Pills and Tablets Bottles Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies

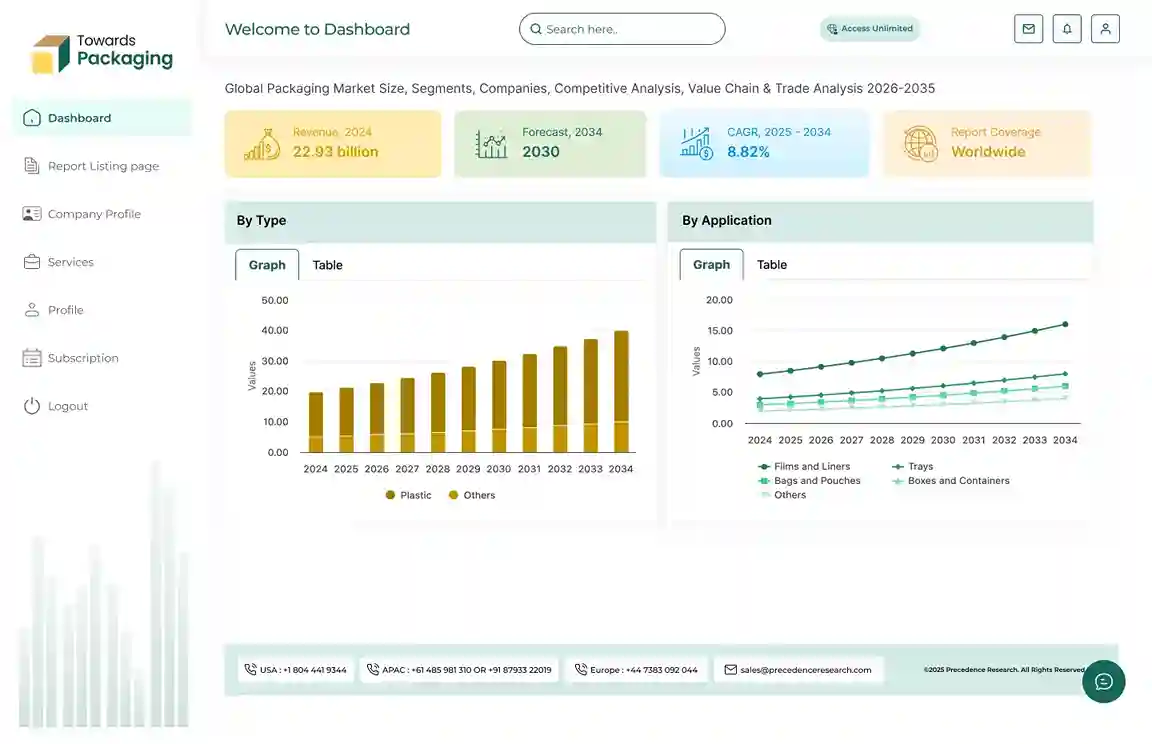

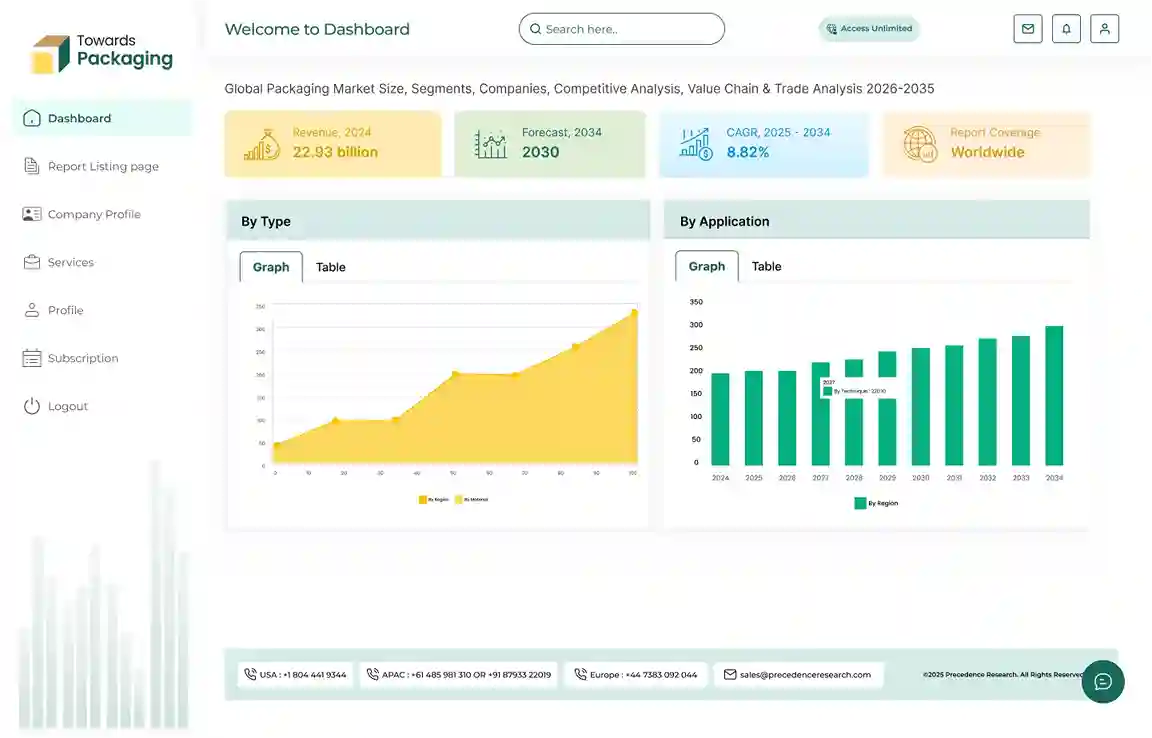

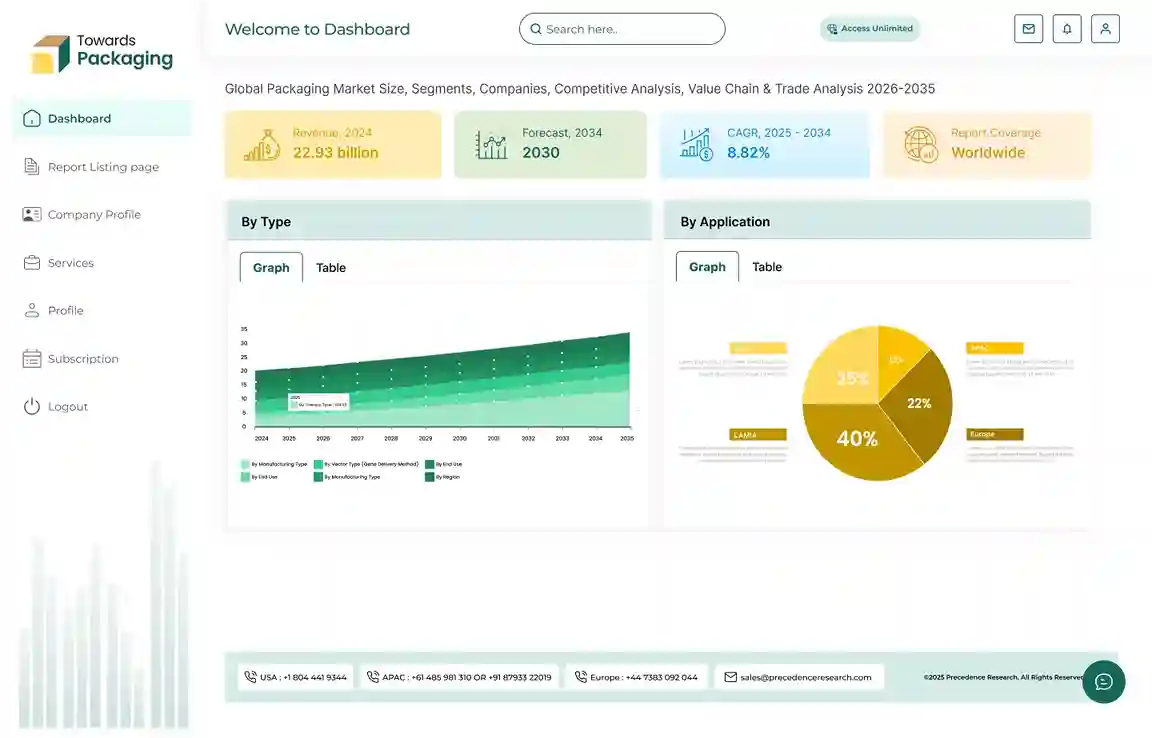

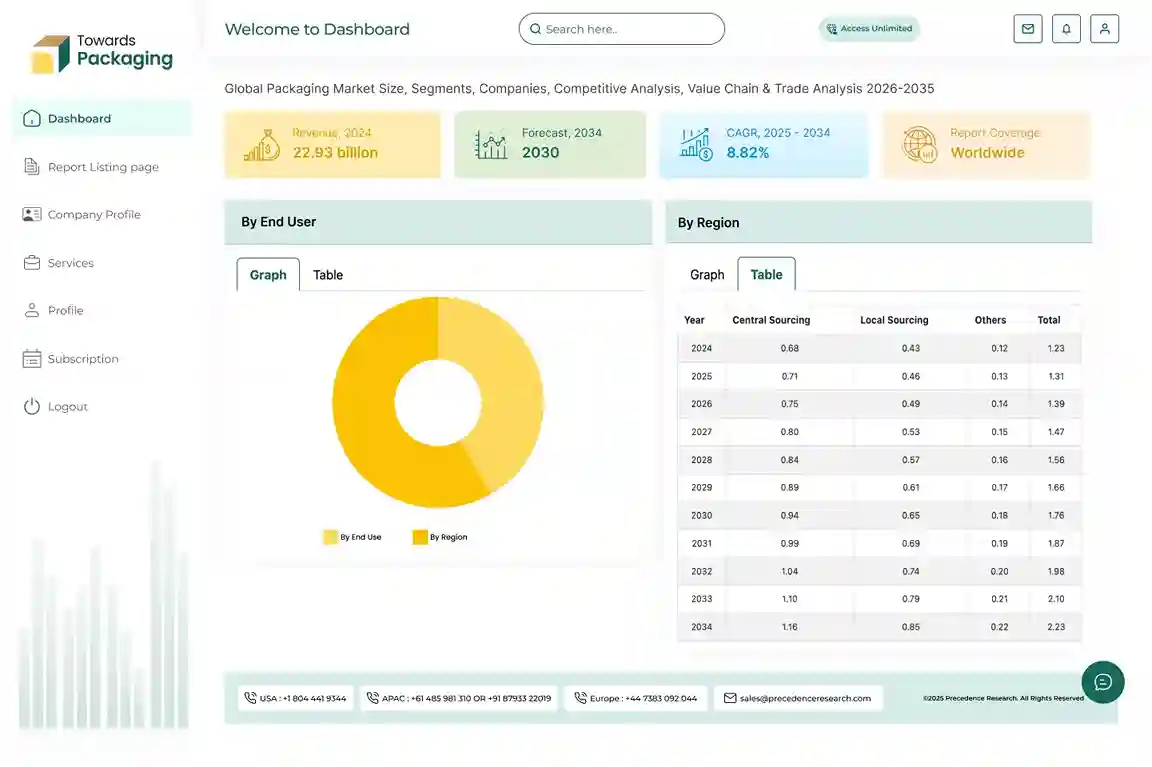

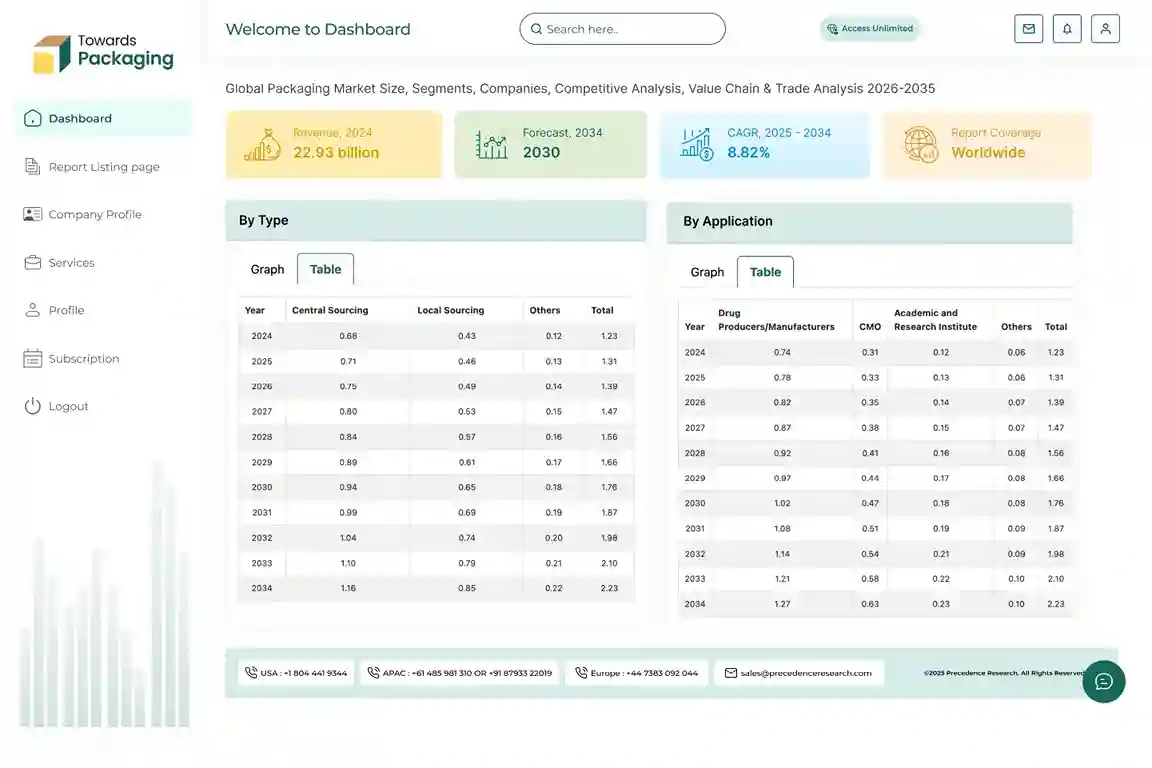

The pills and tablets bottles market is projected to experience substantial growth, reaching hundreds of millions in revenue between 2025 and 2034. The market analysis covers key segments such as material types (plastics and glass), bottle capacities (ranging from below 50 ml to above 200 ml), and end-users (pharmaceuticals, nutraceuticals, and others). It also includes regional insights into North America, Europe, APAC, Latin America, and the Middle East & Africa. Companies like Gerresheimer AG, Berlin Packaging, and Amcor Plc are driving the market with innovative, sustainable packaging solutions to address growing consumer demand for reliable, eco-friendly options. The market is expected to grow at a 3.16% CAGR.

The pills and tablets bottles market is set to expand substantially over the forecast timeline. These bottles are utilized in the storing and dispensing solid oral dosage forms such as pills, tablets and capsules. These bottles are essential in maintaining the integrity, safety and efficiency of the medications and supplements, providing convenience and ease of use to the consumers as well as the healthcare professionals. Typically made from materials like plastic (HDPE, PET) or glass, these bottles come in various sizes and feature secure closures to prevent contamination, moisture or accidental ingestion by children. These bottles are used by both the pharmaceutical and nutraceutical sectors.

The expansion of the global pharmaceutical industry along with the aging population in many regions is expected to augment the growth of the pills and tablets bottles market during the forecast period. Furthermore, the rise in chronic diseases is driving higher prescription rates as well as the growing health awareness and the surge in demand for nutraceuticals and dietary supplements are also anticipated to augment the growth of the market. Additionally, the increasing focus on patient convenience with easy-to-use and portable packaging and the e-commerce expansion coupled with the rising population in the emerging economies is also projected to contribute to the growth of the market in the years to come. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

Key Trends and Findings

- Pharmaceutical packaging is changing due to the ability of 3D printing to produce highly customizable packaging on demand as per the requirements of the patient or prescription. In addition to improving the complicated packaging designs that simplifies the patient experience and compliance, this technology also aids in the waste reduction.

- Recyclability is still a top priority, as most of the organizations switch from utilizing the conventional plastics to more environmentally friendly options. Innovative pharmaceutical packaging has surged due to the quest for the sustainable pill bottles. This sector is actively searching for the sustainable alternatives, ranging from reusable options to packaging composed of the recycled materials. These developments not only help the environment but also help pharmaceutical companies project a more mindful image, which appeals to environmentally conscious customers.

