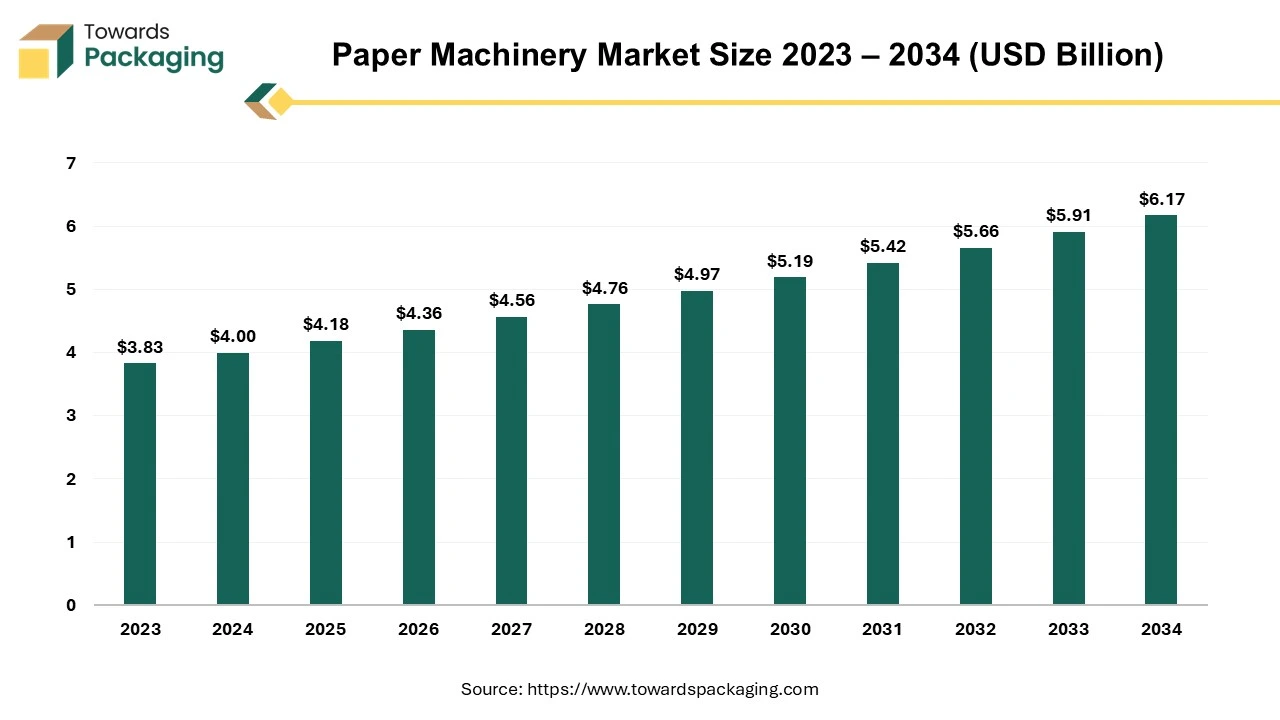

The paper machinery industry is projected to grow from USD 4.00 billion in 2024 to USD 6.17 billion by 2034, with a CAGR of 4.43%. This report covers detailed market segments, including machine types (tissue paper machine, packaging paper machine, kraft paper machine), sheet former shapes (fourdrinier, cylinder, oblong mesh), and operational modes (semi-automatic, fully-automatic). Regional insights are provided for North America, Europe, Asia Pacific, Latin America, and MEA, with key manufacturers such as Valmet, Andritz, and Voith GmbH analyzed for their market positioning. Competitive analysis, trade data, and key suppliers are also included.

A paper machine, also known as a paper-making machine, is an industrial device used in the pulp and paper industry to quickly and efficiently produce huge amounts of paper. The Fourdrinier Machine, which filters out the fibers contained in a paper stock and creates a continually moving wet mat of fiber by using a moving woven mesh, is the basis of modern paper-making machines. This is machine-dried to create a robust paper web. Paper machines typically consist of five or more separate operating sections Forming section, press section, drying section, size press section, calender section, and reel section. The forming section, also known as the wet end, is a continuous revolving wire mesh that uses vacuum to draw water out of suspension in the paper.

This table presents 2024 export statistics for HS Code 8439, which covers: “Machinery for making pulp of fibrous cellulosic material, or for making or finishing paper or paperboard.” Although not finished packaging products, HS 8439 is critical for understanding global manufacturing capacity, machinery exports, and industrial investment within the paper & packaging industry.

| Country | Trade Value (US$) | Net Weight (kg) | Gross Weight | Qty | Qty Unit |

| Australia | 1,089,839 | 23,616.20 | 93 | 0 | N/A |

| China | 895,942,911 | 154,163,772.90 | 0 | 0 | N/A |

| Indonesia | 1,522,522 | 119,214.80 | 0 | 0 | N/A |

| Japan | 50,338,903 | 2,626,664.60 | 0 | 0 | N/A |

| Rep. of Korea | 26,489,625 | 1,653,751.80 | 0 | 0 | N/A |

| Malaysia | 9,433,764 | 799,801.90 | 0 | 0 | N/A |

| Singapore | 37,673,269 | 0 | 0 | 0 | N/A |

| India | 84,294,914 | 6,348,447.10 | 0 | 0 | N/A |

| Philippines | 1,446,802 | 318,408 | 318,408 | 318,408 | kg |

| Other Asia, nes | 57,988,388 | 4,090,975 | 0 | 0 | N/A |

| Country | Trade Value (US$) | Net Weight (kg) | Gross Weight | Qty | Qty Unit |

| Belgium | 6,712,126 | 94,176.80 | 0 | 0 | N/A |

| Croatia | 1,734,153 | 130,388.10 | 0 | 0 | N/A |

| Czechia | 90,208,383 | 5,113,086.40 | 0 | 0 | N/A |

| Denmark | 16,290,648 | 498,444.00 | 0 | 0 | N/A |

| Estonia | 26,149,079 | 2,502,873.10 | 0 | 0 | N/A |

| Finland | 969,455,355 | 0.00 | 0 | 0 | N/A |

| France | 81,120,759 | 1,630,379.20 | 0 | 0 | N/A |

| Germany | 1,071,330,340 | 47,235,895.90 | 0 | 0 | N/A |

| Greece | 506,345 | 54,968 | 0 | 0 | N/A |

| Hungary | 5,716,597 | 0 | 0 | 0 | N/A |

| Ireland | 40,889 | 1,739.70 | 0 | 0 | N/A |

| Italy | 438,252,413 | 24,513,661 | 0 | 0 | N/A |

| Luxembourg | 183,338 | 6,788 | 0 | 0 | N/A |

| Portugal | 638,567 | 17,735.40 | 0 | 0 | N/A |

| Romania | 4,023,409 | 179,396.50 | 0 | 0 | N/A |

| Serbia | 3,931,536 | 513,124.40 | 0 | 0 | N/A |

| Slovakia | 3,652,692 | 301,895 | 0 | 0 | N/A |

| Slovenia | 37,777,279 | 2,637,722.40 | 0 | 0 | N/A |

| Spain | 99,535,920 | 0 | 0 | 0 | N/A |

| Sweden | 402,813,591 | 13,555,431.40 | 0 | 0 | N/A |

| Netherlands | 29,599,622 | 389,382.80 | 0 | 0 | N/A |

| Norway | 9,364,376 | 630,877 | 0 | 0 | N/A |

| Country | Trade Value (US$) | Net Weight (kg) | Gross Weight | Qty | Qty Unit |

| Canada | 136,817,065 | 2,605,390.20 | 0 | 0 | N/A |

| Mexico | 7,412,635 | 0.00 | 0 | 0 | N/A |

| Country | Trade Value (US$) | Net Weight (kg) | Gross Weight | Qty | Qty Unit |

| Brazil | 26,089,948 | 1,163,869.20 | 0 | 0 | N/A |

| Dominican Republic | 33,760 | 12,097.90 | 0 | 93 | u |

| Ecuador | 513,711 | 57,685.20 | 0 | 10 | u |

| El Salvador | 5,148 | 2,550.00 | 0 | 2,550 | kg |

| Argentina | — | — | — | — | — |

| Paraguay | 225,920 | 90,592.50 | 0 | 0 | N/A |

| Peru | 1,745,345 | 117,454.10 | 0 | 792 | u |

| Country | Trade Value (US$) | Net Weight (kg) | Gross Weight | Qty | Qty Unit |

| Israel | 124,000 | 2,936.80 | 0 | 0 | N/A |

| Saudi Arabia | 1,067,566 | 254,714.00 | 0 | 0 | N/A |

| Georgia (Europe/Asia bridge) | 138,297 | 35,600.00 | 0 | 2 | u |

| Moldova | 659 | 113.00 | 0 | 1 | u |

| Mozambique | 23 | 0.50 | 0 | 1 | kg |

| South Africa | 676,578 | 13,518.10 | 0 | 0 | N/A |

| Namibia | 43,288 | 1,352.60 | 0 | 0 | N/A |

| Pakistan (South Asia) | 91,611 | 8,360.40 | 0 | 0 | N/A |

In the past five years, the e-commerce sector has doubled in size, with Amazon leading the way with more than 50 million prime members. The e-commerce market is anticipated to continue growing at a high rate in countries like China and India due to growing internet and smartphone penetration as well as fast urbanization. By the end of 2026, the Indian e-commerce market is projected by India Brand Equity Foundation (IBEF) to reach a valuation of USD 200 billion. The market for paper-making machinery is also anticipated to grow as a result of increased ecological and financial benefits provided by pulp and paper manufacturers. Paper-making machine demand is predicted to rise as a result of population growth and the expansion of the hotel industry.

The global demand for paper napkins is fueled by the growing awareness of personal cleanliness. The market for paper industry machinery is anticipated to be driven by rising demand for paper napkins in homes, restaurants, and other commercial and residential locations. Moreover, increasing investment and funding events by the key players operating in the market to improve the production efficiency is expected to drive the growth of the paper machinery market over the forecast period. The global packaging market size is estimated to grow at a 3.16% CAGR.

The key players operating in the market face certain challenges and limitations in accumulating raw material and manpower which is estimated to restrict the growth of the market. The environmental concerns are rising day by day which is the important reason for facing lack in raw material. Addressing environmental issues is one of the biggest problems the paper sector faces. During the production process, a lot of natural resources, such as energy and water, are frequently used. Moreover, the clearing of forests for raw resources may result in ecological imbalances. One major issue facing the paper industry is the pricing and availability of raw materials.

The cost of raw materials has increased due to limited supplies and increased demand. The production of paper needs a significant amount of energy. Businesses should make investments in managing their energy usage to address issues related to sustainability and energy efficiency. While lowering operating expenses, modern, energy-efficient technology and the use of renewable energy sources can lessen their negative effects on the environment.

Industries make strategic investments in cutting-edge technologies such as artificial intelligence, sophisticated software, and others. Globally, the paper machinery industry will continue to see an increase in innovation. Furthermore, a lot of businesses are going toward more personalization in order to develop unique paper packaging arrangements that draw clients and set them apart. The key players operating in the market are focused on integration of the artificial intelligence and enhance the production efficiency, which is expected to create lucrative opportunity for the growth of the paper machinery market during the forecast period.

For instance,

The tissue paper machine segment held a significant share of the market in 2024. Toweling, face tissue, toilet tissue, and napkins are all included in the category of papers referred to as the sanitary grades. To keep a soft, bulky, absorbent sheet, these grades are manufactured from different ratios of bleached and sulfited kraft pulps with relatively little stock refining. By pressing the wet sheet against a smooth drying roll and then removing it by running it against a flat, stationary metal blade (a doctor blade), machine creping further softens this sheet. The sheet has a creped appearance because it is stacked on top of itself. Dry creping is used on facial tissue, meaning that the drying roll is finished drying before the doctor blade is used. In general, towels are thicker than tissues and are typically creased while still damp.

For personal use, hygienic tissue paper is frequently used as napkins, bathroom tissue, face tissue (paper handkerchiefs), and household towels. Paper has been employed in hygienic contexts. Tissue paper goods work incredibly well to prevent the spread of disease, bacteria, viruses, and germs, thereby promoting cleanliness. Modern society cannot function well without proper hygiene. The global pandemic that began at the beginning of the decade brought to light the critical role that cleanliness and hygiene play in maintaining the health of society, not just in homes but also in communities and the establishments industries frequent, such as restaurants, bars, sports facilities, libraries, and other public areas.

For instance,

The fourdrinier segment held the dominating share of the paper machinery market in 2024. The Fourdrinier machine is a machine that makes paper, paperboard, and other fiberboards. It works by feeding a pulp and water mixture into a moving, endless belt of wire or plastic screen. The machine lets the excess water drain out, creating a continuous sheet that is then dried further using heat, pressure, and suction. The forming section of the Fourdrinier machine employs a specially woven fabric mesh conveyor belt, called a wire since it was originally woven from bronze, to drain a slurry of fiber, mainly wood or other vegetable fibers, into a continuous paper web.

A horizontal drainage area known as the drainage table was employed in the original Fourdrinier forming section. Fourdrinier papermaking is appropriate for manufacturing huge volumes of paper since it can create paper at a very high pace. Big paper machines Fourdrinier paper machines are ideal for generating a variety of paper products because they can create paper in extremely big widths and lengths. Focusing on the advantages offered by the fourdrinier machine the key players operating in the market are focused on installing it in the production line. The key players operating in the market are focused on introduction of the new fourdrinier sheet former machine, which is expected to drive the growth of the segment over the forecast period.

For instance,

The cylinder segment is expected to grow at fastest rate over the forecast period. A cylinder covered with mesh and revolving, partially submerged in a tank of fiber slurry at the wet end, is used in a cylinder mold paper machine to create a paper web with a more sporadic distribution of cellulose fibers. Higher consistency sheets can be formed by cylinder machines. The "cylinder mould" method, which is reserved for fine art items, is more analogous to the antiquated, manual papermaking technique.

Papers produced by the "cylinder mould paper machine" feature a richer surface texture, more randomly oriented fibers in all directions, and a unique uniform sheet structure, or "looking through." Because of this, cylinder mould paper machines are well known for their resilience in a wet state, which is further enhanced when rag plays a significant role in the pulp's composition. The cylinder mould paper machine is utilized for manufacturing kraft paper, fluting paper, duplex board, and test liner. The key players operating in the market are focused on deployment of the cylinder sheet former shape machine to rise the capacity of production and meet the rising demand of paper, which is estimated to fuel the growth of the segment over the forecast period.

The semi-automatic segment has shown a significant growth rate in 2024. The semi-automated paper manufacturing machine is the suitable option for the small – medium scale operating area, as it combines the advantages of automation with the flexibility and authority of manual control, ensuring consistent output and quality. One person can operate the semi-automated paper production machine. The machine will automatically generate the finished products; all company have to do is lay the sheets on the workstation. Automatically, machines will rise and fall. It is the right tool for creating many kinds of paper trays, including square, round, and curved ones.

Unlike traditional paper manufacturing machines, the new flat push-type paper machine combines hydraulic and mechanical principles to improve production speed, stability, paper waste rate, and humanized structural design. Trays made of paper or aluminium foil are frequently made using it. It is possible to create round or square papers and trays in a variety of sizes and shapes by altering the molds.

The fully automatic segment is expected to grow at fastest rate over the forecast period. The fully automatic paper machinery is expected to grow at fastest rate owing to advantages offered such as integrated pneumatic and mechanic technology, faster production speed, increased safety of operation, and heavier frame and automated systems for easy tasks. The fully automatic paper machinery works labor-free, completely automated system for producing paper. The machine will automatically take the paper and manufacture the finished items; the manufacturer set the laminated roll on the workstation. The demand from the market led to the creation of fully autonomous design. One of these machines has an automated collecting mechanism.

Numerous functions, including thermoforming, temperature control, automatic counting, and pneumatic suction paper feeding, can be performed by this equipment. Paper machines make recyclable and ecologically friendly paper. It works well for making square and round papers. The efficiency and precision of the apparatus are enhanced by hydraulic machine technology. The double working station is often fitted with cylinder arrangements for production purposes. The key players operating in the market are focused on developing new fully automated paper manufacturing machine which is expected to drive the growth of the segment over the forecast period.

For instance,

The pulp & paper segment has shown a significant share in the paper machinery market in 2024. The pulp and paper industry is made up of businesses that make pulp, paper, paperboard, and other cellulose-based goods using wood, primarily pulpwood, as a raw material. During the manufacturing process, pulp is fed into a paper machine, which shapes it into a web of paper then presses and dries it to remove water. Pressing is the process of exerting force to remove water from the sheet.

To absorb the water in this process, a specific kind of felt—different from regular felt—is used. In contrast, a blotter sheet is used using hand-made paper for this purpose. Tree pulp is a biodegradable and renewable raw material. Pulp is one of the most adaptable materials available. It can be used for anything from commonplace items like books, tissues, and baby wipes to more inventive products like automobile filters, Liquid-crystal display (LCD) displays, stickers, and renewable fuel. Paper, tissue, board, and specialty paper may all be made from it, making these bioproducts genuinely sustainable.

For instance,

The food and beverages segment is expected to drive at fastest rate over the forecast period in the paper machinery market. One of the world's fastest-growing industries is the food and beverage sector. Numerous establishments offer a variety of food items, from snacks to three-course dinners. The food sector has grown significantly over time and is heading toward higher sales. A lot of food outlets, bars, and restaurant chains have arisen along with the growth of the F&B industries, and the idea of eco-friendly food packaging has become well-known.

Eco-friendly food packaging is defined as that which preserves sustainability in F&B business practices and does not negatively impact the environment. In the past, this business packed food in plastic boxes and containers, however now days, paper food packaging is becoming quite popular in this industry. When food is delivered, customers are happier and the company's brand value is increased when they use paper packaging for their meals.

The wide range of benefits are offered by the paper packaging such as it keeps the food's texture intact when it's carried in the sun, enhances the packaging's appearance, brand that is associated with the idea of sustainability, food becomes simple to handle. When actually consuming the food, the customer is drawn in by the food's attractive appearance in the paper package. The consumer won't even open the box if it is poorly packaged. The food package's top bearing the brand's emblem aids in marketing as well. For food and beverage businesses, attractive paper packaging can be the least expensive form of advertising. The product's sale is greatly influenced by its attractiveness. Paper food packaging is used in bars, restaurants, and food chains. Paper food packaging comes in a variety of forms, including sandwich trays, noodle containers, soup and liquid containers, and paper boxes for solid food.

Asia Pacific led the paper machinery market in 2023. The significant presence of makers of specialized pulp and paper in China and Japan, coupled with easy access to raw materials and equipment, is anticipated to drive up chemical use during the projected period. Additionally, it is anticipated that the market would develop at a rapid pace over the course of the forecast period due to the rising demand for specialized pulp and paper in a number of end-use applications, including labeling, printing, and packaging. Because of their low labor costs, quick economic expansion, and growing industrialization, China and India are expected to have extraordinary growth of the paper machinery market.

In Asia-Pacific, packaging is essential to the purchasing and selling of commodities. Furthermore, the rising trend of home grocery ordering has raised the need for packaging innovations in the area. Various projects are being carried out by governments and other recognized bodies to decrease the global usage of plastic bags. Global prohibitions on plastic are boosting the market for products with paper packaging. This will therefore increase the paper machinery market for machinery used in the paper sector.

The Indian government's Ministry of Commerce and Industry has pushed the e-commerce sectors to gradually do away with single-use plastic in product packaging. Businesses have been urged to create environmentally friendly packaging strategies, which will provide a favourable market for some coated paper products. The increasing need for packaging from the food and beverage industry, Fast-Moving Consumer Goods (FMCG), e-commerce, and pharmaceuticals is driving up the demand for packaging paper.

For instance,

The key players operating in the market are focused on launching the paper machinery in the Asia Pacific region which is expected to drive the growth of the paper machinery market over the forecast period.

For instance,

North America is expected to grow at fastest rate over the forecast period. In the North America region, the demand for paper machinery is rising due to constant need for personal hygiene products. In the same way, paper like premium quality coffee filter, candy and chocolate bags, and tea wraps which are affordable in cost and have high demand in the North America region is estimated to drive the growth of the paper machinery market over the forecast period. Furthermore, the market players operating in the North America region are focused on adopting inorganic growth strategies like partnership for developing advanced technology paper machinery to meet the rising demand of the consumers, which is estimated to drive the growth of the paper machinery market in the near future.

For instance,

By Machine Type

By Sheet Former Shape

By Operation

By End-Use

By Region

December 2025

November 2025

November 2025

November 2025