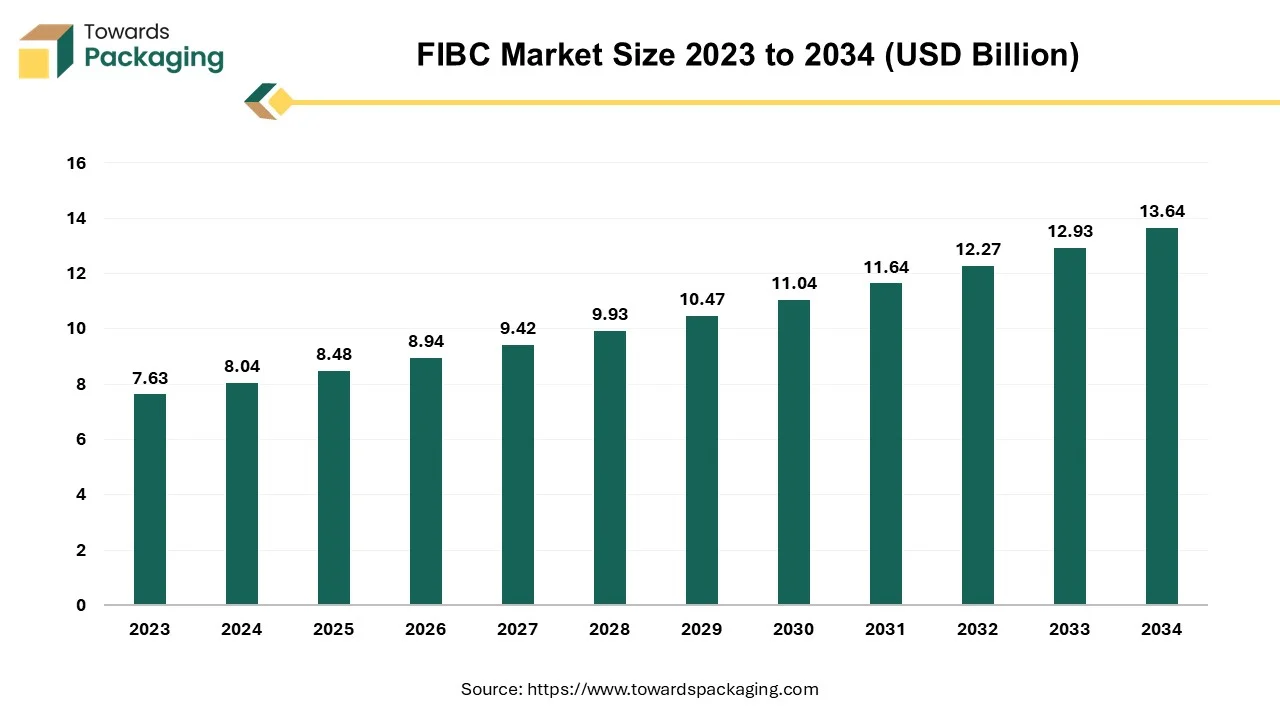

The Flexible Intermediate Bulk Container (FIBC) market is projected to grow from USD 8.48 billion in 2025 to USD 13.64 billion by 2034 at a 5.42% CAGR. We quantify performance by capacity (up to 250 kg; 250–750 kg; above 750 kg 2024 leader), packaging type (Q-bags/baffle 2024 leader, 6-panel, circular, others), and end-user (chemicals & fertilizers largest, plus food & beverages, building & construction, mining, pharmaceuticals). Regional coverage spans APAC (2024 leader), North America (fastest growth), Europe, Latin America, and MEA. Deliverables include competitive benchmarking (Global-Pak, Greif, Berry Global, Rishi FIBC, LC Packaging, DS Smith, Taihua, Masterpack, Conitex Sonoco, Isbir Sentetik), value chain & cost structure, trade statistics and corridor balances, and manufacturer/supplier databases with capacity, certification, and footprint mapping.

FIBC, also known as the flexible intermediate bulk container, is a large bulk container or sack that is used to store or transport various types of products or materials. FIBC bags are the cost-effective solution to the expensive shipping or transporting of materials such as plastic and wooden pallets and containers. The flexible intermediate bulk containers are made from a variety of materials, and the increasing demand for efficient and cost-effective packaging solutions from a wide range of end-use industries is driving the growth of the FIBC market. FIBC has various properties such as durability, environment friendliness, practicality, and reusability that make it the ideal choice for a sustainable packaging solution. These types of bags come in different shapes and sizes as per the requirements of industries and can carry weight loads up to 5000 pounds per bag.

There are different names used for the FIBC bags, such as bulk bags, bulk sacks, super sacks, bulk totes, big bags, jumbo totes, super bags, one-ton bags, and others. There are different types of bags used in different industrial applications based on the weight and size of the product. FIBC bags are generally made from polypropylene, which is a flexible, soft, and lightweight thermoplastic material that makes them durable and have a long lifespan. The global packaging market size is growing at a 3.16% CAGR between 2025 and 2034.

The rapid development of the e-commerce industry globally is contributing significantly to the expansion of the market. The rising disposable income in the population and lifestyle standards are driving the consumer goods industry that is fueling the e-commerce industry. The increase in the e-commerce industry and consumer goods is accelerating the demand for the cost-effective and robust packaging solution that drives the adoption of the FIBC market.

The degradation of bag quality presents a significant obstacle to the growth of the FIBC market. This issue can arise due to various factors, such as environmental conditions, rough handling during transportation, and inadequate material selection. Quality degradation not only affects the durability and reusability of the bags but also jeopardizes the safety of goods during transit. To address this challenge, manufacturers must focus on utilizing high-quality materials, implementing stringent quality control measures, and educating users about proper handling and storage practices. By emphasizing these strategies, the FIBC market can overcome the hurdle of quality degradation and ensure a more sustainable and reliable packaging solution.

The increasing international trade of various products from one country to another. The rising economic development in several countries is driving the import and export trades, which drives the demand for packaging solutions for products of different sizes and weights, which drives the adoption of FIBCs. Thus, the rising international trade is driving the opportunities in the growth of the FIBC market.

The above 750kgs segment dominated the FIBC market in 2024. The FIBC bags come in different shapes and sizes for different industrial applications and packaging solutions. FIBC bags come in various capacities that include up to 250 kg, 250 kg – 750 kg, and above 750 kg. The 750 kg category is considered the preferred choice by several end-use industries, especially the chemical and construction industries. The 750 kg bulk bags have enough space and capacity for storage of heavy materials with durable made-up material. The 750 kg bulk bags are considerably used by various end-use industries for transporting products like construction materials, equipment, chemical materials like petroleum products, and other laboratory chemicals. The use of 750 kg bulk bags is highly adopted by several industries due to its consumer's very little space for storing as per their weight. They are the most cost-effective medium for transporting and storing products compared to other traditional packaging solutions.

The Q-bags segment dominated the FIBC market in 2024. The Q-bags, also known as the baffle bags, are the best solution for efficient packaging and can retail the square shape of the bag; they have the most efficient available space. Q-bags are efficient for different types of packaging solutions for different industrial applications or products such as chemicals, sand, petroleum, minerals, and agricultural products. They are efficient materials for storage, packaging, and transportation purposes. Q-bags are made with 30% more storage than other types of bulk bags. These types of bags are effectively used for storing and transporting dry and liquid products. The Q-bags are steady, durable, firm, and strong, which makes them easy to carry and safer for stored products.

FIBC bags come in a variety of packaging bags that are further subdivided into circular bags, 6-panel bags, and other types of bulk bags. All these bags are generally made from polypropylene, a petroleum product that makes them durable, recyclable, and temperature-resistant. Moreover, the adoption of all these types of FIBC bulk bags by several industrial applications drives the growth of the FIBC market.

The chemical & fertilizers segment held the largest share of the FIBC market. The chemical and fertilizers industries are the largest consumers of flexible intermediate bulk containers due to the higher demand for the large amount of bulk packaging of chemicals and fertilizers that can be used in agriculture as well as in other end-use industries. Chemicals and fertilizers are the fastest growing industry due to the rising demand for chemicals and fertilizers in agricultural use. The agriculture industry plays an important role in the economic development of the countries, and the rising global population is accelerating the demand for the agriculture industry due to the rising demand for food products.

The increasing transportation of chemicals and fertilizers from the manufacturing units to the end user is driving the demand for bulk bags that can be efficiently used for transportation purposes. The chemicals and fertilizers are transported in bulk quantities and are heavy in weight. Thus, the FIBC bags are the ideal solution for catering to the demand for the packaging of chemicals and fertilizers.

Asia Pacific held the largest share of the FIBC market due to the rising industrial production units in regional countries like China, India, Japan, and South Korea for industries such as consumer electronics, healthcare, pharmaceutical, and other industries that are driving the demand for the packaging material that drives the growth of the market. The continuously increasing population of the regional countries is one of the major factors for the industrial demand and development to cater to the increasing demand for consumers. The rising demand for sustainable, recyclable, and cost-effective packaging solutions is driving the demand for the FIBC market in the region.

The rising urbanization and industrialization in India and China are driving the expansion of production units that are driving the demand for the market. Furthermore, the rising foreign investment in the development of industries and rising foreign trade in the countries are further expanding the demand for the FIBC market in the countries.

North America is observed to grow at the fastest rate owing to the higher availability of large-scale manufacturing units and the number of end-use industries that are continuously in demand for efficient and cost-effective solutions to the packaging of products. The rising demand for sustainable, recyclable packaging material for the large-scale packaging of products is driving the growth of the market. The rising investment in industrial development and the launch of new manufacturing units in the region are anticipated to drive the demand for the FIBC market.

The U.S. is expecting equivalent growth in the market with the rising presence of major industrial manufacturing hubs such as pharmaceutical, automotive, food and beverages, chemical, etc., which will contribute to the expansion of the market. Additionally, the increasing awareness about recyclability and sustainability in packaging, as well as in other industries due to the increasing global warming, is also one of the factors positively impacting the growth of the FIBC market in the country.

By Packaging

By Capacity

By End-User

By Region

December 2025

December 2025

December 2025

December 2025