April 2025

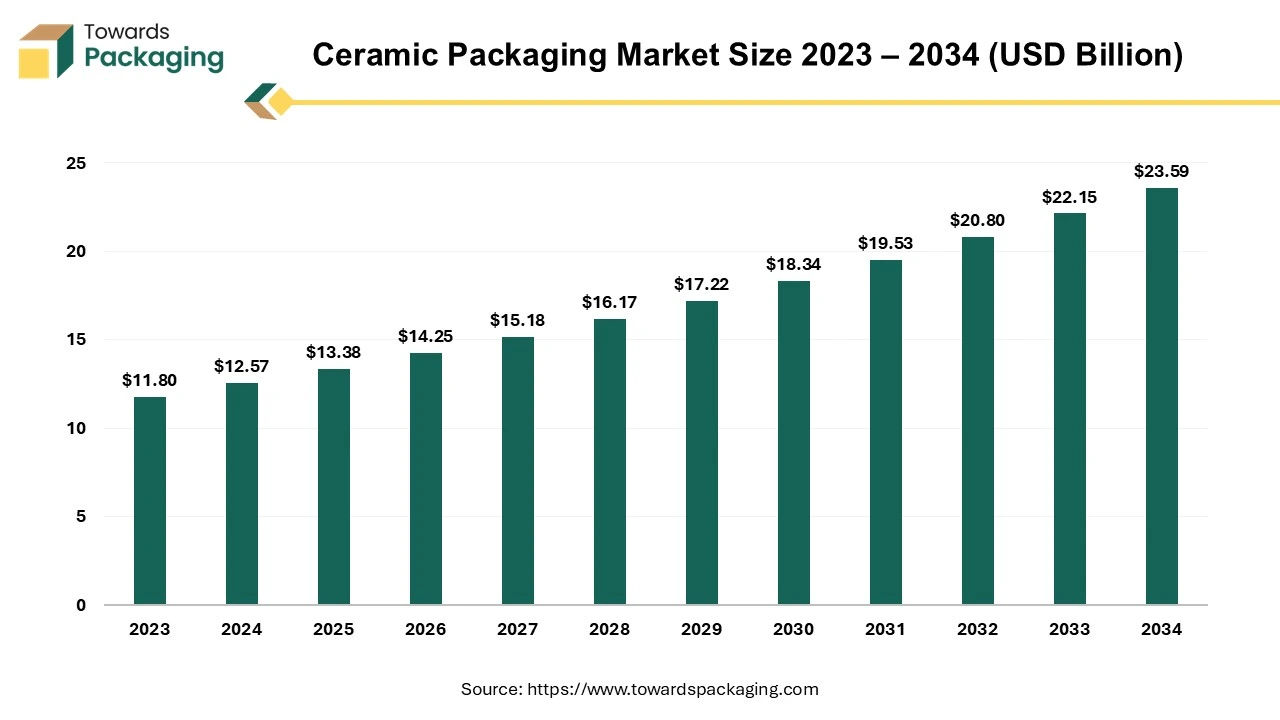

The ceramic packaging market is forecast to grow from USD 13.38 billion in 2025 to USD 23.59 billion by 2034, driven by a CAGR of 6.5% from 2025 to 2034.

The wide adoption of ceramic packaging in several sectors, especially the healthcare sector, has profoundly influenced the market. The rising trend for using eco-friendly products has enhanced this ceramic product market and its packaging as these are delicate and there is a high chance of damage while transporting from one place to another. Growing online ordering trends are also boosting the development of the ceramic packaging market.

The ceramic packaging market plays a significant role in the electronics and healthcare sectors as these are widely adopted ceramic products. The growing demand for a variety of electronic and semiconductor devices leads to continuous innovation in this field which ultimately increases the demand for ceramic packaging. Ceramic materials are preferred due to their special properties of corrosion resistance, mechanical strength, and high thermal stability.

Such properties are ideal for packaging purposes of electronic appliances which are sensitive components. These properties also make ceramic packaging an ideal choice for various product packaging in a variety of sectors such as aerospace, electronics, and healthcare. With the enhancement of the electronics sector due to the rising demand for miniature devices, ceramic packaging plays a vital role in safe storage and intact its properties. Sustainability and eco-friendly packaging demand also boost this market significantly due to its recyclability property that reduces environmental adversities that are caused while using other resources for packaging.

Integration of AI in the ceramic packaging industry has significantly influenced the market with its productivity and improved the quality of production of packaging products. Some of the major changes that have been witnessed due to artificial intelligence are:

AI can help to get a variety of designs and patterns suitable for the packaging of different products. It can gather data including the defects and can provide innovative ideas to fix all those defects which can enhance the safety of the products. AI can help to understand the requirements of customers and design packaging according to the needs of the individual. This enhances the customer and brand relationship as well as improves the reliability of customers.

It can analyse the required product image in detail and recognise any defect in the manufactured product to provide highly accurate packaging of the product. This improves the quality of the production and increases the reliability of the customers over the company.

The automotive industry is developing as a significant driver for the ceramic packaging market. The widespread of electronic devices in advanced vehicles, comprising technologies such as advanced driver-assistance systems (ADAS), power electronics, and infotainment systems, requires reliable and strong packaging options. Ceramic packaging delivers essential sturdiness and thermal administration, making it a preferred option for semiconductor equipment in automotive vehicles. The requirement for high-power and high-frequency electronic equipment is boosting the ceramic packaging market.

As the aerospace, defense, and telecommunications industries continue to evolve, there is a requirement for semiconductor packaging proficient in managing advanced frequencies and power points. Ceramic packaging, with its higher electrical utility and thermal conductivity tendency, addresses these needs, boosting the expansion of high-performing electronic structures.

Technological progressions in ceramic products and packaging advancement are influencing trends in the ceramic packaging market. Recent studies and development efforts emphasise improving the presentation of ceramic packaging through revolutions such as progressive materials, accuracy in industrial technology, and enhanced sealing approaches.

The 5G rollout is boosting the ceramic packaging market, mainly in the telecommunications industry. The placement of 5G networks needs semiconductor equipment. With rising data transfer speed and enhanced power handling potential. Ceramic packaging, with its capability to assist high-frequency applications and effective thermal management, is well-matched for the request of 5G infrastructure and equipment. Environmental deliberations are flattering and progressively significant in the ceramic packaging market. As sustainability attains a primary concern across businesses, there is an emphasis on emerging ecologically friendly packaging choices.

Personalization and elasticity are major trends in the ceramic packaging market. Semiconductor constructors are looking for packaging choices that can be custom-made to precise device needs. Personalized ceramic packaging, with differences in shapes, sizes, and thermal characteristics, allow semiconductor market players to address various application requirements and attain optimal presentation.

Variations in raw material charges, mainly those associated with unconventional ceramics, impact the ceramic packaging market. The accessibility and charge of materials including alumina and aluminum nitride affect the complete charge structure of ceramic packaging manufacture. Market contributors are thoroughly monitoring these raw material resources to accomplish potential charge variations and sustain affordability.

The alumina nitrate ceramic packaging market is important in the raw material segment of this market during the predicted period. It is highly preferred due to its electrical insulation and exceptional thermal properties. Alumina nitrate ceramics are frequently used for several applications because of their exclusive properties. Ceramic packing resources are used in a diversity of sectors, comprising petrochemical, chemical processing, and ecological applications, for tasks including catalyst support, column packing, and purification.

If aluminum nitrate ceramics gradually become a leading option in this industry then, it could be because of their thermal stability, chemical resistance, and other favourable properties. The rising demand for low-coefficient-of-thermal-expansion and high-temperature-resistant ceramics is rising because of the growing acceptance of these mechanisms in the aerospace and railway sectors, thus driving the development of the ceramic packaging sector.

Electronics segment led the ceramic packaging market in 2024, the segment is also observed to sustain the due to the rising demand for high-performance and miniaturization electronic devices. The automotive industry also holds a significant market value, leveraging ceramics for electronics packaging purposes in vehicles to confirm dependability and withstand interesting operating circumstances.

In the other sectors such as the healthcare and medical electronic devices segment, ceramics packaging applications because of their biodegradability and resistance to corrosion, offer growth to the market potential. The energy industry, covering equipment in power electronics and renewable resources, witnessed a growing acceptance of ceramic packaging options.

Asia Pacific held the largest share of the ceramic packaging market in 2024. The rise of industries in various fields and acceptance of sustainable packaging choices in all fields has influenced the market. Several countries such as India, Japan, China, South Korea, and Thailand have extensively influenced this market due to the growing demand for cutting-edge electrical equipment as well as the automotive sector.

These countries are considered manufacturing hubs of miniature electronic equipment and hence majorly rely on ceramic packaging for safe storage of such products. In China, there is a huge investment in developing devices which are compact and such devices are supplied worldwide which enhances the demand for safe packaging of products mainly to keep them corrosion-free. The rising demand for heat-resistance packaging products has also influenced ceramic packaging significantly.

North America witnessed the fastest-growing revenue share for the year 2024. This is due to the presence of a huge number of industries for healthcare, electronics, and automotive. The flourishing consumer electronics sector in the U.S. enhances the demand for ceramic packaging choices, given its appropriateness for shielding subtle electronic mechanisms. The automotive industry in this region also donates suggestively, trusting ceramic materials for electronic packaging to safeguard dependability in numerous automotive applications.

Moreover, the healthcare sector’s demand for corrosion-resistant and biocompatible packaging materials pushes the market. As the U.S. endures to be a technical hub and a majority of consumers use electronic devices, the market is anticipated to preserve a substantial value, with continuing revolution and various market players' collaborations playing a major role in shaping the regional market.

By Material

By End Use

By Region

April 2025

April 2025

April 2025

April 2025