Industrial Drums Market Intelligence Report, Key Trends, Innovations & Market Dynamics

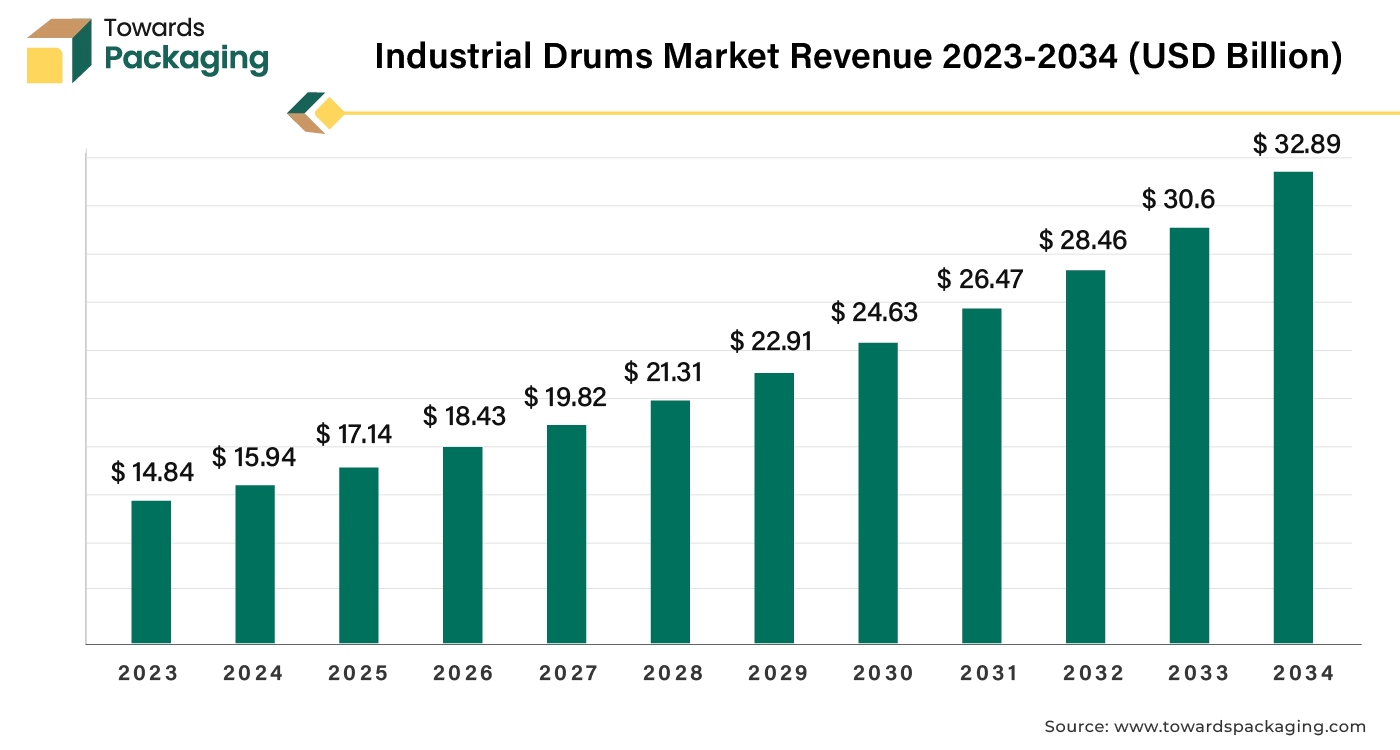

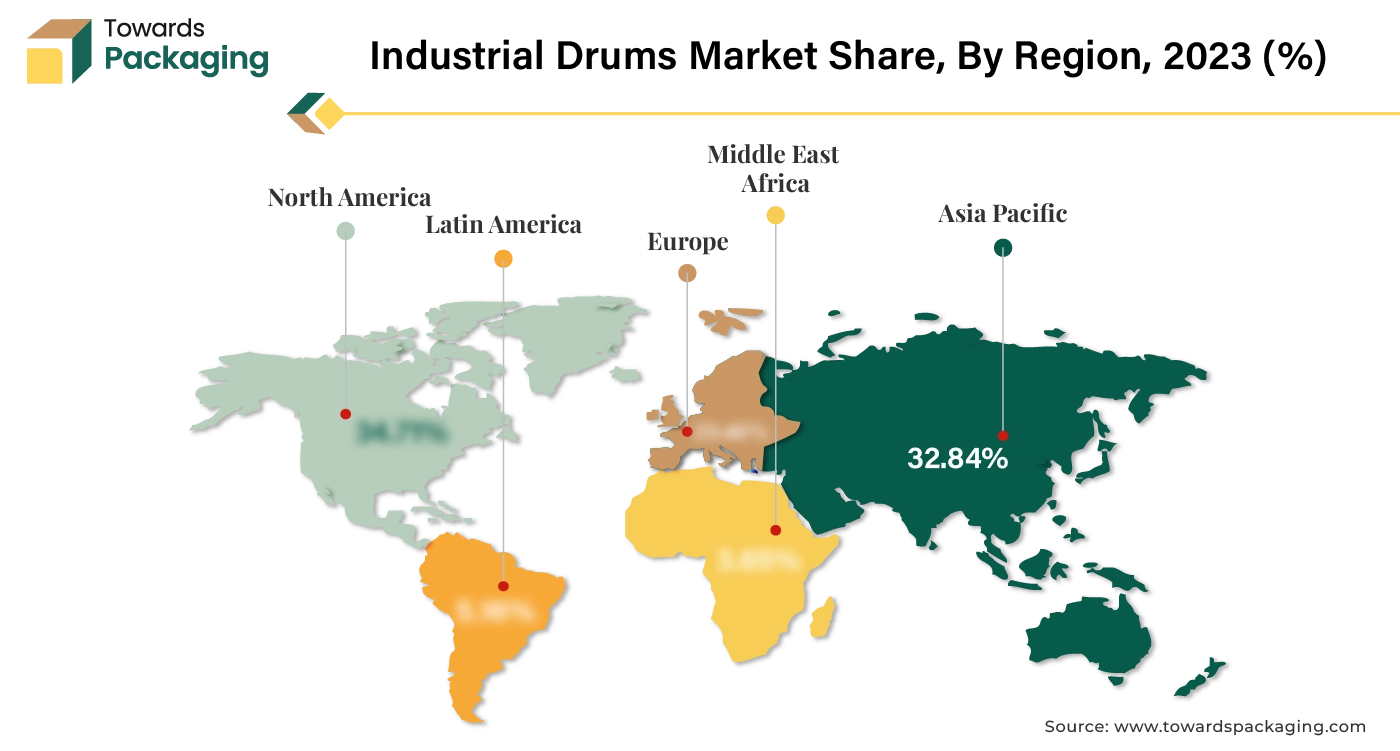

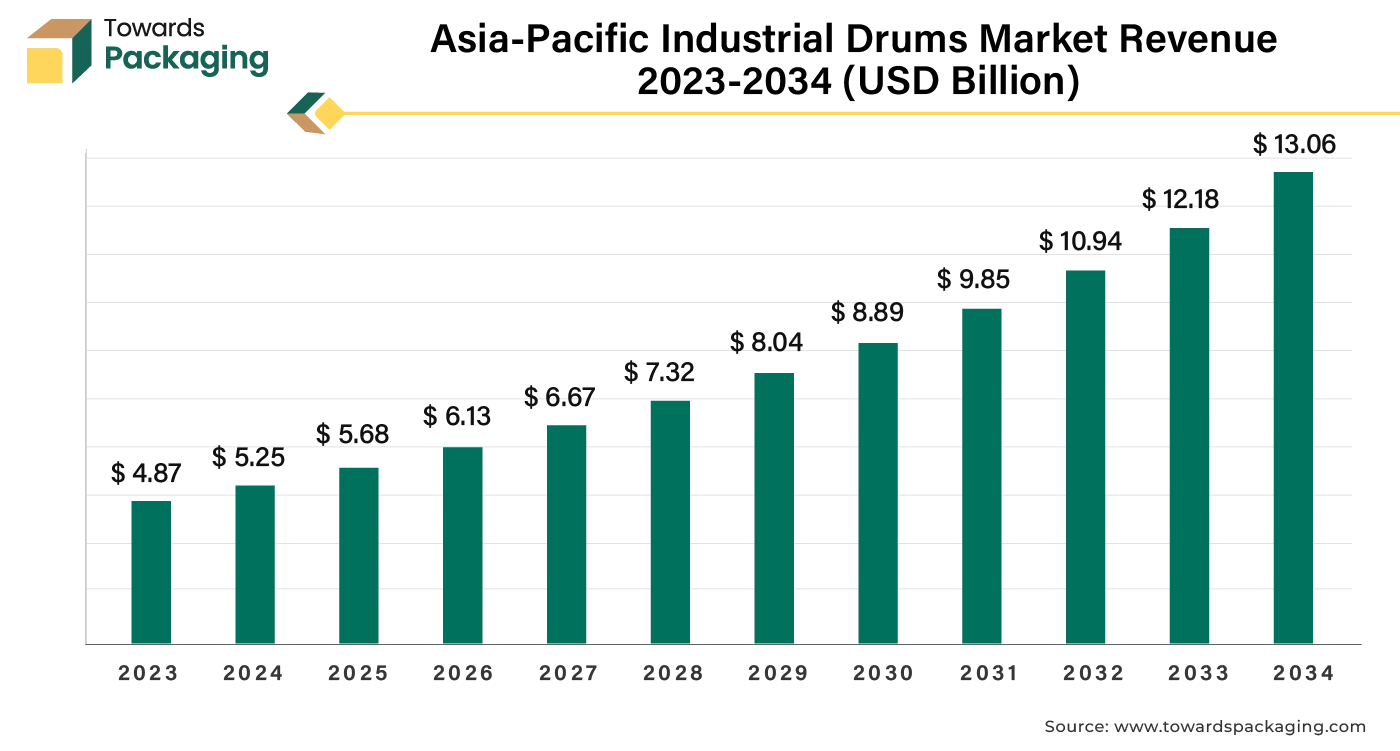

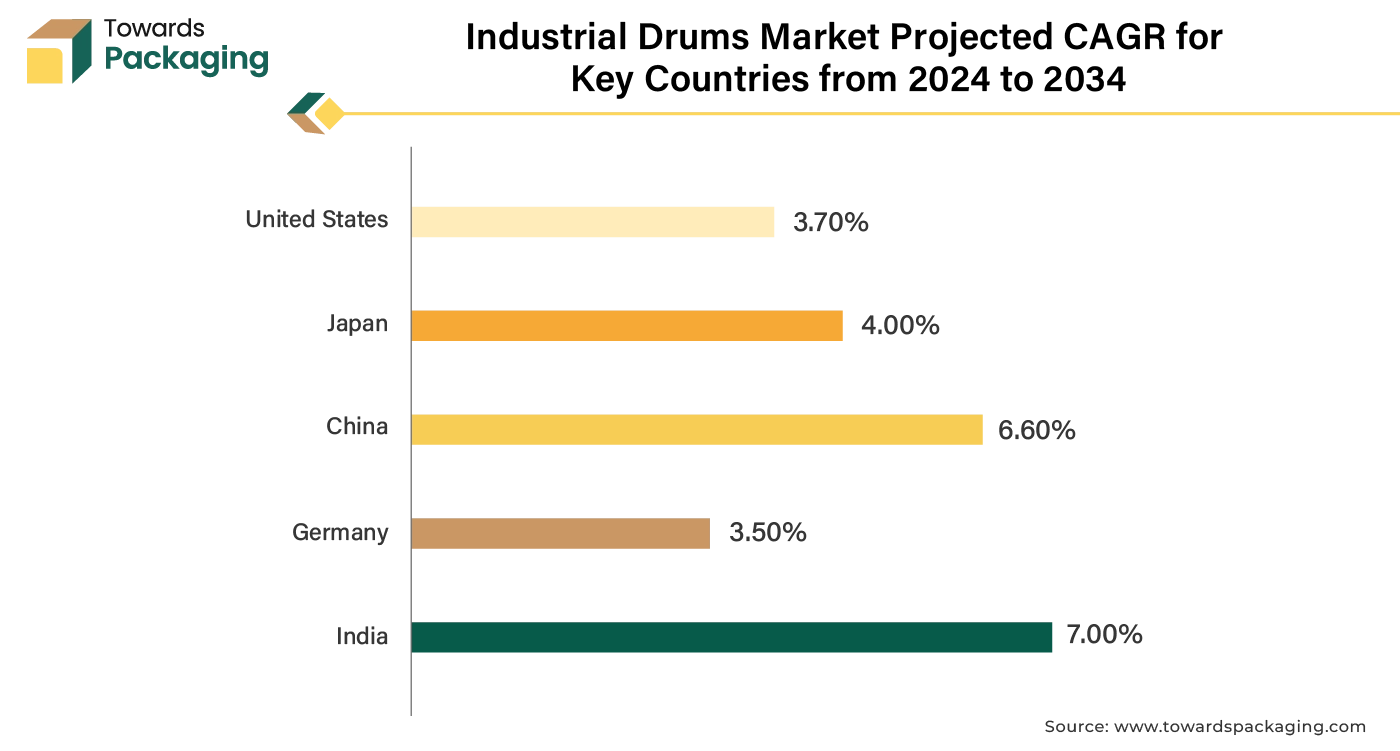

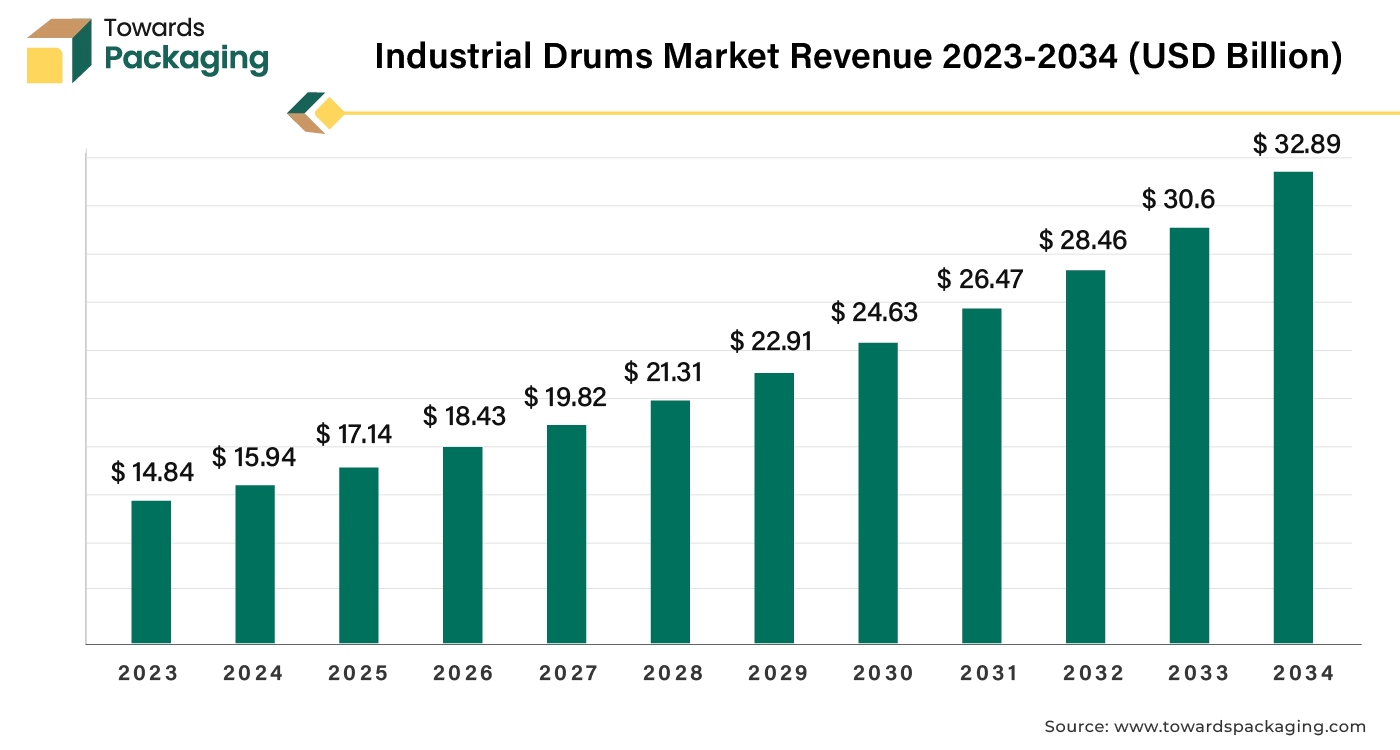

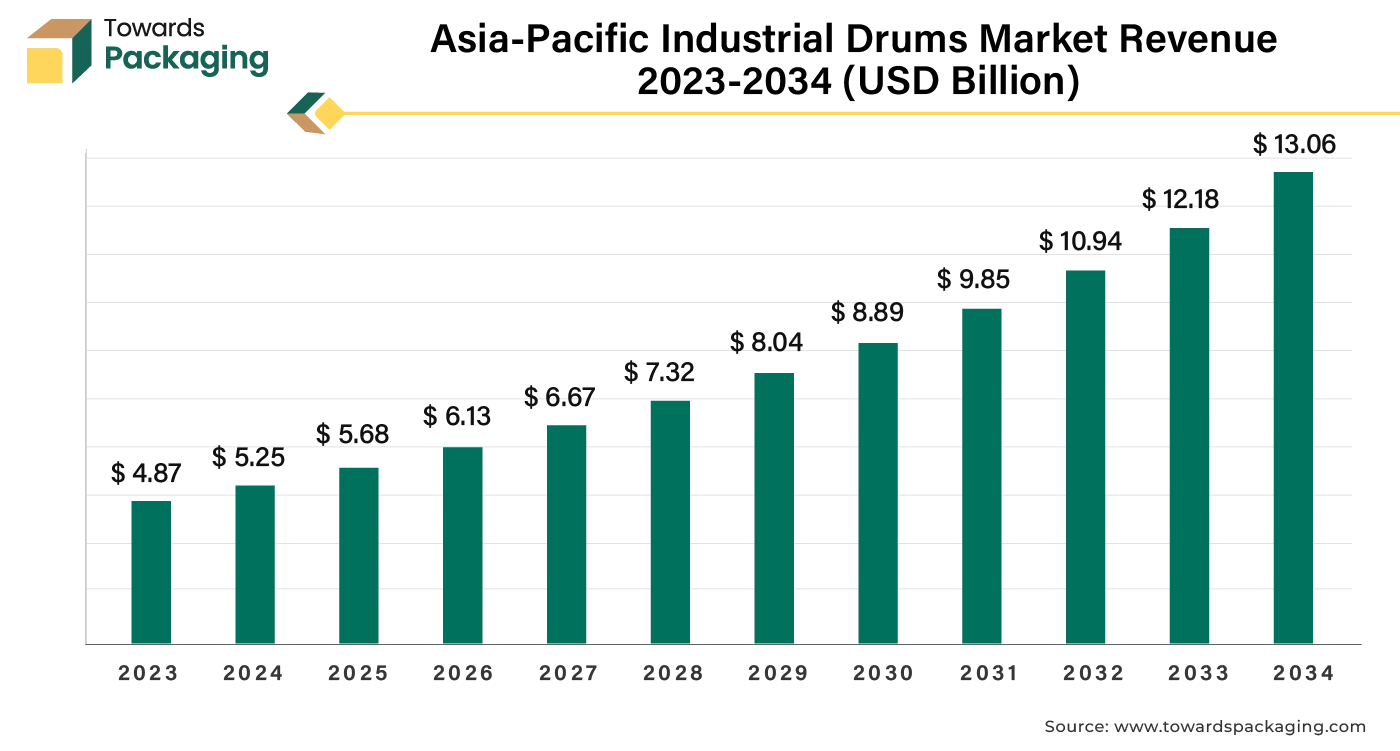

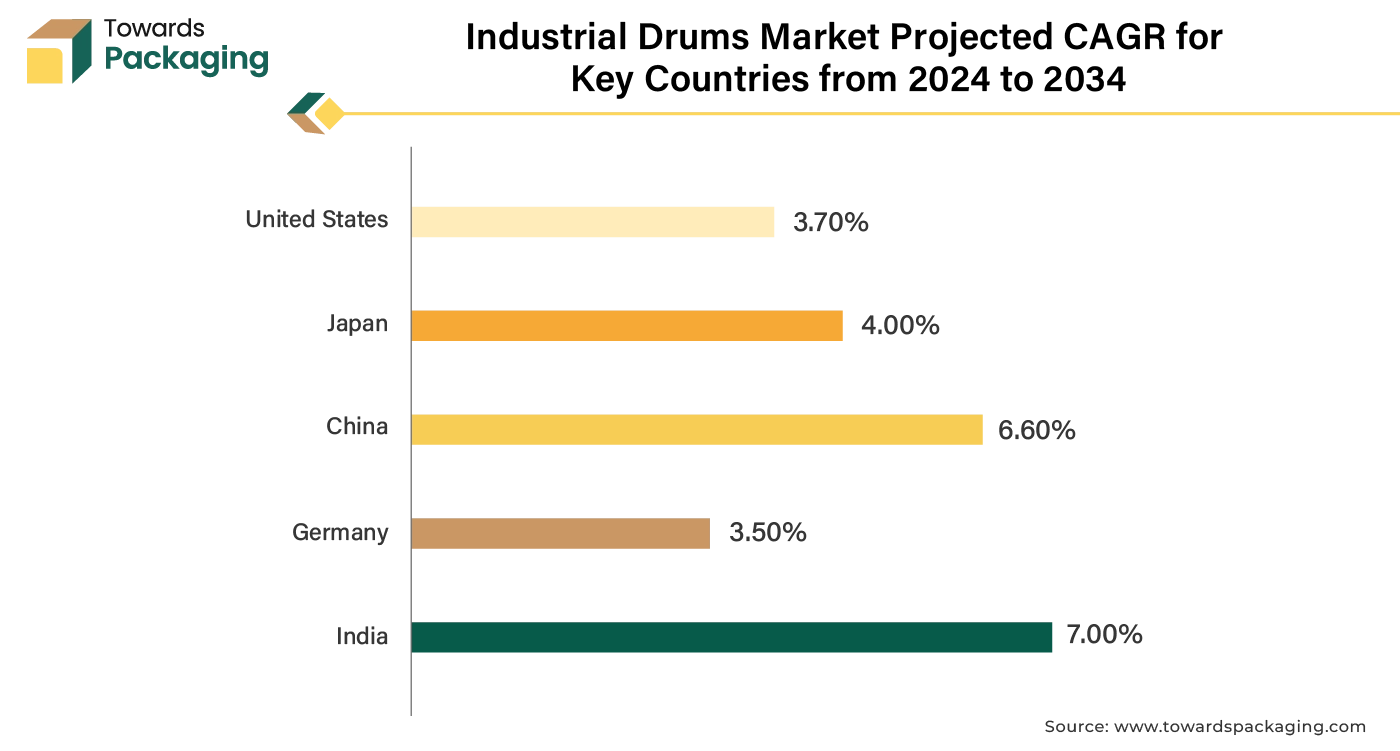

The industrial drums market covers complete sizing and forecasts from USD 17.14 billion in 2025 to USD 32.89 billion by 2034 (7.35% CAGR), with full segment data by product (steel, plastic, fiber), capacity (<100, 100–250, 251–500, >500 L), and end use (chemicals, F&B, petroleum & lubes, pharma, paints/inks/dyes, others). We provide regional statistics for North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, noting APAC’s 2024 lead, North America’s fastest growth, and steel drums and 100–250 L capacity dominance in 2024. The study includes company profiles and shares (Greif, Mauser, Schütz, Balmer Lawrie, Time Technoplast, TPL Plastech, Snyder, and more), competitive analysis, value chain and cost structure, plus trade flows, import/export prices, and manufacturer–supplier databases, with all tables, charts, and growth drivers/risks quantified.

