April 2025

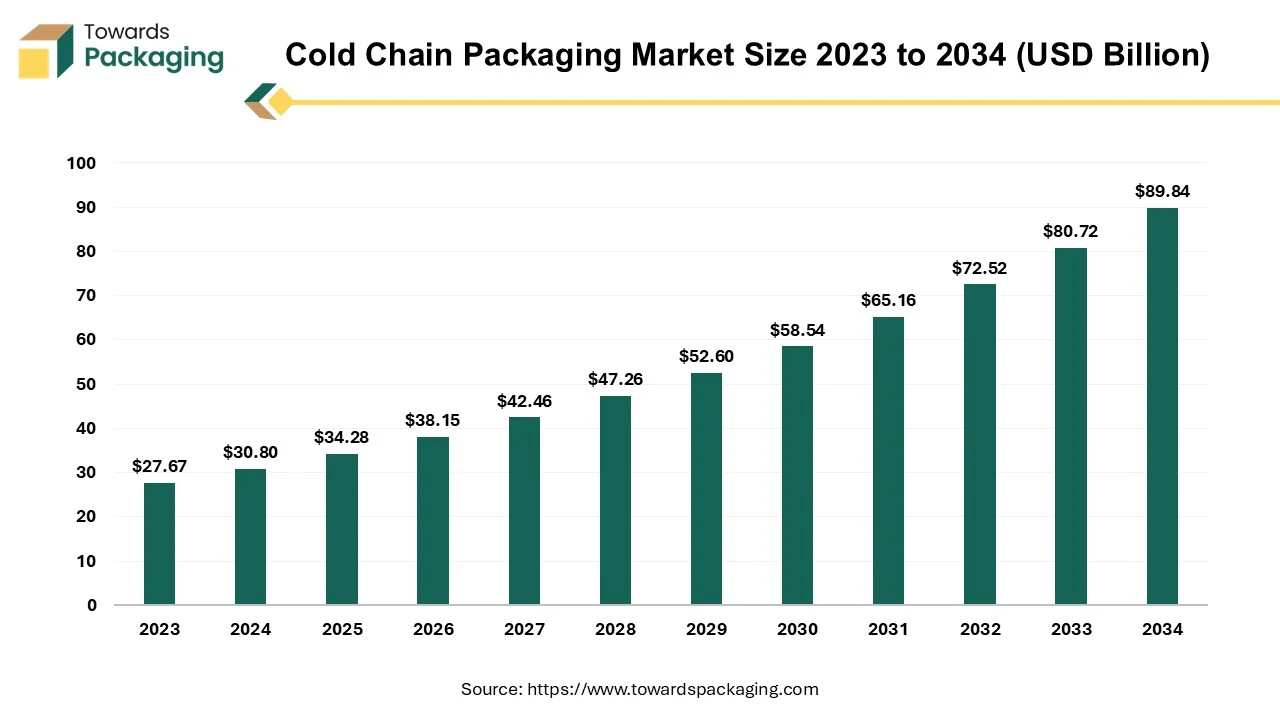

The cold chain packaging market size reached USD 34.28 billion in 2024 and is projected to reach USD 89.84 billion by 2034, with a CAGR of 11.3%. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing cold chain packaging which is estimated to drive the global cold chain packaging market over the forecast period.

Cold chain packaging is known as specialized temperature-controlled packaging designed to maintain the safety, freshness, and stability of perishable goods during transportation and storage. It is an important part of the cold supply chain, ensuring that products such as food, vaccines, pharmaceuticals, and biologics remain within specific temperature ranges to prevent spoilage or degradation.

The cold chain packaging maintains temperatures from frozen (-20°C to -80°C), refrigerated (2°C to 8°C), or controlled room temperature (15°C to 25°C). The cold chain packaging uses materials like polystyrene, polyurethane foam, vacuum-insulated panels, and seaweed-based bioplastics to prevent heat transfer. The cold chain packaging has special gels or liquids that absorb and release heat to stabilize temperature inside the packaging.

The demand for effective cold chain packaging solutions is escalating due to the global consumption of perishable goods, including fresh produce, dairy products, meat, and seafood. The transportation of temperature-sensitive pharmaceuticals, such as vaccines and biologics, necessitates reliable cold chain packaging to maintain product efficacy.

The integration of smart indicators, such as time-temperature indicators and RFID technology, is on the rise, enhancing real-time monitoring and ensuring product integrity throughout the supply chain. Developments in biodegradable and edible packaging materials, including those derived from seaweed, are gaining traction, offering sustainable alternatives to traditional packaging.

Major logistics companies are expanding their cold chain capabilities through strategic acquisitions. For instance, UPS announced plans to acquire Germany-based healthcare logistics firm Frigo-Trans to bolster its cold-chain facilities in Europe.

Eco-Friendly Solutions: There is a growing focus on sustainable packaging solutions, with companies investing in materials and technologies that reduce environmental impact while maintaining temperature control.

Artificial Intelligence (AI) is transforming the cold chain packaging industry by enhancing efficiency, cutting-down waste, ensuring regulatory compliance, and optimizing temperature-sensitive logistics. AI-powered IoT sensors continuously track temperature, humidity, and packaging integrity in real-time. Predictive analytics help detect potential temperature fluctuations before they occur, preventing spoilage. For instance, AI-driven platforms can predict when a cold storage unit may fail, allowing for proactive maintenance. AI enables smart packaging with RFID tags, QR codes, and blockchain integration for real-time tracking. Smart labels provide instant temperature history, ensuring compliance with FDA and WHO guidelines. For Example: AI-driven packaging that changes color if temperature conditions are breached.

AI analyzes weather conditions, traffic, and storage facility availability to optimize delivery routes. Reduces fuel consumption and transit time, keeping products within safe temperature ranges. AI-powered logistics platforms like Flexport and Shipwell optimize shipping for perishable goods. AI-powered computer vision systems inspect cold chain packaging for leaks, damage, or contamination. The AI integration enhances product safety and quality assurance, reducing human error. Example: AI-driven drones inspect warehouse inventory and cold storage conditions.

Smart packaging solutions with IoT sensors, RFID tracking, and real-time temperature monitoring are revolutionizing the industry. Development of eco-friendly and biodegradable cold chain packaging materials (e.g., seaweed-based packaging, biodegradable foam, and compostable insulation) is gaining traction. Use of phase change materials (PCMs) to maintain stable temperatures without excessive refrigeration costs. Hence, increasing innovative advancement in cold chain packaging has estimated to drive the growth of the cold chain packaging market in the near future.

For instance, in June 2024, Overhaul, a world leader in intelligence and active supply chain risk management, announces the release of its state-of-the-art Cold Chain Quality Solution. This cutting-edge software solution ensures ideal conditions across the supply chain for the pharmaceutical, healthcare, and high-value food and beverage industries by providing unmatched risk and quality control for time and temperature-sensitive goods.

The Cold Chain Quality Packaging Solution from Overhaul uses proactive risk management, real-time global visibility, and sophisticated quality control to meet the urgent demand for dependable cold chain logistics. Given that supply chain interruptions cause an estimated 20% of temperature-sensitive products to be damaged in transit, technology reduces substantial financial losses while ensuring patient safety in healthcare supply chains. With its device-agnostic capabilities and extensive monitoring functions, it smoothly integrates with current systems.

The key players operating in the market are facing issue due to lack of infrastructure in developing regions & strict regulatory compliance which has estimated to restrict the growth of the cold chain packaging market in the near future. Limited cold storage facilities, poor road connectivity, and unreliable power supply make cold chain logistics inefficient in many countries. In regions with hot climates, maintaining temperature-sensitive goods becomes even more challenging. For instance, developing markets in Africa, Latin America, and parts of Asia lack proper cold storage and refrigerated transport networks.

Cold chain packaging must comply with WHO, FDA, and Good Distribution Practice (GDP) guidelines for food and pharmaceutical products. Meeting these stringent temperature control regulations increases costs and complexity for companies. The U.S. Food Safety Modernization Act (FSMA) and Europe Union GDP regulations impose strict requirements on tracking and monitoring temperature-sensitive goods. Global supply chain disruptions, fuel price fluctuations, and labor shortages impact cold chain packaging operations.

Increasing consumption of fresh produce, dairy, meat, seafood, and frozen foods is driving the need for effective cold chain packaging. Growth in online grocery shopping and food delivery services is further boosting demand for insulated and temperature-controlled packaging. Companies like HelloFresh, Blue Apron, and Walmart Grocery require reliable cold packaging solutions for perishable deliveries.

The pharmaceutical sector relies on cold chain packaging for vaccines, biologics, insulin, blood samples, and specialty drugs that require strict temperature control. The COVID-19 pandemic accelerated demand for ultra-cold packaging solutions, such as those needed for Pfizer and Moderna vaccines. The expansion of biotechnology and personalized medicine is further increasing the need for secure cold chain logistics.

According to the data published by the National Grocers Association, in February 2025, While overall grocery expenditure climbed by just 2.5% over the previous year, monthly food sales increased by 16.6% year over year in January 2025. Consequently, groceries accounted for 15% of total food sales in January 2025, a rise of 180 basis points from 2024.

The expanded polystyrene (EPS) segment held a dominant presence in the cold chain packaging market in 2024. Expanded Polystyrene (EPS) is extensively utilized in cold chain packaging because of its excellent thermal insulation, lightweight nature, and cost-effectiveness. Expanded polystyrene (EPS) has low thermal conductivity, meaning it effectively slows down heat transfer, keeping products at stable temperatures during transit.

It is extremely light, reducing shipping costs while still providing structural strength. Expanded Polystyrene (EPS) can be molded into various shapes and sizes to fit different packaging needs, ensuring secure and efficient storage of perishable goods like vaccines, pharmaceuticals, and food products. While disposal has been a concern, Expanded Polystyrene (EPS) can be recycled and repurposed, making it more environmentally viable than before.

The insulated containers segment accounted for a significant share of the cold chain packaging market in 2024. Insulated containers provide stable thermal protection, ensuring temperature-sensitive products (like pharmaceuticals, biologics, and perishable foods) remain within required temperature ranges during transit. These containers are used across multiple industries, including food, pharmaceuticals, and chemicals, making them essential for maintaining product integrity.

Many insulated containers are designed for multiple uses, making them more cost-effective and environmentally friendly compared to single-use packaging. Innovations in phase change materials (PCM), vacuum insulation panels (VIPs), and high-performance EPS/EPP foams have enhanced the efficiency and reliability of insulated containers. The rise of online grocery delivery, meal kit services, and international pharmaceutical shipments has fueled the demand for reliable cold chain packaging solutions. Insulated containers reduce product loss due to temperature excursions, leading to long-term savings for companies.

The fish, meat & seafood segment registered its dominance over the global cold chain packaging market in 2024. Fish, meat, and seafood are highly perishable and prone to bacterial contamination if not stored at the correct temperature. Cold chain packaging maintains low temperatures, slowing microbial growth and preserving freshness. Proper temperature control ensures that these products remain safe for consumption longer, reducing waste and improving supply chain efficiency. Specialized cold chain packaging, such as vacuum-sealed and insulated containers, helps prevent dehydration and oxidation, which can affect the taste and appearance of seafood and meat.

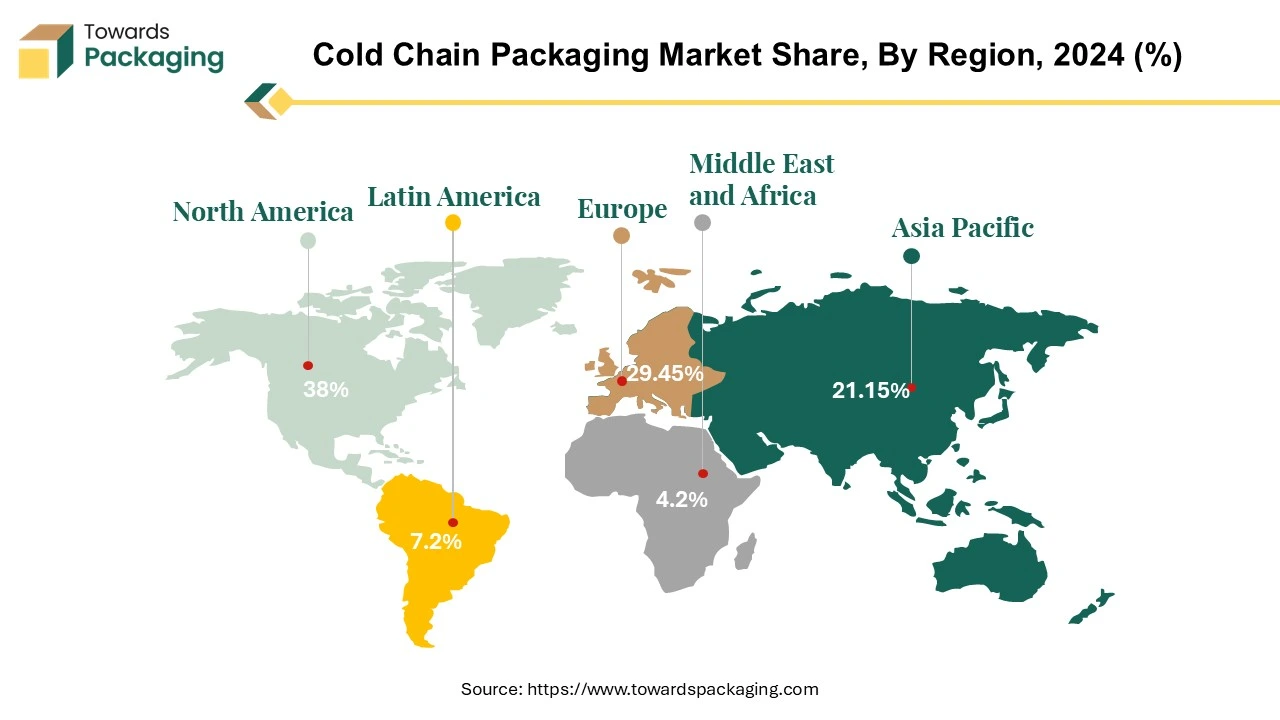

North America region dominated the global cold chain packaging market in 2024. The U.S. and Canada have a robust pharmaceutical sector that requires strict temperature-controlled packaging for vaccines, biologics, and other temperature-sensitive drugs. - The presence of major pharmaceutical companies like Pfizer, Moderna, and Johnson & Johnson boosts demand. Growth of plant-based and alternative protein markets in North America has estimated to drive the growth of the cold chain packaging market in the region. The demand for plant-based meat, dairy alternatives, and functional beverages is rising, requiring temperature-controlled storage and packaging. Companies like Beyond Meat and Oatly depend on cold chain logistics to maintain product integrity.

The U.S. cold chain packaging market account the large share. Major agricultural hubs and seafood industries in the West Coast (California, Washington, Oregon) drive demand for efficient cold storage and packaging. Strong meat, dairy, and frozen food industries in the Midwest (Illinois, Ohio, Minnesota, Wisconsin) fuel the growth of the cold chain packaging market. Northeast states -Massachusetts, New Jersey, Pennsylvania, New York are house for major pharmaceutical and biotech companies that require advanced cold chain solutions for vaccines, biologics, and specialty drugs. Florida, Georgia, Texas, North Carolina states are experiencing a boom in online grocery shopping, meal kit deliveries, and direct-to-consumer frozen food shipments.

Asia Pacific region is anticipated to grow at the fastest rate in the cold chain packaging market during the forecast period. Asia-Pacific is responsible for the highest amount of global R&D expenditures, as well as a significant portion of vaccine research and development patents and publications, according to the United Nations ESCAP. Due to incentives offered by Asia Pacific nations for investments in vaccine research and development, multinational pharmaceutical companies are moving some of their R&D operations to the region in addition to offshoreing a portion of their production. Higher incomes in China, India, and Southeast Asia are driving demand for fresh produce, dairy, meat, and seafood. Companies like Alibaba’s Freshippo, JD.com, and GrabFood are expanding cold storage and packaging needs.

China cold chain packaging market is estimated to grow at fastest rate over the forecast period. The Chinese government enforces GB/T 28842 (cold chain logistics standards) to improve food safety. Initiatives like the Five-Year Plan in China promote modern cold chain warehousing and distribution. More demand for cold chain packaging for imported fruits, seafood, and dairy (e.g., from the U.S., Australia, and Europe). China is a leading producer of vaccines (e.g., Sinovac, Sinopharm), requiring advanced cold storage and packaging. CIMC Cold Chain specializes in passive temperature control packaging solutions for the pharmaceutical, life sciences, and cold chain logistics sectors. The company offers a range of products, including medical insulation containers and phase change materials (PCMs), and has provided cold chain services for over 600 million vials of COVID-19 vaccines.

Europe region is seen to grow at a notable rate in the foreseeable future. The European cold chain business is confronted with issues like appropriate handling (63%), product packaging (31%), and sufficient storage (31%), according to A.P. Moller-Maersk. These persistent problems have drawn investments aimed at building out Europe's cold chain infrastructure, which may have a favorable impact on market expansion.

For instance, Cold Chain Federation Magnavale, one of the top cold storage companies in the UK, stated in May 2023 that it would invest USD 161.3 million (GBP 130 million) to build a cold store that could hold 101,000 pallets. Europe has a large market for vaccines, biologics, and specialty drugs that require strict cold chain packaging.

Countries like Germany, Switzerland, France, and the UK house leading pharmaceutical companies (e.g., Roche, Novartis, GSK, Sanofi, Bayer). The Good Distribution Practice (GDP) regulations ensure strict temperature control, boosting high-quality packaging demand. The European Union enforces regulations to reduce carbon emissions, leading to innovation in biodegradable and recyclable cold chain packaging. Countries like Germany, the Netherlands, and France are investing in energy-efficient refrigerated warehouses.

By Material

By Product

By End Use

By Region

April 2025

April 2025

April 2025

April 2025