Peelable Lidding Films Market Size, Trends, and Growth Insights

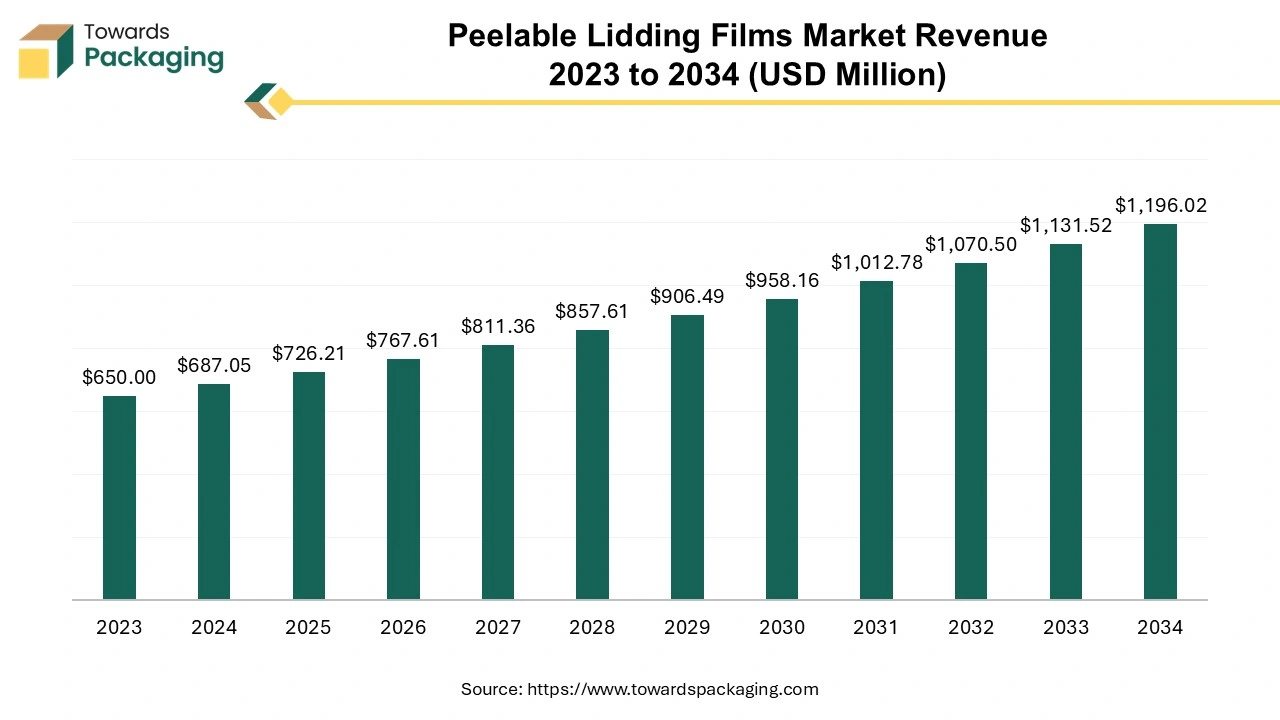

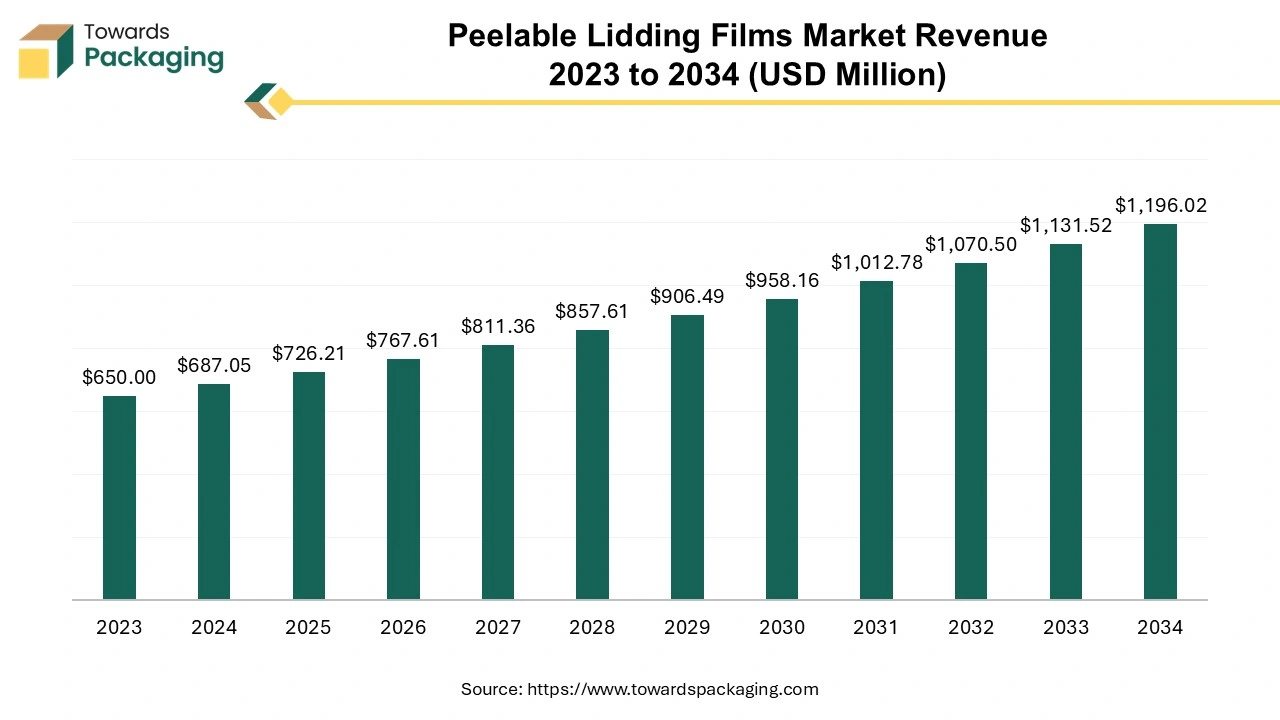

The global peelable lidding films market is set to rise from USD 687.05 million in 2024 to USD 1,196.02 million by 2034, registering a CAGR of 5.7% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing peelable lidding films which is estimated to drive the global peelable lidding films market over the forecast period.

Key Highlights of the Peelable Lidding Films Market: Trends, Growth, and Opportunities

- The global peelable lidding films market size is projected to grow at a CAGR of 5.7% to reach USD 1196.02 million by 2034.

- The demand for peelable lidding films is driven by trends in convenience packaging, sustainability, and the growth of online food and product delivery services.

- Manufacturers are increasingly focusing on eco-friendly films, using biodegradable polymers and recyclable materials to meet consumer and regulatory demands.

- The Asia-Pacific region holds a significant share of the market, with rapid urbanization and rising disposable incomes driving demand for convenient food packaging.

- Europe is expected to grow at the fastest rate due to stringent environmental regulations and a consumer preference for sustainable packaging.

- Polyethylene Terephthalate (PET) dominated the market in 2024, providing superior protection, clarity, and recyclability, aligning with sustainable packaging trends.

- The HoReCa segment (Hotels, Restaurants & Catering) is a major consumer of peelable lidding films due to their convenience, hygiene, and space-saving benefits.

- Innovations in peelable lidding films, such as the use of recycled materials and thinner, lighter films, are helping manufacturers meet sustainability goals.

- The market faces challenges such as competition from alternative packaging solutions, raw material cost fluctuations, and regulatory compliance complexities.

- Key players in the market, including Amcor, Toray Plastics, and DuPont Teijin Films, are focusing on acquisitions, mergers, and the launch of innovative products to drive growth.

Peelable Lidding Films Market: Ensuring Protection with Advanced Barrier Solutions

The peelable lidding films market refers to the segment of packaging materials specifically designed for food, pharmaceuticals, and other consumer products. These films are used to seal containers, providing a protective barrier while allowing for easy opening by peeling back the film. Key features often include:

- The market includes various materials, such as polyethylene terephthalate (PET), Poly Vinyl Chloride (PVC), and aluminum, and is influenced by trends in convenience packaging, sustainability, and regulatory requirements.

