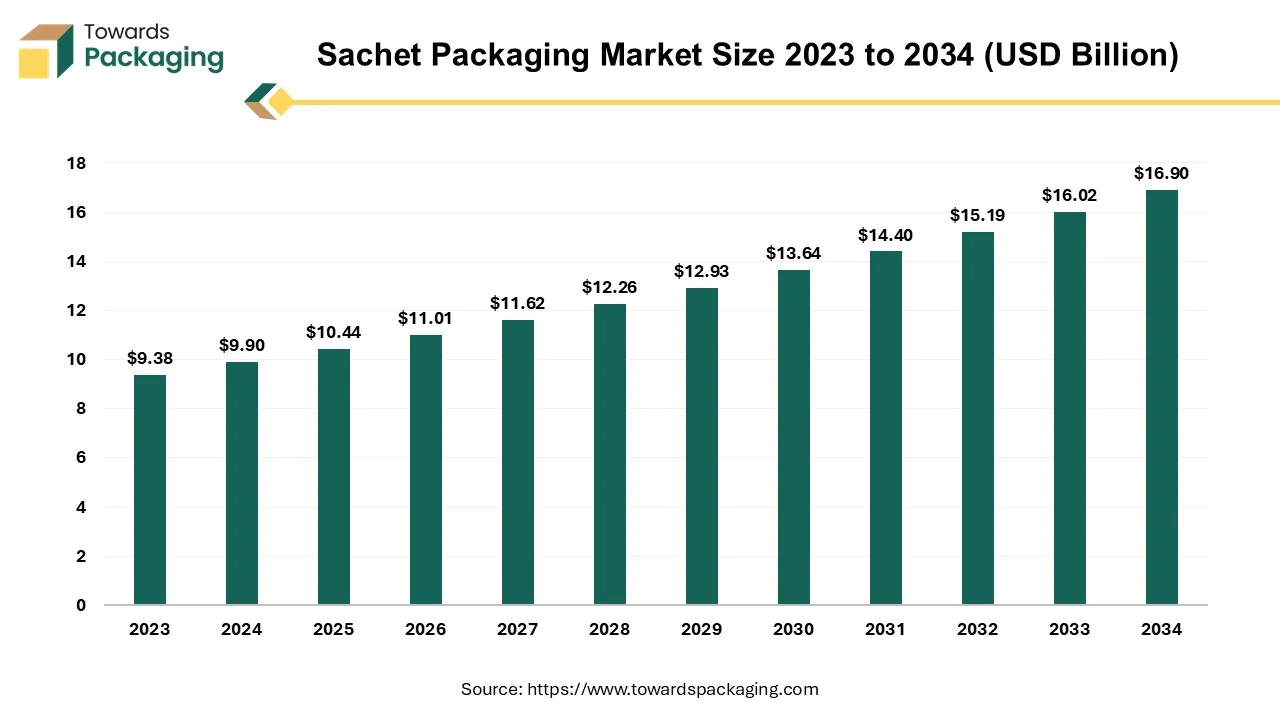

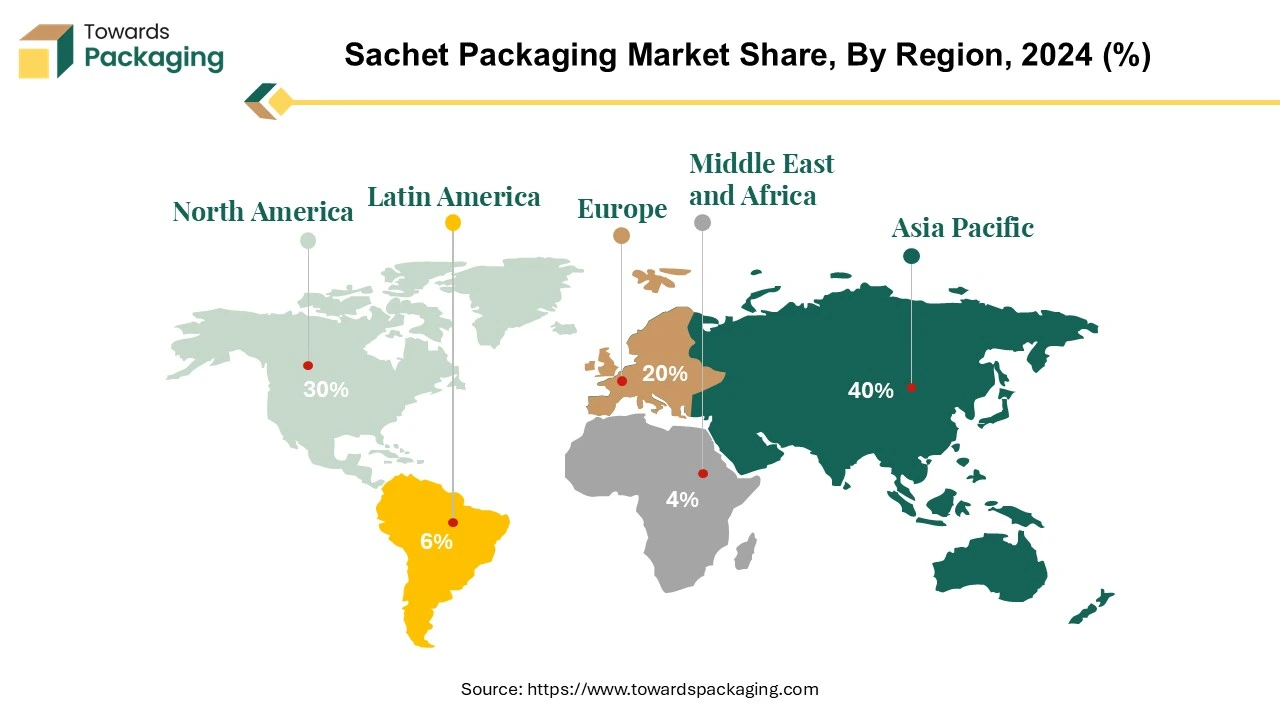

The sachet packaging market is expected to grow from USD 10.44 billion in 2025 to USD 16.90 billion by 2034, with a CAGR of 5.5% during the forecast period. This market spans multiple regions, including Asia Pacific, North America, Europe, and more, with Asia Pacific dominating the market in 2024. Key segments include types (plastic, aluminum foil, paper, and others), applications (cosmetics, pharmaceuticals, food & beverages), and pack sizes (1 ml-10 ml, 11 ml-20 ml, and more). Major companies like Amcor Plc, ProAmpac Holdings LLC, and Huhtamaki Group are driving growth through technological innovations, sustainability efforts, and strategic acquisitions.

Sachet packaging refers to small, sealed, flexible packets made from materials like plastic, aluminum foil, or paper laminates. These single-use or portion-sized packages are commonly used for food, personal care, pharmaceuticals, and industrial products. The sachet packaging is convenient for travel, single-use applications, and sample-sized products. The sachet packaging is often manufactured from plastic, aluminum foil, and paper laminates to provide air, moisture, and light resistance. The sachet packaging Uses minimal material, making it an economical packaging solution.

| Metric | Details |

| Market Size in 2024 | USD 9.90 Billion |

| Projected Market Size in 2034 | USD 16.9 Billion |

| CAGR (2025 - 2034) | 5.5% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Application, By Pack Size and By Geography |

| Top Key Players | Amcor Plc, ProAmpac Holdings LLC, Constantia Flexibles, Huhtamaki Group, Sonoco Products Company. |

Consumers increasingly seek products that provide ease of utilization and time efficiency. Sachet packaging caters to this demand by providing single-use, portable portions that are easy to open and dispose of. This trend aligns with the growing preference for on-the-go consumption and individual servings.

Brands are leveraging sachet packaging to enhance product appeal through innovative designs and high-quality printing. Attractive sachet designs can strengthen brand identity and attract consumers, especially in competitive markets.

The integration of new technologies in sachet packaging is improving product preservation and consumer experience. Developments such as active and intelligent packaging can extend shelf life and monitor product freshness, enhancing overall quality.

There is a growing emphasis on sustainable packaging solutions. Manufacturers are adopting eco-friendly materials and designs to reduce environmental impact. This includes using recyclable or biodegradable materials and optimizing packaging to minimize waste.

Ensuring product safety and adhering to regulatory standards are paramount in sachet packaging. Packaging designs now focus on tamper-evidence and compliance with health and safety regulations to protect consumers and maintain brand trust.

AI integration can significantly enhance the sachet packaging industry by improving efficiency, quality control, sustainability, and supply chain management. AI-powered computer vision can detect defects in sachets, such as misprints, seal failures, or leaks, in real time. Machine learning algorithms can classify faulty sachets and automatically adjust machinery to correct errors, reducing waste. AI-driven predictive maintenance monitors packaging machines, detecting potential failures before they happen, reducing downtime. AI can optimize filling accuracy, ensuring precise quantities in each sachet, reducing material waste and product loss.

AI-powered QR codes and NFC tags on sachets can provide consumers with product details, expiration dates, and usage instructions. AI-driven augmented reality (AR) applications can offer interactive experiences, such as virtual demonstrations or promotional offers. AI can optimize material usage, reducing excess packaging and ensuring eco-friendly solutions (e.g., biodegradable or recyclable sachets). Smart algorithms can suggest alternative packaging materials based on cost, sustainability, and durability factors. Daily Harvest meal delivery service utilizes AI to optimize packaging processes, ensuring efficient use of materials and maintaining product quality during transit. AI calculates the precise amount of dry ice needed based on shipment size and weather conditions, reducing waste and enhancing customer satisfaction.

Online shopping platforms prefer lightweight, durable sachets to reduce shipping costs and improve product protection. Growth of personalized skincare, healthcare, and meal delivery services drives demand for sachet packaging. They take up less space in warehouses, allowing retailers to store and distribute products more efficiently. Online retailers use sachets for free samples or travel-size products, encouraging customers to try new items before buying in bulk. Many subscription-based services (e.g., meal kits, skincare, and wellness brands) use sachet packaging for pre-measured, single-use portions.

DTC brands use sachets to enhance unboxing experiences and offer customized product portions for customers.

For instance, Mondi Group, packaging company, provides a comprehensive portfolio of e-commerce packaging, including kraft and functional barrier paper, paper bags, and corrugated solutions. Their offerings are sustainable by design, catering to the growing demand for eco-friendly sachet packaging in the e-commerce sector.

The key players operating in the market are facing issue due to high cost of raw material as well as competition from alternative packaging options which has estimated to restrict the growth of the sachet packaging market in the near future. Sachets are often made of multi-layer plastic, which is difficult to recycle. Increasing global restrictions on single-use plastics impact market growth. Sachets are mainly used for liquids, powders, and small portions of products, making them unsuitable for larger or premium packaging needs. Growing demand for sustainable packaging, such as biodegradable materials, paper-based solutions, and refillable containers, is reducing reliance on sachets. Many countries are imposing bans or restrictions on plastic sachets due to environmental concerns, forcing manufacturers to look for alternatives.

The need for precise, hygienic, and single-use packaging in the pharmaceutical sector is growing. Sachets are becoming popular for oral hygiene products, vitamins, and medical powders. With the growing preference for the self-medication, more customers are preferring single-use sachets for digestive aids, pain relievers, and supplements, which has increased the demand for sachet packaging. Due to shift towards healthy life style the demand for the nutritional powders, collagen, protein supplements, and probiotic sachets, is increasing which has estimated to create opportunity for the growth of the sachet packaging market in the near future.

Companies investing in sustainable materials (e.g., bioplastics, paper-based sachets) are attracting eco-conscious consumers. Innovations in fully recyclable sachets can help companies meet regulatory requirements while maintaining affordability. Brands adopting circular economy models (e.g., refillable sachets, collection programs) can differentiate themselves.

Collaborating with waste processors helps address plastic waste concerns and improve brand image. High-end brands are using sachets for exclusive product sampling and travel-friendly packaging. Digital engagement through sachets (e.g., QR codes linking to promotions or product info) enhances customer interaction.

The plastic segment held a dominant presence in the sachet packaging market in 2024. The plastic sachet packaging is extensively utilized as it is efficient, cost-effective, and versatile. Plastic sachets are lightweight, reducing transportation costs and carbon footprint. Plastic is cheaper to manufacture compared to alternatives like metal, glass, or biodegradable materials. Plastic films can be easily shaped, sealed, and laminated for different packaging needs. Plastic materials like polyethylene (PE), polypropylene (PP), and PET create strong barriers against moisture, oxygen, and light. Plastic sachets allow high-quality printing of logos, product details, and QR codes for marketing.

The personal care & cosmetics segment accounted for a significant share of the sachet packaging market in 2024. Sachet packaging is widely used in personal care & cosmetics due to several key advantages that align with consumer behavior, industry trends, and cost considerations. Small sachets are easy to carry, meeting airline regulations and on-the-go consumer needs. Sachets protect sensitive formulations (e.g., serums, creams) from air, light, and moisture, preserving product efficacy. Sachets reduce shipping weight and cost, making them a preferred choice for sample kits and travel-size beauty boxes. Sachets allow brands to offer low-cost samples, helping customers test products before purchasing full-size versions.

The pharmaceuticals segment is anticipated to grow with the highest CAGR in the sachet packaging market during the studied years. The sachet packaging is being widely used for pharmaceutical sector as it gives accurate dosage to patient and convenient to carry while travelling. The sachet packaging is ideal for oral rehydration salts (ORS), antibiotics, probiotics, and dietary supplements. Governments and NGOs use sachets for mass distribution of essential medicines like ORS and vitamin supplements in underserved areas.

The 1 ml – 10 ml size segment dominated the sachet packaging market globally. The 1 ml-10 ml size sachet packaging widely used for single-dose pain relief gels, antiseptics, medicines, and energy boosters. The 1 ml - 10 ml size is common for face creams, conditioners, shampoos, serums, and lotions. Ideal for sauces, instant coffee, ketchup, honey, and powdered supplements. Brands utilize sachets to introduce new products at minimal cost.

Asia Pacific region dominated the global sachet packaging market in 2024. Countries like China, India, Indonesia, and the Philippines have massive populations, creating high demand for affordable, single-use packaging. Rising disposable incomes in India, China, and Southeast Asia are increasing demand for sachets in personal care, food, and pharmaceuticals. Many consumers in developing economies like India, South Korea, Japan prefer small, affordable sachets rather than bulk purchases.

China is a major player in the sachet packaging market, driven by high consumer demand, strong manufacturing capabilities, and government policies. China is a global leader in beauty and skincare, with high demand for trial-size sachets of serums, creams, and shampoos. Sachets are widely used for instant coffee, milk powder, condiments, and sauces in China’s fast-growing convenience food sector. China promotes AI-driven and automated packaging solutions to enhance efficiency. Favourable trade policies help Chinese sachet manufacturers expand globally. China's sachet packaging market is bolstered by several leading manufacturers offering innovative and customizable solutions which have been mentioned here as follows: Logos Pack, Yantai Bagmart Packaging Co., Ltd, Dongguan Fuliter Paper Products Co., Ltd, and RinPac.

North America region is anticipated to grow at the fastest rate in the sachet packaging market during the forecast period. The North America has well established food, beverages, cosmetics, pharmaceutical and chemicals industries which has driven the demand for sachet packaging. North America’s well-developed logistics & retail infrastructure makes sachet distribution efficient across e-commerce, supermarkets, and convenience stores.

SC Johnson, headquartered in Wisconsin, United States and known for products like Ziploc bags, is actively addressing the global plastic waste crisis. CEO Fisk Johnson has committed to advocating for environmental regulations and funding research on plastic pollution's health impacts. The company is introducing sustainable packaging solutions and promoting industry-wide regulations to enhance recycling efforts and reduce plastic waste.

Europe region is seen to grow at a notable rate in the foreseeable future. The European Union's Single-Use Plastics Directive and Packaging Waste Regulations push brands toward sustainable sachet solutions. Companies in Europe are developing monomaterial, paper-based, and compostable sachets to reduce plastic waste. European consumers demand eco-friendly alternatives, influencing major brands to switch to low-impact materials. Europe leads in high-barrier films, multilayer laminates, and resealable sachets to improve product shelf life and reduce waste. European consumers prefer single-use sachets for instant coffee, energy drinks, and functional foods. Major European players like Huhtamäki, Amcor, Sealed Air, Constantia Flexibles, and Mondi Group dominate the sachet packaging sector.

Germany sachet packaging market is witnessing steady growth over the forecast period. The key players operating in Germany are constantly focused on innovation of sustainable sachet packaging which has estimated to drive the growth of the sachet packaging market in Germany. For instance, in 2023, Erdbär launch The company's dedication to sustainability is demonstrated by Freche Freunde's new eco-friendly bag, which gives them a distinct edge in the German kid's snack industry.

A significant accomplishment in lowering the company's environmental impact is the prepared multi-layer laminated pouch with spout and cap, which is primarily composed of bio-based polyethylene derived from renewable resources like sugar cane. Children's snacks from Freche Freunde are perfect for on-the-go because they are made entirely of organic fruit and vegetables and don't contain any added sugar or additives. Gualapack's world-first introduction of a new generation of environmentally friendly CheerNEXT, composed of over 80% renewable derived polymers, reflects the Group's longtime commitment to lessening the environmental effect of its goods.

By Type

By Application

By Pack Size

By Geography

December 2025

December 2025

December 2025

December 2025