- The utilization of the mycelium, the fungal root structure, to produce the biodegradable packaging materials is an additional inventive strategy for the eco-friendly pharmaceutical packaging. Packaging made-up of mycelium not only provides excellent protection for the delicate pharmaceutical items but it is also biodegradable. The ability of this packaging to minimize waste as well as the greenhouse gas emissions throughout every stage of the product life-cycle is making it popular.

- Reusable packaging choices are growing in popularity, which is indicative of a larger industry trend to reduce waste. To prolong the package lifecycle and reduce the need for single-use plastics, organizations are investigating and adopting the multi-use packaging options that can be either be refilled or returned.

- Asia-Pacific is expected to grow at a fastest CAGR during the forecast period owing to the rising healthcare access, increasing disposable income, and a booming nutraceutical industry.

- North America held largest market share in 2023. This is due to the presence of well-established pharmaceutical industry and high healthcare expenditure as well as the rising chronic disease prevalence.

Market Drivers

Growing Pharmaceutical Industry

The growing pharmaceutical industry is projected to support the growth of the pills and tablets bottles market during the forecast period. This is owing to the increasing global burden of diseases, expanding healthcare access as well as increase in R&D spending on the introduction of the new drugs. According to the report by the Congressional Budget Office, in 2019, the US pharmaceutical sector spent $83 billion on research and development. That sum, after accounting for inflation, is roughly ten times the annual expenditure of the industry in the 1980s. Compared to the preceding ten years, the number of new pharmaceuticals licensed for sale climbed by 60% between 2010 and 2019, reaching an all-time high of 59 novel medications approved in 2018. Also, as per the European Federation of Pharmaceutical Industries and Associations, the research-based pharmaceutical industry in Europe invested a projected € 41,500 million in 2021 for the R&D.

Furthermore, the increasing prevalence of the chronic diseases as well as the aging population which needs a long-term medication routine in turn drives the demand for the safe and reliable packaging. As per the World Health Organization, the number of individuals in the world who are 60 years of age or older is expected to double and reach 2.1 billion by 2050. It is also projected that between 2020 and 2050, the number of people 80 years of age or older will triple, reaching 426 million. Thus, the demand for pill bottles is likely to increase to maintain the effectiveness of the medications. Additionally, as the pharmaceutical industry shifts towards more patient-centric care, the need for user-friendly packaging that facilitates proper dosing is further expected to contribute to the growth of the market within the estimated timeframe.

Market Restraints

Competition from Alternative Packaging

The presence of various alternative packaging options is expected to limit the growth of the market during the forecast period. The blister pack is gaining popularity as a packaging option that is ideal for today's security-conscious customers and authorities. Blister packing supports in anti-counterfeiting efforts in addition to functioning well with serialization and track & trace procedures. Furthermore, whether it's an innovative clinical-trial drug or an OTC (over-the-counter) pain reliever, the blister pack continues to be the most effective packaging option for improving patient compliance. Blister packing enables producers to comply with the strict worldwide regulations by protecting individual doses until the point of consumption. Additionally, blister packs have shown to be a practical and easy-to-use packaging style for solid oral dose drugs. This may be especially true for elderly people, as they frequently experience difficulties opening prescription bottles.

Furthermore, as stick packs have so many excellent attributes, it has become clear over time that stick packs are among the most valued package formats by both users as well as packaging companies. Compared to the sachet format, the stick pack package uses 33% less film, significantly lowering the amount of material needed to produce single-dose packets. For the end user, the stick pack format provides a convenient and simple opening. This feature gives the consumer the greatest amount of convenience when using the product, free from issues like drips, spills, or other difficult and inconvenient aspects. These alternative packaging options are increasingly being adopted due to their convenience, sustainability and functionality, challenging the dominance of the traditional pill and tablet bottles in various market segments.

Market Opportunities

Growth in E-commerce

The increasing popularity of online pharmacies and the direct-to-consumer sales is anticipated to augment the growth of the pills and tablets bottles market in the near future. Implementing e-commerce to circulate information can result in significant gains in financial transactions for the pharmaceutical industry and its users. This integrated network reduces the geographical distances and allowing timely access to the health-related data and the most recent biotech knowledge will improve the services for both users and the pharmaceutical community at large.

The emergence of massive internet companies like Ali JinDong and the e-commerce transformation of conventional pharmaceutical firms have propelled pharmaceutical e-commerce into a thriving industry, showcasing remarkable expansion as the result of technologically-driven industrial advancement. With an increasing number of consumers opting to purchase medications via pharmaceutical e-commerce platforms, user satisfaction feedback from online reviews can serve as a vital research foundation for platform growth and improvement. Additionally, a number of internet pharmacies increased the range of products they offered by adding dietary supplements, over-the-counter (OTC) pharmaceuticals, medical supplies, and prescription drugs.

Furthermore, as more consumers prefer to buy medications online, manufacturers must guarantee that the products are delivered safely to the consumers without compromising safety or quality. E-commerce packaging options must be durable enough to survive the challenges of shipping while keeping products tamper-proof and undamaged during transit. Manufacturers can innovate by creating packaging products that are customized to the needs of the e-commerce supply chain. As a result of the increasing online pharmacy business due to the growing internet penetration and online shopping habits, the demand for packaging will continue to rise, providing a huge growth opportunity for the pills and tablets bottles market in the years to come.

Key Segment Analysis

Material Type Segment Analysis Preview

The plastic segment captured largest market share in 2023. Among all materials, plastic is one of the most versatile materials. Plastic is lightweight, flexible and particularly hard to break. It may be utilized to create packaging in a variety of sizes and designs. When looking into materials for pharmaceutical packaging, there are all these benefits. The orange pill bottles which are extremely used for storing medications are made-up of polypropylene. Orange pill bottles are made of recycled polypropylene. Polypropylene and polyethylene are also the most frequent raw materials used to make the pharmaceutical bottle caps. Furthermore, plastic bottles made-up of polyethylene terephthalate (PET) are becoming increasingly popular as the industry's preferred packaging option. PET plastic bottles support environmental sustainability as well, which is in line with the pharmaceutical industry's growing focus on sustainable operations.

End-Use Segment Analysis Preview

The pharmaceuticals segment held the largest market share in 2023. This is owing to the increasing burden of the diseases along with the growing demand for the prescription medications. According to the World Health Organization (WHO), the percentage of chronic diseases continues to increase and is affecting millions of people worldwide particularly in the aging populations that require consistent medication management. Furthermore, growing awareness and diagnosis of chronic illnesses coupled with the increasing availability of healthcare services particularly in the emerging markets is also expected to contribute to the segment growth of the market. Additionally, the strict regulatory environment governing the pharmaceutical packaging is further anticipated to fuel the growth of the segment in the near future.

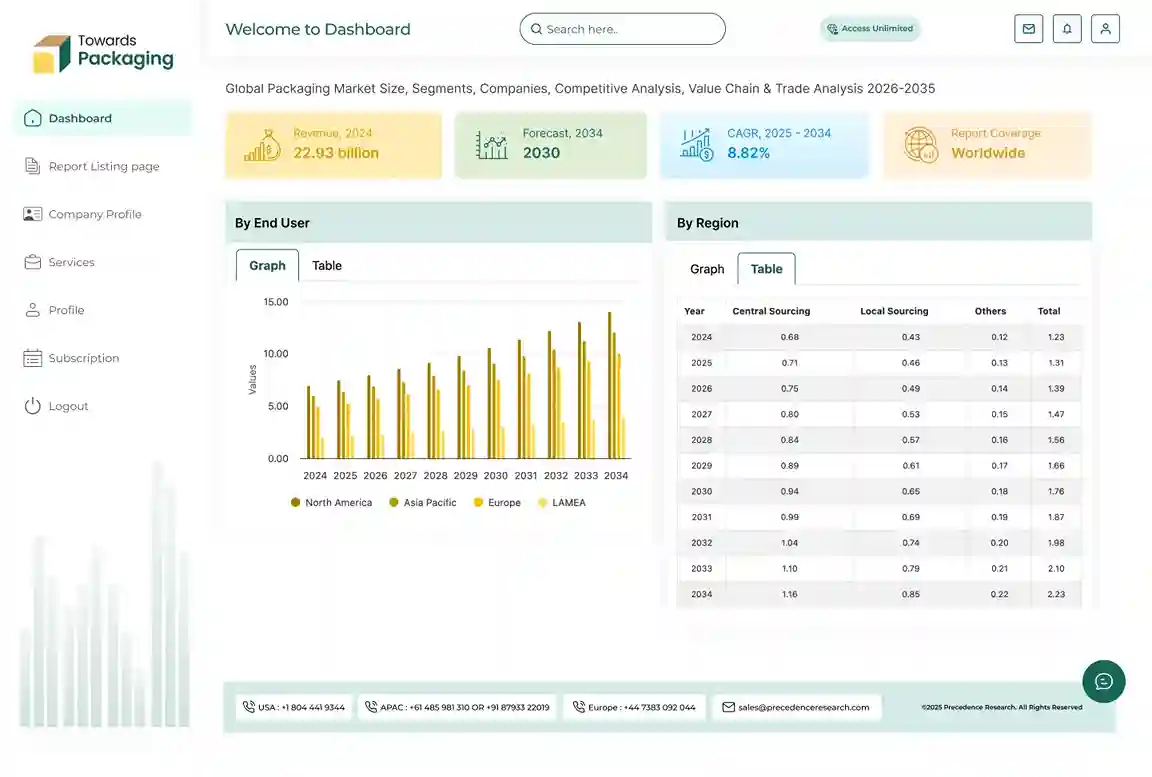

Regional Insights

North American pill and tablet bottle market has emerged as the largest market in the world in 2023. This is attributed to the growing spending on the healthcare products, easy accessibility of pill and tablet bottles through online/offline channels along with the availability of the smart pill and tablet bottles in the market. Another factor contributing to this development is the accessibility of the smart and intelligent pill bottles with designs that are senior and child-friendly and that support medication adherence with advanced technology capabilities. For example, in 2022 Drug Plastics launched the unique Pop & Click Closure System, which is easy to use and child-resistant for compliance and security, especially for people who have trouble with traditional closure systems. Furthermore, the well-established healthcare facilities and the stringent regulations for drug packaging are further expected to support the growth of the market in the region.

Asia Pacific is likely to grow at fastest CAGR during the forecast period. This is due to the growing healthcare industry in the developing economies such as China and India. China is the largest contributor to the pill and tablet bottle market owing to the high demand for bottles from the large population consuming a wide range of healthcare services. India is another major contributor to the regional pill and tablet bottle market owing to the growing income of the middle-class population subsequently spending more on the healthcare products.

According to the Economic Survey 2022–23, India's public spending on the healthcare reached 2.1% of GDP in FY23 and 2.2% in FY22, up from 1.6% in FY21. Apart from India and China, developed economies such as Japan, Australia and South Korea with strong spending power are also likely to contribute to the rising demand for pill and tablet bottles in the region.

Recent Developments by Key Market Players

- January, 2024: PillSafe Technology introduced advanced drug distribution technology where the pharmacist places the pills into the PillSafe container, snaps on the top and sets the bottle to deliver the prescribed quantity according to the specific schedule set by the doctor.

- December, 2022: Upstate pharmacy announced to provide locking pill bottles. The pill bottles with locks are a relatively recent invention. A code specific to each locking pill bottle will be given, along with operating instructions. The alignment of all four numerals is necessary for the bottle to open successfully. There are two sizes available for the bottles based on the size of the prescription pills.

Pills and Tablets Bottles Market Players

- Gerresheimer AG

- Berlin Packaging

- Stoelzle Glass Group

- The Remarkable Technology Co., Ltd

- Kaufman Container

- AARDEX Group

- Amcor Plc

- Berry Global, Inc.

- Rongtai Glass Products Co., Ltd.

- Nordtek Packaging Ltd.

- Origin Pharma Packaging

Pills and Tablets Bottles Market Segments

By Material Type

- Plastics

- Glass

By Bottle Capacity

- Below 50 ml

- 50-100 ml

- 101-200 ml

- Above 200 ml

By End-Use

- Pharmaceuticals

- Nutraceuticals

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (0)

No graphs available.