April 2025

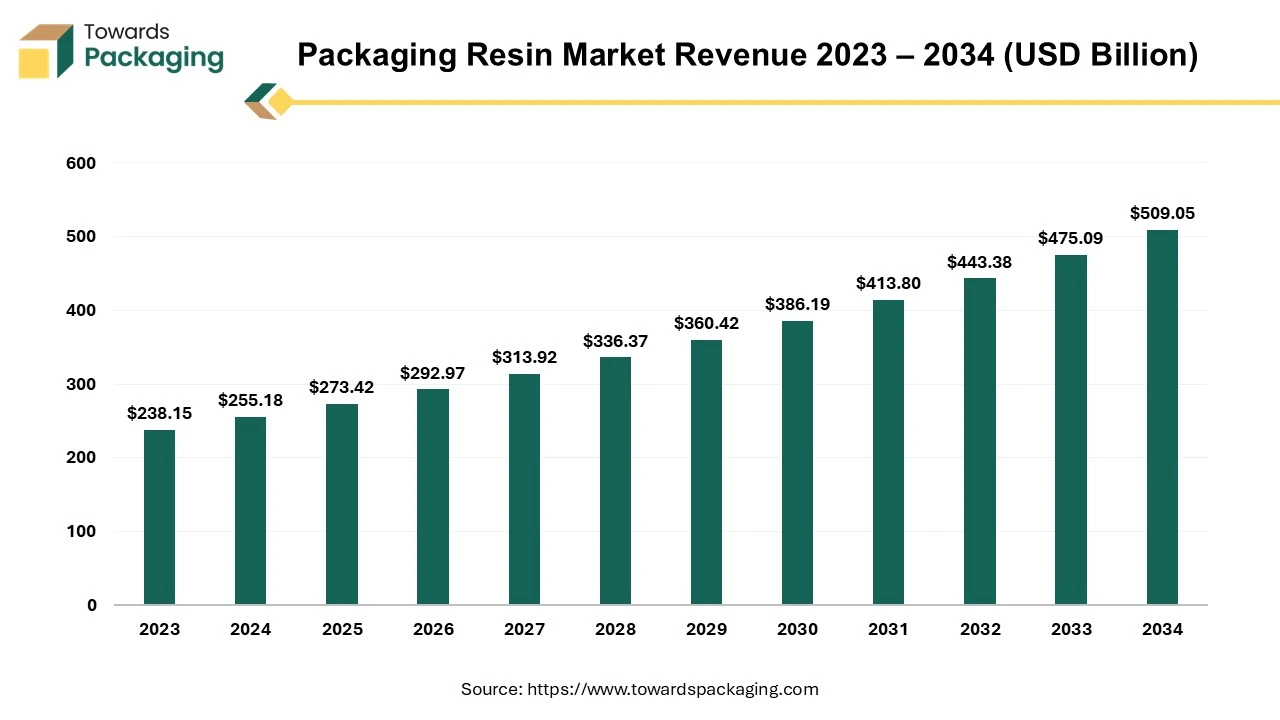

The global packaging resin market size reached US$ 238.15 billion in 2023 and is projected to hit around US$ 509.05 billion by 2034, expanding at a CAGR of 7.15% during the forecast period from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing packaging resin which is estimated to drive the global packaging resin market over the forecast period.

The synthetic polymers utilized to develop packaging materials that are designed to protect, contain, and preserve products throughout their lifecycle is known as packaging resin. These resins are molded, extruded, or formed into various shapes and types of packaging, such as bags, films, bottles, trays, and containers, depending on the specific resin type and its intended utilization. The role of packaging resin in modern manufacturing and consumer goods is critical, as it allows safe storage, easy handling, transport, and enhanced shelf life of a wide variety of products.

There are several different types of packaging resins which have been mentioned here as follows: polyethylene, polypropylene, polyethylene terephthalate, polyvinyl chloride, polystyrene, polycarbonate and polyamide. Polylactic acid and polyhydroxyalkanoates are the biodegradable resins. Each of these resins has specific advantages that make them ideal for certain applications, such as protecting food from contamination, offering durability during transportation, or providing easy recyclability for sustainability.

Due to busy lifestyle there is rise in demand of the packaged and ready-to-eat food. Packaging resins are integral to the food and beverage sector, where they ensure product safety, freshness, and extended shelf life. The growth of packaged food, convenience foods, and beverages (especially bottled drinks) is a significant driver. Increasing launch of the packaged and ready-to-eat food has risen the demand for the packaging resin, which is estimated to drive the growth of the packaging resin market in the near future.

Shift towards Biodegradable and Recyclable Materials: The demand for eco-friendly packaging solutions has been a dominant trend, driven by both regulatory pressures and consumer preference for sustainable products. Companies are increasingly using recyclable plastics, bioplastics, and compostable materials to reduce environmental impact. Increased Focus on Circular Economy: Packaging companies are investing in systems that allow for the recycling of materials like polyethylene terephthalate (PET) and polyethylene (PE). This includes developing packaging that can be easily sorted, reused, or recycled.

The development of high-performance resins, such as polyamide (PA), polycarbonate (PC), and ethylene vinyl alcohol (EVOH), is growing, especially for premium applications that require higher barrier properties (e.g., for food, pharmaceuticals, and electronics packaging). The demand for packaging resins in the pharmaceutical industry is growing due to the need for sterile, tamper-evident, and safe packaging for medicines and medical devices. The key players operating in the market are focused on carrying out research for developing packaging resin which will be suitable for packaging biologic and pharmaceutical products, which is estimated to create lucrative opportunity for the growth of the packaging resin market in the near future.

The key players operating in the market are facing issue in fulling the consumer demand due to high cost of raw material and regulatory rules, which is observed to hamper the growth of the packaging resin market in the near future. The cost of key raw materials, such as crude oil and natural gas, which are used to produce resins like polyethylene (PE) and polypropylene (PP), can be volatile. This makes price stability a challenge for manufacturers and can lead to unpredictable costs. The global resin market is often affected by supply chain issues, such as the availability of feedstock materials or disruptions from natural disasters or geopolitical tensions. These factors can impact production timelines, lead to shortages, and raise costs. With the rise of alternative materials like paper, glass, and aluminum, especially in food and beverage packaging, there is growing competition for market share. While resins remain a popular choice, alternatives that promise lower environmental impacts are increasingly attractive to both consumers and brands.

Asia Pacific region dominated the global packaging resin market in 2023. After the Covid-19 breakout in China the innovation and introduction of vaccines increased in Asia Pacific region which has observed to rise the growth of the packaging resin. APAC is becoming a key hub for biopharmaceutical manufacturing. As the biopharmaceutical sector grows, it creates a demand for advanced packaging solutions, such as multilayered films and specialized containers to protect biologic drugs. These packaging needs often rely on high-performance packaging resins to meet specific storage and transportation requirements, supporting packaging resin market growth.

Asia Pacific region is an increasingly important market for global pharmaceutical companies, with increasing exports and the distribution of medicines across multiple countries. To meet these consumer needs, pharmaceutical products require packaging that can withstand long transit times and varying environmental conditions. Resins that provide better barrier properties, moisture resistance, and temperature stability are in high demand, driving growth in the packaging resin market over the course of period.

Hence, rapid industrialization and well established pharma sector of Asia Pacific region has driven the growth of the packaging resin market

North America region is anticipated to grow at the fastest rate in the packaging resin market during the forecast period. North America, particularly the United States and Canada, has a large and diverse consumer base. With high disposable income, a growing middle class, and a large population, there is a consistent demand for a wide variety of food and beverage products. This provides a strong market for companies to establish and expand their businesses. The food and beverage industry in North America is known for its continuous innovation, from the development of new flavors and product categories to the incorporation of new technologies (e.g., plant-based foods, clean-label products, and functional foods).

The region’s cultural diversity has fostered a wide range of tastes and dietary preferences, encouraging food and beverage companies to offer an extensive variety of products to cater to different consumer needs. From fast food and packaged snacks to organic and health-conscious food, the demand for varied products allows businesses to establish themselves across many niches. Hence, the well-established food and beverages industry in the North America region drives the growth of the packaging resin market in the near future.

Polypropylene (PP) segment held a dominant presence in the packaging resin market in 2023. Polypropylene (PP) has good tensile strength and is resistant to impact, making it an ideal choice for packaging that needs to protect the contents during handling and transportation. It can withstand stress without cracking or breaking easily. Polypropylene is resistant to many chemicals, oils, and solvents, which helps preserve the quality of food and other consumer goods. This property makes it suitable for packaging a wide range of products, from food and beverages to household cleaners. Polypropylene (PP) can be easily recycled, has heat resistance properties, chemical resistance properties, has transparency and clarity.

Food & Beverage segment registered its dominance over the global packaging resin market in 2023. As consumers seek convenience, there is a more demand for on-the-go, ready-to-eat, and easy-to-prepare food and beverage packets. Packaging resins like polyethylene (PE), PET, and polypropylene (PP) are essential for creating packaging solutions that ensure products remain fresh, portable, and easy to use. Packaging resins, especially those with barrier properties (such as PET and multi-layer films), help extend the shelf life of food and beverages by protecting against moisture, oxygen, light, and contaminants.

This extends the freshness of products, reduces food waste, and meets consumer expectations for product quality and safety. Growing consumer and regulatory pressure for sustainability is driving demand for packaging materials that are either recyclable or made from renewable sources. Resins like PET and those used in biodegradable or compostable packaging are gaining popularity due to their reduced environmental impact. This trend aligns with the industry's shift toward eco-friendlier packaging options.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025