Medical Device Packaging Market Analysis, Demand, and Growth Rate Forecast

The medical device packaging market is forecasted to expand from USD 34.27 billion in 2026 to USD 65.27 billion by 2035, growing at a CAGR of 7.42% from 2026 to 2035. This report covers full segment data across sterile and non-sterile applications and product types (pouches, bags, trays, containers, boxes, blisters, clamshell packs, others), materials (plastic, glass, paper & paperboard, aluminum, metal, others), distribution channels (direct, retail), end users (monitoring & diagnostic equipment, disposable consumables, therapeutic equipment), and accessories (labels, lidding, others).

It provides regional analysis for North America (industry hub), Europe, Asia-Pacific (fastest growth), LAMEA, and MEA, profiles leading firms (Amcor, Berry Global, 3M, DuPont, Sonoco, Constantia, CCL, Klöckner Pentaplast, Nipro, Texchem-pack, Nelipak, SteriPack), competitive benchmarking, value-chain mapping from raw materials to converters to OEMs, trade/route data for key import–export corridors, and manufacturer/supplier databases with capacity, capabilities, and certifications.

Report Highlights: Important Revelations

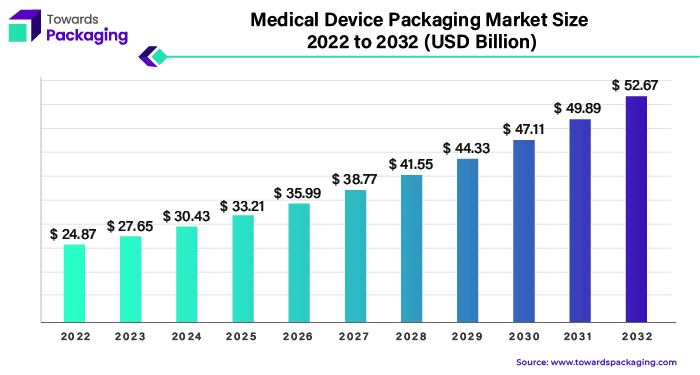

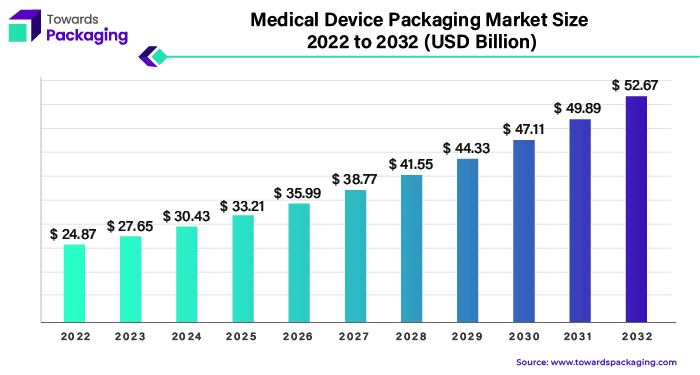

- Global medical device packaging sector starting at a value of USD 24.87 billion in 2022.

- The market is expected reaching an value of USD 52.67 billion by 2032.

- This expansion is growing at a CAGR of 7.42% over the period from 2023 to 2032.

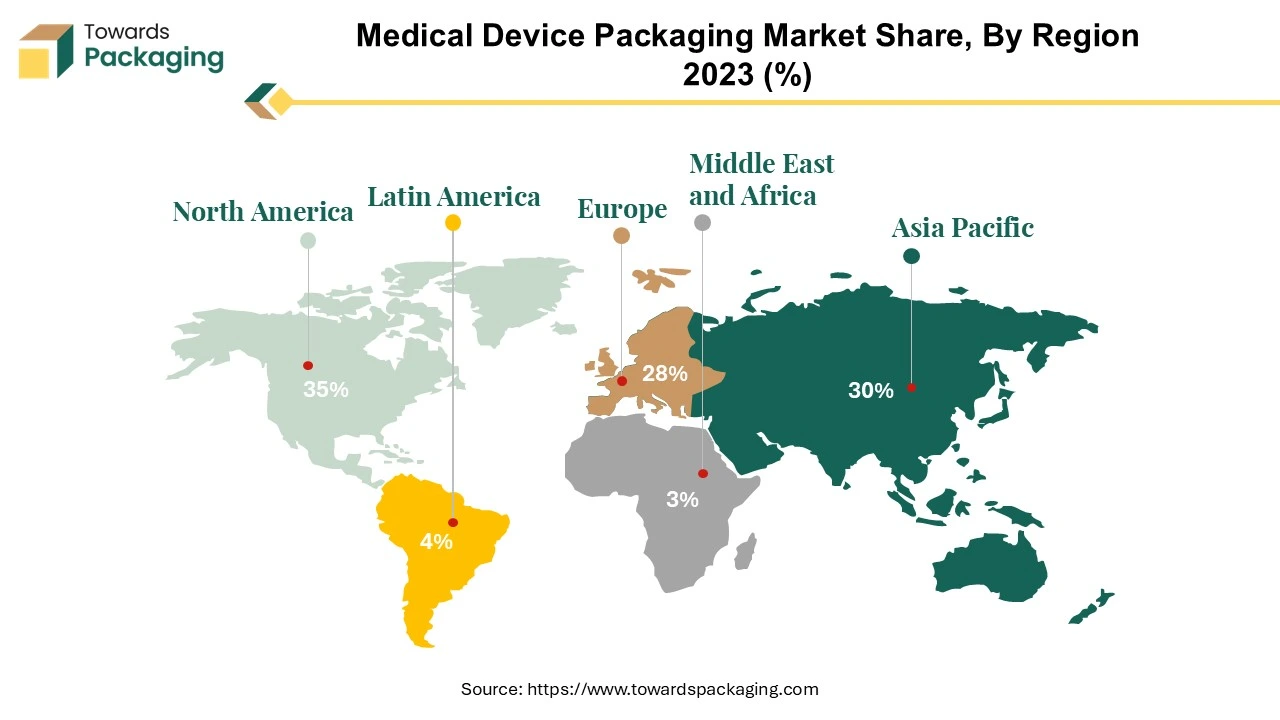

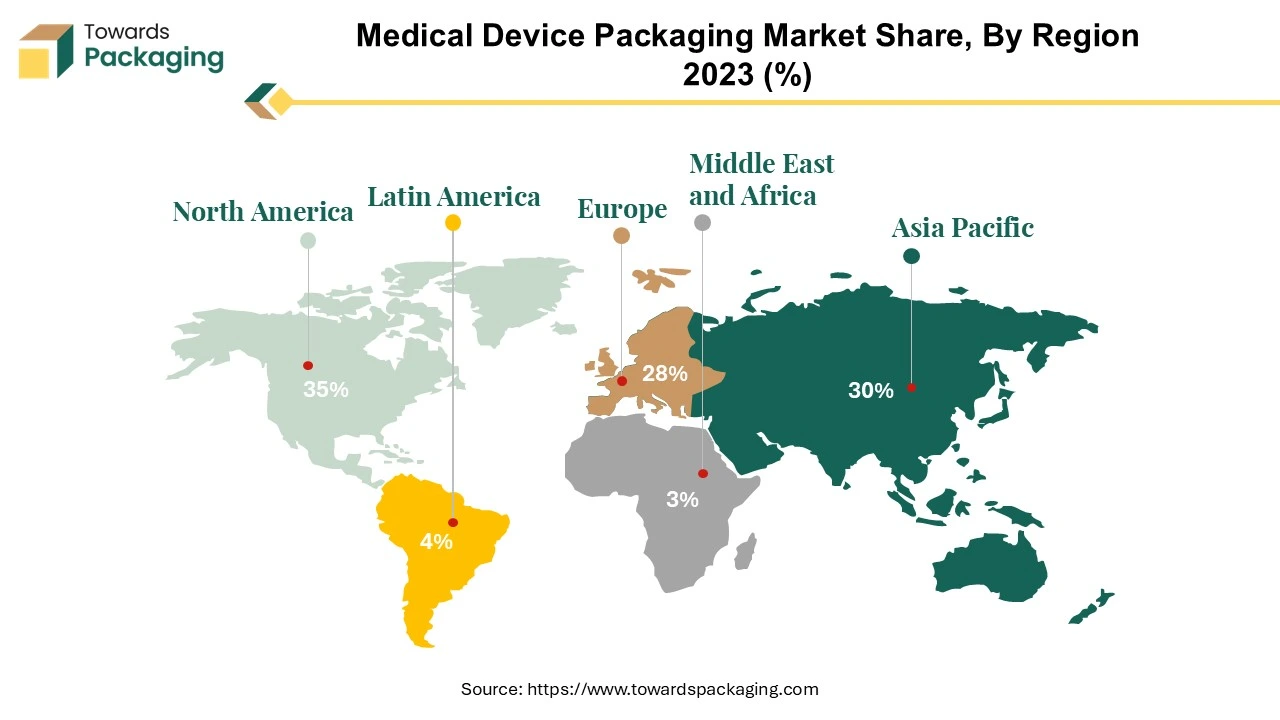

- North America is the central hub for the medical device packaging industry.

- Rising market prospects in medical device packaging across the Asia-Pacific region.

- Essential role of plastic in packaging for medical devices.

- Medical device packaging pouches: ensuring precise device protection.

- Global momentum in sterile medical device packaging.

- Direct distribution channel for medical device packaging solutions.

- Critical role of packaging in monitoring and diagnostic equipment.

- Importance of labels in the medical device sector.

Medical device packaging is made up of the materials and processes used to encapsulate, protect, and display medical equipment. It is an essential component of the device's entire design and development process. This encapsulation encompasses not only the physical containers and wraps, but also the meticulous planning, manufacturing, and labelling procedures that maintain the devices' integrity, sterility, and usability during storage, transit, and distribution. Adopting medical device packaging standards allows for the adoption of effective packaging solutions early in the product development process. This proactive method not only decreases stress, but it also encourages the creation of a more streamlined and impactful product, eliminating unforeseen costs and mitigating risks. Medical packaging serves as vital for the safe and efficient delivery of drugs, equipment, and other medical supplies. It not only protects the goods during transportation and storage, but it also serves as a barrier to contamination and deterioration, especially in high-traffic areas like the emergency room.

A constant focus on broad objectives is critical throughout the design process. The intricacies of medical device package design have a substantial impact on a variety of factors, including transportation logistics, user contact, and sterilisation procedures. Anticipating post-usage scenarios is also essential for ensuring flawless performance once the device is in the hands of end users. It is challenging to stay current with the most recent global standards for medical device packaging. Manufacturers must closely follow these standards to assure product safety, efficacy, and compliance with end-user specifications. Compliance involves a wide range of requirements, including stringent quality control systems, comprehensive labelling processes, and sophisticated traceability mechanisms. To preserve compliance and market relevance in an ever-changing regulatory context, regular monitoring and agility are essential. Proactive cooperation with regulatory agencies and industry consortia can provide early warning of upcoming changes, allowing manufacturers to alter their packaging strategy and increase their market position.

