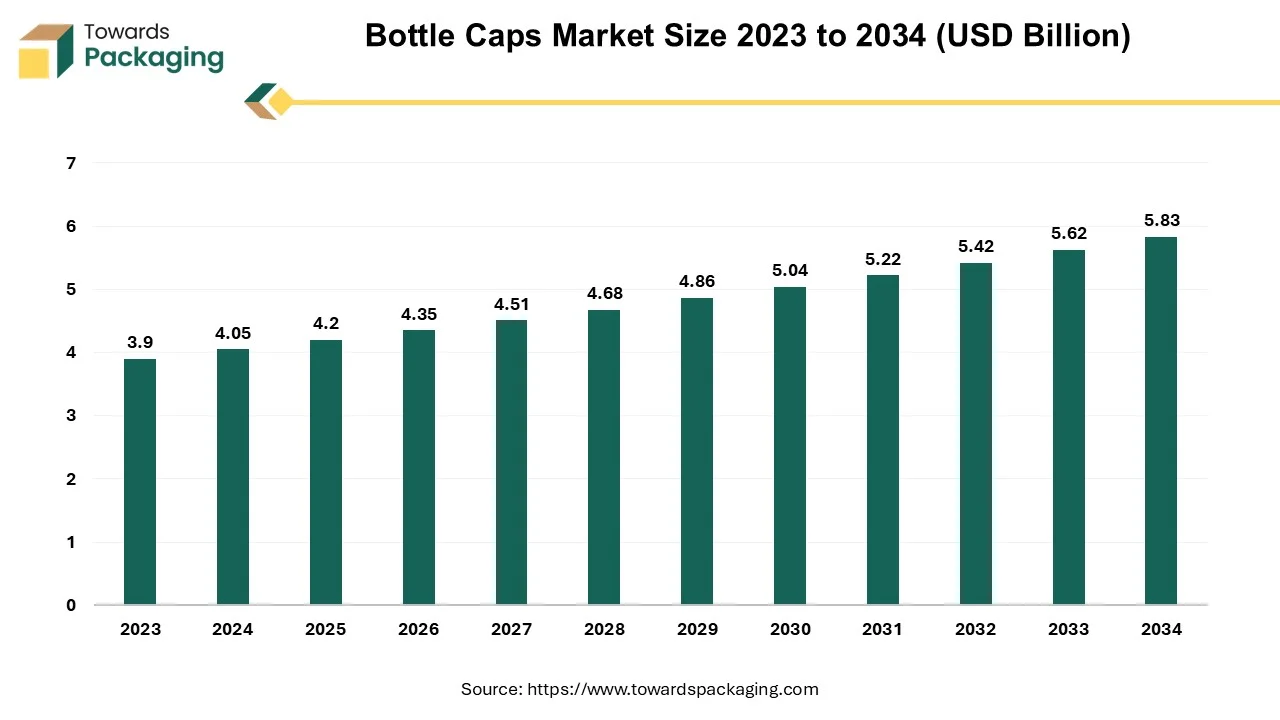

The bottle caps market is forecasted to expand from USD 4.36 billion in 2026 to USD 6.05 billion by 2035, growing at a CAGR of 3.72% from 2026 to 2035. This market covers all segments, including screw caps, flip-top caps, and tamper-evident caps, with detailed regional insights from North America (36.81% share in 2023), Europe, APAC, Latin America, and the Middle East & Africa. Competitive analysis includes key players like Amcor, Ball Corporation, and Crown Holdings, with extensive trade data, manufacturers, and suppliers’ information.

The increasing launch of new fast-moving beverages is raising the demand for bottle caps, which is expected to drive the growth of the global bottle caps market over the forecast period.

The top opening of a bottle is sealed or closed with bottle caps. They are made to keep the product contained inside the container and prevent leakage from the outside while maintaining the product's quality. Typically, bottle caps are made of threaded or crown cork metal. Most of the jar lids are lug cap style. Metal bottle caps are typically used on glass bottles, whereas plastic bottle caps are used on plastic bottles. There are metal caps coated in plastic. Additionally, brand information could be put on the caps. Certain bottle caps are made to dispense liquids, such as sauces, oils, and condiments. The food and beverage, Fast Moving Consumer Goods (FMCG), pharmaceutical, and chemical industries all make extensive use of them.

Based on how they are made, plastic bottle caps come in a variety of styles. The caps are made to function with a variety of liquid kinds and viscosities. A straightforward screw cap with a silicon release valve installed allows the user to pour straight from the bottle and release a predetermined amount of product via the cap hole. A variety of bottle cap models are available, each custom-made to fit a specific application, including screw, disc, flip, bottle over the cap, twist, push/pull, nozzle pull top, double button disc, double-twisting locking, dosing bottle, and locking caps for pharmaceutical products.

The ideal characteristics of bottle caps have been mentioned as follows: mechanical qualities such as elasticity/flexibility, durability, strength, and toughness, and to endure pressure/impact; characteristics of insulation, such as resistance to leaks, tight sealing, heat, water vapor, gas, and light, odor. Features of safety such as resistance to corrosion, non-toxicity, ability to keep out insects and pests, and antimicrobial properties, processing attributes including printing compatibility, ease of use in automated processes, and appropriateness for processing into a variety of products; additional factors include a large number of suppliers, simplicity in handling, affordability, and simple availability of the raw ingredients. The bottle caps are made of various materials, which are mentioned here: polyethylene terephthalate (PET), polypropylene, liners, metal, and gaskets, among others. The global packaging market to grow at a 3.16% CAGR between 2024 and 2034.

In the beverage packaging sector, caps are widely used since they are essential for maintaining the freshness, flavor, and texture of beverages. To extend the shelf life of beverages, there has been an increasing trend in recent years to use packaging options, including cartons and pouches. Additionally, the need for caps in the beverage industry is driven by the global presence of some major beverage firms, such as Anheuser-Busch Firms LLC, Coca-Cola Company, and PepsiCo, which in turn boosts market growth. Many who lead busy lives depend on bottled beverages. Effective packaging options, such as bottle caps, are therefore in greater demand since they facilitate simple handling and are spill-proof.

Bottle tops contribute to the preservation of freshness and safety by preventing external contamination. Whether they are printed with trademarks or have unique designs, bottle caps are also utilized as a marketing tool for the company. Bottle caps are in huge demand by the beverage, cosmetic, and food industries for compatible packaging solutions. The key players operating in the market are focused on innovating and launching new products, which is expected to drive the growth of the global bottle caps market over the forecast period.

The key players often face a shortage of raw materials due to some restrictions imposed by the government or regulatory bodies, which can hamper the growth of the bottle caps market in the near future. Following the COVID-19 pandemic, the shutdown of resorts, hotels, and bars in 2020 had a detrimental effect on the alcoholic beverage sector. Global lockout regulations, on the other hand, led to a rise in the drinking of beer and other beverages at home. Cans are more likely to be utilized for at-home consumption because of their handy package size, which increases the demand for metal can closures.

The percentage of beer cans among all beer container types rose to 67% in 2020 from 60% in 2019, according to the National Beer Wholesalers Association, a trade association with headquarters in the United States.

In the packaging industry, particularly in the chemical and pharmaceutical sectors, capping machines are commonly used to safely seal bottles. Quality and sanitization improvements made possible by capping machines improve the production process, which is one of the causes projected to fuel demand for these equipment. Different kinds of bottles, including plastic, glass, and metal, are packed using capping machines.

The demand for processed foods has grown recently due to rising disposable incomes and the rising living standards of health-conscious customers, which has driven the growth of the food and beverage industry. Furthermore, the key players operating in the market are focused on adopting inorganic growth strategies like partnerships, which help to develop advanced technology for manufacturing bottle caps, which is estimated to create lucrative opportunities for the growth of the bottle caps market during the forecast period.

The screw closures segment dominated the bottle caps market in 2024. Screw closures are quite easy to screw on and off of containers, enabling frequent opening and closing without sacrificing the product's integrity. Because of this, they can be used for a variety of products, such as food and drink, medications, and personal hygiene items. Screw caps serve the primary function of enabling customers to unscrew, drain the contents, and then screw them back on tightly. Screw caps, which are frequently composed of aluminum or plastic, are utilized to preserve a variety of goods, including soft beverages, big chemical barrels, honey jars, and tiny pharmaceutical vials.

Screw caps are widely used by the brewing industries like wine as they don’t contaminate wine like other crown or cork caps. Hence, due to the increase in the launch of the new wine brand and the bottles for wines, the demand for screw caps is increasing, which is estimated to drive the growth of the market over the forecast period. The wine company has looked for alternatives to cork closures due to their inadequacies, and screw caps have become a popular option. Screw caps, as opposed to cork, offer a hermetic seal that keeps oxygen out of the bottle and significantly lowers the possibility of cork taint. By doing this, the wine's actual flavors and scents are preserved, and it stays unadulterated and fresh. The practical benefits of screw caps over cork closures are also present. They require no corkscrew and may be opened and resealed more easily, keeping the wine's integrity intact for extended periods of time. Furthermore, compared to cork production, screw caps are more environmentally benign because they are easily recyclable and do not contribute to deforestation.

Several end-use sectors, including food, cosmetics, pharmaceutical, and automotive, use dispense caps of different kinds, including triggers, pumps, and flip-flops. This market is expected to increase as a result of the availability of several dispensing cap types based on the packaged product, ease of use, and controlled flow of packaged goods. Furthermore, crown closures have structures resembling crowns and are mostly composed of metal. Soft drinks, energy drinks, and beer come in glass bottles and are typically sealed with crown closures. As a result, it is anticipated that growing beverage consumption will raise demand for packaging closures.

The plastic segment held the largest share of the bottle caps market in 2024. Although plastic material is less biodegradable and produces CO2 during production, it is a worry for the environment. As a result, recycling is becoming more popular in the cap and closure industry, where many businesses are using recycled content as a raw material to reduce their reliance on virgin plastic. The increasing launch of recyclable plastic bottles is estimated to drive the growth of the segment over the forecast period.

The metal segment is expected to witness significant growth in the bottle caps market over the forecast period. Metal has become more popular in the market since it is more resilient and sustainable than plastic materials. Glass beverage bottles, food product cans, and medicine bottles are all frequently covered with metal closures. The key players operating in the market are focused on launching metal bottles and growing their industry according to trends that are estimated to drive the growth of the segment over the forecast period.

BlueTriton Brands, Inc., a bottled-water marketer, revealed the launch of aluminum bottles with screw caps for several of its brands. The newly introduced aluminum bottles with screw caps are fully recyclable, and some part of the new bottle sales is earmarked for environmental groups.

The beverages segment dominated the global bottle caps market in 2024. High rates of consumption of alcoholic and non-alcoholic beverages worldwide. Bottle caps and other packaging solutions become more in demand as a result. There are many different kinds of beverages that may be found, such as milk beverages, carbonated drinks, and bottled water, all of which need different designs for their packaging. Because the caps provide a tight seal and shield the contents from leaks, contamination, and air exposure, they help preserve the flavor, quality, and shelf life of beverages.

Reusable, resealable, and portable bottle caps enable consumption and prevention while on the go. The demand for caps in the beverage market is influenced by consumers' desire for specific cap styles for specific beverage kinds. There is a lot of international trade and export activity in the beverage business, especially in segments like alcoholic beverages, which is leading to generating high demand for bottle caps. Moreover, the increasing launch of new brands of wines and beer has increased the demand for bottles of various sizes, which is indirectly raising the demand for bottle caps.

The pharmaceutical products segment is expected to grow at the fastest rate in the bottle caps market over the forecast period. The pharma sector is a rapidly growing sector as well, and many new drugs and medicines are being launched from time to time that require secure capped bottles. Among the many important benefits of screw caps are their ease of opening, airtight seal, ability to keep out oxygen, and extended shelf life. Additionally, their closures stop leaks, which is crucial for packing potentially dangerous medicinal items. The increasing launch of recyclable bottles with caps for pharmaceutical packaging is estimated to fuel the growth of the segment over the forecast period.

On the other hand, the machinery used to package pharmaceutical bottles might be entirely or partially automated. It can complete the necessary tasks more quickly than a typical packing clerk. It has automatic labeling, counting, and filling capabilities. An infeed turntable that accepts dry, clean bottles is another feature of the pharmaceutical bottle packing apparatus. This allows for the management of different filling sizes without requiring human contact. After the containers are full, the packaged items are ready to be shipped. Medicinal packing machinery is a process used to enclose different medicinal goods. It is available in multiple sizes. It can be modified for use in smaller pharmaceutical factories and customized to meet the needs of different pharmaceutical companies.

The packaging suppliers segment dominated the bottle caps market in 2024 owing to increasing innovation and the launch of new bottles. Different kinds of glass, plastic, and metal bottles are packed using capping machines. The food and beverage sector has grown as a result of customers' increased demand for processed meals in recent years due to rising disposable incomes and rising living standards among health-conscious consumers.

The bottled water industry segment dominated the bottle caps market in 2024. The increasing launch of reusable bottled water by the key players operating in the market is estimated to drive the growth of the segment over the forecast period. In addition, the key players operating in the market are focused on launching new bottle caps, which is estimated to drive the growth of the bottle caps market over the forecast period.

Asia Pacific dominated the bottle caps market in 2024. The beverage sector is expanding significantly in the Asia Pacific region as a result of factors such as urbanization, changing lifestyles, rising disposable incomes, and growing consumer awareness. The demand for caps as a packaging material has increased as a result of the trend toward packaged beverages. Bottle caps and packaging materials are manufactured in large quantities in Asia Pacific, which also exports bottle caps to international markets.

The existence of densely populated nations like China and India, together with the expanding food and beverage sector, is anticipated to propel the regional market. Moreover, it is anticipated that rising demand from nations like South Korea and Japan for cosmetics and home care items would increase the use of caps and closures. Furthermore, the increasing launch of recyclable bottles for beverages by the key players operating in the Asia Pacific market is expected to drive the growth of the bottle caps market over the forecast period.

North America is expected to grow at a significant rate in the bottle caps marketduring the forecast period. Increased demand for bottle caps in the beverage sector is being caused by rising consumption of alcoholic and non-alcoholic beverages in countries like the U.S. and Canada. It is anticipated that the region's launch of new beverage varieties will increase demand for its packaging products. Furthermore, the market players operating in North America are focused on launching bottle caps with new materials, which is estimated to fuel the growth of the bottle caps market during the forecast period.

By Type

By Material

By Application

By Distribution Channel

By End User

By Region

January 2026

January 2026

January 2026

December 2025