Industrial Drums Market Key Takeaways

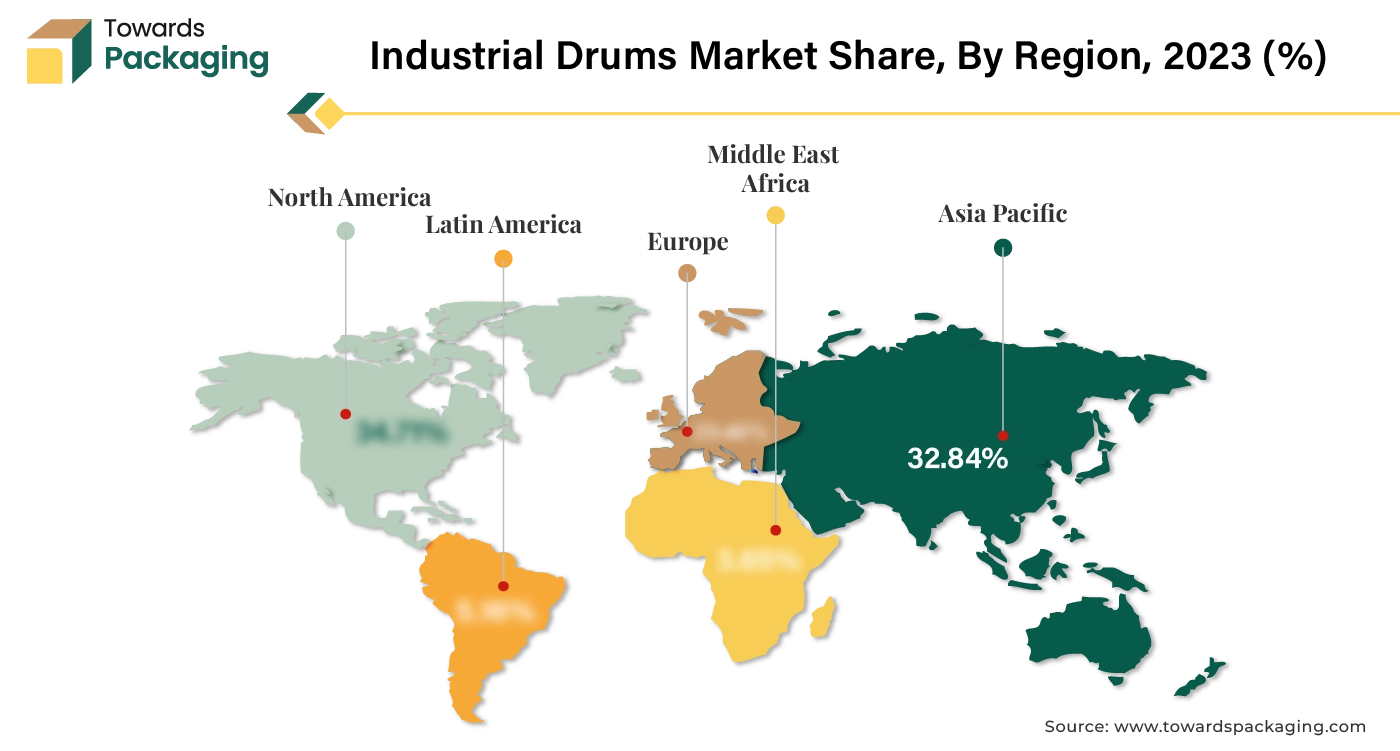

- Asia Pacific dominated the industrial drums market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

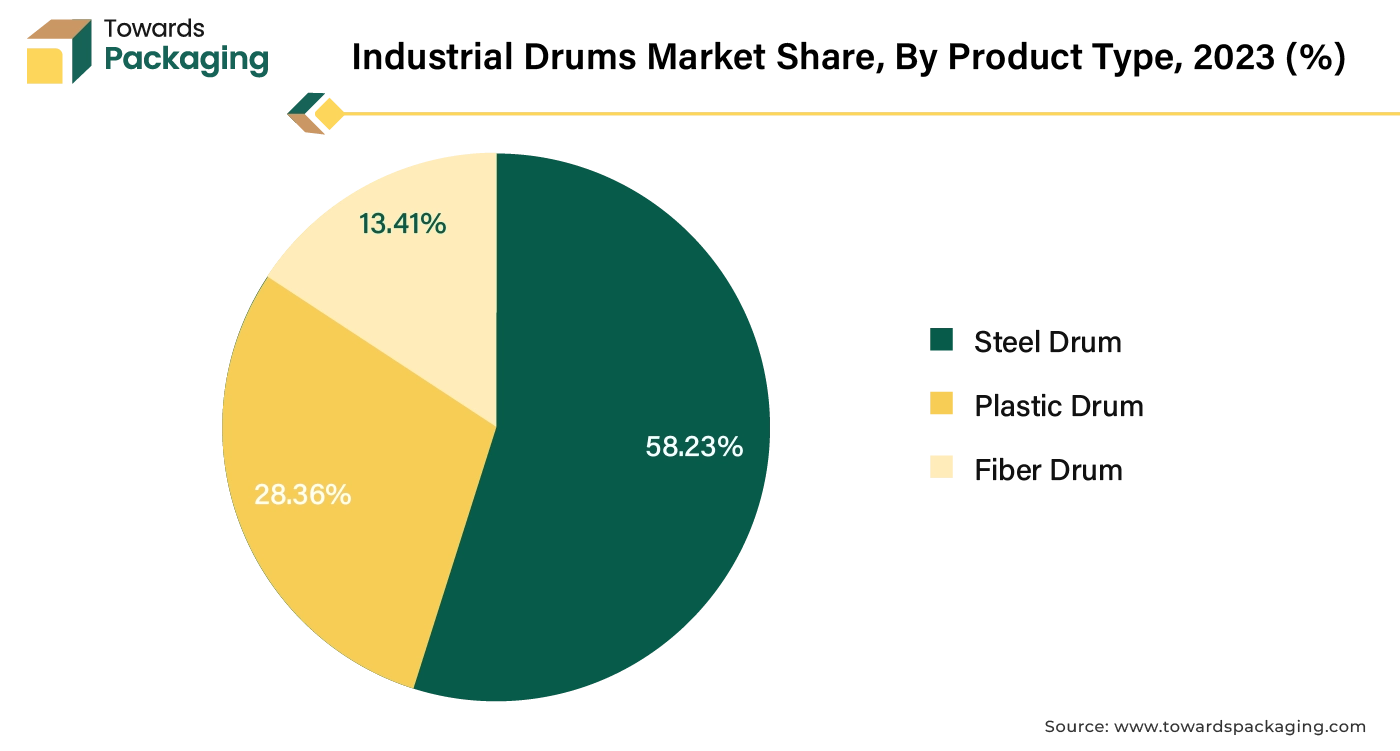

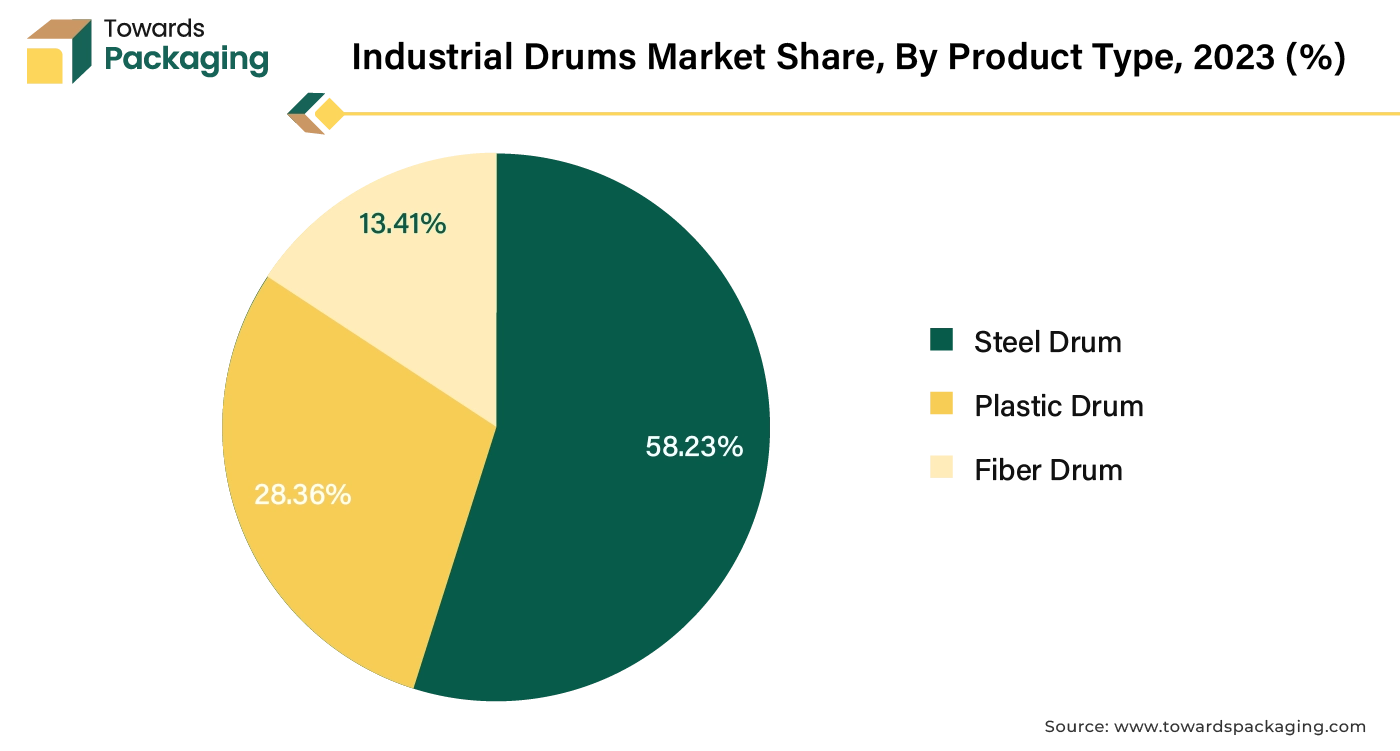

- By product type, the steel drums segment dominated the market with the largest share in 2024.