Medical device packaging is an essential component of the entire product lifecycle, necessitating meticulous attention to detail and strict adherence to evolving regulatory regulations. Manufacturers can handle the complexity of packaging design, safeguard product integrity, and boost consumer trust in their offerings by including efficient packaging solutions early in the design process and being informed about regulatory changes.

For Instance,

- In January 2024, Sanner Group, a global leader in healthcare packaging and medical device Contract Development and Manufacturing Organisation (CDMO), has acquired Springboard, a medical device design and development expert for regulated markets.

Medical Device Packaging Market Trends

Eco-friendly and Sustainability Packaging

Growing concern about environmental sustainability is pushing medical device manufacturers to adopt eco-friendly packaging solutions. This includes reducing plastic usage, using biodegradable materials, and implementing recyclable or reusable packaging.

Governments and regulatory bodies are increasingly imposing regulations around packaging waste and environmental sustainability. This is driving the development of packaging that meets sustainability goals without compromising safety and sterility.

IoT Integration and Smart Packaging

Smart packaging solutions, including those with Radio Frequency Identification (RFID) or Near Field Communication (NFC) technology, are gaining traction. These technologies enable better tracking and traceability of medical devices from manufacturer to end user, ensuring compliance and improving supply chain visibility.

IoT-enabled packaging is being developed to monitor environmental conditions (temperature, humidity) during shipping and storage. This is particularly important for sensitive products like biologics, vaccines, and diagnostic devices.

Sterilization and Infection Control

Packaging solutions that support the efficient and safe sterilization of devices are critical. Innovations in sterilization techniques, such as hydrogen peroxide vapour, ethylene oxide, and gamma radiation, are influencing packaging design to ensure that devices remain sterile until use.

The demand for tamper-evident packaging continues to rise, especially for high-risk medical devices. Packaging must be designed to provide clear visual indicators that the package has not been opened or altered.

Customization and User-Friendly Designs

There is a growing emphasis on making medical device packaging more user-friendly, especially for home care settings. This includes easy-to-open packaging, clear labeling, and designs that ensure proper use and reduce the risk of error.

As medical devices become more complex, packaging is being tailored to provide optimal protection, including anti-static packaging for electronics or custom-molded packaging to prevent damage during transport.

Automation and Supply Chain Optimization

The trend toward automation in manufacturing and packaging processes is growing. Automated packaging lines can improve efficiency, reduce human error, and enhance scalability, especially in the production of medical devices in high volumes.

Packaging plays a critical role in optimizing the supply chain. Innovations in packaging that reduce space, improve durability, and ease transport can help streamline the distribution process and lower costs.

Security and Anti-Counterfeiting

As the global market faces increasing concerns about counterfeit products, packaging is evolving to include enhanced security features such as holograms, barcodes, and tamper-evident seals. These features help ensure the authenticity of medical devices and protect against fraud.

Some regions, such as the U.S. and Europe, have implemented serialization requirements for medical devices to track and trace products through the supply chain, helping to prevent counterfeit devices from entering the market.

Home Healthcare

Packaging for Home Use: With the growing demand for home healthcare, packaging must be designed with convenience and safety in mind for both healthcare professionals and patients. This includes packaging that facilitates easy use, storage, and disposal of medical devices in home settings.

Market Opportunity

Technology Advancement and Adoption of Inorganic Growth Strategies

There is an increasing demand for eco-friendly, recyclable, and biodegradable packaging materials, in line with global sustainability trends and stricter regulations on plastic waste. With the rise of advanced materials like high-barrier films and coatings, packaging can offer better protection for sensitive medical devices, such as those that require sterile environments. Increasing adoption of the inorganic growth strategies like collaboration to develop advance technology for medical device packaging, is estimated to create lucrative opportunity for the growth of the medical device packaging market in the near future.

- For instance, in February 2024, ProActive Intelligence Moisture Protect (MP-1000) was developed and introduced by Aptar CP Technologies in collaboration with ProAmpac. This platform technology offers a flexible packaging solution that absorbs moisture by fusing ProAmpac's flexible blown film technology with Aptar CSP's exclusive 3-Phase Activ-Polymer technology. In addition to protecting the contents from moisture exposure that usually happens when moisture molecules pass through the packaging, the technological solution adsorbs surplus moisture inside the container.

North America Hub of Medical Device Packaging Business

North America dominated the global medical device packaging market in 2023. North America, particularly the U.S., has one of the most stringent regulatory environments for medical devices, with agencies like the Food and Drug Administration (FDA) and Health Canada enforcing rigorous standards. Packaging plays a critical role in meeting these regulations, including ensuring device sterility, preventing contamination, and maintaining traceability. This has driven demand for highly specialized, compliant packaging solutions.

The U.S. is one of the largest markets for medical devices globally, with a highly developed healthcare system, a large aging population, and continuous technological advancements in medical treatments. The growing need for advanced medical devices—from implants to diagnostics and surgical tools—has resulted in a parallel demand for sophisticated packaging that ensures safety, performance, and compliance.

When it comes to the export of medical instruments, the US becomes a significant player in the global market. In 2022, the United States topped the export rankings, closely followed by Germany, Mexico, China, and the Netherlands. However, the United States remained the leading importer of medical equipment, with the Netherlands, Germany, China, and Japan following closely behind. These export-import dynamics demonstrate how important the U.S. market is to the global medical device industry and how much of an impact it has on the medical device packaging industry.

For Instance,

- In January 2024, Contract manufacturer Arterex has acquired Micromold, a business that uses plastic injection moulding to create precision, customised micromolded parts for the medical sector.

