April 2025

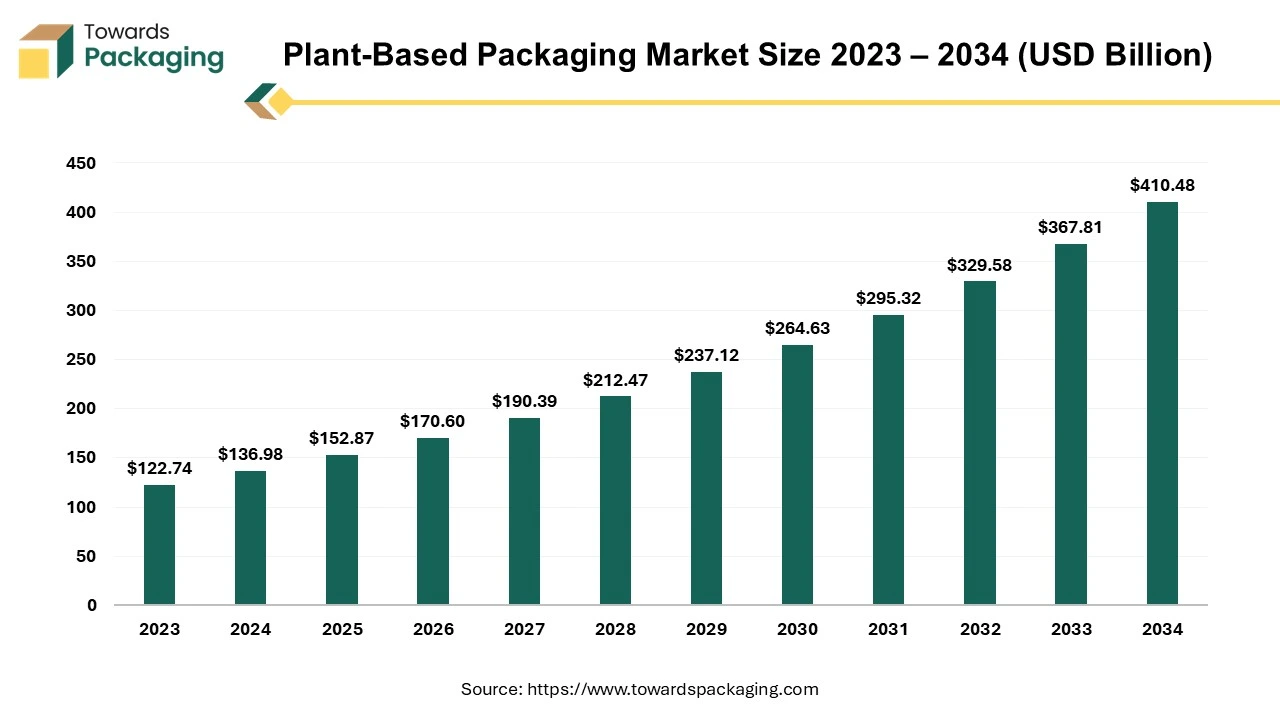

The plant-based packaging market is forecasted to expand from USD 152.87 billion in 2025 to USD 410.48 billion by 2034, growing at a CAGR of 11.6% from 2025 to 2034.

Plant-based packaging is produced from natural, renewable plant materials. Unlike many forms of standard packaging, such as plastics, it is fully organic and can take numerous forms.

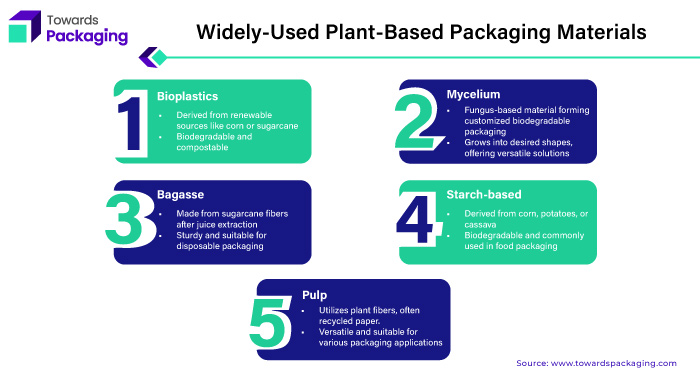

Plant-based packaging employs materials derived from sustainably cultivated plants rather than non-renewable hydrocarbon sources. When food manufacturers or contract packagers mention "plant-based packaging," they usually mean bioplastics, the most popular plant-derived polymers. Currently, two common forms of bioplastics are in use: biodegradable PLA and bio-PET. While both come from plants, they are manufactured in distinct ways.

Biodegradable PLA, or polylactic acid, is created by bacterial fermentation of dextrose into lactic acid. Many food businesses have already switched to plant-based packaging, while others are in the process. The benefits of plant-based packaging are numerous, particularly given the significant reduction in manufacturing costs since its introduction. Depending on the plant-based bioplastic used, it offers comparable or higher protection to petroleum-based alternatives.

The need for environmentally friendly products—such as plant-based packaging—is only going to increase as consumers place a higher priority on sustainability. The need of sustainable practices in a variety of industries, including food packaging, is highlighted by this change, which is indicative of a larger movement towards greener lives.

For Instance,

North America is at the forefront of the plant-based packaging market, with coordinated efforts and programs promoting adopting sustainable packaging solutions. One significant endeavor is the Sustainable Packaging Coalition (SPC), a collaborative organization that promotes sustainability in the packaging industry. The SPC has developed extensive recommendations for sustainable packaging, promoting plant-based materials and compostable packaging. They provide vital tools and assistance to businesses looking to incorporate sustainable practices, such as plant-based packaging solutions.

Major North American retailers, such as Walmart and Target, have also committed to sustainability goals for their packaging. They aggressively explore eco-friendly alternatives, such as plant-based packaging, to meet consumer demand for more environmentally responsible products.

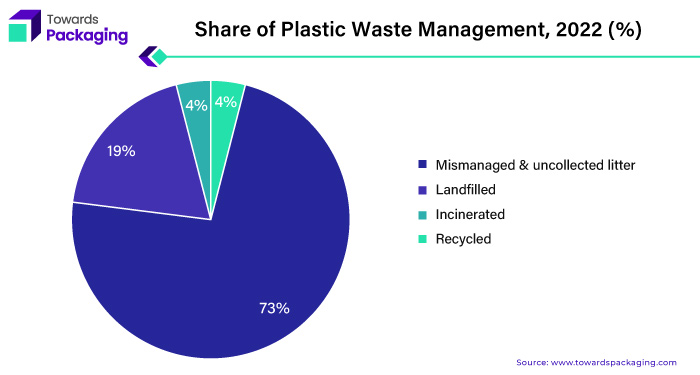

The global recycling rate for plastic trash needs to improve, with only 9% recycled and the other 22% needing to be managed responsibly. In response, the United States has seen a spike in legislative action, with 370 measures proposed in 42 states to ban petroleum-based plastics and single-use items. This proactive approach indicates a rising awareness of the critical need to eliminate plastic pollution and adopt more sustainable alternatives.

For Instance,

Europe emerges as the second-leading region in the plant-based packaging market, wielding significant influence in the sector. With a solid market share of 32.0% in 2022, Europe's impact is palpable. The EU Circular Economy Action Plan stands as a flagship initiative driving the region towards greater sustainability and circularity, with a notable focus on promoting plantable packaging options.

Various European nations have enacted legislation and initiatives aimed at curbing plastic waste and encouraging the adoption of sustainable packaging alternatives.

France, for instance, has implemented bans on single-use plastic bags and is aiming to phase out additional single-use plastics by 2040. Similarly, Italy has prohibited single-use plastics such as plates, cutlery, and straws. Moreover, Europe boasts a thriving ecosystem of companies specializing in plantable packaging solutions, showcasing innovation and sustainability at the forefront. Notably, UK-based startup GreenBottle has developed an innovative plantable packaging solution for milk and other liquid products, setting a benchmark for eco-friendly packaging practices in the region.

Bioplastic is the leading material segment in plant-based packaging market. Bioplastics are a class of polymers made from renewable biomass sources such as maize starch, sugarcane, and other plant-based components.

These alternatives to traditional petroleum-based plastics are more environmentally friendly, use renewable resources, and have a lower carbon footprint. Despite their eco-friendliness, many bioplastics are as durable as ordinary plastics, disintegrating only under certain conditions. Some bioplastics, for example, are designed for home composting, whereas others require industrial composting facilities.

Global plastic output is expected to rebound in 2023, driven by rising demand and the advent of innovative uses and goods. This revival includes bioplastics, with manufacturing capacity projected to increase significantly from roughly 2.18 million tonnes in 2023 to an estimated 7.43 million by 2028. This trend demonstrates the growing understanding and use of bioplastics as a possible alternative to the environmental problems of regular plastics.

A comparison of production capacities with actual production in 2023 reveals that the bioplastics sector is operating at nearly total capacity. Although it varies substantially between polymers, ranging from 60% to 100%, the average utilization rate in 2023 is 82%.

For Instance,

Flexible packaging plays a significant role in the plant-based packaging market, offering versatile and sustainable solutions for various products. This packaging format, characterized by materials like bioplastics and compostable films derived from plant-based sources, aligns with the growing demand for eco-friendly alternatives to traditional packaging.

Regarding material composition, plant-based flexible packaging encompasses a range of options, including bio-based plastics like polylactic acid (PLA), cellulose-based films, and compostable laminates. These materials offer comparable performance to conventional plastics while reducing reliance on fossil fuels and mitigating environmental impact.

Key drivers fuelling the growth of plant-based flexible packaging include increasing consumer awareness and demand for sustainable packaging solutions, regulatory initiatives promoting the use of renewable materials, and advancements in technology enabling the production of high-quality, cost-effective plant-based packaging materials.

For Instance,

The food and beverage sector plays a crucial role in the plant-based packaging market, representing a significant portion of the overall demand. Consumers increasingly seek eco-friendly packaging options, particularly in the food and beverage industry, where sustainability and health-consciousness intersect.

The global market for plant-based packaging in the food and beverage sector is projected to grow substantially in the coming years and driven by increasing consumer awareness about environmental issues, stringent regulations on single-use plastics, and the growing preference for sustainable packaging solutions.

Specific segments such as dairy products, beverages, and fresh produce are witnessing notable adoption of plant-based packaging within the food and beverage industry. For instance, plant-based alternatives to traditional plastic bottles are gaining traction in the beverage sector, driven by concerns over plastic pollution and the desire for biodegradable packaging options.

For Instance,

The competitive landscape of the plant-based packaging market is dominated by established industry giants such as TIPA (U.S), Tetra Pak (Switzerland), Vegware (UK), Coca-Cola Company (U.S), Amcor Plc (Australia), Evergreen Packaging (U.S), Berry Global Inc (U.S), Emsur (U.S), Sealed Air (U.S), Heinz (U.S), SINTEF (UK) and BASF (UK). These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

The lowest possible carbon footprint is the goal of Coco Cola's years-long collaboration with technology partners to develop the appropriate technologies for a 100% plant-based bottle. It's exciting that these technologies are now available and can be scaled by value chain participants.

For Instance,

Tetra Pak and its supplier Braskem are the first in the food and beverage business to ethically obtain plant-based polymers utilising the Bonsucro requirements for sustainable sugar cane. This decision further reinforces the company's commitment to driving ethical and responsible business practices throughout global supply chains while reducing the carbon impact of its packaging.

For Instance,

By Material

By Application

By End Use

By Region

April 2025

April 2025

April 2025

April 2025