April 2025

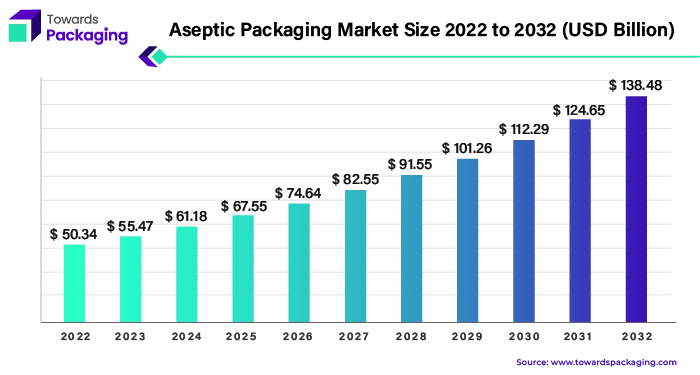

The aseptic packaging market is projected to reach USD 169.70 billion by 2034, growing from USD 67.98 billion in 2025, at a CAGR of 10.7% during the forecast period from 2025 to 2034.

Aseptic packaging has become growing in acceptance among producers over the past few decades. This refers to the procedure of placing commercially sterilised goods into sterilised containers that preserve aseptic conditions and securing them hermetically. This approach makes it possible to package shelf-stable goods without additionally requiring for preservatives, assuring that the items can be ingested without refrigeration for up to a year. Aseptic filling is widely used in many industries, notably in the food and healthcare sectors, hence the FDA established rigid regulations for it.

Aseptic packaging offers several benefits, one of which is its capacity to preserve product stability without necessitating refrigeration, hence permitting worldwide distribution without requiring cold storage. This not only lessens the impact on the environment but also improves global accessibility to necessities. Aseptic packaging is a greener option for firms and fits in nicely with sustainability objectives. It drastically lowers plastic waste because the packaging is made mostly of renewable resources and uses about 60% less plastic than traditional solutions. Less energy is also used throughout the production process, which helps with environmental conservation.

Aseptic filling reduces the possibility of product waste while also guaranteeing product safety and freshness. It eases distributors' concerns about product turnover and gives customers the guarantee of freshness for a longer duration by prolonging the shelf life of products and decreasing reliance on preservatives. Aseptic packaging offers advantages including longer shelf life, less environmental impact, and better accessibility to necessary products globally, making it an appealing option for producers looking for efficient, economical, and sustainable packaging ideas.

Packaging materials need to meet the following criteria:

Aseptic packaging is becoming increasingly popular among manufacturers. According to The Freedonia Group, the demand for this type of packaging is expected to grow at 6.8% annually, reaching $6.4 billion by 2020. Here’s why:

For Instance,

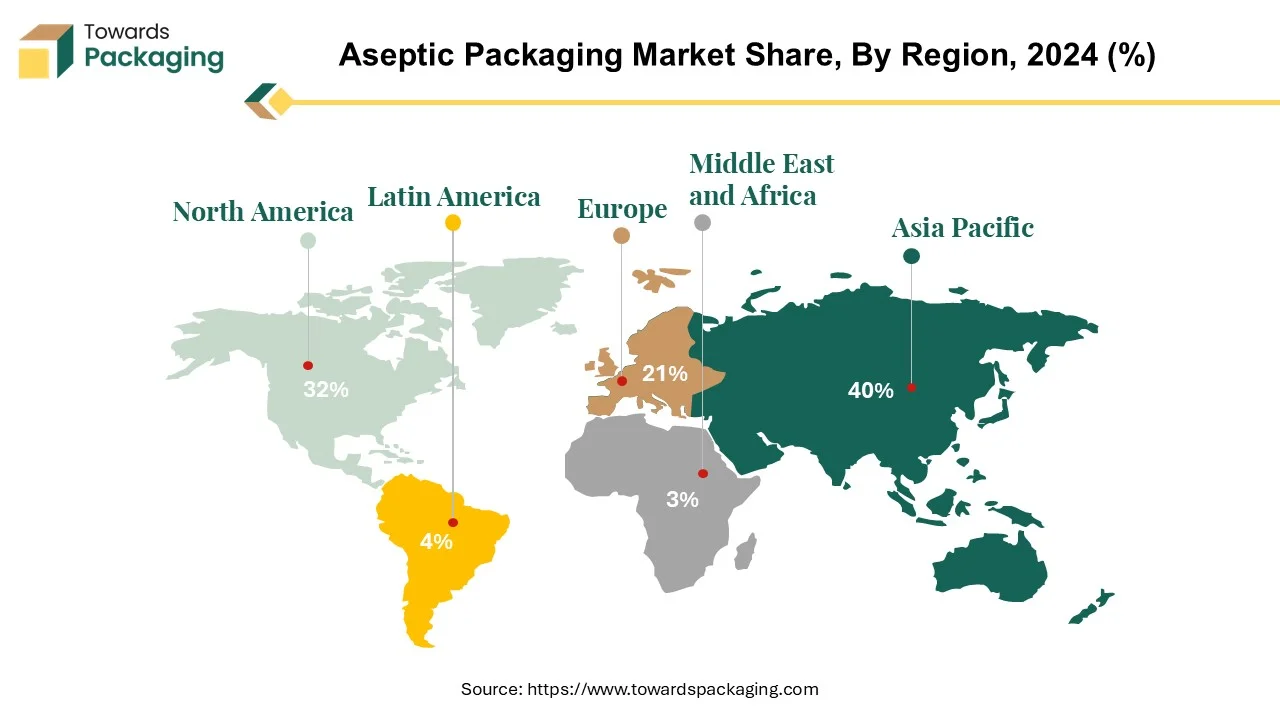

The region comprising Asia-Pacific signifies itself as the key centre for the aseptic packaging market, featuring the largest global presence. Asia is expected to experience the fastest development in this industry, with China and India heading in this field globally. China, in specifically, is anticipated to produce significant improvements, contributing to 28% of the overall market value growth.

Liquid dairy goods are the primary driver of the aseptic packaging sector in China. The Chinese milk products market's commercial scale exceeded 440 billion yuan in 2022, up 4% from the previous year. Based on statistics from China Analytics Consultancy, this market is anticipated to develop at 4.8 %, which will help the aseptic packaging company develop. Aseptic packaging was in great demand in China, which accounted for $4.5 billion, or 56 % from the the Asia-Pacific region region's total demand for the product, based on most recent statistics. With annual average development of more than 19% throughout the last ten years, China's aseptic packaging industry has experienced strong expansion. Several factors are driving this economic trajectory, including the robust growth of the industrial sector, growing personal wages, more consumption, and positive trends in urbanisation.

These components are projected to keep improving China's finished goods demand, which will render aseptic packaging solutions necessary. The increase in Chinese exports towards advanced consumer economies will drive up the need for better packaging, which will increase aseptic packaging consumption in the area. In the aseptic packaging industry, the Asia Pacific area, and China in specific, are positioned as major players with robust development potential driven by economic considerations, urbanization trends, and rising exports.

For Instance,

Aseptic packaging has grown progressively more prevalent in North America, and within the decade that follows, consumer demands for healthy beverages is going to drive this expansion. It is expected that aseptic packaging is going to gain a larger share of the market globally, particularly across North America, since customers continued placing a premium on adopting nutritious choices. Aseptic packaging is American-originated and is increasingly popular since it protects the product's quality and freshness while requiring preservatives. Several aseptic filling and packaging technologies are used in the US for both acidic and low-acid foods to meet the needs of the industry and a wide range of consumer preferences.

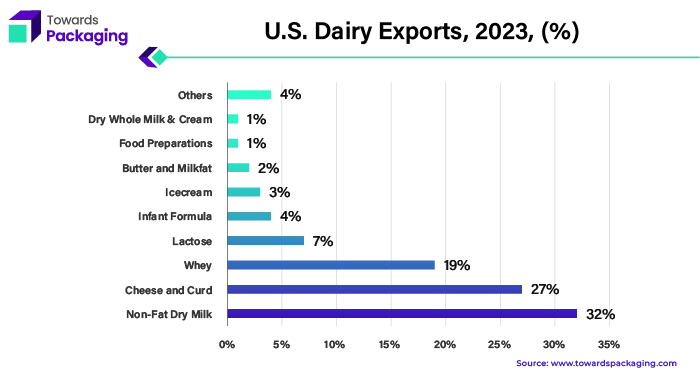

The US dairy industry is expected to experience some challenges in 2024, which will affect the value of exports early in the year. Still, greater demand for skimmed products is anticipated in the final quarter of the year due to increased price competition in the United States.

Aseptic packaging's launch in the US opened the door for its subsequent spread throughout North America. As consumers place more focus on adopting health-conscious consuming practices, aseptic packaging is well-positioned to be essential in satisfying evolving customer needs and market expectations in this region.

For Instance,

In the industry of aseptic packing, cartons are the most popular product. Aseptic beverage cartons, also known as liquid paperboard (LPB) cartons, are essential for distributing shelf-stable dairy and fruit juices for customers across the globe. They are identified by their layered polymer-coated paperboards that include an aluminium foil layer. These cartons are essential to maintaining the longevity and freshness of the food. Hydra pulping is a common method used to recover the paper fibre that make up around 75% of the contents of the carton. The cellulose fibres that are recovered are then used to make building materials like boards and tiles, which makes full use of the carton and reduces waste.

The majority of beverage cartons are gathered via mixed door-to-door groups, offering an array of package alternatives. With the steps of separating and reusing that proceed, each mix presents unique difficulties. Since the incorporation of both paper and PE (polyethylene), beverage containers have a distinct ultraviolet signal; still, certain laminated papers and disposable coffee cups also exhibit comparable signals. When it comes to the material made up of beverage cartons, the usual breakdown is 72.5% fiberboard, 24% polymer, and 3.5% aluminium.

In order to recover valuable resources and reduce environmental damage, this component emphasises the significance of effective recycling methods. In the packaging business, cartons especially aseptic LPB beverage cartons are essential to the distribution of shelf-stable beverages to customers throughout the world. To promote sustainability and lessen environmental impact, efforts must be made to improve recycling procedures and efficiently handle carton waste.

For Instance,

Aseptic packaging is an essential technique for protecting food and drink items by eliminating pathogenic microorganisms from the supply chain. It guarantees a longer shelf life along with the preservation of premium food items. As more consumers choose "natural" (preservative-free) products and liquids that offer extra benefits, a large variety of food and drink items are now aseptically packaged in different shapes and sizes, including cartons, cups, pouches, and bottles. Aseptic packaging involves sterilisation equipment and packaging materials with chemicals like peracetic acid (PAA) or hydrogen peroxide (H2O2) without adding preservatives or creating more heat tolerance to the beverage bottles. The demand for aseptic packaging has increased due to the rise in pre-packaged, ready-to-eat food consumption in many nations across the world as a result of rising disposable income.

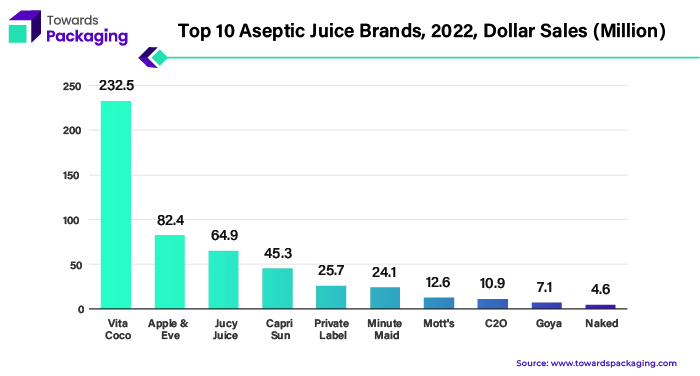

The subcategory of aseptic juice drinks experienced a 16.6% increase in dollar sales and a 9.7% increase in unit sales. In contrast, the subcategory of aseptic juices experienced a 16.2% increase in unit sales and a 22.8% increase in dollar sales.

Urbanisation is occurring rapidly; on an annual basis, some 1.4 million people move to cities around the globe, as UN Secretary-General Antonio Guterres has mentioned. A wide range of food products require aseptic packaging, which is being driven by this change in population dynamics and how food is acquired and preferred.

Manufacturers are increasingly embracing sustainable packaging strategies, which is a noticeable trend. As consumers' expectations for sustainable products rise and environmental conservation becomes more widely recognised, companies are placing a higher priority on aseptic packaging and other eco-friendly packaging solutions in order to reduce their carbon footprint. As more people become urbanised, aseptic packaging becomes more important in satisfying customer demands for high-quality, preservative-free food and beverages. These demands are also being driven by a shift towards more sustainable packaging methods and rising disposable income.

For Instance,

The competitive landscape of the aseptic packaging market is dominated by established industry giants such as SIG, I. du Pont de Nemours and Company (US), Becton, Dickinson and Company (US), Bemis Company, Inc. (US), Reynolds Group Holdings Limited (New Zealand), Amcor Limited (Australia), Robert Bosch GmbH (Germany), Tetra Laval International S.A. (Switzerland), Greatview Aseptic Packaging Co., Ltd. (China), IMA S.P.A (Italy), and Schott AG (Germany). These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

SIG is a top supplier of creative, adaptable, and sustainable packaging. SIG expands its aseptic packaging goods globally and presents its sustainable SIG Terra line.

For Instance,

The best-selling line of carton packages for liquid foods with a long shelf life worldwide is Tetra Brik® Aseptic. It has several alternatives that can help you in your efforts to combat climate change, and it is available in a broad variety of shapes and volumes. Perfect for a variety of products, such as wine, milk, cream, plant-based drinks, tomato-based products, still drinks, and so on.

For Instance,

By Product Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025