Pharmaceutical Containers Market Size and Global Growth

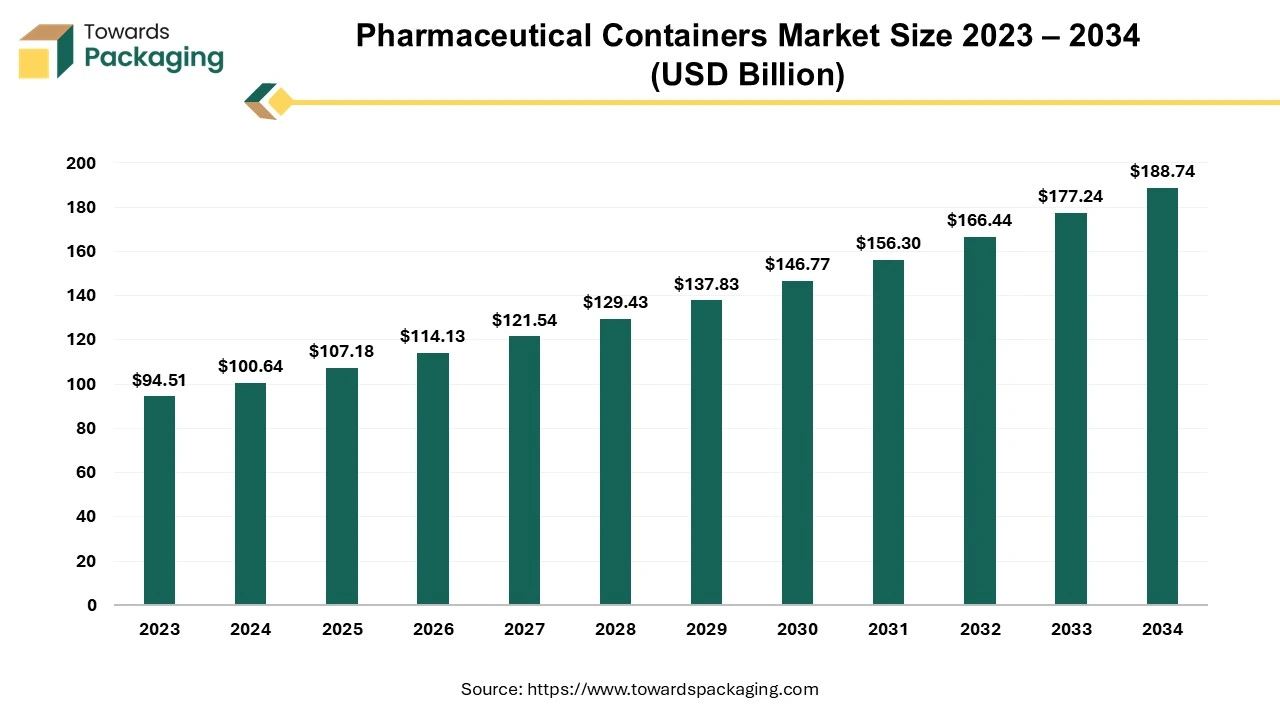

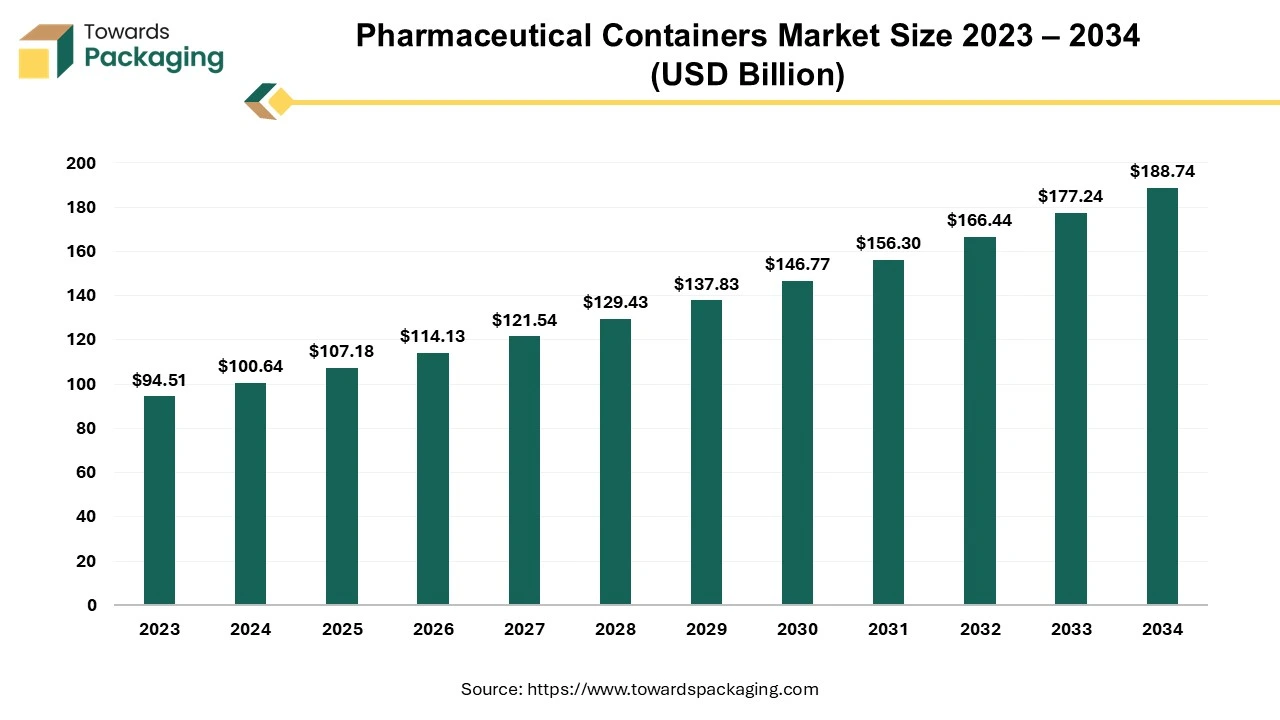

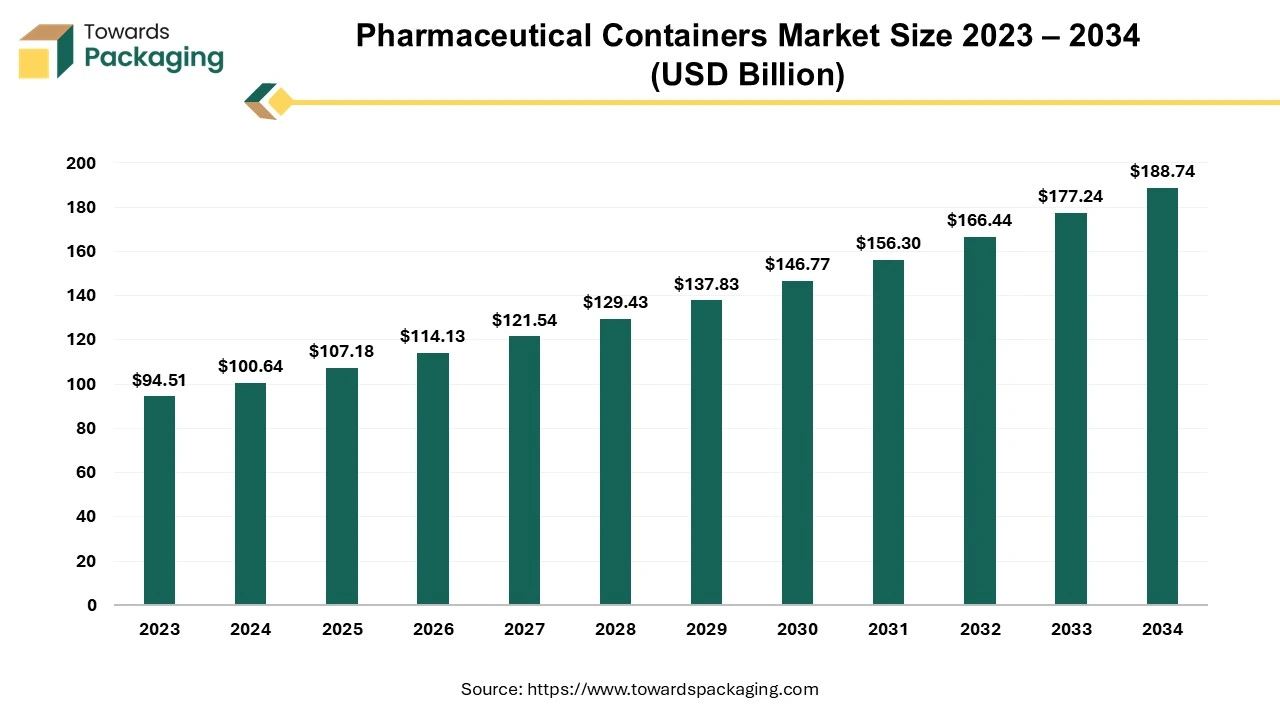

The pharmaceutical containers market is forecasted to expand from USD 114.13 billion in 2026 to USD 200.99 billion by 2035, growing at a CAGR of 6.49% from 2026 to 2035. This report covers detailed market segmentation by product types such as bottles, vials, and prefilled syringes, and material types including plastic and glass. Regional insights are provided for North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, while the competitive landscape is analyzed through key players like Amcor, Gerresheimer, and Berry Global. Additionally, we explore trade data, market shares, and the role of manufacturers and suppliers in the value chain.

The pharmaceutical containers market is set to expand substantially over the forecast timeline. A pharmaceutical container is a container that can come into close contact with the product while holding the medicine. An immediate container is one that comes into immediate contact with the medications. Products may not come into direct contact with some of the containers; for example, every unit is packaged in a sachet and kept in a container. Pharmaceutical packaging is essential as it protects the medicine, aids in identification, makes transportation easier and gives information about the contents without actually contacting the product.

The rising prevalence of chronic diseases along with the aging populations in many regions is expected to augment the growth of the pharmaceutical containers market during the forecast period. Furthermore, the stringent regulatory requirements imposed by health authorities as well as the shift towards biologics and injectable drugs are also anticipated to augment the growth of the market. Additionally, the increased healthcare spending and improved access to the medications in emerging economies coupled with the rise of personalized medicine and tailored drug therapies is also projected to contribute to the growth of the market in the years to come.

Key Trends and Findings

- Pharmaceuticals are now produced in prefilled containers and delivery systems such as auto-injectors, wearables and prefilled syringes and cartridges, rather than only being supplied in conventional vials. Furthermore, the company is producing drugs that are self-administered and do not require the presence of a healthcare provider.

- One of the most common causes of medicine recalls is particle contamination, or invisible materials found in drug containers. Healthcare providers currently take sufficient precautions to prevent medication side effects in the individuals they care for. Eliminating lubricants and additives from medication delivery systems and containers that may result in unfavorable drug responses is a much-needed trend that will require research into novel materials and packaging techniques.

- The U.S. Drug Supply Chain Security Act (DSCSA), whose adherence deadlines extended into late 2023, along with European Union (EU) regulations requiring pharmaceutical serialization, which went into effect in February 2019, is accelerating serialization and track-and-trace efforts aimed at pharmaceutical authenticity and traceability.

- Prescription compliance assistance like blister packs with incorporated schedules for dosage or smart reminders, are incorporated into packaging solutions to help patients follow their recommended prescription regimen and achieve better treatment outcomes. Additionally, individualized patient demands are met by customizable packaging alternatives like unit-dose packaging or customized dosage instructions, which support personalized medicine and improve patient engagement.

