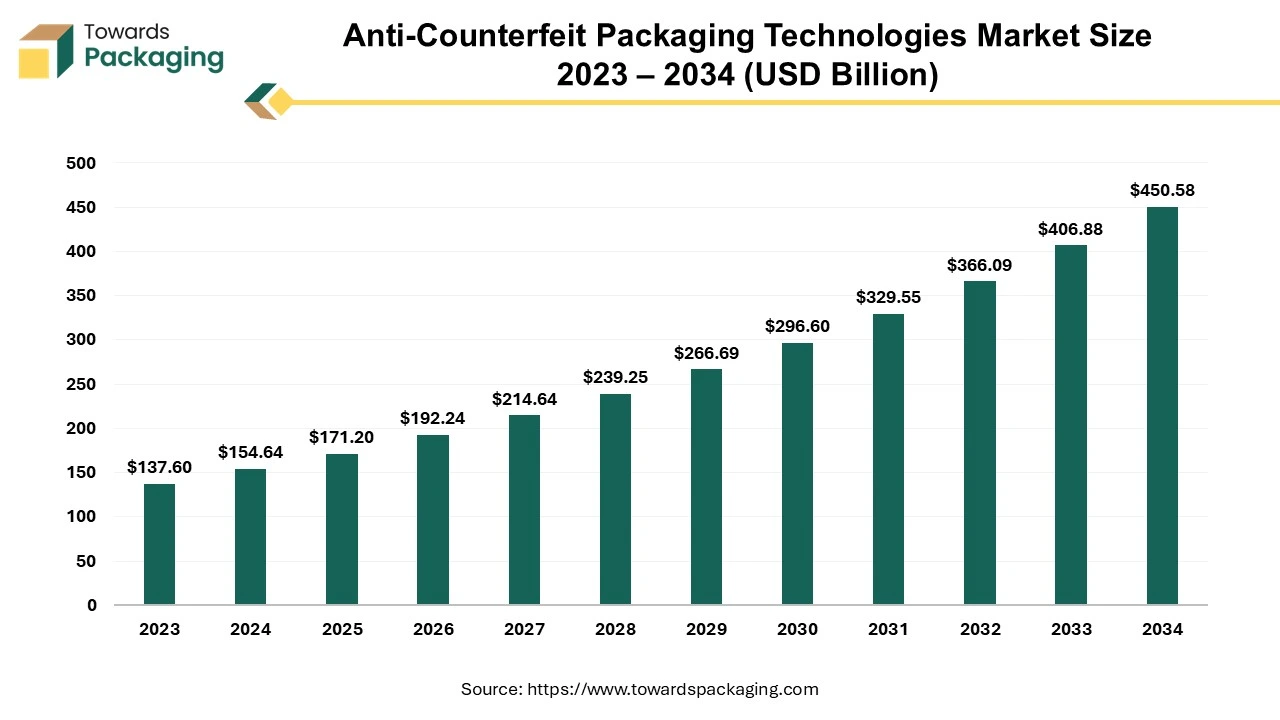

The Anti-Counterfeit Packaging Technologies Market is poised to grow from USD 154.64 billion in 2024 to USD 450.58 billion by 2034, at an 11.91% CAGR. This market expansion is driven by the increasing demand for secure packaging solutions to combat the growing global problem of counterfeit goods, which affects industries such as pharmaceuticals, food & beverage, and luxury goods. Advancements in AI-driven technologies, RFID tags, holograms, QR codes, and smart packaging are crucial in ensuring product authenticity. With Asia-Pacific expected to grow at a 14.45% CAGR, the rise in e-commerce and consumer goods counterfeiting in this region is significantly boosting market demand.

The anti-counterfeit packaging technologies market is anticipated to augment at a substantial CAGR during the forecast period. Nowadays, almost anything can be faked in this fast-paced world. Counterfeiting goods, be it money, high-end handbags and the shoes or simply food, is a challenging issue that many of the largest manufacturers in the world are trying to solve. Anti-counterfeit packaging is designed to prevent counterfeiting by using security features like RFID tags, security inks or microprinting to make sure that the products are authentic. Furthermore, the packaging might also have hidden security features like cryptographic signatures or tamper-evident seals which is likely to increase its demand across various industries.