- By capacity, the 100 to 250 liters segment dominated the industrial bulk packaging market in 2024.

- By End Use, chemicals segment shown the significant growth rate during the forecast period.

Industrial Drums Market Overview

Commercial Drums are large, cylindrical industrial containers known as "industrial drums" are mostly used for storage and transportation. Industrial drums, one of the earliest forms of container, are used mostly for bulk products storage and transportation (mostly liquids). Industrial drums are affordable, durable, and strong. Above all, they work well to guarantee that the items kept inside are kept safe from harm and contaminates. These drums' robust features provide effective storage while still being environmentally friendly. They are typically made of materials like steel, plastic, or fiberboard. Steel drums are sturdy and can be either carbon steel or stainless steel. They are often used for hazardous materials, chemicals, and heavy-duty applications. They come in different gauges and can be either open-head or tight-head. Plastic drum are made from high-density polyethylene (HDPE) or other plastic materials, these drums are lightweight, resistant to corrosion, and suitable for chemicals, food products, and pharmaceuticals.

They also come in open-head and tight-head varieties. Fiber drums are constructed from fiberboard or composite materials, these are lighter than metal drums and are used for dry bulk goods like powders and granules. They are less durable than metal or plastic drums and are often used for non-hazardous materials. Open-head drums have a removable lid secured with a ring or clamp. They are useful for products that need to be accessed frequently or require filling and emptying. Tight-head drums also known as closed-head drums, these have a non-removable lid with small bungs for filling and dispensing.

Drums typically feature bottom and top rims, sometimes known as chines. The majority of steel drums feature plastic or metal rings or rolling hoops for reinforcement. This gives them enough strength to allow them to be easily flipped over and rolled when loaded down with heavy objects, such as liquids. Drums may be balanced, tilted, and rolled on their bottom rim across short to medium distances. The torque, or rolling force, is provided by a two-handed top grip that is also used to rotate the drum. The global packaging market size is growing at a 3.16% CAGR.

Top 5 Factors to Shape the Industrial Drums Market to Grow

- Increasing in adoption of the advanced technology for the production of liquid carton packaging is estimated to drive the growth of the global industrial drums market in the near future.

- The key players operating in the market are focused on geographic expansion and launching their brand in other countries which is expected to drive the growth of the global industrial drums market in the near future.

- Emerging markets and trends for liquid carton packaging is expected to drive the growth of the global industrial drums market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

How Can AI Improve the Industrial Drums Industry?

AI can analyze data from sensors to predict when drums or related equipment will require maintenance or replacement. This minimizes downtime and reduces operational costs, leading to increased efficiency and customer satisfaction. AI-driven vision systems can detect defects or inconsistencies in drum manufacturing, ensuring higher quality products and reducing waste. Improved product reliability can boost customer confidence and expand market share. AI can enhance inventory management and demand forecasting, leading to more efficient production schedules and reduced excess inventory.

This responsiveness can improve profitability and competitiveness. AI can enable more flexible manufacturing processes, allowing for custom designs and specifications based on customer needs. This can attract new clients looking for tailored solutions and expand market opportunities. In the industrial drums industry, AI can optimize production processes for energy usage, reducing costs and environmental impact.

This can appeal to environmentally conscious customers and comply with regulatory standards. AI can analyze industrial drums market trends and customer preferences, providing valuable insights for strategic decision-making and product development. This helps companies adapt to changing demands and identify new growth opportunities. AI can analyze market trends and customer preferences, providing valuable insights for strategic decision-making and product development. This helps companies adapt to changing demands and identify new growth opportunities. By leveraging AI, companies in the industrial drums industry can enhance their operational efficiency, product quality, and market responsiveness, driving overall growth in the industrial drums market.

Market Dynamics

Driver

The industrial drums market is primarily driven by the rising demand for efficient bulk packaging and safety across industries such as chemicals, petrochemicals, oil and gas, food and beverages, pharmaceuticals, and agriculture. Rising worldwide trade and cross-border shipments of toxic and non-toxic materials have grown the demand for compliant, durable, and tamper-proof packaging solutions. The choice for reusable and recyclable drums is also strengthening due to sustainability goals and cost-efficiency.

Opportunity

The industrial drums serve strong opportunities through the growth of sustainable and eco-friendly materials, like recyclable plastics, lightweight steel, and fiber-based alternatives, to meet global environmental regulations. Growing integers in reconditioned and reusable drums serves cost savings and assists circular economy models. Technological advancements such as RFID tagging, IoT integration, and smart labelling are creating opportunities for perfect inventory tracking.

Rockwell’s Case Study: A Pioneer in Smart Manufacturing

For instance,

- In March 2024, Rockwell Automation, Inc., digital transformation and industrial automation company, revealed the findings of the ninth annual "State of Smart Manufacturing Report," which provides insightful information on trends, difficulties, and strategies for manufacturers throughout the world. More than 1,500 participants from 17 nations, including the U.K., France, Germany, Italy, and Spain, were polled for the study. This paper has numerous findings, but three stand out in particular: the manufacturing industry is entering a new phase of growth, technology is being used to give workers superpowers, and operational resilience is becoming more and more important.

According to manufacturers, Al is the most important capability that will lead to the greatest commercial results. In 2024, 79% of manufacturers in the U.K. anticipate using generative aluminium (GenAl) in their operations. U.K. firms anticipate using Al and ML in advanced analytics at a rate of 94%, which is higher than the global average of 91%. The biggest obstacle to integrating smart manufacturing technology in the U.K. is a lack of skill set, with 33% of respondents-the highest rate among all European nations polled.

Compared to Germany's 41% and France's 40%, only 25% of U.K. manufacturers believe they don't have the trained labor force to outperform the competition over the next 12 months. Businesses reported a 30% year-over-year growth in technology spending throughout Europe. The greatest percentage of corporations in Europe, 73% of U.K. businesses invest between 21% and 50% of their operational budget in technology. According to 34% of U.K. businesses, management at top organizations uses data to create better Al and ML applications.

Rapid Expansion of Industries to Support the Market’s Growth

The Increasing industrial activities, particularly in sectors like chemicals, pharmaceuticals, and food and beverages, drive demand for industrial drums for storage and transportation of various materials. The rise in global trade and logistics increases the need for durable packaging solutions, including industrial drums, to handle and transport bulk goods across borders. Innovations in drum materials and designs, such as corrosion-resistant coatings and sustainable materials, enhance the functionality and appeal of industrial drums in various industries. Advancements in drum manufacturing technology improve the strength, safety, and efficiency of industrial drums. Rapid industrialization in emerging economies increases the demand for industrial drums in these regions. The key players operating in the pharmaceutical company are focused on adopting inorganic growth strategies like partnership to develop pharmaceutical packaging drums and other solutions, which is estimate to drive the growth of the industrial drums market over the forecast period.

For instance,

- In January 2024, Bormioli Pharma, a company focused on providing medical devices and pharmaceutical packaging signed partnership with Loop Industries, Inc., a clean technology company focused on manufacturing 100% recycled plastic products, to develop c drums less than 100 liters with 100% recycled virgin quality Loop polyethylene terephthalate (PET) resin.

- Furthermore, in March 2024, SOLIZE India, technology solution providing company signed partnership with Scapos AG, engineering solutions and software company, for revolutionising industrial packaging designs.

High Cost of Initial Investment and Availability of Alternatives Options to Hamper Market Growth

The primary factor restricting the market's expansion is the substantial initial outlay needed for the production and acquisition of industrial drums. A lot of small and medium-sized businesses also need to produce more drums; therefore, they choose less expensive options. Additionally, the weight of these drums has a big impact on the cost of shipping. Further impeding the growth of the market is the fact that manufacturers are choosing lighter packaging options due to the high shipping costs associated with hefty drums for long-distance transportation. The availability of different bulk containers, flexi tanks, and intermediate bulk containers (BC) would potentially restrict the market's growth.

Expansion of End-users to Offer Multiple Opportunities to the Market

Industrial drums are affordable, robust, and long-lasting. Above all, their efficacy is in guaranteeing the comprehensive safeguarding of the merchandise kept within against harm and pollution. These drums are environmentally sustainable in addition to providing effective storage thanks to their robust characteristics. Drums are a great option for storing and transporting items in a variety of sectors because of their properties. The chemical industries have increased their demand for these drums since they are frequently composed of high-density polyethylene or steel, which offers outstanding chemical resistance and prevents leaks or spills. Additionally, these drums are a crucial means of transportation for bulk materials, liquids, and powders in the food and beverage industry, which contributes to the industrial drums market growth.

Sturdy Steel Drums to Remain the Largest Share Holder

The steel drums segment held the dominating share of the industrial drums market in 2024. The steel drums are robust and can withstand heavy handling and harsh environments, making them ideal for storing and transporting hazardous or heavy materials. They offer excellent resistance to a wide range of chemicals, making them suitable for containing chemicals, oils, and other potentially corrosive substances. Steel drums provide a tight seal and can be fitted with secure closures to prevent leaks and contamination, ensuring the safe handling of sensitive materials. Steel drums are durable enough to be reused multiple times, and they can be recycled at the end of their lifecycle, which is beneficial for environmental sustainability.

They come in standardized sizes, such as 55 gallons, which simplifies logistics and handling across various industries. Steel drums can handle a wide range of temperatures without degrading, making them suitable for both high and low-temperature storage needs. These properties make steel drums a versatile and reliable choice for industrial applications. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to develop and expand industrial packaging, which is estimated to drive the growth of the segment over the forecast period.

For instance,

- In December 2021, Novvia Group, company focused on distribution of life sciences packaging, signed acquisition agreement with JWJ Packaging, a company focused on supplying drums and other rigid containers and based in U.S. The acquisition helped both the companies to expand its product offering by including intermediate bulk containers, steel and plastic drums and other shipping accessories.

The plastic drums segment is expected to grow at fastest rate over the forecast period. Plastic drums are lighter than metal drums, reducing shipping costs and making handling easier. They are resistant to impacts, corrosion, and weather conditions, which helps protect contents during transit. Generally, less expensive than metal drums, both in terms of initial cost and long-term maintenance. They often have features such as secure, tamper-evident lids and can be less prone to leaks compared to metal drums. Many plastic drums are designed to be stackable, which optimizes storage space and reduces shipping costs. Suitable for a wide range of materials, including hazardous and non-hazardous goods. Overall, these benefits contribute to reducing shipping costs and improving the safety and efficiency of transporting goods.

Storage Capacity 100-250 Liters Drums to Lead the Market

The 100 to 250 liters segment held the significant share in 2024. Drums with capacities ranging from 100 to 250 liters are commonly used for various purposes, including storage and transportation of liquids and solids. Suitable for storing chemicals, oils, food products, and other liquids or solids. Made from materials like steel, plastic, or fiber, which can withstand harsh conditions and heavy usage. Larger volumes can reduce the number of containers needed, which can lower overall costs. The 100 to 250 liters drum provides a compact storage solution, optimizing space in warehouses or facilities. Many come with features like lifting rings, bungs, or handles that simplify moving and pouring.

Depending on the material, drums can often be cleaned and reused, which is environmentally friendly. These drums are useful across a range of industries, including manufacturing, agriculture, and logistics. Due to increasing smuggling activities the demand for the 100 to 250 liters drums have increased due to its large quantity and compact storage solutions. Moreover, due to increasing war like situation the need for compact solution drums increased to transport oils which is estimated to drive the segment over the forecast period.

For instance,

- In June 2024, according to the data published by the International Bar Association, international membership organisation for legal practitioners, reported that Russia's economy experienced a 5.5 percent GDP growth in the third quarter of 2023 as a result of the war in Ukraine and the international sanctions that followed. The country's continued export of oil and gas with minimal obstacles has been made possible by sanctions loopholes and Russian ingenuity, which have allowed the country to skirt international law and continue growing economically. Oil supplies have been diverted by Russia to countries like China and India; refined oil eventually finds its way to Western nations. Since July 11, 2023, the price of Urals has risen above the US$60 price cap, making it more important to assess compliance with sanctions.

Less than 100 liters segment is estimated to grow at fastest rate over the forecast period. The less than 100 liters drum is often used for water tanks, for storing fishes, as home décor for storing material, etc. The less than 100 liters drums are ideal for locations where space is limited, such as small apartments or compact commercial areas. Many less than 100 liters drums are lightweight and easier to move or relocate as needed. Generally, less expensive than larger versions, making them budget-friendly for specific needs. The less than 100 liters are perfect for targeted uses like storing small quantities of liquids, keeping items cool, or managing waste in confined spaces. Smaller units are often easier to clean and maintain due to their size. Overall, these less than 100 liters drums segments offer practical solutions for managing space and resources effectively.

Expanding Chemical Industry to Hold the Lion’s Share

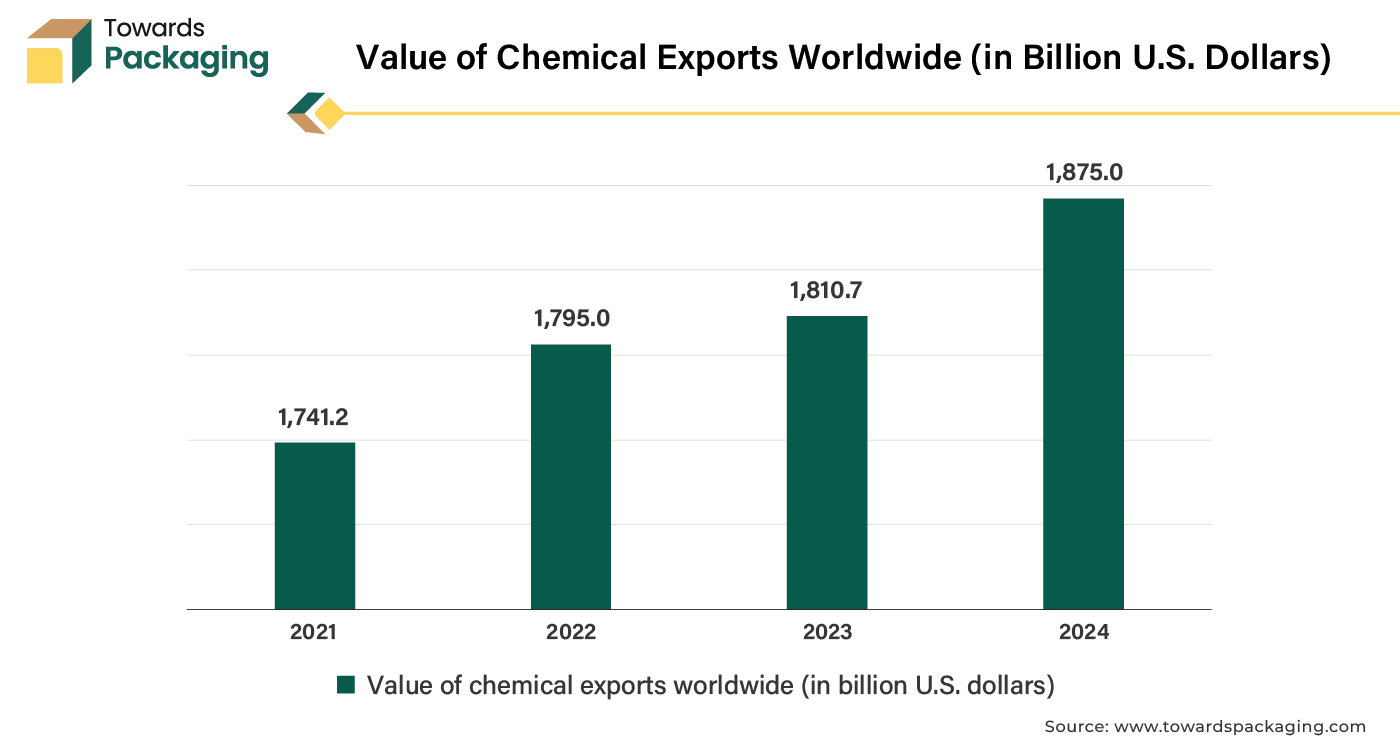

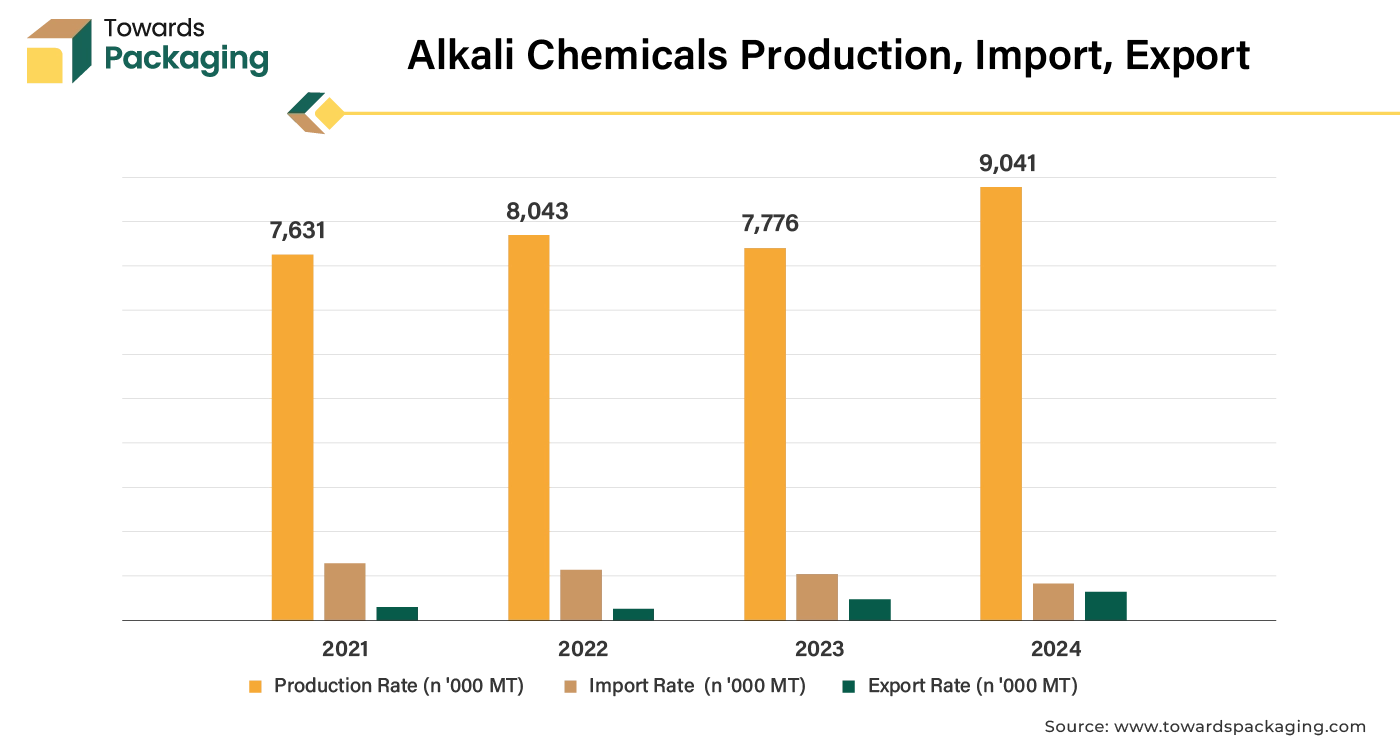

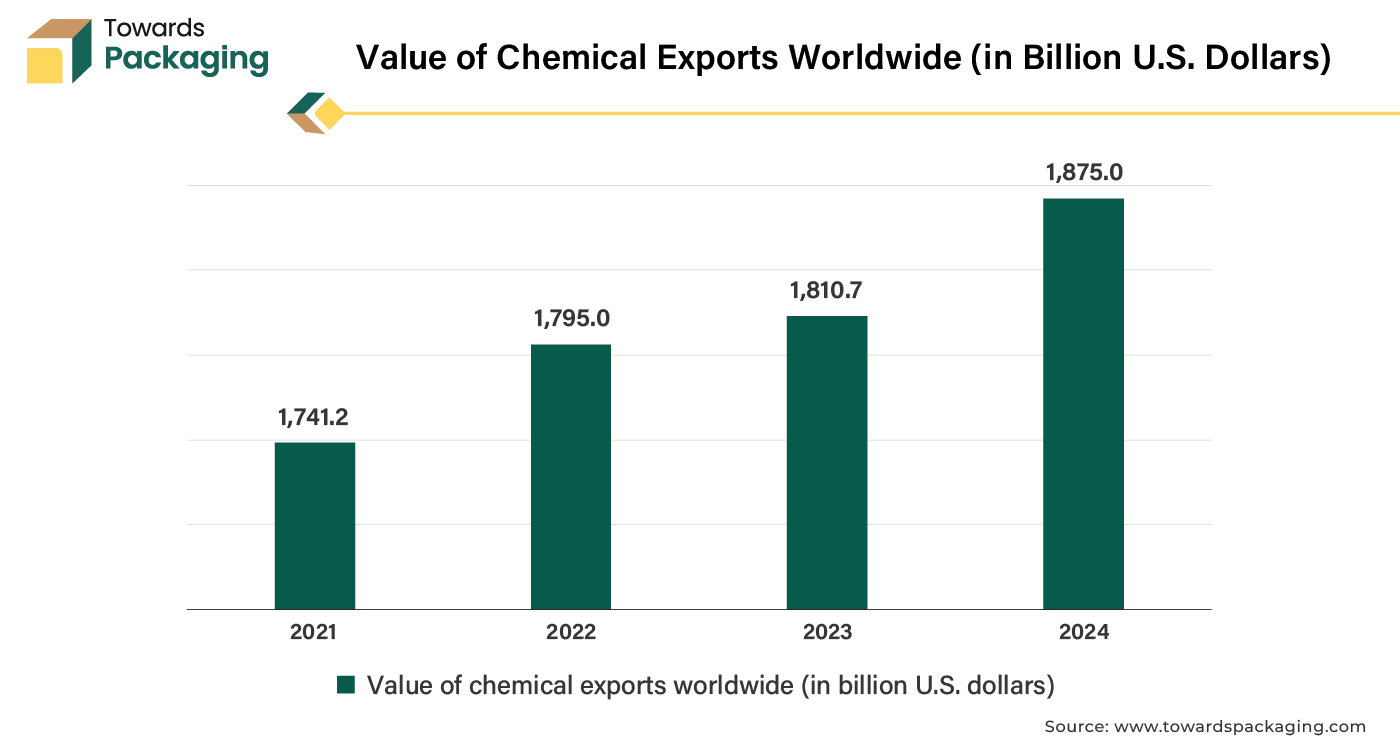

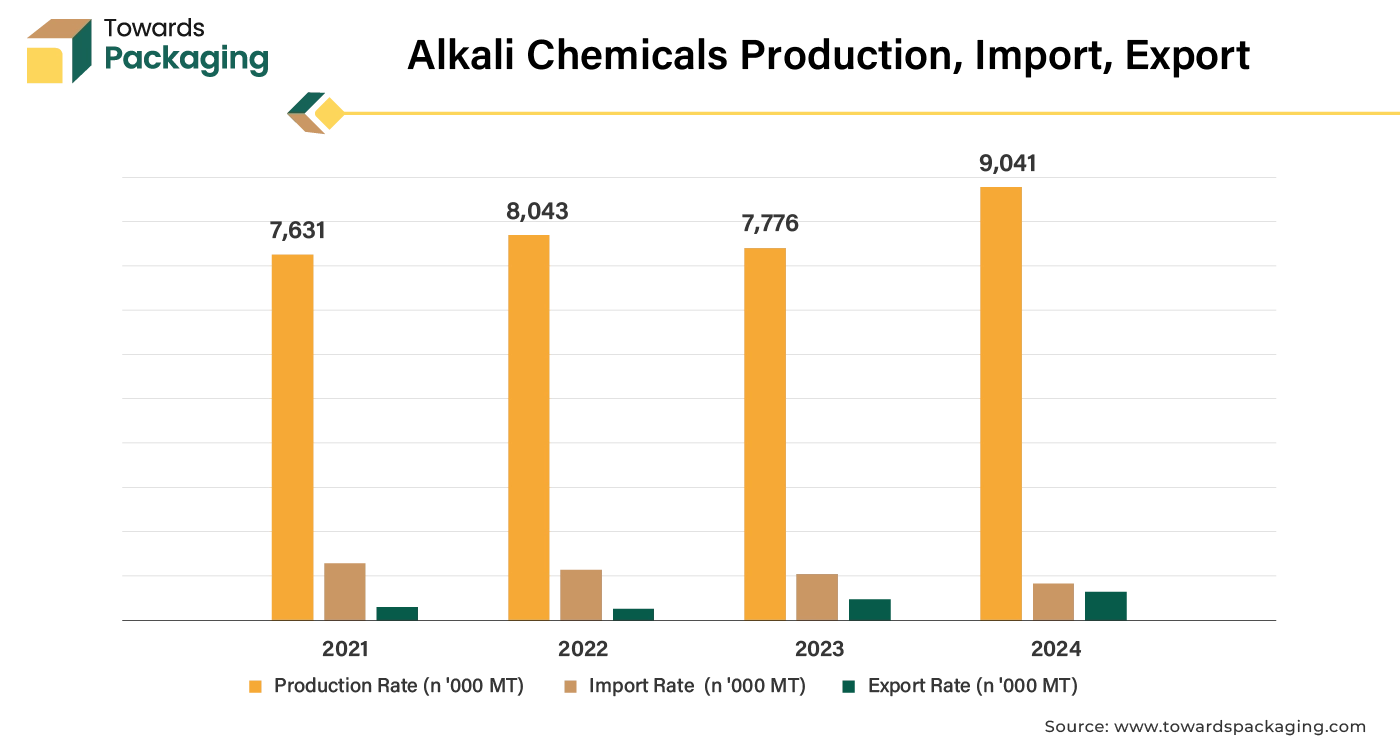

The chemicals segment held the significant share in 2024. Industrial drums are becoming increasingly popular in the chemical industry because they provide a reliable containment solution for corrosive compounds and hazardous liquids. Additionally, they offer superior chemical resistance and stop dangerous liquids or chemicals from leaking or spilling, which contributes to the segment's rapid expansion. Rapid industrialization has risen the chemical exportation which is estimated to drive the growth of the segment over the forecast period.

For instance,

- In June 2024, according to the data published by the International Council of Chemical Associations, trade association it reported that the chemical production has risen up by 3.4% globally in 2024.

Both steel and plastic drums are used for the safe storage and transportation of chemicals, helping to prevent leaks and spills. Regulations and safety standards in the chemical industry drive the need for reliable containment solutions. Steel drums offer high durability and strength, making them suitable for heavy or corrosive chemicals. Plastic barrels, on the other hand, are resistant to many chemicals and are lighter, which makes them easier to handle and transport. Modern drums can be customized for various chemical properties, including resistance to specific substances and different capacities. This flexibility meets the diverse needs of the chemical industry. Moreover, rapid growth in chemical industry sector as compared to other industry also estimated the rapid growth of the segment over the forecast period.

The food & beverages segment is expected to grow at fastest rate over the forecast period. Drums are efficient for bulk storage and transportation of liquids and semi-liquids, helping streamline logistics and reduce costs. Drums provide a sealed environment that helps in preserving the quality of food and beverage products, protecting them from contamination and spoilage. The industry often requires specific packaging solutions that comply with health and safety regulations, and drums can meet these standards. Many drums are designed to be reusable and recyclable, aligning with the industry's push towards more sustainable practices. As food and beverage companies expand and increase production, the demand for efficient bulk handling solutions like drums grows. Overall, these factors contribute to the increased demand for drums in the food and beverage sector.

Growing Industrialization & Consumers: Asia’s Booming Market

Asia Pacific held the highest share of the industrial drums market. Rapid industrialization and the expansion of manufacturing sectors in countries like China, India, and Vietnam drive the demand for industrial drums, used for storing and transporting chemicals, oil, and other materials. Large-scale infrastructure projects in India, Malaysia, China, etc., including construction and transportation, increase the need for industrial drums to handle and transport construction materials and other supplies. The growth of the chemical and pharmaceutical industries in the region necessitates the use of industrial drums for safe storage and transportation of chemicals and pharmaceuticals.

The expansion of trade and logistics networks in Asia Pacific boosts the demand for durable and efficient storage solutions, including industrial drums. Overall economic growth in many Asia Pacific countries enhances industrial production, leading to increased consumption of industrial drums. Rapid development of chemical and petrochemical industry as well as rise in invest policy for development of petrochemical industry in Asia Pacific region has driven the growth of the industrial drums market over the forecast period. Moreover, the key players operating in the Asia Pacific market are focused on adopting inorganic growth strategies like agreement for development of petroleum and chemicals plants is estimated to drive the growth of the industrial drums market during the forecast period.

For instance,

- In May 2024, an agreement has been struck for Shell Singapore Pie Ltd, a subsidiary of Shell plc, to sell its Energy and Chemicals Park in Singapore to CAPGC Pte. Ltd., a joint venture between Glencore Asian Holdings Pte. Ltd. and Chandra Asri Capital Pte. Ltd. Through the deal, CAPGC Pte. Ltd. will acquire Shell's entire stake in Shell Energy and Chemicals Park Singapore.