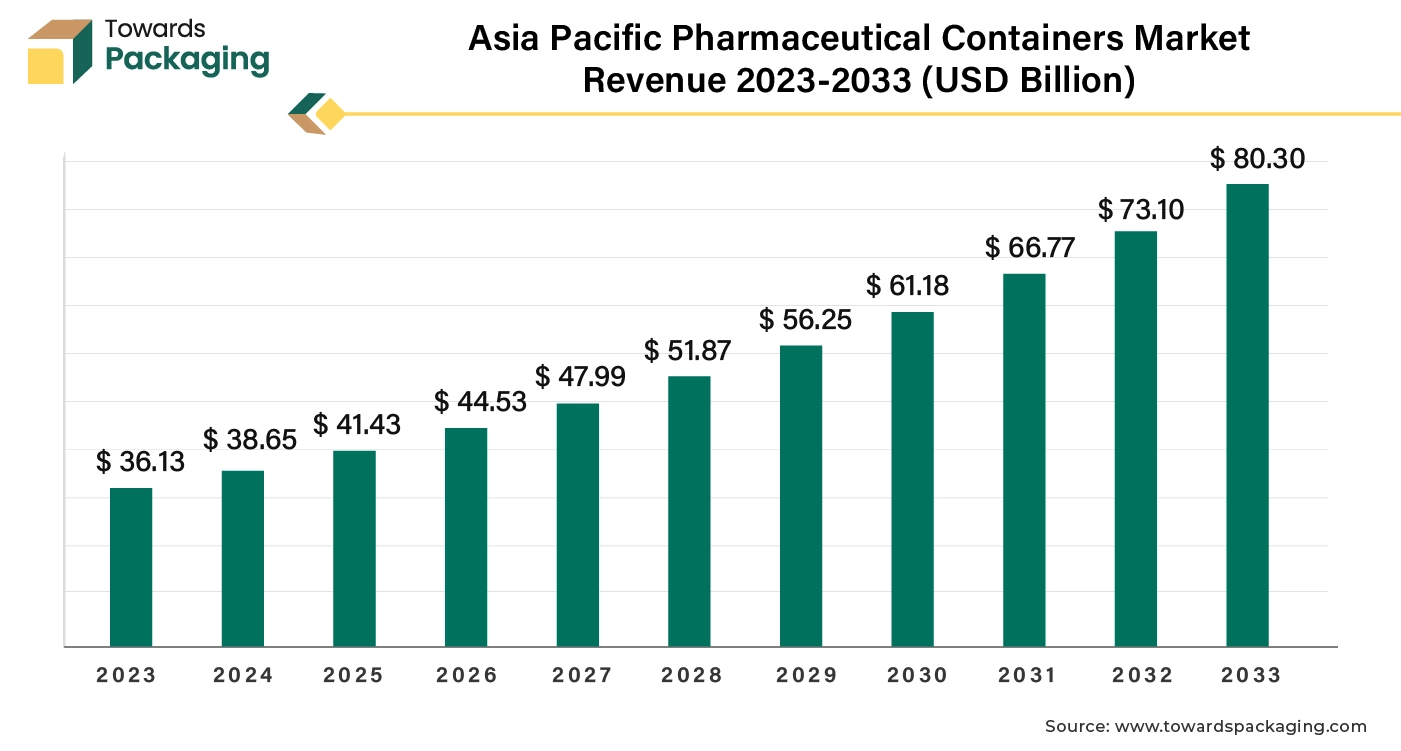

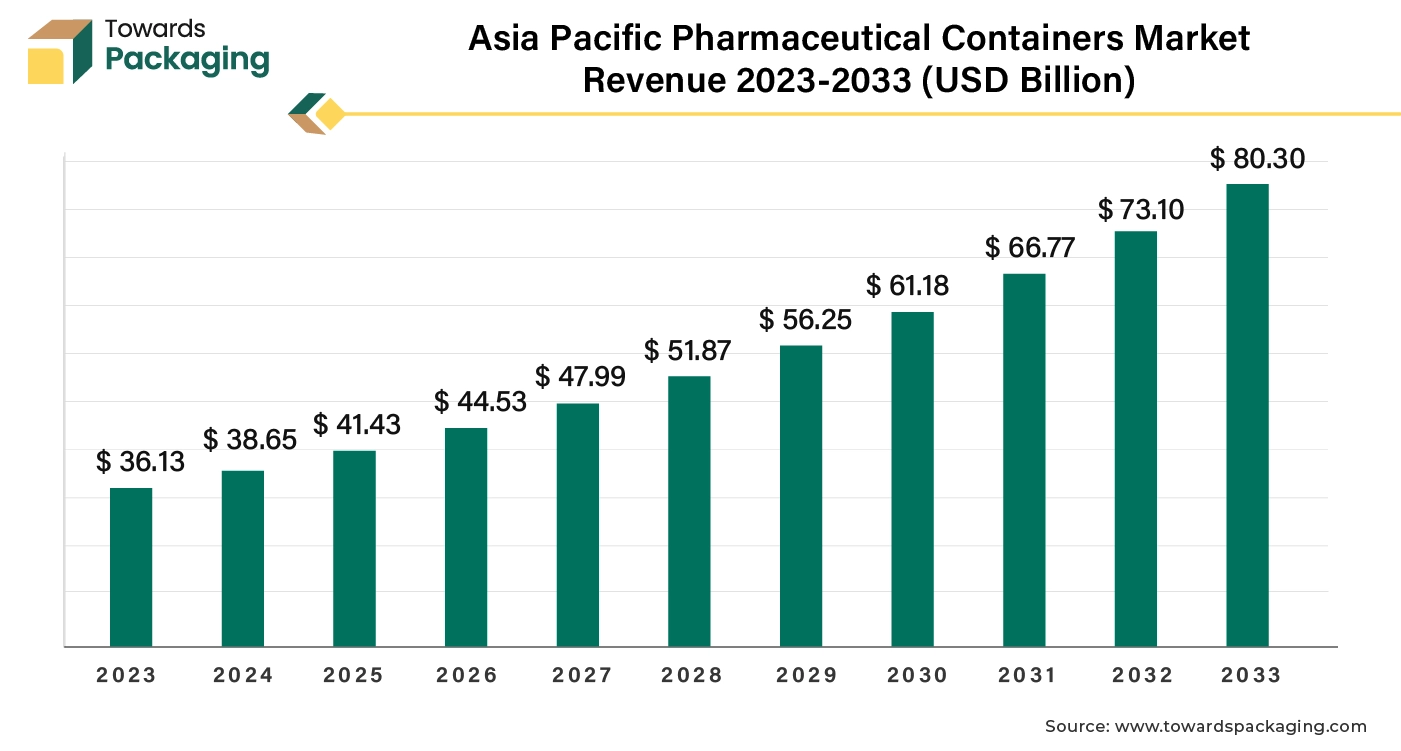

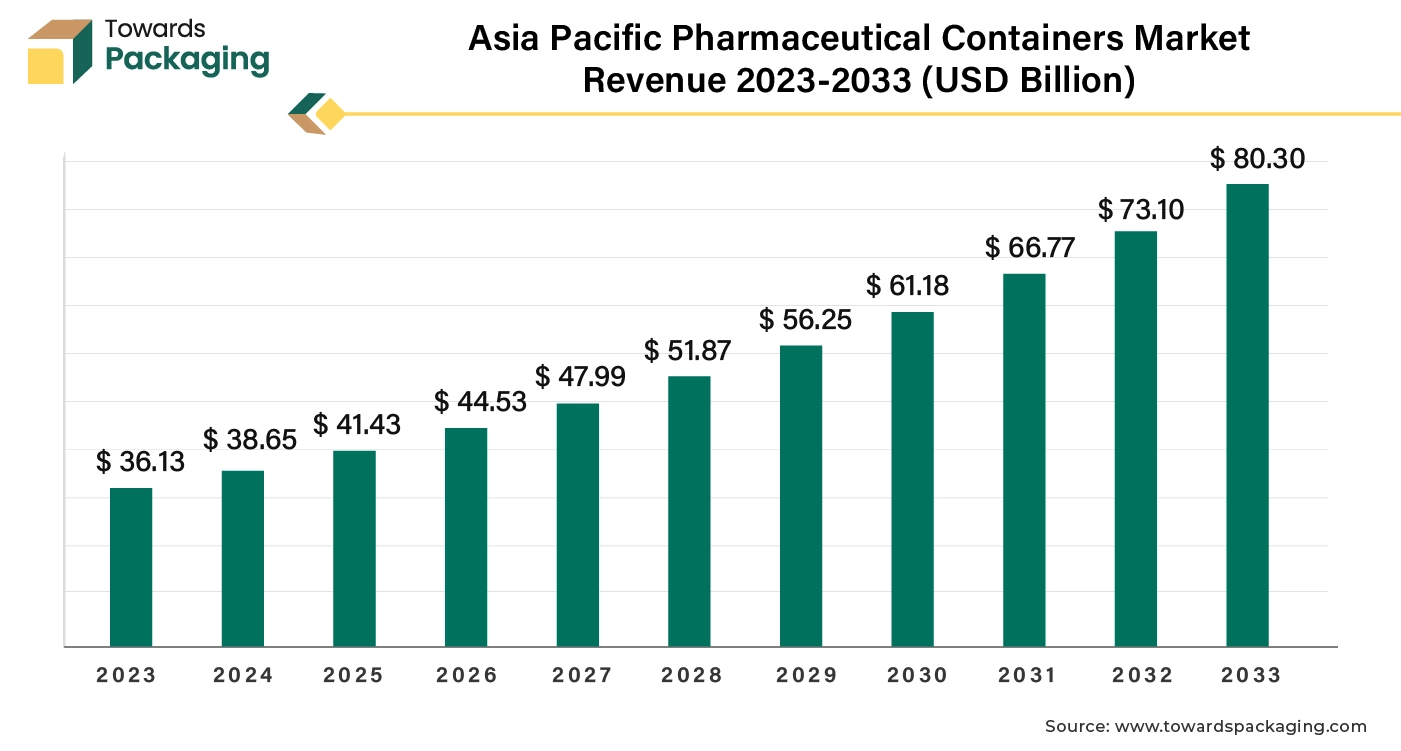

- Asia-Pacific is expected to grow at a fastest CAGR of 8.47% during the forecast period owing to the increasing healthcare access, rising disposable incomes and expanding pharmaceutical production in countries like China and India.

- North America held considerable market share of 22.82% in 2023. This is due to the well-established pharmaceutical industry, stringent regulatory standards and high healthcare spending.

Integrating Artificial Intelligence (AI) in Pharmaceuticals Containers Industry

Artificial Intelligence is lowly and steadily making headway into every industry, offering various applications that could help boost productivity. AI is already being adopted on a large in healthcare and pharmaceutical industry. It has plenty of scope in the pharmaceuticals containers industry too. Packaging plays such a major role, especially in pharmaceuticals. AI technology can be connected to software monitoring dosage, ingredient types etc. This will support the development of a quality management systems which will help in maintenance of quality throughout the supply chain process.

AI combined with machine learning (ML) could be utilized to analyze vast amount of data that will help in demand forecasting, ensuring there are no disruptions in the supply chain. AI technology has other applications like smart packaging for personalized medicine, predictive maintenance, inventory management, IoT enabled RFID’S, reducing costs and human errors etc. AI can help the pharmaceuticals containers industry grow further with its innovative technology.

U.S. Import Shipments for Plastic, Glass & Aluminum Products from Sept 2023 to Sept 2024

| Consignee Name |

Shipper Name |

Sum of Quantity |

Sum of Weight (kg) |

Product Description |

Estimated Price Range (USD) |

| PAC Tech International Inc |

Polyplas Dominicana S A |

197,251,500 |

204,831 |

Aluminum Plates, Sheets, and Strip |

$2.00 - $5.00 per kg |

| PAC Tech International Inc |

Polyplas Dominicana S A |

182,700,000 |

188,193 |

Aluminum Plates, Sheets, and Strip |

$2.00 - $5.00 per kg |

| PAC Tech International Inc |

Polyplas Dominicana S A Calle Anibal de Espinosa |

57,340,000 |

469,149 |

Plastic Articles for the Packing of Goods |

$1.50 - $4.00 per kg |

| PAC Tech International Inc |

Polyplas Dominicana S A Calle Anibal de Espinosa |

23,400,000 |

397,320 |

Plastic Plates, Sheets, Film, Foil, and Strip |

$1.50 - $4.00 per kg |

| Aisin North Carolina Corp |

Aisin Corp |

21,698,777 |

1,645,918 |

Plastic Containers for Storage |

$1.00 - $3.00 per unit |

| Aisin North Carolina Corp |

Aisin Corp |

10,534,395 |

733,663 |

Plastic Containers for Storage |

$1.00 - $3.00 per unit |

| Aisin Texas Corp |

Aisin Corp |

10,473,330 |

988,907 |

Plastic Containers for Storage |

$1.00 - $3.00 per unit |

| Grifols Biologicals Inc |

Nihon Taisanbin Glass Bottle MFG Co |

8,108,688 |

710,440 |

Glass Bottles and Jars |

$0.50 - $2.00 per unit |

| Grifols Therapeutics LLC |

Nihon Taisanbin Glass Bottle MFG Co |

6,999,264 |

641,328 |

Glass Bottles and Jars |

$0.50 - $2.00 per unit |

| Kaufman Container |

H and H Glass Inc |

6,553,344 |

633,256 |

Glass Bottles and Jars |

