Commodity Plastics Market Growth Drivers, Circular Economy Trends and Strategic Opportunities for Sustainable Innovation

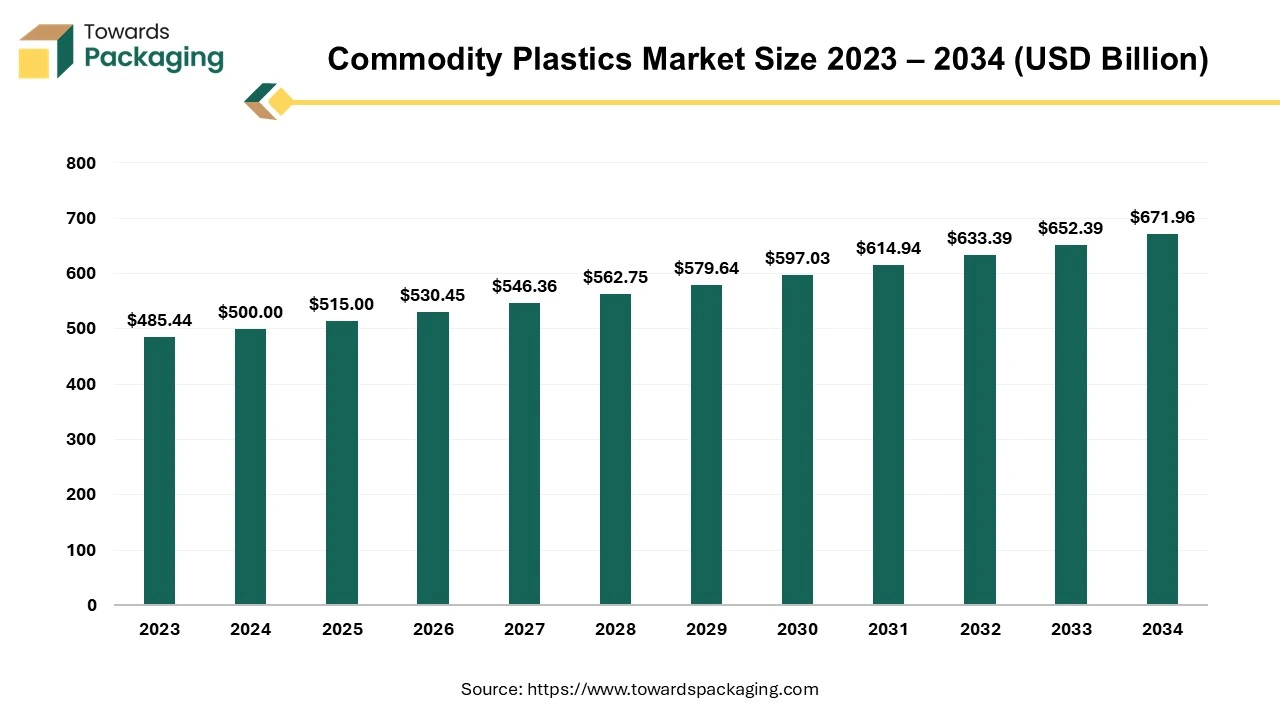

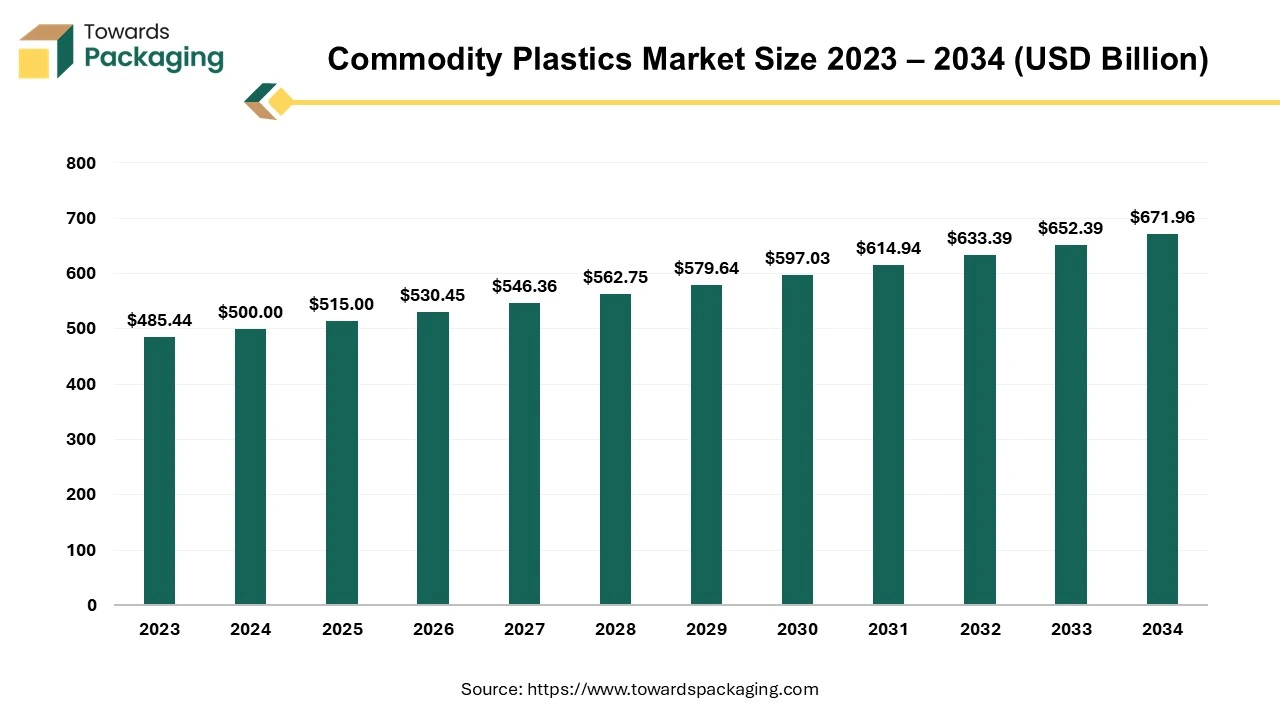

The commodity plastics market is growing steadily, reaching USD 530.45 billion in 2026 and projected to rise to USD 692.12 billion by 2035 at a 3% CAGR (2025–2034). This report covers detailed segmentation across packaging, automotive, consumer goods, and other uses, along with regional insights for North America, Europe, Asia-Pacific, Latin America, and MEA. It also includes profiles of leading companies, competitive benchmarking, value chain coverage from raw material supply to distribution, global trade flows, and a breakdown of top manufacturers and suppliers.

Key Insights into the Global Commodity Plastics Market

- North America dominated the commodity plastics market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By product, the polyethylene (PE) segment registered its dominance over the global commodity plastics market in 2024.

- By end user, the packaging segment dominated the commodity plastics market in 2024.

Commodity Plastics Market Overview

The Commodity Plastics Market encompasses the production and widespread use of low-cost, high-volume plastics such as polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and polyethylene terephthalate (PET). These plastics are characterized by moderate physical properties and ease of processing, making them ideal for applications that do not require advanced performance. Due to their affordability, versatility, and manufacturability, commodity plastics dominate sectors including packaging, construction, automotive, and consumer goods. According to the American Chemistry Council, commodity plastics account for the majority of global plastic production, underscoring their critical role in everyday products and industrial applications.

Source: American Chemistry Council, Plastics Industry Overview (2023).

Sustainability-Driven Breakthroughs in the Commodity Plastics Market

Recent breakthroughs in the commodity plastics market reflect a global movement toward sustainable and circular plastic usage. Key developments include:

U.S. Plastics Pact Goals (2025):

- Eliminate problematic or unnecessary plastic packaging.

- Ensure 100% of plastic packaging is reusable, recyclable, or compostable.

- Achieve an average of 30% recycled or responsibly sourced content in plastic packaging.

India’s R-PET Mandate:

- Implementation of mandatory 30% recycled PET content in plastic packaging by 2025.

- Supports minimum content legislation aimed at reducing virgin plastic dependency.

- Encourages industry-wide investment in recycling infrastructure and innovation.

These advancements mark a significant step toward reducing environmental impact and promoting circular economy principles in the global commodity plastics market.

Source: Ellen MacArthur Foundation, U.S. Plastics Pact Roadmap 2025 (2023).

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 500 Billion |

| Projected Market Size in 2034 |

USD 671.96 Billion |

| CAGR (2025 - 2034) |

3% |

| Market Segmentation |

By Product, By End-Use and By Region |

| Top Key Players |

BASF SE, SABIC, Dow Inc., DuPont de Nemours, Inc. |

Key Trends Reshaping the Commodity Plastics Market: Sustainability, Innovation, and Strategic Shifts

The commodity plastics market is undergoing significant transformation, driven by environmental, technological, and economic factors. Key trends shaping the industry include:

- Sustainability and Eco-Friendly Plastics:

There is growing investment in recyclable, biodegradable, and bio-based plastics to address regulatory mandates and consumer demand for sustainable materials. Innovations such as seaweed-based bioplastics are emerging to combat plastic waste and reduce dependency on fossil-based materials.

- Circular Economy Initiatives:

The industry is advancing recycling technologies and designing products with end-of-life recyclability in mind. Companies are prioritizing closed-loop systems to reduce environmental impact and improve material recovery rates.

- Geopolitical and Economic Influences:

Ongoing geopolitical tensions, regulatory shifts, and economic instability, especially in Asia and Europe, are prompting strategic consolidations and operational adjustments among market leaders.

- Petrochemical Investments:

With the global shift toward electric vehicles reducing fuel demand, major oil companies are pivoting toward petrochemical investments. This underscores the growing importance of commodity plastics in offsetting revenue losses from traditional energy sources.

- Infrastructure and Capacity Expansion:

To meet rising global demand, companies are investing in new production facilities and upgrading existing infrastructure, particularly in emerging markets with increasing consumption needs.

Source: International Energy Agency (IEA), The Future of Petrochemicals (2023).

Artificial intelligence (AI) is increasingly revolutionizing the plastics industry by enhancing efficiency, quality, innovation, and sustainability. Key areas where AI is driving impact include:

- Real-Time Process Optimization:

AI systems monitor and analyze production processes in real time, identifying inefficiencies and recommending adjustments. This results in reduced energy consumption, minimized waste, and improved throughput.

- Defect Detection and Quality Control:

Machine learning models use image analysis and sensor data to detect manufacturing defects early. This ensures consistent product quality while reducing material loss and rework costs.

- Predictive Maintenance:

AI algorithms analyze data from machinery sensors to anticipate equipment failures. This enables proactive maintenance scheduling, significantly reducing unplanned downtime and maintenance expenses.

- Supply Chain Optimization:

AI enhances supply chain efficiency by forecasting demand, managing inventory, and streamlining logistics. These improvements lead to cost reductions and more responsive customer service.

- Accelerated Material Innovation:

Through simulation and data modeling, AI expedites the development of new plastic formulations and processing techniques, reducing the R&D timeline and cost.

- Sustainable Manufacturing:

AI supports eco-friendly initiatives by optimizing recycling processes, lowering carbon emissions, and enabling the design of biodegradable plastics.

Source: McKinsey & Company, How Artificial Intelligence is Changing the Chemicals Industry (2023).

E-Commerce Boom Driving Growth in the Commodity Plastics Market

The rapid expansion of the e-commerce sector is a significant driver fueling the demand for commodity plastics, particularly in the packaging industry. As online retail continues to grow, the need for secure, efficient, and cost-effective packaging solutions becomes increasingly critical. Key factors contributing to this trend include:

-

Rising Demand for Protective Packaging:

Products sold online require durable packaging to withstand handling and transit. Commodity plastics like polyethylene (PE) and polypropylene (PP) are widely used in bubble wrap, shrink wrap, and plastic mailers due to their impact resistance and flexibility.

-

Convenience and Utility of Single-Use Plastics:

Despite growing environmental concerns, single-use plastic materials such as air pillows and stretch films remain popular for their lightweight properties, cushioning ability, and low cost, supporting high-volume shipping needs.

-

Customization and Branding Capabilities:

E-commerce brands increasingly use printed packaging to boost customer engagement. Commodity plastics are easily customizable, allowing logos, colors, and branding messages to be applied, enhancing the unboxing experience.

-

Support for Rapid Fulfillment Models:

Same-day and next-day delivery models require packaging that is easy to handle, seal, and transport. Commodity plastics meet these requirements by offering durability and flexibility in high-speed fulfillment environments.

As e-commerce continues to reshape global retail dynamics, commodity plastics are expected to remain integral to packaging strategies across industries.

Source: Packaging Europe, E-commerce Packaging Trends and Sustainability Insights (2023).

Sustainability Challenges and Shifting Consumer Preferences Restrain the Commodity Plastics Market

The growth of the commodity plastics market is being increasingly restrained by evolving consumer preferences and mounting sustainability concerns. These challenges are compelling market players to reevaluate traditional plastic use and production models. Key restraining factors include:

- Rising Environmental Awareness:

Heightened global concern over plastic pollution and its ecological impact has led to a surge in demand for environmentally friendly alternatives. Public pressure and awareness campaigns are influencing purchasing behavior and policy frameworks.

- Regulatory Pressures:

Governments across regions are implementing stringent regulations to curb the use of single-use and non-recyclable plastics. These policies include bans, taxes, and mandated recycled content requirements, directly impacting the demand for commodity plastics.

- Consumer Shift Toward Eco-Friendly Products:

Modern consumers increasingly favor sustainable packaging and products. This shift is driving demand away from traditional commodity plastics toward bio-based and biodegradable alternatives, limiting market expansion.

- Emergence of Alternative Materials:

Materials such as biodegradable plastics, paper-based solutions, and reusable metal packaging are gaining traction. Their adoption across sectors like food & beverage, personal care, and e-commerce reduces reliance on conventional plastics.

These factors collectively pose a challenge to the commodity plastics industry, compelling manufacturers to innovate or pivot to sustainable material solutions to remain competitive.

Source: European Environment Agency (EEA), Plastics, the Environment and Human Health (2023).

Emerging Economies and Innovation Unlock Growth Opportunities in the Commodity Plastics Market

The commodity plastics market is poised for substantial growth, driven by expanding applications, regional industrialization, and innovation across sectors. Key opportunities include:

- Industrial Growth in Emerging Markets:

Rapid urbanization and economic development in regions such as Asia-Pacific, Latin America, and Africa are fueling demand for commodity plastics in packaging, construction, and automotive sectors. These regions are witnessing increased consumption of plastic-based consumer goods and infrastructure components.

- Healthcare and Medical Packaging Expansion:

The global rise in healthcare demand, particularly in light of recent health emergencies, has led to increased consumption of personal protective equipment (PPE), medical devices, and pharmaceutical packaging. Commodity plastics like polypropylene (PP) and polyethylene (PE) are critical for manufacturing syringes, IV bags, and sterile packaging, presenting lucrative market potential.

- Lightweighting in Automotive and Aerospace:

Regulatory mandates to reduce emissions and improve fuel efficiency are accelerating the replacement of metals with lightweight plastics in vehicles and aircraft. Commodity plastics provide a cost-effective solution that supports improved performance, lower fuel consumption, and compliance with emission standards.

These factors collectively represent a promising landscape for sustained investment and innovation in the commodity plastics industry.

Source: International Trade Administration (ITA), Global Plastics Market and Emerging Economy Outlook (2023).

Polyethylene Dominates the Commodity Plastics Market with High Versatility and Demand

In 2024, polyethylene (PE) emerged as the leading segment in the commodity plastics market, driven by its broad utility, cost-effectiveness, and favorable physical properties. Key factors contributing to its dominance include:

- Exceptional Versatility:

Polyethylene can be easily processed into various forms, such as films, sheets, containers, and pipes. This makes it suitable for diverse end-use applications across packaging, construction, and consumer goods.

- Durability and Lightweight Nature:

PE provides excellent strength-to-weight ratio, offering durability and impact resistance without adding bulk. This characteristic is particularly valued in packaging and transportation applications.

- Chemical and Moisture Resistance:

PE exhibits strong resistance to chemicals, moisture, and environmental stress cracking, making it a reliable material for packaging food, pharmaceuticals, and industrial chemicals.

- Growing Adoption of LDPE Films:

Low-density polyethylene (LDPE) is widely used for manufacturing thin, flexible films utilized in plastic bags, shrink wraps, and packaging films. Its transparency also enhances consumer product visibility, boosting its demand in retail and consumer packaging.

Polyethylene’s adaptability and high-performance characteristics ensure its continued dominance in the commodity plastics market, especially as demand for efficient and cost-effective materials grows across sectors.

Source: PlasticsEurope, Market Data & Trends in the European Plastics Industry (2024).

PMMA Segment Set for Fastest Growth in the Commodity Plastics Market (2024–2034)

The Poly Methyl Methacrylate (PMMA) segment is projected to register the fastest growth in the commodity plastics market between 2024 and 2034, driven by its unique combination of optical, physical, and aesthetic properties. Key growth drivers include:

- Exceptional Optical Clarity:

PMMA offers superior light transmission and clarity, often exceeding that of glass, making it the material of choice for applications like display panels, lenses, optical devices, and lighting fixtures.

- High Weather and UV Resistance:

The material retains its transparency and structural integrity even under prolonged exposure to sunlight and harsh environmental conditions. This resilience makes it ideal for outdoor applications such as signage, roofing sheets, and protective barriers.

- Aesthetic Versatility:

PMMA’s smooth surface, high gloss, and excellent coloration capabilities contribute to its widespread use in high-end consumer goods, decorative items, and furniture.

- Demand from Automotive and Electronics Industries:

With the expansion of automotive lighting, infotainment systems, and advanced electronic displays, PMMA is gaining traction due to its lightweight and durable nature compared to traditional glass.

Given its performance attributes and increasing application scope, PMMA is expected to play a key role in the evolving commodity plastics landscape over the next decade.

Packaging Segment Leads the Commodity Plastics Market with Cost-Effective Versatility in 2024

In 2024, the packaging segment held the largest share of the commodity plastics market, driven by the need for affordable, durable, and lightweight materials across various industries. Key factors contributing to the dominance of this segment include:

- Cost-Effectiveness:

Commodity plastics such as polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polystyrene (PS) are economical to produce, making them an attractive option for high-volume packaging needs.

- Lightweight for Efficient Logistics:

The low weight of these plastics significantly reduces transportation costs and enhances handling efficiency, which is critical in large-scale distribution and e-commerce operations.

- Moldability and Design Flexibility:

These plastics can be easily formed into diverse shapes and sizes, enabling the production of bottles, containers, pouches, wraps, and films to meet varying packaging requirements.

- Strength and Durability:

Despite their lightweight nature, commodity plastics provide reliable mechanical strength and protection, ensuring the safety of goods during transit and storage.

Given their performance, affordability, and adaptability, commodity plastics remain the material of choice for packaging solutions across industries such as food and beverage, personal care, pharmaceuticals, and household products.

Source: Smithers, The Future of Packaging Materials to 2029 (2024).

Medical & Pharmaceutical Segment to Drive Highest CAGR in the Commodity Plastics Market

The medical & pharmaceutical segment is projected to register the highest compound annual growth rate (CAGR) in the commodity plastics market from 2024 to 2034. This growth is driven by rising healthcare demand, increasing production of medical devices, and the cost-efficiency of commodity plastics. Key growth factors include:

- Biocompatibility for Medical Applications:

Commodity plastics such as polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC) are biocompatible, allowing safe use in contact with human tissues and fluids. This makes them essential for producing IV bags, catheters, syringes, and tubing.

- Chemical Resistance and Stability:

These plastics exhibit strong resistance to disinfectants, solvents, and pharmaceutical compounds. Their ability to maintain structural and chemical stability under exposure to various substances ensures reliability in clinical and packaging environments.

- Cost-Effective for Single-Use Devices:

Due to their low production cost, commodity plastics are ideal for manufacturing disposable medical devices and pharmaceutical packaging. This is especially critical for maintaining sterility and reducing infection risks.

- Growing Demand for Healthcare Infrastructure:

Expanding healthcare infrastructure, aging populations, and increased awareness of hygiene and safety post-pandemic have amplified the demand for plastic-based medical products globally.

As healthcare systems modernize and the global need for affordable, durable medical materials rises, the medical & pharmaceutical segment will remain a key growth driver in the commodity plastics industry.

Source: World Health Organization (WHO), Global Strategy on Health and Innovation (2024).

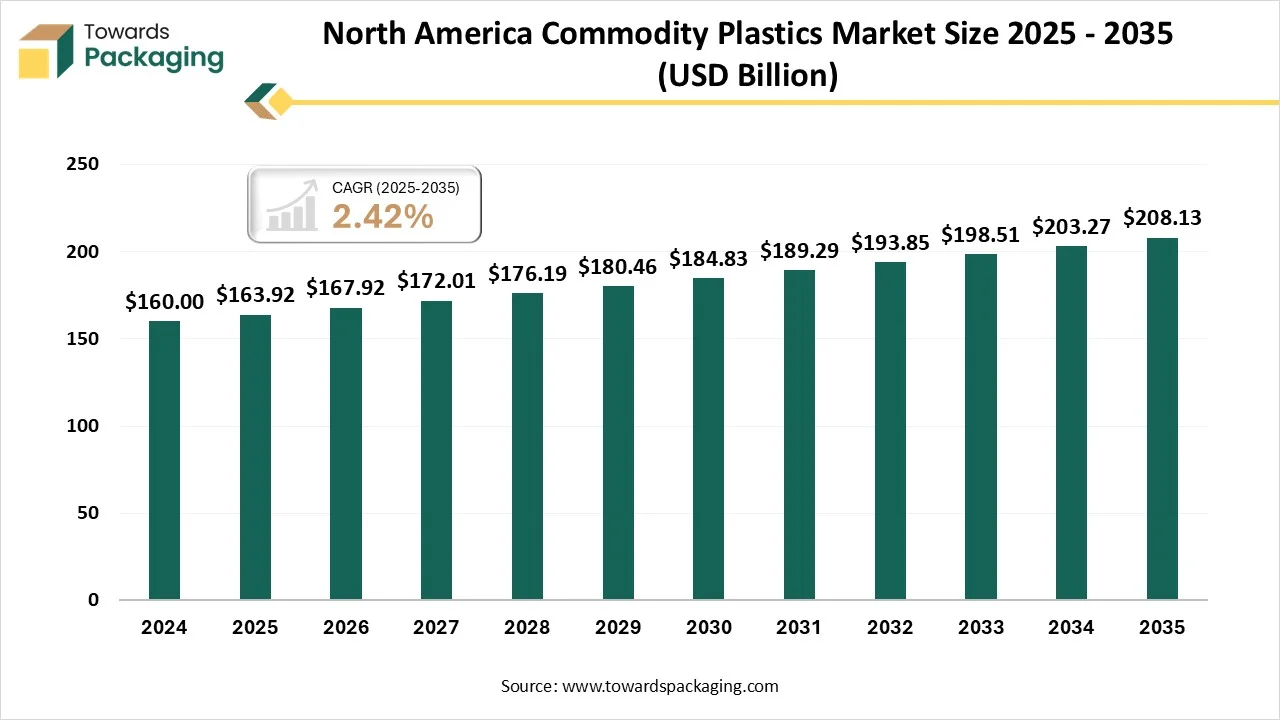

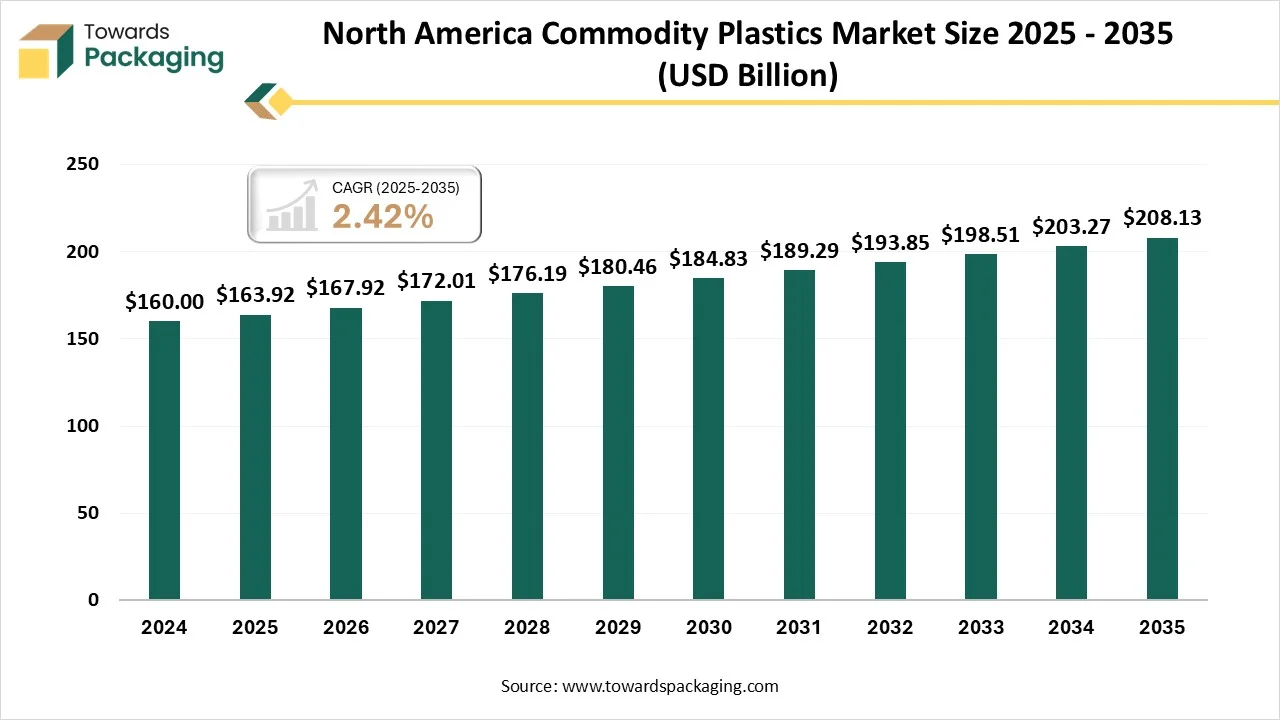

North America Leads the Commodity Plastics Market in 2024 with Strong Industrial and E-Commerce Momentum

In 2024, North America emerged as a dominant region in the commodity plastics market, driven by a combination of industrial strength, technological advancement, and rapid e-commerce expansion. Key factors contributing to this leadership position include:

- Integrated and Resilient Supply Chains:

North America's well-developed industrial base supports local production of commodity plastics, reducing dependency on imports. This enhances operational efficiency and lowers production and transportation costs.

- Strong Manufacturing Ecosystem:

The U.S. boasts a large and diversified manufacturing sector that spans packaging, automotive, construction, and consumer goods—key industries that rely heavily on commodity plastics like PE, PP, and PVC.

- Booming E-Commerce Sector:

E-commerce giants such as Amazon and Walmart continue to drive demand for plastic-based packaging solutions, including shrink wraps, mailers, and protective films, bolstering overall consumption of commodity plastics.

- Automotive Innovation and Growth:

Companies like Tesla are contributing to the demand for lightweight plastic components in electric vehicles, further stimulating the commodity plastics market across automotive applications.

The combination of strong industrial infrastructure, innovation leadership, and increasing end-use demand has solidified North America's role as a key growth engine for the global commodity plastics market.

Source: U.S. Department of Commerce, Manufacturing and Plastics Industry Trends Report (2024).

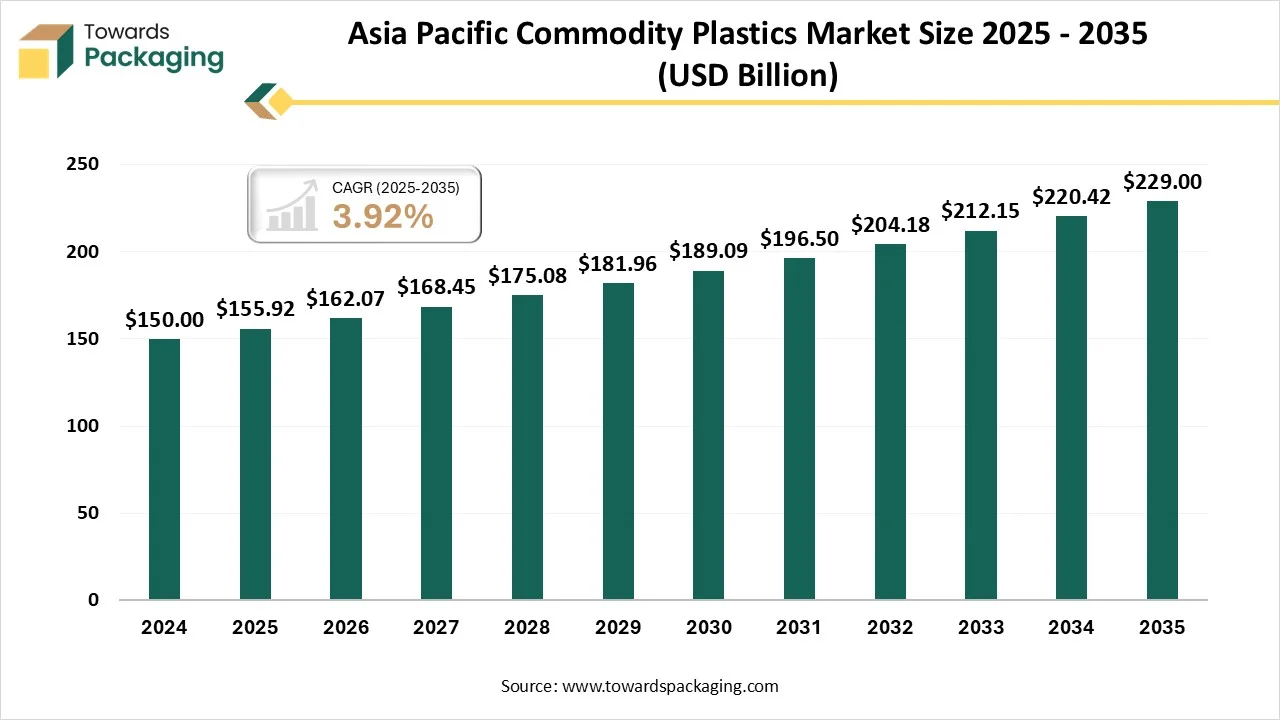

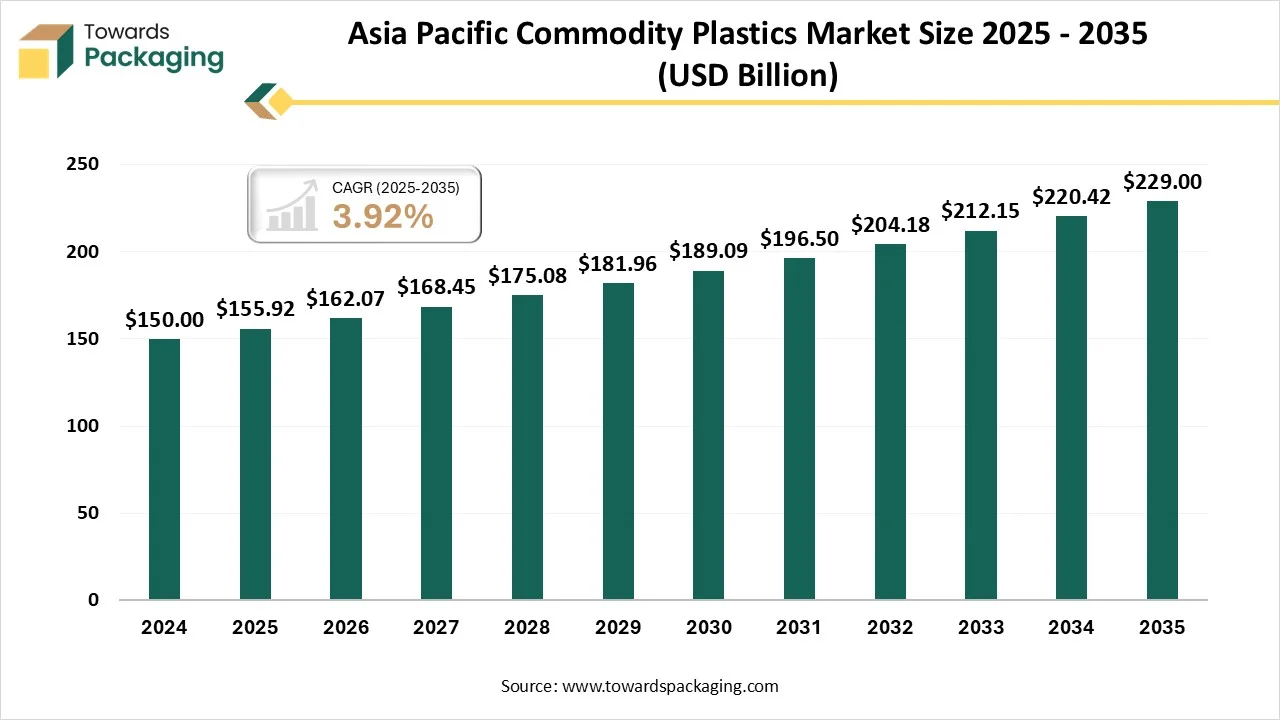

Asia Pacific to Witness Fastest Growth in the Commodity Plastics Market Driven by Automotive and EV Surge

The Asia Pacific region is projected to experience the highest growth rate in the global commodity plastics market during the forecast period (2024–2034), fueled by its dominance in vehicle manufacturing and the rapid expansion of the electric vehicle (EV) sector. Key growth drivers include:

- Automotive Manufacturing Powerhouse:

Countries such as China, India, Japan, and South Korea are leading producers of automobiles, creating robust demand for commodity plastics used in dashboards, interior trims, bumpers, and other vehicle components.

- EV Market Expansion:

The accelerating adoption of electric vehicles across Asia Pacific is driving increased consumption of lightweight and durable plastic materials. Commodity plastics like polypropylene (PP) and polyethylene (PE) are essential for reducing vehicle weight, enhancing energy efficiency, and improving safety.

- Cost-Effective Manufacturing and Supply Chains:

The region benefits from lower production costs and a strong base of raw material availability and skilled labor, making it an attractive hub for commodity plastics production and consumption.

- Government Support and Infrastructure Development:

Supportive policies for clean energy vehicles, infrastructure investments, and a growing middle-class population further reinforce regional demand for plastics across automotive, consumer, and packaging sectors.

These factors collectively position Asia Pacific as a key driver of future growth in the global commodity plastics market.

Source: International Energy Agency (IEA), EV and Automotive Industry Outlook – Asia Pacific 2024.

Rapid Industrialization Fuels Commodity Plastics Market Growth in the Middle East and Africa

The Middle East and Africa (MEA) region is projected to witness notable growth in the commodity plastics market during the forecast period, driven by industrial expansion, resource availability, and strategic economic initiatives. Key factors influencing regional growth include:

- Industrialization and Urban Development:

Rapid industrialization, urbanization, and construction activities across MEA are increasing the demand for commodity plastics in packaging, infrastructure, and medical applications.

- Abundant Petrochemical Resources:

The region’s rich reserves of oil and natural gas ensure a stable, cost-effective supply of feedstock for petrochemical production, particularly polyethylene (PE) and polypropylene (PP).

- Strategic Infrastructure Projects:

Major developments like the PDH-PP project in Al Jubail, Saudi Arabia, scheduled to launch in Q1 2025, will add 800,000 tons/year of PP capacity, significantly strengthening regional supply.

- Growth in FMCG and Automotive Sectors:

Saudi Arabia is leading regional demand, especially in the fast-moving consumer goods (FMCG) sector, supported by rising disposable incomes and growing consumption of packaged goods and vehicles.

- Government Support and Policy Initiatives:

Programs such as Vision 2030 and the National Industrial Development and Logistics Program (NIDLP) are actively promoting industrial growth, plastic manufacturing, and downstream diversification.

- Global Trade Collaborations:

Strengthened ties with European, Asian, and African markets are expanding export opportunities and encouraging technology transfer and investment in plastics production.

Together, these factors make MEA a fast-emerging hub for commodity plastics, with Saudi Arabia at the forefront of regional expansion.

Source: Gulf Petrochemicals and Chemicals Association (GPCA), Annual Industry Report 2024.

Key Players in the Global Commodity Plastics Market

The global commodity plastics market is characterized by the presence of major multinational corporations that play a crucial role in innovation, supply chain integration, and global distribution. These key players are actively involved in strategic initiatives such as capacity expansion, mergers & acquisitions, and development of sustainable plastic solutions to maintain market leadership. Leading companies in the commodity plastics sector include:

- BASF SE

A global chemical leader based in Germany, BASF is actively investing in circular plastics and sustainable product innovations.

- SABIC

Headquartered in Saudi Arabia, SABIC is one of the world’s largest producers of polyethylene (PE) and polypropylene (PP), with a strong focus on petrochemicals.

- Dow Inc.

A major U.S.-based company offering a broad portfolio of polyethylene and polystyrene solutions for packaging, consumer goods, and industrial applications.

- DuPont de Nemours, Inc.

Known for high-performance materials, DuPont continues to innovate in plastic solutions for medical, electronics, and industrial uses.

- Evonik Group

Specializing in specialty chemicals, Evonik contributes to enhancing the performance of commodity plastics through additives and modifiers.

- Sumitomo Chemical Co., Ltd.

A key Japanese player involved in polyethylene and polypropylene production with a growing footprint in Asian and global markets.

- Arkema

A French specialty materials company with a focus on sustainable and high-performance plastics used in diverse industrial applications.

- Eastman Chemical Company

U.S.-based Eastman is engaged in producing advanced plastic materials, emphasizing circular economy and recycling technologies.

- Chevron Phillips Chemical Co., LLC

Jointly owned by Chevron and Phillips 66, this company is a major supplier of olefins and polyethylene in North America and beyond.

- Exxon Mobil Corporation

A global energy and petrochemical giant, ExxonMobil is a significant producer of commodity plastics with investments in circular plastic technologies.

These companies collectively shape the competitive dynamics of the commodity plastics market, setting trends through technological innovation, sustainability commitments, and expansive global operations.

Source: Plastics News, Top 100 Global Plastic Producers Report 2024.

Recycling and Circular Economy Fuel Innovation in the Global Plastics Market

The plastics industry is undergoing a major transformation, driven by increasing regulatory pressure, corporate sustainability goals, and changing consumer expectations. Key players are accelerating investments in circular economy models and recycling innovations to meet these evolving demands. Notable recent developments include:

Shift in Recycled Plastics Pricing Trends: According to Luke Milner, Associate Editorial Director, EMEA Chemicals at S&P Global Commodity Insights, as of May 2023, market fundamentals and pricing of recycled plastics are diverging from those of traditional virgin, fossil-based materials. This has heightened the need for new pricing models and increased transparency in the recycled plastics market.

Strategic Circular Economy Expansion in Asia: In April 2024, LyondellBasell announced a joint venture with Genox Recycling to establish a mechanical plastics recycling facility in Zhaoqing, Guangdong Province, China.

- The facility processes post-consumer plastic waste into new polymers.

- This initiative supports local recycling capabilities for Chinese consumers and brands.

- It aligns with LyondellBasell’s global strategy to grow its circular and low-carbon product portfolio, as highlighted by Yvonne van der Laan, EVP of Circular and Low Carbon Solutions at LyondellBasell.

These developments reflect a broader industry shift toward sustainable material sourcing, localized recycling infrastructure, and the decarbonization of plastic production. Collaboration, innovation in mechanical recycling, and region-specific solutions are becoming critical levers in enabling a circular future for the plastics industry.

Source:

- S&P Global Commodity Insights, Plastics Market Trends (2023)

- LyondellBasell Corporate Newsroom, Circular Solutions Expansion in China (2024)

New Advancements Reshaping the Commodity Plastics Industry in 2024–2025

The commodity plastics industry is entering a transformative phase, marked by data-driven transparency, AI integration, and certified sustainability initiatives. Recent advancements from key players and data providers are driving increased efficiency, accountability, and environmental progress. Highlights include:

Independent Price Assessments for Mixed Plastic Waste (March 2025): Platts, a division of S&P Global Commodity Insights, announced the first-of-its-kind independent market price assessments for mixed plastic waste in the United States and Europe.

- This move enhances transparency in recycled materials pricing.

- It supports improved decision-making for recyclers, manufacturers, and regulatory bodies amid growing circular economy efforts

AI-Driven Market Intelligence – Ask ICIS (May 2024): ICIS, a leading global commodity intelligence provider, launched Ask ICIS, an AI-powered assistant designed to offer instant access to premium chemical and energy market insights.

- Leveraging generative AI and decades of proprietary data, this tool responds to the increasing demand for real-time, accurate intelligence in volatile markets.

- It supports faster strategic decisions for stakeholders in the plastics and broader commodities sectors.

Sustainability Certifications and Circular Offerings by BASF (April 2024): BASF SE unveiled a new range of certified recycled plastic products aimed at accelerating its circular plastics strategy.

- Sites and products are certified under ISCC PLUS and REDcert², globally recognized sustainability standards.

- This initiative aligns with BASF’s commitment to reducing plastic waste and advancing traceable, low-carbon material sourcing.

These advancements signal a broader industry movement toward data transparency, digital transformation, and certified circularity, laying the groundwork for a more efficient and sustainable commodity plastics value chain.

Source:

- S&P Global Commodity Insights, Platts Launches Mixed Plastic Waste Price Assessments (March 2025)

- ICIS, Ask ICIS – Your AI-Powered Commodity Market Assistant (May 2024)

- BASF SE, Sustainability and Recycled Plastics Portfolio Expansion (April 2024)

Commodity Plastics Market Segmentation by Product Type

The commodity plastics market is segmented based on product type, each serving distinct end-use applications due to their unique physical and chemical properties. The key product segments include:

- Polyethylene (PE):

The most widely used commodity plastic, known for its versatility, low cost, and excellent moisture resistance. Commonly used in films, packaging materials, containers, and pipes.

- Polypropylene (PP):

Valued for its high chemical resistance, low density, and fatigue resistance. Extensively used in automotive parts, textiles, food packaging, and medical devices.

- Polyvinyl Chloride (PVC):

Known for its rigidity and durability, PVC is commonly utilized in construction (pipes, window frames), medical applications, and consumer goods. It can also be made flexible through plasticizers.

- Polyethylene Terephthalate (PET):

Highly favored for its strength, transparency, and recyclability. Widely used in beverage bottles, food containers, and synthetic fibers.

- Polystyrene (PS):

Lightweight and cost-effective, polystyrene is primarily used in disposable cutlery, insulation materials, packaging foams, and lab equipment.

- Poly Methyl Methacrylate (PMMA):

Known for its excellent optical clarity and UV resistance, PMMA is used in display panels, automotive lighting, signage, and decorative applications.

These segments cater to a wide array of industries, including packaging, automotive, construction, healthcare, and electronics, contributing to the expansive growth of the global commodity plastics market.

Source: PlasticsEurope, Plastics – the Facts 2024.

Commodity Plastics Market Segmentation by End-Use Industry

The global commodity plastics market is categorized by end-use industry, reflecting the widespread application of these materials across diverse sectors. Key end-use segments include:

- Packaging:

The largest and most dominant segment, driven by demand for lightweight, cost-effective, and durable materials for food packaging, e-commerce logistics, and consumer goods. Polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are commonly used in this sector.

- Medical & Pharmaceutical:

A rapidly growing segment due to the biocompatibility and chemical resistance of commodity plastics like PP and PVC. These materials are essential for producing syringes, IV bags, tubing, and pharmaceutical packaging.

- Building & Construction:

Commodity plastics, particularly PVC, are widely used in pipes, window frames, insulation, and flooring materials due to their durability, corrosion resistance, and ease of installation.

- Electrical & Electronics:

Plastics like PP and PS offer electrical insulation, fire resistance, and dimensional stability, making them ideal for applications in wiring insulation, circuit boards, and electronic housings.

- Automotive & Transportation:

Demand in this segment is driven by the need for lightweight, durable materials to enhance fuel efficiency and reduce emissions. Applications include dashboards, bumpers, and interior trims.

- Textile:

Polypropylene and PET are used in nonwoven fabrics, fibers, and textile components, especially in applications such as carpeting, geotextiles, and industrial fabrics.

- Consumer Durable Goods:

Used in household appliances, storage containers, toys, and furniture due to their moldability, impact resistance, and cost-effectiveness.

- Others:

Includes agriculture, sports equipment, and industrial applications where commodity plastics offer performance and cost advantages.

This segmentation highlights the extensive versatility and economic value of commodity plastics across both industrial and consumer markets.

Commodity Plastics Market Segmentation by Region

The global commodity plastics market is segmented regionally to account for economic development, industrial presence, regulatory frameworks, and consumer demand across different geographic areas. The key regions and their respective sub-regions include:

North America

A mature market with advanced manufacturing and a strong e-commerce backbone. Growth is supported by the packaging, automotive, and healthcare industries.

Europe

Europe emphasizes sustainability and recycling regulations, driving innovation in bio-based and circular plastic solutions.

- Germany

- United Kingdom (UK)

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Asia Pacific

The fastest-growing region due to industrialization, high automotive production, and rising consumer demand for packaged goods.

- China

- Japan

- India

- South Korea

- Thailand

Middle East and Africa (MEA)

Growth supported by petrochemical investments, economic diversification (e.g., Saudi Vision 2030), and rising infrastructure development.

- South Africa

- United Arab Emirates (UAE)

- Saudi Arabia

- Kuwait

This regional segmentation provides a comprehensive view of market dynamics and growth opportunities shaped by local consumption patterns, industrial activity, and regulatory policies.