April 2025

The aseptic packaging for the pharmaceutical market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation.

The aseptic packaging for the pharmaceutical market is experiencing steady growth within the estimated timeframe. One of the most important innovations in the packaging sector is aseptic packaging that prolongs the shelf life of the products while maintaining their sterility. Aseptic packaging, in contrast to the conventional packaging techniques, entails disinfecting the product as well as the packing material independently before combining them in a sterile setting. This guarantees that no bacteria and other dangerous microbes will contaminate the finished product and gives customers long-lasting safe products. In situations when conventional sterilizing techniques are inappropriate for heat-sensitive formulations such as injectables, biologics, vaccines, ophthalmic solutions and oral suspensions, this technique is specifically important. As pharmaceutical industry continues to advance, aseptic packaging continues to be essential for protecting the drug integrity as well as the patient health.

The rising demand for biologics such as monoclonal antibodies, vaccines and mRNA therapies is expected to augment the growth of the aseptic packaging for the pharmaceutical market during the forecast period. Furthermore, the shift toward ready-to-use formats like pre-filled syringes, vials and single-dose containers along with the growth in percentage of the chronic diseases and aging populations are also anticipated to augment the growth of the market. Additionally, the expansion of the global pharmaceutical industry in the emerging markets as well as the advancements in the automation and robotics coupled with the stringent regulatory standards around sterility and contamination control is also projected to contribute to the growth of the market in the near future.

The growing percentage of chronic diseases owing to the increasing adoption of sedentary habits, unhealthy diets and higher levels of stress is anticipated to support the growth of the aseptic packaging for the pharmaceutical market during the estimated timeframe. According to the World Health Organization (WHO), at least 43 million people died from noncommunicable diseases (NCDs) and chronic illnesses in 2021, accounting for 75% of deaths worldwide that were not caused by pandemics. An NCD caused 18 million deaths before the age of 70 in 2021; low- and middle-income nations account for 82% of these premature fatalities. 73% of fatalities from NCDs occur in low- and middle-income nations. The majority of NCD deaths—at least 19 million in 2021—are attributable to cardiovascular illnesses, which are followed by cancer (with 10 million deaths), chronic respiratory conditions (4 million deaths) and diabetes (more than 2 million deaths comprising kidney disease deaths, due to diabetes).

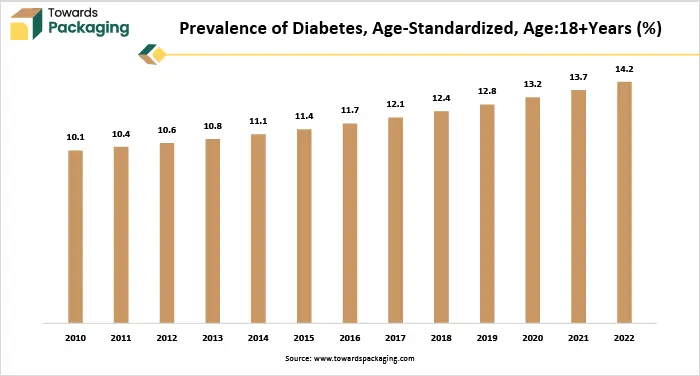

Also, as per the graph there is a consistent increase in the global age-standardized prevalence of diabetes among adults aged 18 and older from 2010 to 2022. In 2010, the prevalence was 10.1% and it gradually rose each year, reaching 14.2% by 2022. This represents a 40.6% increase over the period, signaling a major public health concern. As these diseases mostly require ongoing treatment as well as daily medication, there is a growing need for the pharmaceuticals that provide reliable sterility and extended shelf life. Medications like insulin, blood thinners, asthma inhalers and immunosuppressant must remain stable and uncontaminated throughout their usage. Consequently, the demand for aseptic pharmaceutical packaging is expected to increase within the estimated timeframe.

The risk of contamination is likely to limit the growth of the aseptic packaging for the pharmaceutical market during the forecast period. Aseptic packaging is designed to maintain the sterility throughout the pharmaceutical product’s lifecycle, but even the slightest deviation in the process due to the equipment malfunction, human error as well as the environmental inconsistency can introduce microbial, particulate and chemical contamination. Such errors can make the entire batches unusable, resulting in the expensive product recalls, regulatory penalties and loss of the consumer trust. For instance, in March 2024, over 55,000 bottles of febuxostat pills that are utilized to treat gout were voluntarily recalled by Sun Pharma's U.S. branch following a complaint of microbial contamination in the organization's production plant.

Also, as per the Parenteral Drug Association article, the U.S. Food and Drug Administration (FDA) Drug Recalls webpage reported 37 microbial contamination recalls in 2022. Three people have died from eye diseases caused due to the contaminated items and five sterile drug product recalls have been added after the publication of the Microbial Control of Raw Materials Used in Pharmaceuticals article. Some pharmaceutical companies continue to use methods that increase the possibility of contamination of sterile drug products. In aseptic processing, contamination risks exist at multiple stages from sterilization of the containers and components to filling, sealing as well as storage. Furthermore, the industry’s move toward high-potency and personalized medications increases the complexity of maintaining the sterility. As a result, the risk of contamination continues to act as a major constraint in scaling aseptic packaging operations efficiently.

The rise of the personalized medicine and cell/gene therapies owing to the growing prevalence of complex, chronic and rare diseases is likely to augment the growth of the aseptic packaging for the pharmaceutical market in the years to come. As per the U.S. Food and Drug Administration, in 2023, the FDA approved 20 new personalized medicines, approximately 38 percent of the approved 55 new molecular entities (NMEs). Personalized medications currently make up more than 25% of all novel therapies authorized since 2015. For six of the past seven years, they have accounted for over one-third of new medicine approvals. The FDA also authorized 6 new gene or cell-based therapies, released a draft rule on the regulatory supervision of laboratory-developed tests, expanded the indications for many of its current personalized therapies as well as approved numerous new diagnostic indications that will enable targeted treatment decisions for a variety of medical conditions.

Furthermore, the clinical pipeline for advanced therapies is expanding globally. As per the American Society of Gene & Cell Therapy (ASGCT), early in 2024, 32 gene therapies consisting of genetically modified cell therapies as well as 68 non-genetically modified cell therapies and 28 RNA-based therapies were authorized for the clinical usage. The U.S. FDA authorized Amtagvi for the treatment of melanoma in Q1 2024, Beqvez by Pfizer received clearance in Canada for hemophilia B, and CARsgen's CT-053 was authorized for use in China for multiple myeloma, further confirming the positive trend in this field of medicine. These therapies are often manufactured in small batches, making them vulnerable to contamination and are highly sensitive to the environmental conditions. As a result, this opens up opportunities for aseptic packaging systems that provide sterility and temperature control.

Once considered as a futuristic concept, artificial intelligence (AI) is now a driving force behind innovation in the pharmaceutical sector. It is likely to modernizing the way sterile products are packaged through introducing intelligent automated systems that increase the precision with safety. AI technologies are assisting pharmaceutical manufacturers to automate aseptic fill-finish processes, guaranteeing consistent sterility while reducing dependency on the manual intervention. Through the advanced computer vision and machine learning algorithms, AI can detect even the smallest packaging anomalies as well as potential contaminants in real-time while preventing the costly recalls and maintaining product integrity.

AI also promotes intelligent environmental monitoring in addition to quality control, automatically regulating vital parameters like humidity, temperature, and air pressure to maintain the aseptic standards. As the pharmaceutical industry shifts towards personalized therapies and small-batch production, AI is expected to make it possible to modify aseptic packaging lines for flexibility and precision without compromising safety. Using AI tech across packaging operations, pharmaceutical companies are not only streamlining processes but also advancing toward a future of intelligent aseptic packaging systems that are important in delivering the safe medicines to the patients worldwide.

The plastic segment held considerable share in the year 2024. Plastic is utilized in the aseptic packaging due to its versatility, durability and cost-efficiency. It has better barrier attributes against moisture, oxygen and impurities, and these are important in preserving the sterility of sensitive medications. Plastics like polypropylene (PP) and polyethylene (PE) are compatible with the advanced aseptic technologies such as blow-fill-seal (BFS) and form-fill-seal (FFS) and this helps with seamless integration into contamination-free production lines. Plastic is shatter-resistant and this makes it safer for handling and transport specifically in the hospital and home-care settings. Additionally, plastics enable the production of the lightweight, flexible, customized and ergonomic packaging formats that improve the patient convenience as well as reduce the shipping costs. Also, innovations in the biodegradable and recyclable plastics are also expected to support the segment's growth throughout the projected period.

The pharmaceutical manufacturers segment held largest share in the year 2024. Pharmaceutical manufacturers are the primary producers of the sterile drugs that need the contamination-free packaging. These companies handle a broad range of sensitive formulations which should comply with the strict regulatory standards set by bodies like the FDA, EMA and WHO. To comply with these regulations as well as maintain the product integrity, pharmaceutical manufacturers continue to invest in the aseptic technologies. Additionally, they also have the financial resources and technical infrastructure to scale up the production and maintain the high standards of sterility. With the global rise in various diseases, pharmaceutical manufacturers are increasingly producing targeted therapies that depend on sterile packaging. Their ability to manage large-scale production, global distribution, and regulatory compliance makes them the largest consumers of aseptic packaging in the pharmaceutical supply chain.

North America held considerable market share in the year 2024. This is due to the strong presence of leading pharmaceutical and biotech companies such as Pfizer, Johnson & Johnson and Moderna, among others. Furthermore, the growing investment in the biologics, vaccines, and advanced therapies also expected to support the regional growth of the market. For instance, in March 2025, Johnson & Johnson declared approximately $55 billion investment in technology, manufacturing, and research and development in the US over the following four years. A $2 billion investment in a 500,000-square-foot biologics production plant in Wilson, North Carolina, is part of this statement. Additionally, the stringent regulatory framework such as FDA and cGMP coupled with the existence of advanced manufacturing infrastructure and adoption of the automation and robotics in packaging are also expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR during the forecast period. This is due to the rapid growth of pharmaceutical manufacturing hubs in countries like India, China, and South Korea. Additionally, the growing population as well as increasing incidence of chronic and infectious diseases is also expected to contribute to the regional growth of the market. With 1.4 billion people, India continues to be one of the most populated nations in the world, accounting for around 17% of the global population. India's population reached 1,425,775,850 in April 2023, matching and eventually surpassing China's population. Furthermore, the increasing government investments in the healthcare infrastructure and domestic drug production and rising demand for affordable generic drugs and biosimilars as well as automation solutions are likely to contribute to the regional growth of the market.

By Material

By Packaging Type

By End User

By Region

April 2025

April 2025

April 2025

April 2025