$0.50 - $2.00 per unit |

Market Drivers

Increasing Prevalence of Chronic Diseases

The rise in chronic diseases such as diabetes, cancer and cardiovascular conditions is projected to support the growth of the pharmaceutical containers market during the forecast period. This is owing to the sedentary lifestyles, poor dietary habits and a lack of physical activity contributes significantly to the development of chronic diseases. Obesity is a major risk factor for several chronic diseases, including type 2 diabetes, cardiovascular diseases, and certain cancers.

According to the International Diabetes Federation (IDF), 10.5% of the population of adults (20-79 years) has diabetes, with nearly fifty percent uninformed of the fact that they have been diagnosed with the condition and more than 90% of those with diabetes suffer from type 2 diabetes. IDF estimates also indicate that by 2045, 1 in 8 adults, or 783 million, will suffer from diabetes; a 46% increase and that by 2030, there will be 643 million people worldwide with diabetes.

Chronic illnesses often need long-term medicine and continuous drug delivery, increasing the demand for the pharmaceutical products in a wide range of applications. The rise in the diabetes cases has created a greater demand for insulin administration systems that necessitates secure and sterile pharmaceutical containers such as vials, ampoules and pre-filled syringes. Similarly, cancer treatments may require complicated pharmaceuticals demanding unique packaging techniques to assure drug stability and safety. Cardiovascular illnesses, which necessitate continuing medication care, add to the growing demand for effective containers that maintain drug effectiveness over extended durations. Pharmaceutical companies are also increasingly searching for packaging options that not only protect the drug's integrity but also promote user convenience and compliance, and this is driving growth of the pharmaceutical container market.

Market Restraints

Environmental Impact of Plastic-Based Containers

The environmental risk of plastic packaging in pharmaceuticals is anticipated to impede the growth of the pharmaceutical containers market during the forecast period. The pharmaceutical sector is one of the leading causes of pollution in the world and must balance meeting the strict health as well as safety standards set by authorities with the demands of contemporary consumers who are concerned about the environment. As a result, the pharmaceutical packaging sector faces a constant challenge.

Furthermore, plastic has historically been popular due to its cost-effectiveness by manufacturers, sterility and chemical inertness. However, the pharmaceutical sector is responsible for nearly 300 million tonnes of plastic waste annually, half of which is made up of single-use plastics. This dependence on the plastics has resulted in a global waste crisis.

Single-use plastic containers are mostly not biodegradable and their effects on the environment are becoming a serious concern. As governments strengthen environmental restrictions and customers demand more environmentally friendly packaging, pharmaceutical companies face increasing pressure to shift to sustainable alternatives such as biodegradable or recyclable materials. This transition, however, poses numerous challenges.

