April 2025

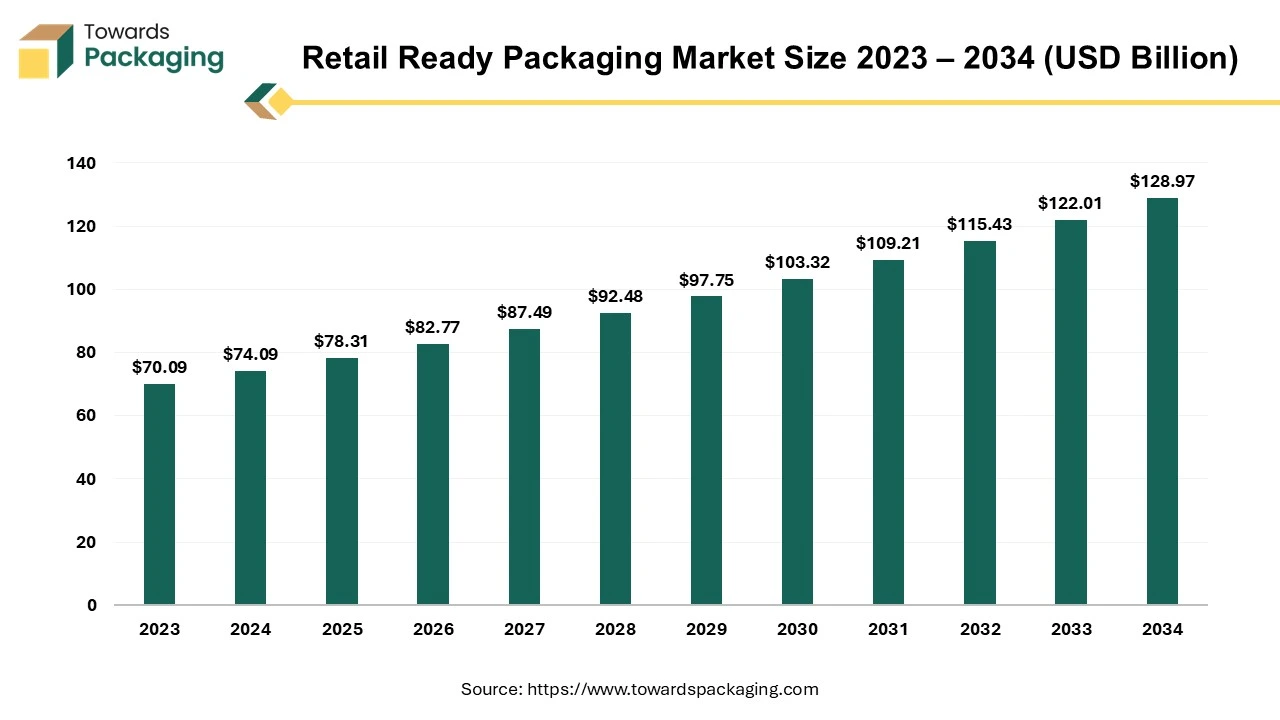

The retail ready packaging market is set to grow from USD 78.31 billion in 2025 to USD 128.97 billion by 2034, with an expected CAGR of 5.7% over the forecast period from 2025 to 2034.

Retail ready packaging (RRP) also called as shelf-ready packaging is a tray, box, sleeve, bin or other exhibit that is designed to be transitioned from delivery to "Retail ready" status without detaching individual products from the container.

Packaging serves as a pivotal element in the marketing strategy, not only adding value to commonplace goods but also playing a vital role in meeting consumers' evolving expectations. In the contemporary landscape of fiercely competitive modern trade and the rapid integration of new technologies, the current thrust in packaging development is directed towards enhancing its functionality within the logistics process. An equally important consideration is how packaging can seamlessly integrate into wholesale and retail display spaces.

In response to these standards, adopting retail ready packaging (RRP) has become widespread. The top 250 companies increased retail revenue by 8.5% yearly, up from 5.2% the previous year. With a 31.3% annual sales increase, the clothes and accessories sector had the most significant yearly sales growth. The top 250 merchants had an average net profit margin of 4.3%. With 73% of Consumer Industry CXOs increasing their efforts in sustainability over the past year, this remains a top priority. E-commerce retail sales are predicted to increase by 56% from $5.211 trillion in 2021 to $8.148 trillion in 2026.

Retail ready packaging reduces labour costs for retailers and opens up a world of possibilities for local businesses. It provides a unique opportunity for these businesses to elevate their products to meet retailers' specifications. This potential for growth and improvement should instil a sense of hope and optimism in our readers, particularly those who are part of or invest in local businesses. Retail ready packaging is more than just a trend it's a paradigm shift in packaging strategies. It offers a multifaceted approach that aligns with the dynamics of modern retail. But as the demand for efficient logistics and visually appealing retail displays continues to grow, it becomes clear that we've only just scratched the surface of what RRP can offer. The need for further research and refinement in retail ready packaging concepts is evident, and this should pique the curiosity of our readers, encouraging them to stay tuned for future developments in this exciting field.

Artificial Intelligence (AI) is helping change the landscape of various industries. Retail sector is already utilizing AI for various application to smoothen functioning. In the packaging industry, there is a slow and steady adoption of AI applications at different levels of their operational processes. Streamlining and optimization are two major benefits of integration of AI into the packaging Industry. For retail packaging, AI is set to transform the how the retail packaging operations run, designing of products, distribution, efficiency of supply chain, technological advancements integration, delivery processes etc. For example, with AI, the retail packaging supply chain will benefit for predictive modeling, automation and data analytics, and sustainable packaging solutions. Artificial Intelligence goes a long way to reducing human error, cost saving, maintaining quality standards, optimization, efficiency etc. are all pros of AI integration into the retail ready packaging market.

| Trends | |

| Smart Packaging Integration | Sustainable and eco-friendly packaging is a prominent trend in the retail ready packaging market. Consumers are increasingly environmentally conscious, and retailers are aligning their packaging strategies accordingly. This trend involves the use of recyclable materials, reduced packaging waste, and the adoption of innovative, eco-friendly designs to meet the growing demand for sustainable practices in the retail sector. |

| Customization for Brand Differentiation | Retailers are increasingly seeking customized retail ready packaging solutions to differentiate their brands on the shelves. Customization may involve unique shapes, colors, and branding elements that make products stand out and create a strong visual identity. This trend caters to the competitive nature of the retail landscape and the importance of brand recognition. |

| E-commerce-Focused Packaging | With the rise of e-commerce, there's a growing emphasis on packaging designs that cater to online retail channels. Retail ready packaging is being adapted to withstand the rigors of shipping, ensure product protection during transit, and facilitate easy unpacking for fulfillment centers. This trend reflects the evolving dynamics of consumer shopping behaviors and the increasing significance of e-commerce in the retail sector. |

| Efficiency and Automation in Packaging Processes | Efficiency in the supply chain is a critical consideration for retailers. Retailers are adopting retail ready packaging solutions that optimize logistics processes, reduce labor costs, and enhance overall operational efficiency. Automation technologies, such as robotic packaging systems, are being explored to streamline the packaging and stocking processes in retail environments, contributing to cost savings and improved productivity. |

