April 2025

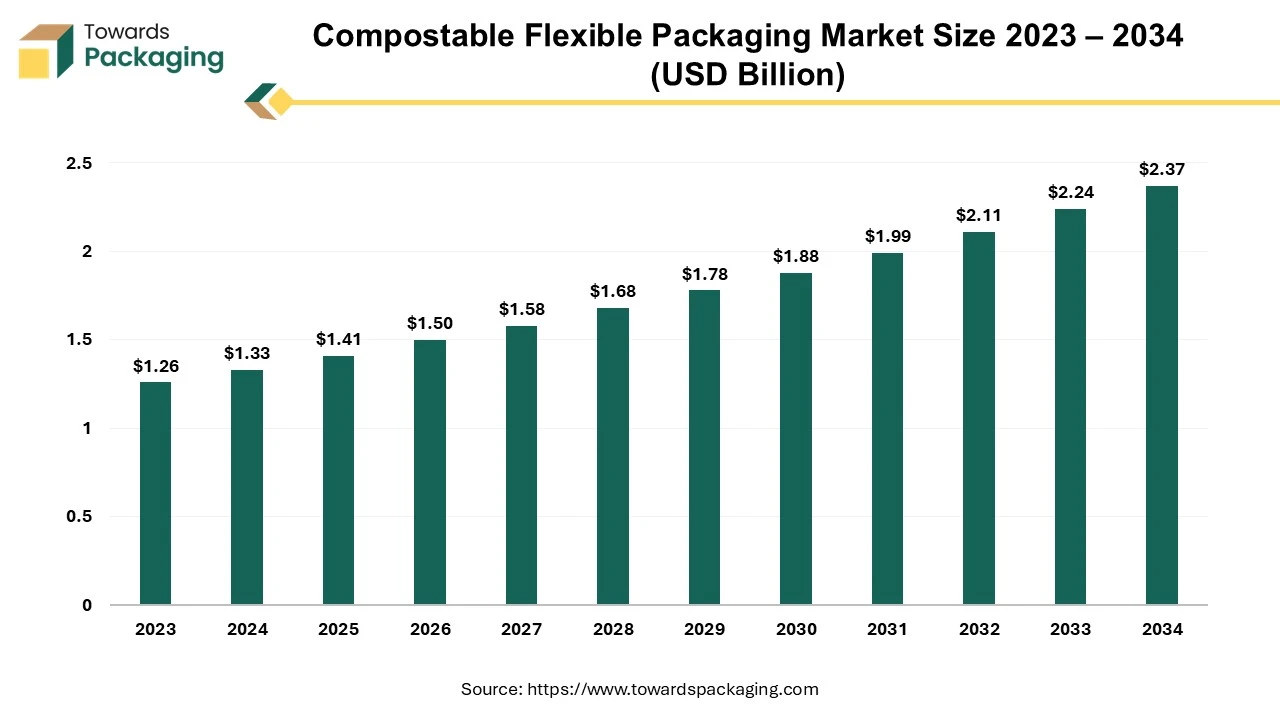

The compostable flexible packaging market is expected to increase from USD 1.41 billion in 2025 to USD 2.37 billion by 2034, growing at a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

Compostable flexible packaging is generated from various recycled and plant-based components, such as wood pulp and potato starch, making it an environmentally beneficial choice. Unlike some non-compostable rivals, natural components in compostable flexible packaging do not emit harmful pollutants when disposed of, helping to create healthier soil. An evolution in compostable flexible packaging has led to bioplastic, a plant-based alternative with qualities similar to less sustainable equivalents. Bioplastic, suitable for applications such as smoothie cups and fruit juices, is economically compostable because it is made from renewable sources and is also recyclable and reusable. It is well known that flexible packaging has reductions in each of these areas.

Bioplastic flexible packaging manufacturers often spend in improving their manufacturing capabilities in order to meet market demand. Technological improvements, raw material availability, and the scalability of manufacturing processes all have an impact on production capacity.

Biodegradable and compostable flexible packaging both share the characteristic of breaking down, but the key distinction lies in the decomposition process. Compostable flexible packaging breaks into natural elements, enriching soil health and converting around 90% into CO2 over approximately 3-6 months. In contrast, biodegradable packaging, which may contain additional microorganisms, breaks down into smaller pieces but may require special facilities due to potential soil contamination. Bamboo is a popular choice since it is inexpensive and widely available, and cardboard and paper, in addition to being recyclable and reusable, can now be composted. Biodegradable and compostable flexible packaging degrade, but the critical distinction is in the decomposition process.

For Instance,

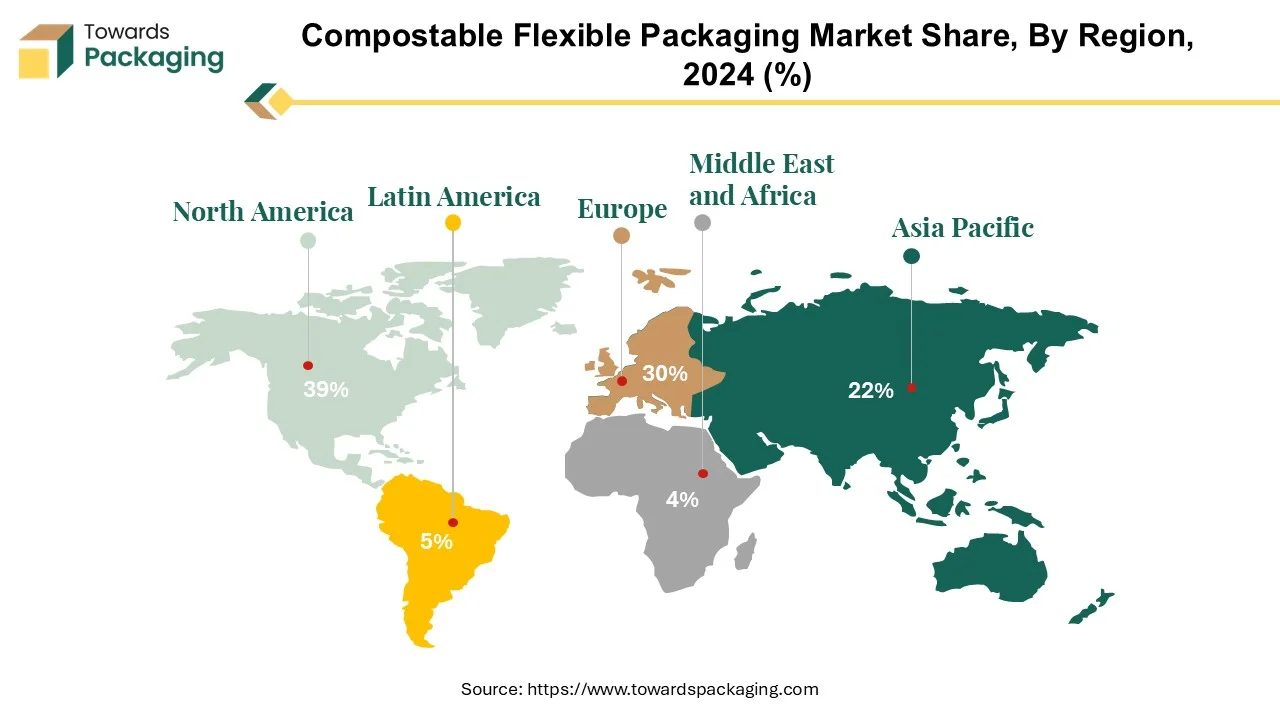

Compostable flexible packaging is experiencing robust growth in North America, establishing the region as the largest market for sustainable packaging solutions. This development represents a significant stride for U.S. businesses seeking eco-friendly alternatives to combat plastic pollution and enhance their sustainability efforts. In the U.S., an estimated 40 million tons of municipal plastic waste are generated, with approximately 80 percent anticipated to end up in landfills due to challenges in plastic recycling rates.

The cooperation that promotes local compostable flexible packaging production is strategically important since it tackles the country's critical issue of plastic waste management. With municipal plastic waste causing environmental issues, the advent of compostable flexible packaging offers a sustainable option that matches worldwide initiatives to minimize reliance on conventional plastics. Furthermore, this initiative is critical in reducing the carbon impact of packaging since manufacturers may now purchase biodegradable materials locally rather than transporting them from abroad.

With rising demand for creative and sustainable packaging solutions, brands and manufacturers see the importance of compostable flexible packaging in meeting customer expectations for environmentally conscious products. This shift towards compostable flexible packaging indicates a commitment to a circular economy in which materials are designed to be regenerative and contribute to plastic waste reduction.

In June 2023, Tipa collaborated with US package makers PPC Flexible Package and Clearview Packaging, the first in the US to employ Tipa's technology to create compostable flexible packaging for its customers.

Europe has emerged as a significant player in the compostable flexible packaging market, with the second-largest market share. The area demonstrates a solid commitment to sustainability by actively collecting and processing around 10.2 million tonnes of post-consumer plastic waste in recycling facilities located throughout and beyond Europe. This collaborative initiative represents a significant step forward in addressing environmental concerns about plastic waste, demonstrating Europe's commitment to implementing sustainable packaging solutions. About one-third of plastic garbage in Europe has been successfully recycled, demonstrating the region's commitment to responsible waste management. However, a considerable fraction, about 25%, continues to end up in landfills, indicating the need for ongoing trash reduction and recycling efforts. In line with these objectives, the European Union (EU) has set an ambitious target of raising the plastic recycling rate to 55% by 2030.

The growing popularity of compostable flexible packaging in Europe indicates the region's dedication to addressing the growing need for sustainable and recyclable packaging solutions. This transition is critical for creating a more circular and eco-friendly approach to packaging, which is consistent with the larger worldwide drive to reduce the environmental impact of packaging materials. As public awareness of sustainability issues grows, European businesses and consumers are actively embracing compostable alternatives to help create a more sustainable and circular economy.

For Instance,

Bioplastics originate from renewable resources, including cornflour, sugarcane, and other plant-based materials, as opposed to traditional plastics made from fossil fuels. Compostable flexible packaging, on the other hand, is intended to degrade into natural and non-toxic components under precise composting conditions, lowering the environmental effect of traditional packaging materials.

Several reasons contribute to the rise of bioplastics in the compostable flexible packaging market. Consumer preferences are evolving towards environmentally friendly items, and governments worldwide are enacting measures to limit plastic waste. This has led firms to embrace sustainable practices, resulting in increased demand for bioplastic-based packaging solutions.

Bioplastics constitute less than 1% of the annual plastic production, exceeding 390 million tonnes. Despite the challenges posed by the Covid-19 pandemic, overall global plastic production has risen. Notably, there is newfound momentum in bioplastics production capacities projected for 2022, fueled by increasing demand and the emergence of advanced applications. The anticipated growth is substantial, with global bioplastics production capacity projected to surge from around 2.23 million tonnes in 2022 to approximately 6.3 million tonnes by 2027.

This industry's key players are bioplastic resin manufacturers, converters, and packaging businesses. These organisations are involved in research and development to improve the performance and cost-effectiveness of bioplastic materials for flexible packaging. Collaborations and partnerships across the supply chain are also becoming more popular as a means of addressing the complex problems connected with sustainable packaging solutions.

The bioplastic in compostable flexible packaging market serves a variety of industries, including food and beverage, personal care, and pharmaceuticals. Flexible packaging is a popular choice for many products due to its versatility, and the incorporation of bioplastics corresponds with the broader sustainability aims of firms in several industries.

There are bioplastic alternatives for practically every traditional plastic material and application. Polymer development, including PHA (Polyhydroxyalkanoates), PLA (Polylactic Acid), PAs (Polyamides), and PP (Polypropylene), will lead to increased manufacturing capacity and diversification during the next 5 years.

The food and beverage sector dominates the market for compostable flexible packaging. This distinction results from several factors demonstrating the critical role that compostable flexible packaging plays in meeting the unique requirements and sustainability objectives of the food and beverage industry. Food goods must be packaged to extend their shelf life and protect against external elements like light, air, and moisture because they are perishable. These requirements are satisfied by compostable flexible packaging, which also offers strong barrier qualities and environmental friendliness. This is especially important in the food industry because quality and freshness are paramount.

Bioplastics are used in several applications, including packaging, consumer items, electronics, automobiles, and textiles. Packaging continues to be the largest market area. In 2022, bioplastics will account for 48 percent of the total market. Total production capacity of non-biodegradable and biodegradable materials, In Non-biodegradable includes PET, PE, PA,PP, PTT and others packaging material, where Biodegradable includes PBAT, PBS, PLA, PHA, Starch blends and Cellulose films.

Eco-friendly and sustainable goods are becoming increasingly popular in the food and beverage industry. Consequently, food and beverage producers progressively utilize compostable flexible packaging to conform to these inclinations and exhibit their dedication to ecological consciousness. This is consistent with general industry trends in which businesses integrate sustainable practices through their supply chains. Compostable flexible packaging's adaptability enables creative and eye-catching designs, satisfying the aesthetic standards frequently connected to food packaging. This flexibility is beneficial in the food and beverage sector, where customers are influenced by product differentiation and aesthetic attractiveness.

In 2022, the acreage used for growing sustainable feedstock for bioplastics is expected to expand marginally to over 0.8 million hectares. This represents around 0.015 percent of the world's agricultural acreage, which is approximately 5.0 billion hectares. Along with the estimated increase in bioplastics production by 2027, the land usage share is expected to rise to roughly 0.06 percent. This is a small proportion in comparison to the available agricultural land. There is no competition between producing bioplastics and using renewable feedstock for food and feed.

Packaging, bioplastic, and food and beverage firms work together to enhance compostable flexible packaging customized to meet this further customer's needs. Consequently, the food and beverage sector pioneers the use of compostable flexible packaging and substantially contributes to the continuous advancement and creation of sustainable packaging options in the broader marketplace.

For Instance,

The market for compostable flexible packaging is expanding through business-to-business (B2B) recycling, filling in the gaps in the recycling capacity for up to 89,000 tonnes of flexible packaging and 734,000 tonnes of corrugated cardboard. This invention demonstrates a calculated strategy to promote more environmentally friendly waste management techniques and close current recycling gaps. Longer-term, more significant changes towards reusable packaging are anticipated due to the short-term emphasis on boosting B2B reuse. Their substantial environmental impact makes it clear that reusable packaging techniques are essential. The efficiency and sustainability advantages of reusable alternatives are demonstrated by the fact that every kilogram of quantified reusable packaging systems has the potential to avoid the usage of 16 kg of single-use packaging on average.

Among B2B settings, pallet wrap and bags are among the applications where the most commonly used material highlighted at 34% is employed. In business-to-consumer (B2C) contexts, the remaining 66% are used." About company supply chains and direct-to-consumer situations, this distribution emphasizes the adaptability of reusable packaging solutions and their potential to address sustainability problems. Growth in the compostable flexible packaging market, especially in B2B recycling and reusable packaging systems, indicates a commitment to promoting a more environmentally friendly and circular approach to packaging across various industries as businesses become more aware of the environmental impact of packaging materials and investigate sustainable alternatives.

For Instance,

The competitive landscape of the compostable flexible packaging market is characterized by established industry leaders such as TIPA Ltd, SmartSolve Industries, Özsoy Plastik, Ultra-Green Sustainable Packaging, Hosgör Plastik, Eurocell S.r.l, Tetra Pak International SA. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

TIPA's compostable food packaging extends the shelf life and preserves the freshness of the food. Waste packaging material has potential uses.

Ultra green packaging that is sustainable specifically created for the foodservice sector, our high-end, environmentally friendly packaging prevents seepage of salad bar items, permits take-n-bake pizzas to be baked in an oven-to-table pan, removes the possibility of plastic contamination from microwaving, saves bakeries time and money and much more. Ultra green sustainable packaging is resilient, compostable, and resistant to heat, cold, and liquids. It can handle any challenge you throw at it.

Food product bags with the NatureFlexTM brand are composed of a biodegradable material with exceptional gloss and transparency that is safe to touch with food. This maintains the organoleptic qualities of the packaged product and makes it stand out. The bags comprise NatureFlexTM, a novel material manufactured from cellulose pulp that is robust and ideal for holding food items like chocolates, biscuits, short and long pasta, etc.

By Material

By End Use

By Region

April 2025

April 2025

April 2025

April 2025