April 2025

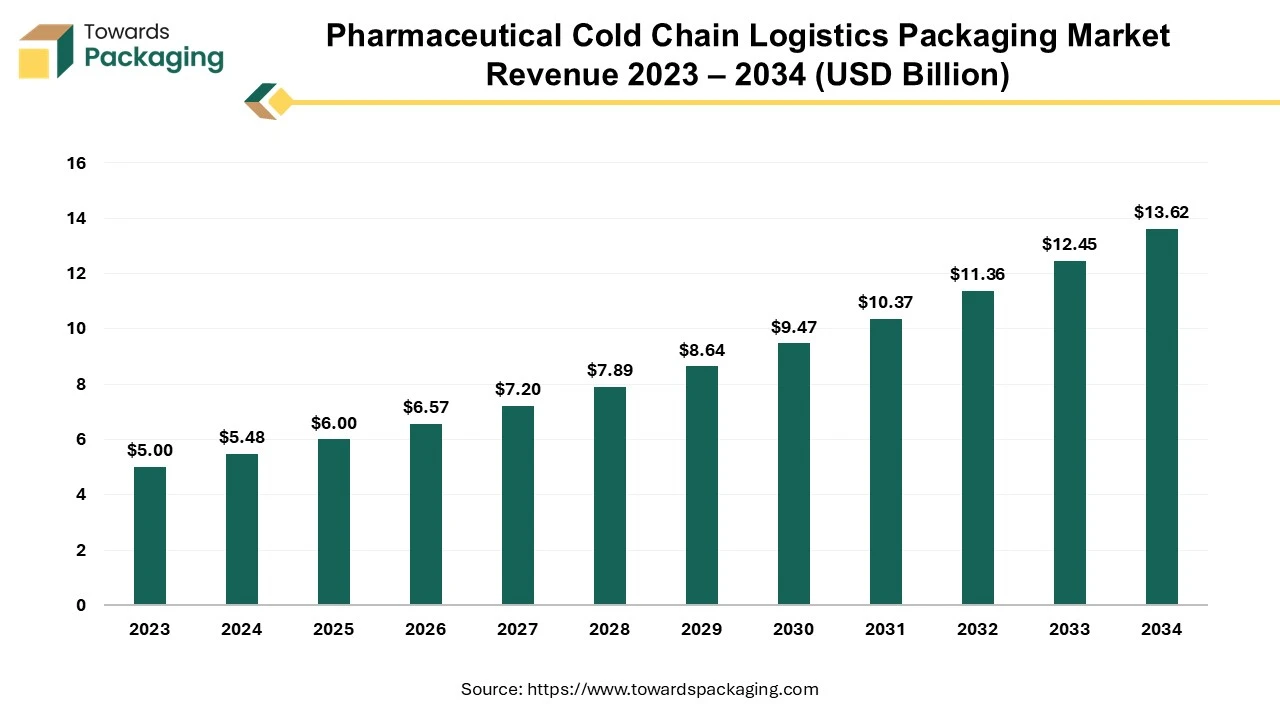

The global pharmaceutical cold chain logistics packaging market size reached US$ 5.48 billion in 2024 and is projected to hit around US$ 13.64 billion by 2034, expanding at a CAGR of 9.55% during the forecast period from 2024 to 2034.

The market is proliferating due to the increasing demand for certain drugs, vaccines, and biologics that require safe and flexible pharmaceutical packaging. The growing trend of online ordering systems is boosting the pharmaceutical cold chain logistics packaging market.

The pharmaceutical cold chain logistics packaging market experiences strong growth influenced by the rising demand for temperature-sensitive products and drugs. For safe transport and storage of temperature-controlled or frozen products, refrigerated, and cryogenic goods biotech companies, clinics, and hospitals depend on cold-chain logistics. The rising government investment in the healthcare sector and invention, fusions, and achievements movement further drive the market, confirming GDP guideline compliance and efficient logistics across air, sea, and overland transport sections. Inventions in temperature-maintaining products and noting components improve the efficacy and consistency of the cold chain packaging market. The healthcare sector is showing a major transition towards convenience and portable packaging due to the growing online facility in this sector.

Rising investment of the government to private companies for the development of both the pharmaceutical sector and biotechnology sector to provide more facilities to patients and advancement in the treatment of patients ultimately drive the pharmaceutical cold chain logistics packaging market. These packaging are widely used for transporting injections, drugs and pharmaceutical products. Particularly planned for temperature-complex products such as pharmaceutical containers that play a vital role in preserving the quality and effectiveness of medicines during transporting to long-distance.

Additionally, automated retrieval and emerging countries, storage systems, biosimilars, small molecule drugs, vaccines, temperature-sensitive pharmaceuticals, biologic drugs, medications, novel drugs, government bodies, healthcare setup, healthcare facilities, cold storage packaging, technological developments, temperature guidelines, temperature monitoring, radio frequency identification (RFID) system, biopharmaceuticals, healthcare cold chain logistics product, and clinical trial supplies are essential features in confirming the effectiveness and protection of medical products transportation. Hence, such features are influencing the market development during the predicted period.

Customization Competences

Logistics facilities deliver customisable solutions to meet the varied requirements of the pharmaceutical market. Late-stage customisation, mainly in the pharmaceutical industry, delivers assistance such as enhanced storage space and lower charges. This policy exchanges hired logistic warehouses with on-spot ones, restructuring processes and decreasing overhead costs.

Growing Technological Advancement

Inventions in tracking and heat regulator technologies play an essential part. These developments confirm the exact monitoring and care of ideal storing situations for pharmaceuticals, addressing the severe supervisory demands in the market.

Expansion Sustainable Solutions

A noteworthy change towards environmentally friendly practices reminds the acceptance of green logistics results, such as the usage of recyclable devices, and fewer write-offs and additional products. This ecologically sensible method donates to a helpful market viewpoint, dazzling the industry's assurance of sustainability.

Expansion in Research and Development Investments

Producers and logistics benefactors are enthusiastically capitalizing on research and development. This assurance proposes to improve the safety, effectiveness, and ecological sustainability of pharmacological logistics, supporting global industry extension.

The market is speedily growing due to numerous key features one of the key drivers is the rising worldwide demand for medications, which is boosting the requirement for reefer vessels in the pharmaceutical industry. Moreover, there has been a noteworthy upsurge in the number of frozen warehouses globally, further enhancing the market development.

These movements highlight the rising importance of temperature-maintained storage and transport in numerous trades, particularly pharmaceuticals, and are anticipated to influence the market to move forward in the upcoming years.

The absence of a logistics set-up and low acceptance of cutting-edge technologies are the key challenges deterring the market. Many reasons such as the lack of suitable infrastructure, absence of skilled employees, developed frequency of old-fashioned technology, and varying power sources are hindering the development of the market.

North America witnessed the highest revenue share for the year 2023 this growth is because of the expansion of pharmaceutical companies in countries such as the U.S. and Canada. The huge investment in this region by a variety of businesses for research and development of medicines and its safe supply to a wider section across the globe has resulted in dominating the pharmaceutical cold chain logistics packaging market.

The rising infrastructures such as hospitals, clinics, and many others boost the advancement of pharmaceutical cold chain logistics packaging solutions for the safety of storage and transportation of temperature-sensitive drugs and vaccines.

The COVID-19 pandemic led to an unprecedented demand for cold chain logistics to store and distribute vaccines. North American countries were key players in vaccine production and distribution, which significantly boosted the region's cold chain logistics infrastructure. Governments in the region are increasingly investing in biopharmaceutical research and development (R&D), further driving the demand for cold chain logistics packaging solutions to ensure product integrity.

Asia Pacific is estimated to grow at the fastest rate over the forecast period. In several countries such as China, Japan, India, Thailand, and South Korea there is a rapid growth of medicine-producing hubs and supply to national and international markets. Growing initiatives of the government to improve the poor health conditions in this region have led to the growth of cold chain logistics packaging.

This region is spreading its medical products manufacturing and distributing business rapidly which boosts the market's growth. The rise in the earning level of people also led to the growing demand for healthcare facilities. Asia is home to some of the most populous countries in the world, including China and India. With an aging population and increasing incidence of chronic diseases, the demand for pharmaceuticals is rising rapidly. Many of these medicines require cold chain logistics to maintain their efficacy, especially vaccines, biologics, and other temperature-sensitive drugs.

By type, the single use segment led the pharmaceutical cold chain logistics packaging market in 2023. This segment has a major focus on disposable packaging solutions for temperature-sensitive products developed in the pharmaceutical industries. It is to maintain the safety and integrity of the packaging which stores and transports medicines or several other healthcare products. The key factor associated with this field is the rapid technological advancement in packaging solutions to reduce contamination risk.

By application, the temperature-sensitive segment led the pharmaceutical cold chain logistics packaging market in 2023. The healthcare sector handles a large number of temperature-sensitive medicines, vaccines, and various other products for which there is a need for enhanced-quality cold chain logistics packaging. This market has helped to maintain the effectiveness, value, and safety of medicines which boosts development. The majority of diagnostic centres need advanced-quality packaging and its investment has lifted this market.

By Type

By Application

By Region Covered

April 2025

January 2025

February 2025

February 2025