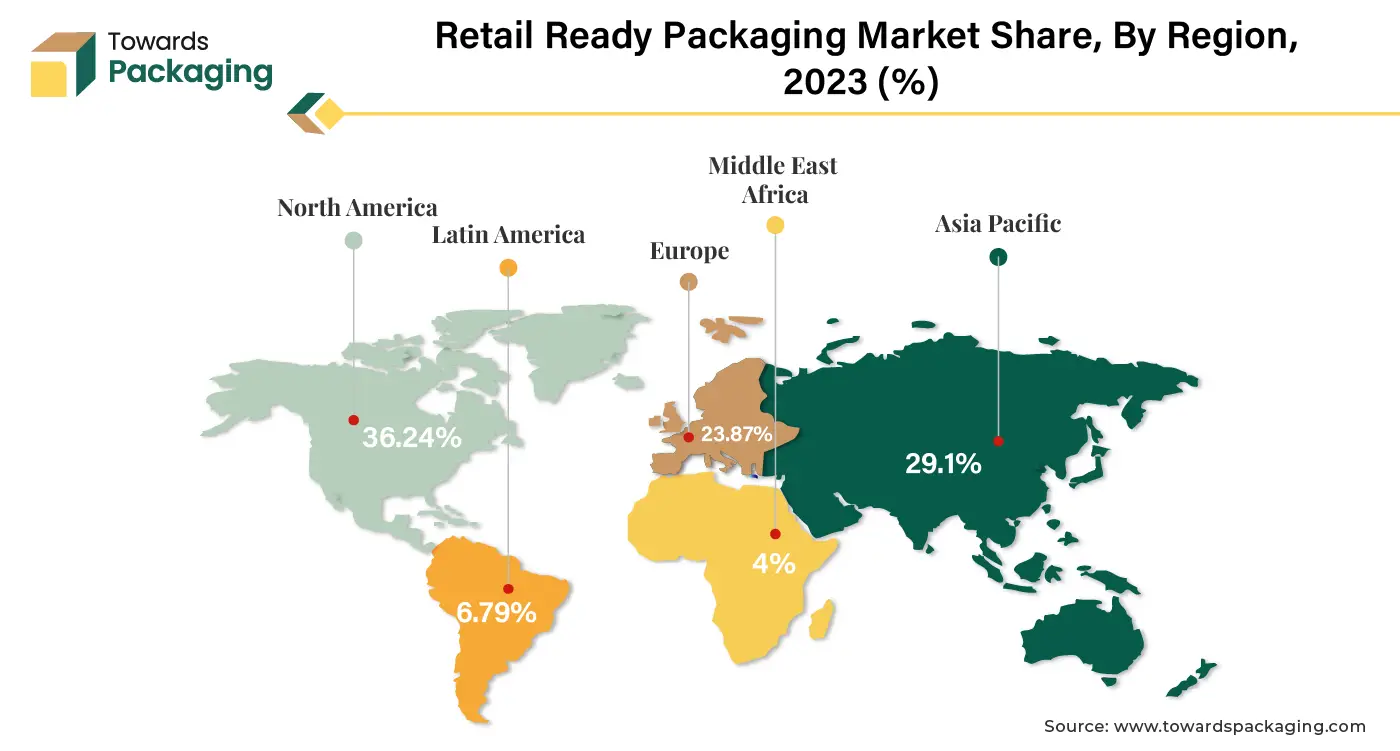

The retail ready packaging market has established a significant stronghold in North America, reflecting its dominance in the region's retail landscape. As of the latest trends observed, North America remains a crucial hub for innovative packaging solutions, with retail ready packaging at the forefront of this evolution.

One of the primary factors contributing to the dominance of retail ready packaging in North America is the region's highly developed and competitive retail sector. Major retailers in the United States and Canada, ranging from supermarket chains to department stores, have embraced the efficiency and visual appeal of retail ready packaging. The streamlined stocking processes facilitated by RRP play a crucial role in meeting the demands of fast-paced, high-volume retail environments. Retail ready packaging's success in North America can be attributed to its ability to enhance product visibility and brand recognition. In a market where consumers are inundated with choices, the packaging's role in capturing attention is paramount. RRP ensures that products are easily identifiable on the shelves and provides a platform for effective branding with clear graphics and product information.

For Instance,

The convenience and time-saving aspects of retail ready packaging align seamlessly with North American consumers' preferences for efficient shopping experiences. Retailers appreciate the reduced labour costs associated with quick and easy shelf replenishment, enabling them to allocate resources more effectively and focus on improving customer service. Furthermore, the North American retail landscape has witnessed a surge in e-commerce activities, and retail ready packaging has proven adaptable to this shift. Brands and retailers increasingly recognize the importance of packaging designs catering to traditional brick-and-mortar stores and online platforms. Retail ready packaging's versatility in meeting the requirements of various retail channels positions it as a preferred choice in the dynamic North American market.

Regulatory considerations and sustainability factors also play a role in North America's continued dominance of retail ready packaging. As sustainability becomes a central focus in the packaging industry, RRP solutions that optimize material usage and minimize waste align with evolving environmental standards and consumer preferences.

The retail ready packaging (RRP) market in the Asia-Pacific region is witnessing a surge in prominence, marked by the emergence of dynamic players reshaping the packaging landscape. As one of the fastest-growing regions globally, Asia-Pacific has become a focal point for innovative packaging solutions, with retail ready packaging at the forefront of this transformation. The rise of retail ready packaging in Asia-Pacific is closely tied to the region's evolving retail dynamics. The market is characterized by a diverse retail landscape that includes traditional brick-and-mortar stores, hypermarkets, supermarkets, and an accelerating shift towards e-commerce Asia-Pacific accounting for 4.5 million metric tons. As consumers in Asia-Pacific increasingly seek convenience and efficiency in their shopping experiences, retailers are turning to retail ready packaging to streamline their stocking processes and enhance product visibility on the shelves.

Local and regional players in the Asia-Pacific retail ready packaging market is leveraging the versatility of RRP to cater to a wide range of industries. From food and beverages to electronics and personal care products, these emerging players are customizing packaging solutions to meet the specific needs of diverse markets. This adaptability is a crucial factor contributing to the success of retail ready packaging in the region. Furthermore, the influence of e-commerce in Asia is driving the demand for packaging solutions that seamlessly transition between traditional retail shelves and online platforms. Retail ready packaging, focusing on easy shelf stocking and consumer appeal, aligns well with the requirements of physical stores and digital marketplaces. Emerging regional players are capitalizing on this trend to establish a strong foothold in the evolving retail landscape.

For Instance,

Sustainability considerations are also gaining traction in the Asia-Pacific retail ready packaging market. As consumers become more environmentally conscious, packaging solutions that emphasize recyclability and reduced environmental impact are gaining preference. The regional players' emergence is marked by an increased focus on incorporating sustainable practices into retail ready packaging offerings, aligning with global efforts towards eco-friendly packaging solutions. The retail ready packaging market in the Asia-Pacific is witnessing the ascent of dynamic players who understand and cater to the region's diverse and rapidly evolving retail landscape. Their ability to provide customized, efficient, and sustainable packaging solutions positions them as key contributors to the ongoing transformation of the Asia-Pacific retail ready packaging market.

Due to its versatile and sustainable characteristics, paperboard material has emerged as a leading segment in the retail ready packaging (RRP) market. This material, composed of layers of paper pressed together, offers a range of benefits that align with the evolving demands of the retail landscape. One of the critical reasons for the prominence of paperboard in retail ready packaging is its adaptability. Paperboard provides a sturdy yet lightweight solution, making it an ideal choice for packaging various products. This material can be easily customized to accommodate different shapes and sizes, enhancing its versatility for multiple industries, including food and beverages, personal care, and household products.

The visual appeal of paperboard is another factor driving its dominance in the RRP market. Its smooth surface allows for high-quality printing, enabling vibrant graphics and brand messaging. This feature is crucial in attracting consumer attention on retail shelves, where products vie for recognition in a competitive environment. The aesthetic possibilities offered by paperboard contribute to effective branding and product differentiation. Moreover, sustainability considerations significantly influence the preference for paperboard in retail ready packaging. As consumers increasingly prioritize eco-friendly choices, retailers and brands turn to materials that align with environmental consciousness.

Paperboard is recyclable and biodegradable, making it an environmentally friendly option compared to specific plastic counterparts. This aligns with the broader industry trend toward sustainable packaging solutions and addresses the growing demand for eco-conscious practices. The cost-effectiveness of paperboard also contributes to its leading position in the retail ready packaging segment. Paperboard is often more affordable than some alternative materials, providing a cost-effective solution for brands and retailers. This cost efficiency and its adaptability and visual appeal make paperboard a preferred choice for businesses seeking effective and economical retail ready packaging solutions. Additionally, regulatory trends promoting sustainable practices and reducing single-use plastics further bolster the prominence of paperboard in the RRP market. Governments and industry associations encourage using recyclable materials, and paperboard aligns well with these initiatives.

For Instance,

Die Cut Containers represent a tailored packaging solution crafted from flat sheets of material, primarily corrugated cardboard. The manufacturing process involves precision die-cutting, employing specialized tools to cut, fold, and assemble the material into tray shapes. The assembly can be executed through automated machines (Machine Erect) or manual processes (Hand Erect), determined by production volume and specific requirements. The defining feature of Die Cut Containers lies in their adaptability and customization capabilities. These trays can be meticulously designed to perfectly accommodate a product's precise dimensions and contours, ensuring a secure fit and optimal protection.

For Instance,

The precision afforded by the die-cutting process enables the incorporation of intricate designs and features. Handles, specialized locking mechanisms, and ventilation holes can be seamlessly integrated into the tray, offering enhanced functionality. Die Cut Containers also provide flexibility in design options, ranging from high-quality litho-laminated cartons for a premium aesthetic to plain octagonal trays that accentuate the product. Die Cut Containers have applications in various scenarios. They are particularly suited for products requiring a bespoke fit, items with unconventional shapes, luxury or artisanal goods, and situations where packaging significantly influences overall presentation. Examples include gourmet foods, high-end electronics, and speciality gifts, where the tailored design enhances protection and visual appeal.

For Instance,

The food and beverage sector stands out as a leading end-user segment in the retail ready packaging (RRP) market, driving innovation and shaping the packaging landscape to meet the unique demands of this industry. The significance of retail ready packaging in the food and beverage sector is underscored by the need for efficient, visually appealing, and sustainable packaging solutions. One key factor contributing to the prominence of food and beverage as a leading end-user segment is the consumer-driven demand for convenience. Retail ready packaging is designed to streamline retailers' stocking and display processes, ensuring that products can be quickly shelved and replenished. In the fast-paced environment of the food and beverage industry, where quick access and efficient stocking are paramount, retail ready packaging emerges as a strategic solution to enhance operational efficiency.

Visual appeal is another critical aspect driving the adoption of retail ready packaging in the food and beverage sector. The packaging not only serves as a protective barrier but also acts as a powerful marketing tool. Eye-catching graphics, branding elements, and clear product visibility on the shelves influence consumer purchasing decisions. For food products, in particular, where the packaging is often the first point of contact with the consumer, the visual appeal becomes a key driver for product recognition and sales.

Furthermore, the perishable nature of many food products necessitates packaging that ensures freshness and prevents spoilage. With its protective features, retail ready packaging plays a pivotal role in extending the shelf life of food items. It acts as a barrier against external factors such as light, moisture, and contaminants, preserving the quality and integrity of the products. Sustainability considerations are increasingly influencing the food and beverage industry's packaging choices, and retail ready packaging aligns well with these eco-conscious trends. Manufacturers and retailers in this sector opt for packaging solutions that reduce environmental impact. Retail ready packaging offers opportunities for material optimization, waste reduction, and recyclability, making it an attractive option for businesses aiming to enhance their sustainability credentials.

For Instance,

The rapid evolution of product packaging is driven by the boom in e-commerce, the lasting impacts of the global pandemic, and economic pressures. These factors have pushed brick-and-mortar retailers to demand more efficient solutions from suppliers to ensure products reach consumers swiftly and effectively.

One such solution is retail-ready packaging (RRP), also known as shelf-ready packaging. RRP offers several advantages, enhancing how products appear on retail shelves and more:

Although not a new concept, retail-ready packaging has gained momentum. Walmart, the world's largest brick-and-mortar retailer, introduced RRP to suppliers over a decade ago. Club store retailers followed suit, simplifying stock management and meeting high demand. Observing the benefits, other merchandisers also adopted RRP.

Retail-ready packaging is a win-win-win for the entire supply chain, enhancing the buyer’s journey and boosting sales:

“Retail-ready packaging is shelf-ready and combines the protective properties of a well-designed corrugated shipping container with the attention-getting properties of a display,” providing a comprehensive solution for modern retail challenges.

By Material

By Product Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025