April 2025

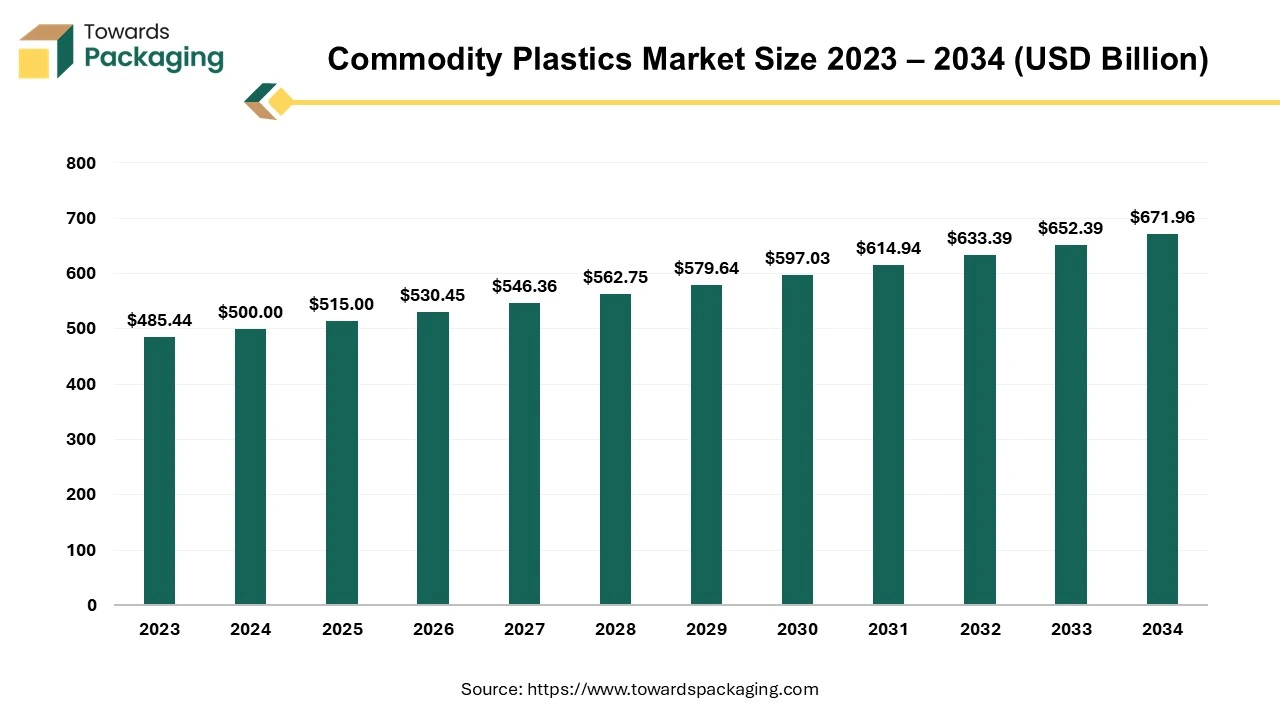

The global commodity plastics market was valued at USD 500 billion in 2024 and is projected to reach approximately USD 671.96 billion by 2034, expanding at a CAGR of 3% from 2025 to 2034. Key players are actively adopting inorganic growth strategies, including mergers and acquisitions, to enhance technological advancements in commodity plastic manufacturing. These strategic initiatives are expected to fuel innovation, improve production efficiency, and drive market expansion throughout the forecast period.

Commodity plastics are a class of plastics that are extensively utilized and produced in large volumes for everyday products. These plastics are typically inexpensive, have moderate properties, and are easily processed into various forms. They are utilized in applications where high-performance characteristics are not required. The commonly used commodity plastics are polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and polyethylene terephthalate (PET) among others. These plastics are valued for their cost-effectiveness, ease of manufacturing, and versatility in a wide range of applications.

There is a rising focus on eco-friendly plastics. Companies are investing in the development of recyclable, biodegradable, and bio-based plastics to minimize environmental impact and meet regulatory requirements. Environmental concerns are influencing the industry, with a push towards sustainable practices and the development of biodegradable and recyclable plastics. Innovations in bioplastics, such as those derived from seaweed, are being explored to address plastic waste issues.

