April 2025

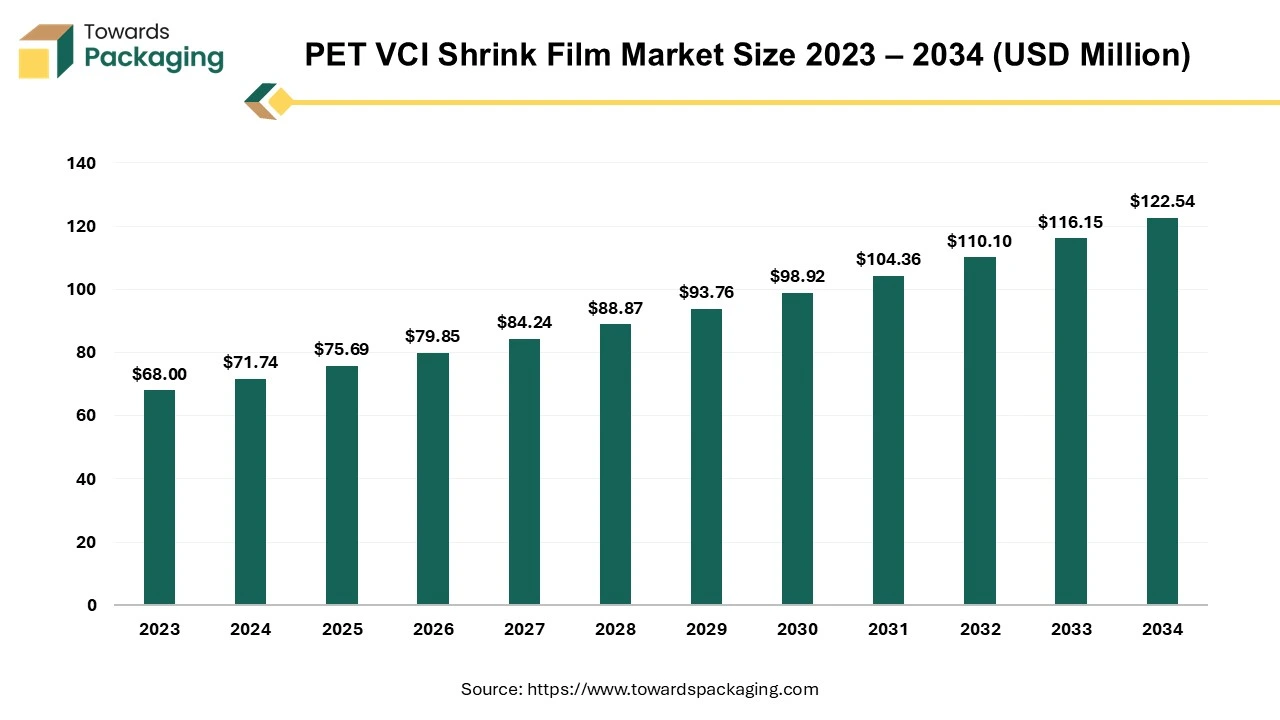

The PET VCI shrink film market is anticipated to grow from USD 75.69 million in 2025 to USD 122.54 million by 2034, with a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

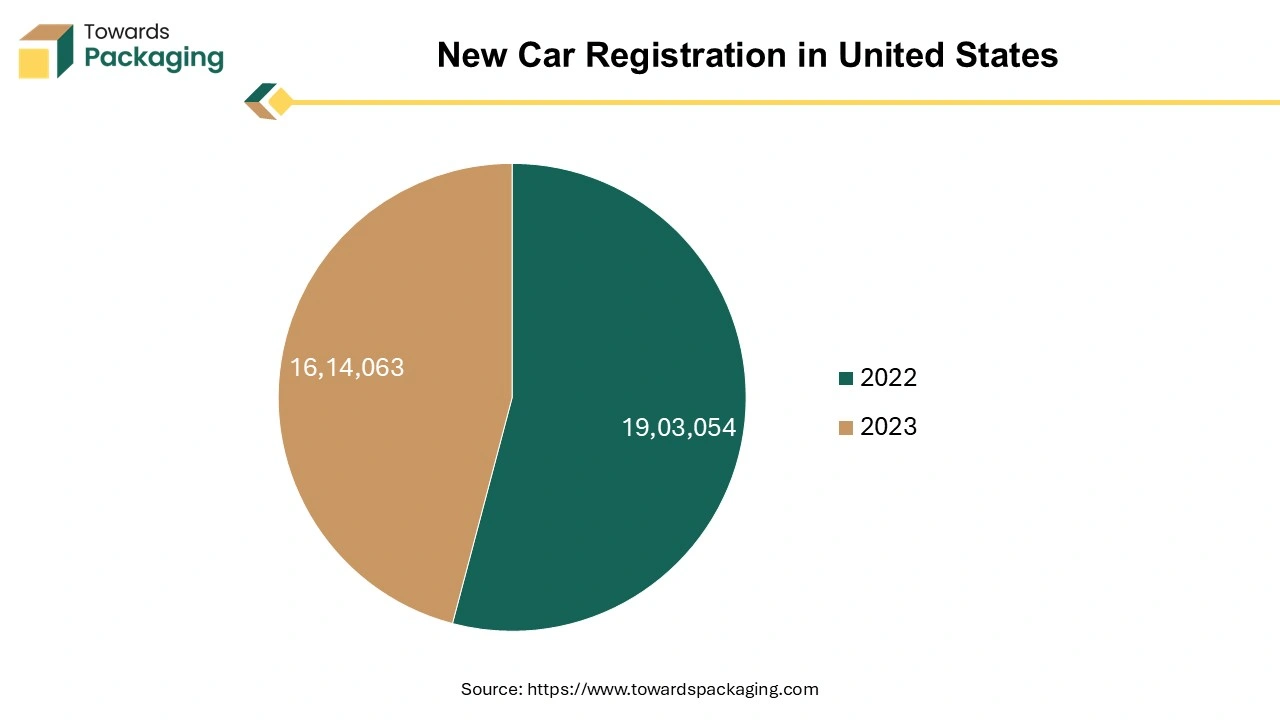

The market is increasing due to the growing automotive, machinery, and electronics packaging that needs to protect from rusting. The rising automotive market is boosting the PET VCI shrink film market.

PET VCI shrink film packing is heat-sealable and shrinkable packaging film that is used to wrap metals or any machinery items to protect them from rust during storage or transportation. It is an alternative to expensive multi-layer packaging film to reduce the requirement of dehumidification and vacuum packaging.

These shrink films wrap tightly around the object which avoids contact with the metal body and moisture and protects it from any kind of damage. These films are made up of polyethylene terephthalate (PET) that includes volatile corrosion inhibitors (VCI). These films when heated wrap tightly as the PET film shrinks and creates a vacuum around the metal body. This technology is mainly valued in markets where metal parts are vulnerable to corrosion and rust, such as aerospace, automotive, and manufacturing.

The PET VCI shrink film market is facing noteworthy development influenced by the growing industrial sector and globalization in trade. As worldwide supply chains enlarge, the requirement for actual packaging solutions to protect products during transit has become crucial. These films are mainly valued for their ability to protect metal products from rusting and make them crucial for sectors such as aerospace, automotive, and electronics.

PET, has received importance as a wrapping material because of its incomparable strength, versatility, and clarity. PET VCI shrink film, a focused arrangement of PET, is extensively manufactured for packaging due to its exclusive shrink nature. Traditional shrink substances such as POF (Polyolefin) and PVC are good for metals but the PET shrink film delivers higher precision and lustre which makes it a perfect option for goods where visual demand is decisive.

With the evolving automotive industry increasing a huge demand for technological advancement. As the global automotive market is growing the demand for such films also increasing along with environmental concerns. A significant driving factor of PET VCI shrink films are commonly transparent. These films permit high prominence, allowing customers to see the packed product. This feature is mainly beneficial for trade wrapping, where the visual performance of the machines plays a vivacious role in appealing to customers. Moreover, PET VCI shrink film claims excellent stretchable strength and slit resistance, safeguarding that goods remain strongly packaged during transport and management. Its sturdiness makes it appropriate for an extensive variety of applications such as food & beverage packing to different consumer products.

While PET VCI shrink film has multiple profits, it is important to accept the challenges linked with its use. A major concern is its low resistance towards heat during storage this property can result in premature contraction. Market Players often face such issues through advanced technologies and formulations, improving the firmness and performance of PET VCI shrink films.

Asia Pacific witness the highest revenue share for the year 2024. The PET VCI shrink film market is speedily growing, influenced by the rising demand for manufacturing industries influence the growth of demand for good-quality films. All the developing countries such as China, India, Japan, South Korea, and Thailand have influenced the packaging market to expand. The eco-friendly, durable, and cost-effective nature of the shrink films increases their demand in the packaging market.

Well-known players are introduced by expanding their quality packaging by enhancing customer expectations. This region has a high demand for durable packaging that is driving this shrink film market by producing biodegradable and recyclable films. All the major market players are constantly working to provide eco-friendly PET VCI shrink film to the manufacturing industry. The rising demand for new model vehicles has also influenced this market as it enhances the scope of films that are crucial for protecting metal parts in the market.

North America is estimated to grow at the fastest rate over the forecast period. The rising concern for innovative packaging solutions is due to the rising demand for innovation in the automotive sector. The existence of well-known market players with innovative industrial abilities and strong supply networks further reinforces North America's situation as a leading market for PET VCI shrink films.

Furthermore, strict monitoring standards and superiority needs in North America influence the acceptance of high-performance rust protection formulations such as PET VCI shrink films. Manufacturers in the region focused on film quality and durability, demanding the usage of cutting-edge packaging films to protect metal components from rust during storage and transportation of the products.

There is a huge demand for shrink film in the food and beverages industry to keep food fresh and contamination-free by creating a strong barrier between food and bacteria. In April 2024, Kuhne Anlagenbau announced the launch of Triple Bubble lines. It is the thinnest and most recyclable shrink film developed at NPE 2024.

By material type, the PE shrink film segment led the PET VCI shrink film market in 2024. PE-based VCI shrink films have strong rust shields and also provide superior machine-driven capacity and sturdiness, making them appropriate for an extensive variety of applications in the market. Industries like electronics, automotive, and aerospace depend on PE VCI shrink films to protect their metal apparatuses during the process of transportation, storage, and export.

By end user, the aerospace & defence segment led the PET VCI shrink film market in 2024. This development is due to its vital role in shielding raw resources and semi-finished and also finished metal goods from rust. Markets are intricate in the manufacture and handing out of key metals like aluminum, steel, and copper depending on VCI shrink films to confirm the integrity and excellence of their metal resources during shipping, storage, and handling.

By Material Type

By End-Use

By Region

April 2025

February 2025

February 2025

February 2025