North America is estimated to be the fastest growing and lucrative market over the forecast period. The expansion of industries such as chemicals, pharmaceuticals, and food and beverage in North America drives demand for durable and lightweight plastic drums for storage and transportation. The rise of e-commerce and logistics in North America has also boosted the demand for plastic drums, as they are ideal for handling and shipping a wide range of products. Stricter regulations in North America on packaging, particularly in the handling of hazardous materials and food products, have led companies in North America to invest in high-quality, compliant packaging solutions. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to develop new industrial packaging solutions, which is estimated to drive the growth of the industrial drums market in North America.

For instance,

- Greif, Inc., a company focused on providing industrial packaging services and products and headquartered in Ohio, U.S. signed new pilot-project partnership with IonKraft, a barrier technology company specialized in plasma-based coatings. The partnership aims to alter and resolve the challenges of sustainability and recyclability plastic drums and jerrycan packaging that requires an additional barrier solution.

Europe is estimated to be the third leading region in the global industrial drums market. Europe is a significant manufacturing and industrial hub. The demand for industrial drums is driven by industries such as chemicals, pharmaceuticals, food and beverage, and oil and gas, which rely on these drums for the storage and transportation of various materials. The European market often leads in technological innovations, including advancements in the design and manufacturing of industrial drums, enhancing their functionality and efficiency. Europe has stringent environmental and safety regulations, which increase the need for high-quality and compliant industrial drums. These regulations drive the demand for drums that meet specific standards. Europe has experienced economic stability and growth, contributing to increased industrial activity and, consequently, a higher demand for industrial drums. There is a growing emphasis on sustainability and recycling in Europe. Many companies are investing in reusable and recyclable drum solutions, contributing to the market's expansion. These factors collectively drive the robust growth of the industrial drums market in Europe.

Latin America

Industrial drum packaging in Latin America is witnessing steady demand, driven by the growth of industries such as agrochemicals, chemicals, food and beverages, and pharmaceuticals. Local manufacturers and global players are concentrating on generating durable steel and plastic drums suited for bulk transport, while also accepting regional challenges like infrastructure limitations and growing sustainability concerns. Companies are increasingly introducing eco-friendly drum solutions and lightweight designs to develop handling, safety, and compliance, making industrial drums an important part of the region’s supply chain and logistics.

Middle East and Africa

In the Middle East and Africa, industrial drum packaging is an important component of regional logistics and industry across sectors like oil and gas, petrochemicals, chemicals, pharmaceuticals, food and beverages, and agriculture. Countries within the Gulf Cooperation Council, notably Saudi Arabia, the UAE, and Egypt, are experiencing rising demand for industrial drums due to fast growth in petrochemical and industrial infrastructure. Durable drums, IBCs, and related packaging solutions are crucial for handling hazardous materials and operational bulk transport.

Recent Major Advancements in the Industrial Drums Market

- In February 2024, Körber AG, automation company, signed acquisition with Rondo-Pak, LLC, print and packaging solutions providing company, in expansion of its capabilities in the field of packaging for the pharmaceutical and biotech industries and, in particular, strengthening its market position.

Industrial Drums Market - Key Companies

Global Industrial Drums Market Segments

By Product Type

- Steel Drum

- Plastic Drum

- Fiber Drum

By Capacity

- Less than 100 Liters

- 100 to 250 Liters

- 251 to 500 Liters

- Above 500 Liters

By End Use

- Food & Beverages

- Chemicals

- Agriculture

- Petroleum & Lubricants

- Pharmaceuticals

- Paints, Inks & Dyes

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait