April 2025

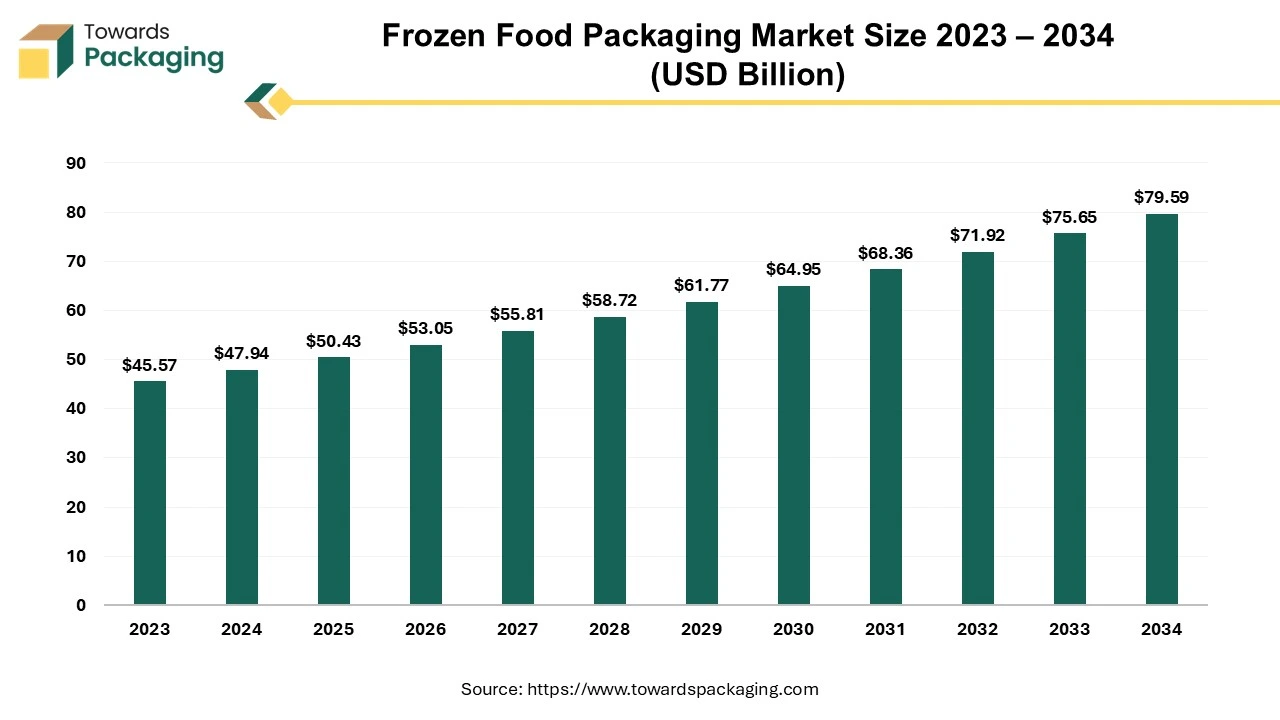

The frozen food packaging market size was calculated at USD 47.94 billion in 2024 and is projected to reach around USD 79.59 billion by 2034. The market is expanding at a CAGR of 5.2% between 2024 and 2034.

The rapid growth in revenue within the global frozen food packaging market can be attributed to several key factors. Firstly, the increasing international trade of frozen food products has created a significant demand for packaging solutions to ensure safe transportation and preservation. Moreover, improving transportation facilities and logistics has further facilitated the global trade of frozen food, driving the need for effective packaging.

The emerging markets of the Asia Pacific have witnessed a notable increase in the consumption of frozen food products. This growing demand in these regions has contributed to the expansion of the frozen food packaging market. Additionally, innovative refrigerator displays in supermarkets have played a crucial role in attracting consumers toward frozen food products, thus driving the demand for suitable packaging solutions.

Advancements in freezing technologies have enabled the preservation of food quality and extended shelf-life, thereby boosting the sales of frozen food products. In conjunction with this, a well-developed and efficient supply chain has ensured the availability of frozen food products to consumers, thereby stimulating market growth.

Technological advancements in the cold chain industry have been instrumental in maintaining the required temperature and ensuring the quality and safety of frozen food during transportation and storage. These advancements have positively influenced the revenue growth of the frozen food packaging market.

Furthermore, developments in the retail landscape, such as the expansion of modern retail formats, have provided more opportunities for the sales of frozen food products. This, in turn, has increased the demand for appropriate packaging solutions to prevent food spoilage and enhance product visibility on store shelves.

The continuous technological advancements have also benefited flexible packaging manufacturing companies. They have developed improved packaging designs and introduced new film types that offer enhanced functionality and efficiency in preserving the quality of frozen food products. These advancements have not only catered to the evolving needs of the market but have also contributed to the overall growth of the frozen food packaging industry.

The growth of the frozen food packaging market is supported by the increasing adoption of online food delivery services in developing countries. The convenience offered by online grocery shopping channels has become a significant factor in boosting the sales of frozen meat, vegetables, and ready meals. Consumers find it convenient to order frozen food products online and have them delivered directly to their doorstep, contributing to the expansion of the market.

Furthermore, there has been a notable shift in consumer preference towards sustainable packaging options. As consumers become more environmentally conscious, there is a growing demand for eco-friendly alternatives in packaging materials for frozen food. This shift is driving the need for packaging solutions that are more sustainable and have a reduced impact on the environment. Materials such as molded pulp, paper, and bioplastics are gaining popularity as they offer more eco-friendly packaging options for frozen food products.

Molded pulp packaging, made from recycled paper or other fibers, provides a biodegradable and compostable option for packaging frozen food. It offers protection and insulation to the products while being environmentally friendly. Similarly, paper-based packaging materials are renewable, recyclable, and biodegradable, making them a preferred choice for sustainable packaging solutions.

Bioplastics, derived from renewable sources such as corn-starch or sugarcane, are gaining traction as an eco-friendly alternative to traditional plastics. They offer similar functionality to conventional plastics but have a lower environmental impact. Bioplastic packaging materials are biodegradable and can be composted, reducing the accumulation of plastic waste.

The increasing demand for sustainable packaging materials for frozen food aligns with the growing consumer awareness of environmental issues and their desire to make more environmentally friendly choices. As a result, the market for eco-friendly alternatives in frozen food packaging is experiencing significant growth.

The growing demand for the longer shelf life of food products is due to the changing lifestyle of working individuals. With the busy lifestyle of people, there is a huge demand for ready-to-eat food as working individuals are running lack of time. Finding stability between food protection and the usage of ecologically friendly packaging supplies. Also, strict guidelines governing food protection, category, and packaging necessities need continuing acquiescence and alteration, particularly when it is about worldwide skill where dissimilar countries have diverse rules, confusing source chains and packaging methods.

The growing importance of sustainability in frozen food packaging cannot be ignored, as 79% of consumers consider recyclable, reusable, or compostable packaging to be "somewhat important" or "very important." While many surface-printed polyethylene packages already meet recycling standards, it is advisable for manufacturers to consult their packaging suppliers to verify recyclability. However, the commonly used multi-material laminates found in gusseted pouches and steam-in-bag packaging often pose challenges regarding recyclability.

Conventional multi-material laminates are favoured for their attractive appearance, enhanced stiffness in standup pouches, and suitability for steam-in-bag applications. They also offer the advantage of compatibility with high-speed form/fill/seal equipment, enabling efficient production processes.

Several key factors need to be considered when transitioning from multi-material laminates to more sustainable and recyclable packaging structures. Heat resistance is a crucial consideration, as recyclable films typically exhibit different heat resistance properties compared to conventional laminates. Recyclable films often have lower heat resistance, which can impact production speed, seal quality, and the application of reclose features. Therefore, enhancing the heat resistance of recyclable films to achieve higher production speeds, improve seal aesthetics, and facilitate the incorporation of reclose features is essential.

Manufacturers aiming to adopt more sustainable and recyclable packaging must carefully assess the performance characteristics of alternative materials. Striking a balance between sustainability and essential functional attributes, such as heat resistance, is vital to ensure that the packaging meets both environmental requirements and operational needs. Close collaboration with packaging suppliers and rigorous testing and validation are instrumental in identifying recyclable materials with the necessary heat resistance for specific applications.

Furthermore, it is important to consider the overall lifecycle impact of the packaging, including aspects such as material sourcing, energy requirements during production, and end-of-life disposal options. By embracing sustainable and recyclable packaging solutions, manufacturers can align their practices with consumer expectations, reduce their environmental footprint, and contribute to developing a circular economy.

Moreover, it is essential for the packaging to be designed to endure the challenges of cold chain distribution while accommodating the specific fill weight requirements. Additionally, the package must possess adequate puncture resistance to cater to foods prone to punctures, such as fries and green beans. Each situation presents unique circumstances, as products, filling machinery setups, and distribution chains vary extensively.

The interest in compostable packaging is also a significant focus for brands and retailers. While compostable packages serve a purpose, it is crucial to consider the package cost and whether consumers have the necessary infrastructure to compost them. In many sauceless frozen food applications, the package remains clean and dry after use, making it suitable for recycling if the packaging material is recyclable. Generally, recycling is preferred over composting unless the package plays a role in diverting more food waste to composting facilities.

The e-commerce sector has witnessed remarkable year-on-year growth in the frozen food segment, with a notable increase of 46% for the week ending June 13, 2021. This growth is particularly significant considering the challenging circumstances posed by the COVID-19 pandemic in June 2020. Approximately 12.5% of frozen food purchases are made through e-commerce channels, indicating a substantial potential for future expansion in this domain. Establishing a strong online presence and effectively utilizing social media platforms are essential for driving further growth in this sector.

When shipping frozen food products directly to consumers' homes, it is crucial to conduct thorough testing of the packaging to ensure it can withstand the rigors of the shipping process. The packaging must protect the product during transit and deliver a positive user experience for the consumer upon receiving the package. This entails creating a packaging design that strikes a balance between product protection and user convenience.

The packaging should be robust enough to safeguard the frozen food product from potential damage during shipping, such as temperature fluctuations and physical impacts. Adequate insulation and proper sealing mechanisms are key elements in preserving the quality and integrity of frozen food throughout the delivery process.

It is also essential to prioritize the consumer's experience when designing the packaging for frozen food shipping. The package should be user-friendly and intuitive, making it easy for consumers to open, access, and store frozen food products. Clear instructions and labelling can enhance the user experience by providing necessary information on handling and storage.

Furthermore, as e-commerce relies heavily on visual appeal, attention should be given to the overall presentation and branding of the packaging. A well-designed and visually appealing package can capture consumers' attention and create a positive impression, contributing to brand loyalty and repeat purchases.

In conclusion, the growth of e-commerce in the frozen food sector presents significant expansion opportunities. Establishing a strong online presence and leveraging social media platforms are critical for capitalizing on this growth potential. When shipping frozen food to consumers' homes, careful packaging design and testing are necessary to ensure product protection and a favourable user experience. By prioritizing functionality and aesthetics, businesses can enhance customer satisfaction and drive continued growth in the e-commerce frozen food market.

The frozen food packaging market is a thriving industry specializing in manufacturing packaging materials and solutions specifically tailored for frozen food products. Plastic is a superior choice among the various materials used in this market.

Plastic has gained widespread popularity in frozen food packaging due to its versatility, durability, and cost-effectiveness. Its inherent properties make it an ideal choice for maintaining the quality and extending the shelf life of frozen food products. The barrier properties of plastic effectively shield the products from moisture, oxygen, and other external factors that could compromise their integrity. Moreover, plastic packaging offers transparency, allowing consumers to easily inspect the contents before purchase.

However, acknowledging the growing environmental concerns associated with plastic packaging, particularly in single-use items, is crucial. The industry has witnessed an increasing focus on addressing the environmental impact of plastic waste and pollution.

To mitigate these concerns, substantial efforts have been made to reduce the usage of single-use plastic packaging and promote the adoption of more sustainable alternatives. This includes the development of biodegradable or compostable plastics, as well as the exploration of alternative packaging materials like paperboard, aluminium, or glass. These materials are considered more eco-friendly as they can be recycled or possess a lower environmental footprint.

In conclusion, plastic has been the predominant material in the frozen food packaging market, driven by its advantageous characteristics. Nevertheless, the industry is actively pursuing sustainable practices by exploring alternative packaging materials to combat plastic waste and foster environmental sustainability.

During the projected period, frozen food packaging in the Asia Pacific market is anticipated to have a solid compound annual growth rate (CAGR) of 5.79%. This expansion is mostly related to the increased demand for frozen food packaging, driven by increased consumption of meat, fruits, fish, and vegetables in the region. As a result of changing customer lives and tastes, the market is also seeing the creation of novel product categories, notably in the ready-to-eat sector. This pattern highlights the enormous market potential and commercial prospects in the Asia Pacific frozen food packaging sector.

China dominates the market for frozen food packaging in the Asia-Pacific region, boasting the largest market share. This can be attributed to the country's expansive population and rapid urbanization, resulting in a surge in demand for frozen food products. Chinese consumers actively seek convenient, high-quality food options, driving the market growth. The demand for frozen meat and other commonly consumed products in the frozen food industry has remained stable in the region, primarily due to their widespread availability.

The comparative landscape of the frozen food packaging market is highly competitive and dynamic, driven by the increasing demand for frozen food products worldwide. Companies in this market strive to gain a competitive edge by offering innovative and efficient packaging solutions. The market encompasses various packaging types such as bags, boxes, trays, and pouches, each catering to different frozen food products and providing distinct features to enhance durability and convenience. Material innovation plays a crucial role, with packaging manufacturers constantly exploring new materials and technologies to improve quality and sustainability.

Customization and branding are key factors, as companies offer personalized packaging designs to enhance brand visibility and consumer appeal. Safety and quality standards adherence require robust quality control processes to ensure product preservation and integrity. Packaging solutions that extend the shelf life of frozen food products are in high demand, with advanced technologies like modified atmosphere packaging (MAP) and vacuum packaging being widely adopted. The efficiency of the distribution and supply chain is critical, as companies must optimize storage, transportation, and handling processes to maintain product quality.

The competitive landscape is characterized by intense rivalry, with companies differentiating themselves through product innovation, cost-effectiveness, sustainability, and customer service. Geographic presence is also a significant consideration, with companies expanding into new markets to meet diverse consumer needs. Collaborations between packaging manufacturers, food processors, and retailers are common, enabling the development of comprehensive packaging solutions aligned with industry requirements and consumer expectations. Overall, success in the frozen food packaging market hinges on innovation, sustainability, quality assurance, and effective distribution strategies.

Frozen food consumption is increasing, driven by busy lifestyles, delayed family planning among Millennials, and recent stockpiling due to COVID-19. As more consumers choose frozen foods, there’s a growing concern about whether their packaging is recyclable.

Industry groups want to assure everyone that paperboard packaging for frozen foods is generally recyclable. Despite some claims that much of this packaging is coated and non-recyclable, a recent study paints a different picture.

A major industry organization, which represents a significant portion of the North American folding carton market, surveyed its members about the paperboard used for frozen food packaging in 2019. This included cartons for ice cream, frozen meals, bacon, and other refrigerated items, but not primary packaging like ice cream tubs.

The results showed that about 90% of the paperboard used for frozen food cartons last year was recyclable. Specifically:

This study confirms that most frozen food packaging is indeed recyclable, addressing concerns about its environmental impact.

AVPack Plastic Manufacturers (South Africa), Suzhou Yuxinhong Plastic Packaging Co., Ltd. (China), Natural Value Inc. (U.S.), Coveris (U.K.), Shenzhen Chengxing Packing and Material Co.Ltd (China), Four Star Plastics (U.S.), AMERICAN MANUFACTURE COMPANY (U.S.), The Clorox Company (U.S.), Polyvinyl Films, Inc (U.S.), ECPlaza Network Inc (China), Shenzhen Bull New Material Technology Co., Ltd (China), SHENZHEN XINTENG PACKAGING CO., LIMITED (China), Reynolds Consumer Products (U.S.), XINJIANG RIVAL TECH CO.,LTD (China), Berry Global Inc (U.S.), Amcor plc (Switzerland), Sealed Air (U.S.), Mondi (U.K.), Sonoco Products Company (U.S.).

By Material

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025