Further, the expense of procuring sustainable materials, upgrading production methods and maintaining compliance with environmental and pharmaceutical safety regulations can be prohibitively expensive, particularly for smaller enterprises. Additionally, numerous regions lack the infrastructure for recycling pharmaceutical containers, complicating the adoption of sustainable packaging options. These obstacles, combined with high costs and logistical problems, limit market growth as companies strive to achieve a balance between environmental responsibility and product safety.

Market Opportunities

Rising Biologics and Injectable Demand

The rising demand for biologics and injectable drugs is anticipated to augment the growth of the pharmaceutical containers market in the near future. The last two decades have seen a sharp increase in the study and manufacturing of biologics, with no indication of slowing down. Nearly all biologic subtypes are likely to experience considerable growth in the next five years, despite the expectation that monoclonal antibodies will dominate the market. Between 2022 and 2027, the demand for the gene therapy and genetically-modified cell therapies is projected to grow by 39.6%. This growth will be fueled by sales of the unapproved but promising pipeline medications like RP-A501, a Phase I gene therapy suggested for glycogen storage diseases.

Companies such as Dyne Therapeutics have started patient clinical studies for DYNE-251 and DYNE-101, two of its main antibodyASO conjugate candidates. The application of chimeric antigen receptors (CARs) in CAR T-cell therapy for cancer immunotherapy is another developing field.

The increased adoption of biologics as drugs combined with recent big discoveries of various product types has substantially expanded the application and possibilities of pharmaceutical containers. Biologics include vaccines, monoclonal antibodies, recombinant proteins, RNAi and cell-based therapies, among others that require precise handling and packaging to maintain their stability and efficacy. Injectable drugs, which are routinely used to treat chronic conditions like diabetes, cancer, and autoimmune disorders, also require specialized packaging to guarantee sterility, proper dosing, and patient safety. As the global healthcare industry moves toward personalized and targeted medicines, biologics and injectables become more common, needing innovative packaging alternatives such as vials, ampoules and pre-filled syringes.

