April 2025

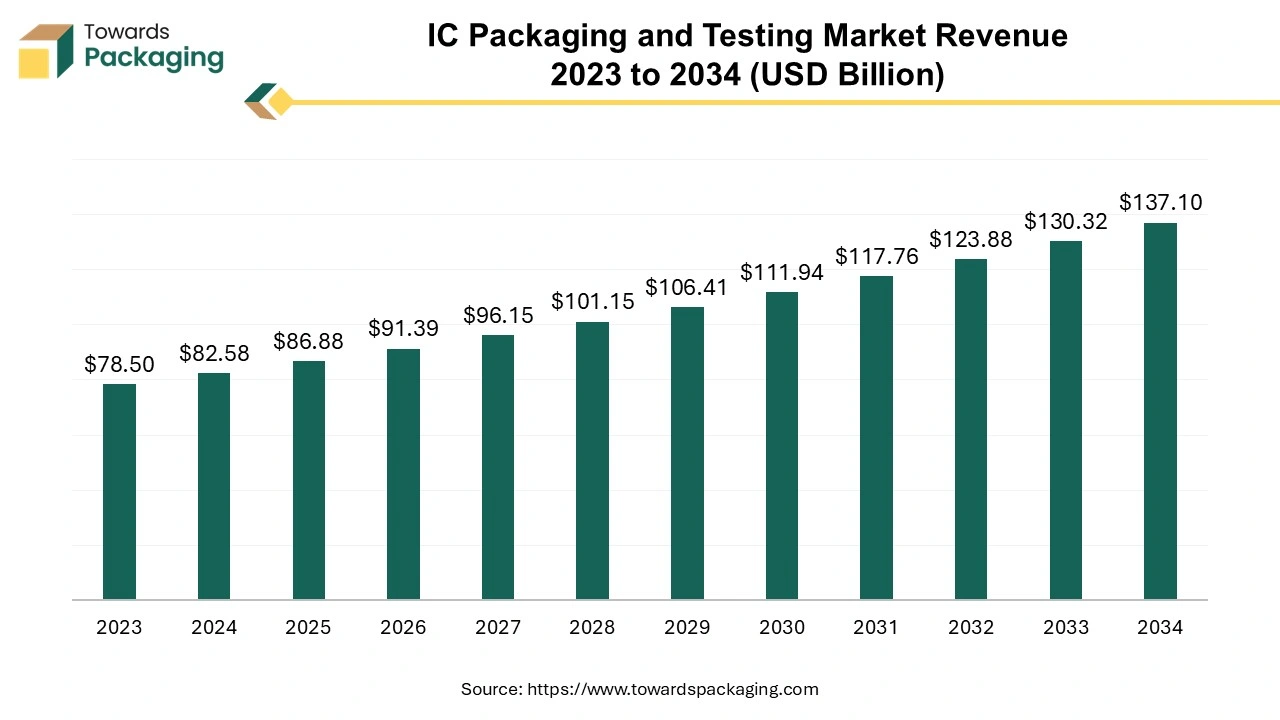

The IC packaging and testing market is projected to reach USD 137.10 billion by 2034, expanding from USD 86.88 billion in 2025, at an annual growth rate of 5.2% during the forecast period from 2025 to 2034.

The market is proliferating due to the increasing electronics and electrical business where there is a need for semiconductor devices and various such electrical parts for different purposes. The rising usage of electrical devices in all sectors influences the demand for IC packaging and testing.

The IC packaging and testing market plays an important role in electronics, confirming that semiconductor equipment functions efficiently in several applications. Integrated circuit packaging signifies the advanced technology that is used to encompass and guard semiconductor chips which provide mechanical backing and enable electrical networks. As the request for minor and more effective electronic devices remains to escalate, the IC packaging and testing industry has progressed to meet these trials, engaging advanced resources and methods to improve performance and dependability. This market includes a wide variety of packaging categories, comprising wire bond, system-in-package (SiP), and flip chip, each appropriate for detailed applications and performance necessities. The global packaging industry size is estimated to grow at a 3.16% CAGR between 2025 and 2034.

Rising Demand for Small Gadgets plays a crucial role in the market’s expansion.

The growing demand for compressed and lightweight electronic devices drives the demand for advanced IC packaging solutions. Miniature gadgets permit producers to generate minor devices without cooperating with performance. The propagation of IoT devices and customer electronics is fuelling the (integrated circuit) IC packaging and testing market. These devices need classy packaging skills to improve functionality and consistency. Revolutions such as system-in-package (SiP), flip-chip technologies, and 3D packaging are improving performance and competence. These developments are essential in consultation with the growing demands for fast data handing out.

There is a rising trend in the direction of environment-friendly packaging alternatives influenced by customer demand for sustainable solutions and compliance with ecological guidelines.

The acceptance of automation and smart industrial skills in packaging methods is improving competence and decreasing manufacturing time to become a crucial trend in the IC packaging and testing market.

As the difficulty of integrated circuit packaging upsurges, the demand for strong testing methods to confirm dependability and performance is increasing, determining the upcoming stability in the packaging market.

Continuous advancements in the technology of the packaging process of integrated circuits such as system-in-packaging (SiP), 3D packaging, and fan-out wafer-level (FOWL) packaging.

Constantly growing support from the government is predicted to enhance the potential of the IC packing and testing market. In several countries, the government is creating helpful incentives for producing semiconductor chips to support semiconductor research and development, manufacturing, and supply chain security. The rising demand for AI applications in numerous sectors such as transportation, healthcare, finance, agriculture, aerospace, telecommunication, manufacturing, defence, and energy also widens the opportunities for semiconductor market players.

With the adoption of AI manufacturing semiconductor processes also sped up and the enhanced functioning chip is developing in the market. This incorporation of AI has lowered the cost of semiconductors which promotes the development of the IC packaging and testing market. Semiconductor plays a crucial role in improving and growing automotive technologies operated in associated electrified and automobile vehicles.

Very intricate procedures associated with cutting-edge IC packaging can result in high engineering charges, which may hinder small and medium manufacturers from investing in this market. Designing and executing operative packaging results in technical challenges comprising thermal management and confirming electrical integrity, which can disturb the market's growth.

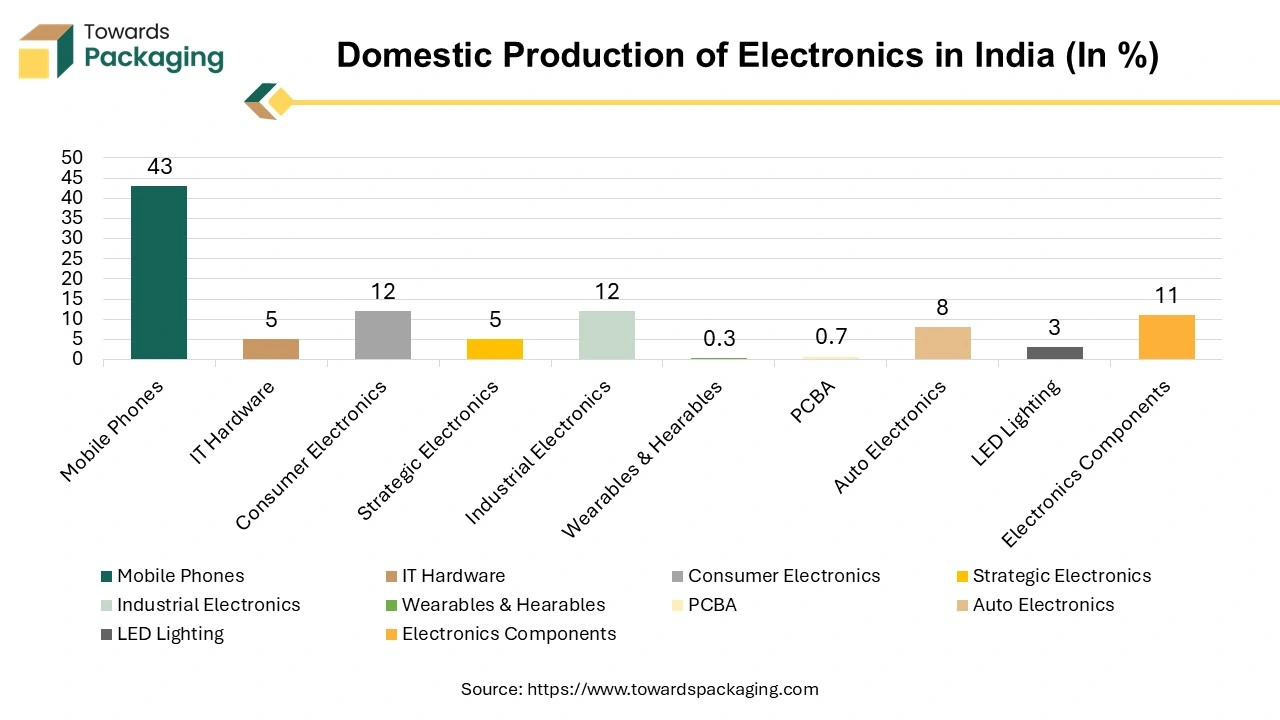

Asia Pacific witnessed the largest market share for the year 2024. This growth in the market is influenced by multiple factors such as the rising usage of electronic products for both commercial and residential purposes, increasing earning sources, growing companies, and several others. The IC packaging and testing market is driven due to the existence of major companies in the semiconductor business in countries such as India, Japan, China, South Korea, and Thailand. These countries are well-known for the best quality production of semiconductors by leading market players available wide supply chains for semiconductors across the globe. This region is dominant also because of strong support by the government with several initiatives and investments in the development of semiconductor infrastructure and technology.

North America is estimated to grow at the fastest rate over the forecast period. This region is another important market for integrated circuit chip packaging and testing, categorized by robust R&D actions and the existence of major market players. The country particularly the United States, is a key hub for semiconductor invention, with major companies such as Qualcomm, AMD, and Intel leading the market. The market development in this region is driven by the growing adoption of cutting-edge technologies in several sectors, comprising telecommunications, healthcare, and automotive. The rising demand for automation and the growth of smart manufacturing in this region have influenced the IC packaging and testing market.

By type, the IC packaging segment led the IC packaging and testing market in 2024. This testing segment supports recognising defects in the early production procedure, confirming that only useful dies continue to the packaging phase. The growing difficulty of integrated circuit projects and the requirement for advanced produce rates are lashing the demand for cutting-edge wafer testing results.

OSAT is an outsourced semiconductor assembly and test benefactor are dedicated market players that deliver packaging and testing facilities to semiconductor producers. OSAT manufacturers play a vital role in the semiconductor supply chain, contributing to scalable and cost-effective solutions for IC packaging and testing chips. The growing difficulty of IC patterns and the requirement for dedicated expertise are influencing semiconductor producers.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025