The increase in consumer safety concerns coupled with the growing need for brand protection against the rising incidence of counterfeit goods is anticipated to support the growth of the market during the forecast period. Additionally, the increasing laws & regulations enforced by governments and the shift towards sustainable packaging solutions across the globe are also expected to drive the growth of the market in the near future. Moreover, the growing demand from emerging economies as well as the surge in sales of the pharmaceutical and healthcare products is also anticipated to contribute to the growth of the market in the years to come.

The increasing demand from consumer packaged goods industry is anticipated to augment the growth of the market. The industry is known for its quick turnover and the broad consumer base. However, there is a serious problem that compromises profits, consumer safety and the brand integrity.

The effects of the counterfeit goods extend beyond simple difficulties; they are a complex issue that has an impact on numerous components of the sector as well as the society at large. This issue is best illustrated by the unexpected pace at which the counterfeit market in this sector is expanding, which is hindering manufacturers' expansion and harming the health and the safety of the consumers. This brings up a key point regarding the importance of the anti-counterfeit packaging technology in the consumer goods sector.

When it comes to protecting the brands from the possibility of counterfeit goods, packaging is important. Therefore, using the proper packaging materials can preserve the integrity of the product as well as the reputation of the brand. When the warning signs or the barriers to entry anti-counterfeit packaging are breached, the end user should be able to see a clear proof that tampering has taken place. To put it briefly, the anti-counterfeit packaging technologies are made to show the signs of the package tampering. Aside from helping to confirm the product's authenticity, the tamper-evident seals and labels also make it more difficult to remove the product without tearing or marking the pack, making it unusable for the future use.

The largest obstacle that anti-counterfeit packaging technologies is currently facing is the availability of numerous counterfeit products as well as medicines which is expected to hamper the growth of the market during the forecast period. According to the World Health Organization, taking false or inadequate medications causes one million deaths annually. This is owing to the growth of the online technologies, which have made it simpler than ever before for anyone to sell fraudulent products or medications online while pretending to be a reputable company.

Furthermore, Customers also value convenience, for instance, they don't want to see the doctor, fill out a prescription and then go to the neighborhood pharmacy. For this reason, they turn to the internet, where anti-counterfeiting measures find it challenging to keep up with the large number of criminals selling counterfeit drugs. Technology also makes it simpler for people to produce fake medical supplies, which is a problem. Since patients and consumers are often unaware of what to look for when determining whether something is genuine or not, more counterfeit goods penetrate the supply chain unnoticed and this is probably going to restrict its demand during the projected period.

There have been continuous innovations in the anti-counterfeit packaging industry. New technology has been developed to incorporate an imperceptible cryptographic signature into the packaging. It combines AI and cryptography to provide authentication that can be completed with any smartphone. Using augmented reality, this cryptographic code integrated into the packaging not only prevents counterfeiting but also has the power to inform as well as engage the consumers.

The most important invention in this case is the cryptographic seal that can be applied to any kind of packaging, irrespective of the size and is completely concealed and unnoticeable to others. Ennoventure was the first company who created and registered this technology in 2019 and the company claims that it has since been used on over 1 billion packages. The organization has created a number of machine learning models to identify the questionable signals from a deep neural network, making it possible to detect the counterfeit product lookalikes with speed.

Neurotags is also at the head of the anti-counterfeiting technology. Every item is assigned with a distinctive NeuroTags code, and this is a traceable and secured identity created by NeuroTag. The AI-powered cloud continuously scans each code and the entire product journey, from the warehouse to the customer, is recorded and shown in real-time on the dashboards for analysis. The clones are identified and invalidated as soon as they appear due to the dual-code anti-counterfeit technology using AI monitoring. Any attempts at unauthorized diversion or illegal distribution are promptly discovered since NeuroTags codes are constantly being monitored. This aids in enforcing on the distributors the pricing strategy and policy.

Furthermore, Advanced Material Development has created a new nanotechnology platform called nMark. It was created to provide products and packaging with next-generation provenance and anti-counterfeiting capabilities. As an extra layer of reasonably priced security, nMark offers the most accurate coding of product data in a format that is hard to duplicate. When integrated into a host material or applied to a surface, nanomaterials exhibit a distinct nanoscopic signature that might significantly improve the current security of packaging. Thus, such advancements are likely to create immense possibilities for the growth of the market in the future.