Key Segment Analysis

Product Type Segment Analysis Preview

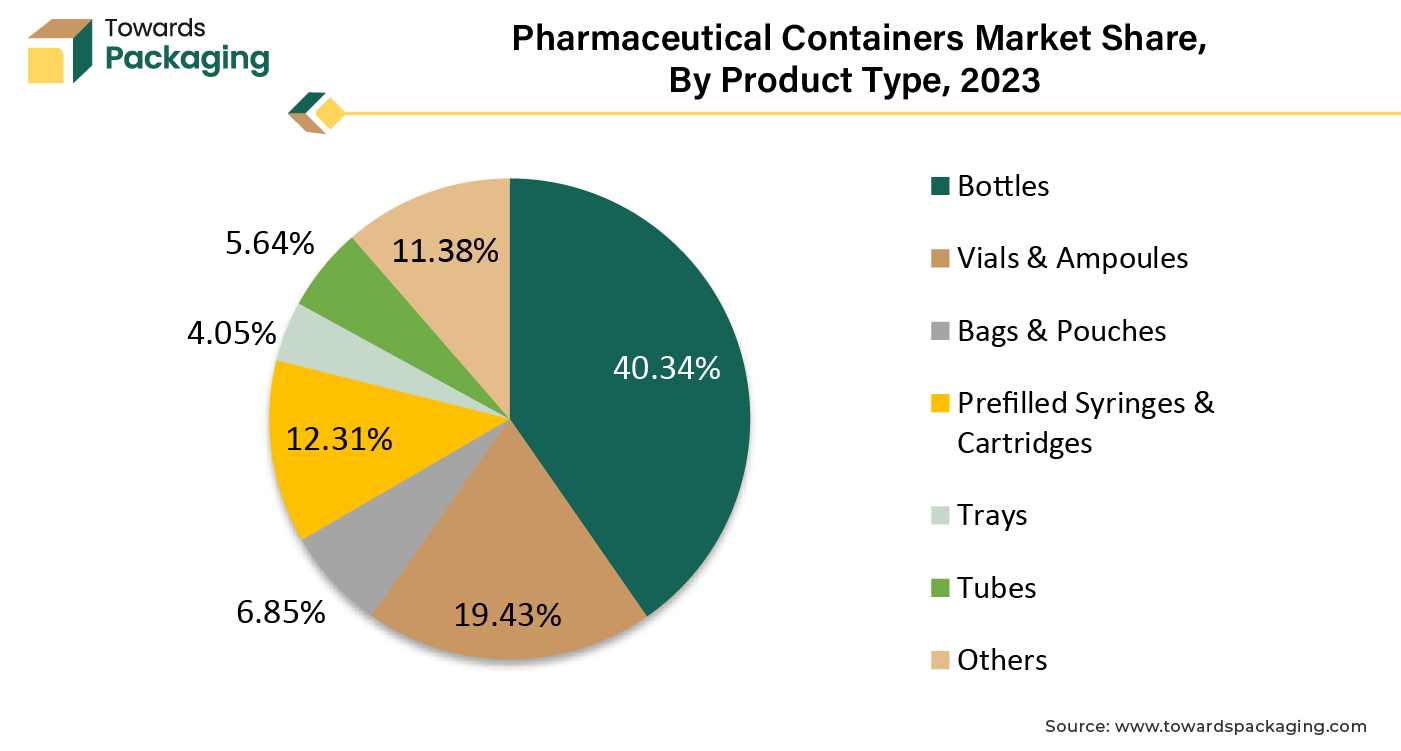

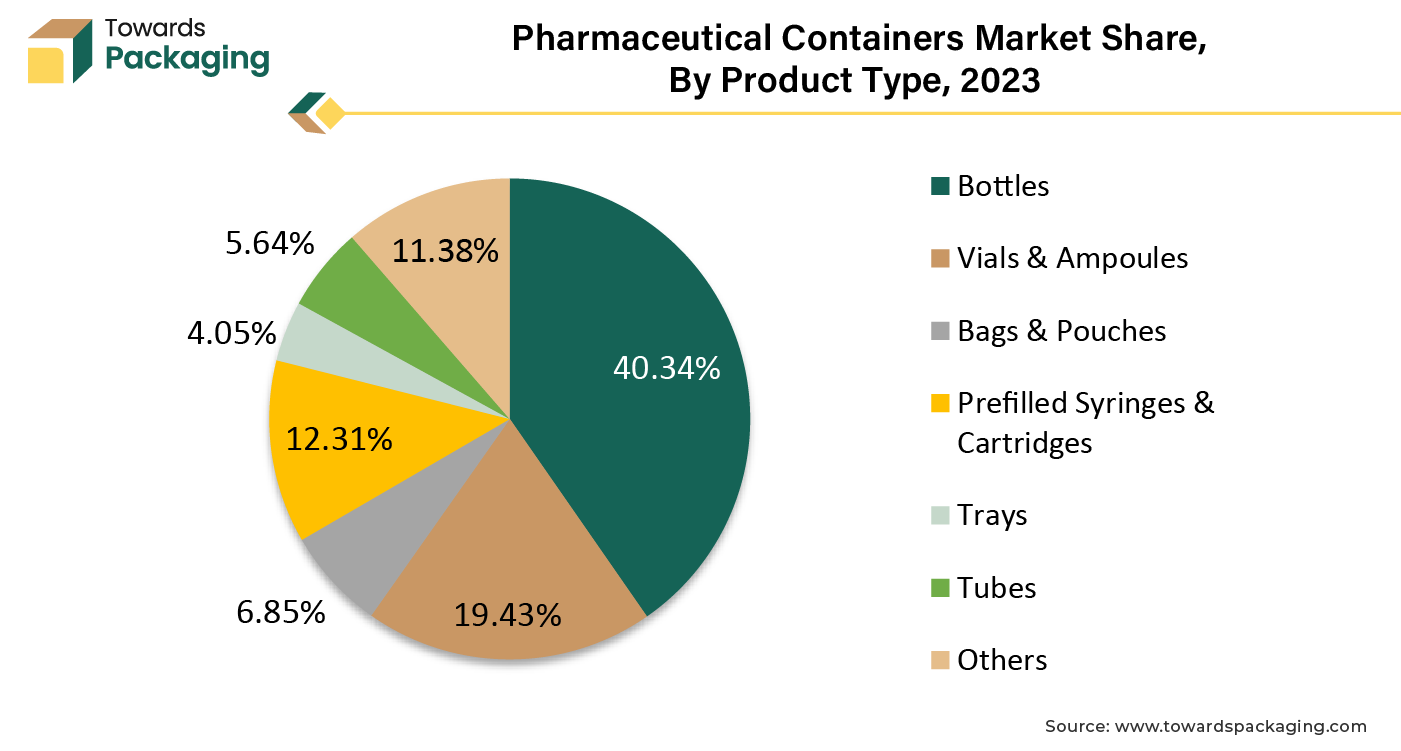

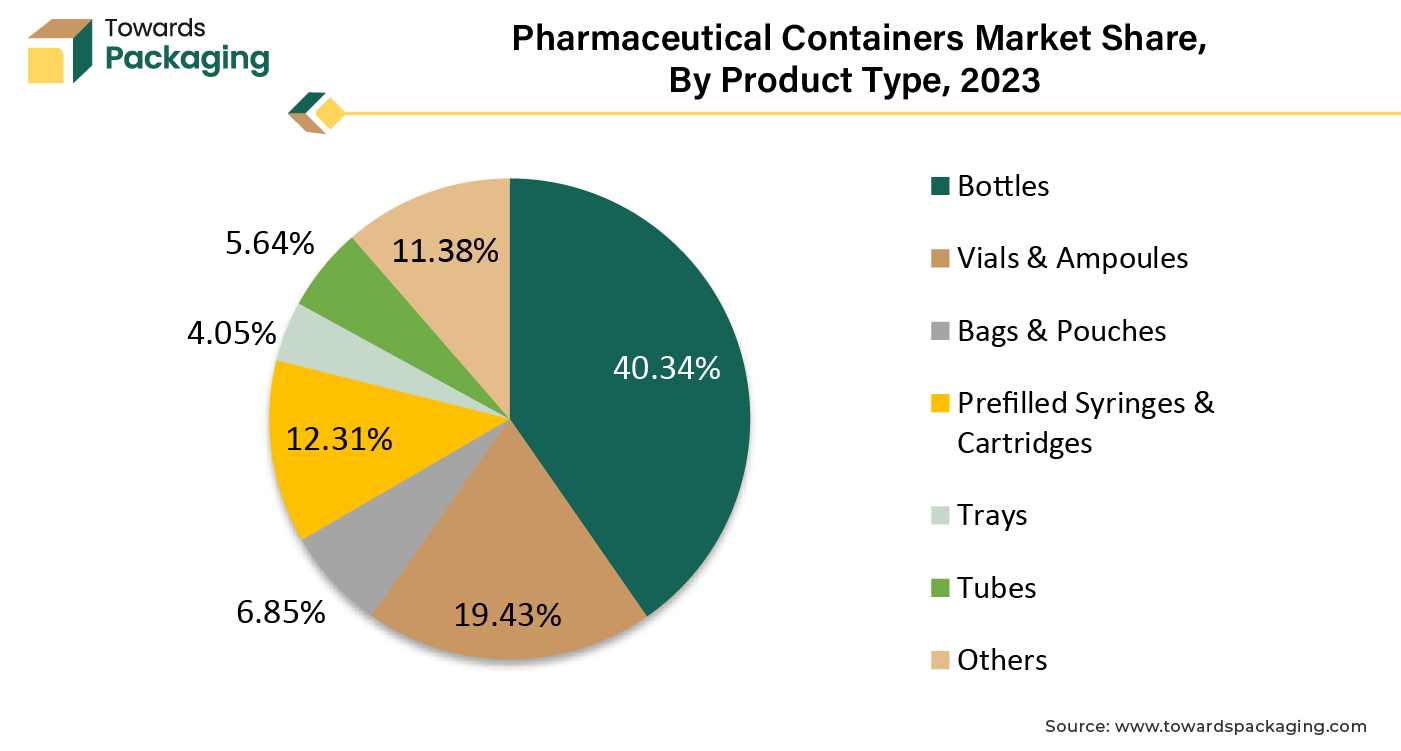

The bottles segment captured considerable market share of 40.34% in 2023. Bottles are often utilized for storing liquids, pills and capsules. Depending on the product, glass or plastic might be used in the manufacturing of bottles. Glass is the best material to use when storing liquids and delicate medicinal products for extended periods of time. For a wide range of the medications and nutraceuticals such as the ibuprofen and vitamin D, bottles of plastic are more adaptable as well as suitable. Pharmaceutical products are shielded from light, moisture and oxygen by good barrier qualities of bottles that can otherwise damage their stability and effectiveness. This preserves the strength and purity of drugs, guaranteeing that the patients will benefit from it.

Furthermore, due to their well-known clarity, bottles enable patients as well as the medical professionals to visually examine the contents, confirm the precision of labels and look for any indications of contamination or tampering. The improved security and increased confidence in the supply chain for pharmaceuticals are a result of this transparency. These factors are expected to contribute to the growth of the segment within the estimated timeframe.

