February 2025

.webp)

Principal Consultant

Reviewed By

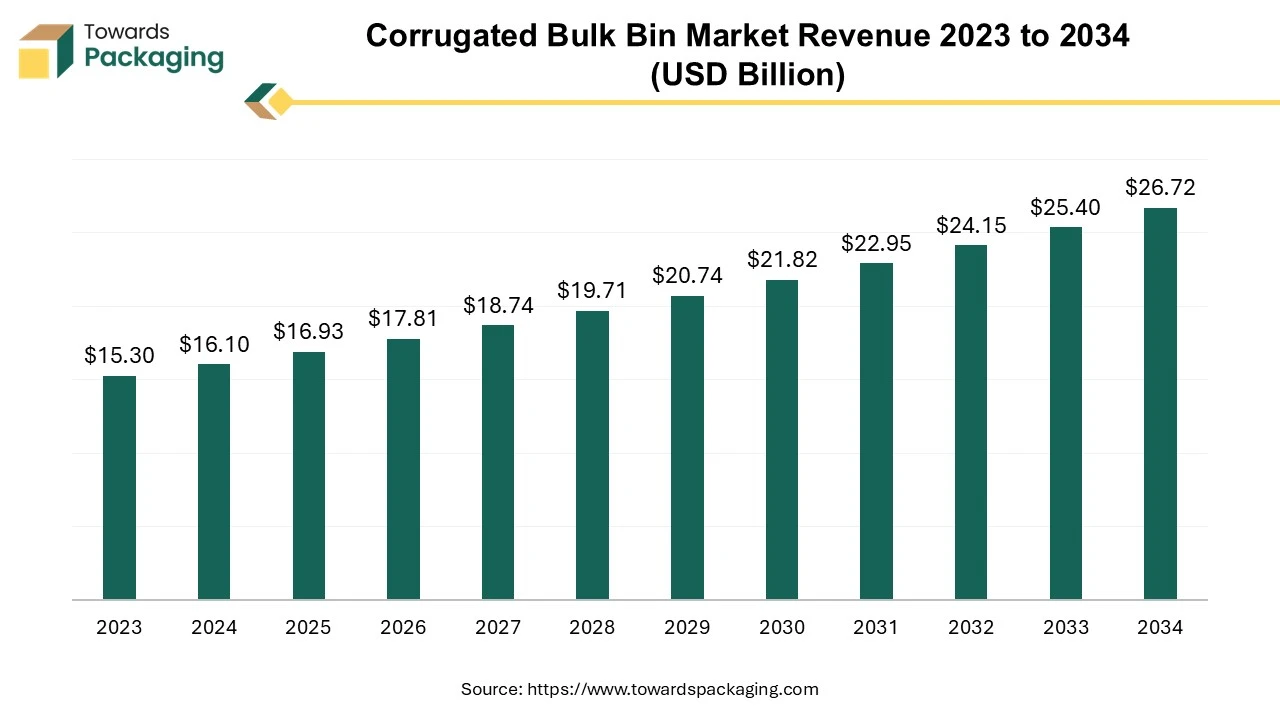

The corrugated bulk bin market is expected to grow from USD 16.93 billion in 2025 to USD 26.72 billion by 2034, with a CAGR of 5.2% throughout the forecast period from 2025 to 2034.

Growing regulations around environmental sustainability and waste reduction encourage the adoption of recyclable packaging materials. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing corrugated bulk bin which is estimated to drive the global corrugated bulk bin market over the forecast period.

A corrugated bulk bin is a type of packaging designed for storing, holding and transporting huge quantities of goods, made primarily from corrugated cardboard. Corrugated bulk bins are typically manufactured from corrugated cardboard, which consists of a fluted walls sandwiched between two liners. This structure provides strength and durability while remaining lightweight. The corrugated bulk bin is generally categorised on the basis of triple wall, double wall, single wall and single faced.

The corrugated bulk bins can vary in design but generally consist of a base, side walls, and a top cover. The walls of corrugated bulk bins are reinforced with additional layers of corrugated cardboard to enhance their load-bearing capacity. They can be tailored to different shapes and sizes depending on the specific needs of the industry. Custom features like ventilation holes or specialized coatings can also be added. Corrugated cardboard is biodegradable and recyclable, making these bins a more sustainable choice in comparison to metal or plastic alternatives.

Corrugated bulk bins are utilized for shipping and storing bulk produce like fruits and vegetables. It is useful for handling components or raw materials in large quantities. Employed for shipping large quantities of goods from suppliers to retailers. Corrugated bulk bins are used to collect and transport recyclable materials. Overall, corrugated bulk bins provide a versatile and environmentally friendly solution for managing bulk goods in various industries, balancing cost and performance effectively.

The corrugated bulk bin industry can improve significantly after integration of AI as it will help manufacturers in design optimization, enhancing manufacturing efficiency, quality control, and supply chain optimization along with customization. Integration of AI can significantly enhance various aspects of the corrugated bulk bin industry, leading to improvements in efficiency, quality, and overall performance.AI-driven simulation tools can optimize bin designs for strength and durability, predicting how different materials and structures will perform under various conditions. AI can facilitate the creation of custom designs by analyzing customer requirements and suggesting optimal configurations.

AI can automate manufacturing processes, such as cutting, folding, and assembling, leading to higher productivity and consistency. AI algorithms can predict equipment failures before they occur, reducing downtime and maintenance costs by ensuring timely interventions. AI-powered vision systems can inspect corrugated bulk bins for defects during production, ensuring high-quality standards and reducing waste. AI can analyze material properties and performance, ensuring that the corrugated cardboard used meets the necessary strength and durability criteria.

The rising industrialization and urbanization has risen the demand for the sustainable bulk packaging. There is growing awareness about environmental sustainability. Corrugated bulk bins are recyclable and biodegradable, which appeals to companies looking to reduce their environmental footprint. Regulatory bodies and governments are imposing stringent rules on packaging waste, encouraging the use of eco-friendly materials like corrugated cardboard. Corrugated bulk bins are often more cost-effective than alternatives like metal or plastic bins, making them attractive for budget-conscious businesses. The key players operating in the market are focused on developing and introducing sustainable corrugated bulk bins to meet rising demand of the consumer, which is estimated to drive the growth of the corrugated bulk bin market over the forecast period.

The key players operating in the market face strong competition from the alternative options like plastic and metal bulk bins which is considered to be the main restricting factor for the corrugated bulk bin market. Corrugated cardboard may not withstand extreme conditions such as high humidity or heavy loads as well as plastic or metal bins. This can limit their use in environments where durability is critical. Corrugated bulk bins have inherent limitations in terms of the weight they can support compared to more robust materials, which might restrict their application for very heavy or dense products.

The availability of advanced packaging solutions such as plastic bulk bins, which offer greater durability and reusability, can be a competitive challenge. Some industries may perceive corrugated bulk bins as lower quality compared to plastic or metal alternatives, potentially leading to reluctance in adopting them for high-value or sensitive goods. Corrugated bins can be susceptible to damage from moisture, crushing, or rough handling, which can impact their effectiveness and lead to higher replacement costs.

The more than 1500 kg segment held a dominant share in the corrugated bulk bin market in 2024. Corrugated bulk bin of load capacity more than 1500 kg are designed to handle large quantities of goods efficiently, making them ideal for bulk storage and transportation. Corrugated bulk bins are typically more affordable than alternatives made from other materials. They provide a cost-effective solution for bulk storage needs.

Despite being made from corrugated materials, these bins are engineered to be robust and can handle heavy loads up to 1500 kg, making them suitable for a range of industries. They can often be customized in terms of size and design to meet specific needs, adding to their appeal. These type of corrugated bulk bins are utilized for shipping engine of automotive industry, hence emerging market for automotive industry has risen the demand for the corrugated bulk bin with load capacity more than 1500 kg.

The hinged segment is estimated to witness significant growth in the corrugated bulk bin market over the forecast period. Hinged corrugated bulk bins offers easy access to contents through their hinged lids or panels, streamlining the process of loading and unloading goods. This convenience can significantly improve operational efficiency. Hinged bins often feature a design that allows them to be collapsed or folded when not in use, saving valuable storage space. This collapsibility makes them ideal for businesses looking to optimize their storage and logistics.

The hinged feature allows for easy access to contents without needing to disassemble or fully open the bin, facilitating smoother operations and reducing handling time. Hinged corrugated bins can be customized to meet specific needs and come in various sizes and configurations. This versatility makes them suitable for a range of industries and applications. Like other corrugated products, hinged corrugated bulk bins are often recyclable and environmentally friendly, aligning with the growing emphasis on sustainable practices in business.

The triple wall category dominated the corrugated bulk bin market in 2024. Triple wall corrugated containers are strong, durable bulk containers used to safeguard large, heavy, and fragile products during storage, shipment, and exhibition. They have the strength of wood but are far lighter, resulting in a cost-effective solution that can be used repeatedly. These corrugated containers, with their durable triple-wall design, offer a cheap transportation choice for large, bulky, and fragile commodities.

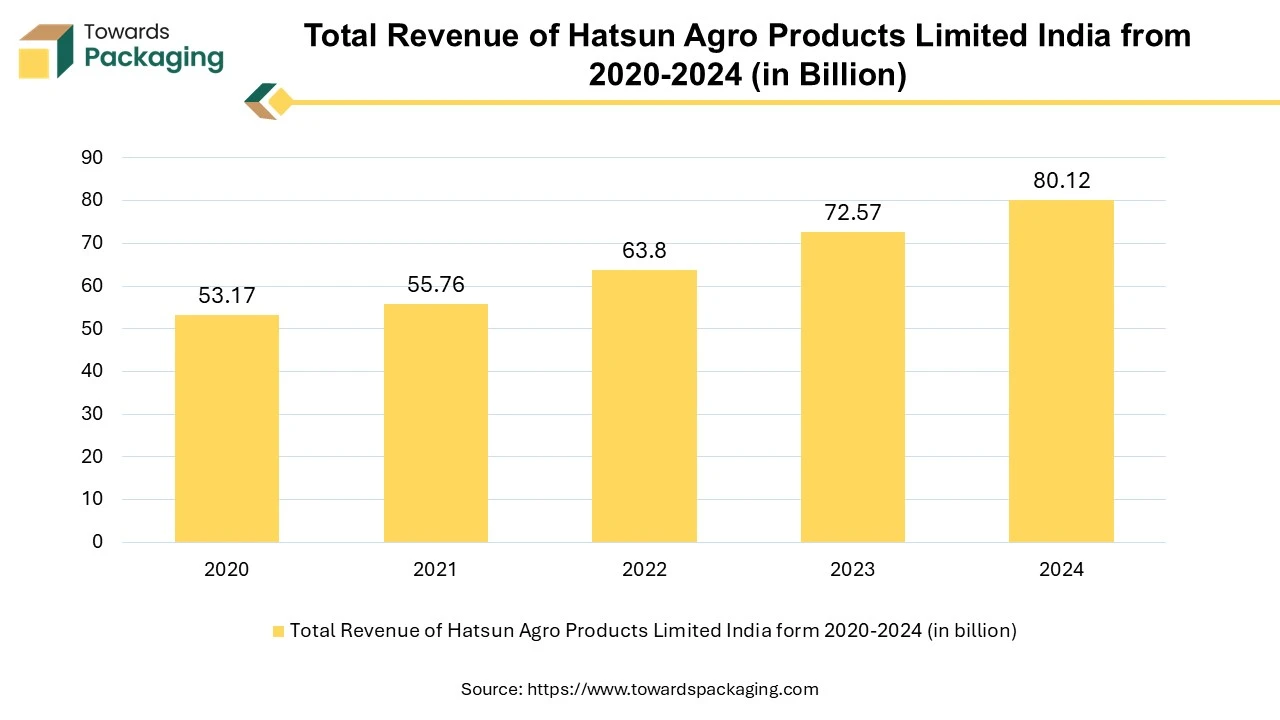

The food & beverages segment held a dominant presence in the corrugated bulk bin market in 2024. Rapid urbanization and industrial growth has expanded the food & beverage industry and stimulated economic activity. This include jobs in farming, distribution, retail, and related sectors. Innovations in agricultural technology, such as improved crop varieties and efficient farming techniques, has boosted productivity and growth in food industry.

In many regions, fruits and vegetables are integral to traditional cuisines and cultural practices, which has driven demand and import/export of fruits. The players operating in the market are focused on adoption of inorganic strategies like collaboration and partnership to develop corrugated bulk bins and improve supply chain of same to retailer. Moreover, the key market players are assisting companies to shift towards sustainable packaging for food & beverage.

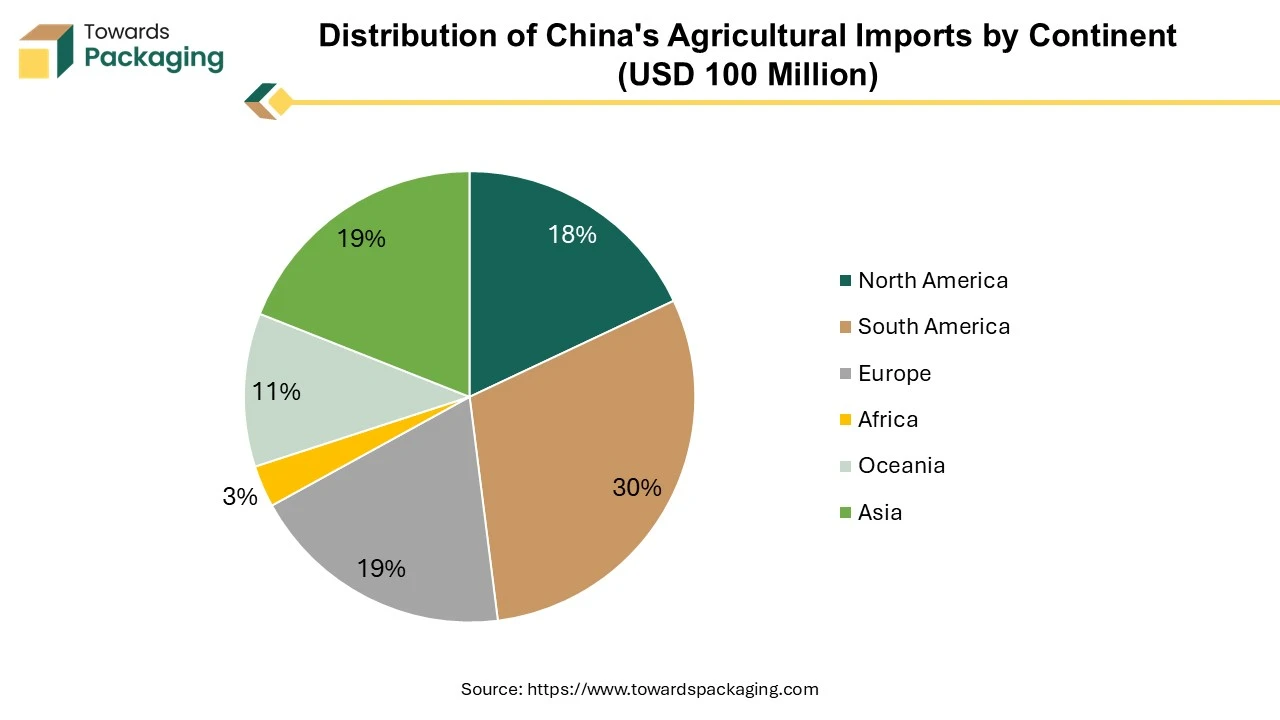

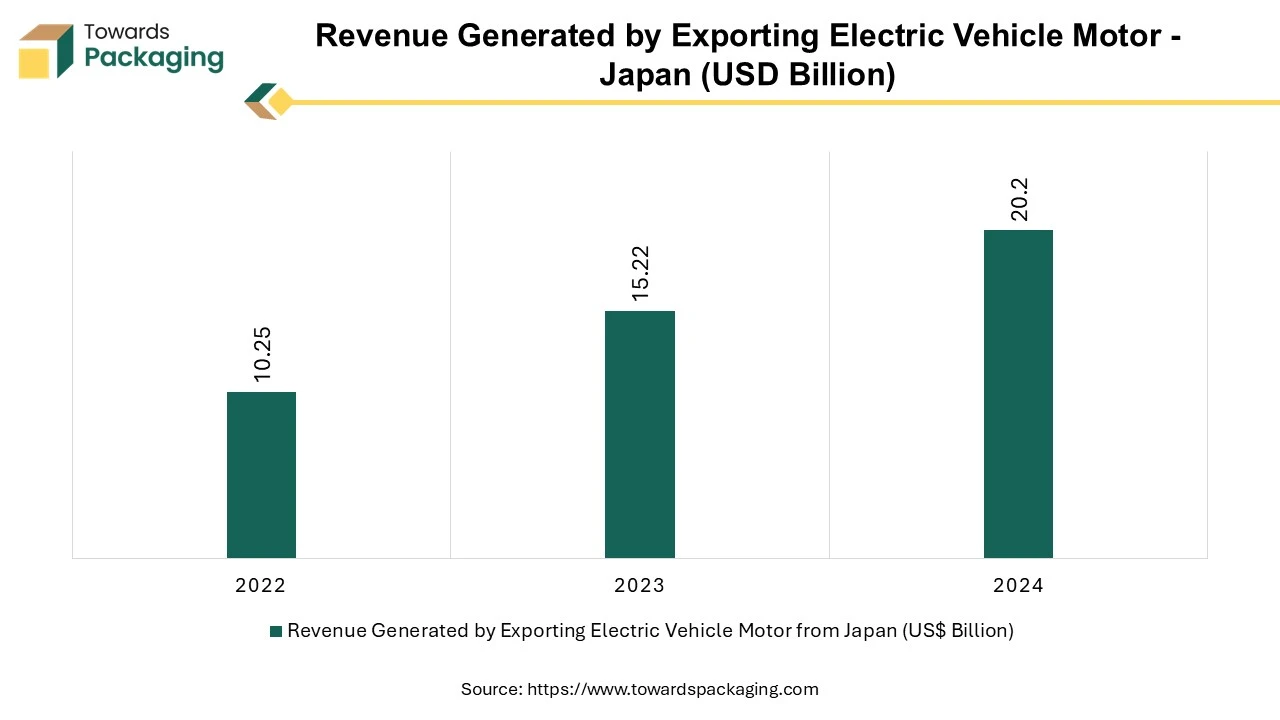

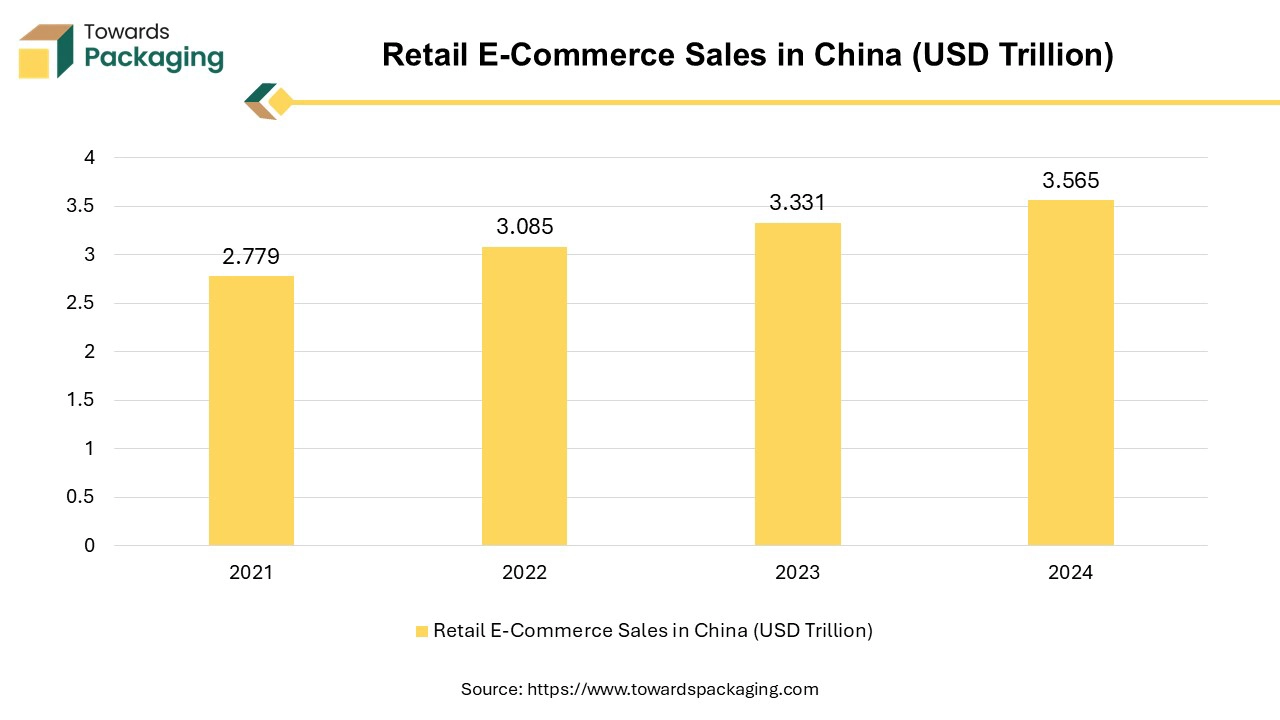

Asia Pacific dominated the global corrugated bulk bin market in 2024. The rising development in the industrial sector and rapid urbanization has support the growth of the corrugated bulk bin market in Asia Pacific region. Japan's advanced logistics and supply chain systems enhance the efficiency of bulk bin use, making them a viable option for various industries, including food and pharmaceuticals. China's rapid economic expansion and industrialization increase demand for efficient packaging solutions, including corrugated bulk bins.

The booming e-commerce sector in China, Japan, South Korea and India drives the need for bulk packaging solutions that are cost-effective and suitable for large-scale distribution. India’s significant agricultural sector drives demand for bulk bins for storing and transporting crops and other agricultural products. The key players operating in the Asia Pacific region are focused on expansion of market by launching new manufacturing of corrugated bulk bins to meet the rising demand by consumers.

Europe region is estimated to grow at fastest rate over the forecast period. The busy lifestyle lead to expansion of e-commerce in Europe increases the need for efficient and durable bulk packaging solutions to handle large volumes of goods. Europe’s sophisticated logistics and supply chain infrastructure supports the use of bulk bins, enhancing efficiency and reducing overall packaging costs. European consumers are increasingly favoring companies that use sustainable packaging solutions, driving demand for environmentally friendly options like corrugated bulk bins. Europe's significant agricultural and food processing industries require bulk packaging for the storage and transportation of goods, boosting the demand for corrugated bulk bins. Increase in grocery export and import in the Europe has risen the demand for the corrugated bulk bins and expanded the corrugated bulk bin market in Europe.

Moreover, the key players operating in the Europe market are focused on market expansion and on increasing the quality of production to meet the rising demand of consumers. The expansion of manufacturing facility has rising the demand of corrugated bulk bins for storing and transportation.

By Load Capacity

By Type

By Format

By End-user

By Region

February 2025

February 2025

January 2025

February 2025