April 2025

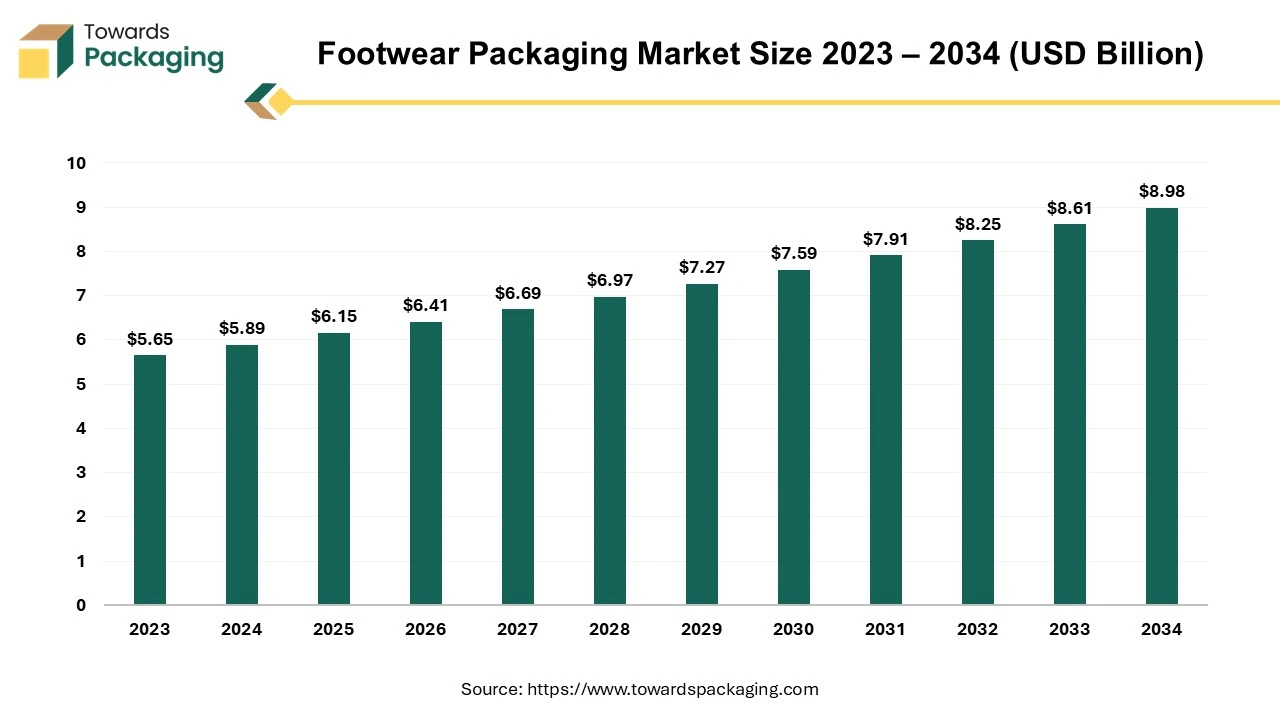

The footwear packaging market is anticipated to grow from USD 6.15 billion in 2025 to USD 8.98 billion by 2034, with a compound annual growth rate (CAGR) of 4.3% during the forecast period from 2025 to 2034.

Footwear packaging, which includes shoe boxes, heel boxes, and sleeper containers, acts as a protective barrier for footwear products. Packaging in the footwear business serves an important role as brand collateral in addition to protecting products during transit. Specialize in creating custom packaging solutions that improve brand awareness and quality for a variety of prominent fashion and footwear companies. In today's competitive market, marketers, business owners, and designers alike must invest in visually appealing and dependable packaging. Packaging not only improves brand looks but also helps to differentiate a company in a saturated market.

In footwear market retail sales forecasted to reach $352 billion in 2023 with 7.8 % increase rate. Leading footwear companies such as Nike, adidas, sketchers, Van Heusen, Jimmy choo and other footwear brands uses premium packaging for customers which is the most important part of footwear to protect and unboxing experience.

By focusing on package perfection, these brands effectively engage customers and strengthen brand identity. In summary, footwear packaging has evolved beyond its practical purpose to become a strategic instrument for brand positioning and consumer involvement in today's dynamic fashion and footwear market.

In July 2022, Coats Group Plc said in a statement with the London Stock Exchange that it has reached a formal agreement to purchase 100% of Texon International Group Limited. Texon manufactures structural components for the global footwear, accessories, and garment sectors and operates in Asia and Europe.