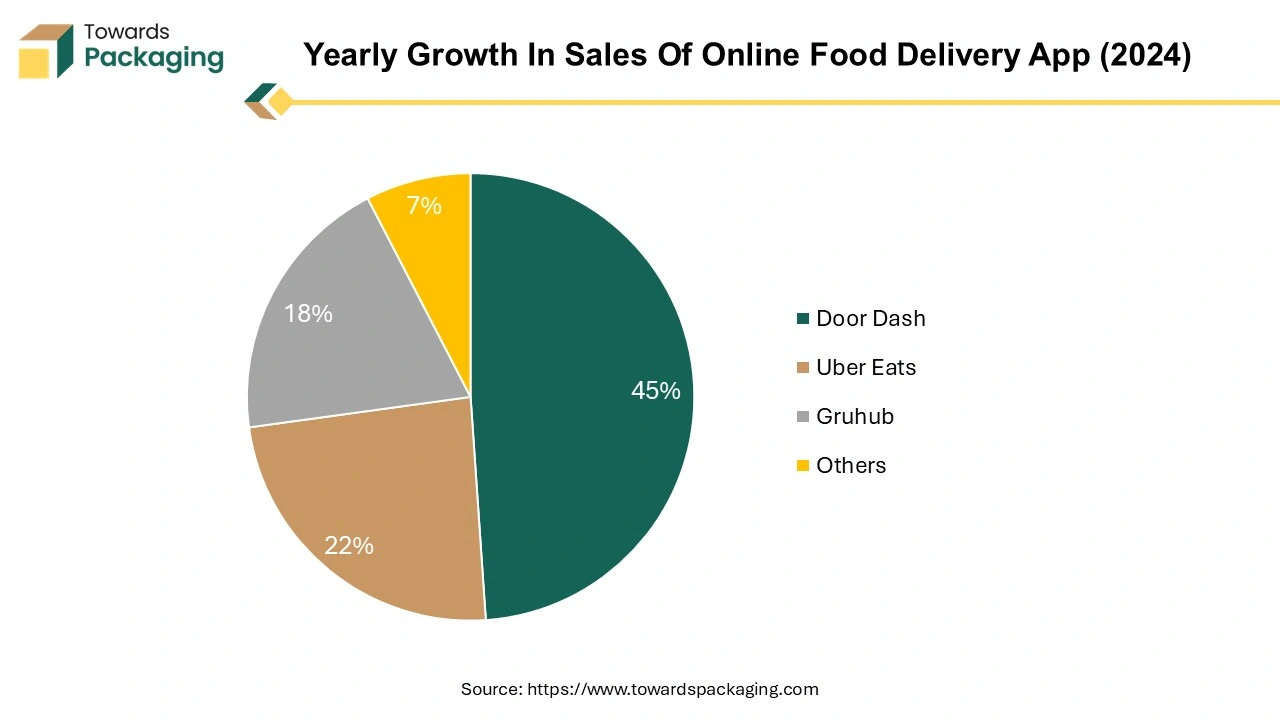

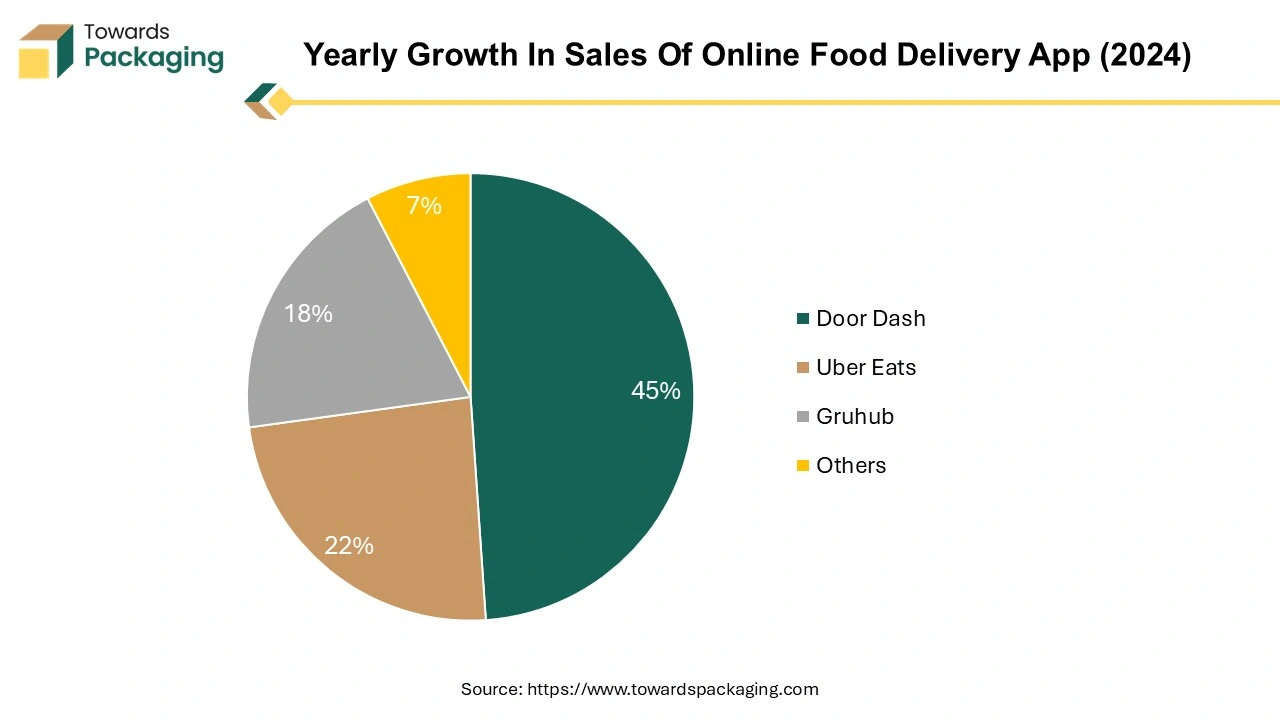

- he rise in online food and product delivery services necessitates robust and protective packaging solutions. The trend towards convenience foods and ready-to-eat meals drives demand for effective packaging solutions.

- Increased consumer demand for easy-to-use packaging that enhances the user experience. Increasing sales of the grocery, vegetables and food on ecommerce platform, has risen the demand for the peelable lidding films and is estimated to drive the peelable lidding films market.

According to the Brick Meets Click/Mercatus Grocery Shopper Survey, conducted August 30-31, 2024, all three fulfillment methods reported year-over-year (YOY) sales increases, and the U.S. online grocery market completed August 2024 with $9.9 billion in monthly sales, a 7.0% increase over the previous year.

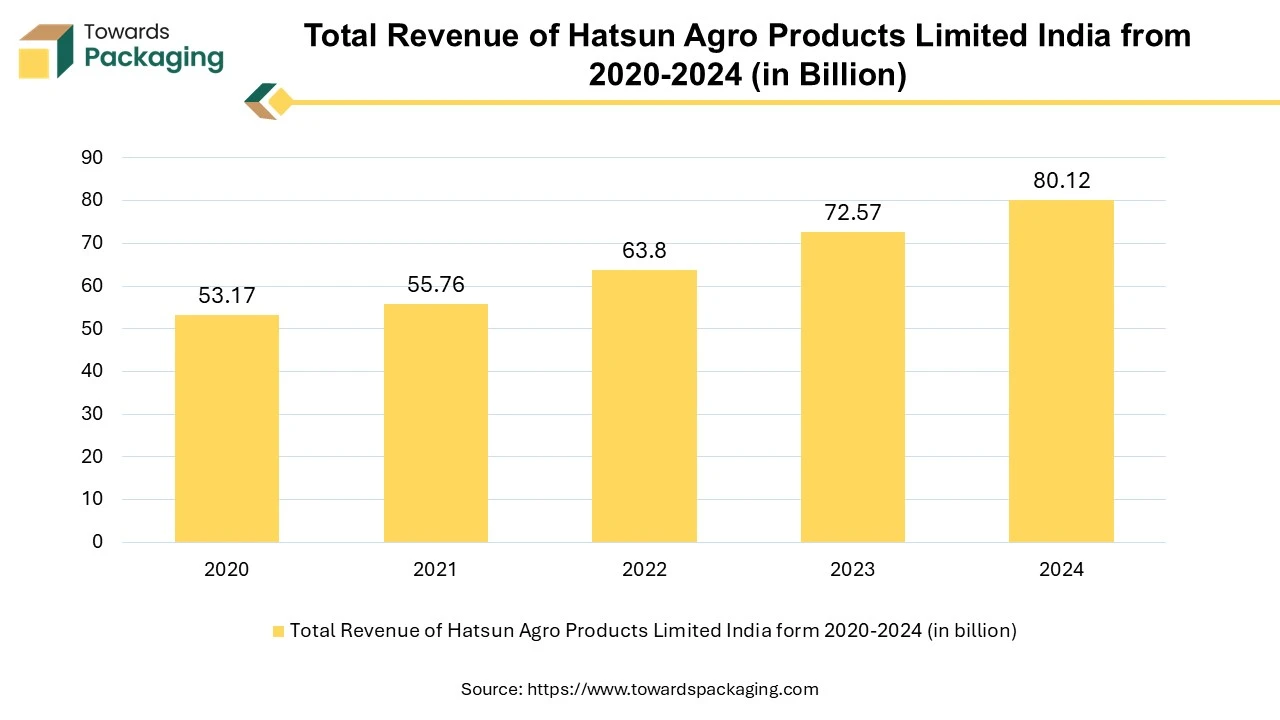

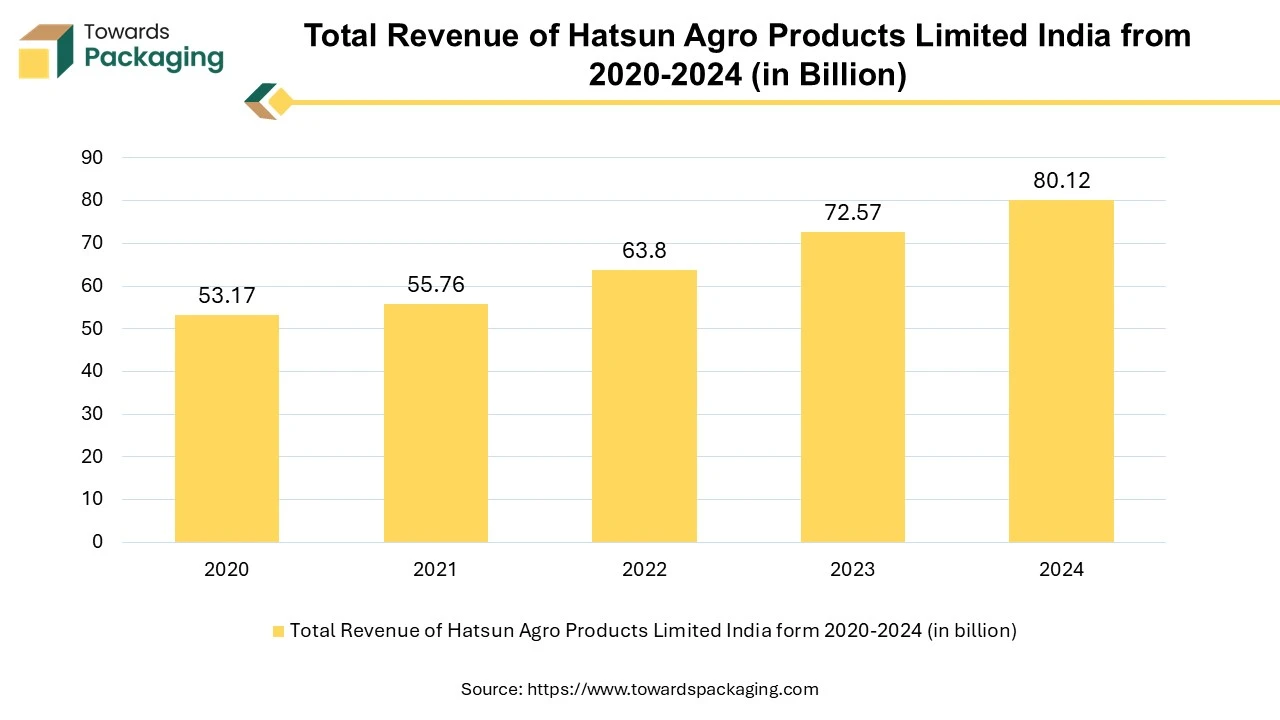

- In the fiscal year 2024, BigBasket, an Indian grocery delivery business, announced sales of more than 100 billion Indian rupees. Compared to the prior fiscal year, this represented a 6.27 percent gain.

5 Key Factors Fueling the Growth of the Peelable Lidding Films Market

- The key players operating in the market are focused on geographic expansion and launching their grocery and food brand in other countries which is expected to drive the growth of the peelable lidding films market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Emerging markets and trends for peelable lidding films is expected to drive the growth of the global peelable lidding films market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of peelable lidding films is estimated to drive the growth of the global peelable lidding films market in the near future.

Current Trends Shaping the Peelable Lidding Films Market

Sustainability Focus

Manufacturers are developing eco-friendly films to meet consumer demand for sustainable packaging, contributing to market growth. Growing urbanization and disposable incomes in regions like Asia-Pacific are expanding the market for peelable lidding films. There is a growing demand for films made from biodegradable polymers that break down more easily in the environment, reducing plastic waste. Many manufacturers are developing lidding films that can be easily recycled, encouraging a circular economy and addressing consumer concerns about plastic pollution. Innovations aimed at creating thinner, lighter films without compromising functionality are being adopted to minimize material usage and waste.

As consumers become more environmentally conscious, brands are emphasizing sustainable packaging in their marketing strategies, which is driving demand for eco-friendly lidding solutions. Increasing focus on sourcing raw materials from sustainable sources, such as bioplastics derived from renewable resources, is gaining traction. Companies are investing in energy-efficient manufacturing processes to reduce their carbon footprint during production.

Market Opportunity

Innovation in Eco-friendly Materials

Developing biodegradable and recyclable films can attract environmentally conscious consumers and meet regulatory requirements. Stricter regulations regarding plastic use and waste management are pushing manufacturers to adopt sustainable practices and develop compliant products. Increasing launch of the new material for the peelable lidding films in the market is estimated to create lucrative opportunity for the growth of the peelable lidding films market in the near future.

- For instance, in August 2024, SÜDPACK Verpackungen, a company focused on manufacturing high-performance films for the packaging of food, non-food and medical products, revealed the introduction of the sustainable packaging solution, polyethylene terephthalate floatable lidding films, which is recyclable in nature. The PET- polyethylene terephthalate floatable lidding films are engineered for utilizing with mono-APET trays. The new PET- polyethylene terephthalate floatable lidding films line serves as sustainable packaging choice for sliced ham, meats, and pure cheese, without compromising on quality and processing reliability.

Key Challenges Facing the Peelable Lidding Films Market

Several factors may restrain the growth of the peelable lidding films market:

- Competition from Alternative Packaging: The rise of alternative packaging solutions, such as flexible packaging and rigid containers, may divert demand away from peelable lidding films.

- Regulatory Challenges: Compliance with varying regulations and standards across regions can complicate market entry and increase costs for manufacturers.

- Raw Material Costs: Fluctuations in the prices of raw materials can impact production costs, potentially leading to higher prices for consumers.

- Environmental Concerns: Despite advancements, some peelable films may still be perceived as less eco-friendly, limiting their appeal among environmentally conscious consumers.

- Consumer Preferences: A growing consumer preference for minimal or no packaging can reduce the demand for peelable lidding films.

- Technological Limitations: Challenges in achieving desired barrier properties and shelf life can hinder product performance and market acceptance.

- Market Saturation: In mature markets, intense competition and saturation can limit growth opportunities for new entrants.

Regional Insights and Growth Opportunities in the Peelable Lidding Films Market

Asia's Growing Popularity of Ready-to-Eat Meals: Fueling the Growth of the Peelable Lidding Films Market

Asia Pacific region held a significant share of the peelable lidding films market in 2024. Rapid urbanization in Asia Pacific region is leading to changes in lifestyle and increased demand for convenient food packaging, boosting the need for peelable lidding films. A growing awareness of health and nutrition is driving demand for fresh and organic food products, which often utilize peelable films for packaging. As disposable incomes rise, consumers are more willing to spend on packaged and ready-to-eat meals, enhancing demand for innovative packaging solutions.

Europe's Focus on Sustainability and Regulatory Compliance

Europe region is anticipated to grow at the fastest rate in the peelable lidding films market during the forecast period. The region is seeing a shift towards biodegradable and recyclable films, driven by stringent environmental regulations and consumer preferences. There is a strong consumer and governmental emphasis on sustainability, leading to increased demand for eco-friendly and recyclable packaging options. European regulations regarding food safety and packaging waste are pushing manufacturers to adopt high-quality and compliant packaging solutions, including peelable lidding films.

- For instance, in December 2022, Sappi Rockwell Solutions, Scotland, U.K. based packaging solutions manufacturing company, revealed the introduction of the Starlid GPE-CL is an extrusion coated lidding film specifically processed and formulated on Sappi Rockwell’s solvent-free coating line. The Sappi Rockwell Solutions company currently coats up to 60% PCR film, that is compatible with various tray types, including 100% recycled PET trays.

Polyethylene Terephthalate (PET): Dominating the Peelable Lidding Films Market in 2024

The Polyethylene Terephthalate (PET) segment held a dominant presence in the peelable lidding films market in 2024. PET provides superior protection against moisture, oxygen, and UV light, which helps extend the shelf life of food products. The clarity of PET allows for high visibility of the packaged product, which is appealing for consumers and enhances product presentation.

PET is known for its mechanical strength, making it resistant to tearing and puncturing, which is essential for maintaining product integrity during handling and transport. PET can be engineered to achieve desired peel strength, allowing for easy opening while maintaining a secure seal during storage. PET is highly recyclable, aligning with increasing consumer demand for sustainable packaging solutions and helping manufacturers meet environmental regulations.

HoReCa Sector (Hotels, Restaurants & Catering) to Drive Notable Growth in the Peelable Lidding Films Market

The HoReCa (Hotels, Restaurants & Catering) segment to accounted for a considerable share of the market in 2024. Peelable lidding films provide an easy-to-open solution, allowing customers to quickly access their food without needing utensils or tools, enhancing the dining experience. These films create a secure seal that helps maintain food freshness, protect against contamination, and extend shelf life, which is crucial in food service settings.

Many suppliers offer customizable lidding films, allowing establishments to brand their packaging and enhance their marketing efforts. Using peelable films minimizes direct contact with food, promoting hygiene and safety, which is especially important in the food service industry. Stackable and compact packaging solutions help save space in kitchens and storage areas, making them practical for busy environments. These factors contribute to the widespread adoption of peelable lidding films in the food service industry, enhancing operational efficiency and customer satisfaction.

Exploring New Advancements and Innovations in the Peelable Lidding Films Industry

- In June 2023, KM Packaging, uneviled the introduction of the advanced lidding solution K Peel PLUS+ with potential recycled material.

- In December 2022, KM Packaging, packaging solution manufacturer of packaging solutions, introduced a sustainable lidding film range to fulfill APCO national targets.

- In march 2024, INEOS, chemical producing company uneviled the introduction of the new film packaging with 50% recycled plastic which is eco-friendly.

Peelable Lidding Films Market Key Players

- Amcor

- Toray Plastics

- DuPont Teijin Films

- ProAmpac

- Berry Global

- Sappi Rockwell Solutions

- Uflex Limited

- Mitsubishi Polyester Film

- Sealed Air

- Toyobo

- Mondi Group

- Cosmo Films

- Coveris

- Sunrise Packaging Material

- Flair Flexible Packaging

- Flexopack SA

- Winpak Ltd

- Effegidi International

- Plastopil Hazorea

- KM Packaging

Peelable Lidding Films Market Segments

By Type

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Others

By Application

- HoReCa (Hotels, Restaurants & Catering)

- Supermarkets

- Household

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait