April 2025

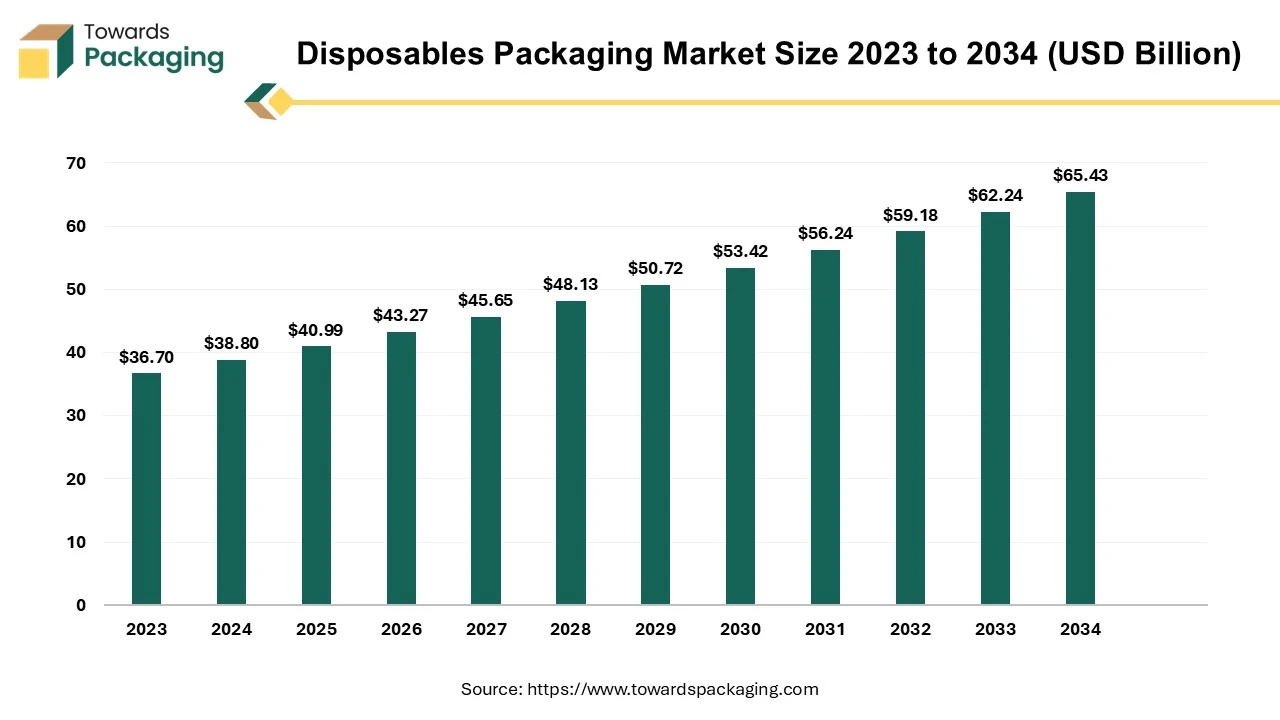

The disposables packaging market is set to grow from USD 40.99 billion in 2025 to USD 65.43 billion by 2034, with an expected CAGR of 5.72% over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The disposables packaging market is expected to witness considerable growth during the forecast period. Disposable packaging is intended to be utilized just once and then discarded. It is used in the food business to store, transport and consume food. Disposable packaging is often made-up of materials such as plastic, paper, aluminum and foam, among others. It is widely used in fast food restaurants, take-out restaurants as well as catering businesses.

Disposable packaging comprises plates, cups, bowls, utensils, tray sheets, and single-serving butter packages. It is convenient, safe and sanitary, and it saves time by removing the need for dishwashing. It also contributes to the quality and freshness of the food. This packaging is additionally utilized for a variety of the healthcare products and is designed to guarantee sterility and the safety of patients. Several of the most popular product categories that use single-use packaging are pre-fillable syringes and needles, orthopedic, endoscopy, cardiology, dental, surgical instruments and wound care supplies, among others.

The rising trend of on-the-go consumption and convenience-based products along with the expansion of e-commerce and online food delivery services is expected to augment the growth of the disposables packaging market during the forecast period. Furthermore, the healthcare industry’s increased emphasis on hygiene and safety as well as consumer preferences are shifting towards sustainable packaging options is also anticipated to augment the growth of the market.

Additionally, the advancements in material technologies such as the development of innovative bioplastics and compostable materials coupled with the demographic changes such as the growth of the middle class in emerging economies are also projected to contribute to the growth of the market in the years to come. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

The rise in food delivery services is expected to fuel the growth of the disposables packaging market within the estimated timeframe. Food delivery has increased by threefold since 2017 and is now a billion-dollar global industry. After a period of strong historical expansion, the market in the US nearly doubled in size during the COVID-19 epidemic. The emergence of appealing, easy-to-use applications and technologically advanced driver networks as well as the evolving customer demands, has made ready-to-eat meal delivery an important sector. As per the analysis by the National Restaurant Association, it is projected that the foodservice sector will generate $1 trillion in revenue by 2024. Also, almost eight out of ten operators anticipate that their sales in 2024 will either increase (33%) or remain constant (45%) from 2023 levels and 22 percent are expected to open-up new sites in 2024.

Furthermore, major companies in the online food delivery sector are working towards providing new services to remain competitive as well as meet evolving expectations of the consumer. For instance, in September 2023, Grubhub declared the launch of the On-Demand Delivery, a new product feature. With the help of this service, self-delivery diners on the Grubhub Marketplace can ask a Grubhub delivery person to handle last-mile logistics on an order-by-order basis as needed.

The ease of having meals delivered straight to the consumers' homes or workplaces has become a popular trend owing to the busy lifestyles, urbanization and a growing dependency on mobile apps and digital platforms for food ordering. Disposable packaging is necessary for guaranteeing that meals are served fresh, undamaged and hygienic, specifically in an industry where food safety and presentation is the key to the customer experience. Also, the rise of cloud kitchens and the delivery-only restaurants is further likely to create the demand for disposable packaging.

The growing environmental awareness and the introduction of stringent regulations are likely to hinder the growth of the market within the estimated timeframe. Disposable packaging is mainly designed with single use plastics. Non-biodegradable plastic packaging has drawn heavy criticism for contributing to the landfills and marine pollution. An estimated 36% of the total plastic produced is utilized for single use that substantially adds to the problem of plastic waste worldwide. According to the Organization for Economic Co-operation and Development (OECD), just 9% of the plastic litter has been recycled worldwide, in spite of various attempts to recycle it. Approximately 79% of plastic has been disposed of in landfills or the environment, while the rest, or 12%, being burned. Also, the International Union for Conservation of Nature and Natural Resources estimates that each year, 20 million metric tons of plastic waste finds their way into the ecosystem. It is projected that by 2040, that sum is likely to increase enormously.

This growing environmental awareness has resulted in the introduction of the stringent regulations by governments that are aimed at reducing the utilization of the disposable plastics. For instance, in July 2024, a new objective was declared by the Biden-Harris administration to phase out the federal acquisition of single-use plastics from events, food service processes, and packaging by 2027 and by 2035 from other federal activities completely.

Also, in September 2023, the UK government announced bans and restrictions on various single use plastics products. The new restrictions state that no establishment in England, be it a takeout operator, retailer, food vendor or associated with the hospitality sector, will be permitted to sell the single-use plastic balloon sticks, cutlery, polystyrene cups and food containers. As a result, environmental concerns remain a significant restraint on the growth and viability of the disposables packaging market within the estimated timeframe.

The growing demand from emerging economies is projected to fuel the growth of the disposables packaging market in the years to come. This is due to the rapid urbanization, rising disposable incomes and the expansion of the middle class. As per the data by the United Nations Conference on Trade and Development (UNCTAD), urbanization has been more noticeable in developing economies over the past 10 years, specifically in Asia and Oceania, where the urban rate increased from 44.0 percent in 2012 to 50.6% percent in 2022. During the same time frame, Africa had a growth of 4.6 percentage points. Also, between 2018 and 2050, China, India and Nigeria would collectively be responsible for 35% of the global urban population growth. It is predicted that 416 million more people will live in urban areas in India, 255 million in China and 189 million in Nigeria.

As urban populations rise, there is a higher demand for easy, ready-to-use packaging options in a variety of industries such as food, hygiene products, and healthcare. In these regions, disposable packaging is becoming important for modern lifestyles, as busy consumers seek quick and easy alternatives for daily demands. Additionally, the rise of the e-commerce sector in emerging nations is further likely to create opportunities for the market growth. For instance, as per the data by the Mexican Online Sales Association, the value of the domestic e-commerce market in 2022 was projected to be USD 26.2 billion, up by 23% compared to 2021. In 2022, there were approximately 63 millions of Mexicans using e-commerce, a 5.5 million rise since 2021. This rapid expansion of the food delivery and retail sectors in cities throughout China, India and Mexico has created substantial demand for the disposable packaging that guarantees hygiene and product safety.

The plastic segment held considerable market share of 55.61% in 2024. Plastics are the preferred material, specifically in the medical and packaging sectors owing to its affordability, sterility, safety, simplicity of manufacturing and flexibility. Single-use plastics include things like bags, meal packaging, straws, coffee stirrers, cups and cutlery. Polymers that are mostly utilized in the making of single-use plastics are HDPE (High Density Polyethylene), LDPE (Low Density Polyethylene), PP (Polypropylene), PS (Polystyrene) and PET (Polyethylene Terephthalate), among others. Plastic is an excellent choice of material utilized for packaging in the industries such as food delivery and e-commerce, where products must be protected during the transit while being lightweight. Additionally, plastic has excellent barrier properties, enabling food and beverages to remain fresh for longer periods and this is important in the food service industry.

The food segment held the largest market share in 2024. This is attributable to the on-going rise of the convenience-oriented consumer lifestyles along with the increase in the in the fast-food, takeout and food delivery sectors. Additionally, growth of food delivery platforms like Uber Eats, DoorDash and local services in emerging markets as well as the growing trend of ready-to-eat meals, meal kits, and on-the-go snacks is also projected to contribute the growth of the segment in the global market. Also, the awareness of food safety and hygiene following the COVID-19 pandemic globally are further likely to fuel the segment's growth in the years to come.

North America is likely to grow at a considerable CAGR of 4.39% during the forecast period. This is due to the increasing prevalence of fast-food chains, food delivery services, and takeout culture as well as the growth of platforms like DoorDash and Uber Eats across the region. For instance, in May 2024, Uber Technologies, Inc. and Instacart established a strategic alliance to offer Instacart clients food delivery from Uber Eats. Customers of Instacart across the country will be able to place orders from thousands of restaurants via the Instacart app, which is powered by Uber Eats. Furthermore, the surge in private-label products and the increasing focus of retailers such as Walmart, Target and Amazon on creating distinct packaging is also expected to contribute to the regional growth of the market.

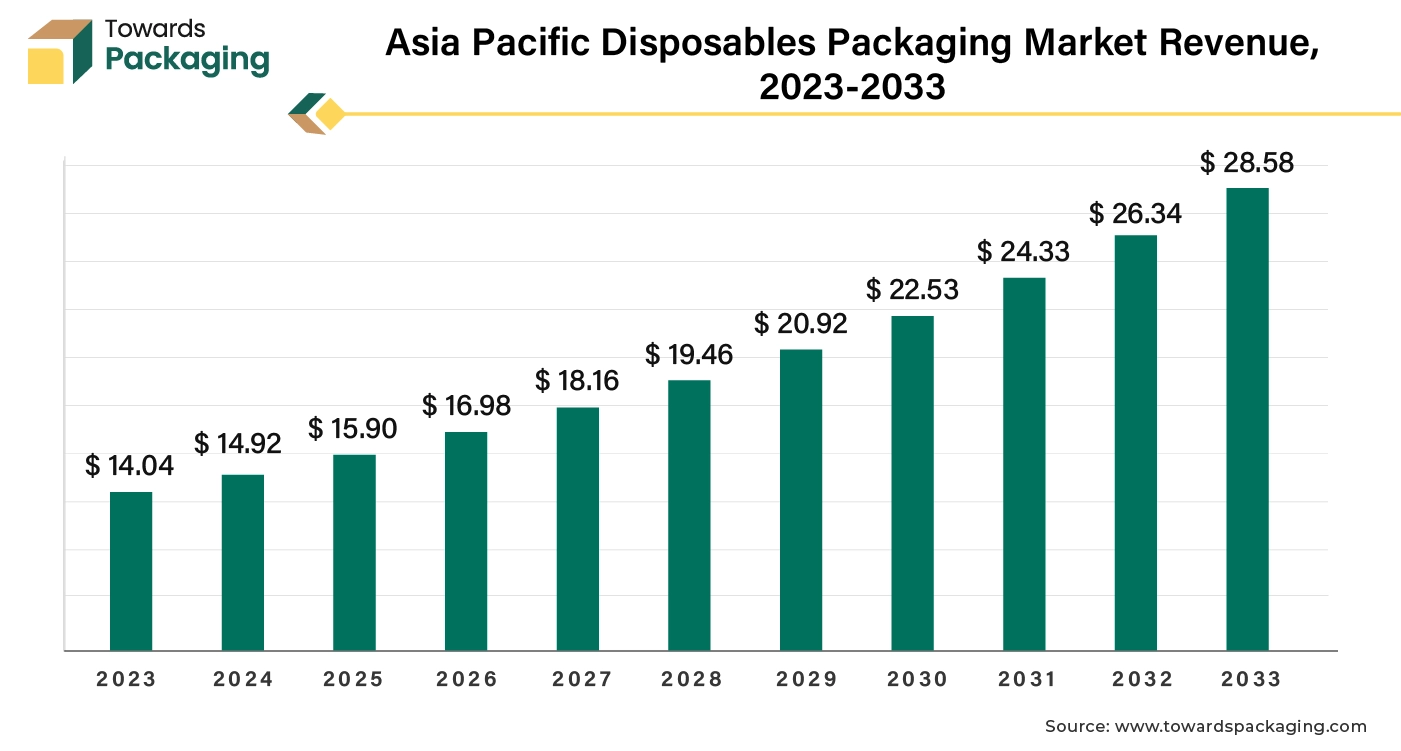

Asia Pacific held largest market shares and is likely to grow at fastest CAGR of 7.49% during the forecast period. This is owing to the growth of the e-commerce platforms like Flipkart, Myntra and Shopee along with the rise of food delivery apps like Zomato, Swiggy and GrabFood across the region. Furthermore, the rising disposable income and changing consumer lifestyles are also expected to support the regional growth of the market. Additionally, the growing quick-service restaurant industry with global chains like McDonald’s, KFC, and local favorites as well as the growth in packaged food sector is also anticipated to promote the growth of the market in the region in the near future.

By Material

By Product Type

By End-User

By Region

April 2025

April 2025

April 2025

April 2025