April 2025

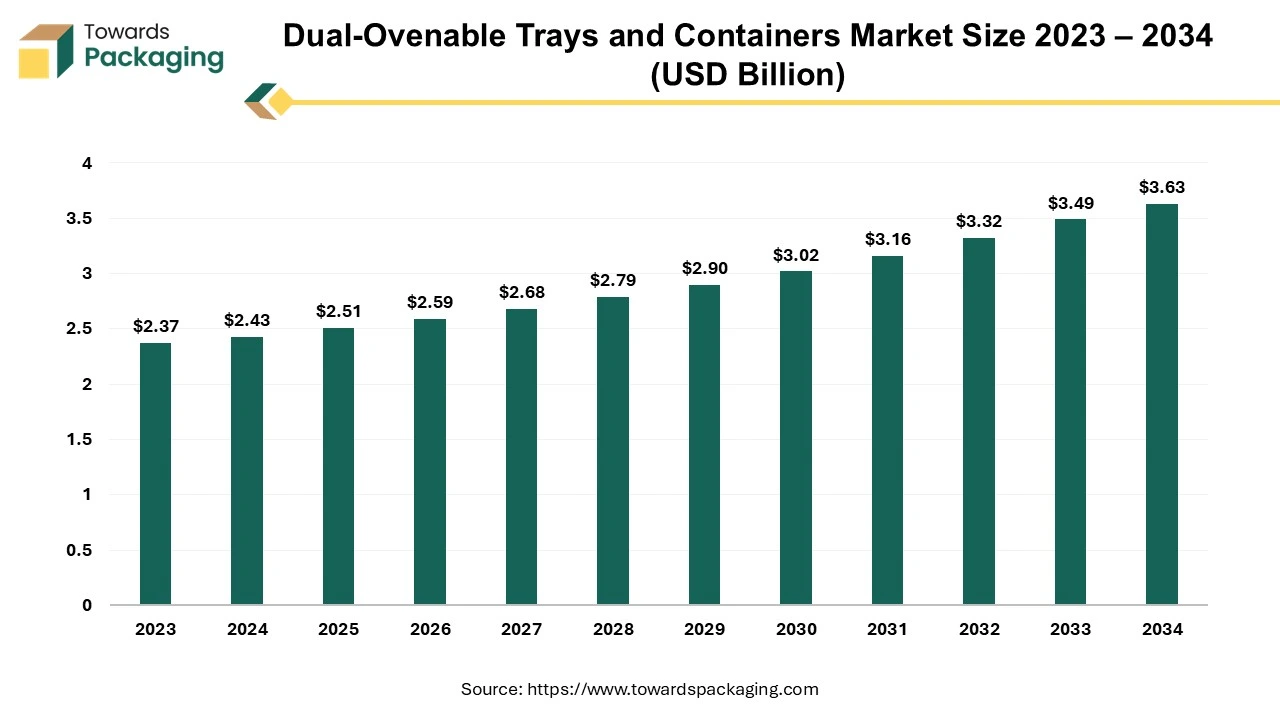

The global dual-ovenable trays & containers market size to advance USD 3.63 billion by 2034, growing from USD 2.51 billion in 2025 at a CAGR of 4.08% during the forecast period. This growth is driven by the rising demand for convenient, heat-resistant, and sustainable packaging solutions, particularly in the ready-to-eat and frozen food sectors.

The dual-ovenable trays & containers market is anticipated to grow at a substantial rate during the forecast period. Dual-ovenable adaptability refers to their ability to tolerate high temperatures and bake in both the oven and a microwave. Since the trays and containers are mainly made of CPET (crystallized polyethylene terephthalate), they can be used in ovens up to 400 degrees Fahrenheit.

Additionally, they provide better microwave performance, specifically when it comes to foods that contain fats or oils that can produce "hotspots" when heated. They are also excellent in the freezer. These products are used across various industries, primarily food packaging. They allow seamless cooking, heating as well as serving without transferring the food to another container.

The rising consumer demand for ready-to-eat and convenience foods along with the expanding food delivery and takeaway services, coupled with the rise in quick-service restaurants is expected to augment the growth of the dual-ovenable trays & containers market during the forecast period. Furthermore, the innovations in the packaging technologies such as improved heat resistance and eco-friendly materials coupled with the strict environmental regulations is also anticipated to augment the growth of the market.

Additionally, the rising disposable incomes in the developing regions as well as the growing preference for the premium, aesthetically appealing packaging and the increased focus on extending the food shelf life and guaranteeing product safety is also projected to contribute to the growth of the market in the near future.

The rising popularity of ready-to-eat (RTE) frozen and microwavable meals is likely to augment the growth of the dual-ovenable trays & containers market during the estimated timeframe. This is owing to the busy lifestyles and increasing urbanization. Consumers are seeking convenient meal options that require minimal preparation time. Global food companies are entering in this space and capitalizing on the growing demand for the ready-to-eat food. For instance:

RTE frozen and microwaveable meals present an easy and healthy alternative to traditional cooking. Dual-ovenable trays and containers will serve as flexible packaging for this segment, transitioning easily from freezer to oven, guaranteeing its simplicity of use and constant meal quality. As these meals gain popularity among working professionals and students, demand for dual-ovenable packaging is expected to grow over the forecast period.

The availability of substitutes such as aluminum, glass and reusable silicone containers is likely to restraint the growth of the dual-ovenable trays & containers market during the forecast period. Aluminum is a widely preferred material due to its excellent heat conductivity, lightweight nature and ability to withstand high temperatures. Vinyl and epoxy resins are applied to aluminum trays that absorb microwave heat and eliminate arcing. They are sealed using foil laminates or transparent lidding material. They retain their stiffness even after being placed in the freezer, microwave, or regular oven. It is also highly recyclable, with an established recycling infrastructure in most of the regions, making it an attractive option for the environmentally conscious consumers and organizations.

Similarly, silicone containers are gaining popularity as durable and versatile option for food storage as well as heating. These materials are perceived as more eco-friendly and support the growing consumer and regulatory focus on reducing the plastics.

Furthermore, glass containers that are labeled as oven-safe and composed of tempered or borosilicate glass can tolerate high temperatures in the oven. Glass is 100% FDA certified for a range of uses and does not release chemicals when exposed to hot or cold temperatures. Glass can be recycled more easily than plastic. Glass is a sustainable choice because it contains recycled material in almost every piece one comes across.

Additionally, retort pouches are also frequently utilized in the food sector for products that need to last for a long time without refrigeration such as soups, sauces as well as ready-to-eat meals. Customers like them for being convenient and simple to use and these pouches can be microwaved or heated in boiling water for easy and quick preparation. The availability of these alternatives challenges the dual-ovenable trays market by diverting demand and requiring manufacturers to innovate to remain competitive.

The rapid expansion of the online food delivery and takeaway services owing to the shifting consumer lifestyles as well as proliferation of smartphones and widespread internet access is expected to create substantial growth opportunity for the dual-ovenable trays & containers market in the near future. Most of the companies in the online food delivery services are expanding through partnerships as well as incorporating new technologies and even new companies are entering in the segment. For instance:

Consumers now expect meals that maintain their freshness, taste, and quality during transit and are easy to reheat directly in ovens or microwaves. Dual-ovenable trays and containers provide heat-resistant packaging, improving the overall consumer experience. Thus, the continued growth of these online food delivery services is expected to create demand for the dual-ovenable trays and containers market in the years to come.

A revolution in the food packaging has begun with the introduction of the Artificial Intelligence (AI), which promises improved consumer experience, sustainability as well as efficiency. Food packaging has always been influenced by consumer preferences such as freshness, excellent quality, and taste that determines the caliber of the food delivered. F&B packaging companies can easily adjust to the new products requirements with no reprogramming due to the AI-driven automation.

With subordinate purposes involving accountability, tamper warning, and portion size checks, several packaging techniques have emerged over time. Advancements in packaging technologies have been made in an effort to prolong food products' shelf lives while preserving their nutritional content and guaranteeing their safety along with the convenience for the fast-paced lifestyle.

Manufacturers can experiment with materials and structural designs using AI-models to build trays and containers with better heat resistance, durability and equal heat distribution. AI technologies provide fine customization, helping producers to create multi-compartment trays, stackable designs, and ergonomic benefits that suit to specific foodservice and retail requirements.

Furthermore, AI can examine large datasets of the consumer preferences, usage patterns and feedback to provide suggestions for practical improvements like better lid sealing or anti-spill features. To minimize the material consumption and shipping expenses without compromising capacity, machine learning algorithms can optimize the packing weight and dimensions. AI is also likely to assist organizations in identifying growth possibilities and new demands by monitoring the industry trends. These improvements make this market more adaptable, sustainable as well as responsive to the consumer demands.

The crystallized polyethylene terephthalate (CPET) segment held largest share of 45.57% in the year 2024. These containers are widely used for both traditional oven cooking and microwave packaging. The white and black CPET containers are mostly used for prepared foods and may be heated to +180 °C for 30 minutes in a conventional oven or microwave. These containers exhibit outstanding physical behavior (tasteless, odorless) and are resistance to harmful chemical agents as well as organic and inorganic compounds (such as oils, fats, etc.).

This versatility is important for packaging frozen meals, baked goods and ready-to-eat dishes. CPET is also highly durable, maintaining its structural integrity during transit, storage as well as cooking, guaranteeing food safety and quality. The above mentioned factors are likely to support the segmental growth of the market during the forecast period.

The foodservice segment held largest share of 60.62% in the year 2024. This is owing to the shifting consumer lifestyles and technological advancements across the globe. Furthermore, the busy work schedules and the rise of dual-income households along with the increasing urbanization are also likely to contribute to the growth of the segment within the estimated timeframe. Additionally, the widespread adoption of digital platforms and availability of various payment options and subscription options coupled with the rise of the localized food businesses available online are further expected to support the segmental growth of the market in the near future.

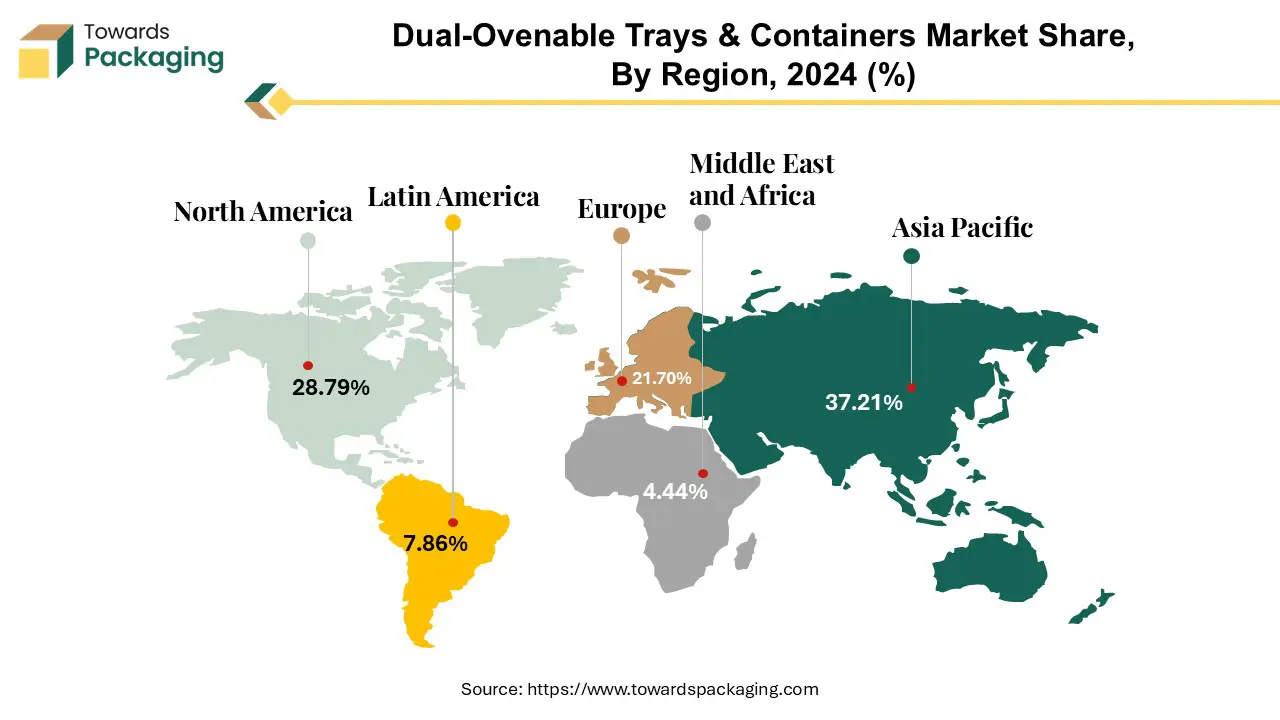

North America held substantial market share of 28.79% in the year 2024. This is owing to the widespread adoption of platforms like Uber Eats, DoorDash and Grubhub across the region as well as increasing partnerships and mergers to strengthen their positions. For instance, Uber Technologies, Inc. and Instacart established a strategic alliance to offer Uber Eats restaurant delivery to Instacart users. Customers will be able to place orders from hundreds of thousands of restaurants around the country via the Instacart app, which is powered by Uber Eats.

Customers of Instacart can now effortlessly handle all of their food needs from a single app thanks to this agreement, which also gives them access to the finest online grocery collection in the United States and restaurant delivery. Additionally, the high consumption of convenience foods along with the burgeoning takeaway culture is also expected to contribute to the regional growth of the market. Furthermore, the increasing frozen food sale is also expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at the fastest CAGR of 6.01% during the forecast period. This is due to the increasing disposable incomes and a growing middle class population. Also, the growing food services industry with the prevalence of quick-service restaurants (QSRs), cloud kitchens and meal kit delivery services is likely to contribute to the regional growth of the market.

According to the NRAI Indian Foodservices Industry report, as of FY24, the food services industry in India is projected to reach USD 93.16 billion (Rs 7, 76,511 crores) by FY28 at a CAGR of 8.1%. Furthermore, the expansion of the supermarkets and hypermarkets in urban and semi-urban areas are also expected to contribute to the regional growth of the market.

By Material Type

By Product Type

By End-Use Industry

By Region

April 2025

April 2025

April 2025

April 2025