Expanding Market Opportunities in Medical Device Packaging in the Asia-Pacific

Asia Pacific region is anticipated to grow at the fastest rate in the medical device packaging market during the forecast period. The presence of well-established medical device companies like Nipro, Hoya, Olympus, Ansell, Terumo, Philips Healthcare, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Sonic Healthcare, Shimadzu, Nihon Kohden Corporation, Lepu Medical Technology and Medtronic make Asia Pacific region largest exporter for medical device. Hence, as the Asia Pacific region is the largest exporter of the medical device, the requirement of the medical device packaging is at higher rate in Asia Pacific region.

Medical device production and consumption have seen a noticeable upsurge in the Asia-Pacific region, which includes China, India, Japan, South Korea, and Australia. Medical technology breakthroughs, rising healthcare costs, and population expansion are the main causes of this spike. The yearly need for medical equipment is $ 13 billion, of which 65% is met by imports, despite India producing medical devices valued at about $7.68 billion, of which $3.5 billion are exported and $4.3 billion are utilised locally. Only 35 per cent of market demands are met by domestic enterprises, highlighting the need for improvement to lessen reliance on imports and strengthen India's position in the medical device sector.

For Instance,

- In September 2023, India's medical device business has expanded at a constant rate of 14%-15% per year for the most of the last decade, although it still accounts for only 1.5% of the total worldwide market.

Medical Device Packaging Market, DRO

Demand:

- Demand for Maintaining sterility is essential in medical device packaging to avoid microbiological infection and assure patient safety.

Restraint:

- The global nature of the medical device industry, combined with complicated supply chains, complicates medical device packaging logistics, which include sourcing, production, sterilisation, transportation, and distribution.

Opportunity:

- The increased emphasis on sustainability and environmental responsibility creates an opportunity for the development of environmentally friendly medical device packaging.

Indispensable Role of Plastic in Medical Device Packaging

Plastic is essential for medical device packaging because of its versatility, durability, and compliance with sterilisation techniques. Polyethylene, polypropylene, and polycarbonate are common materials used in medical packaging, achieving a mix of attributes necessary for device integrity and safety. These packaging are critical for the safe distribution and storage of medicinal items, emphasising the necessity of contamination-resistant designs, particularly in healthcare settings where patient safety is important. PP is a prominent material used in medical device packaging. It is an extremely durable substance that can withstand impact, moisture, and chemicals. PP is also a great moisture barrier, making it perfect for packing medical items that need to be kept sterile.

Organisations such as Sterile Aware and Van der Stahl Scientific are working to improve sterile packaging systems through novel methodologies such as medical device pouch testing. Their ISO 17025 empirical testing facility and co-developed testing technologies address infection concerns associated with packaging problems.

Plastic acts as an excellent barrier against contamination, moisture, and environmental conditions that may jeopardise device sterility and performance. Its flexibility to be moulded into a variety of forms and sizes enables customised packaging solutions. Despite environmental worries, plastic has substantial benefits for the industry.

The lightweight nature of plastic packaging allows for more cost-effective shipping and distribution of medical devices while also decreasing the total environmental footprint. Furthermore, plastics can tolerate sterilisation procedures such as gamma radiation, ethylene oxide gas, and steam autoclaving, guaranteeing that devices are sterile until use. In conclusion, plastics are critical for maintaining the quality and performance of medical devices throughout their existence.

For Instance,

- In January 2024, Arterex, a contract manufacturer, announced the acquisition of Micromold, Inc. Arterex, a contract manufacturer, has acquired Micromold, a company that manufactures unique quality micromoulded parts for the medical market using plastic injection moulding.

AI Integration Revolutionizes Medical Device Packaging Market

Artificial Intelligence (AI) is poised to significantly enhance the Medical Device Packaging Market by driving innovation, efficiency, and precision. AI-powered technologies are revolutionizing packaging processes through advanced automation, predictive analytics, and intelligent design optimization.

AI algorithms enable real-time monitoring and control of packaging lines, ensuring consistent quality and reducing the likelihood of defects. Predictive maintenance, driven by AI, forecasts equipment failures before they occur, minimizing downtime and extending machinery lifespan. This proactive approach not only boosts operational efficiency but also reduces operational costs.

AI enhances the customization and personalization of packaging solutions. By analyzing data on market trends and consumer preferences, AI systems can design packaging that meets specific regulatory requirements and customer demands. This capability supports the development of innovative packaging solutions that improve product safety, usability, and sustainability.