Advances in recycling technologies and an emphasis on a circular economy are becoming central to the industry. Companies are developing more efficient recycling processes and products designed for easier recycling to reduce plastic waste.

Geopolitical tensions, economic fluctuations, and regulatory shifts are presenting challenges to the industry. Supply chain pressures and market saturation, particularly in regions like Asia and Europe, are leading to consolidation efforts and strategic adjustments by major players.

Major oil companies are investing in petrochemical facilities to offset declining fuel requirement due to the rise of electric vehicles and more efficient internal combustion engines. This shift underscores the growing importance of petrochemicals, including commodity plastics, in the energy transition.

Companies are investing in new facilities and expanding existing capacities to meet growing demand. This includes the establishment of new petrochemical plants and modernization of production facilities.

Artificial intelligence helps to analyze production processes in real-time, identifying inefficiencies and suggesting optimizations. This can lead to reduced energy consumption, minimized waste, and improved production rates. Machine learning models can detect defects in plastics during manufacturing by analyzing images and other data. This ensures higher product quality and minimizes the costs associated with defective products.

The artificial intelligence helps in predict equipment failures before they occur by analyzing data from sensors on machinery. This helps in scheduling maintenance proactively, reducing downtime and maintenance costs. AI integration assists in optimize the supply chain by predicting demand, optimizing inventory levels, and improving logistics. This leads to cost savings and better customer service.

AI assist in developing new plastic formulations by simulating how different materials and processes will interact. This speeds up innovation and reduces the time and cost of bringing new products to market. The artificial intelligence helps in developing more sustainable production processes, such as optimizing recycling methods and reducing carbon footprints. It can also aid in the design of biodegradable plastics.

Due to the expansion of the E-commerce platform the demand for the commodity plastics for packaging purpose increased, which has driven the growth of the commodity plastics market in the near future. E-commerce relies heavily on secure, lightweight, and cost-effective packaging solutions. Commodity plastics, such as polyethylene (PE) and polypropylene (PP), are ideal for packaging materials like bubble wrap, shrink wrap, and plastic bags, leading to increased demand.

Products shipped through e-commerce platforms require durable packaging to prevent damage during transit. Plastic packaging provides the necessary protection, driving the growth of commodity plastics. The convenience of single-use plastic packaging, such as air pillows and plastic films, is essential for e-commerce logistics. Despite environmental concerns, these plastics remain in demand due to their utility in ensuring product safety.

E-commerce companies often seek customized packaging for branding purposes. Commodity plastics allow for easy customization, such as printing logos and brand messages, which enhances customer experience and brand recognition. The rise of rapid delivery services, such as same-day or next-day delivery, requires efficient and reliable packaging solutions. Commodity plastics offer the durability and flexibility needed for quick packaging and handling.

The key players operating in the market are facing issue due changing consumer preferences and environmental concerns, which may restrict the growth of the commodity plastics market in the near future. The increasing awareness of plastic pollution and its impact on the environment has led to stricter regulations and consumer demand for sustainable alternatives. This has put pressure on the industry to reduce the use of non-recyclable and single-use plastics.

The development and adoption of alternative materials, such as biodegradable plastics, paper, and metal, can restrict the growth of commodity plastics by providing more sustainable or durable options for consumers and industries. Consumers are increasingly opting for eco-friendly and sustainable products. This shift in consumer preferences away from conventional plastics can restrict demand and drive companies to seek alternative materials.

Rapid industrialization and urbanization in emerging economies, such as Asia-Pacific, Latin America, and Africa, offer significant growth opportunities. Increasing consumer demand for packaged goods, construction materials, and automotive products in these regions drives the need for commodity plastics.

Increasing demand for personal protective equipment (PPE), medical devices, and pharmaceutical packaging presents opportunities for the plastics industry to supply essential materials, especially in the context of global health crises. Hence, due to increase in launch of the new medical devices and healthcare products the demand for the commodity plastics has raised, which has created lucrative opportunities for the growth of the commodity plastics market in the near future.

The push for lighter and more fuel-efficient vehicles and aircraft creates opportunities for commodity to replace traditional materials like metal. This trend is driven by regulatory pressures to reduce emissions and enhance energy efficiency.

The polyethylene (PE) segment held a dominant presence in the commodity plastics market in 2024. The polyethylene (PE) material is highly versatile and can be easily molded into various shapes and forms, making it suitable for a wide range of applications, including packaging g, films, containers, and pipes. The polyethylene (PE) is lightweight yet offers excellent durability and impact resistance, making it ideal for products that need to be strong but easy to transport and handle.

The polyethylene (PE) exhibits strong resistance to chemicals, moisture, and environmental stress, which enhances its suitability for packaging and storage of various substances, including food, chemicals, and pharmaceuticals. LDPE, in particular, is flexible and can be manufactured into thin films, which are extensively utilized for plastic bags, shrink wrap, and other packaging materials. Its transparency also makes it suitable for products where visibility is important.

The Poly Methyl Methacrylate (PMMA) segment is expected to grow at the fastest rate in the commodity plastics market during the forecast period of 2024 to 2034. Poly Methyl Methacrylate (PMMA) has excellent optical clarity and light transmission properties, often surpassing glass. This makes it ideal for applications requiring high transparency, such as display screens, lenses, and lighting covers. Poly Methyl Methacrylate (PMMA) exhibits good resistance to weathering, UV radiation, and environmental elements, maintaining its clarity and strength over time.

This makes it suitable for outdoor applications like signage and roofing. Its smooth surface, glossiness, and ability to be coloured or tinted add to its aesthetic appeal, making it popular in consumer products, furniture, and decorative applications.

The packaging segment accounted for a significant share of the commodity plastics market in 2024. Commodity plastics like polyvinyl chloride (PVC), polyethylene (PE), polypropylene (PP), and polystyrene (PS) are relatively inexpensive to produce, making them a cost-effective choice for packaging applications. These plastics are lightweight, reducing transportation costs and making them easy to handle.

This is particularly important for large-scale distribution and logistics. Commodity plastics can be easily molded into various shapes and sizes, making them suitable for a wide range of packaging applications, from bottles and containers to films and wraps. Despite being lightweight, many commodity plastics offer good mechanical strength and durability, protecting the contents from damage during transportation and handling.

The medical & pharmaceutical segment is anticipated to grow with the highest CAGR in the commodity plastics market during the studied years. Many commodity plastics are biocompatible, meaning they can safely come into contact with human tissues and fluids without causing adverse reactions. This makes them ideal for medical devices like IV bags, syringes, and tubing. Commodity plastics are resistant to a wide range of chemicals, including many solvents, disinfectants, and drugs. This property is important for pharmaceutical packaging and medical devices that need to remain stable and effective when exposed to different substances.

Commodity plastics like polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC) are relatively inexpensive to produce, making them an economical choice for manufacturing an extensive range of medical devices, including single-use items. These plastics are resistant to many chemicals, including disinfectants, drugs, and bodily fluids, which is significant for maintaining the integrity of medical devices in various environments.

North America region held a significant share of the commodity plastics market in 2024. With a robust industrial base, North America can integrate supply chains, reducing dependency on imports and enhancing the local production of commodity plastics. This can lead to cost reductions and efficiency gains. Owing of the backing of a sizable manufacturing sector of U.S. that serves a variety of industries, including consumer goods, packaging, construction, and the automotive sector.

The market has been further driven and boosted to a new high by giants like Amazon and Walmart in the e-commerce sector and Tesla in the automotive business. Furthermore, the confluence of these industry factors has established the U.S. commodity plastics market as a dominant force in North America, exhibiting robust and steady expansion.

Asia Pacific region is anticipated to grow at the fastest rate in the commodity market during the forecast period. Asia Pacific is a global leader in vehicle production, with countries like China, India, Japan, and South Korea being major automotive manufacturing hubs. The high volume of vehicle production requires large quantities of commodity plastics for various applications. The rise of the electric vehicle market in Asia Pacific is driving demand for lightweight and durable materials. Plastics are essential in electric vehicle components such as interior panels, battery casings, and charging infrastructure, contributing to the growth of the commodity plastics sector.

By Product

By End-Use

By Region

April 2025

April 2025

March 2025

March 2025