routine maintenance. This makes it possible for the AI to keep an eye to identify any abnormalities in the machines and alert users accordingly. An increasing amount of research is being done on "deep learning" artificial intelligence, which is essentially giving software very few parameters and letting it figure out how to operate on its own using trial and error. Artificial Intelligence (AI) and automation will revolutionize the packaging sector by making possible unfeasible and physically dangerous procedures. These technical developments present significant opportunities for companies to innovate and obtain a competitive edge in the market as they continue to develop.

The automatic segment captured considerable market share of 58.16% in 2024. In a fully automated packing system, technology automates every step of the process, eliminating the need for manual operation. It provides numerous benefits such as increased productivity with reduced labor costs, better quality consistency and a larger production capacity.

Compared to human operators, automated packaging devices can process hundreds of pieces per minute, which leads to quicker processing times and better production capacities. If automated equipment is configured and maintained correctly, there is a very low chance that it will make a mistake during packaging processes (such as placing the incorrect quantity of products into the packaging), which improves process quality and consistency. Thus, the above mentioned factors are expected to support the growth of the segment in the end-of-line packaging market during the forecast period.

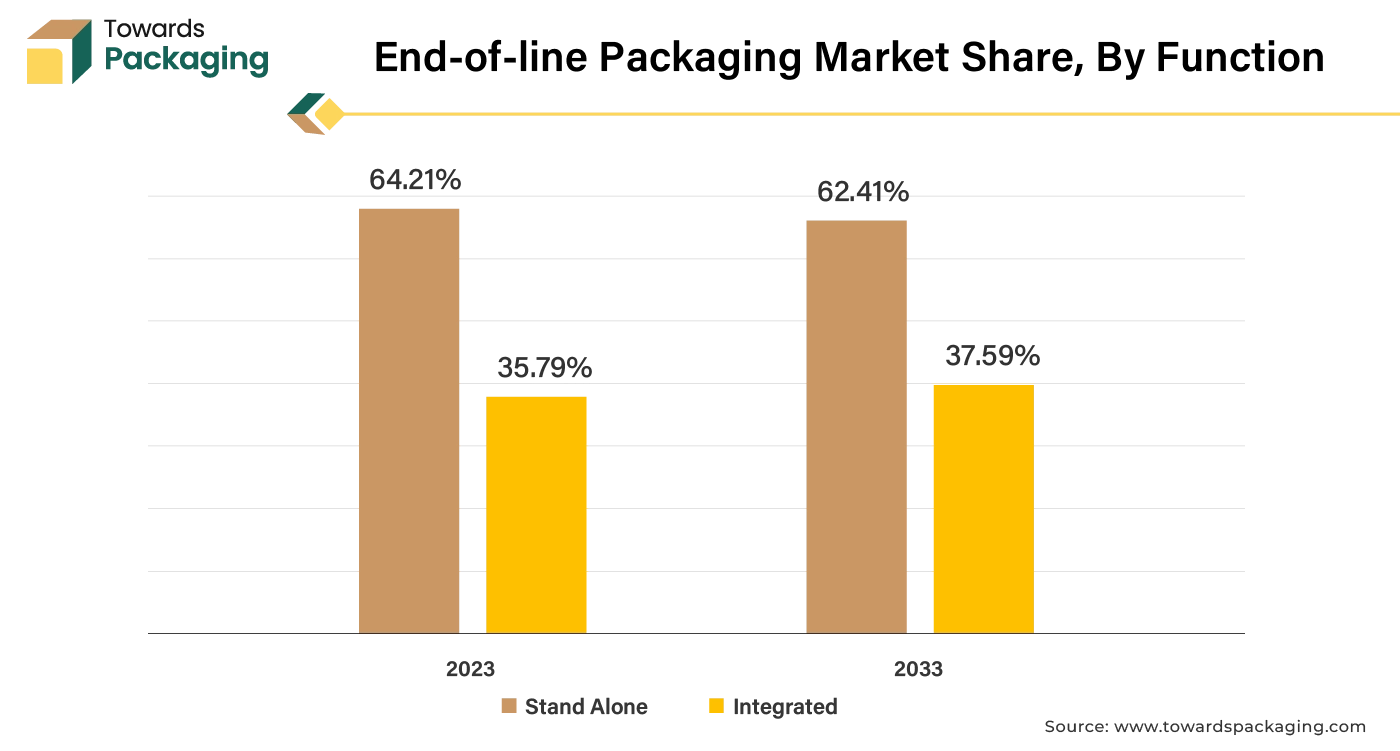

The stand-alone segment held considerable market share of 64.21% in 2024. Automatic or semi-automatic lines that operate separately from rest of the parts of the equipment are known as standalone machines. Usually, new players in the industry choose for self-contained equipment to minimize their cash flow. Standalone machines can be designed to support various end-line packaging automation scenarios, just like automated equipment. Some packagers may just need help with one step of the packaging process, for example, packing, labeling, capping, or filling. Stand-alone machinery can be used in a variety of sectors for packaging procedures other than capping, for instance, labeling or case packing, based on which is most difficult for the product.

Asia Pacific is likely to grow at fastest CAGR of 6.32% during the forecast period. This is owing to the increasing manufacturing activities across various industries including automotive, electronics, consumer goods and pharmaceuticals. According to the data by the India Brand Equity Foundation, by 2025–2026, India's manufacturing sector might be worth $1 trillion USD. India has the capacity to grow into a major hub for global manufacturing and contribute more than $500 billion to the world economy annually by 2030.

Additionally, the governments across the economies such as China and India, are introducing policies to promote industrial automation and smart manufacturing such as "Made in China 2025" and India’s "Make in India", which is also anticipated to promote the growth of the market in the region in the years to come. Furthermore, the growing middle class as well as urbanization across the region are also expected to support the growth of the market within the estimated timeframe.

North America held considerable market share of 29.84% in 2024. This is due to the high cost of labor and the growing focus on efficiency across the region. Furthermore, the growing trend of online shopping and the stringent regulatory requirements regarding packaging safety, traceability and hygiene is also expected to contribute to the regional growth of the market. Also, the early adoption of Industry 4.0 technologies, which integrate automation, data exchange and IoT (Internet of Things) into manufacturing processes, is further expected to support regional growth of the market in the years to come.

By Technology

By Order Type

By Function

By End-User

By Region

December 2025

December 2025

December 2025

December 2025