AI aids in regulatory compliance by automating the documentation process and ensuring that packaging meets stringent standards. As AI continues to advance, its integration into the medical device packaging sector promises to accelerate growth, drive technological advancements, and offer significant competitive advantages for market participants.

Medical Device Packing Pouches Safeguarding Medical Devices with Precision

Medical device packing pouches are specialised containers made to enclose and safeguard particular medical devices while they are being distributed, stored, and transported. The materials used to make these pouches are usually laminates or plastic films, which are selected for their compatibility with sterilisation procedures, durability, and barrier qualities. Pouches can be manufactured of several types of plastic, such as polyethylene and polypropylene, and are commonly used for medical devices and equipment. One way to preserve single-use items and do away with the need to sterilise them beforehand is to seal plastic bags.

Maintaining product integrity and preventing contamination are made possible by the design of medical device packing pouches. Pouches must successfully protect electronics from outside elements like dust, moisture, and germs so that they stay sterile until needed., Pouches ought to be effortlessly opened and sealed to enable convenient access to the contained gadget while maintaining its sterility. To fit a range of device types, from tiny instruments to larger equipment, medical device packing pouches are available in multiple sizes and designs. Patients and medical professionals might be reassured by some pouches that have signs to verify sterilisation procedures.

Medical device packing pouches are critical to ensure the safety, efficacy, and quality of medical devices throughout their life cycle. Emphasising the value of accuracy and meticulous attention to detail in their creation, their design and material selection are meticulously adjusted to match the particular requirements of each device.

For Instance,

- In March 2023, The Sterimed Group has successfully acquired Granton Medical, a UK-based producer of sterilisation pouches and supplier of packing services to the medical device market, through its UK subsidiary Westfield Medical.

Global Acceleration to Sterile Medical Device Packaging

Medical device packaging serves as a critical safeguard against contamination, particularly for sterile products intended for invasive, implantable, or single-use applications that involve contact with human tissues or fluids. This packaging acts as a barrier between the device and its surroundings, shielding it from potential contaminants during storage, transportation, and handling. Sterile medical device packaging employs materials such as foil bags, Tyvek pouches, and rigid containers, selected for their low permeability to water vapor and air. This characteristic is essential in preventing the ingress of microorganisms that could compromise the sterility of the enclosed device.

Before sealing, sterilization techniques such as gamma irradiation or ethylene oxide gas are often employed to eradicate any microbial contaminants present on the device or within the packaging itself. These measures are crucial in reducing the risk of infections, as hospital-acquired infections contribute significantly to global mortality rates, with millions of deaths reported annually due to such infections. Due to this factor market for sterile medical device packaging is estimated to increase at high rate.

The primary types of sterile packaging commonly utilized in medical devices include trays made of metal or plastic and pouches constructed from paper or plastics. Each type is tailored to the specific requirements of the device it encases, ensuring optimal protection and sterility throughout the product's lifecycle. By employing stringent sterilization and packaging protocols, medical device manufacturers aim to mitigate the risk of infections and uphold the safety and efficacy of their products for patients and healthcare providers alike.

For Instance,

- In November 2023, the founders of SteriPack Ireland Limited ("SteriPack Ireland"), Garry Moore, and Sterimed Infection Control have announced their decision to pool their business operations in the field of medical packaging. It meets all the requirements for both single-use and reusable sterile medical equipment packaging.

Direct Distribution Channel for Medical Device Packaging

Manufacturers who offer their packaging materials directly to end users or consumers, eschewing middlemen like distributors or wholesalers, are contributing to the direct distribution channel for medical device packaging. The distribution, marketing, and sales of the packaging solutions are directly under the makers' control in this channel. For both producers and buyers, this distribution strategy has a number of benefits. It gives producers more control regarding terms of branding, price, and customer relations. McKesson Medical-Surgical, the largest wholesale distributor of medical-surgical supplies and equipment in the United States, generated USD 231.1 billion in revenue during the past year.

They offer specialised assistance and service and can modify their packaging solutions to suit the needs of individual clients. Manufacturers can also benefit from increased value chain capture and possible profit margin expansion through direct distribution. Customers can save money by purchasing directly from manufacturers, as there are no markups from intermediaries. It also gives you direct access to the manufacturer's expertise and assistance, which means you get better service and are more responsive to your needs.

The direct distribution channel for medical device packaging has expanded significantly in recent years. This expansion can be ascribed to a number of factors, including increased need for specialised packaging solutions as the medical device industry expands, advancements in packaging technology, and the trend towards customisation and personalised service.

In February 2024, Riverside Medical Packaging, a UK-based contract packaging provider for medical devices, has announced the demerger of its Shawpak business unit.

Importance of Packaging for Monitoring and Diagnostic Equipment

End-user monitoring and diagnostic equipment in medical device packaging includes specialised devices that monitor and diagnose patients' health status or physiological characteristics. These devices are critical instruments in healthcare settings, allowing experts to collect precise data for diagnosis, treatment, and monitoring of patients' ailments.

Medical device packaging for monitoring and diagnostic equipment fulfils multiple vital functions. It preserves these devices' sensitive components throughout storage, transportation, and handling, ensuring they are functional and accurate when deployed. Packaging must ensure the sterility of any components that come into touch with patients or body fluids in order to avoid contamination and infection.

Regulatory compliance is a key feature of medical device packaging for monitoring and diagnostic equipment. To guarantee that the devices are approved and marketable, manufacturers must ensure that packaging materials and methods meet regulatory criteria for safety, sterility, and labelling.

For Instance,

- In January 2024, A second manufacturing facility and new production location in Bensheim, Germany, as well as the company's headquarters, position the Sanner Group for future expansion.

Significance of Labels in the Medical Device Industry

Labels are an essential means of communication between manufacturers and consumers in a number of industries, such as pharmaceuticals, food goods, and medical equipment. Labels are extremely important in the medical device industry when it comes to products meant for human use. They offer vital details including how to use them, who the intended users are, any risks, and safety measures.

It is essential for medical device manufacturers to make sure that labels are readable and undamaged for the duration of the product. For labels to properly convey vital information to end users, they must endure handling, storage, distribution, and use. Patient safety may be jeopardised by a compliance label that separates or becomes unreadable during storage or transit. Thus, in order to preserve regulatory compliance and guarantee the safe and proper use of medical equipment, businesses must place a high priority on the longevity and adherence of labels.

For Instance,

- In February 2024, Coveris, a European supplier of sustainable packaging solutions, has made an investment in its label business by purchasing S&K LABEL, a company situated in the Czech Republic.

Supply Chain in the Medical Device Packaging Market

The supply chain in the medical device packaging market is a complex network ensuring the timely and safe delivery of packaging solutions for medical devices. It begins with raw material suppliers providing essential components like plastics, metals, and specialized films. These materials are then transported to packaging manufacturers who design and produce various packaging types, such as sterile pouches, blister packs, and bottles.

Once packaged, products move through distribution channels where logistics companies handle storage and transportation to ensure compliance with regulatory standards and maintain product integrity. The distribution network often involves multiple stages, including warehousing, inventory management, and final delivery to healthcare providers or directly to medical device manufacturers.

Quality control is a critical component, involving rigorous testing and validation processes to ensure that packaging meets safety and regulatory requirements. Additionally, supply chain management in this market must adapt to challenges such as supply chain disruptions, changing regulations, and evolving technology.

The Medical Device Packaging Market Ecosystem: Key Components and Company Contributions

The Medical Device Packaging Market is a multifaceted industry integral to ensuring the safety and effectiveness of medical products. Key components of this market include primary packaging (such as pouches, blister packs, and trays), secondary packaging (boxes and cartons), and tertiary packaging (pallets and containers). Each layer plays a crucial role in protecting medical devices from contamination, damage, and degradation during storage and transportation.

Companies across the spectrum contribute significantly to this ecosystem. Amcor and Berry Global lead in innovative primary packaging solutions with a focus on advanced materials and sterilization technologies. West Pharmaceutical Services excels in designing high-performance, sterile packaging systems that meet stringent regulatory standards. Sealed Air and Sonoco Products Company provide robust secondary and tertiary packaging solutions, enhancing logistics and distribution efficiency.

Furthermore, companies like SteriPack and Nelipak Packaging contribute specialized packaging services tailored to the unique needs of medical devices, including custom designs and stringent compliance with industry regulations. Together, these players ensure that medical devices remain safe, sterile, and effective, reflecting the complexity and importance of the medical device packaging market.

Canadians Misled About Egg Packaging and Animal Welfare: Survey Reveals Common Misconceptions

A recent survey of over 1,000 Canadians has highlighted widespread misinformation about egg packaging and animal welfare. Many consumers mistakenly believe that hens are housed in better conditions than they actually are, which is influencing their buying decisions—often leading them to spend more on eggs.

The survey revealed that among the 95 percent of Canadians who buy eggs, more than half consider animal welfare a crucial factor in their purchasing decisions. Yet, only 7 percent think that accurate welfare labels on egg cartons are unimportant. Most consumers reported paying extra for certain egg brands, under the impression that these brands offer superior conditions for hens.

Latest Announcements by Industry Leaders

- In November 2023, Daniel Roiz, sales and marketing director Amcor HealthCareäEMEA stated that mono-polyethylene solution tackles the crucial problem of recyclable medical packaging and is a big step in assisting the medical industry in safely adopting more environmentally friendly packaging options. Amor's R&D specialists is highlighted in sustainable packaging for medical devices launch, which also shows dedication to innovation for the healthcare sector. The CEO of the Amcor plc., state that the company is committed to continuing to advance the of medical device packaging solution portfolio towards delivering on company’s R& D team pledge to develop all of Amor's packaging to be recyclable or reusable by 2025.

The next generation of Amor's Medical Laminates solutions has been released. Amor is a world leader in creating and manufacturing ethical packaging solutions. The development of all-film packaging that can be recycled in the polyethylene stream is made possible by Amor's most recent invention. The novel technology helps medical enterprises achieve their sustainability goals without sacrificing patient safety by lowering the final package's carbon footprint while preserving the performance requirements of device applications.

Key Players and Competitive Dynamics in the Medical Device Packaging Market

The competitive landscape of the medical device packaging market is dominated by established industry giants such as Berry Global Inc., Amcor Limited, Mitsubishi Chemical Holdings Corporation, 3M COMPANY, CCL Industries Inc., Constantia Flexibles, Klöckner Pentaplast Group, Sonoco Products Company, Dupont De Nemours Oliver-Tolas, NIPRO, and Texchem-pack. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Berry Global prioritises innovation and customisation to satisfy the changing needs of the medical device sector. The company invests substantially in R&D to provide cutting-edge packaging solutions that prioritise safety, sterility, and usability. Berry Global also prioritises collaboration with medical device makers to understand their individual needs and customise packaging solutions accordingly.

For Instance,

- In September 2023, Berry Global Group Inc. (BERY) disclosed that it has begun a process to assess strategic options for its health, hygiene, and specialties sector.

Amcor has adopted a global expansion plan to increase its footprint in the medical device packaging market. The company uses its large global network and manufacturing skills to provide a wide range of packaging solutions targeted to specific locations and customer segments.

For Instance,

- In January 2023, Amcor, a global packaging company, has reached an agreement to buy MDK, a medical device packaging company based in China. MDK, a Shanghai-based company, provides paper-based packaging and coating services to medical device manufacturers in China.

Recent Developments in the Medical Device Packaging Market

- In May 2024, the innovative manufacturing and packaging equipment that Webblogic, a leader in medical device manufacturing technology, is planned to introduce is tailored for the pharmaceutical, life sciences, and medical device industries. In addition to offering top-notch production and packaging tools for the life science and medical device sectors, Webblogic offers a comprehensive range of services, including technology licensing, design, development, and commercialization.

Medical Device Packaging Market Player

Medical device packaging leading market players are Berry Global Inc., Amcor Limited, Mitsubishi Chemical Holdings Corporation, 3M COMPANY, CCL Industries Inc., Constantia Flexibles, Klöckner Pentaplast Group, Sonoco Products Company, Dupont De Nemours Oliver-Tolas, NIPRO, and Texchem-pack.

Market Segments

By Material

- Plastic

- Glass

- Paper & Paperboard

- Aluminium

- Metal

- Others

By Product Type

- Pouches

- Bags

- Trays

- Containers

- Boxes

- Blisters

- Clamshell Packs

- Others

By Application

- Sterile Packaging

- Non-Sterile Packaging

By Distribution Channel

By End User

- Monitoring & Diagnostic Equipment

- Disposable Consumables

- Therapeutic Equipment

By Accessories

By Region

- North America

- Asia Pacific

- Europe

- LAMEA