North America dominates the global footwear packaging business, home to several of the world's major footwear brands. To improve product protection and appeal, these brands place a high priority on high-end, personalized packaging solutions. The United States is the tenth largest shoe manufacturer in the globe, which accounts for 21% of total footwear output. Nike, the biggest brand, produces an impressive $46.7 billion in sales in the United States.

Mexico has 8,996 plants that produce 250 million pairs every year, with Guanajuato making 156.2 million pairs alone. Brazil, known for its high-quality brands such as Calvin Klein, Neiman Marcus, and Gucci, produces an astounding 800 million pairs each year.

Sales of Converse and Nike Brand in the US comprised about 43% of the total sales in the fiscal year 2023, a modest rise from 40% the year before. Nike's distribution network includes thousands of retail locations in a variety of industries, such as department stores, sporting goods stores, and shoe stores. Together, the top three American clients accounted for around 22% of all sales in the nation during this fiscal year. This strong showing emphasizes the strategic value of efficient packaging solutions in North America and the importance of the continent in the global footwear market.

In May 2023, A long-term supply deal was announced by Dow and New Energy Blue for North America, whereby New Energy Blue will produce bio-based ethylene using sustainable agricultural leftovers.

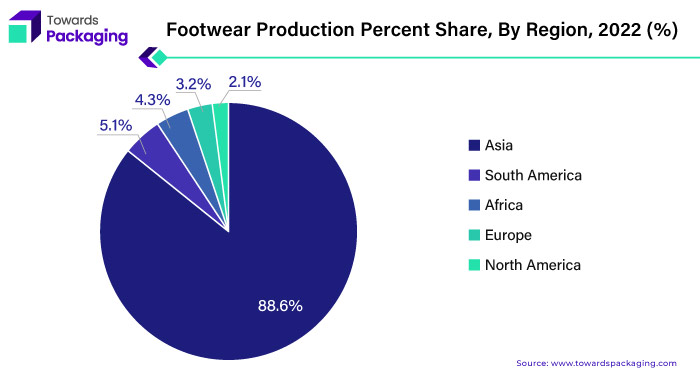

Asia Pacific emerges as the second most important region in the footwear packaging industry, owing to high demand for packaging materials such as paper cardboard and corrugated boxes. The region's importance is highlighted by its role as a footwear manufacturing hub, with items frequently spending extended periods of time in transit or storage via container ships.

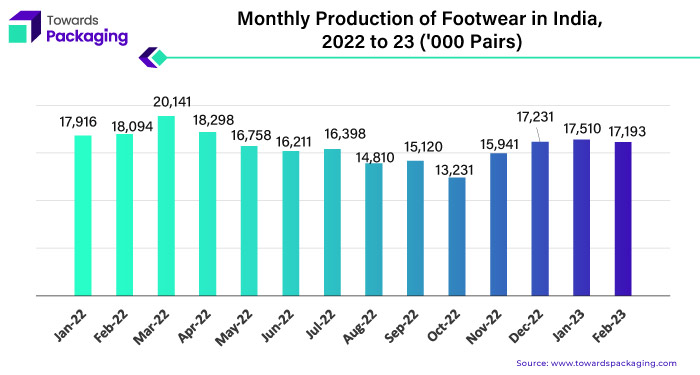

India contributes to the largest share in the production of footwear. China dominates global production, producing a whopping 60% of all shoes, reaching 13 billion pairs every year. This output serves both domestic and international markets. Vietnam follows closely after, with around one billion pairs exported annually, valued at $20.78 billion, made possible by its vast network of 2,200 shoe factories. Indonesia stands third for manufacturing and sixth in exports, producing 1.4 billion pairs annually worth $5.19 billion.

Thailand targets a market value of $2.66 billion by 2023 and contributes to the industry with 245 million pairs annually. The country offers a variety of items, including sandals, leather shoes, and sneakers. In the meantime, 483 million pairs are produced annually in Pakistan's 80,000 factories, mostly for export to the US, Europe, and Arab nations.

The footwear packaging market is expanding at a remarkable rate in the Asia Pacific countries that have the largest packaging markets, which is indicative of the region's significant position in the global footwear sector.

Corrugated boxes are the most popular product category in the footwear packaging market since they are used to transport and handle finished goods in a variety of manufacturing sectors. The capacity of corrugated packaging to preserve footwear items' shape, color, and look while providing total protection for them during transit is what drives demand for it.

Technological developments in digital printing, high-speed automatic gear, and the advent of e-commerce are driving this market's explosive boom. Corrugated boxes' affordability, recyclability, robustness, and durability, are preferred by customers. corrugated cardboard Made of three layers of sheets, these boxes trap air traps in these boxes and provide a cushioning effect that protects the contents while being transported.

Shoeboxes are often employed as point-of-sale display items, and YouTube videos featuring their unboxings are common. E-commerce does, however, come with certain drawbacks, as shoes may be kept in storage for long periods before dispatch, raising the possibility of damage occurring during transport.

As a package producer with FSC accreditation, put sustainability first by obtaining paper from forests that are ethically managed, which uses 30–50% less energy than conventional paper production techniques. Visually appealing packaging encourages consumers to reuse it, which lowers landfill waste and promotes environmental conservation.

In April 2022, Nike unveiled the One Box initiative. Nike has spent the last few months researching how to make shoe packing and shipping more environmentally friendly. With One Box, sneakers will never again be double-boxed. Rich Hastings describes what inspired the concept.

Shoes are the major product in the footwear packaging market, providing a comfort and stylish essential for men and women alike. Thanks to their adaptable design, cardboard shoeboxes are praised by producers, shippers, retailers, and customers. In addition to providing physical protection and optimizing shipping space, these boxes may be stacked and used as powerful display tools in retail establishments. Both the volume of shoes sold and how many shoes are shown at the point of sale have increased dramatically in the footwear industry.

Once controlled by industry titans like PUMA, ADIDAS, and NIKE, the "Sports Shoes" market has grown to encompass more than 20 well-known companies with substantial global sales statistics. India also established its clusters by utilizing methods that foreign brands pioneered, especially in the "sports shoes" market.

The shoe industry has innovated gradually but successfully, adapting to changing retail customer needs. To satisfy customer needs, this creative push for innovation has resulted in inventive developments in building materials and techniques. The division of shoes into "Sports" footwear is a prime example. Multinational firms, whose success depended on creative style, innovative materials, and performance-focused designs, first dominated this market.

The usage of silica gel in footwear packaging is a crucial component that is frequently disregarded. These desiccant packets help prolong the life and general quality of the goods by absorbing moisture and keeping shoes dry and free of moisture during storage and transportation.

In November 2021, The Nature Conservancy is a global environmental nonprofit. Skechers USA, The Comfort Technology CompanyTM, announced that the brand has been working with the organization for many years and contributed an initial donation of $800,000 to help the organization fulfill its purpose of protecting the lands and seas of our planet.

The practice of distributing packaged footwear items to final consumers through a variety of retail channels is referred to as retail distribution sales in the footwear packaging sector. Several important parties are usually involved in this distribution network, such as retailers, wholesalers, manufacturers, and finally the end users. Shoeboxes and other appropriate packaging are used by manufacturers to package their footwear products for display and delivery. After packaging, these goods are sent either straight to retailers or to wholesalers.

Footwear has a visual appeal and comfortable sizing that draws customers to retail stores. Well-known companies have opened stores in several areas, making these reliable footwear brands easily accessible to customers. The broad accessibility of this product improves consumer convenience and supports the general prosperity of retail distribution sales in the market for footwear packaging.

Retailers display and sell packaged footwear products to customers. These could be niche shops, online merchants, or physical establishments. Retailers are vital to the footwear packaging sector because they ensure product availability, present products in an enticing manner, and provide clients with a positive shopping experience.

In June 2023, the innovative pre-owned children's concept store Kidkanai, opened by French retailer Kiabi, is a product of a partnership between Nexgen Packaging, a leading supplier of environmentally friendly cartons and paper fiberboard hangers, and the store. Kidkanai benefited from Nexgen Packaging's production of its Ditto environmentally friendly hangers, which allowed the retailer to better match with its objective for sustainability in the retail industry.

The competitive landscape of the footwear packaging market is dominated by established industry giants such as Elevate Packaging, Viupax, Packman, Royal Packers, Precious Packaging, Cross Country Box Company, Great Little Box Company, SNEAKERBOX, Kanishka Printer, Nike, Merrypak, Marber, Wolverine Worldwide and Skechers. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

ViupaxTM offers a unique form that uses up to 50% less space than conventional shoe boxes. Boost container packing effectiveness and drastically cut down on environmental impact.

For Instance,

Skechers prioritizes sustainable packaging. Constantly looking for new ways to improve use of ecologically friendly materials, and undertake frequent assessments to guarantee that these products are FSC-certified, recycled, or ethically obtained. Shoeboxes that comply with the FSC® criteria for responsible sources hold 99% of the footwear bearing the Skechers brand.

For Instance,

By Packaging Type

By Footwear Type

By Distribution

By Region

April 2025

April 2025

April 2025

April 2025