February 2025

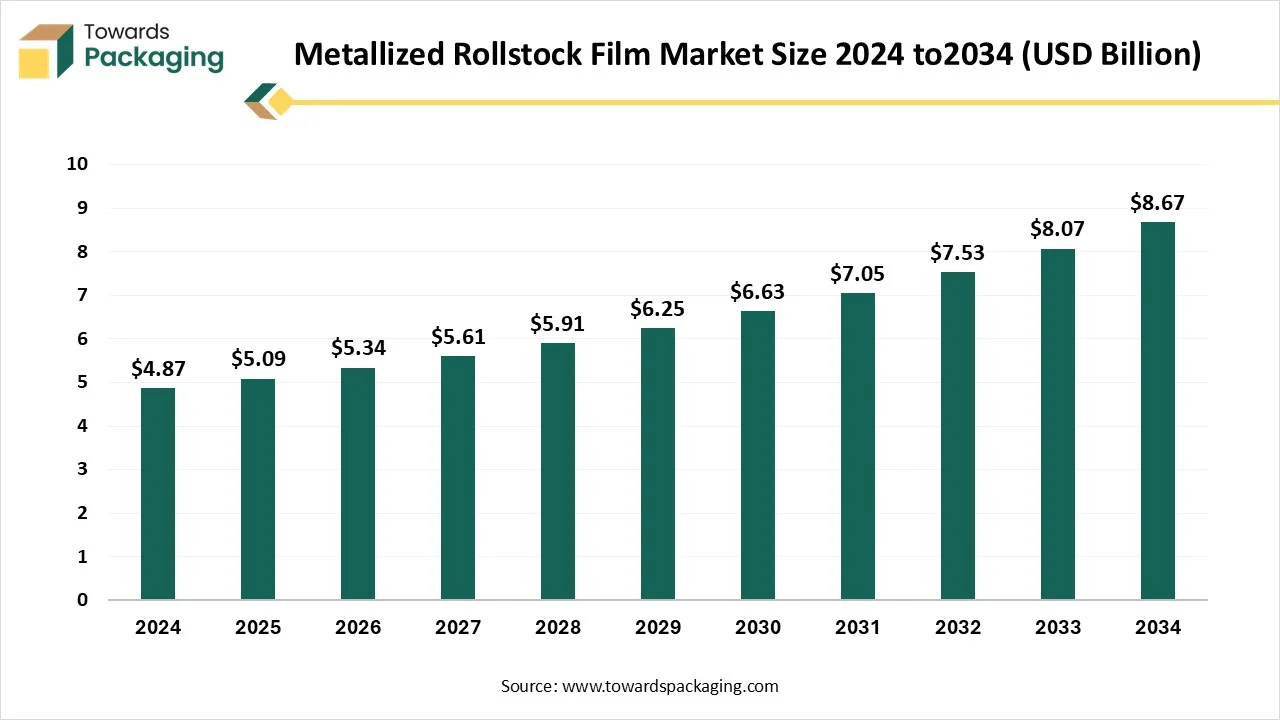

The global metallized rollstock film market is expected to increase from USD 5.09 billion in 2025 to USD 8.67 billion by 2034, growing at a CAGR of 6.09% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The metallized rollstock film market continues to grow at a steady rate within the estimated timeframe. Rollstock films are metalized with a light layer of aluminum to provide different degrees of protection or application based on the product and its specifications. It has an average price point and a high barrier capacity. A zip-lock plastic bag, for instance, doesn't need a high barrier, but food product packaging frequently does. The film's barrier qualities are improved by the metallization and this improves its resistance to light, oxygen and moisture. These films are commonly utilized in food, pharmaceuticals, cosmetic & personal care and other industries. Some manufacturers also provide sustainable metallized films to reduce the environmental impact.

The increasing demand for high-barrier packaging in the industries such as food, beverage and pharmaceutical is expected to augment the growth of the metallized rollstock film market during the forecast period. Furthermore, the rise of e-commerce and flexible packaging along with the adoption of sustainability trends and regulatory pressures are also anticipated to augment the growth of the market. Additionally, the technological advancements in the vacuum metallization and nano-coatings as well as the growth of the personal care and cosmetics industry coupled with the increasing consumer demand for sustainable and recyclable packaging is also projected to contribute to the growth of the market in the near future.

| Metric | Details |

| Market Size in 2024 | USD 4.87 Billion |

| Projected Market Size in 2034 | USD 8.67 Billion |

| CAGR (2025 - 2034) | 6.09% |

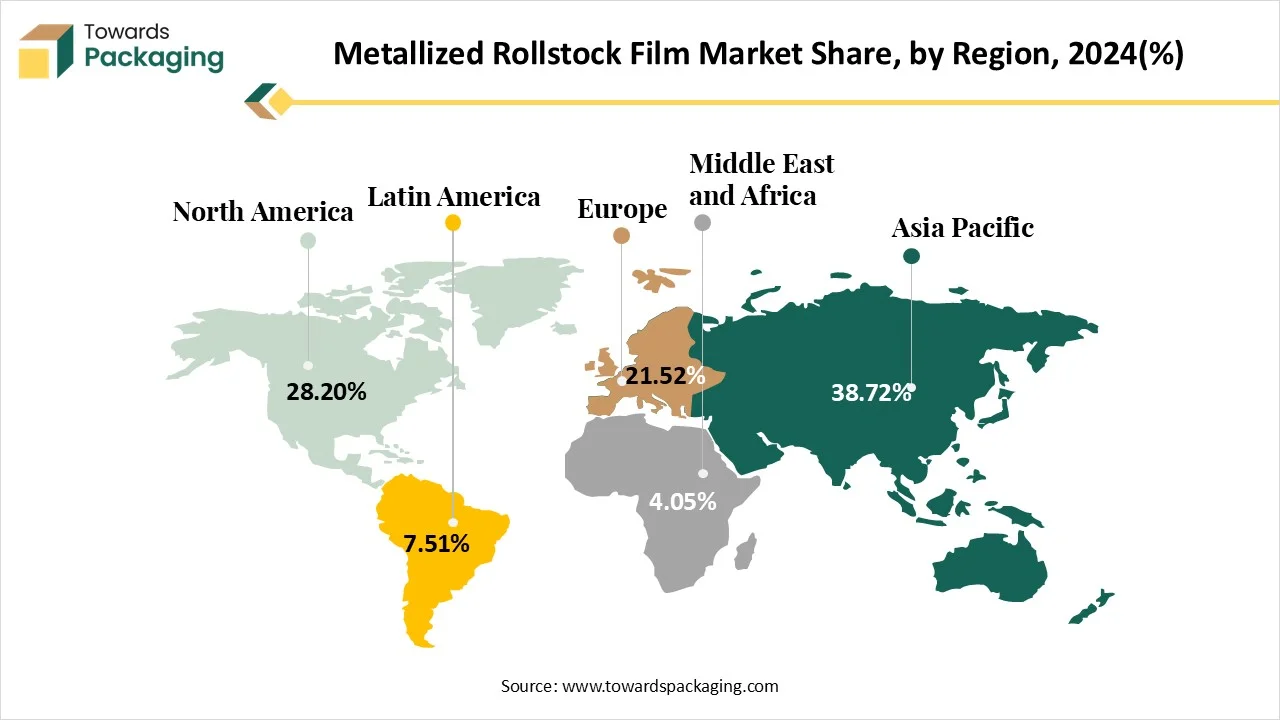

| Leading Region | North America |

| Market Segmentation | By Material Type, By Thickness, By End Use and By Region |

| Top Key Players | Jindal Poly Films Ltd., UFlex Ltd., Toray Industries Inc., Amcor plc, Taghleef Industries, Mondi Group |

The increasing awareness about the advantages of metallized rollstock film is anticipated to support the growth of the metallized rollstock film market during the estimated timeframe. As organizations and consumers become more informed about material options, metallized films are gaining popularity for their exceptional barrier properties against moisture, oxygen, light and contaminants. These attributes are valuable in the food and beverage packaging, where shelf life as well as product freshness is important. Furthermore, the economic factor is most likely the primary driver for switching from the regular aluminum foil to metallized rollstock film. Metallized films have a lower density and are being less expensive per kilogram. The cost of the conversion is also decreased since metallized PET or metallized polypropylene helps equipment to operate more quickly.

Additionally, there is no chance of barrier weakening because of the scratches as the metallized side is inside the laminate. Thus, it is possible to simplify the unprinted packaging design by using metallized film. Simultaneously, less packaging material is utilized, which reduces the waste. This directly contributes to cost savings. Also, using the metallized sheets against aluminum foil provides multiple technological benefits, one of which is the issue of down-gauging. It is easy to reduce the metallized rollstock film without compromising its valuable barrier qualities. Down-gauging is restricted when utilizing only aluminum foil due to the growing barrier reduction and the challenge of controlling the foil during printing and laminating. In addition, metallized PET has fewer pinholes and improved flex-crack resistance. This rising understanding of the performance and sustainability is pushing more brands to adopt the metallized rollstock films, driving consistent growth across the industry.

The difficulty in recycling the multilayer structures is anticipated to hinder the growth of the metallized rollstock film market during the estimated timeframe. These films are commonly made-up of multiple layers of various different materials such as plastic substrates (like PET or BOPP) combined with a thin aluminum or metallized coating to achieve the high barrier properties. While this construction improves the performance, it creates complexity during recycling, as separating these layers is both technically challenging and economically unviable with most conventional recycling systems. Furthermore, recycling MLP becomes extremely challenging when it is not sufficiently separated from plastic debris. Multilayer packaging cannot be recycled using traditional methods; instead, it must be separated from mono-material plastics. To create high-quality recycled products, extremely effective sorting and separation methods are needed, but these methods can be expensive, complex as well as energy-intensive.

Additionally, due to the inadequate elimination or washing of the waste stream, the various contaminants from the waste water and non-polymeric materials might make recycling challenging. Food residue, glue, wax, ink, oil and other substances found in the MLP are the main pollutants that can make recycling more difficult. These could potentially have an effect on the recycled products' quality. The compounds on the recycled plastic granules such as additives, oligomers and their by-products have since been observed. Also, the governments and regulatory bodies are pushing for more sustainable and recyclable packaging formats, putting pressure on the manufacturers to move away from hard-to-recycle materials. As a result, companies may face regulatory penalties, restricted market access and negative consumer perception if they continue to use non-recyclable multilayer films.

The development of the eco-friendly metallized films attributed to the growing focus on sustainability as well as circular economy goals is likely to augment the growth of the metallized rollstock film market in the near future. The packaging sector has long been a major source of pollution in the world, producing several million tons of plastic waste every year. According to the studies, packaging alone accounts for over 40 percent of the plastic waste materials, most of which is disposed of in the ocean and landfills. Biodegradable high barrier metallized films are becoming revolutionary as industries move toward sustainability. These films provide safe disposal options and give the same level of protection as compared to the traditional materials.

For instance

Moreover, the growing consumer demand for the eco-conscious brands as well as the increasing regulatory bans on the single-use plastics are prompting the companies to adopt the sustainable alternatives. Brands from the snack food and personal care sectors are also switching to the recyclable metallized pouches to reduce the environmental impact while maintaining the product appeal. These innovations are helping the companies to meet their sustainability targets and also opening opportunities for the new markets and eco-minded consumers, positioning the sustainable metallized films as a key driver for the future growth.

Artificial Intelligence (AI) is no longer just a buzzword—it’s expected to become a transformative force in the metallized rollstock film market, quietly revolutionizing how films are designed, produced as well as delivered. From the factory floor to the finished packaging, AI is adding intelligence into every stage of the value chain. In manufacturing, smart algorithms and machine learning are being utilized to fine-tune critical processes such as film extrusion, coating and metallization. This guarantees consistent barrier performance, optimal thickness and minimal material waste along with better energy efficiency and production speed. AI also helps real-time quality monitoring through computer vision systems that can detect surface defects, inconsistencies and contamination far more accurately than manual inspection methods.

In terms of the logistics and inventory, AI is helping the manufacturers and converters predict the demand patterns, manage raw material sourcing as well as reduce the lead times that are valuable in the sectors like food and personal care packaging. Additionally, data analytics is likely to assist the R&D teams in designing next-generation metallized films with improved recyclability and customized functionalities that are specific to the end-use industries. For example, AI can simulate various material combinations and forecast their barrier behavior, decreasing the time to market the new films. The integration of AI is expected to change the sector into a more intelligent and sustainable value chain, allowing stakeholders to remain competitive in an increasingly efficient market landscape.

The metallized PET segment held largest share of 57.32% in the year 2024. The packaging companies have undergone a revolution with the introduction of the novel material known as "metallized PET film." The lightweight and flexible nature of metallic PET film makes it a perfect option for a wide range of packaging designs. It is easily molded and formed, enabling innovative and useful packaging options that fulfill the requirements of various products. It is favored by manufacturers and packaging designers due to its adaptability. A metallized PET film's highly reflective surface can be utilized to block electromagnetic radiation and produce an eye-catching visual effect in packaging. Beyond protection, metallized PET also provides high tensile strength, dimensional stability and heat resistance, which are important for the high-speed packaging lines as well as various converting processes. These factors are likely to support the segmental growth of the market during the forecast period.

The food & beverage segment held largest share of 49.31% in the year 2023. This is due to the rising demand for organic, low-calorie and functional foods along with the growing demand for the ready-to-eat and on-the-go meals. Furthermore, the technological advancements in the food processing, packaging and delivery as well as the growing prominence of preserving freshness and extending shelf life of the food is also likely to support the growth of the segment in the global market. Additionally, the increasing percentage of the food delivery providers and coupled with the rising e-commerce sector is expected to contribute to the segmental growth of the market during the forecast period.

North America held considerable market share of 28.20% in the year 2023. This is due to the high consumption of ready-to-eat meals, snacks, frozen foods, and beverages across the region. According to the International Food Information Council (IFIC) Food & Health Survey conducted in 2024, 74 percent of the Americans admit that they snack at least once daily. More than 56 percent of all Americans eat smaller meals or snack instead of conventional meals. Also, the presence of the large packaging converters and rapid adoption of the innovations like digital printing are also expected to support the regional growth of the market. Additionally, the strict environmental regulations by the FDA and EPA coupled with the growing consumer demand for eco-friendly packaging are also further expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 8.09% during the forecast period. This is due to the changing lifestyles, rapid urbanization and rising middle-class income across the economies like India and China. Additionally, the growing e-commerce & retail sector are also expected to contribute to the regional growth of the market. According to the statistics by the India Brand Equity Foundation, the e-commerce sector in India is expected to grow at a compound annual growth rate of 15% and is expected to reach US$ 345 billion (Rs. 29,88,735 Crore) by FY30. Furthermore, high population density and expanding urban centers are likely to contribute to the regional growth of the market.

By Material Type

By Thickness

By End Use

By Region

February 2025

February 2025

February 2025

February 2025