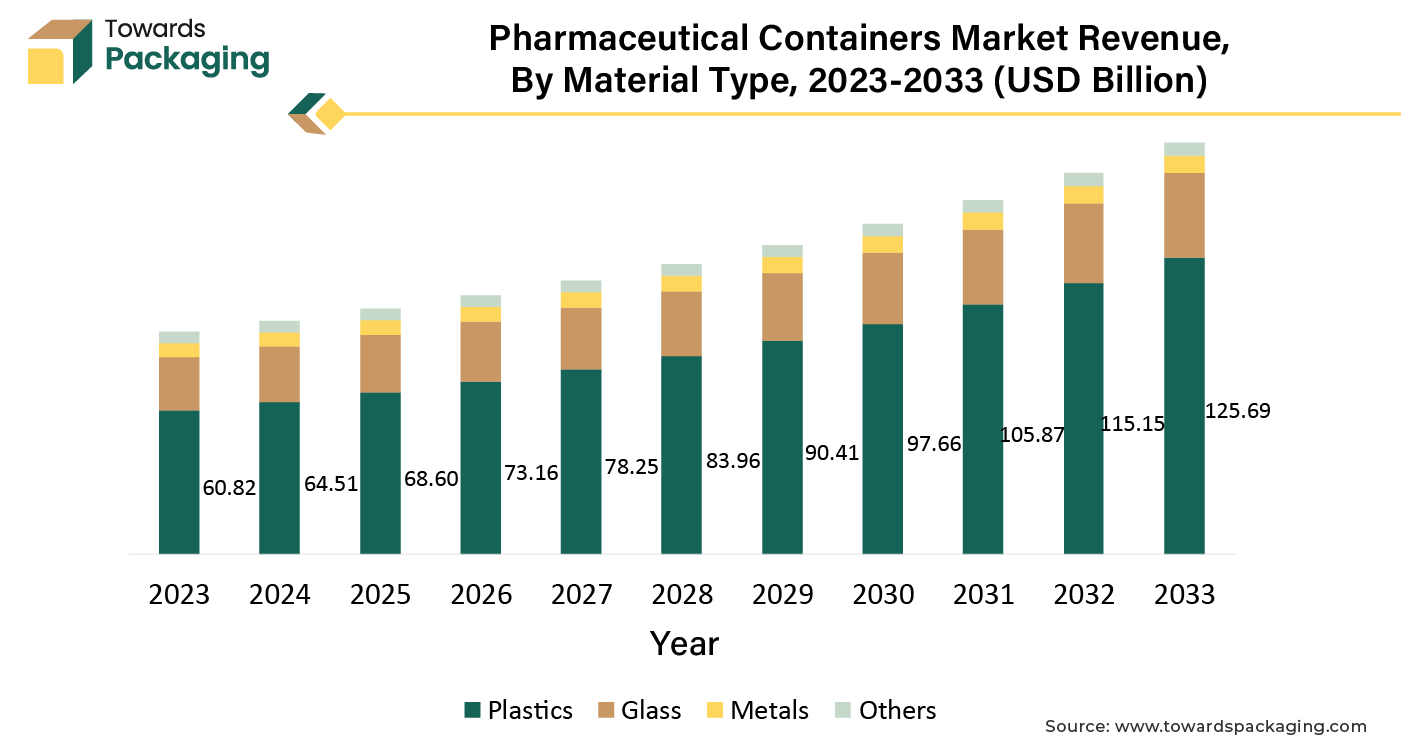

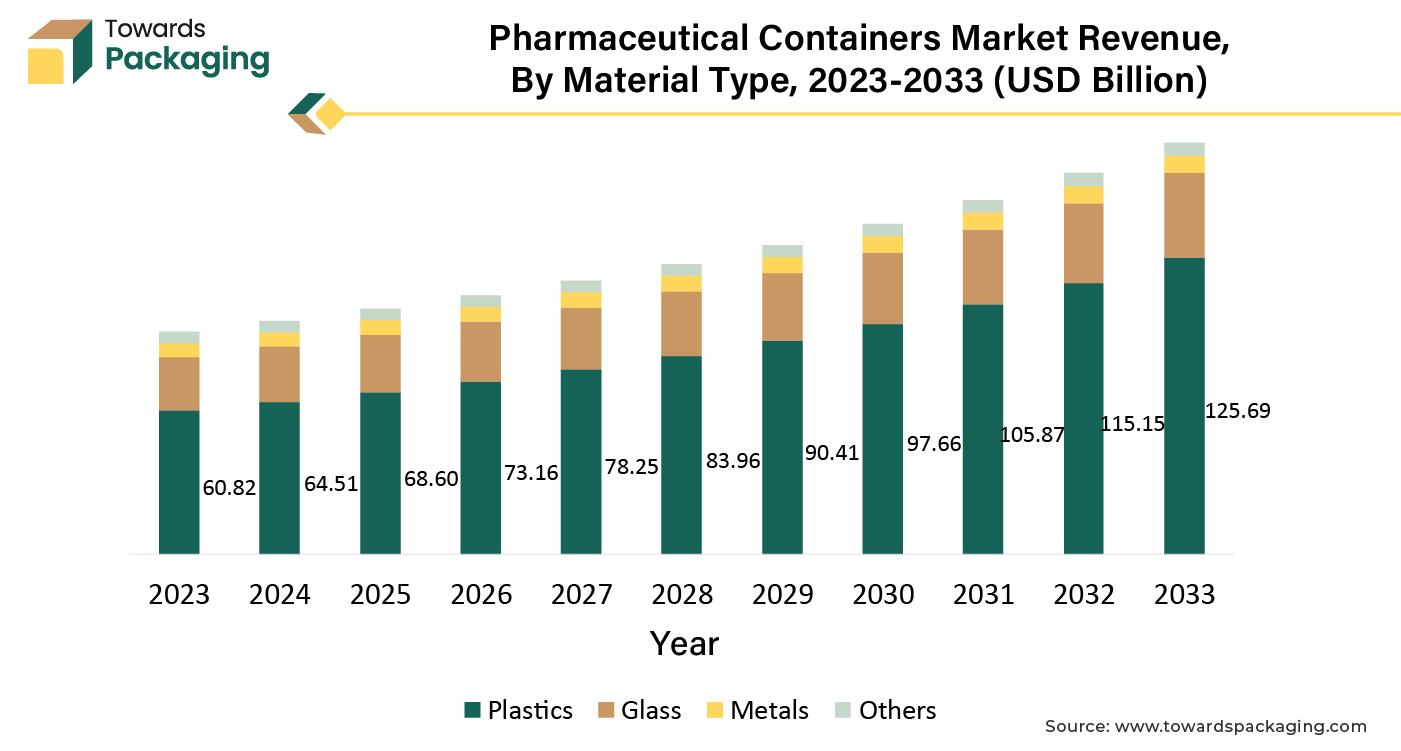

Material Type Segment Analysis Preview

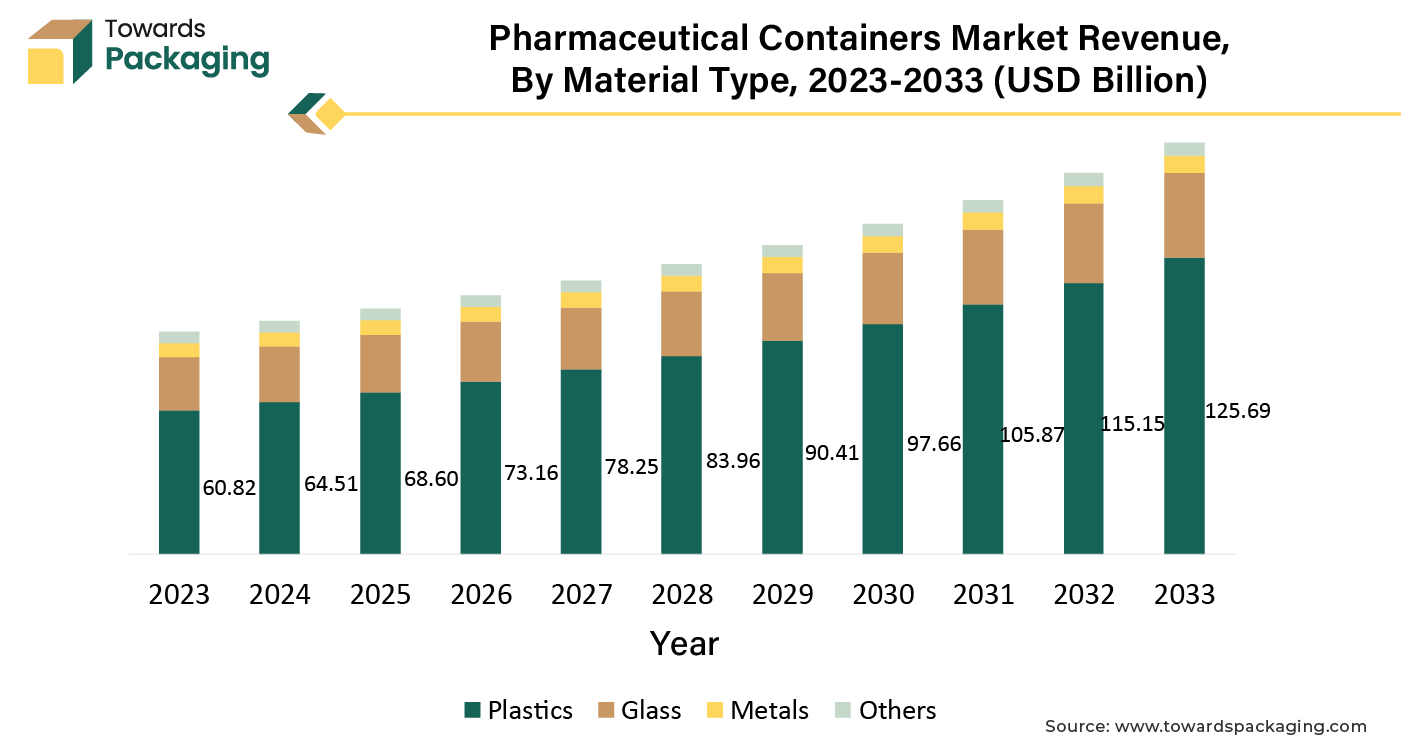

The plastic segment held considerable market share of 64.35% in 2023. The pharmaceutical industry utilizes plastic as one of the major packaging materials. Pharma packaging products are made-up of different types of plastics such as polypropylene, HDPE, LDPE and Polyethylene Terephthalate (PET). A variety of medications can be stored and protected using each product, depending on the plastic's characteristics, which include weight, flexibility, corrosion resistance and rigidity. Despite of the material's natural attributes, additives can be used to further improve its qualities. The growing concern about the adverse environmental effects of plastics has driven this sector to seek alternatives for packaging that is better for the environment.

These comprise biodegradable, recyclable and recycled polymers. Also, the low weight of the containers made-up of plastic significantly lowers the cost of transportation. Transporting more bottles simultaneously is possible with lighter loads, which results in reduced fuel expenses which are expected to support the segmental growth of the market in the years to come.

Regional Insights

Europe held considerable market share of 28.85% in 2023. This is due to the increasing stringent pharmaceutical packaging regulations globally, enforced by agencies and the increase in the production and consumption of biologics and injectable drugs across the region. Furthermore, the increasing the prevalence of chronic conditions such as cardiovascular diseases, arthritis and Alzheimer’s is also expected to contribute to the regional growth of the market. Also, the production of generic drugs and with growing exports of these drugs is further expected to support regional growth of the market in the years to come.

Asia Pacific is likely to grow at fastest CAGR of 8.47% during the forecast period. This is owing to the rapidly growing pharmaceutical industry in countries like India and China. As per the data by the India Brand Equity Foundation, the pharmaceutical industry in India has grown over the past nine years at a compound annual growth rate of 9.43%, making it the third in the world in terms of the pharmaceutical production volume. The pharmaceutical market in India is projected to grow to a value of US$ 65 billion by 2024, approximately US$ 130 billion by 2030, and US$ 450 billion by 2047. Additionally, the rising incomes and economic development along with the growing healthcare spending is also anticipated to promote the growth of the market in the region in the years to come.