Counterfeiting in industries like food and beverages, pharmaceuticals, electronics, and luxury goods is increasing. Demand for anti-counterfeit packaging technologies like holograms, tamper-evident seals, and serialization solutions is growing to protect brand reputation and consumer safety. The rise of online shopping has heightened the risk of counterfeit products entering the supply chain. Anti-counterfeit packaging is becoming essential for companies to ensure product authenticity in direct-to-consumer shipments.

Artificial Intelligence (AI) is set to significantly transform the anti-counterfeit packaging technologies market by enhancing security measures, improving efficiency, and driving innovation. AI's integration into packaging solutions enables advanced authentication methods, such as machine learning algorithms that can analyze and detect counterfeit patterns with high accuracy. By utilizing AI, companies can implement real-time tracking and monitoring systems that ensure product integrity from production to consumer.

AI-driven analytics facilitate the identification of vulnerabilities in supply chains, allowing for proactive measures against counterfeiting. Smart packaging solutions, equipped with AI-powered sensors and data processing, offer dynamic responses to potential threats, such as unauthorized tampering or duplication.

AI enhances consumer engagement through interactive packaging that can provide product information, authentication codes, and personalized experiences via mobile apps. This not only boosts consumer trust but also helps brands gather valuable data on consumer behavior and product performance.

AI integration in anti-counterfeit packaging is poised to elevate market growth by delivering more robust and adaptable security solutions, fostering greater brand protection, and ensuring a safer consumer experience.

The track & trace segment captured a substantial market share of 40.65% in 2023. This is owing to the increasing consumer awareness about the risks associated with counterfeit products, mainly in sectors such as pharmaceuticals, food and luxury goods. Track & Trace enables transparent traceability of the products within the entire manufacturing and delivery process (end-to-end) and also helps to distinguish counterfeits from originals based on their origin, serial numbers and transport history.

Furthermore, packaging of the product is provided with an individual serial number, which identifies the product as unique. A reliable tracking system is integrated into the production lines, partners, customers and suppliers. This is likely to increase the demand for this technology during the forecast period.

The pharmaceutical segment held largest shares of 25.35% and is expected to grow at a considerable CAGR of 13.82% during the forecast period. This is owing to the increasing threat of fake drugs in the big pharma. According to the data by Pfizer, the prescription drug counterfeiting has grown to be an annual $200 billion illegal global industry. Additionally, Europol revealed that the trade in the counterfeit pharmaceuticals is still growing. Contrary to their tenth-place ranking in 2019, counterfeit pharmaceuticals ranked seventh in terms of most frequently seized goods in 2020. The quantity of customs procedures linked to the fake drugs was the primary cause for this increase. Moreover, this increase in fake medications has increased the adoption of anti-counterfeit packaging solutions by the manufacturers.

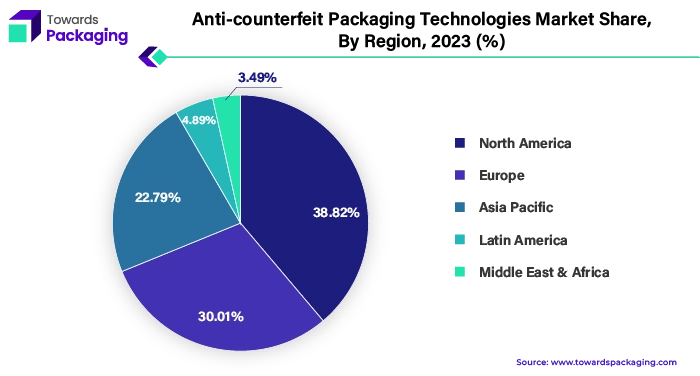

North America held largest shares of 38.82% in 2023 and is expected to grow at a considerable CAGR of 10.98% during the forecast period. This is owing to the stringent food safety regulations along with the growing demand for transparency in product sourcing and authenticity across the region. As of August 2022, nearly 17,000 counterfeit items valued at an estimated $2.4 billion had been seized by the U.S. Customs and Border Protection (CBP). Among the counterfeit items that were seized were footwear, clothing, and consumer electronics. This has resulted in increase in the demand for anti-counterfeit packaging technologies. Also, the growing market for electronics and high-value consumer goods coupled with the increasing need for protection of the brand reputation is further expected to drive the demand for anti-counterfeit packaging technologies in this region in the years to come.

North America region held a significant share of the anti-counterfeit packaging technologies market in 2023. North America is home to some of the largest pharmaceutical companies and is a major hub for drug manufacturing and distribution. Ensuring drug safety and compliance drives demand for serialization, tamper-evident, and traceable packaging. Many leading companies in the anti-counterfeit packaging industry, such as 3M, Avery Dennison, and Zebra Technologies, are headquartered in North America. These companies drive innovation and ensure the region remains a leader in anti-counterfeit solutions.

North America has a well-established technological ecosystem, supporting innovations like: Blockchain for supply chain transparency, Advanced digital printing for secure labeling, RFID and NFC technologies for authentication, etc. Strong research and development in anti-counterfeit solutions bolster the North America region's leadership.

In comparison to conventional inlay manufacturing procedures, the inlays and tags provide significant carbon footprint savings of 70–90%, as shown by independent Life Cycle Analysis (LCA) studies. The five products in the expanded range include: AD Midas Flagtag U9 Pure, AD Dogbone U9 Pure, AD Belt U9 Pure, AD Web U9 Pure, and AD Miniweb U9 ETSI Pure.

Asia Pacific is expected to grow at fastest CAGR of 14.45% in the global anti-counterfeit packaging technologies market during the forecast period. The increasing percentage of drug counterfeiting is expected to contribute to the regional growth of the market during the forecast period. Moreover, the growth of e-commerce has increased the risk of counterfeit products entering the market as well as the rising demand for luxury goods is also expected to contribute to the growth of the market across the region.

The supply chain for anti-counterfeit packaging technologies involves several crucial stages, each designed to ensure product authenticity and protect brands from counterfeiting. It starts with the procurement of high-quality raw materials, where suppliers are carefully selected based on their reliability and adherence to stringent quality standards.

Once materials are secured, they move through manufacturing facilities where advanced anti-counterfeit features, such as holograms, QR codes, and tamper-evident seals, are integrated into packaging. This stage demands precise coordination to ensure that each feature is correctly applied and tested for effectiveness.

Post-manufacturing, the packaging is distributed through a network of logistics providers who must handle the products with care to maintain the integrity of the anti-counterfeit measures. Advanced tracking systems and secure logistics solutions are employed to monitor and manage the movement of goods throughout the supply chain.

Finally, the end-users, including retailers and consumers, play a critical role in verifying the authenticity of the products using the embedded security features. This collaborative approach across the supply chain ensures the effectiveness of anti-counterfeit technologies, protecting both businesses and consumers from fraudulent activities.

The anti-counterfeit packaging technologies market is driven by a combination of advanced components and significant contributions from leading companies. At its core, the market features several key technologies including holograms, RFID tags, QR codes, and digital watermarks. Holograms provide visual security features that are difficult to replicate, while RFID tags offer electronic verification through radio waves. QR codes enable quick scanning and verification using mobile devices, and digital watermarks embed hidden information within packaging materials.

Companies play pivotal roles in this ecosystem by developing and integrating these technologies into packaging solutions. For example, companies like Zebra Technologies and Avery Dennison lead with innovative RFID solutions, enhancing product tracking and authenticity. Toppan Forms and Holostik focus on advanced holographic and security printing technologies to prevent counterfeiting. Additionally, firms like De La Rue and SICPA specialize in incorporating secure inks and digital watermarks into packaging.

Together, these technologies and companies work to safeguard products against counterfeiting, ensuring consumer safety and brand integrity across various industries.

Some of the key players in anti-counterfeit packaging technologies market are Avery Dennison Corporation, 3M Company, AlpVision SA, Sicpa Holding SA, DuPont, Zebra Technologies Corporation, CCL Industries Inc., Authentix, Inc., Systech International, and Applied DNA Sciences Inc., among others.

By Technology

By Application

By Region

January 2026

December 2025

December 2025

December 2025