April 2025

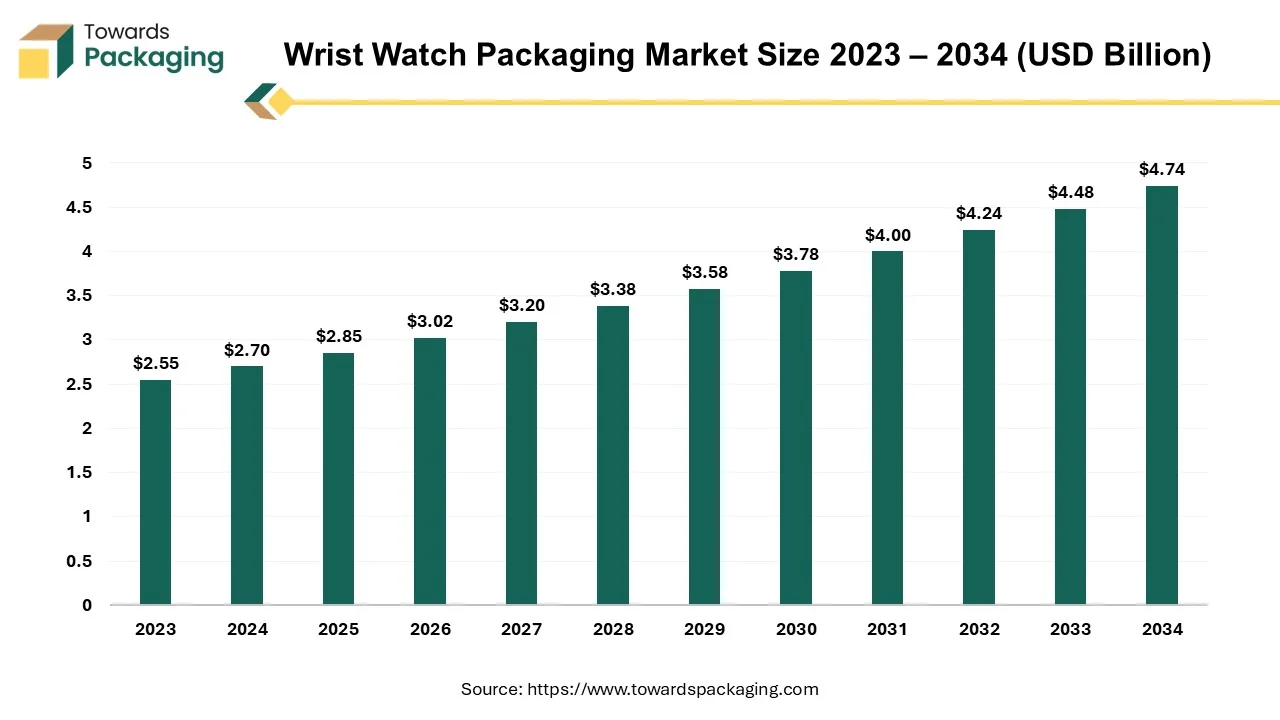

The wrist watch packaging market is projected to reach USD 4.74 billion by 2034, growing from USD 2.85 billion in 2025, at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The watch packaging market continues to experience considerable expansion driven by convenience, design aesthetics, and product protection. Watch suppliers usually do not manufacture their packaging; they outsource this duty to specialized packaging vendors. Branding is critical in driving wristwatch sales, with sophisticated packaging encouraging impulse purchases. This tendency is not confined to traditional watchmaking hubs like Switzerland and the United States but has also moved to growing markets like Great Britain, Italy, Singapore, Malaysia, and China. These markets create high-quality mechanical and electronic timepieces with sophisticated designs, contributing to the industry's revenue.

Moral concerns such as responsible material procurement and human rights are becoming more relevant to industry executives and customers. Consumers in some nations, including the United Kingdom, Switzerland, Germany, the United Arab Emirates, and Singapore, choose minimum or recycled packaging, indicating a growing awareness of environmental problems. This reflects a movement in the sector towards sustainability, consistent with customer preferences and global efforts to promote environmentally sensitive practices. As the industry evolves, watch packaging suppliers and manufacturers must address these ethical and environmental concerns to preserve consumer trust and meet customer demands.

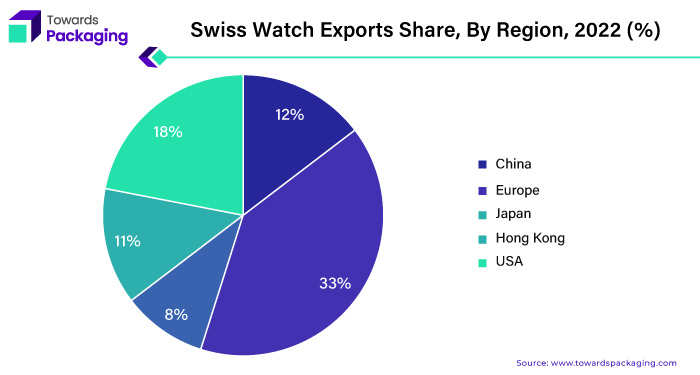

With 15% of all timepieces exported in 2022, the US has emerged as the Swiss watch industry's largest single market during the last two years. Europe and Japan are still stable, with 30 percent and 6 percent, respectively. Watch exports to the US and China have followed different paths. The trend of exports to the US has been positive.

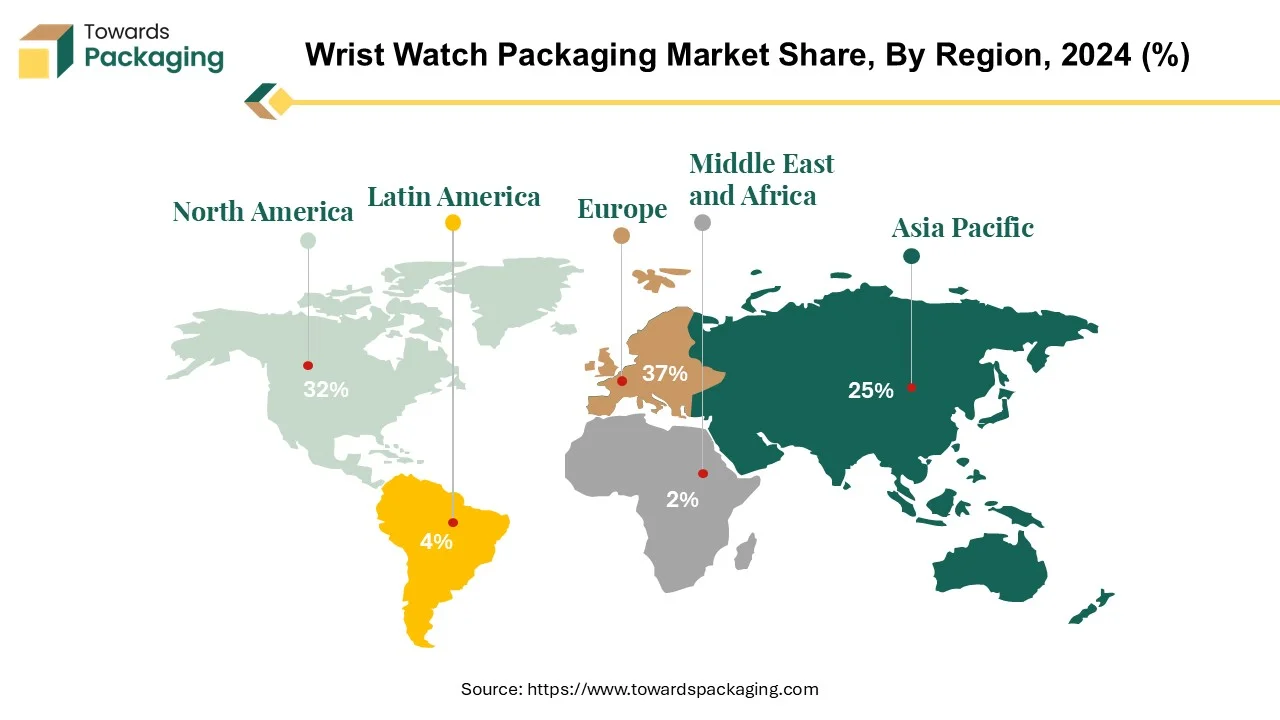

Europe leads the watch packaging business with intense domination, particularly in five important European markets where consumer engagement exceeds 50% on average. Switzerland, the cradle of luxury watchmaking, remains a significant player in the European watch market. The country's consistent dedication to precision and craftsmanship solidifies its leading position in the industry.

Switzerland's long-standing reputation for manufacturing superbly constructed timepieces has cemented its position as a leader in the European watch market. The country's solid horological legacy and unwavering pursuit of quality have contributed to its long-standing dominance in the luxury watch industry. Swiss watchmakers are respected globally for their unmatched attention to detail and dedication to quality, which are flawlessly reflected in the packaging of their esteemed.

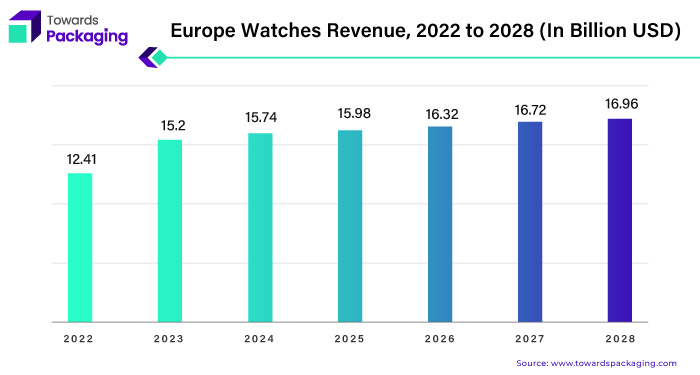

The value of the European watch market has increased significantly since 2022, which has had a favorable impact on the revenue generated by watch packaging. This boom in watch sales in Europe has directly contributed to increased demand for packaging solutions customized to the specific needs of timepiece producers. The revenue presented is based on current currency rates and includes the market impact of the Russia-Ukraine war.

For Instance,

North America has emerged as the second-largest market in the watch packaging sector. Based on projections, non-luxury segments will account for 65% of total watch sales by 2024. Within this landscape, the United States is seeing a significant increase in demand for luxury timepieces, driven by customers' increased appreciation for craftsmanship and exclusivity.

In the United States, packaging design has a powerful influence on consumer behavior, with 72% of Americans stating that packaging aesthetics substantially impact their purchasing decisions. Furthermore, when luxury items are presented in premium packaging, 61% of buyers are likelier to purchase them again.

This consumer attitude emphasizes how important packaging is in determining luxury timepieces' perceived value and appeal. As consumers increasingly seek products that exude refinement and luxury, manufacturers are compelled to invest in packaging solutions that protect their watches and embody the brand's personality and values.

For Instance,

Cardboard and paperboard are the dominant materials in the watch packaging market, accounting for a considerable portion of sales. These materials, known for their adaptability, durability, and eco-friendliness, are preferred by watch manufacturers and packaging suppliers due to their ability to balance usefulness and aesthetic appeal.

In recent years, there has been an upsurge in demand for sustainable packaging options, leading to an increase in the use of cardboard and paperboard in the watch business. As customers become more environmentally concerned, there is an increasing trend for recyclable, biodegradable packaging materials derived from renewable sources. Cardboard and paperboard match these qualities, making them famous for packaging luxury timepieces.

Cardboard and paperboard account for a sizable portion of watch packaging sales due to their extensive use across multiple price segments and consumer demographics. As demand for luxury watches continues to rise, fueled by rising disposable incomes and shifting consumer preferences, the reliance on cardboard and paperboard as preferred packaging materials is expected to persist, cementing their position as key revenue drivers in the watch packaging market.

For Instance,

Boxes have emerged as the top product in the watch packaging market, accounting for a sizable portion of the revenue. Boxes are a popular packaging method for watch manufacturers worldwide due to their practicality, variety, and ability to provide ideal protection for timepieces.

Boxes dominate the watch packaging industry due to their ability to meet various needs and preferences across price points and consumer categories. Boxes come in multiple designs to meet brand aesthetics and client expectations, ranging from clean and minimalist for contemporary watches to lavish and ornate for luxury timepieces.

The lengthy and intricate supply chain that goes into creating luxury timepieces is frequently a black box, with little to no understanding of the origins of the raw materials, the procedures, and the individuals involved.

For Instance,

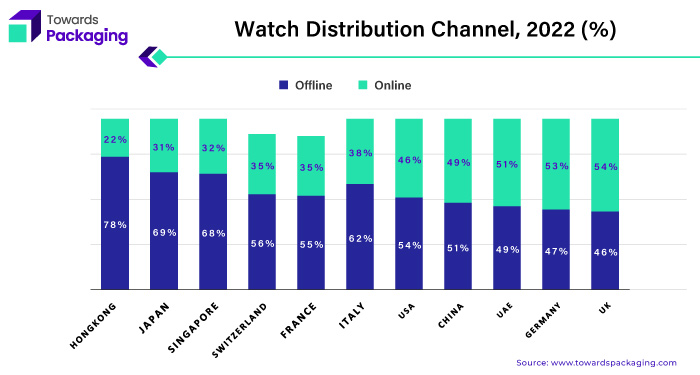

The watch packaging market is undergoing significant changes, especially with the rise of online distribution channels as major players. These platforms accommodate changing customer demands while being easily accessible and convenient. Consumers now have easy access to a large variety of watch packaging alternatives online because of the rise of digitalization in retail. Additionally, watch packaging makers can extend beyond conventional limits by tapping into worldwide markets through internet platforms.

Online purchases for new watches are preferred by 40% of consumers, with Millennials and Gen Z accounting for 43% of this tendency. Though there has been a minor decrease in this total from prior years, it could be because more timepieces are now available in physical locations. Store purchases are still standard, especially in places where conventional shopping experiences are highly valued, such as Hong Kong, Singapore, Japan, and Switzerland.

Major luxury giants like LVMH, Kering, and Richemont only receive a small percentage of their retail sales from e-commerce, even though these sales are becoming increasingly popular. That being said, projections indicate that by 2030, the proportion of watches bought online may rise to thirty percent from roughly half the amount it already represents.

Luxury watch demand, a steady trend throughout the years, is the primary driver of the watch packaging market's expansion. But what's impressive is the growth spurt of late. Revenue saw a noteworthy 15% growth in 2022, while volumes increased by 12%. Lower volumes threaten the business as a whole, even though certain luxury brands may still be able to make a respectable profit from their reduced production. Within the sector's ecosystem, the increase in exports fuels an increase in the sales of packaging supplies.

For Instance,

The competitive landscape of the wrist watch packaging market is dominated by established industry giants such as Interpak (U.S.), Quadpack (Spain), Shiseido Company Limited. (Japan), Meadows Publishing Solutions (U.S), Amspak Inc. (Canada), Pink Knots (India), Studioabd. (India), Studioabd. (India), NATIONALPAK LIMITED (U.K.), MK Packaging (India), LOMB ART AG (Switzerland), DELU Ltd. (Germany), Linkupak. (U.S.), Cyberpac (U.K.) Silgan Holding Inc. (U.S.) and AVERY DENNISON CORPORATION (U.S.). These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Interpak specializes in unique packaging designs that enhance watches' visual attractiveness. Recognizing the value of branding in the watch business, Interpak provides packaging customization options, allowing watchmakers to exhibit their personality through packaging design features such as logos, colours, and text.

For Instances,

Quadpack integrates sustainability into its packaging solutions by offering eco-friendly materials and manufacturing processes. They respond to the growing consumer demand for environmentally responsible packaging by providing options such as recycled materials, biodegradable packaging, and reduced packaging waste.

For Instances,

By Cardboard & Paperboard

By Product

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025