In a country like India, the government initiatives are promoting the pharmaceutical sector. This is attracting investment as well as creating interest in local pharmaceutical equipment manufacturing, which will help drive pharmaceutical production directly increasing demand for pharmaceutical containers. During the forecast period, such policies will make India an important region for the pharmaceutical container market.

Recent Developments by Key Market Players

- June, 2024: In response to a request for assistance from a major pharmaceutical business in order to satisfy its sustainability ambitions, Cherwell launched a new range of prepared media called Redipor Plastic Bottle. Cherwell has developed and introduced new plastic bottled media products that have undergone terminal sterilization. These products provide a more economical and ecologically friendly substitute for glass bottled media in the sterile pharmaceutical manufacturing process.

- January, 2024: Loop Industries, Inc. and Bormioli Pharma unveiled a novel pharmaceutical packaging container that is made entirely of virgin, recycled Loop PET resin. With its 100% recycled virgin quality PET, Loop can provide the pharmaceutical industry with an environmentally friendly packaging option while also meeting the industry's growing demand for eco-friendly products. The lowest quality PET and polyester fiber waste is upcycled into 100% recycled virgin quality LoopTM PET resin using the Infinite LoopTM process.

Key Market Players

Some of the key players in pharmaceutical containers market Amcor Limited, Gerresheimer AG, Berry Global, Inc., Schott AG, AptarGroup, Inc., West Pharmaceutical Services, Inc., Becton, Dickinson and Company (BD), Owens-Illinois, Inc., Catalent, Inc., Nipro Corporation, CCL Industries Inc., Corning Incorporated, Stölzle Glass Group, SGD Pharma, Vetter Pharma International GmbH and SGD Pharma, among others.

Market Segments

By Product Type

- Bottles

- Vials & Ampoules

- Bags & Pouches

- Prefilled Syringes & Cartridges

- Trays

- Tubes

- Others

By Material Type

- Plastics

-

- Polyethylene

- LDPE

- HDPE

- Polyvinyl Chloride

- Polypropylene

- Polyethylene Terephthalate

- Others

- Glass

- Metals

- Others

By Region

- North America

-

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa