May 2025

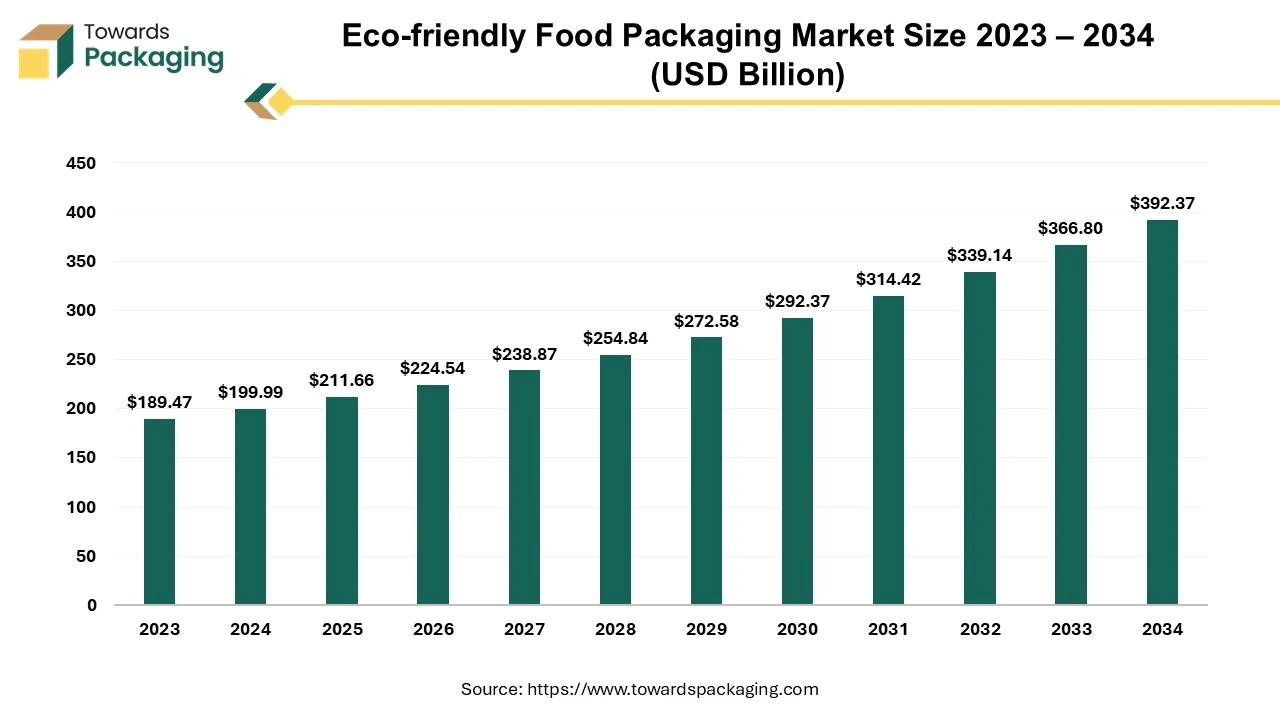

The global eco-friendly food packaging market size reached US$ 199.99 billion in 2024 and is projected to hit around US$ 392.37 billion by 2034, expanding at a CAGR of 6.97% during the forecast period from 2025 to 2034.

The eco-friendly food packaging market is predicted to witness strong growth in the years to come. Eco-friendly food packaging materials can be recycled, composted, biodegradable or used again. Plastic food packaging can cause endocrine system disruption and accumulate in the ocean, among other health and environmental hazards. Eco-friendly packaging, fortunately, has many advantages for consumers, companies, and the environment. Plant-based extracts such as wheat, bamboo and wood, as well as sustainable bioplastics are frequently utilized in sustainable packaging for food. According to the research, eco-friendly packaging has a much lower rate of chemicals and also non-intentionally added substances (NIAS) migrating into food and the body than plastics. Eco-friendly alternatives are therefore safer compared to plastic packaging.

The rising environmental awareness among organizations and consumers along with the stringent government regulations and bans on the single-use plastics in various countries is expected to augment the growth of the eco-friendly food packaging market during the forecast period. Furthermore, technological advancements in the material science such as the development of the bio-based plastics and recyclable paper-based materials are also anticipated to augment the growth of the market. Additionally, the growing consumer inclination towards the eco-friendly products as well as the expansion of the food and beverage industry coupled with the corporate sustainability initiatives and commitments by major brands to achieve the net-zero emissions is also projected to contribute to the growth of the market in the near future.

The growth of the quick-service restaurants (QSRs) and food delivery services is anticipated to support the growth of the eco-friendly food packaging market during the estimated timeframe. With approximately 70 percent of the adults in America already ordering takeaway and 60 percent doing so at least once a week, the pandemic considerably increased the popularity of the takeout and delivery. Emerging restaurant concepts with smaller footprints and fewer dining areas are appearing in response to this desire. Nowadays, delivery, drive-thru, and carry-out account for over 75% of restaurant traffic; QSRs see an even greater percentage. In addition to lowering development and operating costs, this move to more compact, effective designs also helps firms stay competitive through responding to consumer preferences. This has further prompted restaurants and food service providers to adopt biodegradable, compostable and recyclable alternatives. For instance

Some food delivery services are also piloting reusable packaging systems, in which customers return containers for cleaning and reuse. The usage of plant-based bioplastics, molded fiber trays and edible packaging are anticipated to increase, resulting in sustainable solutions for the food service industry over the long run.

The high production cost is anticipated to hamper the growth of the eco-friendly food packaging market during the estimated timeframe. Adopting the eco-friendly packaging might seem like the best option, but there are unstated expenses involved. These extend beyond the price tag of the material of the packing. It also covers the manufacturing, shipping as well as disposal of the packaging. Fillers made of shredded paper cost about $30, while packing peanuts cost about $20. However, packing peanuts are not recyclable and need to be disposed of properly, and additional shredded paper is required for keeping a product safe. Since eco-friendly packaging is a relatively young sector and its techniques are still being developed, it is generally more expensive to produce. It costs about one cent to make a plastic bag and about four cents to make a paper bag.

Similarly, as biodegradable polymers need advanced production techniques and natural raw materials, they are typically 20–30% more expensive compared to conventional plastics. It can be more challenging for corporations to acquire biodegradable plastic and eventually give clients this more sustainable option when they purchase because the average cost can range from $2 to $7 USD per kilogram. Furthermore, the survival of a small company may be greatly impacted by these expenses therefore mindful selection is important. Sustainable packaging is not always the most economical, even though it is environmentally good. The higher prices of eco-friendly packaging solutions are a big turnoff for customers, even if more than half of them say they would be willing to spend more on it. The cost of producing sustainable packaging is on the rise due to inflationary pressures, rising energy prices, as well as the shortage of resources. This has led to a gap in pricing, which frequently influences buyers to choose less expensive and less sustainable options.

The increasing focus on the corporate sustainability initiatives is expected to create substantial opportunity for the growth of the eco-friendly food packaging market in the near future. Leading food and beverage companies, like PepsiCo, Nestle, Coca-Cola, McDonald’s, Starbucks, and Unilever, have committed to moving toward 100 percent recyclable, biodegradable or compostable packaging in coming years. As a result, these global brands need to take proactive measures to reduce plastic waste and carbon emissions, as well as comply with environmental regulations which in turn increase the demand for sustainable packaging material.

The Coca-Cola Company recently revealed its latest sustainability targets that focus on the design of packaging and post-use collection, with the aim of achieving these targets by 2035. These take the place of earlier objectives pertaining to reusable packaging, recycled content as well as recyclability. One new objective is to increase the usage of recycled plastic to between 30% and 35% worldwide, as well as utilize 35% to 40% recycled content in primary packaging materials. The other new objective is to work with partners to collect used packaging; the corporation wants to make sure that 70% to 75% of the same number of bottles and cans that are placed into the market each year are collected.

Similarly, Nestle is making a greater effort to use packaging that is sustainable. The organization recently announced new initiatives and advancements in the direction of a waste-free future. By 2025, Nestle wants all of its packaging to be recyclable or reusable, setting high goals. During the same time frame, the corporation also wants to minimize its usage of virgin polymers by one-third. In keeping with its pledge, Nestlé has declared a $30 million investment to expand the supply of recycled plastics for utilization in food in the US.

Additionally, Starbucks and Unilever are also working on the returnable and reusable packaging models to reduce their dependency on waste materials. These sustainability promises not only help in managing the environmental concerns, but they also influence the consumer expectations and industry trends. As major organizations set the example, small and medium-sized enterprises are urged to use greener packaging, resulting in a general push toward sustainability in the food industry.

The current landscape is being altered by emerging artificial intelligence (AI) technologies, which expedite the process of identifying alternatives without the excessive expenses and timeframes seen in conventional methods. Loving Earth, a company based in Australia that packages its vegan chocolate bars in a compostable film made from wood pulp and non-GMO corn, and No Evil Foods, which sells small batch plant-based meat substitutes that come in completely compostable materials printed using plant-based ink, are just two examples of companies that have invested time, money along with creativity into finding creative ideas for sustainable packaging.

The science-based artificial intelligence (AI) can help organizations do everything much more quickly and at scale. For data scientists, infusing AI into research provides a means to get to the lab-based experiments with the most promising materials quickly. By running thousands of experiments virtually for the most promising candidates, scientists can quickly identify potential compounds and speed the discovery of better performing, safer, and more environmentally sustainable packaging materials.

Waste management is another important aspect of sustainable packaging. The optimization of waste recycling procedures can be greatly improved with AI and ML. These tools can spot chances for better disposal of waste and higher recycling rates by examining trends in consumer behavior and recycling practices. This reduces the quantity of packaging waste that ends up in landfills and makes it possible to develop more environmentally friendly packaging materials, which involves compostable or bio-based substitutes.

New science-infused AI techniques may also prove important in reducing the plastic leaching and speeding up the development and commercialization of the sustainable materials and additives, which will result in better-performing, more eco-friendly packaging. These techniques involve improving the bio-content of formulations as well as discovering low-toxicity plasticizers. As artificial intelligence evolves, its integration into packaging material innovation along with smart packaging ideas will be a key in accelerating the adoption of eco-friendly food packaging while increasing cost efficiency and sustainability across industries.

The recyclable segment held largest share of 45.43% in the year 2024. The selection of the packing materials has become important in a time when consumer choices and company practices are increasingly influenced by environmental concerns. The trend for recyclable packaging has accelerated for a number of strong reasons such as cost savings, improved brand perception as well as environmental sustainability. Recycling packaging demonstrates a company's commitment in reducing its environmental impact. Customers who care about the environment are drawn to this dedication, which may increase the brand loyalty. Consumers are more inclined to support organizations that share their beliefs and utilizing the sustainable packaging can provide a good first impression on the customers. Furthermore, packaging materials that may be recycled contribute to a reduction in the landfill waste. Companies can minimize their impact on the landfills and support the waste management systems that prioritize recycling and reuse by using these products.

The bags & pouches segment held largest share of 40.25% in the year 2024. These packaging options meet the increasing need for practical and eco-friendly substitutes in the retail, food processing and restaurant sectors. The production of the bags and pouches uses less energy and material than rigid containers, which lowers the carbon footprint. Additionally, they are reasonably priced that makes them a desirable choice for the companies wishing to transition to environmentally friendly packaging without having to make big expenditure changes. Due to their great durability, resistance to leaks, and ease of storage, these packaging designs have become increasingly popular as online food delivery and takeout services have grown. Furthermore, pouches are now very effective at maintaining food freshness, increasing shelf life, and avoiding infection thanks to developments in barrier technology. This makes them perfect for snack foods, frozen dinners and dry goods.

Europe held largest market share of 36.45% in the year 2024. This is due to the well-increasing demand for sustainable products across the region. Statistics gathered by ITC from five EU nations (Germany, France, Italy, the Netherlands, and Spain) show that retailers in important EU markets now place a high priority on sustainable product sourcing. 92 percent of the merchants anticipate a rise in sales of sustainable items over the next five years, while 85 percent report an increase in sales of eco-friendly goods during the previous five years. Additionally, the European Union's ban on plastic straws, cutlery, and certain food containers are also further expected to contribute to the regional growth of the market. Also, the closed-loop recycling systems along with the well-established waste management and recycling system are also expected to support the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 9.22% during the forecast period. This is due to the government regulations and bans on the single-use plastics in countries like China, India, Japan and Australia. Additionally, the rapid growth of the food delivery as well as takeout sector by platforms like Zomato, Swiggy, Meituan and GrabFood are also expected to contribute to the regional growth of the market. Furthermore, the expansion of quick-service restaurants (QSRs) and the fast-food chains along with the strong growth of the retail and e-commerce industry is likely to contribute to the regional growth of the market.

By Type

By Product

By End-user

By Region

May 2025

May 2025

May 2025

May 2025