April 2025

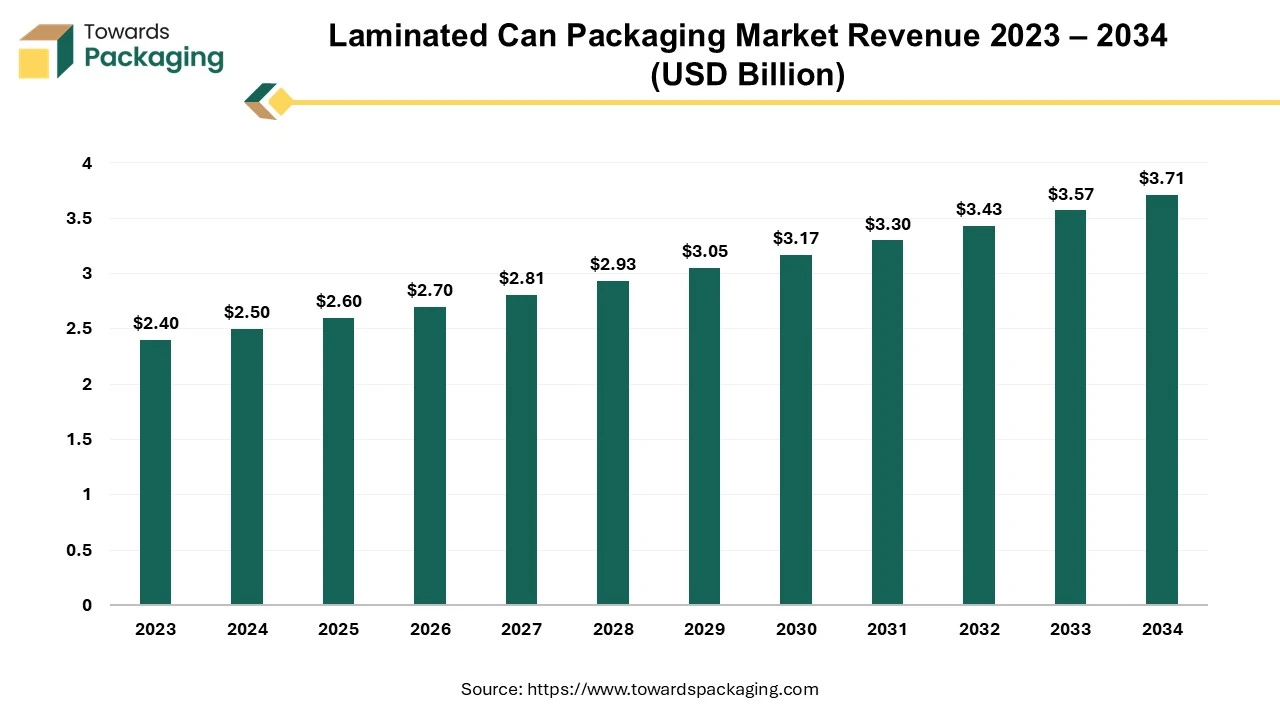

The global laminated can packaging market size reached US$ 2.50 billion in 2024 and is projected to hit around US$ 3.71 billion by 2034, expanding at a CAGR of 4.05% during the forecast period from 2024 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing laminated can packaging which is estimated to drive the global laminated can packaging market over the forecast period.

The container manufactured by bonding layers of materials together to create a strong, durable package is known as laminated can packaging. This process typically combines metal, plastic, and sometimes paper to enhance barrier properties, protect contents from light and moisture, and improve overall strength. Laminated cans are often used for beverages and food products, offering benefits like extended shelf life and improved freshness. Laminated can packaging is an innovative approach in the food and beverage industry, designed to enhance the preservation and presentation of products. This method involves the combination of multiple materials to create a can that offers superior protection and functionality.

The laminated can packaging is metal layer typically made up of aluminum or steel, which provides structural integrity and acts as a barrier against oxygen, light, and moisture. The laminated can packaging is often manufactured from polymers like polyethylene or polypropylene, this layer can enhance flexibility, sealability, and provide an additional barrier against environmental factors. Laminated can packaging represents a significant advancement in food and beverage packaging technology. By leveraging the strengths of various materials, it offers superior protection, enhanced shelf life, and aesthetic appeal. As sustainability and quality remain key priorities for consumers, laminated cans are likely to gain further traction in the market.

The rise of online shopping of increases the need for durable and lightweight packaging options, benefiting laminated can usage. The eCommerce platform fosters a preference for convenience in purchasing, leading to greater demand for packaging that preserves product integrity and extends shelf life. Laminated cans provide excellent protection against moisture, light, and oxygen. As eCommerce allows for a broader selection of products, including niche and specialty items, laminated can packaging can accommodate various food and beverage products, enhancing their market appeal. Online retailers often emphasize packaging design to attract customers. Laminated cans offer high-quality graphics and customization, which can enhance brand visibility in a competitive market.

Zomato's average monthly transacting user base increased by 8% year over year to 18.4 million in fiscal 2024. In the prior fiscal year, the growth rate was sixteen percent. According to data given by its biggest investor, Prosus, Swiggy's gross merchandise value (GMV) for food delivery increased 17% year over year in the first half of 2023, compared to 40% growth during the same period in 2022.

Rising emphasis on eco-friendly materials and recyclable packaging. Consumers and regulations are pushing for sustainable solutions, prompting innovations in laminated can designs. The key players are exploring recyclable laminates and inks, ensuring that packaging can be easily processed at recycling facilities. There’s a growing interest in developing laminated packaging using biodegradable materials to reduce environmental impact. The utilization of water-based and soy-based inks is rising, which are less harmful to the environment compared to traditional solvents. Companies are prioritizing sustainability certifications and transparent supply chains to meet consumer demands for responsible sourcing and manufacturing practices.

Brands are focusing on unique packaging designs to differentiate themselves in a competitive market. Laminated cans can be easily customized, allowing for vibrant graphics and branding.

As the beverage industry diversifies with introduction of the new products like functional drinks, cocktails, ready-to-drink, and plant-based beverages, the need for versatile packaging solutions increases. Laminated cans can accommodate various formulations and preserve flavor and freshness. In a competitive market, beverage brands seek innovative packaging to stand out. Laminated cans allow for vibrant graphics and unique designs, enhancing brand visibility. The beverage industry is prioritizing safety and health, with consumers seeking products that maintain freshness and quality. Laminated cans provide excellent barrier properties, protecting contents from external elements. As the beverage industry expands into emerging markets, the demand for convenient, cost-effective packaging options grows, further driving the laminated can packaging market. Therefore, increasing launch of the new beverages has created lucrative opportunity for the growth of the global laminated can packaging market in the near future.

The key players operating in the global laminated can packaging market are facing challenges in high cost of installing the advanced technology for manufacturing the laminated cans and competition from the alternative packaging options. The materials and technology used in producing laminated cans can be more expensive compared to traditional packaging options, potentially limiting adoption by cost-sensitive manufacturers.

The availability of other packaging types, such as glass, plastic, and metal cans, which may be more established and easier to recycle, can hinder the growth of laminated can packaging. Stringent regulations regarding packaging materials and safety standards can pose challenges for laminated can producers, especially in different regions. Laminated cans can be more difficult to recycle due to the complexity of the materials involved, which may deter environmentally conscious brands and consumers.

North America region dominated the global laminated can packaging market in 2024. North America has a robust beverage sector, including soft drinks, alcohol, and ready-to-drink products, driving demand for innovative packaging solutions like laminated cans. There is a growing consumer demand for convenience, sustainability, and premium packaging, which laminated cans effectively address. North American consumers and companies increasingly prioritize sustainable practices, and laminated cans, particularly aluminum-based ones, align with these preferences. Increasing launch of the new functional drink in the North America region has risen the demand for the laminated can packaging, which is estimated to drive the growth of the market in the region.

Asia Pacific region is anticipated to grow at the fastest rate in the laminated can packaging market during the forecast period. Increasing urbanization in countries like China and India is driving demand for convenient food and beverage packaging. Significant investments in manufacturing and distribution infrastructure enhance the availability and efficiency of laminated can packaging. Due to well established pharmaceutical industry in Asia Pacific region there is rise in the demand for the laminated can packaging.

As the pharmaceutical sector expands, the need for effective, protective, and compliant packaging for drugs and medical products will rise, boosting demand for laminated cans. Laminated cans offer advantages like tamper-proof seals and moisture resistance, which are critical for pharmaceutical products. This aligns with regulatory requirements, encouraging adoption.

The ABL segment held a dominant presence in the global laminated can packaging market in 2024. ABL offers superior barrier protection against moisture, light, and oxygen, which is crucial for preserving the quality of beverages and food products. Aluminum is lightweight yet strong, making it ideal for shipping and handling while maintaining product integrity. ABL is often perceived as more sustainable, as aluminum is widely recyclable and can be repurposed multiple times without loss of quality. Many beverage brands prefer aluminum due to its premium feel and better branding opportunities with vibrant printing capabilities.

The key players operating in the market are focused on developing laminated aluminium surface for cans which is estimated to drive the growth of the growth of the segment over the forecast period.

The food segment registered its dominance over the global laminated can packaging market in 2024. As consumer lifestyles become busier, the demand for ready-to-eat and convenient food products increases, driving the need for effective laminated can packaging. With growing consumer awareness about sustainability, food brands are seeking eco-friendly packaging solutions. Laminated cans can be designed for recyclability, aligning with these trends.

Laminated cans provide excellent barrier properties, helping to preserve the freshness and shelf life of food products, making them appealing to food manufacturers. The food industry encompasses a wide variety of products, including snacks, beverages, and prepared meals, all of which can benefit from the versatility of laminated can packaging. Laminated cans allow for attractive designs and branding, which can enhance product visibility and appeal on store shelves, driving sales for food manufacturers.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025